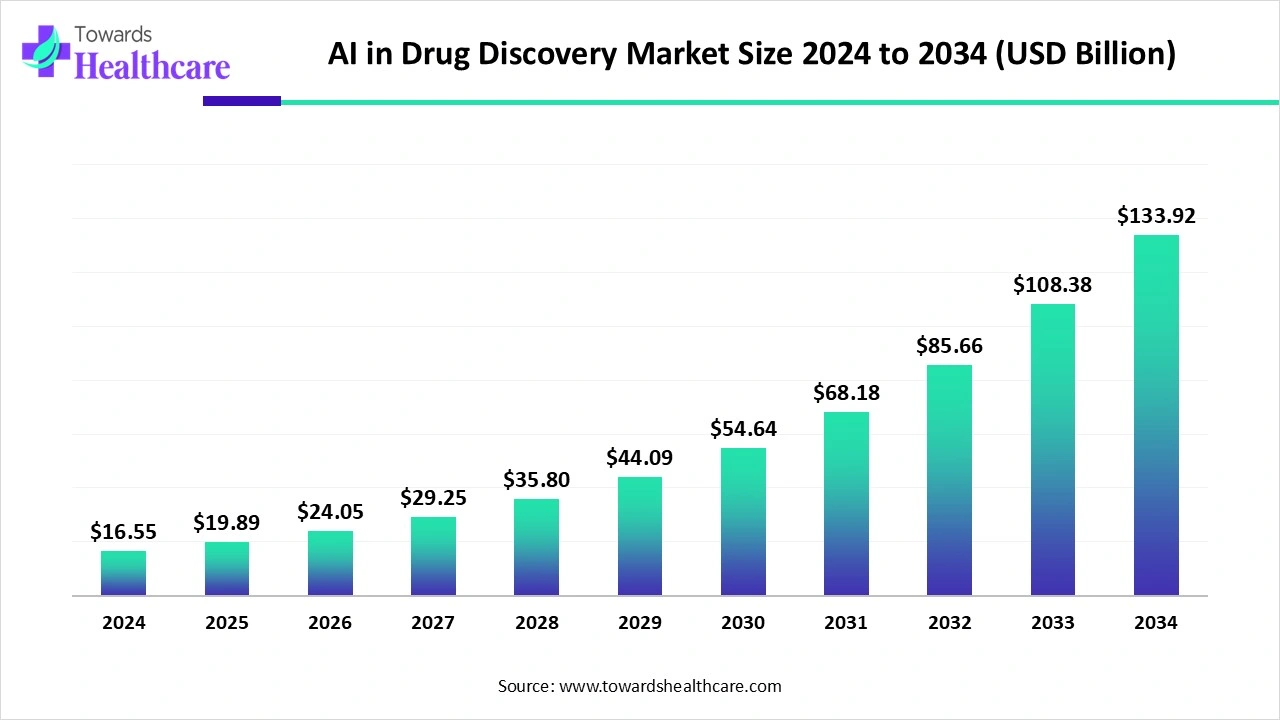

The global AI in Drug Discovery Market was valued at USD 19.89 billion in 2025 and is projected to grow to USD 133.92 billion by 2034 (CAGR 23.22% from 2024–2034), driven by AI’s ability to shorten R&D cycles, reduce costs, improve target identification and enable precision/repurposing strategies.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5010

Market size

2025 baseline and long-term projection

◉Market size: USD 19.89 billion (2025).

◉Forecast: USD 133.92 billion (2034) — implies aggressive expansion as AI penetrates discovery and preclinical/clinical workflows.

Compound Annual Growth Rate (CAGR)

◉Stated CAGR: 23.22% (2024–2034) — consistent with rapid adoption, high venture funding and integration with cloud/computational infrastructure.

Regional contribution (snapshot & growth pattern)

◉North America dominates the absolute market (North America USD 11.32B in 2025, rising to USD 74.81B in 2034), indicating large incumbents, deep R&D budgets and cloud/AI infrastructure.

◉Europe and Asia Pacific show substantial growth trajectories (Europe USD 4.38B in 2025 → USD 27.98B in 2034; Asia Pacific ~USD 2.82B in 2025 → USD 22.38B in 2034), reflecting research ecosystems and expanding startups.

Market scaling dynamics

◉Absolute increase from 2025→2034: USD 114.03B, meaning large new addressable spend across pharma, biotech, CROs, and tools/platform providers.

◉Rapid top-line expansion indicates movement from pilot projects to productionized AI-driven discovery pipelines.

Unit economics & downstream value capture

◉AI vendors that can demonstrably improve hit-to-lead conversion, shorten timelines or reduce experimental cycles will capture disproportionate value (platforms, SaaS, compute & data services).

Investment and M&A signal

◉Multiple acquisitions and high funding rounds (e.g., startups raising >$1B or multiple acqui-hires) indicate investor conviction and consolidation potential.

Segment concentration (by solution type)

◉Core revenue pools: platform subscriptions (SaaS), project collaborations (co-discovery deals), licensing of AI-designed assets, and compute/data services.

Cost offsets and ROI

◉Given average cost to bring a drug to market (USD 2.6B), even modest reductions in attrition or time-to-candidate justify large vendor valuations and market spend.

Temporal adoption curve

◉Early adopters: large pharma and digitally mature biotech. Fast followers: CROs, niche biotech, academic translational units. Broad market: majority of mid-size pharma by late decade.

Sensitivity factors

◉Market size dependent on: data availability & sharing, regulatory comfort with AI outputs, demonstrated clinical validation of AI-derived molecules, and cloud/computing cost trends.

Market trends

Surging venture funding & unicorn/large rounds

◉Example: Xaira Therapeutics (Apr 2024) debut backed by >$1B funding — signals large capital inflows into platform biology + generative approaches.

Startups emerging in regional hotspots

◉India example: Peptris (Dec 2023) $1M pre-seed in Bangalore — shows geographic spread of innovation beyond traditional hubs.

Platform commercialization (SaaS + compute + generative AI)

◉MilliporeSigma’s AIDDISON™ (Dec 2023) — SaaS platforms that combine generative AI, ML and CADD (computer-aided drug design) are moving into commercial offerings.

Consolidation and capability build via M&A

◉Ginkgo Bioworks acquisitions (Feb 2024) to augment AI models, assays and RNA toolkits — trend toward vertical integration of wet lab + ML stacks.

Cloud & hyperscaler partnerships

◉Exscientia–AWS extension (July 2024) — demonstrates reliance on cloud ML/compute scale and the importance of partnerships with hyperscalers.

Regulatory & public policy moves shaping adoption

◉Examples: Canada creating a Canadian Drug Agency and funding rare disease strategy — government programs encourage faster translation and can drive demand for AI-enabled discovery.

Open model / community efforts

◉Google’s announcement of TxGemma (March 2025) — open AI models targeted at therapeutic entities accelerates researcher access and could democratize some capabilities.

Cross-industry collaborations

◉Pharma ↔ AI vendor collaborations (e.g., WeComput partnership) indicate co-development rather than pure vendor/customer relationships.

Shift from individual modules to end-to-end platforms

◉Movement from isolated tools (docking, QSAR, image analysis) to integrated pipelines covering target ID → optimization → preclinical prediction.

Expanding therapeutic focus

◉While oncology is currently largest application, infectious disease and polypharmacology research are gaining traction, fueled by pandemic lessons and vaccine/therapeutic R&D needs.

AI impacts / roles in drug discovery

1. Target identification & nomination (systematic hypothesis generation)

◉AI ingests multi-omic datasets, literature, clinical records and screens for correlated disease drivers.

Impact: reveals non-obvious targets (e.g., network hubs), reduces false leads, and ranks targets by druggability and safety risk.

2. Virtual screening & hit identification at scale

◉Deep models predict binding probability across enormous chemical spaces far faster than docking.

◉Impact: transforms screening from experimental high-throughput to virtual first pass, lowering reagent/time costs and expanding chemical diversity.

3. De novo molecular design and optimization

◉Generative models propose novel scaffolds optimized for potency, ADME properties, and synthesizability.

◉Impact: accelerates hit-to-lead cycles by offering candidate structures that balance multiple constraints simultaneously.

4. Predictive ADMET & toxicity modeling

◉AI predicts absorption, metabolism, off-target interactions and toxicity endpoints from structure + biology.

◉Impact: earlier elimination of unsafe chemotypes, reducing late-stage failures and costly animal studies.

5. Lead prioritization & multi-objective optimization

◉Multi-objective optimization algos balance potency, selectivity, PK, synthesis routes and cost.

◉Impact: reduces iterative wet-lab cycles required to converge on viable candidates.

6. Biomarker discovery & patient stratification for trials

◉ML on clinical data + omics finds biomarkers to select high-probability responder cohorts.

◉Impact: increases trial signal, decreases required sample size, and reduces trial duration and cost.

7. Clinical trial design optimization

◉AI models simulate trial outcomes, suggest adaptive designs, and propose enrollment criteria to minimize attrition.

◉Impact: improves probability of success; aligns with stated market advantage of reducing clinical cycle time and increasing productivity.

8. Drug repurposing and polypharmacology prediction

◉Network models and similarity embeddings uncover new indications for existing molecules and predict multi-target activity.

◉Impact: faster route to clinic (known safety profile), cost reduction, and addressing multifactorial diseases.

9. Automation + closed-loop wet lab (lab automation integration)

◉Integration of ML with robotic platforms closes the loop: propose → synthesize → assay → retrain.

◉Impact: accelerates iteration cadence from months to days; enables efficient model retraining with real experimental data.

10. Knowledge synthesis & decision support (literature / IP mining)

◉NLP models extract relationships from literature, patents, clinicaltrials, enabling faster diligence and hypothesis formation.

◉Impact: reduces duplication, surfaces prior art / constraints, and helps teams decide where to invest experiments.

Regional insights

North America (dominant market & innovation epicenter)

Market size & trajectory

◉USD 11.32B (2025) → USD 74.81B (2034): largest absolute market and fastest absolute dollar growth.

Enablers

◉Large pharma R&D budgets, concentration of AI/ML talent, advanced cloud infrastructure, robust VC ecosystems.

Business models

◉Enterprise deals (co-discovery, licensing), large partnerships with hyperscalers, and platform SaaS adoption.

Regulatory & payer dynamics

◉FDA engagement and pharma regulatory sophistication allow earlier pilots to scale; reimbursement pressure drives cost-saving tech adoption.

Risks

◉High cost base, competition for talent, and expectations for near-term ROI from investors.

Europe

Market size & trajectory

◉USD 4.38B (2025) → USD 27.98B (2034).

Enablers

◉Strong academic centers, translational institutes, and patient data registries; emphasis on precision medicine and public funding.

Regulatory posture

◉Balanced approach: robust data protection and clinical validation requirements — slows some rollouts but increases quality of evidence.

Strengths & opportunities

◉Leadership in biology-driven AI startups (Insilico, Owkin, Iktos, Deep Genomics) and collaborations with hospitals/biobanks.

Asia Pacific (fastest regional growth rate)

Market size & trajectory

USD 2.82B (2025) → USD 22.38B (2034) — high percentage growth as ecosystems mature.

Enablers

◉Growing biotech startups, lower operating costs for wet labs, improving regulatory frameworks, and massive population data for epidemiology.

Countries of note

◉China: rapid clinical trial registration growth (2022→2023), active regulatory updates; India: vibrant AI/ML talent pool and emerging biotech startups.

Risks & constraints

◉Data sharing/legal differences, fragmented market, and IP / commercialization pathways variability.

Latin America & Middle East & Africa (emerging but strategic)

Market size & trajectory

◉Latin America: USD 0.97B (2025) → USD 6.77B (2034).

◉MEA: USD 0.39B (2025) → USD 1.98B (2034).

Enablers

◉Localized research centers, increasing partnerships with global pharma, and interest in regional disease burdens.

Challenges

◉Infrastructure, funding, and limited local venture scale — adoption likely via partnerships and off-site cloud services.

Market dynamics

Demand drivers

◉Rising chronic disease burden (e.g., CDC stats referenced): more need for rapid, cost-effective therapeutics.

◉Economic pressure: average drug development cost (~USD 2.6B) incentivizes AI for cost reduction.

Supply dynamics

◉Growth of AI vendors offering diverse offerings (generative, predictive, platform, data curation).

◉Hyperscaler capacity and cloud pricing shape compute cost economics.

Competition & differentiation

◉Differentiators: quality/volume of training data, algorithmic novelty, wet-lab integration, regulatory evidence of clinical impact, and domain expertise.

Partnerships & business models

◉Typical models: SaaS subscriptions, milestone-based discovery partnerships, licensing, equity/joint ventures and acquisitions.

Regulatory & ethical constraints

◉Need for explainability, validation of AI predictions in vitro/in vivo and compliance with data privacy laws — affect time-to-market for platforms’ outputs.

Adoption barriers

◉Data access costs, skill gaps in pharma teams, concerns over model interpretability, and cultural inertia in lab practices.

Enablers of scale

◉Demonstrated case studies where AI outputs became clinically validated assets; public programs and funding (e.g., national drug strategies) can accelerate adoption.

Risk & mitigation

◉Risk: over-promising (hype) → mitigation: rigorous validation, transparent benchmarks, and phased pilots tied to experimental readouts.

Value capture

◉Vendors providing integrated wet-lab + model feedback loops or unique datasets can command premium pricing and strategic partnerships.

Outlook

◉Shift from exploratory pilots (2020s) to mainstream, regulated workflows by end of decade if AI consistently reduces attrition and accelerates candidate progression.

Top 10 companies

1. Exscientia

Product/Offering: End-to-end AI discovery and automation platform (design → optimization → candidate selection).

Overview: Publicly notable AI-drug discovery company; extended partnerships with AWS to scale ML and automation.

Strength: Integrated platform approach, strong industry partnerships, and demonstrated collaborations with pharma.

2. Insilico Medicine

Product/Offering: Generative chemistry and target ID platforms combining deep learning with biological datasets.

Overview: AI company focused on generative models to propose novel compounds and biomarkers.

Strength: Deep learning expertise applied to de novo design and translational biomarker discovery.

3. Atomwise

Product/Offering: Structure-based virtual screening and lead discovery using deep learning (atom-level models).

Overview: Early mover in ML docking/virtual screening.

Strength: Scalable virtual screening, sizable compound libraries, and pharma collaboration network.

4. IBM (Watson Health)

Product/Offering: ML/NLP platforms for biomedical data analysis, literature mining and decision support.

Overview: Large enterprise provider with cross-industry reach.

Strength: Enterprise credibility, large datasets, and integration capabilities for pharma customers.

5. Google (DeepMind / TxGemma)

Product/Offering: Advanced AI models (e.g., TxGemma — models understanding therapeutic entities, molecules, proteins).

Overview: Hyperscaler with leading research teams producing open/model toolkits for researchers.

Strength: World-class foundational models, compute resources, and potential to democratize access (open models).

6. BenevolentAI

Product/Offering: AI platform for target discovery, biomedical knowledge graphs and drug repurposing.

Overview: Knowledge graph + ML approach to accelerate hypothesis generation.

Strength: Graph-based knowledge synthesis and translational focus.

7. Aitia (formerly GNS Healthcare)

Product/Offering: Causal ML and simulation models for patient stratification and drug response prediction.

Overview: Rebranded/former GNS Healthcare — expertise in translating complex data to clinical predictions.

Strength: Causal inference focus and real-world evidence modeling strengths.

8. BioSymetrics, Inc.

Product/Offering: ML platforms for biomarker discovery and patient stratification tied to drug discovery pipelines.

Overview: Specializes in combining clinical and molecular datasets for translational insights.

Strength: Deep domain expertise in biomarkers and clinical genomics.

9. Insitro

Product/Offering: Machine learning + high-throughput biology to generate disease models and discover targets.

Overview: Uses data generation (cellular/tissue assays) integrated with ML to produce validated insights.

Strength: Integration of wet-lab data generation with ML model training loops.

10. Berg Health (now part of BPGbio Inc.) / CYCLICA (acquired by Recursion) — combined note

Product/Offering: Berg: biologically driven AI platforms; CYCLICA: cyclic peptide discovery tech (now within Recursion).

Overview: Acquisitions indicate consolidation and absorption of niche technologies into larger AI discovery firms.

Strength: Domain-specific IP (e.g., cyclic peptides) and biologically grounded discovery approaches.

Latest announcements

Google — TxGemma (March 2025)

What: Announcement of TxGemma, an open collection of AI models that understand therapeutic entities (small molecules, proteins, chemicals).

Implication: Democratizes access to specialized models for researchers; accelerates hypothesis testing and property prediction across modalities.

Ginkgo Bioworks acquisitions (Feb 2024)

What: Acquired Reverie Labs, Proof Diagnostics, Patch Biosciences.

Implication: Strengthens Ginkgo’s AI foundation models, RNA tools and ML-assay capabilities — clarifies trend of combining biological hardware with ML stacks.

MilliporeSigma — AIDDISON™ (Dec 2023)

What: SaaS platform combining generative AI, ML and CADD to boost success rates of therapies.

Implication: Large legacy life-science companies pivoting to provide platformized AI drug discovery tools.

Exscientia–AWS extension (July 2024)

What: Extended partnership to leverage AWS ML and AI capabilities for Exscientia’s automation platform.

Implication: Shows critical role of hyperscalers in providing scalable compute and ML infrastructure for AI drug discovery operations.

Iambic Therapeutics (Oct 2024)

What: Claimed release of an AI model that could significantly reduce time and cost to develop new drugs.

Implication: Early stage claims of transformative models continue to surface; emphasizes need for independent validation.

Accenture investment in 1910 Genetics (Oct 2024)

What: Accenture Ventures investment into 1910 Genetics to advance multimodal AI + lab automation for small/large molecules.

Implication: Consultancies and systems integrators are placing strategic bets on multimodal, automated discovery platforms.

Recent developments

Massive funding events & new startups

Xaira Therapeutics (Apr 2024) debut with >$1B financing illustrating large capital flows into platform drug discovery.

Startups raising seed/pre-seed globally

Peptris Technologies (Dec 2023) in Bangalore — shows expansion of AI drug discovery ecosystems outside US/Europe.

Hyperscaler & pharma partnerships

Exscientia + AWS (Jul 2024) and similar collaborations embed cloud ML capabilities into discovery pipelines.

Consolidation via M&A

Ginkgo Bioworks acquisitions (Feb 2024) and CYCLICA acquisition (May 2023 by Recursion) — vertical consolidation of wet-lab, assay and AI capabilities.

Enterprise product launches

MilliporeSigma’s AIDDISON™ (Dec 2023) — enterprise SaaS offerings from established life-science vendors.

Open model efforts

Google’s TxGemma (Mar 2025) — trend to release therapeutic-aware foundational models.

Government & policy moves

Canada’s National Strategy for Drugs for Rare Diseases and CDA formation — public funding and agency activity to support drug pipelines where AI can help.

Clinical trial & regulatory environment changes

China NMPA seeking input to expedite foreign innovative drugs (June 2024) — indicates regulatory modernization that may help AI-discovered assets enter markets.

Academic & industry cross-pollination

Owkin and pathologist workflow initiatives (Jan 2025) — digital pathology + AI to relieve clinician burden and feed discovery pipelines.

Claims of transformational AI models

Iambic (Oct 2024) and others announcing models that purport to reduce time/cost — signal both innovation and the need for independent validation.

Segments covered

1. Solution type / technology

Subpoints: Generative models, deep learning, supervised ML, reinforcement learning, knowledge graphs, CADD integrations.

Explanation: Each technology targets specific discovery tasks — generative models for design, deep learning for pattern recognition in imaging/omics, knowledge graphs for hypothesis linking.

2. Platform vs Project services

Subpoints: SaaS platforms (subscription), project-based collaborations (milestone payments), licensing.

Explanation: Platforms scale across customers; projects are bespoke and often the route for high-value co-discovery deals.

3. Data & compute services

Subpoints: Curated datasets, private/pseudonymized clinical data, compute credits (hyperscalers).

Explanation: Data is a competitive moat; compute enables model training and inference at scale.

4. Wet-lab integration / automation

Subpoints: Robotic synthesis, high-throughput screening integration, closed-loop experimentation.

Explanation: Essential for closing ML loops and accelerating empirical validation of AI hypotheses.

5. Validation & regulatory evidence generation

Subpoints: In vitro, in vivo, translational biomarkers, RWE (real-world evidence).

Explanation: Demonstrable experimental validation builds credibility, necessary for licensing and regulatory acceptance.

6. Specialty modalities

Subpoints: Small molecules, biologics, RNA modalities, cyclic peptides.

Explanation: Different modalities require tailored ML models and wet lab capabilities.

7. Clinical enablement & trial optimization

Subpoints: Biomarkers, patient selection, adaptive trial simulations, endpoint prediction.

Explanation: Downstream value in improving trial success probability and speed.

8. Repurposing & polypharmacology platforms

Subpoints: Knowledge graph repurposing, network pharmacology.

Explanation: Fastest route to clinic when safety profiles are known — high ROI for proven signals.

9. IP, legal & commercialization support

Subpoints: Patent landscaping, freedom-to-operate screening via NLP.

Explanation: Important to convert AI discoveries into protectable commercial assets.

10. Professional services & consultancy

Subpoints: Integration, validation, regulatory strategy services.

Explanation: Critical for enterprise customers lacking in-house AI/drug discovery expertise.

Top 5 FAQs

Q1: What is the current market size and projected growth for AI in drug discovery?

A: The market was evaluated at USD 19.89 billion in 2025 and is expected to reach USD 133.92 billion by 2034, growing at a 23.22% CAGR (2024–2034).

Q2: Which region currently leads the AI in drug discovery market?

A: North America leads in absolute terms (USD 11.32B in 2025, growing to USD 74.81B in 2034) due to large pharma presence, funding, cloud infrastructure and talent.

Q3: How does AI actually reduce drug discovery costs and timelines?

A: AI accelerates target ID, virtual screening, de novo design, ADMET prediction and trial design, which reduces wet-lab cycles, lowers attrition and compresses timelines — valuable given the typical drug development cost of USD 2.6 billion and low post-Phase I approval rates (<10%).

Q4: Who are major players to watch?

A: Key companies include Exscientia, Insilico Medicine, Atomwise, IBM (Watson), Google/DeepMind (TxGemma), BenevolentAI, Aitia (GNS), BioSymetrics, Insitro, and firms absorbed by larger players such as CYCLICA/Recursion.

Q5: What are the main barriers to broader adoption?

A: Primary restraints include data access/costs, model explainability, regulatory validation needs, high technical/infrastructure costs, and the cultural/organizational shift required in pharma R&D.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5010

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest