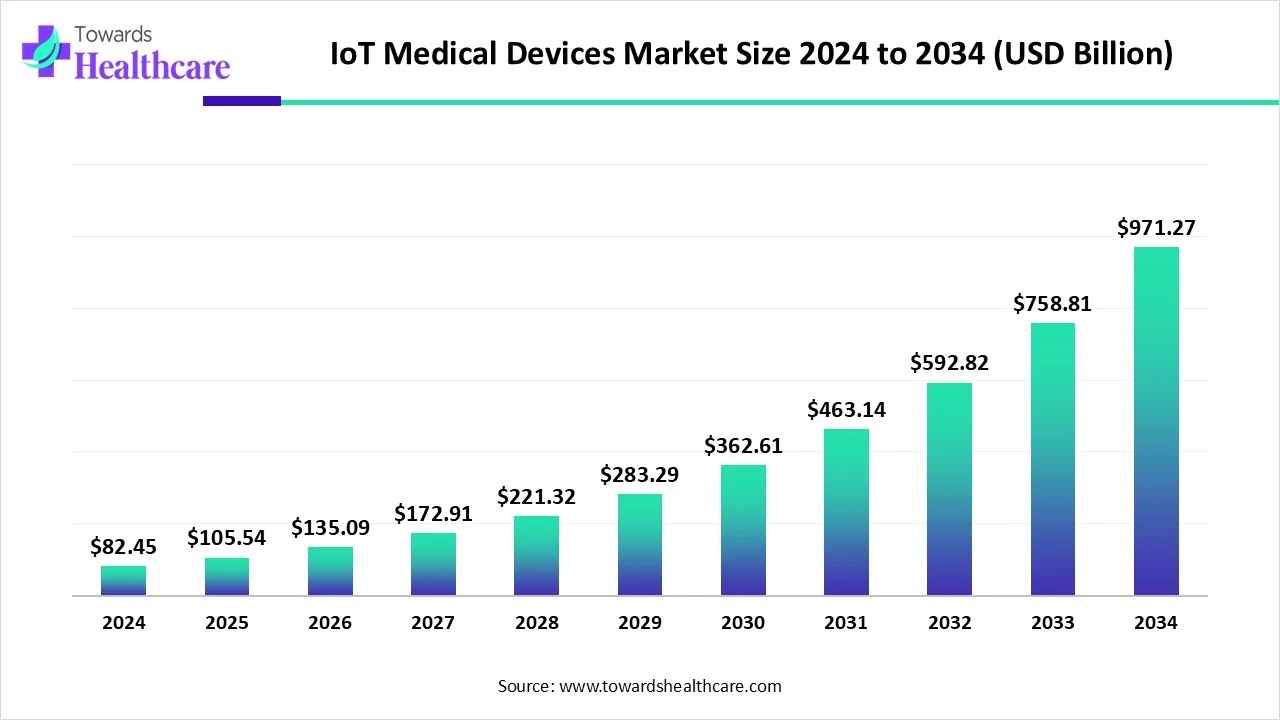

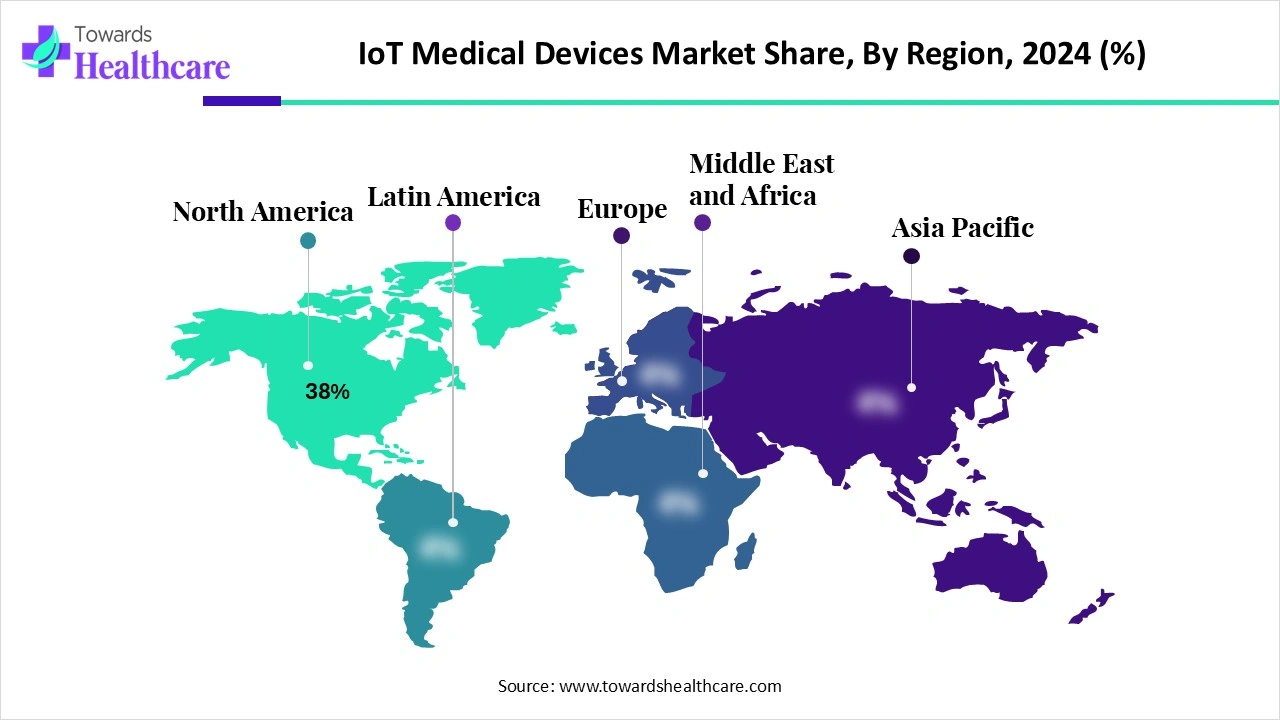

The global IoT medical devices market was valued at USD 82.45 billion in 2024, expanded to USD 105.54 billion in 2025, and is projected to reach USD 971.27 billion by 2034, growing at a CAGR of 28% (2025–2034). North America dominated the market in 2024 with a 38% revenue share, while Asia Pacific is projected to grow fastest during the forecast period. Wearable devices led the market in 2024 with 45% revenue share, while implantable devices are expected to grow at the highest CAGR. Bluetooth connectivity held the highest share (35%) in 2024, but cellular IoT is projected to be the fastest growing technology segment.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/6045

Market Size Insights

Market Valuation Growth

◉2024: USD 82.45 billion

◉2025: USD 105.54 billion

◉2034: USD 971.27 billion

◉CAGR: 28% (2025–2034)

Regional Market Share (2024)

◉North America: 38% share (dominant region)

◉Asia Pacific: fastest CAGR due to healthcare digitization & patient base expansion

◉Europe: steady adoption of IoT-based remote monitoring

◉Latin America & MEA: emerging adoption, driven by telemedicine expansion

Device Type Share (2024)

◉Wearable Devices: 45% market share (dominant)

◉Implantable Devices: fastest growth (biochips, smart pacemakers, glucose implants)

◉Stationary/Bedside Devices: widely used in hospitals

◉Remote Monitoring Devices: high adoption for chronic disease & elderly care

Connectivity Share (2024)

◉Bluetooth: 35% market share (dominant)

◉Wi-Fi: strong adoption for hospital-based devices

◉Cellular (3G/4G/5G): fastest CAGR, supported by 5G-enabled healthcare solutions

◉LPWAN, Zigbee, others: niche adoption in specific hospital/home settings

End-User Share (2024)

◉Hospitals & Clinics: 50% share (dominant)

◉Home Healthcare: fastest CAGR (driven by patient preference & self-monitoring adoption)

Market Trends

Rising Technology Adoption in Healthcare

◉IoT integrated with AI, ML, and predictive analytics for personalized care.

◉Remote diagnostics & chronic illness monitoring on the rise.

Virtual Care & IoT Partnerships

◉MediBuddy + ELECOM (Feb 2025): Development of IoT health devices for preventive care & personalized health plans.

Remote Patient Monitoring Growth

◉Remote monitoring accounted for 40% share in 2024.

◉Elderly care & assisted living projected as fastest-growing application due to aging populations.

Wearable Device Dominance

◉Smartwatches, ECG monitors, glucose trackers led 45% share in 2024.

◉Preventive healthcare & aging population driving adoption.

Connectivity Advancements

◉Bluetooth dominates 35% share, but cellular (5G & beyond) expected to transform telehealth, brain-computer interfaces, and remote surgery.

AI’s Role in IoT Medical Devices

Real-Time Data Processing

◉IoT devices generate massive real-time datasets.

◉AI processes and translates into actionable insights for doctors & caregivers.

Predictive Healthcare & Early Diagnosis

◉AI detects anomalies in vital signs, glucose levels, heart rhythm before critical escalation.

◉Predictive models prevent hospital readmissions.

Personalized Medicine

◉AI integrates patient lifestyle, genomic & IoT data to deliver customized care plans.

AI-Powered Remote Patient Monitoring

◉Combines IoT sensors with AI for continuous disease tracking.

◉Enhances elderly care with fall detection, medication reminders, & emergency alerts.

Pandemic & Aging Population Solutions

◉AI+IoT reduces doctor-patient contact while ensuring care continuity.

◉Addresses growing burden of elderly care globally.

Regional Insights

1) North America — (38% share in 2024)

Structural advantages

◉Large healthcare R&D ecosystem (major med-tech hubs, academic medical centers) that accelerates prototyping, clinical validation, and commercialization of IoT medical devices.

◉Sophisticated payor and provider networks willing to pilot remote monitoring and digital therapeutics, enabling scale beyond pilot projects.

Regulatory & standards environment

◉Active regulatory approvals for AI/ML-enabled devices (your data: ~950 AI/ML devices approved in the U.S. by Aug 2024) — this both de-risked clinical acceptance and encouraged industry investments.

◉Federal strategy alignment (Federal Health IT Strategy 2024–2030) provides funding, interoperability focus and a policy roadmap for telehealth/IoT integration — this reduces adoption friction at scale.

Commercial & clinical pull

◉Large hospital systems (IDNs) and integrated care networks are primary buyers of advanced bedside/diagnostic IoT equipment; their procurement drives economies of scale.

◉Consumer health market (wearables) rapidly feeds clinical workflows via patient-generated data (Apple, Fitbit ecosystems).

Key risks specific to region

◉High regulatory bar means longer time-to-market for invasive or high-risk implantables despite large addressable market.

◉Data governance & state/federal privacy laws add compliance complexity for vendors.

2) Asia Pacific — (Fastest projected CAGR)

Demand fundamentals

◉Large and aging patient populations plus rising chronic disease prevalence create a strong need for remote care and continuous monitoring.

◉Rapidly improving healthcare access in urban & semi-urban areas drives demand for connected devices.

Policy & national programs

◉China’s national health planning (Healthy China initiatives) actively encourages digital health investments and telemedicine scaling — platforms & IoT vendors can find large domestic demand and supportive policy.

◉India: government-led initiatives and funding (Rs 500 crore plan — your input) plus digital ID/records programs (Ayushman Bharat / PM Digital Health Mission) create a foundation for device data integration into national health stacks.

Infrastructure & tech adoption

◉Mobile penetration is high; smartphone + low-cost wearables act as a delivery channel for home healthcare services.

◉5G rollouts and improvements in broadband capacity support higher-bandwidth IoT uses (teleconsultation, imaging transfer, remote diagnostics).

Commercial implications

◉Opportunity to localize lower-cost wearables & remote monitoring solutions for mass markets.

◉Partnerships between telehealth platforms and device OEMs (example: MediBuddy + ELECOM in your content) reflect a platform + device go-to-market play.

3) Europe — (steady adoption, privacy-centric)

Drivers

◉High prevalence of chronic conditions (cardio, respiratory) and strong public healthcare systems drive procurement of remote patient monitoring and preventive devices.

◉Consumers show high demand for self-management tools (wearables, home monitors).

Regulatory & data rules

◉Strong data protection emphasis (GDPR + national rules) forces device and cloud providers to architect privacy-by-design systems and often onshore data processing — this raises vendor compliance costs but increases patient trust.

◉Example: Germany’s new stricter specs for cloud processing of health data (2024) forces tighter vendor certification and may favor large, established suppliers or certified cloud partners.

Clinical adoption patterns

◉Public tenders by national health services prioritize validated devices that integrate with existing EHRs and care pathways, favoring mature vendors and interoperable solutions.

4) Latin America & MEA — (emerging, opportunistic)

Market character

◉Mixed public/private systems: adoption pockets in urban centers and private hospitals; rural areas still underserved but telemedicine is bridging gaps.

◉Brazil & Mexico: largest market opportunities due to population size and increasing digital health projects.

Adoption drivers

◉Telemedicine programs and remote monitoring devices provide cost-effective ways to expand access to specialists.

◉Gulf states (UAE, Saudi) — heavy investments in “smart hospital” projects and digital transformation create demand for advanced bedside IoT and remote monitoring solutions.

Barriers

◉Variable regulatory clarity and limited reimbursement frameworks in many countries restrict rapid enterprise scale unless vendors pursue private payor channels or direct-to-consumer models.

Market Dynamics

Drivers

Continuous monitoring improves outcomes & reduces cost

◉IoT devices enable longitudinal data capture (vs. snapshot clinic vitals), allowing earlier intervention and reduced readmissions.

Telemedicine + home healthcare growth

◉Patient preference for at-home care and payer incentives push adoption of home monitoring kits and remote triage.

Platform economics & data monetization

◉Large device fleets + cloud platforms enable SaaS/recurring revenue models (device + data + analytics).

Technology convergence

◉5G, edge computing, AI, and secure cloud stacks together enable higher-value use cases (real-time imaging transfer, remote surgery assist).

Restraints

Security & privacy are systemic blockers

◉Lack of global standards and inconsistent regional rules increase device certification burdens and liability exposure.

Data ownership & interoperability

◉Fragmented data silos (device vendors, EHRs, payers) slow clinical integration; vendors must invest in APIs, HL7/FHIR compatibility.

Clinical validation & reimbursement

◉Payers require clinical outcomes evidence; proving ROI for remote monitoring can be costly and time-consuming.

Opportunities

IoT-assisted robotic & telesurgery

◉Low-latency networks + haptics can enable remote surgical assistance and multiplexed robot control — long-term high TAM use case.

Edge AI for on-device triage

◉Embedding ML models at the edge reduces latency and bandwidth needs and improves privacy by filtering sensitive data before cloud upload.

Cyber-resilient devices

◉Post-quantum and PKI advances (your SEALSQ note) open a vendor differentiation path: certified quantum-resistant devices for high-security customers.

Top Companies

Medtronic

◉Products: Connected pacemakers, insulin pumps, implantable cardiac devices with telemetry.

◉Overview/Strengths: Leader in implantable market; regulatory experience and global clinical footprint; strong hospital relationships for device lifecycle services.

Abbott Laboratories

◉Products: IoT-enabled glucose monitoring systems (continuous glucose monitors), cardiac monitors.

◉Strengths: Well-established diabetes care ecosystem; clinician trust; large installed base for software updates and new features.

Philips Healthcare

◉Products: Hospital-grade patient monitoring systems, connected imaging solutions, telehealth platforms.

◉Strengths: Deep relationships with hospitals and health systems; integrated hardware + software solutions; focus on acute care IoT.

GE Healthcare

◉Products: Diagnostic imaging (connected CT/MRI), enterprise imaging platforms with device telemetry.

◉Strengths: Imaging leadership + AI partnerships that allow higher margin, value-added services (AI reads, triage).

Apple (Health Devices)

◉Products: Apple Watch (ECG, fall detection, oxygen, heart health features).

◉Strengths: Mass consumer reach, strong UX, clinical validation studies that enable consumer-to-clinic data flow.

Dexcom

◉Products: Continuous glucose monitoring systems integrated to smartphone apps & cloud.

◉Strengths: Specialized diabetes focus, tight clinician workflows, proven adherence benefits.

Siemens Healthineers / Johnson & Johnson / Boston Scientific

◉Products: Imaging, diagnostics, implantables (respectively).

◉Strengths: Enterprise contracts with hospitals, strong regulatory and servicing capabilities.

Emerging OEMs & software vendors (Withings, AliveCor, ResMed, Validic, Qualcomm Life)

◉Focus: Consumer & clinical wearable devices, remote patient management platforms, IoT connectivity modules.

◉Strengths: Niche solutions and platform partnerships (e.g., cloud marketplaces and integration play).

Latest Announcements

mCare Digital — mCareWatch 241 (July 2024)

◉What: IoT smartwatch targeted at patient monitoring with emphasis on reliability and assistive features.

◉Implication: Signals ongoing fragmentation/competition in wearable monitoring; smaller specialized OEMs can capture vertical niches (eldercare, remote monitoring) if they focus on usability and integration.

MediBuddy + ELECOM (Feb 2025)

◉What: Platform + hardware partnership to develop everyday health management IoT devices and use combined data for preventive care.

◉Implication: Exemplifies platform + device bundling strategy — telehealth companies extending into device ownership to lock in data flows and create longitudinal patient records.

Recent Developments

SEALSQ (June 2025) — Quantum-resistant IoMT security & PKI

◉Technical impact: Moves security from “best effort” to certified architectures for high-security environments (hospitals, government). Vendors that integrate such features early may be preferred for critical care deployments.

Validic on AWS Marketplace (Feb 2025)

◉Commercial impact: Simplifies procurement for health systems that buy via cloud marketplaces; increases enterprise visibility for remote patient management platforms; lowers integration friction with cloud providers.

Segments Covered

By Device Type

Wearables

◉Use cases: continuous vitals, activity, ECG snapshots, medication adherence.

◉Commercial model: DTC + clinician subscription; data streams feed remote monitoring hubs.

Implantables

◉Use cases: long-term cardiac rhythm management, drug delivery, biosensing.

◉Considerations: regulatory burden, surgical implantation pathways, long product lifecycles and service contracts.

Stationary/Bedside Devices

◉Use cases: connected ventilators, infusion pumps, central monitors.

◉Integration: needs hospital network compatibility, HL7/FHIR integration, and cybersecurity certification.

Remote Monitoring Kits

◉Use cases: bundled devices for COPD, heart failure, diabetes; include patient gateway + clinician dashboards.

◉Economics: recurring subscription for monitoring + analytics; evidence required to secure reimbursement.

By Connectivity Technology

Bluetooth

◉Strength: low power, easy phone pairing — dominant in consumer wearables.

Wi-Fi

◉Strength: hospital LANs & high bandwidth bedside devices.

Cellular (3G/4G/5G)

◉Strength: coverage, mobility, low latency for advanced use cases (remote imaging transfer, telesurgery). 5G slicing can create dedicated quality channels for health traffic.

LPWAN / Zigbee

◉Strength: low power, long range for specialized sensors and asset tracking.

By End-User

◉Hospitals & Clinics: prioritize device reliability, service & EHR integrations.

◉Home Healthcare: prioritizes usability, battery life, remote provisioning, reimbursement readiness.

◉Telemedicine Providers: prefer turnkey device + platform solutions for rapid deployment.

Top 5 FAQs

1 What is the IoT medical devices market size & growth?

2024: USD 82.45B; 2025: USD 105.54B; 2034 projection: USD 971.27B. CAGR 28% (2025–2034).

2 Why is North America the largest market (38% share)?

Because of strong R&D, early digital health adoption, regulatory approvals for AI/ML devices, federal health IT strategies and large hospital procurement.

3 Which device and connectivity categories dominate and why?

Wearables (45% in 2024) dominate due to consumer adoption and chronic disease monitoring; Bluetooth (35% in 2024) dominates connectivity for wearables, while cellular/5G is the fastest-growing segment for higher bandwidth clinical applications.

4 What are the main constraints for vendors?

Data privacy/security, regional regulatory variation, interoperability needs, and proving clinical/economic value for reimbursement.

5 What strategic opportunities should vendors prioritize today?

Build end-to-end solutions (device + cloud + analytics), invest in security & interoperability (FHIR, certified cloud), pilot home healthcare bundles with clear clinical outcome measurement, and prepare for 5G-enabled high-value use cases (real-time imaging, remote procedures).

Check out the details below!

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6045

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest