The global stem cell banking market is on a remarkable growth trajectory, driven by the expanding applications of stem cells in treating life-threatening diseases and genetic disorders. As of 2024, the market is valued at USD 7.85 billion, projected to rise to USD 9.12 billion in 2025, and further expected to reach around USD 35.12 billion by 2034, growing at a robust CAGR of 16.14% (2025–2034).

Market Overview

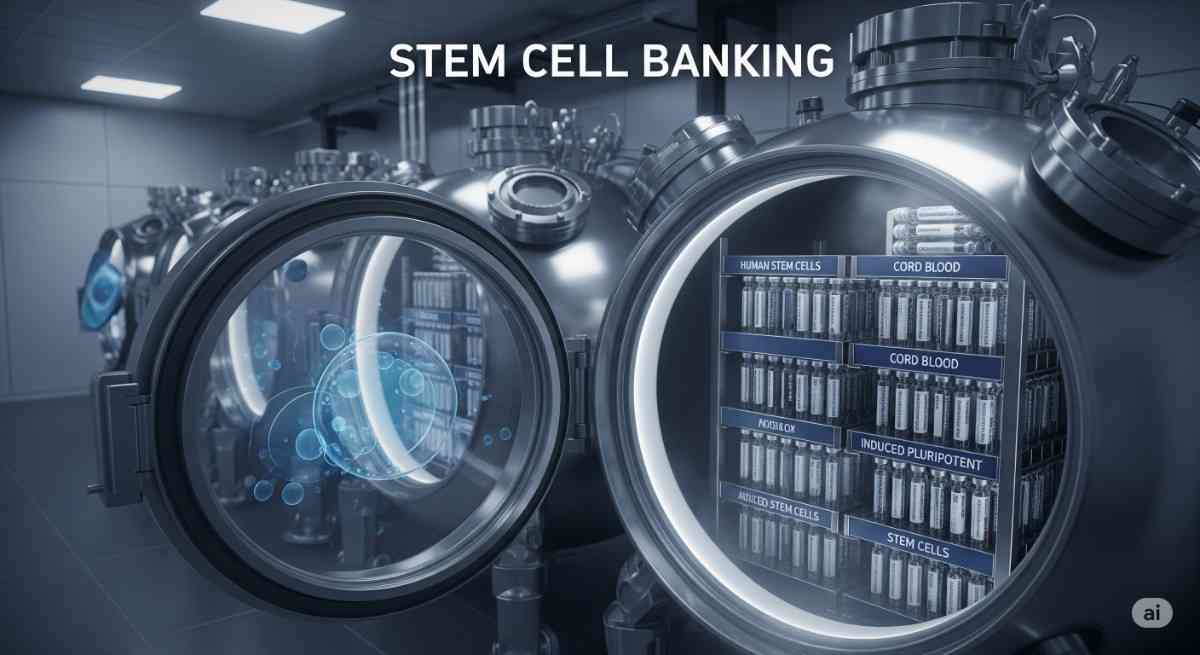

Stem cell banking involves collecting, processing, and preserving stem cells for future therapeutic use. Increasing awareness, technological advancements in regenerative medicine, and rising healthcare investments globally are fueling demand. Government initiatives and private sector partnerships are further strengthening the market infrastructure.

-

2024 Market Size: USD 7.85 billion

-

2034 Forecasted Size: USD 35.12 billion

-

CAGR (2025–2034): 16.14%

-

Top Region (2024): North America with 35–40% market share

-

Fastest Growing Region: Asia-Pacific

Key Segments Driving Growth

-

By Stem Cell Type: Umbilical cord stem cell banking dominates (~55-60% share); adipose tissue stem cell banking is the fastest-growing segment.

-

By Application: Therapeutic applications lead, with oncology representing 45–50% of revenue.

Leading Companies in the Stem Cell Banking Market

1. Cord Blood Registry (CBR)

-

About: CBR, a pioneer in stem cell preservation, focuses on umbilical cord blood and tissue banking.

-

Products: Cord blood and tissue banking, genetic testing, and newborn stem cell services.

-

Market Cap: Approx. USD 2.1 billion.

2. Cryo-Cell International

-

About: Founded in 1989, Cryo-Cell is the world’s first private cord blood bank.

-

Products: Cord blood, cord tissue, and menstrual stem cell banking services.

-

Market Cap: Approx. USD 400 million.

3. ViaCord

-

About: A PerkinElmer company, ViaCord has been offering stem cell banking solutions for over 25 years.

-

Products: Umbilical cord blood banking, genetic testing, and newborn stem cell banking.

-

Market Cap: Parent PerkinElmer ~USD 16 billion.

4. LifeCell International

-

About: The largest stem cell bank in India, LifeCell provides community stem cell banking.

-

Products: Cord blood and tissue banking, advanced genetic screening services.

-

Market Cap: Private company; estimated valuation USD 800 million.

5. StemCyte

-

About: StemCyte specializes in public and private cord blood banking and therapeutic applications.

-

Products: Cord blood units for transplant, research, and therapy.

-

Market Cap: Approx. USD 200 million.

6. Texas Cord Blood Bank

-

About: A nonprofit organization providing public cord blood banking services in Texas.

-

Products: Cord blood collection and storage for research and therapy.

-

Market Cap: N/A (nonprofit).

7. Neostem (now Caladrius Biosciences)

-

About: Focuses on stem cell therapies and banking solutions for regenerative medicine.

-

Products: Stem cell collection, processing, and therapeutic solutions.

-

Market Cap: Approx. USD 50 million.

8. Future Health Biobank

-

About: A leading European stem cell bank with a global presence.

-

Products: Umbilical cord blood and tissue banking, dental stem cell banking.

-

Market Cap: Private company; estimated valuation USD 300 million.

9. California Cryobank

-

About: Known for reproductive tissue and stem cell banking services.

-

Products: Cord blood banking, sperm/egg banking, and reproductive services.

-

Market Cap: Part of CooperSurgical; parent company ~USD 3 billion.

10. Lonza Group AG

-

About: A major player in life sciences, Lonza also offers cell and gene therapy services.

-

Products: Contract development, manufacturing services for cell therapy, stem cell banking.

-

Market Cap: Approx. USD 40 billion.

Recent Advancements Driving the Market

-

AI Integration in Stem Cell Research: Improving cell analysis and storage efficiency.

-

Regenerative Medicine Partnerships: Collaborations between hospitals and stem cell banks.

-

Regulatory Support: Governments promoting cord blood donation and biobanking standards.

Request a customized case study tailored to your business needs and gain deeper insights

into healthcare market strategies: sales@towardshealthcare.com

FAQs About the Stem Cell Banking Market

1. What is the future of the stem cell banking market?

The market is projected to reach USD 35.12 billion by 2034, driven by increased demand for regenerative medicine and personalized therapies.

2. Which region holds the largest share of the stem cell banking market?

North America leads with a 35–40% share, while Asia-Pacific is expected to grow at the fastest pace.

3. What types of stem cells are commonly banked?

Umbilical cord blood stem cells dominate the market, followed by adipose tissue stem cells.

4. Who are the top players in the global stem cell banking market?

Leading companies include Cord Blood Registry, Cryo-Cell International, ViaCord, LifeCell International, and StemCyte.

5. Why is adipose tissue stem cell banking growing rapidly?

Adipose tissue offers an abundant and accessible source of mesenchymal stem cells for regenerative therapies.

Source : https://www.towardshealthcare.com/insights/stem-cell-banking-market-sizing

Invest in Our Premium Strategic Solution: https://www.towardshealthcare.com/price/5867