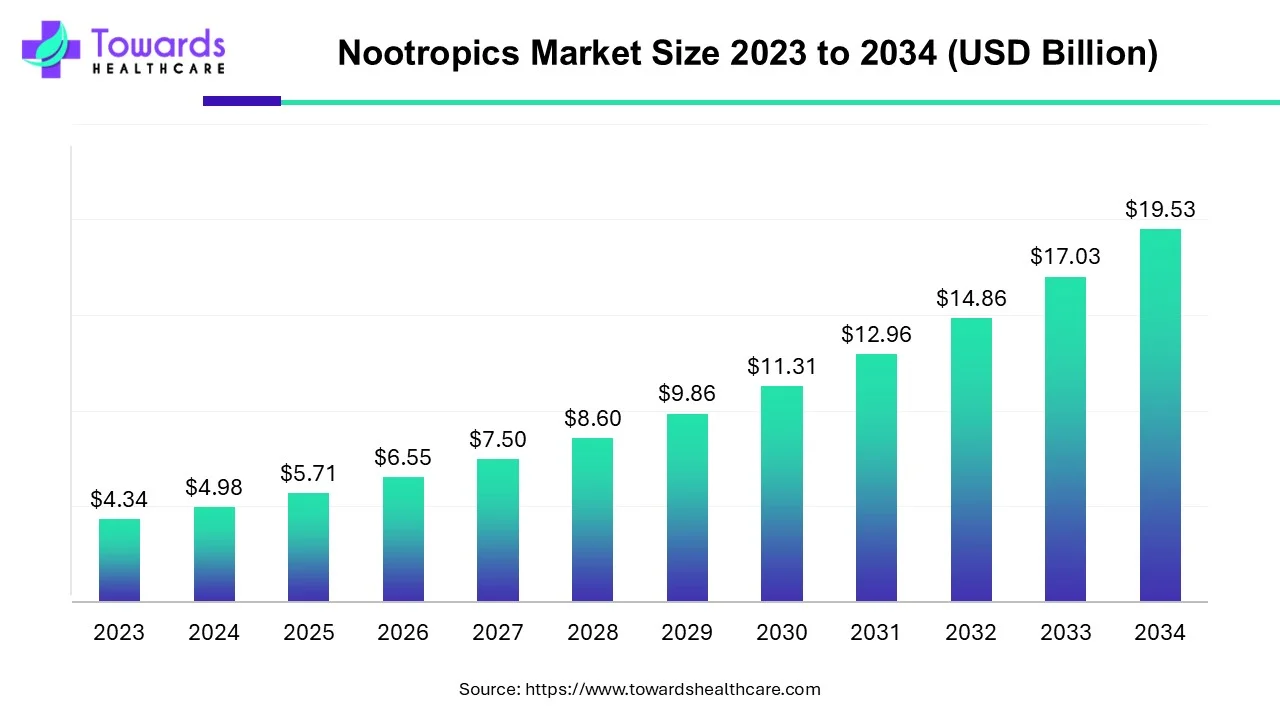

The global nootropics market size reached USD 5.71 billion in 2025 and is projected to grow to USD 19.53 billion by 2034, expanding at a CAGR of 14.64% (2025–2034). Growth is driven by rising wellness expenditure, aging population, prevalence of brain-related disorders (dementia, Parkinson’s, hyperactivity), and increasing demand for natural plant-based cognitive enhancers.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/5438

Market Size

◉2023 Size – Market base was slightly below USD 5 billion (2024 = USD 4.98 billion).

◉2024 Size – USD 4.98 billion, dominated by North America.

◉2025 Size – USD 5.71 billion with strong demand in cognitive supplements and holistic health.

◉2034 Projection – USD 19.53 billion, growing nearly 4x from 2024 levels.

◉Growth Rate – CAGR of 14.64% (2025–2034), one of the fastest among wellness and functional foods.

◉Dominant Segments – Capsules/Tablets led in 2024; Drinks to expand fastest.

◉Channel Dynamics – Offline dominated 2024; Online segment to be fastest-growing.

Regional Growth –

◉North America held the largest share in 2024.

◉Asia Pacific to witness fastest CAGR.

Market Trends

Natural & Plant-Based Nootropics

◉Herbal Supplements Popularity: Growing consumer preference for ashwagandha, bacopa, lion’s mane, ginseng.

◉Alignment with Ethical Wellness: Products meet demand for sustainable, plant-based, and non-synthetic solutions.

◉Trend Over Synthetic Compounds: Shift from synthetic cognitive enhancers to natural, plant-derived nootropics, favored for safety and holistic health benefits.

Athlete-Centric Nootropics

◉Sports Industry Adoption: Paradigm Sports + Ten Percent Club (2024) focuses on improving mental performance, focus, and recovery.

◉Cognitive Performance Benefits: Enhances reaction time, concentration, memory recall, and decision-making under stress for athletes.

◉Competitive Advantage: Offers performance edge without harmful stimulants.

Educational Campaigns & Awareness

◉Brand-led Education: In The Zone Labs (Feb 2025) promoted key ingredients like L-theanine, alpha-GPC, lion’s mane.

◉Consumer Knowledge: Raises awareness of brain health, cognitive enhancement, and functional nutrition.

◉Market Penetration: Helps introduce nootropics to new demographics who may not be familiar with cognitive supplements.

Functional Beverages

◉Emerging Trend: Nootropic drinks like teas, coffees, energy drinks are fastest growing.

◉Consumer Preference: Quick absorption, ready-to-use, combined with adaptogens and vitamins.

◉Holistic Wellness Alignment: Natural ingredients like ginseng and ashwagandha also improve mood, immunity, and fatigue management.

Rising Cognitive Health Awareness

◉Aging Population: Increase in dementia, Parkinson’s, ADHD drives adoption.

◉Preventive & Maintenance Use: Consumers take supplements for memory retention, focus, mental clarity, and neuroprotection.

◉Health & Lifestyle Integration: Brain health becoming part of overall wellness and longevity strategies.

Technological Integration

◉AI and Digital Platforms: Optimize personalized dosage, predictive marketing, and product customization.

◉E-commerce Support: Enhances global accessibility, product reviews, and consumer trust.

◉Consumer Engagement: Platforms provide educational tools, usage tracking, and tailored recommendations.

Role of AI in the Nootropics Market

Consumer Trend Prediction

◉AI analyzes purchasing behavior, lifestyle, and health data.

◉Helps brands forecast demand, tailor campaigns, and optimize product portfolios.

Compound Discovery & Formulation

◉Accelerates identification of new cognitive-enhancing compounds.

◉Simulates ingredient interactions and optimal combinations for efficacy.

Personalized Dosage & Products

◉Tailors formulations based on age, health condition, cognitive goals, and lifestyle.

◉Supports biohacking and self-optimization trends.

R&D Optimization

◉Reduces trial-and-error in formulation testing.

◉Increases efficiency in safety verification, clinical studies, and potency testing.

Safety & Quality Assurance

◉Detects counterfeit or substandard products.

◉Ensures consistency in ingredient sourcing, dosage, and quality.

Consumer Engagement

◉AI chatbots provide personalized guidance.

◉Educational tools increase consumer trust and adoption rates.

Regional Insights

3.1 North America – Dominant Market

◉U.S.: Rising mental health awareness, biohacking trend, and online platforms.

◉Canada: Government initiatives like Brain Health & Cognitive Impairment Initiative focus on elderly care.

◉Strong R&D ecosystem and wellness-conscious population support market dominance.

3.2 Asia Pacific – Fastest Growing

◉China: High student & professional demand, strong e-commerce penetration.

◉India: Herbal supplement awareness (ashwagandha, bacopa), post-pandemic wellness trend.

◉Japan/South Korea: Cultural acceptance of herbal remedies and technological integration.

3.3 Europe

◉UK: Functional beverages and personalized nootropic formulations.

◉Germany: Natural products, strong R&D, e-commerce penetration.

◉Consumers increasingly prioritize mental clarity, stress reduction, and productivity enhancement.

3.4 Latin America

◉Growth driven by dementia prevalence and aging population.

◉Mexico: Government support, medical tourism, accessible brain health services.

◉Brazil: National Dementia Plan, strict regulation of natural health products ensures quality.

3.5 Middle East & Africa

◉UAE & Saudi Arabia: Investments in healthcare infrastructure, adoption of wellness products.

◉South Africa: Growing awareness but limited market penetration.

Market Dynamics

Drivers

1. Personalization Trend

Overview:

◉Consumers increasingly demand customized cognitive enhancement solutions tailored to their individual mental and physical needs.

Key Features:

◉Supplements designed for specific cognitive goals: focus, memory, mental clarity, mood regulation, and productivity.

◉Integration of AI and digital health platforms to recommend personalized dosages and ingredient blends.

Market Impact:

◉Encourages innovation in formulation, including plant-based nootropics, adaptogens, and functional blends.

◉Supports direct-to-consumer (D2C) sales, where brands can offer subscription-based or personalized packs.

◉Helps differentiate products in a highly competitive market, enhancing consumer loyalty.

2. Aging Population & Brain Disorders

Overview:

◉Increasing global aging populations and rising prevalence of neurological disorders drive demand for cognitive supplements.

Key Drivers:

◉Dementia and Alzheimer’s: Supplements for memory preservation and cognitive support are in high demand.

◉Parkinson’s Disease: Nootropics used to improve attention, coordination, and mental energy.

◉ADHD and Cognitive Fatigue: Supplements supporting focus and mental performance among adults and students.

Market Impact:

◉Stimulates research-backed product development targeting specific medical conditions.

◉Creates a long-term stable consumer base among older adults and patients with cognitive impairments.

◉Encourages regulatory attention and collaborations with healthcare providers for safe usage.

3. Functional Beverages & Fast-Acting Forms

Overview:

◉There is a rising preference for convenient, fast-absorbing nootropic forms.

◉Key Forms: Drinks, powders, liquid shots, energy drinks, and ready-to-consume formulations.

Benefits to Consumers:

◉Rapid absorption → immediate cognitive boost.

◉Functional blends with vitamins, adaptogens, and herbal extracts → holistic brain health support.

Market Impact:

◉Supports premium pricing due to convenience and functional benefits.

◉Attracts lifestyle-focused younger consumers seeking on-the-go solutions.

◉Drives innovation in beverages and functional foods, expanding market beyond traditional capsules.

Restraints

1. Lack of Regulations

Overview:

◉Nootropics are largely classified as dietary supplements rather than pharmaceuticals.

Key Challenges:

◉No uniform global safety and quality standards.

Risk of counterfeit products or incorrect dosages.

◉Consumer skepticism due to inconsistent product efficacy.

Market Impact:

◉Companies must invest in transparent labeling, third-party testing, and scientific validation.

◉Slows the adoption among risk-averse consumers and healthcare institutions.

◉Regulatory uncertainties may hinder cross-border expansion and partnerships.

Opportunities

1. E-Commerce Expansion

Overview:

◉Online channels have transformed nootropic distribution, making supplements globally accessible.

Key Trends:

◉Platforms: Brand websites, Amazon, iHerb, Vitacost.

◉Features: Customer reviews, ratings, subscriptions, and social media integration.

Market Impact:

◉Enables direct consumer engagement → increased brand loyalty.

◉Provides data-driven insights on purchasing trends and preferences for product improvement.

◉Supports rapid market expansion, especially in emerging economies with growing internet penetration.

2. Influencer Marketing & Awareness Campaigns

Overview:

◉Nootropic companies leverage influencers, athletes, and wellness advocates to educate consumers.

Key Examples:

◉Paradigm Sports + Ten Percent Club (2024) → focus on athlete cognition and performance.

◉In The Zone Labs (2025) → educational campaigns on lion’s mane, L-theanine, alpha-GPC.

Market Impact:

◉Drives consumer adoption, particularly among health-conscious millennials and Gen Z.

◉Increases brand credibility by showcasing endorsements from experts and verified testimonials.

◉Enhances direct-to-consumer sales by educating the audience about personalized and functional products.

Additional In-Depth Insights

Consumer Behavior:

◉Increasing health literacy and awareness of cognitive wellness → higher willingness to invest in premium nootropic products.

Innovation Drivers:

◉Companies are innovating in AI-driven formulations, natural ingredients, and bioactive compounds.

Competitive Edge:

◉Brands that combine personalization, functional convenience, and scientific backing gain an advantage over generic or mass-market supplements.

Global Insights

◉Production Focus: Capsules, powders, drinks; natural and herbal ingredient sourcing.

◉Innovation: Functional beverages, herbal blends, and biohacking-focused formulations.

◉Quality & Compliance: Leading companies emphasize safety, R&D, and adherence to regulatory frameworks where applicable.

◉Consumer-Centric Approach: Personalized products, transparent labeling, educational campaigns.

◉E-commerce & Distribution: Online platforms complement offline sales to maximize reach.

Mergers and Acquisitions in the Nootropics Market

1. Glanbia’s Acquisition of Aroma Holding Company (April 2024)

Overview:

In April 2024, Glanbia, a global nutrition company, announced the acquisition of Aroma Holding Company, a U.S.-based flavoring business, for $300 million (€281 million), with potential deferred consideration of up to $55 million based on performance in 2024. Wikipedia

Strategic Intent:

This acquisition aims to enhance Glanbia’s capabilities in flavoring, which is crucial for the development of palatable nootropic beverages and supplements.

Market Impact:

By integrating Aroma’s flavoring expertise, Glanbia can improve the sensory appeal of its nootropic products, potentially increasing consumer acceptance and market share.

2. Neutonic’s £2.7 Million Funding Round (2025)

Overview:

In early 2025, Neutonic, a nootropics brand founded by content creators James Smith and Chris Williamson, raised £2.7 million in its first funding round, bringing its valuation to £14.5 million. BusinessCloud

Strategic Intent:

The funding aims to accelerate product development and expand market presence, particularly in the functional beverage segment.

Market Impact:

With the backing of influential figures and substantial funding, Neutonic is poised to disrupt the nootropics market, appealing to a younger, health-conscious demographic.

3. Houlihan Lokey’s Role in M&A Activity

Overview:

Houlihan Lokey, a global investment bank, has been actively involved in advising on mergers and acquisitions within the Vitamins, Minerals, and Supplements (VMS) sector, which encompasses nootropic products. Houlihan Lokey

Strategic Intent:

Their involvement indicates a growing interest and activity in the nootropics market, with an emphasis on consolidation and strategic partnerships.

Market Impact:

The advisory services provided by Houlihan Lokey suggest that larger players are seeking to expand their portfolios and capabilities in the nootropics space through strategic acquisitions.

Market Dynamics Influencing M&A Activity

Market Growth:

The global nootropics market is projected to reach approximately USD 19.53 billion by 2034, growing at a CAGR of 14.74% from 2025 to 2034.

Consumer Demand:

Increasing awareness of cognitive health and the demand for functional beverages are driving the growth of the nootropics market.

Strategic Consolidation:

Companies are pursuing mergers and acquisitions to enhance product offerings, expand market reach, and leverage synergies in research and development.

Implications for the Nootropics Market

Innovation Acceleration:

M&A activities enable companies to combine resources and expertise, leading to accelerated innovation in nootropic formulations.

Market Expansion:

Strategic acquisitions allow companies to enter new markets and demographics, broadening their consumer base.

Competitive Advantage:

Consolidation within the industry can lead to stronger market positions, improved economies of scale, and enhanced brand recognition.

Top Companies in the Nootropics Market (In-Depth)

1. Nootropics Depot

Overview:

A leading global supplier of cognitive enhancement supplements, known for transparency, quality, and research-backed formulations.

Focused on both retail and online markets, making products accessible worldwide.

Products:

Capsules, tablets, powders, and liquid nootropics.

Offers standardized herbal extracts (e.g., Bacopa, Lion’s Mane) and synthetic smart compounds.

Strengths:

Strong R&D advisory board ensures product safety and efficacy.

Emphasis on high-quality sourcing and testing.

Transparent labeling and detailed product information build consumer trust.

2. Kimera Koffee

Overview:

Specializes in nootropic beverages, integrating cognitive boosters into everyday drinks.

Premium positioning with focus on mental clarity, energy, and focus.

Products:

Nootropic coffee blends, functional teas, and drinks enriched with bioactive ingredients.

Incorporates natural compounds like L-theanine, Alpha-GPC, and adaptogens.

Strengths:

Expertise in functional beverage formulation.

Strong appeal to biohackers and working professionals.

Combines convenience and cognitive performance in one product.

3. Alternascript

Overview:

Focuses on plant-based cognitive supplements and natural nootropics.

Brand emphasizes ethical wellness, sustainability, and herbal efficacy.

Products:

Capsules, powders, and blended supplements containing Bacopa Monnieri, Ashwagandha, Lion’s Mane.

Supplements aimed at memory, focus, and stress reduction.

Strengths:

Strong natural ingredient portfolio.

Appeals to holistic wellness-conscious consumers.

Transparent labeling and ethical sourcing reinforce brand credibility.

4. Cephalon LLC & Teva Pharmaceuticals

Overview:

Pharmaceutical giants producing clinically-backed cognitive drugs.

Well-established in global distribution channels and regulatory compliance.

Products:

Prescription-grade cognitive enhancers, such as modafinil and other approved nootropic drugs.

Products target memory, alertness, and cognitive disorders.

Strengths:

Strong clinical research and regulatory expertise.

Wide distribution network ensures global availability.

High trust and reliability in pharmaceutical-grade cognitive products.

5. Onnit & Mind Lab Pro

Overview:

Premium supplement brands targeting performance, cognition, and overall brain health.

Popular among biohackers, athletes, and wellness enthusiasts.

Products:

Capsules, powders, and drinkable cognitive enhancers.

Ingredient-rich formulas like Alpha-GPC, Bacopa Monnieri, L-Theanine, Citicoline.

Strengths:

Focus on efficacy-backed, high-quality formulations.

Strong global consumer trust and brand loyalty.

Extensive marketing and educational outreach, emphasizing cognitive enhancement.

6. Powder City, Mental Mojo LLC, TruBrain, Noocube, Purelife Bioscience

Overview:

Focused on online accessibility and direct-to-consumer sales.

Known for functional blends, customizable formulations, and educational content.

Products:

Capsules, powders, and liquid nootropics.

Target cognitive benefits like memory, focus, mood, and mental clarity.

Strengths:

Strong digital presence, leveraging e-commerce for global reach.

Consumer-focused innovation with blends for specific cognitive goals.

Transparent information and community engagement boost brand trust.

Latest Announcements

BrainBoost Labs + CognitivePharm Partnership

Objective:

◉Accelerate research and development of advanced nootropic products.

◉Focus on next-generation cognitive enhancers targeting memory, focus, attention, and mental clarity.

Strategic Significance:

◉Combines 40+ years of experience from both companies in neuroscience, supplement development, and pharmaceutical research.

◉Positions the partnership as a leader in innovation, capable of creating highly effective, science-backed nootropic formulations.

Expected Outcomes:

◉Launch of clinically validated, safe, and potent products.

◉Potential introduction of personalized or AI-driven nootropic solutions for specific cognitive needs.

◉Strengthening global market presence through innovative, high-quality product lines.

Industry Impact:

◉Encourages competition and innovation in the nootropics market.

◉Sets a benchmark for collaborative R&D efforts in brain health and cognitive enhancement.

Recent Developments

1. Canada – First Nootropic Food Lab (Jan 2025)

Overview:

◉Established by Raymond Thomas, a biology professor at Western University.

◉Merges Western scientific methods with Indigenous dietary knowledge to design functional meals.

Innovation & Focus Areas:

◉Development of brain-boosting meals that enhance memory, focus, and mental clarity.

◉Use of metabolomics analysis to track biochemical impact of foods on cognition.

◉Collaboration with chefs for palatable, nutrient-dense meals that are also functional.

Market Implications:

◉Expands the concept of nootropics beyond supplements to functional foods.

◉Promotes a holistic approach to mental wellness and nutrition.

◉Opens opportunities for new product categories in brain health.

2. Nootropics Depot – Scientific Advisory Board & Research Snapshot (Feb 2025)

Overview:

◉Launch of a Scientific Advisory Board comprising experts in integrative medicine, plant biology, fitness, and ethnobotany.

◉Research Snapshot section ensures transparency in formulations, clinical evaluations, and safety assessments.

Strategic Goals:

◉Ensure highest levels of product safety and efficacy.

◉Increase consumer confidence and transparency in the supplement industry.

◉Provide a data-backed approach to cognitive enhancement, combining traditional herbal knowledge with modern science.

Focus Areas:

◉Metabolomics analysis for assessing impact of nootropics on brain metabolism.

◉Functional meals and supplements designed for enhanced cognitive performance.

◉Cognitive testing to evaluate short-term and long-term effectiveness.

Market Implications:

◉Sets a quality benchmark for other players in the nootropics market.

◉Encourages evidence-based product development.

◉Attracts health-conscious consumers seeking verified results.

Segments Covered

A. By Form

1. Capsules/Tablets – Dominant Segment

Rationale for Dominance:

◉Provide precise dosage, ensuring safety and consistency.

◉Easy to consume without preparation, ideal for daily supplementation routines.

◉Preferred by both consumers and healthcare providers for reliability.

Product Examples:

◉Qualia Mind, Mind Lab Pro capsules containing Alpha-GPC, Bacopa Monnieri, L-theanine.

Consumer Benefit:

◉Convenience and quick integration into daily lifestyle.

◉High bioavailability for active ingredients.

2. Powder – Customizable Segment

Rationale:

◉Flexible dosage allows personalization for individual cognitive needs.

◉Can be mixed with drinks, smoothies, or meals.

Product Examples:

◉Bulk nootropic powders for memory, focus, and mood enhancement.

Consumer Benefit:

◉Customizable experience, appealing to biohackers and performance enthusiasts.

◉Faster absorption when mixed with liquids.

3. Drinks – Fastest Growing Segment

Rationale:

◉Immediate absorption delivers rapid cognitive effects.

◉Blended with adaptogens, vitamins, and herbal extracts.

Product Examples:

◉Nootropic coffees (Kimera Koffee), teas, energy drinks enriched with Lion’s Mane, Ginseng, Ashwagandha.

Consumer Benefit:

◉On-the-go convenience, supports mental clarity, mood, and energy.

◉Fits lifestyle trends of functional beverages for wellness-conscious consumers.

4. Others – Niche/Emerging Segment

◉Forms: Gummies, chocolates, liquid shots.

Rationale:

◉Targets younger demographics or lifestyle-oriented consumers.

◉Growing trend in functional snacks and alternative supplementation.

Consumer Benefit:

◉Fun, convenient, and portable options.

◉Expands market penetration beyond traditional formats.

B. By Distribution Channel

1. Offline – Dominant Segment

Channels: Pharmacies, hypermarkets, health stores, specialty wellness shops.

Advantages:

◉In-person guidance from staff builds consumer trust and credibility.

◉Immediate product availability and opportunity for experiential marketing (events, workshops).

Market Implication:

◉Offline presence remains essential for brand visibility and consumer confidence, especially in traditional markets.

2. Online – Fastest Growing Segment

◉Channels: Brand websites, e-commerce platforms (Amazon, iHerb, Vitacost).

Advantages:

◉Convenience of home delivery, easy price comparison, and access to reviews.

◉Enables personalization and subscription models.

Market Implication:

◉Digital-first approach allows brands to reach global consumers efficiently.

◉Social media and influencer marketing amplify product adoption and awareness.

C. By Region

◉North America, Asia Pacific, Europe, Latin America, Middle East & Africa.

◉Regional breakdown explained in Regional Insights, reflecting market dominance, growth potential, and consumer behavior.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5438

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest