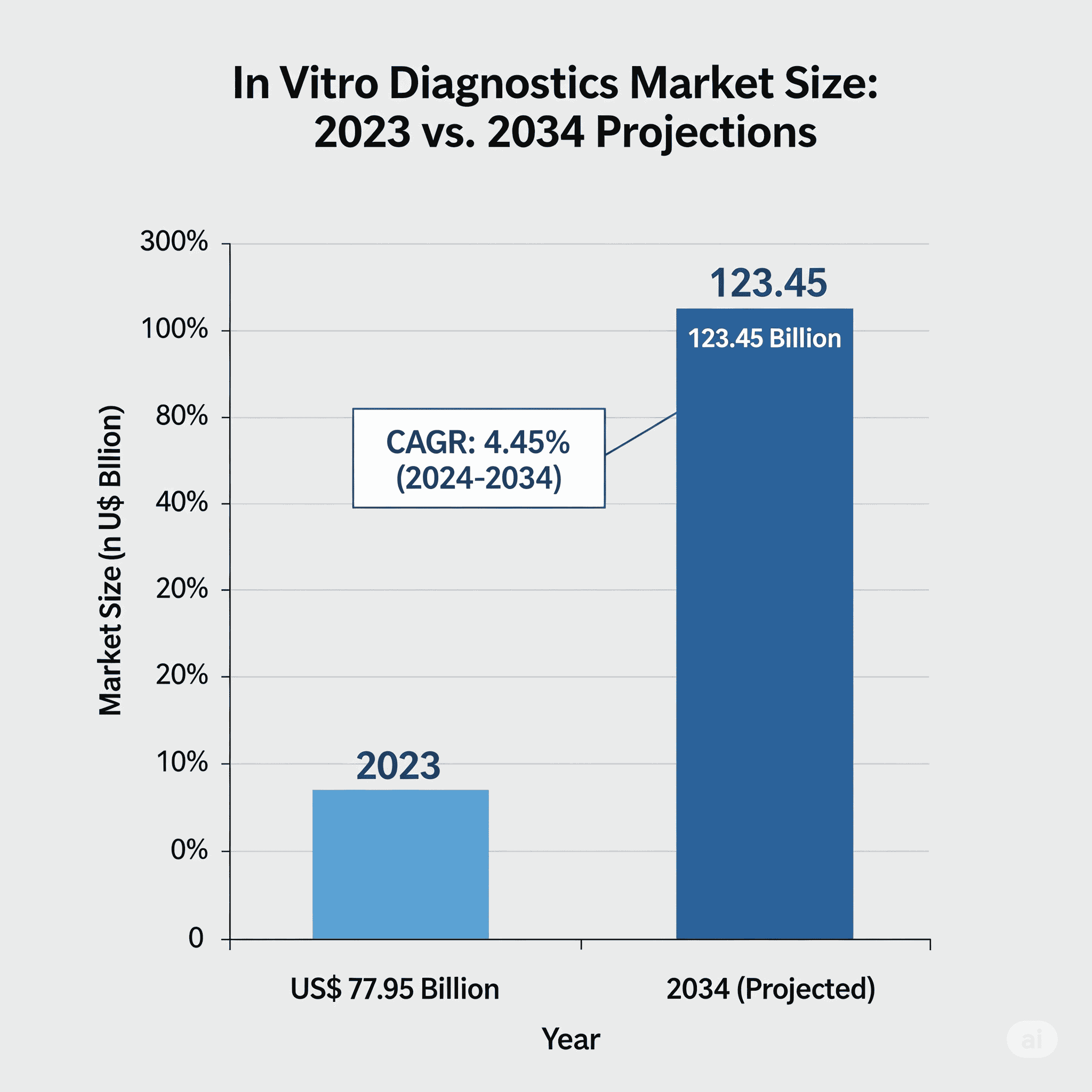

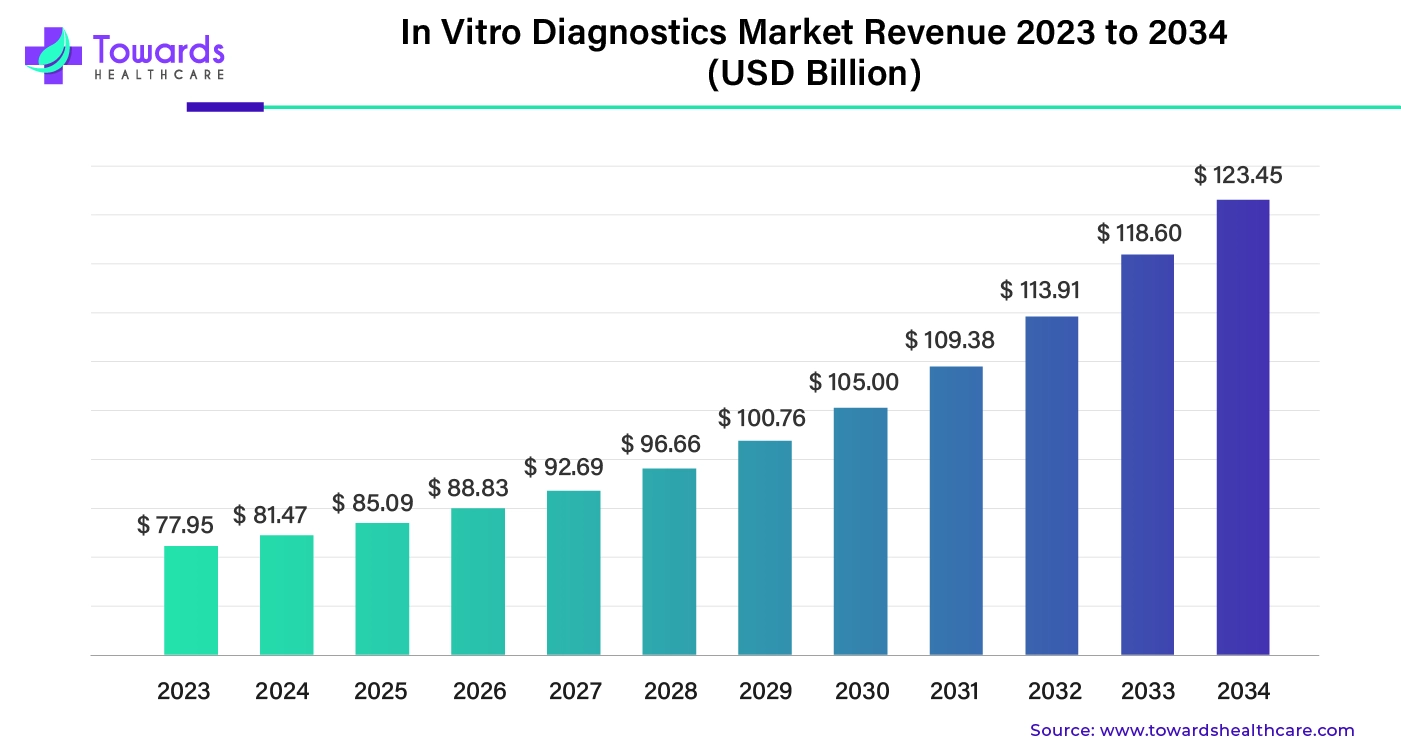

The global in vitro diagnostics market is witnessing strong growth, with a projected market size of USD 123.45 billion by 2034, rising from USD 77.95 billion in 2023. With a compound annual growth rate (CAGR) of 4.45% between 2025 and 2034, the market is being driven by a surge in chronic diseases, rising demand for faster and more accurate diagnostics, and significant technological advancements, especially in AI-powered diagnostics.

Key Market Trends (2024–2034)

Rising Demand for Point-of-Care Testing (POCT):

Increased use in home settings and emergency care due to faster results and convenience.

Growing Role of AI and Automation:

AI-driven diagnostic platforms are enhancing accuracy, especially in pathology and molecular diagnostics.

Expansion in Infectious Disease Testing:

Post-COVID-19 focus remains strong, with growing demand for tests for HIV, hepatitis, and flu.

Shift Towards Personalized Medicine:

Demand for molecular and genetic testing is rising, supporting tailored treatment plans.

High Adoption in Emerging Markets:

India, China, and Southeast Asia are experiencing rapid diagnostic infrastructure growth.

Sements Highlights

By Product

Reagents dominated the market in 2023

-

Most essential IVD component

-

Includes kits, buffers, enzymes, antibodies, etc.

-

High demand due to accuracy, reliability, and clinical approval

By Technology

Immunoassay held the largest market share in 2023

-

Highly used in diagnostics, drug monitoring, and detection

-

Offers high throughput, specificity, and sensitivity

By Application

Infectious Diseases was the top application segment in 2023

-

High global disease burden: malaria, HIV, TB, hepatitis, etc.

-

Rapid diagnostic needs drive demand for IVD

By End-use

Hospitals dominated end-use in 2023

-

High patient footfall and in-house labs

-

Equipped for continuous testing and disease monitoring

-

Elderly and chronic patients drive demand

Regional Segments

North America

- Size & Share: Valued at ~USD 51.4 billion in 2024, holding roughly 43% global share

- Growth Outlook: Expected to grow to ~USD 85.2 billion by 2034, at a CAGR of 5.2–5.23% between 2025 and 2034

- Key Drivers: Advanced healthcare infrastructure, high chronic/infectious disease prevalence, strong R&D and reimbursement policies

Europe

- Size & Share: Estimated at USD 27.5 billion in 2024, accounting for about 25–38% of global revenue depending on source estimates

- Growth Outlook: Forecast to reach USD 38.6 billion by 2030, expanding at ~5.9% CAGR

- Key Drivers: Stringent EU IVDR regulation, aging populations, rising adoption of molecular diagnostics and POC testing in countries like Germany and the UK

Asia‑Pacific

- Size & Share: Approximately USD 21.8 billion in 2024, with strong growth trajectory

- Growth Outlook: Forecast to reach USD 41.46 billion by 2034, growing at ~6.6% CAGR (2025–2034)

- Key Drivers: Expanding healthcare infrastructure, growing disease burden, government initiatives (e.g., India’s National Health Mission), and increasing access in rural areas

Key Insights

North America leads the IVD market with 43% market share in 2023 and is projected to reach USD 85.21 billion by 2034.

Asia Pacific is the fastest-growing region with a CAGR of 6.64%, fueled by rising disease burden and healthcare investments.

Europe will expand steadily at 5.93% CAGR, driven by strong adoption of point-of-care (POC) technologies and rising healthcare demands.

Top Companies in the IVD Market

BD

F. Hoffmann-La Roche Ltd.

Qiagen

Siemens Healthineers AG

Agilent Technologies, Inc.

Bio-Rad Laboratories, Inc.

QuidelOrtho Corporation

Charles River Laboratories

Abbott

Danaher Corporation

bioMérieux SA

Quest Diagnostics Incorporated

Sysmex Corporation

FAQs

1. What is in vitro diagnostics (IVD)?

In vitro diagnostics refers to tests performed outside the human body (in a lab, not inside the body like in vivo), using samples like blood or saliva to detect diseases, conditions, or infections.

2. Why is the IVD market growing so fast?

The rise in chronic illnesses, need for faster diagnostics, increased health awareness, and advancements in AI-based testing are major factors boosting the demand for IVD solutions.

3. Which region dominates the global IVD market?

North America holds the largest share due to its advanced healthcare infrastructure, presence of key industry players, and significant investment in diagnostics and research.

4. What is point-of-care testing (POCT), and why is it important?

POCT refers to diagnostic testing done at or near the patient’s location, rather than in a central lab. It’s critical for quick decision-making, especially in emergency settings or remote areas.

5. How is AI transforming the in vitro diagnostics industry?

AI enhances data analysis, enables early detection, and supports accurate diagnosis by analyzing complex test data faster and more efficiently. Companies like Roche and PathAI are already leveraging AI in diagnostics.

Check out below

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5229

Access our exclusive, data-rich dashboard dedicated to the diagnostics sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com