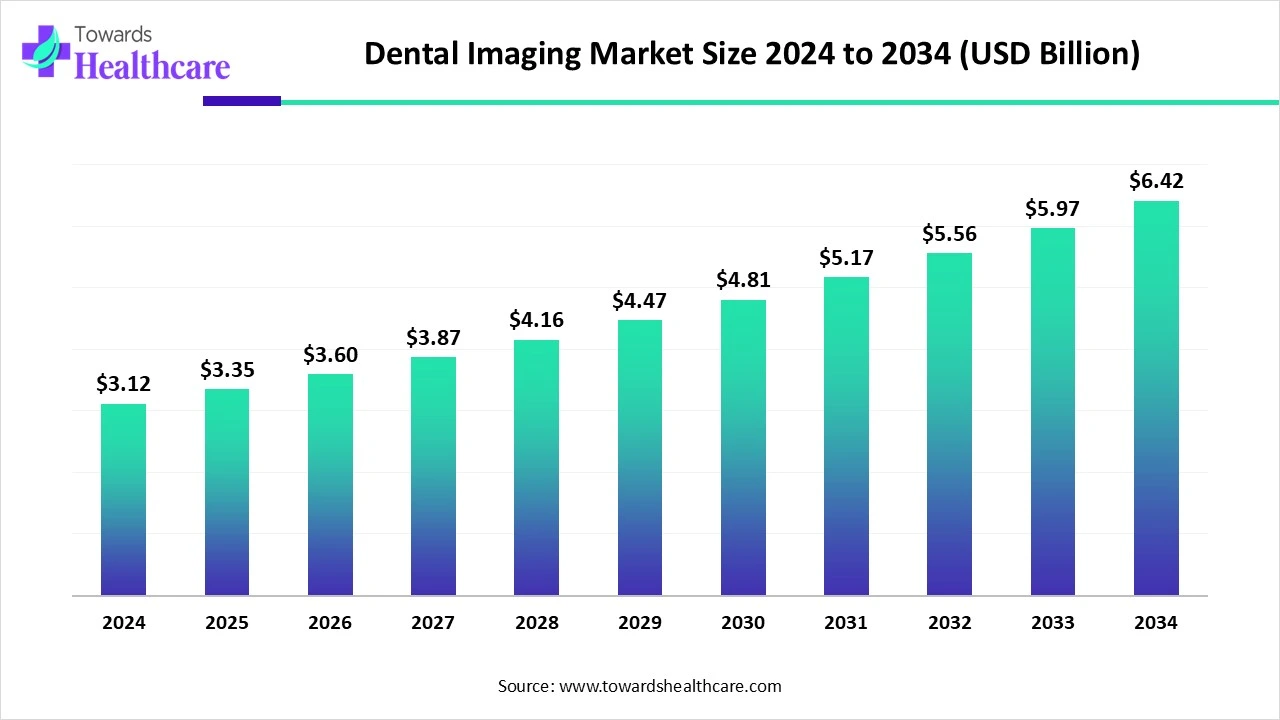

The global dental imaging market was US$ 3.12 billion in 2024, is forecast at US$ 3.35 billion in 2025, and is expected to reach US$ 6.42 billion by 2034 (CAGR 7.46% from 2025–2034), driven by digital imaging (CMOS/PSP), CBCT adoption, AI/software uptake and expanding use in implantology and orthodontics.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6039

Market size

Baseline (2024): Market value stood at US$ 3.12 billion (reported 2024 actual).

Near term (2025): Projected to reach US$ 3.35 billion in 2025 — an increase of US$ 0.23 billion (+7.37% vs 2024).

Long-term (2034): Projected at US$ 6.42 billion by 2034 under the supplied forecast.

CAGR (2025→2034): 7.46% annual growth rate is the basis for the 2034 projection.

Absolute growth (2025→2034): US$ 3.07 billion growth in total nominal value (from 3.35 → 6.42), a ~91.64% cumulative increase over those nine years.

Absolute growth (2024→2034): US$ 3.30 billion increase (3.12 → 6.42), a ~105.77% cumulative increase across the 10-year window.

Average nominal annual increase (2025→2034): about US$ 0.341 billion per year (3.07 / 9 years) in nominal dollars.

CAGR consistency check: applying 7.46% annually to US$3.35 across nine years yields approximately US$ 6.40–6.42 billion (rounding differences explain the tiny gap), confirming consistency between the CAGR and the stated 2034 projection.

Market scale context: the market roughly doubles (≈+100%) from 2024 to 2034; this implies persistent investment in imaging hardware, software and related services.

Implication for stakeholders: steady, mid-single-digit to low-double-digit returns over the decade — attractive for device makers, software/AI vendors and DSOs investing in standardized imaging workflows.

Market trends

Digital imaging supremacy (technology shift):

The digital (CMOS/PSP) segment accounted for ~88% of market revenue in 2024, showing near-ubiquitous migration from film/analog to digital sensors and plates.

Impact: faster captures, instant image transfer to software, simplified EHR integration and reduced running costs for clinics.

Intraoral imaging dominance (modality):

Intraoral imaging led with 34% revenue share in 2024 — it’s the everyday diagnostic backbone (bitewings, periapicals, sensors).

Impact: broad footprint across independent clinics and routine dentistry.

Rapid CBCT adoption (modalities shifting toward 3D):

CBCT is the fastest-growing modality, driven by implantology, surgery and orthodontics where 3D data materially improves planning and outcomes.

Software becoming revenue center (imaging acquisition & 3D planning):

Imaging acquisition & 3D planning software accounted for ~58% market share in 2024 — software is now as strategic as hardware.

Impact: recurring revenue models through licenses, cloud services, and integration fees.

AI/Automation accelerating (emerging but fastest CAGR among software):

AI/automation is expected to grow at the fastest CAGR among software segments — automating detection (caries, pathology), supporting treatment planning, and reducing clinician time per case.

Clinical application concentration in implantology & oral surgery:

Implantology & oral surgery were the largest single clinical application (~32% share) in 2024 — driving demand for CBCT and advanced planning software.

Orthodontics — fastest application growth:

Orthodontics (aligner planning, 3D dental arch analysis) is expected to post the fastest CAGR, benefiting from intraoral scanners and CBCT integration with aligner workflows.

End-user split — independent clinics dominate but DSOs grow fastest:

Independent dental clinics held ~54% share in 2024, reflecting the sector’s fragmented provider base — but DSOs/group practices are the fastest growing end-user segment (scale investments, centralized imaging strategies).

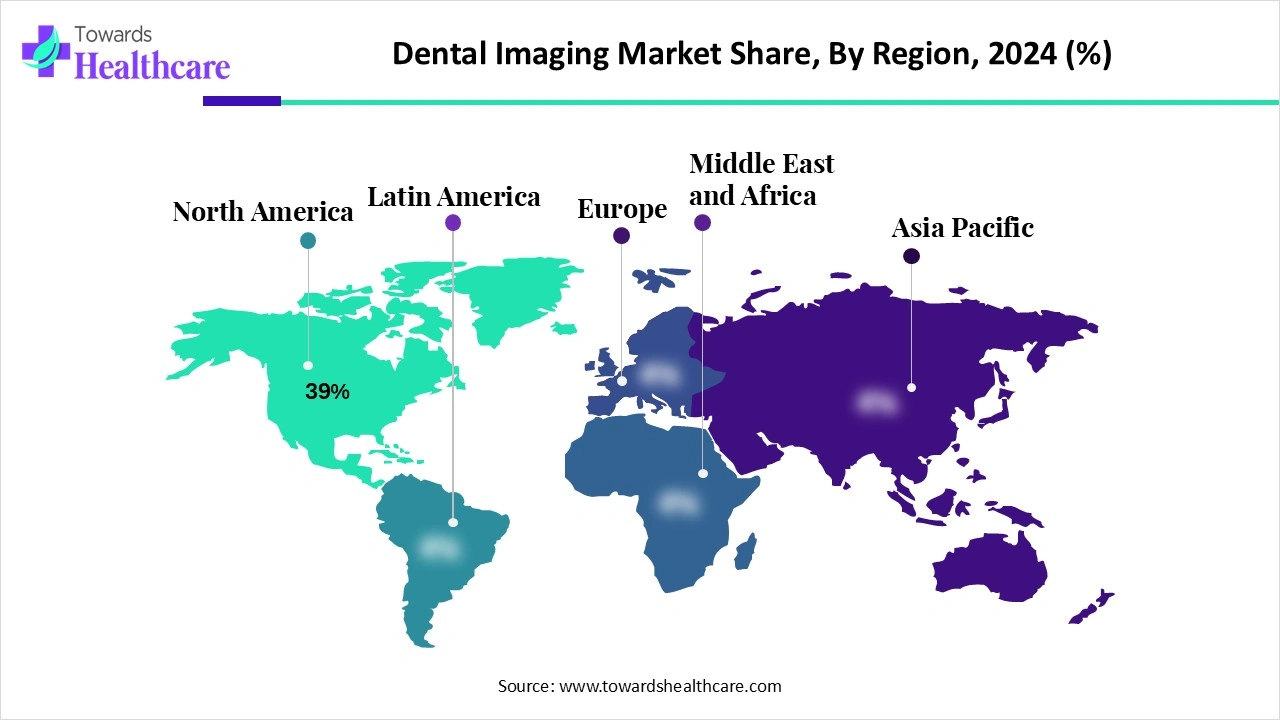

Geography: North America leader, APAC fastest growth:

North America led with ~39% revenue share in 2024. Asia-Pacific expected to register the fastest CAGR driven by infrastructure investments and rising cosmetic dentistry demand.

Product and detection tech cycles:

Frequent product launches (new scanners, detectors, lower-dose hardware) and detector portfolio updates (e.g., flat panels with better dynamic range) are shortening replacement cycles for clinics aiming to stay competitive.

Regulatory & radiation safety concerns persist:

Even as dose-reduction tech improves, radiation safety concerns are a restraining factor affecting frequency of scans (especially in pediatric and sensitive populations).

Integration & chairside workflows matter:

Buyers increasingly value systems that integrate imaging, 3D planning and practice management — the “one-stop” digital workflow can be a decisive purchasing factor.

AI roles and impacts

Automated pathology detection (caries, lesions, bone loss)

Role: AI models flag probable caries, periapical lesions, bone loss and other pathologies on 2D/3D images.

Impact: reduces missed findings, speeds triage, and supports second-opinion workflows.

Example link to supplied content: firms like Pearl AI, Overjet, and VideaHealth are named as market players specializing in AI detection.

3D treatment planning & implant placement assistance

Role: AI automates segmentation of bone and vital structures, suggests optimal implant positions and simulates outcomes.

Impact: reduces planning time for implantology & oral surgery (the leading application at ~32% share), improves surgical accuracy, and lowers complication risk.

Real-world tie: imaging acquisition & 3D planning software dominance (58% share) creates a natural platform for embedded AI tools.

Image quality enhancement & dose optimization

Role: AI denoising and reconstruction techniques enable clinically usable images at lower radiation doses.

Impact: addresses radiation safety concerns and increases clinician confidence to use 3D imaging when appropriate.

Automated measurement, landmarking and cephalometric analysis

Role: AI places cephalometric landmarks, measures angles/linear distances, and generates orthodontic reports.

Impact: speeds orthodontic workflows and supports the fast-growing aligner and orthodontics segment.

Workflow automation & case prioritization

Role: AI triages images arriving at a cloud/PACS server, prioritizes urgent cases and routes them to specialists.

Impact: improves throughput in DSOs and hospitals, reduces turnaround time for urgent findings.

Clinical decision support / predictive analytics

Role: AI aggregates image findings with patient records to predict treatment outcomes, risk of implant failure or progression of disease.

Impact: enables personalized treatment planning and better patient counseling (higher acceptance rates).

Quality assurance, compliance & audit trails

Role: AI flags inconsistent imaging protocols, incomplete captures or suboptimal exposures for operator feedback.

Impact: raises diagnostic quality and provides documentation for regulatory and reimbursement audits.

Augmented reality / visualization support for chairside communication

Role: AI converts image/3D planning data into patient-facing visualizations, overlays and treatment simulations.

Impact: improves patient understanding and consent, supporting case acceptance for cosmetic & implant procedures.

Scalability for DSOs & cloud platforms

Role: AI deployed in cloud/PACS environments scales analyses across networks of clinics.

Impact: DSOs can standardize diagnostics across multiple sites, improving quality control and enabling centralized review.

Commercial models & monetization (SaaS/AI licensing)

Role: AI creates recurring revenue streams (per-scan or subscription) layered on hardware sales.

Impact: shifts vendor economics from single-unit hardware sales to software/AI subscription, increasing customer lifetime value; aligns with the dominance of imaging acquisition & 3D planning software (58% share).

Regional insights

North America (leader — ~39% share in 2024)

Drivers: mature dental care market, high per-capita dental spending, strong private sector reimbursement in many cases, high adoption of cosmetic dentistry and implants.

Technology preferences: rapid adoption of CBCT, advanced digital sensors, and integrated chairside scanners — vendors focus on workflow integration and service contracts.

Buyer behavior: preference for complete solutions (hardware + software + service) and strong demand from DSOs for standardized imaging across networks.

Barriers: cost sensitivity in smaller practices remains; radiation safety awareness encourages dose optimization.

United States (detailed within North America)

Growth factors: large DSO presence, favorable reimbursement for diagnostic imaging in some contexts, high patient willingness to pay for cosmetic/implant treatments.

Innovation hub: many product launches and partnerships (examples given in content: Planmeca–Benevis, DEXIS new solutions, Align iTero launch).

Canada

Drivers: government-backed healthcare system for general medicine (but dentistry largely private/insured), increasing preventive/cosmetic dental attention, adoption of digital radiography and CBCT in urban centers.

Challenges: smaller market scale vs US, geographic dispersion increases installation/maintenance logistics costs.

Asia-Pacific (fastest CAGR forecast)

Drivers: rising middle-class disposable income, expanding dental infrastructure, increased awareness of oral health and cosmetic dentistry, and government investments in healthcare infrastructure.

Country highlights: China, Japan, India, South Korea and Thailand cited as key markets — each with different adoption curves (Japan/ROK: faster adoption and high-end tech; China/India: rapid volume growth and increasing mid-tier device adoption).

Opportunities: lower per-unit market penetration vs North America suggests long runway for device and software sales; local partnerships and price-sensitive product lines will be key.

Europe

Drivers: strong clinical standards, early adoption of digital dental tech in Western Europe, steady investment in CBCT for specialized centers.

Regulatory environment: EU medical device regulations and country-level reimbursement/regulatory idiosyncrasies guide adoption pace.

Latin America

Drivers: growing awareness and demand for cosmetic dentistry, urban clinics investing in digital workflows.

Barriers: price sensitivity and fragmented provider base; selective adoption of higher-end CBCT systems more likely in private specialist centers.

Middle East & Africa (MEA)

Drivers: pockets of high investment (e.g., UAE, Saudi Arabia) and growing private healthcare clusters.

Barriers: overall market smaller, heterogeneous regulations and variable access to financing for equipment.

Market dynamics

A. Key drivers (deep)

Rising prevalence of dental disorders & aging populations → higher diagnostic demand.

Digital transformation of dentistry → conversion to CMOS/PSP sensors, intraoral scanners and CBCT. (Digital = 88% share.)

Growth in implantology & cosmetic dentistry → drives CBCT and 3D planning software (implantology & oral surgery = 32% share).

DSO expansion and standardization → larger centralized purchases and software platform adoption.

AI & cloud software proliferation → software revenue growth and recurring license models (imaging acquisition & 3D planning software = 58% share).

B. Primary restraints (deep)

Radiation safety concerns → cautious use of repeated scans, especially in pediatric/young adult cohorts.

Capital cost & ROI concerns for high-end CBCT → slows adoption in small clinics despite clinical benefits.

Fragmented provider market → slows standardized procurement and complicates after-sales service networks.

Regulatory constraints → device approvals and data privacy rules can delay product launches in specific regions.

C. Opportunities (deep)

3D and CBCT market expansion → high-value devices with software add-ons; cross-sell opportunities.

AI integration for diagnostics & workflow → high CAGR for AI/automation software.

Subscription & cloud models → recurring revenue from imaging software, AI reads, and cloud PACS.

Emerging markets (APAC) → fastest growth potential with increasing private dental spend.

Detector & low-dose innovations → new hardware offerings that reduce radiation concerns.

D. Value-chain analysis (detailed steps & players)

R&D & product development — device sensors (CMOS, photon-counting), CBCT hardware, reconstruction algorithms, AI model training. (Key: Dentsply Sirona, Planmeca, detection tech examples.)

Manufacturing & component sourcing — detectors, X-ray tubes, mechanical assemblies; supply chain critical for uptime.

Packaging, sterilization & logistics — traceability for sensors/consumables and safe delivery to clinics.

Distribution & sales — direct sales to DSOs/large clinic chains and indirect to independent clinics via dealers.

Installation & training — clinical onboarding for CBCT and 3D planning systems.

Software licensing & cloud services — imaging acquisition, 3D planning, AI reads, PACS.

Patient support & services — maintenance contracts, remote diagnostics, upgrades. (Key players: Sirona, Carestream, Vatech cited.)

Top 10 companies

Dentsply Sirona

Products: comprehensive dental equipment portfolio including imaging hardware and software platforms.

Overview: one of the largest integrated dental manufacturers with solutions spanning imaging, restorative and CAD/CAM workflows.

Strengths: broad distribution network, integrated hardware+software ecosystem, large installed base enabling upsell of software and services.

Envista Holdings (DEXIS / KaVo Imaging / i-CAT)

Products: intraoral sensors/solutions (DEXIS), imaging systems (KaVo) and CBCT (i-CAT).

Overview: multi-brand strategy covering sensor to CBCT segments.

Strengths: brand portfolio that addresses both entry/intermediate and high-end markets; cross-brand channel coverage.

Planmeca

Products: CBCT units, 2D/3D imaging devices, and integrated software solutions.

Overview: established supplier of integrated imaging+planning systems.

Strengths: strong software integration, focus on R&D and practice workflow optimization (e.g., partnerships with US networks such as Benevis noted in supplied content).

Carestream Dental

Products: digital radiography, CBCT, 3D imaging and image management software.

Overview: long-standing imaging specialist serving clinics and hospitals.

Strengths: imaging-first reputation, service and maintenance footprint, and imaging workflow expertise.

Vatech

Products: CBCT, intraoral sensors and imaging software.

Overview: hardware and software vendor with growing AI partnerships.

Strengths: recent partnership with Pearl (March 2025) to integrate AI pathology detection, signaling strength in strategic collaborations and software enhancement.

ACTEON Group

Products: imaging equipment (panoramic, intraoral), surgical/implant devices.

Overview: specialist dental imaging and equipment supplier.

Strengths: product specialization and clinical focus that supports imaging use across multiple dental disciplines.

Align Technology

Products: intraoral scanners (iTero family), digital orthodontic/aligner workflow solutions.

Overview: known for strong position in orthodontic imaging and digital impression ecosystems.

Strengths: deep integration with aligner workflows, product innovation (e.g., iTero Lumina launch Jan 2024), and a captive downstream market (aligner users).

Medit

Products: intraoral scanners and associated software ecosystem.

Overview: scanner-centric vendor offering open workflow integrations.

Strengths: focus on scanner accuracy, developer-friendly ecosystem and competitive price/performance in intraoral scanning.

NewTom (Cefla Group)

Products: CBCT and advanced 3D imaging equipment.

Overview: CBCT specialist under a larger industrial group.

Strengths: niche CBCT expertise, targeted product lines for surgical/implant planning.

Pearl AI (representative AI vendor)

Products: AI pathology detection and diagnostic assistance tools for dental images.

Overview: AI software house focused on automating pathology detection and streamlining radiology reads in dentistry.

Strengths: algorithmic focus, partnerships with hardware vendors (e.g., VATECH partnership March 2025) and ability to integrate into imaging software/PACS.

Latest announcements

VATECH + Pearl partnership — March 2025

What happened: VATECH partnered with Pearl to integrate Pearl’s AI-driven pathology detection into VATECH’s imaging software.

Why it matters: Embeds AI into the device vendor’s workflow, improving diagnostic precision and streamlining reads; creates a packaged hardware+AI offering for clinics and DSOs, accelerating AI adoption.

Detection Technology — upgraded flat panel X-ray detector portfolio — Nov 2024 (RSNA)

What happened: Launched a portfolio of 20 flat panel detectors boasting high frame rates, improved image quality at low doses and a wide dynamic range.

Why it matters: Detector innovation drives image quality improvements and supports low-dose capabilities — essential for both medical and dental imaging expansion into hybrid and surgical applications.

DEXIS (Envista) — three new solutions — Sept 2024

What happened: DEXIS rolled out three new solutions to strengthen its digital ecosystem, emphasizing connectivity and simplified workflows.

Why it matters: Demonstrates vendor focus on practice efficiency and interoperability — features buyers increasingly demand.

Align Technology — iTero Lumina launch — Jan 2024

What happened: iTero Lumina launched with a 45% smaller and 50% lighter design and a three-times wider capture field.

Why it matters: Improved ergonomics and capture area accelerate intraoral scanning efficiency — helps orthodontic and restorative workflows.

XpectVision — edge photon-counting intraoral sensor — July 2024

What happened: Introduced an intraoral sensor using photon-counting technology to reduce light scattering and improve direct dental imaging quality.

Why it matters: Photon-counting tech is promising for higher image fidelity and dose efficiency — potential paradigm shift for sensors.

Dental Imaging Technologies — ORTHOPANTOMOGRAPH OP 3D LX — July 2024

What happened: Launched an OP 3D LX unit with flexible FOV options (5×5 cm to 15×20 cm).

Why it matters: Flexibility in FOV makes the system applicable across multiple specialties — from endodontics to complex surgery.

Planmeca — strategic partnership with Benevis — Feb 2024

What happened: Planmeca partnered with Benevis (120 dental offices) to broaden access and collaboration.

Why it matters: Vendor–provider partnerships accelerate equipment deployment and long-term service relationships.

Recent developments

Hardware + AI bundling trend (VATECH + Pearl):

Implication: Device vendors are moving beyond hardware sales to integrated AI-enabled offerings; clinics benefit from out-of-the-box AI reads; software monetization grows.

Detector & sensor innovations (Detection Technology, XpectVision):

Implication: Improvements in panels and photon-counting sensors improve image quality while enabling lower doses — may ease radiation safety concerns and expand CBCT use in marginal cases.

Scanner ergonomics & workflow improvement (iTero Lumina):

Implication: Smaller, lighter intraoral scanners reduce operator fatigue and increase throughput — this supports faster chairside workflows and higher patient throughput.

Flexible FOV CBCTs (ORTHOPANTOMOGRAPH OP 3D LX):

Implication: Multi-FOV systems allow clinics to invest in a single device for broader case coverage — better ROI and cross-specialty utilization.

Vendor–DSO partnerships (Planmeca–Benevis):

Implication: Direct partnerships with clinic chains accelerate deployments, create long-term service agreements and standardize imaging practices across networks.

Software share growth (58% for imaging acquisition & 3D planning):

Implication: Software will increasingly be the value driver: licensing, upgrades and cloud services become central to vendor strategies.

Regulatory & safety conversation intensifies:

Implication: Vendors that can demonstrate dose optimization and validated AI accuracy will have competitive advantage.

Fragmentation to consolidation among providers:

Implication: As DSOs grow, they create larger, repeatable procurement opportunities — attractive for vendors who can supply multi-site solutions and central PACS/AI.

Segments covered

By Modality

Intraoral Imaging (sensors, PSP scanners, intraoral X-ray units)

Role: Primary diagnostic tool for routine dentistry — caries detection, periapicals.

Commercial: High unit volumes, widely installed, major recurring sensor/maintenance revenue.

Panoramic / Pan-Ceph 2D

Role: Broad dental overview imaging for orthodontics and general diagnosis.

Commercial: Staple device across general practices; replacement cycle longer than intraoral sensors.

Cone-Beam CT (CBCT)

Role: 3D imaging for implant planning, surgery, endodontics and orthodontics.

Commercial: Higher unit price, longer sales cycle, but higher ASP and software add-on monetization.

Intraoral Scanners (IOS)

Role: Digital impressions for prosthodontics and orthodontics (aligner planning).

Commercial: Vendor competition on accuracy, ease of use and ecosystem integrations.

Other (fluorescence, near-infrared caries detection, cameras)

Role: Adjunctive diagnostics; early caries detection and soft tissue imaging.

Commercial: Niche but growing; supports preventive dentistry initiatives.

By Technology

Digital (CMOS/PSP) — dominant (≈88% revenue).

Benefits: Instant imaging, digital storage, workflow integration, and lower per-scan marginal costs.

Analog / Film — legacy.

Declining use, mostly sidelined in modern practices except niche/low-resource settings.

By Software

Imaging Acquisition & 3D Planning — dominated the market (~58%).

Function: Capture, reconstruct, plan implants/surgeries and deliver surgical guides.

AI / Automation

Function: Automated detection, segmentation, predictive analytics — fastest CAGR among software.

Visualization / Communication & Cloud PACS

Function: Cloud storage, patient communication, remote consults and multi-site sharing.

By Clinical Application

Implantology & Oral Surgery — largest application (~32%).

Needs: CBCT, surgical planning, guided surgery integration.

Orthodontics — fastest growing application.

Needs: Intraoral scanners, cephalometric analysis and aligner planning integration.

Endodontics, Periodontics, General Dentistry, TMJ & Airway

Each has specific imaging FOV and resolution needs (e.g., high-res for endodontic canals).

By End User

Independent Dental Clinics — largest share (~54%).

Characteristics: Fragmented, wide diversity in buying power.

DSOs / Group Practices — fastest growth.

Characteristics: Centralized purchasing, standardized imaging networks and preference for cloud/PACS.

Hospitals / Academic Institutions — use high-end CBCT and cross-department capabilities.

Dental Labs & Imaging Centers — provide outsourced imaging and 3D model generation for clinics.

By Region (as previously detailed)

North America, Asia-Pacific (fastest growth), Europe, Latin America, MEA with their respective drivers and constraints.

Top 5 FAQs

Q: What is the current size and near-term growth of the dental imaging market?

A: The market was US$ 3.12 billion in 2024, projected at US$ 3.35 billion in 2025, and expected to reach US$ 6.42 billion by 2034, growing at a 7.46% CAGR between 2025 and 2034.

Q: Which region leads the dental imaging market and which is growing fastest?

A: North America led with roughly 39% share in 2024; Asia-Pacific is forecast to register the fastest CAGR during the projection period.

Q: Which technologies and modalities dominate the market today?

A: Digital (CMOS/PSP) technology dominated (~88% of revenue in 2024). Intraoral imaging was the largest modality (~34% share), while CBCT is the fastest-growing modality.

Q: How is AI affecting dental imaging?

A: AI is accelerating diagnostics (automated pathology detection), enhancing 3D planning, improving image quality/dose reduction, automating workflows and creating recurring software revenue. AI/automation is expected to post the fastest CAGR among software segments.

Q: Who are the main players in the market and what are the major recent strategic moves?

A: Top players include Dentsply Sirona, Envista (DEXIS/KaVo/i-CAT), Planmeca, Carestream, Vatech, ACTEON, Align, Medit, NewTom (Cefla), Pearl AI and others. Notable recent moves: VATECH–Pearl partnership (Mar 2025) for AI integration; Detection Technology’s flat panel portfolio (Nov 2024); DEXIS new digital solutions (Sept 2024); Align’s iTero Lumina launch (Jan 2024).

Access our exclusive, data-rich dashboard dedicated to the dental sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6039

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest