Digital Biomarkers Market Trends, Forecast and Overview 2025

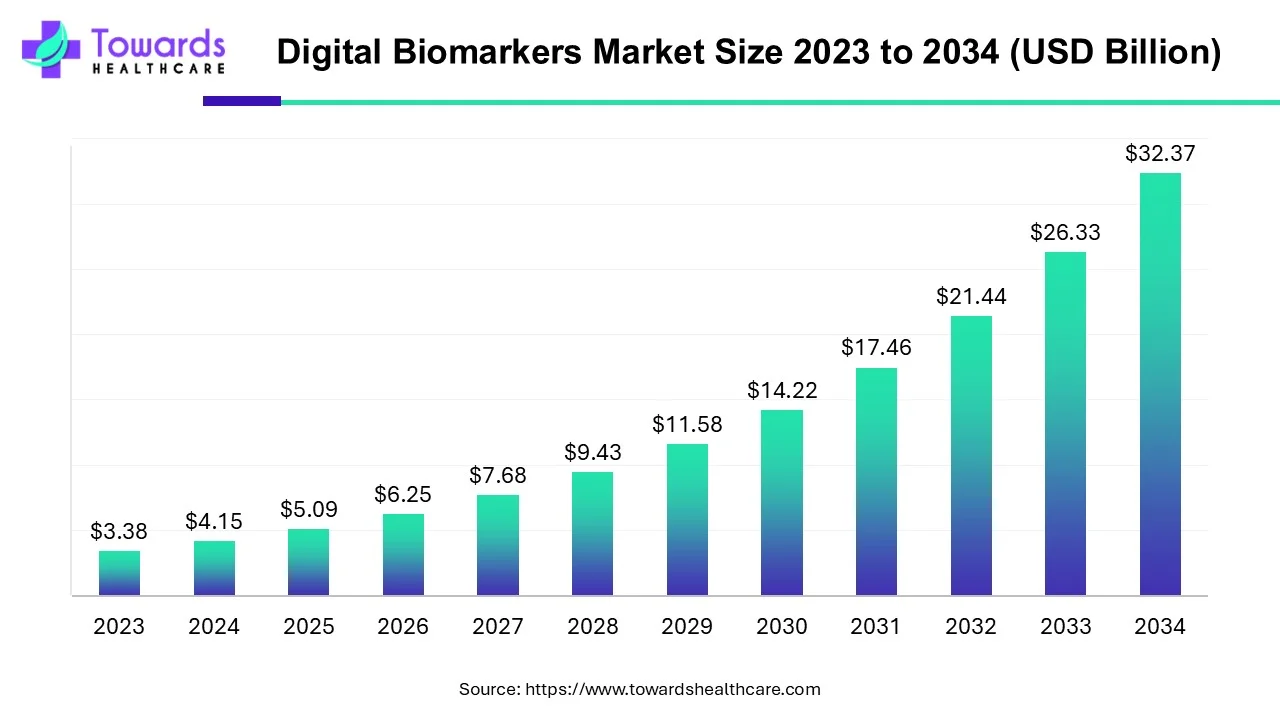

The global digital biomarkers market was valued at USD 5.09 billion in 2025 and is projected to reach USD 32.37 billion by 2034, growing at a CAGR of 22.74% (2025–2034).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5434

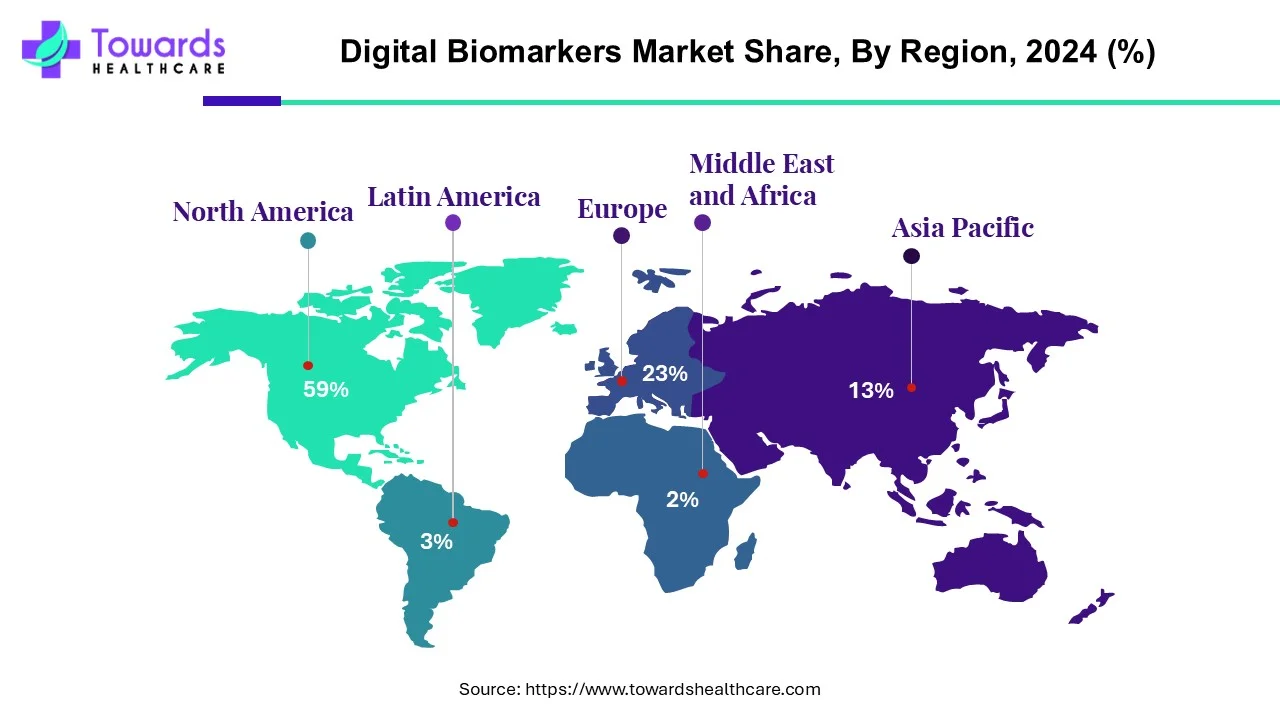

In 2024, North America led with 59% share, while Asia-Pacific is expected to expand fastest. Data collection tools dominated in 2024, while data integration systems are forecasted to grow rapidly. By end-use, healthcare companies held the largest share, and payers are projected to grow fastest.

Table of Contents

ToggleMarket Size

◉2024: USD 4.15 Billion

◉2025: USD 5.09 Billion

◉2034: USD 32.37 Billion

◉CAGR (2025–2034): 22.74%

◉Leading Region (2024): North America (59% market share)

◉Fastest Growing Region: Asia-Pacific (driven by NCDs, aging population, chronic diseases)

Market Trends

Investment Growth

◉Nov 2024: Glasswing Ventures + LDV Capital raised $2.6M for DANNCE.AI (neurological phenotyping platform).

◉Nov 2024: Quibim secured $50M Series A to expand AI-powered imaging biomarkers.

AI-Driven Innovations

◉Companies like AliveCor, Quibim, Biogen, and Empatica advancing AI-enabled monitoring.

Segmental Trends

◉Data Collection Tools (wearables, mobile apps) dominated 2024.

◉Data Integration Systems set to grow fastest due to interoperability needs.

Disease Focus

◉Cardiovascular diseases largest share (32% of global deaths per WHO).

◉Respiratory diseases fastest growing (asthma, COPD cases rising).

End-Use Trends

◉Healthcare companies largest users (R&D, clinical trials).

◉Payers (insurance) fastest-growing due to treatment personalization.

AI’s Role & Impact

Signal Engineering & Feature Discovery

◉Transform raw streams (PPG, ECG, accelerometry, voice, gait video) into validated features (variability, morphology, micro-movements).

◉Self-supervised and representation learning reduce labeling burden; discover latent disease signatures.

Disease Detection & Stratification

◉Early detection for neurological, mental health, and cardiovascular conditions via multi-modal fusion (wearable + phone usage + speech + imaging).

◉Risk stratification with calibrated probabilities to guide triage and care escalation.

Continuous Monitoring & Relapse Prediction

◉Drift-aware models update risk scores in near real-time; detect exacerbations (e.g., respiratory) days in advance; enable just-in-time interventions.

Drug Development Acceleration

◉Biomarker discovery for target engagement and endpoint sensitivity → shorter trials, smaller cohorts.

◉Virtual/hybrid DCTs (decentralized clinical trials): device-agnostic ingestion, anomaly checks, and near real-time safety/efficacy signals.

◉Adaptive designs informed by accumulating digital endpoints.

Clinical Validation & QA Automation

◉Automated artifact detection (motion/noise), outlier filtering, sensor QC, and audit trails for submission-grade data integrity.

Interoperability & Cohort Linkage

◉Entity resolution: harmonize EHR + claims + device with privacy-preserving linkage; federated learning reduces data movement risk.

Personalized Care Pathways

◉Therapy optimization engines: dose titration, behavioral nudges, and scheduling aligned to patient-level biomarker response.

Equity & Access

◉Lightweight models on commodity phones expand reach to rural/underserved areas; offline inference with store-and-forward sync.

Payer & Policy Analytics

◉AI converts continuous biomarkers into economic signals: expected avoidance of acute events, LOS reduction, and adherence prediction for value-based design.

Governance & Safety

◉Model lifecycle: bias testing, calibration, performance monitoring, and versioning; human-in-the-loop review for high-stakes alerts.

Regional Insights

North America (59% share, 2024)

Adoption Drivers

◉Mature digital health infrastructure; widespread wearables/CGMs and app ecosystems.

◉Regulatory enablement (SaMD, PreCert) supports iterative releases and post-market learning.

Use-Case Depth

◉Diabetes & CVD programs (CGMs, smartphone-based tracking), enterprise clinical trial integration.

Execution Enablers

◉Dense biopharma and CRO footprint; strong data engineering talent; reimbursement pilots.

Asia-Pacific (fastest growth)

Demand Fundamentals

◉Aging demographics + rising NCDs (55% of deaths in SE Asia, 2023).

◉Large populations create scale for low-cost, phone-centric biomarkers.

Adoption Vectors

◉Government digital health pushes; provider systems leapfrog to remote monitoring.

Constraints/Focus

◉Device affordability, language/localization, connectivity variance; huge upside via smartphone-native biomarkers.

Europe (notable growth)

Clinical Burden

◉CVD, stroke, cancer, diabetes → sustained demand for real-time diagnostics and monitoring.

System Levers

◉mHealth adoption + public system incentives; strong privacy governance favors privacy-preserving analytics.

Market Angle

◉High emphasis on precision medicine and interoperability standards in multi-country networks.

Latin America

Emergence Factors

◉Modernizing health IT; Brazil/Argentina lead pilots; preference for cost-effective mobile/wearable measures.

Operational Notes

◉Public-private partnerships; training and service models key to scale.

Middle East & Africa (MEA)

◉Growth Spots

◉UAE, Saudi: telehealth scale-ups; hospital digitization.

Challenges

◉Patchy infrastructure in parts of Sub-Saharan Africa → prioritize edge AI, offline workflows, low-power sensors.

Market Dynamics

Drivers

◉Regulatory advancement (SaMD updates, PreCert program concept).

◉Government initiatives: Funding + grants for telehealth and digital programs.

◉Wearables & sensors: Higher fidelity, lower cost, better battery → richer biomarker capture.

◉Enterprise adoption: Healthcare companies integrating biomarkers into drug development and clinical trials.

Restraints

◉Cybersecurity & privacy: High-value PHI targets; cross-border data flows raise risk.

◉Data & sample challenges: Motion artifacts, heterogeneous devices, adherence variance; need robust QA/validation.

Opportunities

◉Integration systems: Fastest-growing layer—interoperability, consent, identity, harmonization.

◉Payers: Rapidly rising demand for personalized authorization and outcomes-based programs.

◉Respiratory acceleration: Fastest growth area (from your data); monitoring and early intervention opportunities.

Structural Challenges (manage-to-win)

◉Clinical validation at scale; generalization across devices/populations.

◉Reimbursement playbooks for digital endpoints; health-economic evidence.

Top Companies (product/overview/strengths)

Roche Holding AG

Overview: Global leader in diagnostics & pharma integrating biomarker-driven precision medicine.

Products/Focus: Diagnostics platforms; digital pathology tie-ins.

Strengths: Scale, regulatory experience, oncology leadership, collaboration with Lunit (navify Digital Pathology).

Bio-Rad Laboratories

Overview: Major diagnostics & life science tools provider.

Products/Focus: Assay and analytics infrastructure relevant to biomarker validation.

Strengths: Installed lab base, quality systems, global distribution.

AliveCor

Overview: Digital cardiology pioneer.

Products/Focus: Mobile ECG-centric cardiac biomarkers.

Strengths: Clinical-grade cardiac signals, consumer-to-clinic bridge.

Biogen

Overview: Neuroscience-focused biopharma.

Products/Focus: Konectom™ smartphone digital biomarkers for neurological function (licensed to Indivi).

Strengths: CNS expertise; partnerships for wider disease coverage.

IXICO

Overview: Neuroimaging analytics company.

Products/Focus: Imaging biomarkers for neurodegeneration (fit for digital imaging pipelines).

Strengths: Trial analytics, disease-specific know-how.

Koneksa

Overview: Digital biomarker platform for clinical research.

Products/Focus: Device-agnostic endpoints, study data integration.

Strengths: Validation in trials; sponsor relationships.

Thermo Fisher Scientific

Overview: Global life sciences leader.

Products/Focus: Tools and platforms enabling data generation and analysis.

Strengths: Scale, compliance, enterprise reach.

Agilent Technologies

Overview: Analytical instrumentation and informatics.

Products/Focus: Measurement science and data environments relevant to biomarkers.

Strengths: Quality, lab informatics, regulatory posture.

Epigenomics AG

Overview: Biomarker discovery/diagnostics.

Products/Focus: Molecular biomarker platforms aligned to digital readouts.

Strengths: IP and assay expertise.

Fitbit Inc

Overview: Wearable device maker (now widely used for activity/physiological signals).

Products/Focus: Continuous data streams for digital biomarkers.

Strengths: Large installed base, consumer engagement.

Akili Interactive Labs

Overview: Digital therapeutic approaches.

Products/Focus: Software-based interventions with measurable biomarkers.

Strengths: Evidence-generating digital endpoints.

ALTODA AG

Overview: (As listed) European innovator in data/analytics for biomarkers.

Products/Focus: Digital analytics layers.

Strengths: Agility, niche expertise.

Kinsa

Overview: Connected thermometry and population signals.

Products/Focus: Symptom/temperature networks → community-level biomarkers.

Strengths: Real-time surveillance at scale.

Merck KGaA

Overview: Science & technology company.

Products/Focus: Oncology development paired with Quibim imaging biomarkers.

Strengths: R&D breadth; precision medicine collaborations.

Siemens Healthineers

Overview: Imaging/diagnostics giant.

Products/Focus: Imaging biomarkers and data integration across modalities.

Strengths: Hospital footprint; enterprise integration.

Huma

Overview: Digital health platform.

Products/Focus: Remote patient monitoring and biomarker capture.

Strengths: Configurable platform; multi-condition support.

Latest Announcements

Biofourmis (Sep 2024)

What: Four oncology collaborations; digital biomarkers + safety algorithms for CRS detection in trials.

Why it matters: Elevates digital biomarkers from supportive to primary safety infrastructure in high-risk oncology; strengthens device-agnostic DCT position.

Lunit × Roche (Sep 2024)

What: Lunit SCOPE PD-L1 22C3 TPS integrated into navify Digital Pathology.

Why: Brings AI pathology into a leading diagnostics workflow; accelerates biomarker testing and improves pathologist productivity—key to precision oncology.

Quibim × Merck KGaA (Jan 2024)

What: Imaging biomarker collaboration for oncology clinical development.

Why: Validates imaging biomarkers as core precision endpoints across multiple phases; boosts evidence generation for regulatory & payer acceptance.

Indivi × Biogen (Mar 2024)

What: Konectom™ smartphone platform licensed to Indivi for neurological assessment.

Why: Scales remote neuro biomarker monitoring; expands beyond MS into additional CNS diseases.

Recent Developments

electronRx — purpleDx (CES 2025)

What: Medical device-compliant cardiac evaluation app with digital indicators of lung function for CRD patients; clinician dashboards for real-time data.

Impact: Blends cardiopulmonary monitoring for comorbidity management; enables home-based assessment and therapy tailoring.

Roche × Lunit (2024)

Development Focus: AI-assisted pathology; improving biomarker testing speed and accuracy.

Impact: Standardizes tumor marker quantification; supports precision medicine workflows.

Biogen × Indivi (2024)

Focus: Multi-year expansion of digital neuro biomarkers; remote progression tracking.

Impact: Enriches longitudinal CNS data, reduces clinic burden, and supports adaptive trial designs.

Segments Covered

By System Component

◉Data Collection Tools (2024 leader)

◉Mobile Apps: Patient-facing capture (symptoms, PROs, phone sensors).

◉Wearables: Continuous physiology (activity, HR/HRV, sleep, rhythm).

◉Biosensors: Targeted measures (glucose, respiratory markers).

◉Desktop Software: Clinic-grade acquisition/processing; study portals.

◉Digital Platforms: Device-agnostic orchestration, enrollment, consent.

◉Data Integration Systems (fastest growth)

◉Interoperability: Normalization across device types and EHR schemas.

◉Identity/Consent: Governance, privacy controls, auditability.

◉Analytics Pipelines: Feature stores, model serving, monitoring, drift handling.

◉Clinician Interfaces: Alerting, summaries, and shared decision support.

By Clinical Practice

◉Diagnostic (2024 leader): Front-door use for detection/triage; accelerates specialist referral.

◉Monitoring (fastest-growing): Continuous, remote disease status; exacerbation prediction.

◉Predictive & Prognostic: Risk scoring for outcomes/events; therapy planning.

◉Other (Safety/PK-PD/Response/Susceptibility): On-treatment safety (e.g., CRS), exposure-response mappings, and population susceptibility signals.

By End-Use

◉Healthcare Companies (largest): Drug development, endpoint strategy, decentralized trials.

◉Healthcare Providers: RPM programs, virtual wards, perioperative/rehab tracking.

◉Payers (fastest growth): Prior authorization optimization, outcome-based reimbursement.

◉Others (Patients, Caregivers): Self-management insights, caregiver dashboards.

By Region

◉North America / Europe / Asia-Pacific / Latin America / MEA (deep drivers detailed above).

Top 5 FAQs

1) What’s the market size and growth outlook?

• USD 5.09B (2025) → USD 32.37B (2034) at 22.74% CAGR; 2024 size USD 4.15B.

2) Which regions lead and which grow fastest?

• North America led with 59% share (2024); Asia-Pacific is the fastest-growing.

3) Which components are most important?

• Data collection tools dominated in 2024; data integration systems show fastest future growth.

4) Who are the primary end-users and who’s accelerating?

• Healthcare companies (largest share, 2024). Payers growing fastest.

5) What trends and investments validate momentum?

• DANNCE.AI $2.6M (Nov 2024), Quibim $50M Series A (Nov 2024), Biofourmis oncology deals (Sep 2024), Roche-Lunit integration (Sep 2024), electronRx purpleDx (Jan 2025).

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5434

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest