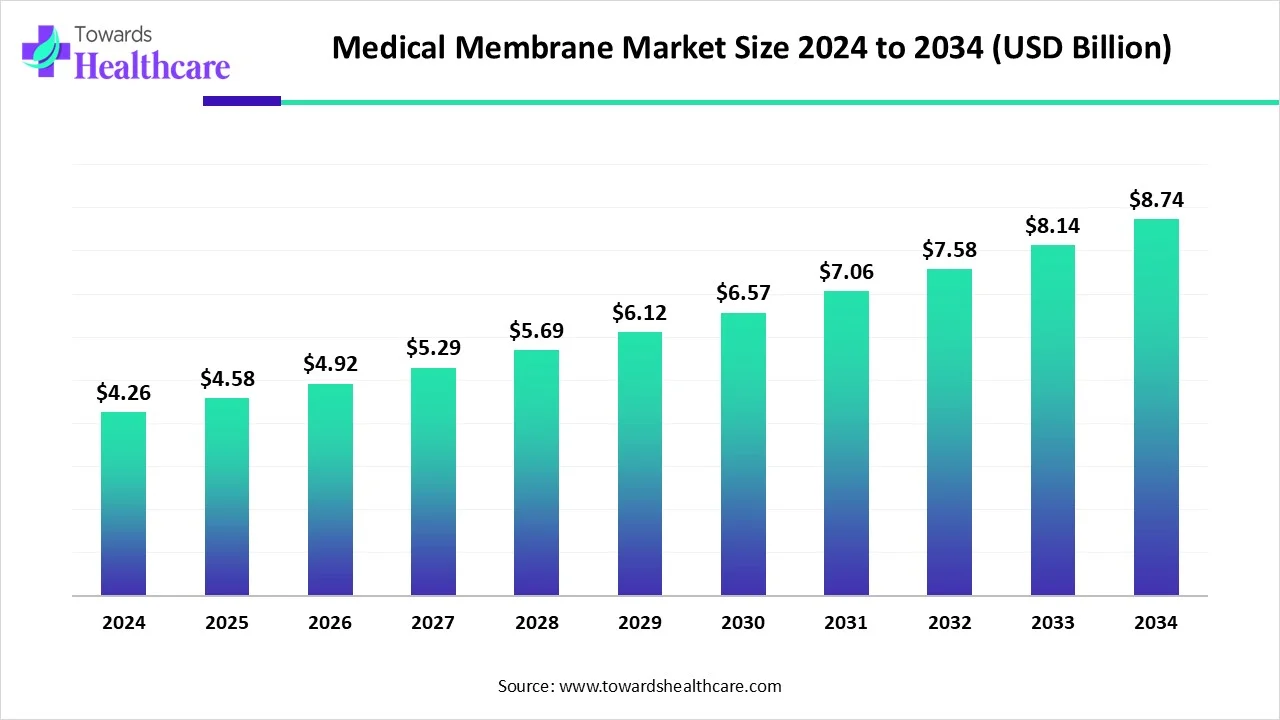

The global medical membrane market was valued at USD 4.26 billion in 2024 and is expected to grow to USD 4.58 billion in 2025. Over the next decade, the market is projected to reach USD 8.74 billion by 2034, representing a CAGR of 7.45% between 2025 and 2034. This steady growth reflects the increasing reliance on membrane technologies in medical and biopharmaceutical applications, driven by rising demand for sterile filtration, drug safety, and advanced biomanufacturing processes.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/5657

Regionally, Europe held the largest share of the market in 2024, thanks to well-established healthcare infrastructure, pharmaceutical R&D hubs, and strong regulatory frameworks that ensure high-quality medical products. North America is expected to experience significant growth during the forecast period, fueled by advancements in healthcare technologies, increased investment in research, and the expanding demand for innovative membrane solutions in hospitals and laboratories.

The market is dominated by leading players such as Amniox Medical, Asahi Kasei, Danaher Corporation, Hangzhou Cobetter Filtration Equipment, Koch Membrane Systems, Merck Group, Mann Hummel, Sartorius AG, W. L. Gore & Associates, and 3M Company, which are driving innovation, strategic collaborations, and funding initiatives to enhance membrane performance and broaden applications.

Medical Membrane Market Size (2024 – 2034)

1. 2024 Market Size:

Valued at USD 4.26 billion.

Represents a baseline reflecting current adoption of medical membranes in pharmaceutical, biotechnological, and medical device applications.

Growth supported by increased demand for sterile filtration, drug purification, and biopharmaceutical manufacturing.

2. 2025 Market Size:

Estimated at USD 4.58 billion, indicating a year-on-year growth of approximately 7.5%.

Growth driven by ongoing technological advancements, rising regulatory requirements for safety and sterility, and expansion of healthcare and pharmaceutical infrastructure globally.

3. 2034 Projected Market Size:

Expected to reach USD 8.74 billion.

Reflects more than double the 2024 value, showing long-term growth potential.

Growth will be fueled by adoption of advanced membrane technologies, rising biopharmaceutical production, and increasing global investments in healthcare innovation.

Key Market Trends

1. Rising Investments in Membrane Technology

Biotechnology and pharmaceutical startups are receiving substantial funding to develop membrane-permeable and orally accessible therapies.

For instance, in February 2024, Insamo secured $12 million in initial financing to advance cyclic peptide drug research. Similarly, TeraPore Technologies raised $10 million in March 2023 to expand its nanofiltration systems for biomanufacturing.

2. Technological Advancements Driving Growth

Nanofiltration and ultrafiltration systems are improving the efficiency, precision, and reliability of medical membranes. These technologies are critical in biomanufacturing, drug purification, and sterile filtration, where contamination control is essential.

3. Strategic Focus on High-Performance Materials

Companies are innovating with high-performance polymers like polysulfone and polyether sulfone, which offer durability, chemical resistance, and consistent filtration efficiency. This focus ensures membranes meet the stringent demands of modern medical and pharmaceutical applications.

4. Expansion of R&D and Biopharmaceutical Applications

Growth in biologics, personalized medicine, and injectable therapies is pushing the demand for advanced membrane technologies that can handle delicate biomolecules and ensure sterility.

Membrane technology is increasingly integral to drug delivery systems, tissue regeneration, artificial organs, and other critical medical procedures.

5. Regional Growth Patterns

Europe’s leadership in the market is tied to strong pharmaceutical manufacturing hubs, while North America’s growth is supported by healthcare modernization, adoption of advanced filtration systems, and increased regulatory compliance for safety and quality.

Role of AI in the Medical Membrane Market

Design and Optimization: AI is transforming the design and optimization of medical membranes, especially in Reverse Osmosis (RO) and Ultrafiltration (UF) systems. AI algorithms can simulate membrane performance, predict fouling patterns, and optimize operational parameters to improve efficiency.

Real-Time Monitoring and Control: Combining AI with sensor technologies enables real-time monitoring of membrane performance. This allows automated adjustments in flow, pressure, and filtration parameters, ensuring consistent product purity and operational efficiency.

Material Development with AI: Advanced AI methods like Generative Adversarial Networks (GANs) are being explored to design new membrane materials with improved biocompatibility, durability, and filtration efficiency.

Future Potential: The growth of AI in membrane technology depends on interdisciplinary collaboration between material scientists, AI experts, and biopharmaceutical engineers. This will help overcome current limitations in membrane development, operational optimization, and predictive maintenance.

Market Dynamics

1. Drivers

Stringent Regulations for High-Purity Products

Pharmaceutical and biopharmaceutical industries require high-purity drugs, vaccines, and biological products.

Medical membranes are critical for sterility and contamination control, ensuring compliance with regulatory standards.

Increasing focus on safety, effectiveness, and purity of medications is directly driving demand for advanced medical membranes.

Growing Pharmaceutical and Biopharmaceutical Industry

Expansion of drug production, biologics, and injectable therapies necessitates reliable filtration systems.

The rising prevalence of chronic diseases and aging populations is increasing the consumption of high-purity medical products.

2. Restraints

High Cost of Membrane Technologies

Advanced membranes involve high research, development, and manufacturing costs.

High upfront costs limit adoption, particularly in regions with lower healthcare budgets.

This pricing barrier affects the accessibility and commercialization of medical membrane-based solutions.

3. Opportunities

Advanced Medical Treatments

Growth in organ transplants, wound care, biopharmaceutical production, and infusion therapies is creating higher demand for precise and efficient membranes.

Factors like aging populations, rising healthcare spending, and better access to modern medical facilities are boosting the need for high-performance membranes.

Regional Segments

1. Europe – Market Leader

Market Share: Europe held the largest share of the global medical membrane market in 2024.

Key Drivers:

Aging population and increasing prevalence of chronic diseases such as diabetes, hypertension, and end-stage renal disease (ESRD) drive demand for dialysis membranes and high-purity filtration systems.

Strong regulatory standards ensure high-quality and safe medical and pharmaceutical products, boosting the use of advanced membranes.

Pharmaceutical and biotech hubs in Germany, Switzerland, and the UK enhance adoption of sophisticated membrane technologies.

Country-Specific Insights:

◉ Germany:

Largest medical membrane market in Europe.

Over 600 pharmaceutical companies employing 140,000 people.

High demand for water treatment, sterilization, and pharmaceutical filtration due to environmental protection and human health initiatives.

◉ UK:

Pharmaceutical sector contributes over £15 billion in gross value added (GVA) annually, supporting 70,000 jobs.

Home to global pharma giants GSK and AstraZeneca.

Strong research ecosystem for drug trials and biopharma research (£4 billion yearly GVA) supports advanced membrane adoption.

Trends:

Focus on high-purity pharmaceutical filtration.

Growing need for IV infusion and sterile filtration systems due to hospital-based care and aging population.

2. North America – Rapid Growth Region

Market Outlook: Significant growth expected over the forecast period.

Key Drivers:

High investment in R&D and medical technology innovations.

Stringent regulatory frameworks for air, water, and drug purity in hospitals and labs.

Rising chronic diseases and an aging population increases demand for advanced membranes in dialysis, drug purification, and sterile filtration.

Country-Specific Insights:

◉ United States:

Increased focus on specialty drug research and development for complex or rare medical conditions.

50 new drugs approved in 2024, along with 18 biosimilars for 8 reference products.

Growing biopharmaceutical production drives demand for ultrafiltration, nanofiltration, and high-performance membranes.

◉ Canada:

Support from Innovative Medicines Canada (IMC) ensures advanced treatments reach the healthcare system.

Legislative backing encourages research, development, and distribution of membrane-based filtration systems.

Trends:

Adoption of ultrafiltration for plasma processing, blood separation, and fermentation recovery.

Increased use of membranes for sterile drug manufacturing and water purification in medical facilities.

3. Asia-Pacific – Fastest-Growing Market

Growth Outlook: Estimated to be the fastest-growing region during the forecast period.

Key Drivers:

Expanding medical device and pharmaceutical manufacturing due to lower labor costs and supportive regulations.

Increasing healthcare access and rising awareness of advanced medical treatments.

Rapid economic growth in countries like China, India, and Japan boosts demand for medical membranes.

Country-Specific Insights:

◉ China:

228 new drug applications approved by the China NMPA in 2024, including traditional medicines, therapeutic biological products, and chemical drugs.

Focus on concurrent development, registration, and launch of drugs for new indications.

Strong domestic demand for membrane-based filtration in pharmaceutical production.

◉ India:

CDSCO approved 19 new drugs in 2024, including first-in-class and next-generation drugs.

Prominent companies like Sun Pharma, Dr. Reddy’s, Lupin, Cipla, Zydus Life Sciences are partnering with global pharma firms.

Growing domestic pharmaceutical production and foreign drug launches increase membrane consumption.

Trends:

Expansion of IV infusion and sterile filtration systems in hospitals.

Manufacturers are setting up local production facilities for membranes to meet regional demand.

4. Other Regions (Middle East & Africa, Latin America)

Growth Outlook: Moderate growth, driven mainly by healthcare infrastructure development and rising pharmaceutical manufacturing.

Key Drivers:

Investments in hospital upgrades and drug manufacturing facilities.

Rising awareness of clean water and sterile drug filtration.

Challenges:

Limited adoption due to high costs of advanced membrane technologies.

Regulatory frameworks are less stringent compared to Europe and North America, which can slow growth.

Segmental Insights

By Material

◉ Polysulfone (PSU) & Polyether Sulfone (PES) Segment

Led the market in 2024.

Advantages: High physical strength, chemical resistance, biocompatibility, and ease of sterilization.

Applications: High-flux and low-flux filters, endotoxin adsorption (PSU), and general pharmaceutical filtration.

◉ Polypropylene (PP) Segment

Expected to witness significant growth during the forecast period.

Advantages: Hydrophobic, chemically stable, compatible with organic solvents, tough, long-lasting, non-toxic, and resistant to breakage.

Applications: Gas filtration in medical devices, infusion solvent pre-filters, laboratory uses.

By Technology

◉ Nanofiltration (NF)

Dominated the market in 2024.

Advantages: Room-temperature separation, precise filtration, enhances transfer of active substances in pharmaceutical operations.

Applications: Purification, refinement, and improving quality of pharmaceutical products.

◉ Ultrafiltration (UF)

Expected to be the fastest-growing segment.

Applications:

Separating process streams in pharmaceuticals

Waste stream treatment for safe disposal/reuse

Providing purified water for uniform product quality

Recovery of fermentation broths for antibiotics production

Plasma processing and blood product separation in healthcare

By Application

◉ Pharmaceutical Filtration

Dominated the market in 2024.

Importance: Ensures drug safety, purity, and compliance with regulatory standards.

Process: Separation of particles, liquids, or gases to sterilize and purify drugs.

◉ IV Infusion & Sterile Filtration

Expected to grow rapidly in the forecast period.

Applications: Parenteral nutrition, drug administration, volume substitution, and patient infusions.

Trends: Shift from intravenous to subcutaneous administration for reduced infusion times and improved patient convenience.

Top Companies in the Medical Membrane Market

◉ Amniox Medical

Focuses on placental tissue-based allografts and regenerative therapies.

Integrates membrane technologies in wound care and surgical applications to enhance biocompatibility and therapeutic outcomes.

Known for leveraging advanced biological membranes for clinical treatments.

◉ Asahi Kasei

A global leader in membrane manufacturing for pharmaceutical and medical applications.

Develops ultrafiltration and nanofiltration membranes used in water purification, sterile filtration, and drug manufacturing.

◉ Danaher Corporation

Provides innovative filtration and life sciences solutions, including medical membranes for sterile filtration, bioprocessing, and laboratory applications.

Focuses on precision-engineered membrane systems to ensure compliance with pharmaceutical and biotech regulations.

◉ Hangzhou Cobetter Filtration Equipment

Specializes in industrial and medical filtration equipment, including membranes for biotechnology and pharmaceutical applications.

Offers customized membrane solutions for laboratories and hospitals.

◉ Koch Membrane Systems

Offers ultrafiltration, nanofiltration, and reverse osmosis membranes.

Focuses on bioprocessing, pharmaceutical water purification, and high-performance filtration systems.

Strengths include high flux and low fouling membranes, designed for longevity and high operational efficiency.

◉ Merck Group

Supplies membranes and filtration systems for pharmaceuticals, biotech, and medical research.

Known for high-performance ultrafiltration and nanofiltration membranes, supporting both research labs and industrial-scale drug production.

◉ Mann Hummel

Primarily recognized for filtration solutions in healthcare and industrial applications.

Provides high-efficiency membranes for medical devices, biopharmaceutical filtration, and water purification.

◉ Sartorius AG

Global leader in biopharmaceutical and lab filtration systems.

Provides membrane products for sterile filtration, ultrafiltration, and nanofiltration, serving drug manufacturers, laboratories, and hospitals.

Focuses on quality, consistency, and regulatory compliance in medical membranes.

◉ W. L. Gore & Associates

Develops high-performance PTFE and specialty membranes for medical, biotech, and pharmaceutical industries.

Strengths include durability, chemical resistance, and biocompatibility.

Applications include drug purification, sterile filtration, and respiratory medical devices.

◉ 3M Company

Offers advanced filtration solutions for sterile applications, water purification, and laboratory processes.

Known for membrane technology in IV infusion, sterile air filtration, and biopharmaceutical production.

Recent Developments and Innovations

◉ Amazon Filters – December 2024

Launched a high-temperature vent filter for pharmaceuticals and biotech.

Key Features:

Sterilizes air and process gases to remove microbiological and particle contamination.

Extends filter lifespan, reduces downtime, lowers operating costs, and minimizes frequent filter replacement.

Impact: Strengthens filtration reliability in high-flow pharmaceutical and biotech processes, ensuring compliance with strict regulatory standards.

◉ Medtronic plc – September 2024

Introduced the VitalFlow™ ECMO system, a flexible extracorporeal membrane oxygenation (ECMO) system.

Key Features:

One-system solution for performance and simplicity.

Bridges the gap between intra-hospital transport and bedside treatment.

Offers clinicians a smarter and more intuitive ECMO experience.

Impact: Enhances membrane-based life support applications, improving patient outcomes in critical care.

◉ Asahi Kasei – April 2024

Began selling a membrane system for Water for Injection (WFI).

Purpose: Provides sterile water critical for injection preparation in pharmaceutical production.

Impact: Supports regulatory compliance for high-purity pharmaceutical manufacturing and addresses growing demand in hospitals and drug production facilities.

Top 5 Questions Searched for

1. What is the medical membrane market size and growth?

The market was USD 4.26B in 2024, expected to reach USD 4.58B in 2025, and projected to hit USD 8.74B by 2034, growing at a CAGR of 7.45%.

2. What materials are commonly used in medical membranes?

Polysulfone (PSU) & Polyether Sulfone (PESU) dominate due to strength, chemical resistance, and biocompatibility. Polypropylene (PP) is growing fast because of chemical stability and versatility in filtration. Other materials include PVDF, PTFE, and Acrylics.

3. Which technologies are prominent in medical membranes?

Nanofiltration leads the market for purification and refinement. Ultrafiltration is the fastest-growing, widely used in pharmaceuticals for plasma processing, blood product separation, and water purification.

4. What are the main applications of medical membranes?

Pharmaceutical filtration dominates, ensuring drug sterility and high quality. IV infusion & sterile filtration is rapidly growing due to increased use in infusion therapies and subcutaneous drug delivery. Other applications include drug delivery, bio-artificial processes, and hemodialysis.

5. Which regions are leading the medical membrane market?

Europe holds the largest share due to advanced healthcare and aging population. North America is growing with high R&D investment and chronic disease prevalence. Asia Pacific is the fastest-growing market, driven by low manufacturing costs, expanding healthcare infrastructure, and rising demand in China, India, and Japan.

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5657

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest