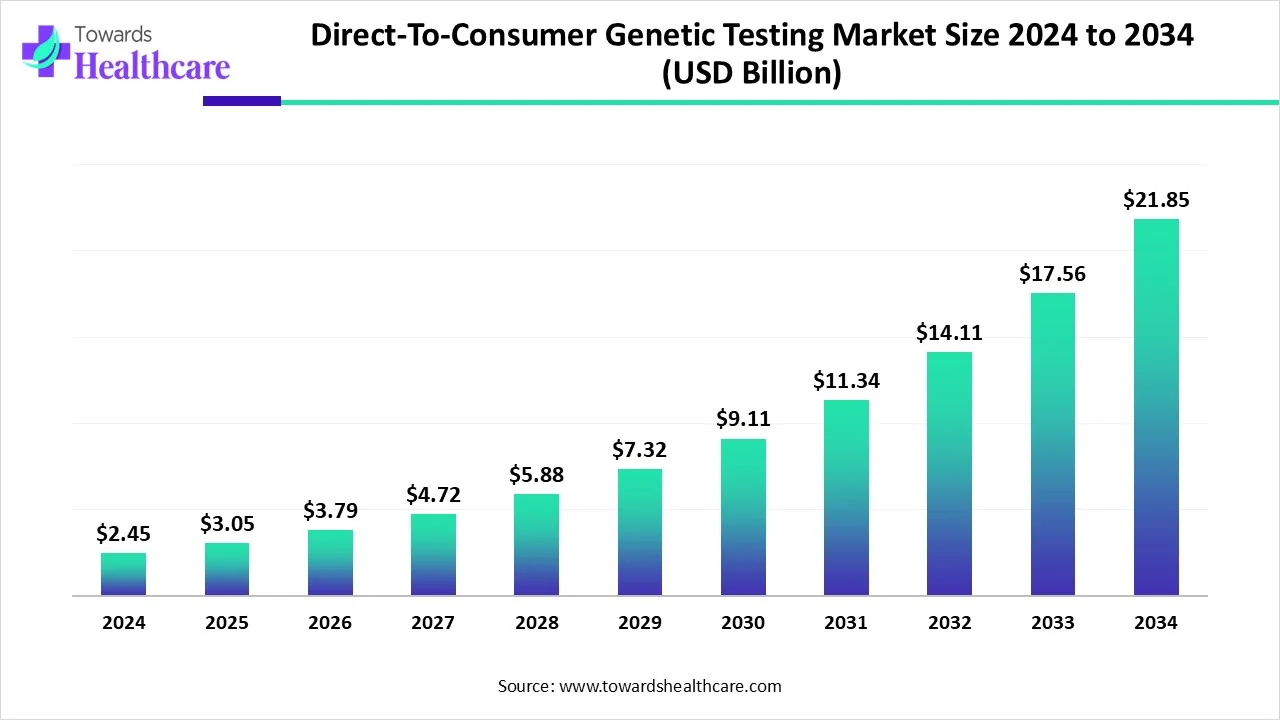

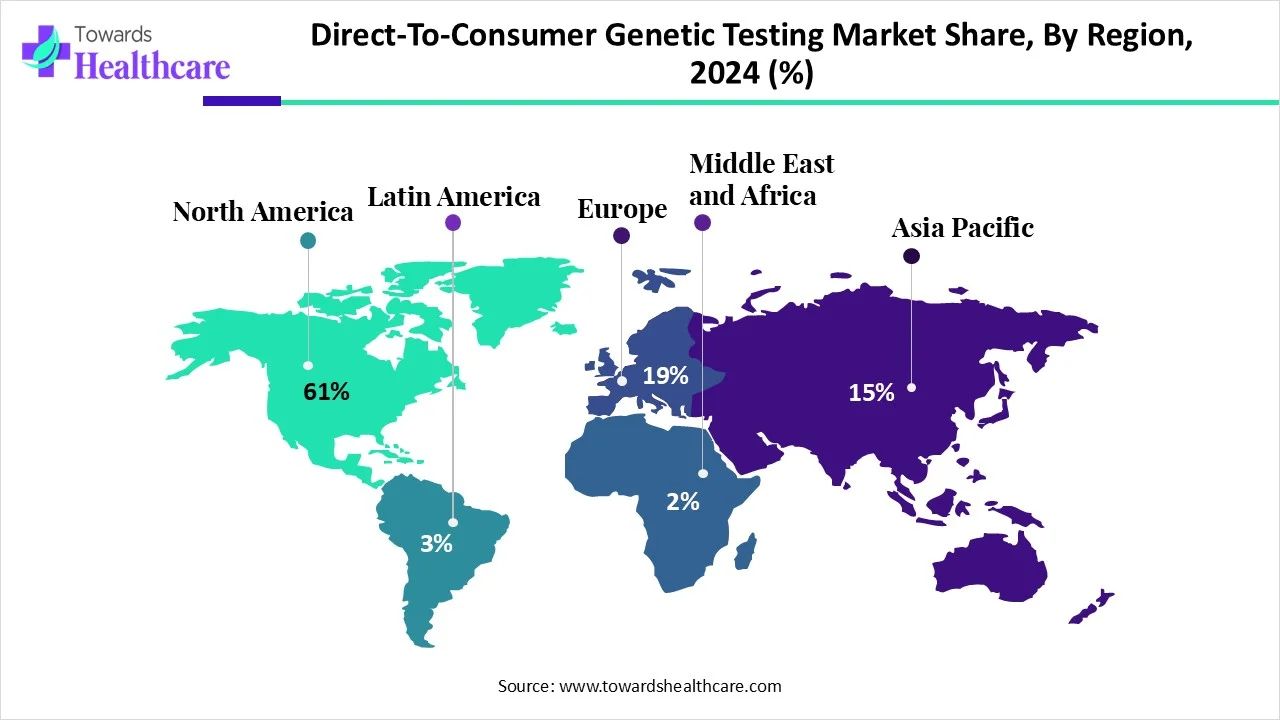

The direct-to-consumer genetic testing market is projected to grow from USD 2.45 billion in 2024 to USD 21.85 billion by 2034, with a CAGR of 24.44%. North America dominated in 2024 with 61% market share, while Europe is projected to experience the fastest growth due to rising awareness and healthcare investments.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5660

The Direct-to-Consumer Genetic Testing (DTC-GT) market enables individuals to access genetic insights directly from companies without going through conventional healthcare systems. These tests use biological samples such as saliva, blood, or cheek swabs, which consumers collect themselves and send to DTC-GT providers.

The companies then analyze the DNA to provide insights into:

Genetic health risks (e.g., cancer, cardiovascular disorders)

Pharmacogenomics (drug response based on genetics)

Predictive health analysis (risk assessment for single-gene and multifactorial disorders)

Nutrigenomics (personalized diet based on genetics)

The increasing prevalence of cancer and genetic disorders is driving market growth. For instance, in the U.S., the total number of cancer-related deaths in 2024 is rising, creating demand for early diagnosis and preventive healthcare through DTC-GT.

Market Size and Forecast

| Year | Market Size (USD Billion) | CAGR 2025–2034 |

|---|---|---|

| 2024 | 2.45 | – |

| 2025 | 3.05 | 24.44% |

| 2034 | 21.85 | 24.44% |

Insights:

The massive CAGR of 24.44% indicates the market is highly dynamic, driven by technological innovations, AI integration, and increasing consumer awareness.

Online platforms and OTC access are expanding adoption globally.

Growth is concentrated in North America but emerging strongly in Europe, Asia Pacific, and Latin America due to advancing healthcare infrastructure and government support.

Market Trends

Collaborations and Partnerships:

◉ May 2025: Targeted Genomics LLC partnered with OraSure Technologies to launch at-home celiac disease testing using FDA-cleared saliva collection devices. This shows innovation in OTC testing and regulatory-compliant home solutions.

◉ April 2025: Ginkgo Bioworks collaborated with Aura Genetics to deploy Reconfigurable Automation Cart (RAC) systems for high-throughput genetic analysis, highlighting automation and scalability in genetic testing.

Rise of Personalized Wellness:

◉ Genetic-based wellness, such as nutrigenomics for mental health and diet, is now integrated into holistic health assessments (e.g., Earth’s Edge Wellness).

◉ Personalized treatment planning is becoming mainstream, leveraging DNA to tailor therapy and nutrition.

Technological Advancements:

◉ Whole Genome Sequencing (WGS) dominates the market due to affordability, accuracy, and integration with AI/ML.

◉ Targeted Analysis is growing because it is rapid, cost-effective, and easier to interpret, making it suitable for preventive testing.

Digital Distribution Platforms:

◉ Online platforms dominate due to convenience, ease of access, and wider test availability.

◉ OTC platforms are rapidly expanding, making genetic testing more accessible to consumers who prefer home testing.

Role of AI in DTC Genetic Testing

◉ Data Analysis and Interpretation:

AI processes complex genetic datasets, identifying patterns and variants that are difficult for humans to analyze.

Predictive modeling using AI improves risk assessment for genetic diseases.

◉ Personalized Treatment:

AI assists in creating tailored treatment plans, improving outcomes and reducing side effects for conditions like cancer, cardiovascular diseases, and neurological disorders.

◉ Drug Development and Pharmacogenomics:

AI identifies drug-gene interactions, allowing companies to develop personalized drugs based on genetic profiles.

◉ Automation and Workflow Efficiency:

AI, combined with robotic systems like Ginkgo Bioworks’ RAC, accelerates high-throughput genetic testing, reducing time and human error.

◉ Integration with Predictive Healthcare:

AI helps predict potential diseases based on genome analysis, enabling preventive healthcare and personalized interventions.

Market Dynamics (Ultra In-Depth)

Drivers

Rising Awareness Among Consumers

◉ Awareness campaigns and healthcare programs educate populations on genetic disorders and early diagnosis.

◉ Increased understanding of personalized medicine and predictive health insights drives adoption of DTC testing.

◉ Growth in conditions like cancer and hereditary disorders pushes consumers toward self-initiated genetic testing.

Technological Advancements in Genetic Testing

◉ Whole Genome Sequencing (WGS) and Targeted Analysis make testing faster, affordable, and accurate.

◉ Integration with AI/ML enhances data interpretation, predictive modeling, and treatment recommendations.

Early Diagnosis and Preventive Healthcare

◉ Rising cancer rates in the U.S. and globally increase the need for genetic-based early detection.

◉ Early identification of disease risk enables consumers to adopt preventive lifestyle measures or targeted treatment plans.

Increasing Personalized Treatment Approaches

◉ Use of genetic insights to customize treatments, diets, and wellness plans.

◉ Reduces side effects, improves effectiveness, and promotes patient satisfaction.

Restraints

Privacy and Data Security Concerns

◉ Massive collection of sensitive genetic data increases risk of hacking and breaches.

◉ Regulatory compliance and ethical concerns affect consumer confidence in DTC-GT companies.

Regulatory Challenges

◉ Variations in national and international regulations on DTC testing limit cross-border expansion.

◉ Some regions require healthcare professional involvement, restricting fully OTC models.

Opportunities

Rising Demand for Nutrigenomics and Wellness Testing

◉ Growing interest in personalized diets and lifestyle plans based on genetic profiles.

◉ Integration with mental health, fitness, and holistic wellness programs.

Expansion of Online and OTC Platforms

◉ Increased e-commerce and telehealth adoption allow companies to reach wider demographics.

◉ Simplifies sample collection, reporting, and follow-up consultations for consumers.

Government and Institutional Support

◉ Funding for genomics research, awareness campaigns, and early disease screening improves accessibility and affordability.

Top Key Players 2025

1. Ancestry.com LLC

Headquarters: United States

Revenue (2024): >$1.3 billion

Global Reach: 27 million connected users; over 65 billion genealogical and historical records; available in 89 markets worldwide.

Core Services:

◉ Genetic ancestry testing

◉ Health insights and risk assessment (via genetic genealogy)

◉ Family tree building and heritage tracing

Technologies Used:

◉ DNA microarray analysis for ancestry

◉ Integration of whole genome sequencing for deeper insights

Market Position:

◉ Largest consumer DNA network globally

◉ Strong brand recognition in ancestry and heritage-based genetic testing

Recent Developments:

◉ Continuously expanding genealogical database to enhance ancestry and genetic insights

2. 23andMe

Headquarters: United States

Revenue & Acquisition: Purchased by Regeneron Pharmaceuticals in May 2025 for $256 million

Core Services:

◉ Health risk reports for genetic conditions (cancer, cardiovascular disease, etc.)

◉ Carrier status testing for inherited disorders

◉ Pharmacogenomics insights for drug responses

◉ Ancestry and wellness reports

Technologies Used:

◉ SNP microarrays

◉ Integration with AI/ML for predictive health analytics

Market Position:

◉ Leading DTC health and ancestry testing company

◉ Strong focus on ethical use of genetic data and patient privacy

Recent Developments:

◉ Acquisition ensures secure handling of customer data

◉ Expansion plans for AI-driven personalized treatment recommendations

3. Labcorp Holdings, Inc.

Headquarters: United States

Revenue (2024): $13.01 billion (Full-year), $3.33 billion (Q4 2024)

Core Services:

◉ Comprehensive genetic testing for diagnostics and research

◉Drug development laboratory services

◉ High-throughput genomics services

Technologies Used:

◉ Whole genome sequencing

◉ Targeted genetic panels

◉ High-throughput automation platforms

Market Position:

◉ Major laboratory service provider; extensive expertise in clinical diagnostics and genomic research

◉ Serves hospitals, healthcare providers, and DTC customers indirectly

Recent Developments:

◉ Scaling up services to integrate AI and robotics for faster testing

◉ Focus on expanding preventive and predictive genetic testing services

4. Genesis HealthCare

Headquarters: United States

Core Services:

◉ Consumer-focused genetic testing for wellness and disease risk

◉ Screening for inherited disorders

◉ Nutrigenomics and personalized health recommendations

Technologies Used:

◉ DNA microarrays

◉ Targeted analysis for specific conditions

Market Position:

◉ Known for wellness-oriented DTC genetic testing

◉ Competes with larger companies by offering specialized, niche services

5. Family Tree DNA

Headquarters: United States

Core Services:

◉ Ancestry and genealogical testing

◉ Carrier status and health risk reports

◉ Family lineage tracing

Technologies Used:

◉ SNP-based testing

◉ Mitochondrial DNA and Y-DNA testing for paternal/maternal lineage

Market Position:

◉ Strong reputation in genealogy-focused genetic services

◉ Caters to consumers interested in ancestry more than health diagnostics

6. Myriad Genetics Inc.

Headquarters: United States

Core Services:

◉ Cancer risk assessment (BRCA1/BRCA2, other hereditary cancers)

◉ Screening for rare genetic disorders

◉ Pharmacogenomics and predictive testing

Technologies Used:

◉ Whole genome sequencing

◉ SNP analysis and targeted gene panels

Market Position:

◉ Leader in clinical-grade genetic testing for hereditary cancer and rare diseases

◉ Focused on healthcare provider partnerships alongside DTC offerings

7. EasyDNA

Headquarters: Global (operates in multiple countries)

Core Services:

◉ Rapid at-home DNA testing for ancestry, health, and paternity

◉ Carrier testing for inherited disorders

Technologies Used:

◉ Saliva and cheek swab collection

◉ Online reporting systems for easy consumer access

Market Position:

◉ Specialized in convenient, fast, home-based testing

◉ Expanding in OTC market

8. Living DNA Ltd.

Headquarters: United Kingdom

Core Services:

◉ Ancestry testing with global sub-regional breakdowns

◉ Health insights and wellness recommendations

Technologies Used:

◉ Whole genome sequencing

◉ Targeted analysis for ancestry and health

Market Position:

◉ Premium ancestry-focused DTC provider with emerging health testing services

Regional Segments

1. North America (Largest Share 61%, 2024)

Key Countries: U.S., Canada

Drivers:

◉ Advanced healthcare infrastructure

◉ Skilled workforce and high-tech laboratories

◉ Government and insurance support for preventive healthcare

U.S. Trends:

◉Expansion of DTC companies

◉ Integration of AI and advanced sequencing for predictive testing

Canada Trends:

◉Rising awareness and adoption

◉Increase in both private and public genetic testing services

2. Europe (Fastest-Growing Region)

Key Countries: Germany, UK, France, Italy, Spain, Sweden, Denmark, Norway

Drivers:

◉Awareness campaigns for early disease diagnosis

◉Growth of genomic research and personalized medicine

◉Technologically advanced healthcare sector

Germany Trends:

◉Increased testing due to rising genetic disorders and preventive healthcare adoption

UK Trends:

◉Growing consumer interest in health management

◉Use of advanced sequencing technologies in DTC testing

3. Asia Pacific (Emerging Growth)

Key Countries: China, India, Japan, South Korea, Thailand

Drivers:

◉Rapidly developing healthcare infrastructure

◉Increasing adoption of advanced diagnostics and sequencing technologies

China Trends:

◉High-throughput genetic screening and precision medicine adoption

India Trends:

◉Government support to make tests affordable

◉Rising prevalence of genetic disorders and growing awareness

4. Latin America (Significant Growth)

Key Countries: Brazil, Mexico, Argentina

Drivers:

◉Rising prevalence of genetic disorders

◉Development of personalized medicine

◉Government initiatives for early screening and awareness

Mexico Trends:

◉Rare Disease Patient Registry shows 71.53% of patients recognized potential genetic origin; 27.77% underwent testing

Argentina Trends:

◉Congenital anomalies affect 1.7% of newborns

◉Around 6,500 clinical laboratories (1,000 public, 5,500 private)

5. Middle East & Africa (MEA – Lucrative Growth)

Key Countries: South Africa, UAE, Saudi Arabia

Drivers:

◉Increasing awareness of genetic disorders

◉Rising research and technological adoption

◉Collaborations between industry and academic institutions

Growth Drivers:

◉Development of advanced DTC platforms

◉Government investments supporting genomic medicine

Recent Developments in DTC Genetic Testing Market (Deep Dive)

1. Targeted Genomics & OraSure Technologies Collaboration – May 2025

Partnership: Targeted Genomics LLC (developer of GlutenID, first FDA-cleared celiac disease DTC test) teamed up with OraSure Technologies, Inc. (manufacturer of ORAcollect·Dx, the only FDA-cleared saliva collection device for OTC).

Significance:

◉Enables at-home celiac genetic testing for consumers without visiting clinics.

◉Expands the OTC genetic testing market, which is growing rapidly alongside online DTC platforms.

◉Enhances user convenience, reducing dependency on traditional healthcare facilities.

Impact on Market:

◉Increases adoption of personalized preventive healthcare.

◉Boosts consumer trust in FDA-cleared, home-based testing solutions.

2. Ginkgo Bioworks & Aura Genetics Collaboration – April 2025

Partnership: Ginkgo Bioworks deployed its Reconfigurable Automation Cart (RAC) system at Aura Genetics’ new 22,000 sq. ft high-throughput facility at UPS Healthcare Labport, Louisville, KY.

Significance:

◉Introduces automation and high-throughput capabilities for large-scale genetic testing.

◉Supports rapid processing of samples, enhancing scalability for DTC providers.

Impact on Market:

◉Reduces turnaround time for genetic analysis.

◉Improves accuracy and efficiency of predictive and nutrigenomics testing.

3. 23andMe Acquisition by Regeneron Pharmaceuticals – May 2025

Deal Details: 23andMe purchased for $256 million along with its genetic samples and data.

Significance:

◉Ensures protection of customer genetic data with high standards of privacy, ethical oversight, and data security.

◉Opens opportunities to integrate AI-based health insights and precision medicine.

Impact on Market:

◉Strengthens consumer trust in data privacy.

◉Positions 23andMe to expand health-focused genetic testing, beyond ancestry.

4. Nutrigenomic Insights in Mental Health Care – May 2025

Development: Earth’s Edge Wellness integrated genetic-based nutrigenomic testing into individualized mental health care at Las Vegas and Laguna Beach centers.

Significance:

◉Merges psychological, energetic, and genetic assessments for personalized care.

◉Offers unique care plans based on individual cellular expression.

Impact on Market:

◉Expands the wellness and lifestyle DTC testing segment.

◉Demonstrates the potential for holistic personalized medicine, combining genetic data with mental health and nutrition.

5. Mediclinic Middle East Gut Microbiome Test – May 2025

Development: Introduction of a DTC gut microbiome testing package.

Services Included:

◉Personalized dietary insights

◉Genetic tests for reproductive health, cardiovascular disease, cancer, and other genetic disorders

Significance:

◉Extends DTC testing beyond DNA, covering microbiome analysis for health and wellness.

◉Offers personalized treatment and nutrition recommendations to consumers.

Impact on Market:

◉Supports growth of the preventive and predictive health segment.

◉Increases consumer awareness of holistic genetic and microbiome health management.

6. Molecular You DTC Testing Platform – May 2025

Development: Launch of a comprehensive blood biomarker analysis platform in the U.S.

Services:

◉Precision medicine

◉Predictive and preventive healthcare

◉Wide-ranging biomarker and genetic testing for early disease detection

Significance:

◉Combines genetic testing with advanced biomarker analysis for actionable health insights.

◉Positions Molecular You as a leader in comprehensive preventive medicine.

Impact on Market:

◉Boosts adoption of integrated testing platforms combining genetics, biomarkers, and AI-driven insights.

◉Encourages personalized healthcare plans, driving DTC testing demand.

Segments (Ultra In-Depth)

1. By Test Type

Predictive Testing (Dominant Segment, 2024)

Focus: Identifies genetic predisposition to diseases such as cancer, cardiovascular diseases, diabetes, neurological disorders.

Popularity Reason: Provides consumers with actionable health insights and risk evaluation.

Applications:

Early diagnosis for preventive measures

Personalized health monitoring

Risk assessment for hereditary diseases

Growth Driver: Rising awareness of genetic disorders and preventive healthcare.

Nutrigenomics Testing (Significant Growth)

Focus: Uses genetic information to optimize diet, weight management, and lifestyle choices.

Benefits:

Personalized nutrition plans

Optimizes fitness and wellness strategies

Reduces risk of nutrition-related diseases

Technology: Often combines SNP analysis and AI-driven recommendations.

Growth Driver: Increasing interest in wellness and lifestyle personalization.

Carrier Testing

Focus: Detects recessive genes that could be passed to offspring.

Importance: Helps couples understand risk of congenital or inherited disorders.

Applications: Preconception and prenatal planning.

Others

Pharmacogenomics: Determines drug response based on genetics.

Reproductive health: Assesses fertility-related genetic markers.

Gut microbiome tests: Evaluates gut health for personalized dietary and wellness insights.

2. By Technology Type

Whole Genome Sequencing (Dominant Segment, 2024)

Provides complete DNA analysis for both ancestry and health insights.

Advantages:

Comprehensive coverage of all genes

Integrated with AI/ML for interpretation

Affordable for advanced consumer testing

Applications: Early disease risk identification, preventive health planning, and research.

Single Nucleotide Polymorphism (SNP) Chips

Focus: Detects specific genetic variations linked to disease risk.

Advantages:

Faster than full WGS

Less complex interpretation

Applications: Disease risk prediction, ancestry testing, nutrigenomics.

Targeted Analysis (Significant Growth)

Focuses on specific genes or mutations instead of the entire genome.

Advantages:

Rapid results

Cost-effective

Easier to interpret

Applications: Targeted health conditions, pharmacogenomics, and genetic counseling.

Others

Epigenetic testing: Examines gene expression changes due to environment/lifestyle.

RNA-based testing: Provides insights into gene activity and disease progression.

3. By Distribution Channel

Online Platforms (Dominant Segment, 2024)

Convenience: Allows ordering kits online, home collection, and easy result access.

Services: Wide range of DTC genetic tests across health, ancestry, and wellness.

Growth Driver: Increasing e-commerce adoption, telehealth integration, and global reach.

Over-the-Counter (OTC) Platforms (Significant Growth)

Focus: Home kits available at pharmacies or online, with FDA-cleared collection devices.

Advantages:

Easy accessibility

Encourages preventive health and early diagnosis

Examples: GlutenID (for celiac disease) by Targeted Genomics & OraSure collaboration

Top Searched Queries 2025

1. What is Direct-To-Consumer Genetic Testing (DTC-GT)?

DTC-GT allows consumers to order genetic tests directly without doctors, using home-collected samples like saliva or blood. It provides insights into disease risk, ancestry, and personalized health.

2. What are the key segments in the DTC Genetic Testing Market?

Segments include test type (predictive, nutrigenomics, carrier), technology (whole genome sequencing, SNP chips, targeted analysis), and distribution channels (online, OTC).

3. How is AI impacting DTC Genetic Testing?

AI analyzes complex genetic data, predicts disease risk, guides drug responses, and helps create personalized treatment plans.

4. Which regions are driving DTC Genetic Testing growth?

North America leads the market, Europe is fastest-growing, and Asia Pacific, Latin America, and MEA are emerging due to rising awareness and tech adoption.

5. Who are the key players in the DTC Genetic Testing Market?

Top companies include Ancestry, 23andMe, Genesis HealthCare, Family Tree DNA, Myriad Genetics, EasyDNA, Living DNA, Veritas, Color Health, and Full Genomes Corp.

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5660

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest