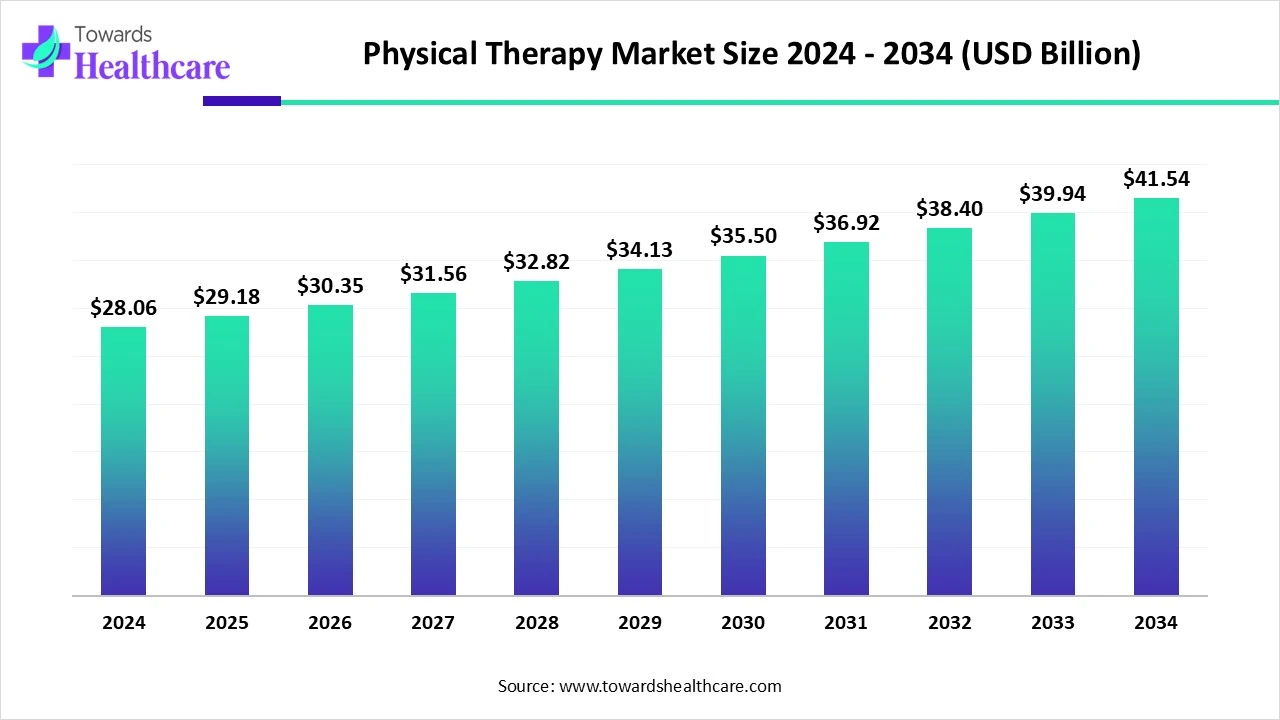

The global physical therapy market was USD 28.06 billion in 2024, rose to USD 29.18 billion in 2025, and is projected to reach USD 41.54 billion by 2034 — an absolute increase of USD 12.36 billion (2025→2034) at a CAGR ≈ 4% (2025–2034).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5929

Market size

Base & forecast figures

●2024 market size: USD 28.06B (base year provided).

●2025 market size: USD 29.18B.

●2034 projected market size: USD 41.54B.

●Absolute growth (2025 → 2034): USD 12.36B.

●Average nominal increase ≈ USD 1.37B per year across 2025–2034.

●CAGR (2025–2034): 4.00% (consistent with your stated 4%).

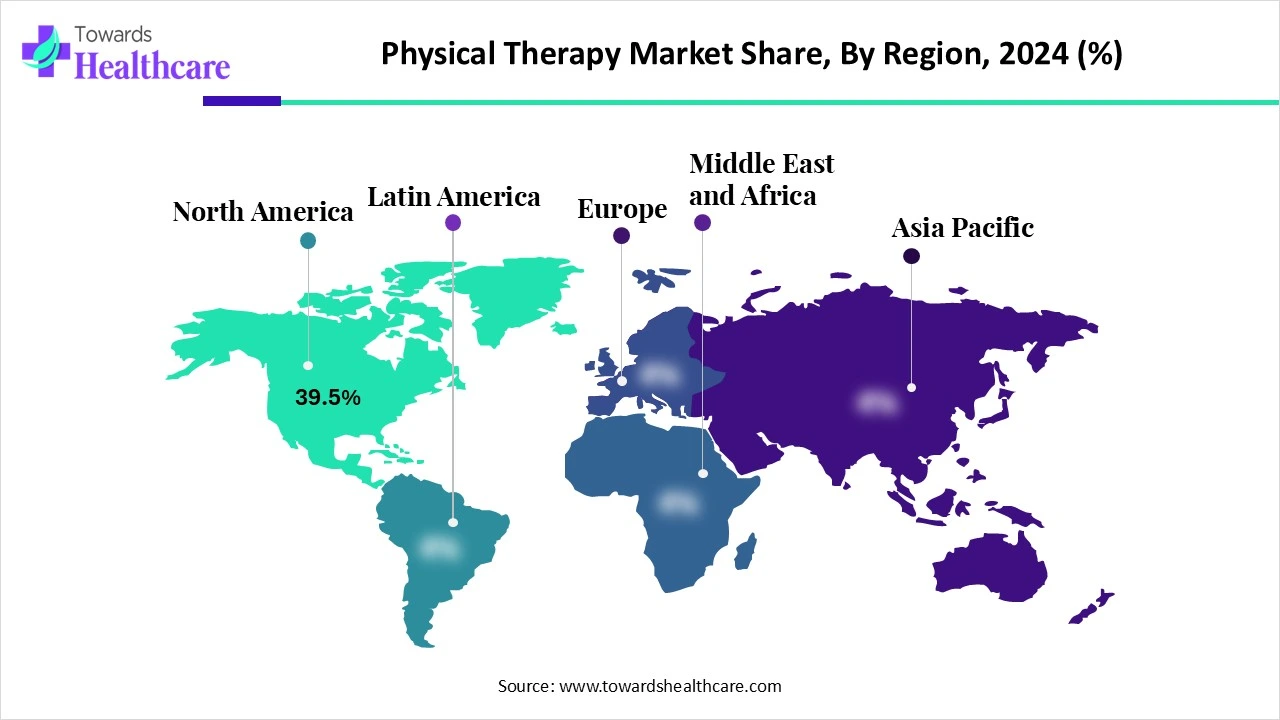

Regional weight (2024 snapshot)

●North America (39.5%) — implies USD 11.08B of the 2024 market is in North America (28.06 × 0.395 ≈ 11.08B).

●Remaining 60.5% (USD 16.98B) is split across Asia-Pacific, Europe, Latin America, MEA — with APAC singled out as the fastest growing region.

●Segment shares (2024, non-application) — market-dollar equivalents

●Orthopedic physical therapy (therapy type): 31.5% → ≈ USD 8.84B (28.06 × 0.315).

●Adult (18–64 years) age group: 58.2% → ≈ USD 16.33B.

●Geriatric (65+): fastest growing age cohort (high long-term upside).

●In-person delivery mode: 73.4% → ≈ USD 20.60B (large incumbent base).

●Outpatient clinics (end-use): 41% → ≈ USD 11.50B (2024).

●Therapeutic exercise equipment (equipment type): 34.7% → ≈ USD 9.74B.

High-growth pockets

●Tele-physical therapy / telehealth platforms: fastest CAGR among delivery modes — from a small base and driven by digital adoption and remote monitoring trends.

●Wearable sensors & robotic assist devices: highest equipment CAGR expectation — implies hardware/software device market expansion within the overall market.

Concentration & structure

●Mix of large service MSOs (multi-site operators) and device manufacturers; top players span both services and equipment.

●Market structure favors outpatient & clinic networks for volume, with technology vendors driving higher value per patient via devices, wearables and software.

Market Trends

Aging population & chronic disease prevalence

●Geriatric cohort (65+) is the fastest-growing age segment — increases demand for long-term rehab, fall prevention and geriatrics specialization.

Rising number of surgeries & post-operative rehab

●Surgical volumes (orthopedic and other procedures) drive post-op PT demand, a major market growth engine; orthopedic therapy was 31.5% of therapy-type share in 2024.

Musculoskeletal disease burden sustaining baseline demand

●Musculoskeletal disorders held 36% of the market in 2024 — a steady, volume-rich category that underpins equipment and service sales.

Shift to outpatient & home settings

●Outpatient clinics held 41% of market revenue (2024); acquisitions (e.g., outpatient/home care deals) show strategy to capture convenience and cost advantages.

Digitalization & telehealth expansion

●Tele-physical therapy is the fastest-growing delivery mode; platforms reduce travel friction and expand geographic reach.

Device innovation — wearables, robotics & therapeutic equipment

●Therapeutic exercise equipment dominated (34.7% share), while wearables & robotic assist devices are the projected fastest-growing equipment class.

AI/ML & big-data integration

●Companies are investing in AI (VALD, Raintree, others), using datasets and AI to improve assessment, documentation and outcome prediction.

M&A and roll-up strategies among service providers

●Large MSOs and therapy networks expand via acquisitions to increase geographic footprint and create standardized care pathways.

Emergence of virtual/VR therapy and gamified rehab

●Product launches (e.g., robotic gait trainers with VR) point to immersive rehab modalities — higher engagement and adherence.

Regional acceleration in APAC and medical tourism

●APAC expected fastest growth due to population scale, infrastructure investments and medical/rehab tourism (e.g., Kerala).

Workforce constraints & skill shortages

●Lack of skilled professionals (e.g., India ≈ 0.59 physiotherapists/10,000 people) is a key restraint — drives telehealth and task-augmentation technologies.

Reimbursement & policy tailwinds (varies by country)

●Favorable reimbursement in many developed markets supports outpatient clinic expansion and access to advanced devices.

AI roles / impacts

Computer vision for objective movement & gait analysis

●What: AI models analyze camera (2D/3D) or sensor data to quantify joint angles, symmetry, range-of-motion, compensations.

●Why it matters: Transforms subjective clinician observations into repeatable metrics for diagnosis, progress tracking and remote assessments.

●Outcome metrics: measurement reliability, reduction in assessment time, improved personalization of exercise dosing.

Predictive risk-stratification & injury prevention

●What: ML models trained on MSK datasets (e.g., VALD’s large MSK dataset) predict individuals’ risk for re-injury or poor rehab outcomes.

●Why it matters: Enables targeted prevention programs, prehab before surgery, and prioritized resource allocation to high-risk patients.

●Clinical KPI: reduction in re-injury rates, lower post-op readmissions.

Personalized exercise prescription & adaptive programs

●What: AI recommends exercise parameters (load, reps, progression cadence) based on patient history, objective sensors, and response curves.

●Why it matters: Accelerates recovery through tailored dosing and reduces clinician bandwidth for routine adjustments.

●Implementation: integrates with therapeutic exercise equipment and tele-platforms.

Remote monitoring via wearables + anomaly detection

●What: Continuous wearable data streamed to ML models to detect deviations (e.g., activity drop, gait deterioration).

●Why it matters: Early intervention triggers prevent setbacks and reduce clinic visits; fits the tele-physical therapy growth thesis.

●Business impact: increases patient retention and improves outcomes-per-dollar.

Robotic control & intelligent assistance

●What: AI controls robotic assist devices (exoskeletons, gait trainers) to adapt assistance/resistance in real time to patient capability.

●Why it matters: Enables scalable high-dose, task-specific practice with safety, crucial for neuro and pediatric populations (e.g., Genrobotics pediatric gait trainer).

●Clinical benefit: increased repetitions, improved motor learning, shorter time to milestones.

Clinical documentation automation & EMR scribing

●What: AI scribes (Raintree’s ScribeIQ example) transcribe therapy sessions, interpret therapy-specific terminology, and populate EMR fields.

●Why it matters: Cuts clinician admin burden, improves coding accuracy, speeds billing cycles, and frees time for patient-facing care.

●Operational metric: clinician time saved per visit; faster documentation turnaround.

Outcome prediction & ROI modelling for payers/providers

●What: Models predict long-term functional outcomes and cost-effectiveness of therapy pathways.

●Why it matters: Supports bundled payments, value-based care contracting, and justifies investment in higher-cost devices for specific cohorts.

●Adoption lever: payers demand evidence — AI helps produce stratified evidence.

Virtual reality (VR) and gamification driven by AI adaptation

●What: AI adjusts game difficulty and therapeutic targets in real time to maintain the “zone of proximal challenge.”

●Why it matters: Improves adherence and motivation, especially in pediatrics and neurorehabilitation.

AI-enabled triage & routing for telehealth platforms

●What: Intake AI routes patients to the right provider type (in-person/tele/hybrid), flags urgent red flags for escalation.

●Why it matters: Optimizes clinic throughput, reduces inappropriate visits and improves access.

Device R&D acceleration through model-driven simulation

●What: ML models simulate patient-device interactions across cohorts, accelerating prototyping of wearables/robotic devices.

Why it matters: Lowers time-to-market and improves design personalization — aligned with VALD’s and other firms’ AI/data strategies.

Implementation challenges & mitigation

●Data privacy (HIPAA/GDPR), model bias, clinical validation (RCTs), clinician acceptance — mitigation via robust privacy design, transparent models, and prospective trials.

Regional insights

North America (dominant — 39.5% share in 2024)

Market size & structure

●USD 11.08B in 2024 (39.5% of global).

●Large presence of MSOs, outpatient chains and sophisticated reimbursement frameworks.

Drivers

●High surgical volumes, established insurance reimbursement, and investments in rehab infrastructure.

●Strong adoption of telehealth and digital tools.

Workforce & labor market

●Robust demand 50M Americans receive PT annually (your provided stat), and ~13,600 job openings per year forecast — implies workforce tightness and wage pressure.

Strategic implications

●Scale players focus on M&A, vertically integrate home care and telehealth (e.g., acquisitions).

●Tech vendors partner with large PT chains for distribution and evidence generation.

Asia-Pacific (fastest growth)

Demand drivers

●Large population base, rising MSK burden and surgery volumes, increasing middle-class healthcare spending.

●Medical & rehabilitation tourism (low-cost care hubs like Kerala noted).

Structural features

●Lower per-capita PT density in many countries → supply gap.

●Rapid adoption of low-cost wearables and telehealth to address workforce constraints.

Opportunity

●High upside for device vendors, tele-platforms, and franchised outpatient clinics; potential for large-scale data collection (e.g., China rehab need estimates).

China (noted rehabilitation need)

Scale

●2020 estimate: 460M people needed rehab; projection to 2034: 636M — signals massive latent demand for PT and rehab services.

Implication

●Demand will pressure expansion of training, facilities and imported device adoption; strong opportunities for local players and international vendors seeking scale.

India

Burden & supply gap

●35–40 crore (350–400M) Indians with chronic musculoskeletal pain (your provided stat).

●Physiotherapist density: ~0.59 per 10,000 people (major access constraint).

Regional hubs & opportunities

●Kerala as a rehab tourism destination with ~3,000 healthcare institutions — gateway for medical tourism and tech pilots.

Europe (steady growth; pockets of high capacity)

Germany

●One physiotherapist per 430 people; 1,079 rehabilitation facilities (2023) with 161,430 beds — advanced rehab infrastructure.

●Large healthcare expenditure (~€494.65B in 2023) supports high per-patient spend.

UK

●One physiotherapist per 1,136 people; NHS shortage ~12,000 physiotherapists needed — access constraint creates opportunities for private providers and telehealth.

Implication

●Western Europe: mature market for high-value devices and evidence-driven service models; Eastern Europe: expansion opportunities.

Latin America, MEA

Features

●Mixed levels of infrastructure; growth driven by urbanization, rising surgery rates, and private sector expansion.

Strategy

●Low-cost devices, telehealth and capacity building (training programs) will be priority.

Market dynamics

Drivers

●Increasing surgeries & post-op rehab demand — directly increases utilization of PT services.

●Rising prevalence of musculoskeletal and neurological disorders — large, persistent patient pools.

●Awareness of non-pharmacological care — patient preference for conservative management boosts PT uptake.

●Favorable reimbursement & funding — supports access to advanced therapies and devices.

●Technology adoption — wearables, robotics, telehealth and AI expand addressable market.

Restraints

●Skilled workforce shortage — e.g., India 0.59 physiotherapists/10k; UK & some markets report significant gaps.

●Fragmentation of care & variable reimbursement — payer differences slow standardized rollout of advanced tech.

●Capital intensity for advanced devices — high upfront cost can limit adoption in smaller clinics.

Opportunities

●Tele-physical therapy & hybrid care — expand reach and reduce per-patient cost.

●Wearables & robotics — higher-margin device sales and recurring software revenue.

●AI & data monetization — predictive tools, outcome measurement and value-based contracting.

●Medical/rehab tourism (APAC & India) — attract international patients seeking quality at lower cost.

●Training & education models — franchising and certification programs to close skill gaps.

Threats / Risks

●Regulatory / reimbursement shifts — cost containment could squeeze margins.

●Data privacy & cybersecurity — particularly for AI/telehealth vendors.

●Clinical validation gap — devices and AI models need high-quality evidence to secure payer support.

Top 10 companies

Select Medical Corporation

●Overview: Large provider/MSO focusing on rehabilitation hospitals and outpatient therapy networks.

●Product / Service: Multi-site inpatient/outpatient rehab services and integrated care pathways.

●Strengths: Scale in inpatient rehab, strong referral relationships with hospitals, ability to standardize care and capture post-acute volumes.

ATI Physical Therapy

●Overview: National outpatient clinic network specializing in orthopedic & sports rehab.

●Product / Service: Clinic-based PT, performance optimization programs, employer partnerships.

●Strengths: Franchise/chain model for scalable outpatient growth, brand recognition in sports/ortho rehab.

Upstream Rehabilitation

●Overview: Provider of physical therapy services often partnering with health systems.

●Product / Service: Outpatient and home-based therapy models, clinically integrated pathways.

●Strengths: System integration focus (embedding into hospitals/health systems), flexible care modalities.

Kindred Healthcare

●Overview: Provider across continuum (post-acute, home health, rehab).

●Product / Service: Inpatient rehab, home health therapy services.

●Strengths: Cross-site care coordination, ability to manage complex post-acute cases.

Athletico Physical Therapy

●Overview: Large outpatient network with a sports-medicine and work-injury focus.

●Product / Service: Orthopedic PT, sports rehab, employer/workers’ comp contracts.

●Strengths: Strong ties to sports medicine, operational excellence in high-volume clinics.

U.S. Physical Therapy, Inc.

●Overview: Nationwide operator of outpatient PT clinics (noting an acquisition of outpatient home care practice in April 2025).

●Product / Service: Clinic and home-based therapy services; increasingly hybrid care models.

●Strengths: Strategic acquisitions broaden care continuum (in-clinic → home), scale & integration.

Concentra Inc.

●Overview: Occupational health and workforce rehabilitation services (network/clinics).

●Product / Service: Work-related injury management, onsite therapy, employer contracts.

●Strengths: Large employer relationships, specialized occupational expertise.

CORA Health Services

●Overview: Regional provider of rehab and outpatient services.

●Product / Service: Orthopedic and post-op rehab services, outpatient-focused.

●Strengths: Regional penetration, partnerships with local systems.

BTL Industries

●Overview: Device manufacturer (therapeutic equipment / electrotherapy / advanced devices).

●Product / Service: Therapeutic devices, expect focus on electrotherapy, laser therapy, and related equipment (device category implied in your equipment list).

●Strengths: Product portfolio breadth, sell-through to clinics and hospitals, potential for bundling hardware+software.

Enovis (DJO Global) / Zimmer MedizinSysteme / Dynatronics Corporation

●Overview: Device & equipment manufacturers supplying therapy, orthopedics, and electrotherapy products.

●Product / Service: Treatment tables, electrotherapy units (TENS/EMS), ultrasound, mobility aids, rehab devices.

●Strengths: Established R&D, distribution channels into hospitals/outpatient clinics, recognized brand names in equipment.

Latest announcements

U.S. Physical Therapy, Inc. — April 2025 acquisition

●What happened: Acquired an outpatient home care practice to provide PT, OT and speech therapy at home; MSO Metro, LLC bought an 80% interest, existing owners retain 20%.

●Why it matters: Signals clinic operators’ push into home-based rehab, closing care gaps and capturing post-acute/homebound patient markets. Supports hybrid care delivery and growth of home therapy volumes.

VALD — September 2024 investment by FTV Capital

●What happened: VALD raised investment to expand globally and launch new products; committed to continued use of AI on its proprietary dataset of tens of millions of MSK health records.

●Why it matters: Illustrates strategic capital flow into AI-driven MSK analytics — will accelerate objective measurement tools and clinician decision-support products.

Genrobotics — January 2025 product launch (India)

●What happened: Launched India’s first robotic-assisted Pediatric Gait Trainer with VR & real-time interactive games.

●Why it matters: Combines robotics + VR to address pediatric neurorehab — demonstrates commercialization of immersive rehab tech in APAC markets.

LainaHealth — May 2025 virtual care model launch

●What happened: Launched virtual care model to expand PT access and reduce delivery cost; pairs licensed PTs with the platform.

●Why it matters: Example of tele-physical therapy commercialization aimed at decreasing wait times and cost — an enabler for scaling remote PT.

Raintree — February 2025 ScribeIQ launch

●What happened: Launched an advanced AI scribe for rehab therapy with deep EMR/EHR integration and specialized healthcare transcription.

●Why it matters: A direct operational productivity play — reduces clinician documentation burden and improves billing/records accuracy.

●Market impact summary: These announcements collectively show simultaneous progress in (a) service delivery models (home & virtual care), (b) AI/data monetization (VALD, Raintree), and (c) device innovation (Genrobotics) — supporting the thesis of hybrid care + tech acceleration.

Recent developments

Service consolidation and vertical expansion

●Larger outpatient networks are acquiring home care practices to create continuum offerings (U.S. Physical Therapy example), enabling patient retention across settings.

Data-driven product investment

●VALD’s funding for AI and product development highlights investor appetite for predictive MSK tools; deep datasets become competitive moats.

Clinical automation & EMR integration

●Raintree’s ScribeIQ demonstrates focus on removing administrative friction — a practical lever to improve clinician productivity and clinic margins.

Virtual care commercialization

●LainaHealth’s virtual care model illustrates moves to operationalize tele-PT at scale, addressing access, cost, and wait times.

High-tech device commercialization in APAC

●Genrobotics’ pediatric robotic gait trainer with VR signals that high-tech rehab devices are crossing into price-sensitive markets when there is clinical demand and local manufacturing/partnerships.

Funding & capital flows into PT tech

●Investment events (VALD) suggest a growing venture and growth capital pipeline for PT tech startups, supporting faster product iteration and market entry.

Segments covered

By Therapy Type

Orthopedic Physical Therapy (dominant: 31.5%)

●Focus: post-op orthopedic rehab, joint/muscle disorders, arthritis management, sports injuries.

●Why dominant: high surgical volumes + sports injury prevalence → large repeatable caseloads; uses therapeutic exercise equipment heavily.

Neurological Physical Therapy (fastest growing therapy type)

●Focus: stroke, spinal cord injury, Parkinson’s, MS; includes gait retraining, balance, neuroplasticity interventions.

●Growth drivers: aging population, stroke survival improvements → higher need for long-term neurorehab.

Geriatric Physical Therapy

●Focus: fall prevention, mobility, osteoporosis/arthritis management; tailor programs for comorbidity management.

●Growth driver: demographic shift and prolonged life expectancy.

Pediatric Physical Therapy

●Focus: developmental delays, cerebral palsy, gait disorders; high potential for robotics/VR.

Cardiopulmonary Physical Therapy

●Focus: COPD rehab, post-cardiac surgery rehabilitation — important for multi-disciplinary care pathways.

Women’s Health & Pelvic Floor

●Focus: pre/post-natal therapy, pelvic floor dysfunction — specialized clinician training required.

Vestibular & Balance Therapy

●Focus: dizziness, balance disorders; diagnostic equipment & specialized training needed.

By Age Group

●Pediatric (0–17) — growth in device/VR adoption for engagement.

●Adult (18–64) — largest share (58.2%); workplace ergonomics, sports injuries prominent.

●Geriatric (65+) — fastest growing; high continuity-of-care needs, fall prevention prominence.

By End-Use

●Hospitals — high acuity, inpatient rehab.

●Outpatient Clinics — 41% share — volume center for elective and post-op rehab.

●Rehab Centers — specialized multi-discipline programs.

●Home Care — growing via acquisitions and portable device penetration.

●Fitness & Wellness Centers — lower acuity, prevention and maintenance services.

●Telehealth Platforms — fastest growth; platform + clinician marketplace models.

By Delivery Mode

●In-person (73.4%) — relies on specialized equipment and hands-on techniques.

●Tele-Physical Therapy — fast growth; enables remote guidance, monitoring and hybrid care.

●Hybrid — likely long-term dominant model (best clinical outcomes + convenience).

By Equipment Type

●Therapeutic Exercise Equipment (34.7%) — treadmills, bikes, resistance systems — bread & butter rehab tools.

●Electrotherapy (TENS/EMS), Ultrasound — common adjuncts.

●Treatment Tables & Mobility Aids — essential clinic capital.

●Wearable Sensors & Robotic Assist Devices — fastest CAGR: remote monitoring, objective outcome capture, automated dosing.

By Region

●Full regional listing in your content (North America, APAC, Europe, LATAM, MEA) — each with different drivers: infrastructure/ reimbursement (NA/EU) vs growth and supply gaps (APAC/India).

Top 5 FAQs

Q1: What is the current global size and growth of the physical therapy market?

A: The market was USD 28.06B in 2024, USD 29.18B in 2025, and is projected to reach USD 41.54B by 2034, growing at a CAGR of ~4% between 2025 and 2034.

Q2: Which region leads the market and which region is growing fastest?

A: North America led in 2024 with 39.5% of revenue (~USD 11.08B). Asia-Pacific is expected to grow the fastest over the forecast period.

Q3: Which segments currently dominate the market?

A: In 2024, orthopedic physical therapy led by therapy type (31.5%), in-person delivery dominated with 73.4%, and therapeutic exercise equipment was the largest equipment category (34.7%). Outpatient clinics were the largest end-use (41%).

Q4: What are the main market drivers and restraints?

A: Drivers include rising surgeries, musculoskeletal disorder prevalence, aging populations, and tech adoption (telehealth, wearables, robotics). The main restraint is a lack of skilled professionals (e.g., India ≈ 0.59 physiotherapists/10,000 people).

Q5: How will AI and technology affect the physical therapy market?

A: AI will change assessment (computer vision), personalization (prescription & progression), remote monitoring (wearables + anomaly detection), documentation automation (AI scribes), robotic assistance, and outcomes prediction. Examples from the market: VALD (AI on huge MSK dataset), Raintree’s ScribeIQ, Genrobotics’ VR+robotic product, and LainaHealth’s virtual care model.

Access our exclusive, data-rich dashboard dedicated to the therapeutic area sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5929

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest