The demand for CDMO (Contract Development and Manufacturing Organization) services in the pharmaceutical and biotechnology industries is rising sharply. As innovative treatments for complex diseases increase, companies are partnering with CDMOs to speed up development and commercialization. Additionally, artificial intelligence (AI) is transforming workflows, improving efficiency, and supporting global market growth.

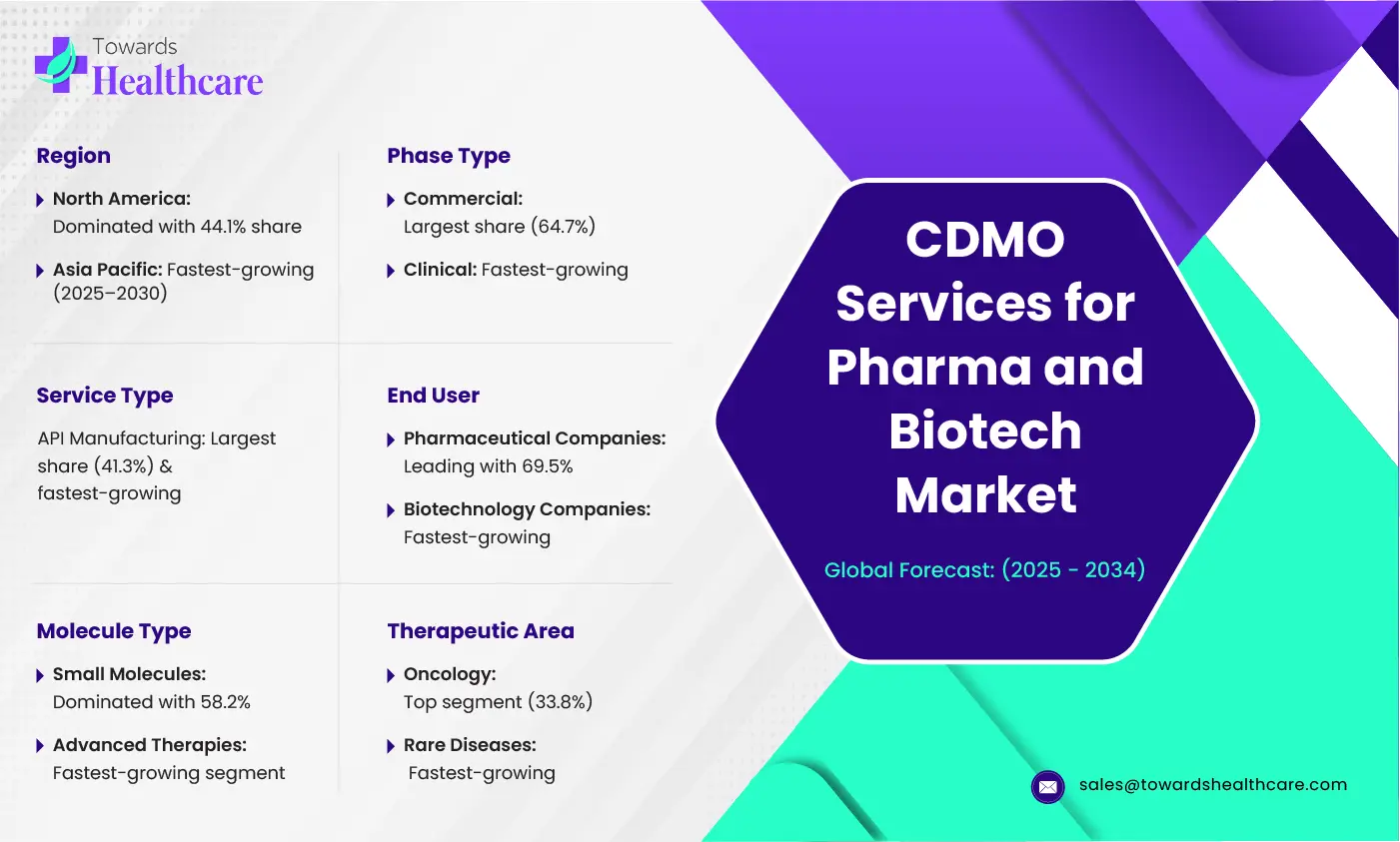

North America Leads, Asia Pacific Emerges as a Growth Hotspot

In 2024, North America dominated the global CDMO services market, holding a 44.1% share. This leadership is driven by strong healthcare infrastructure, ongoing R&D investments, and a high rate of outsourcing by pharma and biotech companies.

Looking forward, Asia Pacific is set to be the fastest-growing region from 2025 to 2030. Countries like China and India are witnessing rising investments, clinical trials, and government support for CDMO services, positioning the region as a global manufacturing hub.

Invest in Our Premium Strategic Solution: https://www.towardshealthcare.com/download-databook/5801

Service Type Trends: API Manufacturing Leads the Way

The API manufacturing segment emerged as the largest in 2024, holding a 41.3% market share. APIs (Active Pharmaceutical Ingredients) are vital for all medicines, and CDMOs help reduce production costs while ensuring compliance with regulations. This segment is also projected to register the fastest growth over the forecast period.

Small Molecules and Advanced Therapies: Shaping the Future

In 2024, small molecules dominated the market with a 58.2% share, supported by their widespread application in drug development. However, advanced therapies are anticipated to grow at the fastest pace in the coming years, driven by increasing demand for gene and cell therapies for chronic and rare diseases.

Commercial Phase Dominates, Clinical Segment on the Rise

By phase, the commercial segment led the market in 2024 with a 64.7% share. CDMOs play a critical role in large-scale production, quality assurance, and regulatory compliance during this phase. Meanwhile, the clinical segment is expected to grow rapidly as pharma and biotech companies seek to streamline clinical trials and accelerate product approvals.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardshealthcare.com/download-sample/5801

Pharmaceutical Companies: The Major End Users

Pharmaceutical companies were the primary end users of CDMO services in 2024, accounting for a 69.5% market share. Their continuous drug development pipelines drive outsourcing needs. Biotech companies, however, are expected to show the highest growth, fueled by increasing biologics and advanced therapies production.

Oncology and Rare Diseases: Key Therapeutic Areas

The oncology segment was the largest therapeutic area in 2024, with a 33.8% share. Cancer treatments often require specialized CDMO support for production and clinical trials. The rare diseases segment is projected to grow fastest due to rising innovation in orphan drug development and supportive regulatory frameworks.

Role of AI in CDMO Services

AI is revolutionizing CDMO operations by improving quality, reducing time-to-market, and cutting costs. It helps optimize production conditions, predict potential issues, and enhance drug development processes. Predictive analytics and machine learning are also enabling smarter decision-making and operational efficiency.

If you have any questions, please feel free to contact us at sales@towardshealthcare.com

Recent Collaborations and Developments

-

June 2025: TAG1 Inc. partnered with PharmaLogic to improve accessibility to Pb-212 generators for radiopharmaceuticals.

-

June 2025: OneSource Specialty Pharma Limited collaborated with Xbrane Biopharma AB for biosimilar manufacturing.

-

June 2025: LOTTE BIOLOGICS signed a deal with Ottimo Pharma to support antibody therapeutics development.

-

April 2025: PCI Pharma Services acquired Ajinomoto Althea to expand sterile fill-finish capabilities in North America.

-

March 2025: Shilpa Medicare launched a hybrid CDMO to offer flexible pathways for pharma and biotech companies.

These collaborations highlight the growing reliance on CDMO services to support complex drug development and manufacturing needs globally.

FAQs

Q. What is driving the growth of CDMO services in 2025?

The growth is driven by increased outsourcing from pharma and biotech companies, the rise of innovative therapies, and the integration of AI for improved efficiency and cost savings.

Q. Why is API manufacturing the largest service segment?

API manufacturing dominates because of its critical role in drug production and the cost efficiencies CDMOs provide for API development and scaling.

Q. How is AI benefiting CDMO operations?

AI enhances quality control, reduces downtime, optimizes production conditions, and speeds up drug development, making CDMO operations more efficient and cost-effective.

Q. Which region is expected to grow fastest in the CDMO market?

Asia Pacific is projected to grow the fastest from 2025 to 2030, supported by rising investments, government initiatives, and the expanding pharma and biotech industries.

Q. Why are biotech companies increasing their use of CDMO services?

Biotech companies are leveraging CDMO expertise to develop biologics, gene therapies, and other advanced treatments that require specialized facilities and regulatory compliance.

To access the full market report : https://www.towardshealthcare.com/price/5801