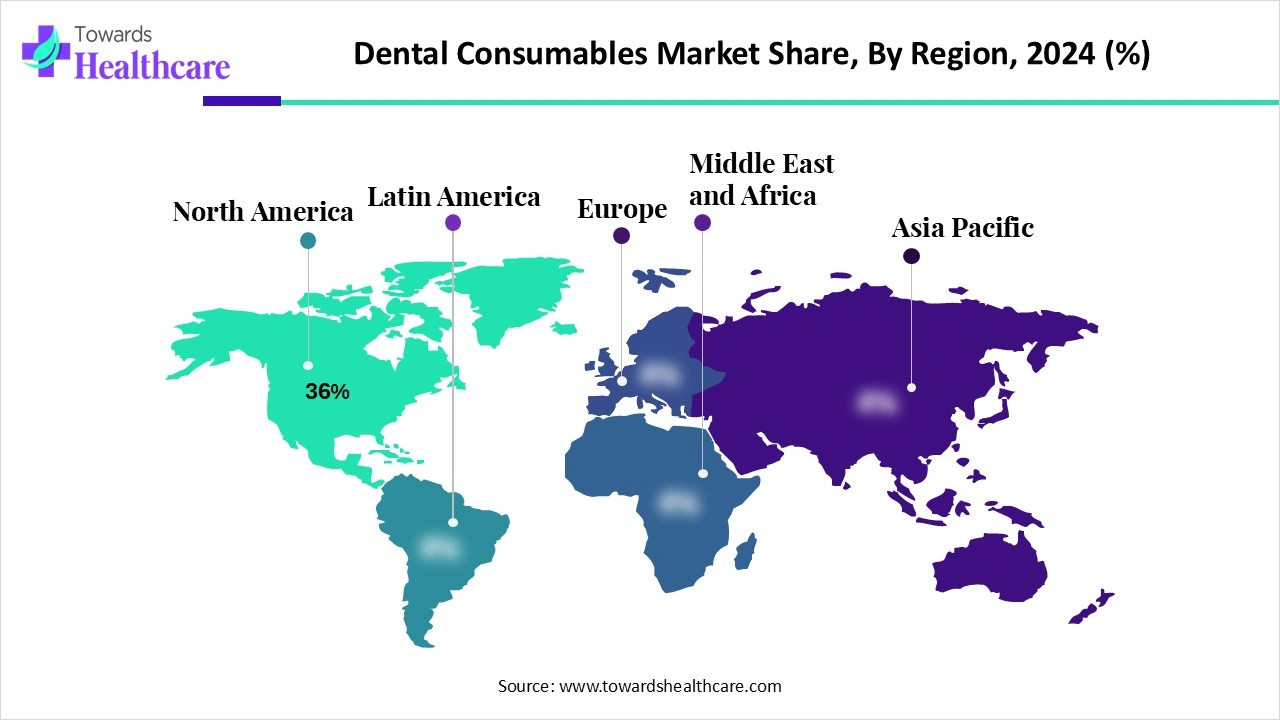

The global dental consumables market was valued at USD 40.7 billion in 2024, projected to grow to USD 42.92 billion in 2025, and expected to reach USD 69.23 billion by 2034. This growth represents a CAGR of 5.46% (2025–2034). Growth is driven by rising awareness of oral health, increasing cosmetic dentistry adoption, rising disposable income, and advanced oral care technologies. North America dominated with 36% share in 2024, while Asia Pacific is the fastest-growing region due to expanding digital platforms, demand for aligners, whitening kits, and preventive oral care.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6046

Market Size

◉2024 Market Size: USD 40.7 billion.

◉2025 Market Size: USD 42.92 billion.

◉2034 Market Projection: USD 69.23 billion.

◉Growth Rate: CAGR of 5.46% (2025–2034).

Regional Share:

◉North America: ~36% in 2024.

◉Asia Pacific: Fastest growth CAGR 2025–2034.

By End User (2024):

◉Dental Clinics – 68% share.

◉DSOs projected fastest CAGR.

By Distribution (2024):

◉Indirect (dealers/distributors) – 64% share.

◉Online/e-commerce growing fastest.

By Materials (2024):

◉Polymers/Composites/Resins – 42% share.

◉Ceramics & glass-ceramics – fastest growing.

By Procedure (2024):

◉Restorative/Operative – 38% share.

◉Prosthodontic/Implantology fastest growing.

Market Trends

Government Programs Boosting Oral Health

◉Colgate’s Bright Smiles, Bright Futures (2024) – partnered with Goa Govt to reach 200,000 children by 2025.

◉Hong Kong’s CDSP (2025) – doubled service capacity for underprivileged patients.

Rise of Cosmetic & Preventive Dentistry

◉Growing demand for whitening kits, aligners, and advanced implants.

DSO Consolidation

◉DSOs help dentists focus on clinical work while managing admin, fueling market adoption.

Digital & AI-driven Dentistry

◉CAD/CAM, 3D printing, and AI in diagnostics transforming workflows.

Material Innovation

◉Biocompatible composites and ceramics preferred over traditional amalgam.

Shift in Distribution Channels

◉Indirect channel dominant but e-commerce expanding fastest due to 24/7 access.

AI Impact

AI in Diagnostics

◉AI algorithms detect cavities, gum disease, and abnormalities in radiographs.

◉Enhances accuracy and early detection.

AI in Digital Dentistry

◉Supports CAD/CAM prosthodontics, 3D modeling, and implant design.

◉Reduces time for fabrication and improves precision.

AI for Workflow Optimization

◉DSOs and clinics use AI to streamline patient scheduling, billing, and inventory of consumables.

AI in Personalized Treatment

◉Aligners and prosthetic planning tailored through AI-based imaging and predictive modeling.

AI + Regulatory Support

◉Rapid FDA approvals for AI-driven dental software/devices allow faster clinical adoption.

AI in Patient Engagement

◉Chatbots and AI-driven education platforms guide patients in oral care and post-treatment monitoring.

Regional Insights

1. North America (36% Market Share in 2024)

Drivers:

◉High prevalence of gum disease among adults and children.

◉Over 2.3 million dental implants performed annually.

◉USD 124 billion spent yearly on dental care.

Example Development (2025):

◉Argen acquired Dental Axess Canada lab and denture clinics to strengthen its position in Canadian digital dentistry.

2. United States

Key Growth Factors:

◉Growing aging population vulnerable to tooth decay, gum disease, and implant needs.

◉Preventive dental check-ups are rising: 64% of adults visit annually (up from 57% the previous year).

◉54% of pregnant women consider dental visits as critical as routine physical health checkups.

Impact:

◉Growing demand for restorative and preventive consumables such as composites, resins, fluoride varnishes, and implants.

3. Canada

Challenges & Demand Drivers:

◉About 24% of Canadians avoid dentists due to treatment anxiety.

◉1 in 4 Canadians experience continuous dental pain caused by missing teeth, gum issues, or cavities.

Impact:

◉Increased adoption of consumables for restorative and pain-management solutions, including implants, prosthetics, and preventive products.

4. Asia Pacific (Fastest Growing Market)

Drivers:

◉High and growing prevalence of caries and periodontal disease.

◉Government-supported oral hygiene initiatives promoting preventive dental care.

◉Rapid economic growth and healthcare spending.

Example Development (2025):

◉NovaBone partnered with BEGO to distribute bioactive graft materials across Asia-Pacific and Europe.

Impact:

◉Fast adoption of whitening kits, clear aligners, digital oral care platforms, and implant consumables.

5. Europe

Growth Drivers:

◉Strong culture of dental implantology and aesthetic dentistry.

◉Increasing adoption of CAD/CAM technologies in restorative and prosthodontics.

Example Development (2025):

◉Septodont + Micro-Mega partnership to distribute advanced endodontic consumables (GenENDO) across EU, UK, and MEA.

Impact:

◉Rapid growth in biocompatible consumables like ceramics and regenerative biomaterials.

Market Dynamics

Drivers

◉Rising Awareness of Oral Health – Preventive check-ups and education campaigns improving adoption.

◉Cosmetic & Restorative Dentistry Demand – Increasing use of whitening, composites, and implant procedures.

◉Growth of Dental Service Organizations (DSOs) – Streamlined practice management enables wider adoption of advanced consumables.

◉Technological Integration – CAD/CAM, 3D printing, and AI-driven diagnostics improving precision.

Restraints

◉High Cost of Advanced Products – Ceramic implants, aligners, and biocompatible materials remain expensive.

◉Low Awareness in Emerging Economies – Preventive care knowledge still limited.

◉Inadequate Infrastructure in Low-Income Regions – Shortage of dental professionals and facilities.

Opportunities

◉Biocompatible Materials – Growing demand for resins, ceramics, and biomaterials replacing amalgam.

◉E-Commerce Expansion – Online supply chains improving affordability and accessibility.

◉AI-driven Solutions – AI in diagnostics, patient engagement, and CAD/CAM prosthodontics.

Top Companies

Dentsply Sirona

◉Products: Restorative materials, endodontics, orthodontics, and implant consumables.

◉Strength: Largest global player with robust R&D capabilities and advanced CAD/CAM solutions.

Colgate Palmolive

◉Products: Preventive consumables such as toothpaste, varnishes, whitening products.

◉Strength: Strong brand recognition and community outreach programs like Bright Smiles, Bright Futures.

Straumann Holding

◉Products: Dental implants, prosthetic components, regenerative biomaterials.

◉Strength: Global market leader in implantology with cutting-edge digital implant workflows.

Ivoclar Vivadent

◉Products: Aesthetic consumables including composites, luting cements, and ceramics.

◉Strength: High expertise in aesthetic dentistry materials with strong innovation in ceramics.

Henry Schein

◉Products: Distributor of a wide range of dental consumables and devices.

◉Strength: Global supply chain leadership and strong online/e-commerce presence.

Latest Announcements

ZimVie (June 2025)

ZimVie’s CEO announced digital dentistry as the new standard in implantology, marking a significant shift toward advanced digital workflows. The company is expanding its RealGUIDE and Implant Concierge platforms to improve precision-guided surgery, treatment planning, and patient outcomes. This move strengthens ZimVie’s footprint in the digital implantology ecosystem, aligning with global adoption trends in AI-driven and CAD/CAM solutions.

Argen (January 2025)

Argen acquired Dental Axess Canada’s lab and denture clinics, furthering its Canadian presence in digital dental solutions. This acquisition enhances Argen’s capabilities in prosthetic manufacturing, digital workflows, and customized solutions, supporting the fast-growing demand for implant-supported dentures and CAD/CAM restorations across North America.

Recent Developments

Septodont + Premier Dental (January 2025)

Septodont, in partnership with Premier Dental, launched BufferPro 8.4% sodium bicarbonate buffering solution. This innovation enables faster onset and enhanced efficacy of local anesthesia, improving patient comfort and reducing treatment delays in oral surgeries and restorative procedures.

Septodont + Micro-Mega (June 2025)

Septodont formed a commercial partnership with Micro-Mega for the distribution of GenENDO endodontic solutions across Europe, UK, and MEA. The collaboration aims to expand Septodont’s presence in the endodontics segment, offering advanced solutions in root canal therapy, obturation, and canal shaping.

NovaBone + BEGO (January 2025)

NovaBone entered into a distribution partnership with BEGO to supply bioactive bone graft consumables across Europe. This alliance supports the growing demand for regenerative dental biomaterials, particularly in implantology and oral surgery, where bone grafting plays a crucial role in long-term treatment success.

Segments Covered

By Product Category

Restorative & Aesthetic Materials

◉Includes composites, adhesives, luting cements, and impression materials.

◉Drivers: Rising demand for minimally invasive procedures and natural aesthetics.

◉Trend: Shift toward nanohybrid composites for durability and improved esthetics.

Prosthodontics & Implant

Includes crown and bridge materials, prosthetic components, and regenerative biomaterials.

◉Drivers: Increasing implant procedures worldwide.

◉Trend: CAD/CAM prosthetics and ceramic-based implant abutments are witnessing rapid adoption.

Orthodontics

◉Includes brackets, archwires, and aligners.

◉Drivers: Growing preference for clear aligners in adults and teens.

◉Trend: AI-based aligner treatment planning is boosting adoption.

Endodontics

◉Includes files, sealers, obturation materials, and posts.

◉Drivers: Rising incidence of root canal procedures.

◉Trend: Use of heat-treated NiTi rotary files and bioceramic sealers for precision and durability.

Periodontics & Preventive

◉Includes sealants, fluoride varnishes, and prophylactic pastes.

◉Drivers: Increasing focus on preventive care and oral hygiene awareness.

◉Trend: Expansion of school-based preventive dentistry programs.

Infection Control

◉Includes gloves, masks, sterilization pouches, and disinfectants.

◉Drivers: Infection prevention protocols post-COVID-19.

◉Trend: Adoption of eco-friendly and biodegradable consumables.

Others

◉Includes whitening kits, anesthetics, and rotary instruments.

◉Drivers: Cosmetic dentistry demand is surging.

Trend: Home-based teeth whitening kits gaining popularity.

By Material

◉Polymers/Composites/Resins (Dominant)

◉Flexible, aesthetic, and widely used in restorative dentistry.

◉Nanocomposites are leading innovation in this category.

◉Ceramics & Glass-Ceramics (Fastest Growing)

◉Preferred for long-term restorations and high strength.

◉Zirconia-based ceramics are gaining adoption in implants and crowns.

Metals & Alloys

◉Used in crowns, bridges, and orthodontics.

◉Facing decline due to shift toward ceramics and composites.

Biomaterials

◉Key for grafting, tissue regeneration, and implants.

◉Growth driven by partnerships like NovaBone + BEGO.

Cements & Adhesives

◉Integral for prosthetic fixation and restorative bonding.

◉Innovations focus on dual-cure and self-adhesive cements.

By Procedure/Indication

Restorative/Operative (Dominant)

◉Core segment for decay management and fillings.

◉Increasing use of minimally invasive restorations.

Prosthodontic/Implantology (Fastest Growing)

◉Driven by global implant adoption.

◉Digital implant workflows enabling faster turnaround.

Orthodontic

◉Clear aligners are the main growth driver.

◉Hybrid aligner systems gaining momentum.

Endodontic

◉Root canal procedures continue to rise globally.

◉Bioceramic sealers improving treatment success rates.

Preventive & Cosmetic

◉Strong role in dental public health and aesthetics.

◉Teeth whitening and preventive coatings in high demand.

By End User

Dental Clinics (Dominant, 68% Share)

◉Backbone of the dental consumables market.

◉Driven by individual practices adopting advanced materials.

Dental Service Organizations (DSOs – Fastest Growing)

◉Centralized purchasing power, rapid adoption of digital solutions.

◉Driving consolidation in the dental market.

Hospitals & Institutes

◉Focus on specialized treatments and research.

◉Training centers increasingly adopting advanced materials.

Dental Labs

◉Growing importance in CAD/CAM prosthetics and 3D printing.

◉Partnerships with DSOs and clinics expanding influence.

By Distribution

Indirect Sales (Dominant, 64% Share)

◉Majorly through distributors and dealers.

◉Traditional model preferred in fragmented markets.

Direct Sales

◉Increasing among large hospitals, institutions, and DSOs.

◉Manufacturers offering bulk pricing and direct support.

Online/E-commerce (Fastest Growing)

◉24/7 accessibility and cost efficiency.

◉Growth driven by B2B platforms and direct-to-dentist sales channels.

Top 5 FAQs

◉What is the market size of the dental consumables market?

– USD 40.7B (2024) → USD 42.92B (2025) → USD 69.23B (2034) at 5.46% CAGR.

◉Which region dominates the dental consumables market?

– North America (36% share, 2024) due to high implant procedures & spending.

◉Which region will grow fastest?

– Asia Pacific due to economic growth, government hygiene programs, and cosmetic dentistry adoption.

◉Which segment is the largest in 2024?

– Restorative & Aesthetic Materials (34% share) and polymers/composites (42% by material).

◉What role does AI play in this market?

– AI enhances diagnostic accuracy, supports CAD/CAM implantology, enables personalized aligner/implant planning, and streamlines DSO workflows.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6046

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest