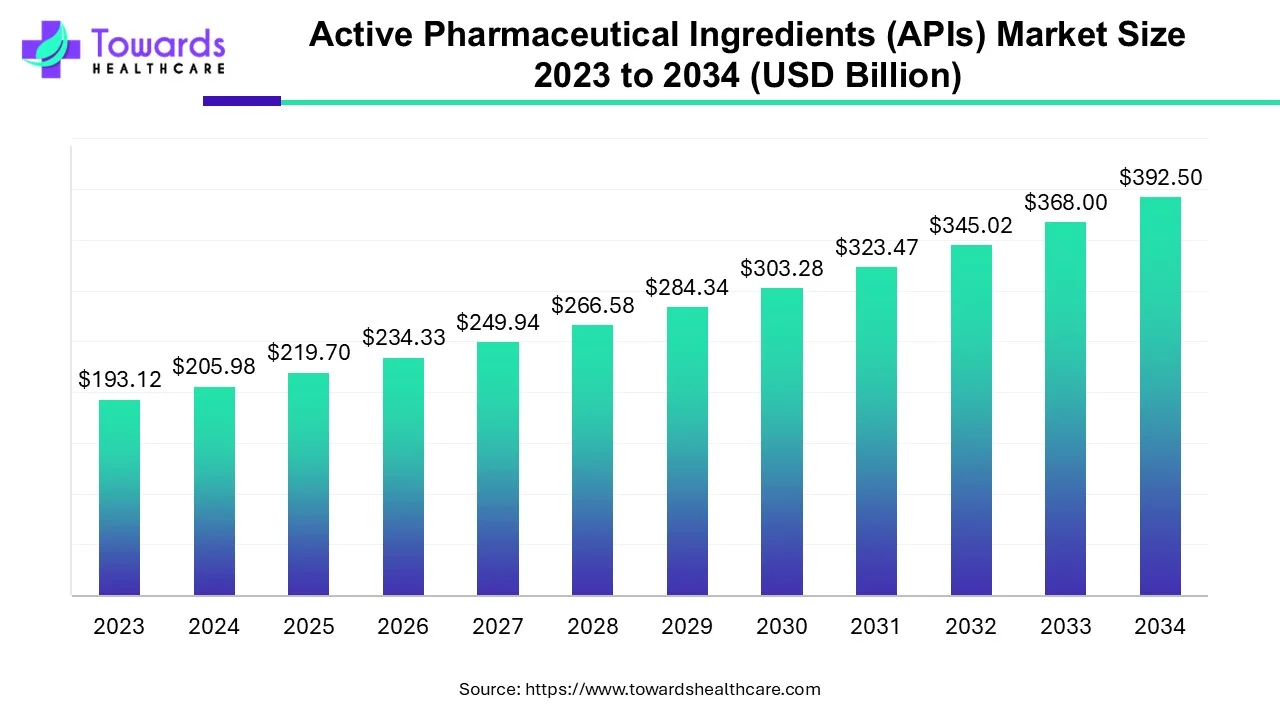

The global Active Pharmaceutical Ingredients (APIs) market was USD 205.98 billion in 2024, is forecast at USD 219.7 billion in 2025, and is projected to reach USD 392.5 billion by 2034 a 6.66% CAGR (2025–2034) (≈78.65% total growth from 2025 to 2034; +USD 172.8B absolute increase).

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ http://towardshealthcare.com/download-sample/5091

Market size of Active Pharmaceutical Ingredients (APIs) Market

Base & forecast numbers

◉2024 market size: USD 205.98 billion (reported).

◉2025 forecast (start of the explicit forecast window): USD 219.7 billion.

◉2034 projection: USD 392.5 billion.

◉Forecast period: 2025–2034 (9 years); CAGR = 6.66%.

◉Absolute increase (2025→2034): USD 172.8 billion; total growth ≈ 78.65% over the period.

Year-on-year baseline movement (2024 → 2025)

◉Increase: USD 13.72 billion (205.98 → 219.7).

◉Percentage rise ≈ 6.66% (consistent with the start of the forecast trajectory).

◉Size by major non-application segments (qualitative dominance / growth)

By synthesis type

◉Synthetic APIs — dominant presence in 2024 (large established small-molecule base, cost efficiency).

◉Biotech APIs — fastest-growing segment (monoclonal antibodies, recombinant proteins, cell-derived products).

By manufacturer type

◉Captive (in-house) API manufacturing — largest share in 2024 (control over IP, privacy, integrated supply).

◉Merchant (CMO/CDMO) — fastest-growing (outsourcing trend, scale, specialized services).

By type (innovative vs generic)

◉Innovative APIs — led market in 2024 (new launches, branded drugs).

◉Generic APIs — highest CAGR expected (patent expiries, cost pressures — generics account for ~90% of U.S. prescriptions by volume).

By drug type

◉Prescription APIs — dominant in 2024 (complex, high-value molecules).

◉OTC APIs — fastest growth (self-medication, high volumes for simple molecules).

Regional sizing cues

◉North America — market leader in 2024.

◉Asia-Pacific — fastest growth (China, India large manufacturing bases).

◉China — produces 20% of world APIs (large export footprint).

◉India — 8% global share; produces 57% of WHO-prequalified APIs (critical generic suppliers).

Structural magnitudes & implications

◉High absolute value and positive CAGR imply sustained capital investment needs (capacity, compliance), ongoing M&A/partnerships, and significant CDMO/CMO opportunity windows.

◉The market’s expansion is both volume-driven (OTC, generics) and value-driven (innovative biologics/ADCs).

Market trends of Active Pharmaceutical Ingredients (APIs) Market

Regulatory activity & domestic resilience initiatives

◉U.S. government evaluations of the API industrial base (July 2024 BIS/IBMSC collaboration) — aim: map supply chains, finance plans, and domestic capacity.

◉FDA increased inspections and fee changes (noted trend) — raises compliance and operating costs for foreign manufacturers supplying the U.S.

Regional capacity expansion & investments

◉Eli Lilly (May 2024): doubled investment to $9 billion at Lebanon, Indiana site to produce tirzepatide (Zepbound/Mounjaro) APIs — reflects biologic/high-demand molecule domesticization.

◉Touchlight (Jan 2025): first synthetic DNA manufacturer to receive GMP at Hampton, UK (capacity >8 kg/year) — signals synthetic biology entering regulated API manufacturing.

Shift to biotech & biologics

◉Biotech APIs (mAbs, recombinant proteins) are the fastest-growing synthesis segment, driven by oncology and precision therapies.

Genericization & patent cliffs

◉Patent expiries and cost pressures push generic APIs to grow fastest in percentage terms — generics’ dominance by prescription volume in markets like the U.S. supports scale manufacturing demand.

Outsourcing & CDMO boom

◉Merchant APIs (CMOs/CDMOs) expanding fastest: customers outsource to access specialized facilities (high-potency, ADCs, sterile biologics) and to reduce capital burden.

Supply-chain concentration & geopolitics

◉China and India as major producers create efficiency but also systemic risk (trade policy, tariffs, export controls). China’s cost advantage (reported 35–40% below Western rivals) and scale (20% world share) shape global sourcing strategies.

Quality & compliance cost pressure

◉High cost of compliance (GMP/GLP, validation, audits, documentation, personnel) restrains some players and fuels consolidation toward well-capitalized manufacturers.

Sustainability & circular economy interest

◉Integration of biomass recycling, APC conversion, and metagenomics interest — sustainability is emerging as a strategic theme, albeit with technical and logistical challenges.

Innovation hubs & funding

◉API Innovation Center (APIIC) funding (Sept 2024: USD 14M + APIIC USD 2.4M) to domestically develop APIs for asthma, diabetes, anxiety — targeted public funding to fix shortages.

M&A and capacity deals focused on ADCs & high-potency APIs

◉Examples: Lonza long-term extensions for ADC production (Oct 2024), HAS Healthcare planned acquisition of Cerbios (Mar 2025) — clear strategic push into complex biologics.

Therapeutic drivers

◉Oncology (fastest application growth) and cardiology (largest share in 2024) strongly influence API demand profiles; approvals (55 new drugs in 2023; 50 novel drugs in 2024) accelerate API requirements.

Commercial & pricing dynamics

◉Rising demand for affordable generics vs high margins on novel biologics creates a bifurcated market: scale players vs specialized biotech manufacturers.

AI’s role / impact in Active Pharmaceutical Ingredients (APIs) Market

AI-accelerated discovery & target-to-lead generation

◉ML models analyze high-dimensional biological and chemical datasets to prioritize chemical series (synthetic APIs) or biologic candidates (antibodies, peptides).

◉Result: fewer failed leads, compressed preclinical timelines, earlier de-risking of API candidates — translates into faster API demand for successful candidates.

Computational retrosynthesis & route optimization

◉AI planning tools propose synthetic routes minimizing steps, hazardous reagents, or cost — directly reduces COGS for synthetic APIs and speeds scale-up.

◉Enables alternative supply strategies when raw inputs are constrained.

Process optimization & model-based control (bioprocessing)

◉For biotech API manufacturing (fermentation/cell culture), AI optimizes feed strategies, harvest time, and media composition; reduces batch variability, increases yields, and shortens scale-up risk.

◉Predictive control reduces batch failures for high-value biologics (mAbs, ADC intermediates).

Quality control & impurity profiling

◉ML applied to spectrometry and chromatographic fingerprints can flag impurities, predict degradation pathways, and link process conditions to impurity profiles — lowers out-of-spec events and reduces re-work.

Real-time monitoring & PAT (Process Analytical Technology)

◉Integration of sensors + AI enables real-time PAT, enabling immediate corrective actions; this reduces rejects and improves regulatory traceability.

Predictive maintenance & equipment uptime

◉AI models predict equipment failures (reactors, centrifuges, chromatography skids), enabling preemptive maintenance and higher OEE (overall equipment effectiveness) — especially critical for capacity-constrained facilities.

Supply-chain forecasting & inventory optimization

◉Demand forecasting models for API offtakes (considering patent expiries, approvals, seasonal demand) reduce stockouts and excess inventory, especially for merchant APIs supporting multiple customers.

Regulatory & document automation

◉NLP and document-intelligence tools automate parts of batch record verification, trend analysis during QA review, and preparation of regulatory submissions (e.g., DMF, CTD modules) — cuts back documentation labor associated with high compliance costs.

Digital twins & virtual scale-up

◉Plant/line digital twins simulate scale-up scenarios and process changes, allowing engineers to evaluate modifications virtually before large CAPEX investments.

Cell-line and strain engineering (biotech)

◉AI guides genetic edits, expression optimization and predicts stability, accelerating development of high-yield production cell lines and lowering biologic API COGS.

Formulation and excipient selection

◉Predictive modeling suggests excipient/API pairings that improve bioavailability and stability, reducing time to market for new formulations built around existing APIs.

Regulatory monitoring & pharmacovigilance signals

◉AI scrapes and structures safety signals (post-market surveillance) which can feed back to API process controls and change management.

Commercial analytics & lifecycle management

◉Pricing optimization, competitor product intelligence, and product portfolio simulations help companies decide when to invest in captive capacity vs sell APIs to merchants.

◉Net impact: AI reduces technical and regulatory risk, compresses timelines, improves yields/quality, and redistributes investment (more into digital/automation and less purely into brute-force manual QC). For the API market this means faster time-to-demand for successful molecules, lower per-unit production costs for complex APIs over time, and higher thresholds for compliance and quality expectations.

Regional insights

North America (Lead region in 2024)

Drivers

◉Ageing population and chronic disease burden → sustained demand for high-value APIs (cardiology, oncology).

◉High R&D spend and frequent FDA approvals (50 novel drugs in 2024 noted) driving API demand.

Policy & supply-chain actions

◉U.S. federal evaluations (HHS/BIS/IBMSC work, July 2024) — indicates active policy to onshore/secure API supply.

◉Increased FDA inspections and application fee changes → higher compliance costs for suppliers to the U.S.

Implications

◉Opportunity for domestic CDMO/CAPEX expansion (e.g., Eli Lilly $9B investment).

◉Pricing pressure on imports if tariffs and trade actions rise.

Asia-Pacific (Fastest-growing region)

China

◉Produces 20% of world APIs, exports to 189 countries; cost advantage estimated 35–40%.

◉NMPA approvals: 123 new chemical drugs in 2024 → strong domestic innovation pipeline raising local API demand.

◉Risks: export controls, geopolitical tension, concentration risk for importers.

India

◉8% global API market share; 57% of WHO-prequalified APIs produced in India.

◉Projected to grow rapidly (a cited forecast: 13.7% CAGR over an initial multi-year window).

◉Strengths: cost-efficient manufacturing, large generic supply base, skilled workforce.

Implications

◉APAC’s low cost + scale keeps global generics competitive, while China and India also move into more complex APIs and biologics manufacturing.

Europe

Ecosystem & regulation

◉Strong biotech clusters (Germany, Switzerland, UK) and rigorous EMA processes.

◉Germany policy initiatives to accelerate clinical trials (reducing red tape) → fosters pipelines requiring APIs.

Manufacturing & innovation

◉High personnel costs reduce competitiveness for simple generics but favor high-value biologics, specialty APIs, and innovation.

Latin America

Growth potential

◉Emerging pharma hubs (Brazil, Mexico) with government investments (e.g., Brazil BRL 4.2B program) to expand domestic manufacturing.

Current state

◉Mexico imports much of its APIs (produces 4% of API needs), aiming to bolster local capacity.

Middle East & Africa (MEA)

Trends

◉Gradual development driven by government healthcare investment, smaller domestic pharma sectors.

◉Opportunity: regional manufacturing to reduce import dependency for essential medicines.

Market dynamics

A. Core growth drivers

◉Demographics & disease burden — ageing populations → more chronic disease therapies (cardio, diabetes, oncology).

◉Innovation pipeline — sustained novel drug approvals (55 in 2023; 50 novel in 2024) → demand for innovative APIs.

◉Generics penetration — cost pressures & patent expiries → massive volume demand for generics (90% of U.S. prescriptions by volume).

◉Biologics & ADCs — mAbs and conjugates push demand for complex biotech APIs and specialized CDMO services.

◉Public funding & policy — targeted funding (APIIC funding, national programs) to shore up domestic supplies.

B. Key restraints / risks

◉High cost of compliance — GMP/GLP, validation, documentation, inspections; rises in the regulatory burden increase fixed costs.

◉Supply-chain concentration — reliance on China/India exposes importers to geopolitics and localized disruptions.

◉Raw material volatility — fluctuations in chemical feedstocks and commodity prices affect COGS.

◉Skilled labor & capex intensity — sophisticated biologics lines require high operator skill and heavy CAPEX.

C. Strategic opportunities

◉CDMO expansion — outsourced merchant API growth driven by specialized capabilities (HPAPIs, ADCs).

◉AI & digitalization — efficiency gains across discovery, process control, QC, and supply chain.

◉Sustainability / circular approaches — biomass recycling and APC conversion become differentiators for long-term cost and regulatory compliance.

◉Onshoring & redundancy — governments incentivize local capacity (grants, procurement preferences), creating new projects.

D. Competitive & structural dynamics

◉Bifurcated market — mass-scale producers for generics vs. specialized producers for innovative/biotech APIs.

◉M&A & partnerships — strategic acquisitions for ADC capabilities and capacity (HAS/Cerbios, Lonza partnerships).

◉Pricing & margin pressure — generics compress margins; biologics and specialty APIs offer higher margins but greater complexity.

Top companies

Teva Pharmaceutical Industries Ltd.

◉Products: Generics, many API lines supplying global generic formulations.

◉Overview: Large Israeli multispecialty generics leader with expansive distribution.

◉Strengths: Scale manufacturing, broad product portfolio, strong generics market penetration (Q4 2024 revenue reported as USD 4.2B; full-year USD 16.5B per your data).

Pfizer Inc.

◉Products: Innovative APIs for proprietary drugs, alliances for manufacturing.

◉Overview: Big pharma with integrated R&D, global supply networks.

◉Strengths: R&D pipeline, global commercialization, regulatory & scale experience.

Novartis International AG

◉Products: Innovative APIs, biologics portfolios via Sandoz (generics/biologics spinoffs historically).

◉Overview: Large multinational with both innovative and generic footprints.

◉Strengths: Deep R&D, global market access, diversified portfolio.

BASF SE

◉Products: Chemical building blocks and specialty intermediates used in API synthesis.

◉Overview: Major chemical supplier into pharma value chains.

◉Strengths: Raw material integration, global chemical manufacturing scale.

Dr. Reddy’s Laboratories Ltd.

◉Products: Generics, APIs across therapeutic areas (gastro, cardio, diabetology, oncology).

◉Overview: Indian multinational focusing on large generics and API production.

◉Strengths: Diversified product mix, export capability; your content reports Q4 2024 revenue USD 70.83B and FY 2024 USD 279.16B — these numbers seem inconsistent with common public scales and should be verified.

Lonza

◉Products: Large CDMO for biologics (mAbs, ADCs), custom API manufacturing services.

◉Overview: Leading global biomanufacturing partner for biologics and ADCs.

◉Strengths: High-value biologics capacity, long-term commercial partnerships (e.g., ADCs extension Oct 2024).

Merck KGaA

◉Products: Specialty chemicals, reagents and some API-related services.

◉Overview: European chemical/biotech player with integrated supply offerings.

◉Strengths: R&D support, analytical & life-science tools complement API production.

Boehringer Ingelheim

◉Products: Innovative APIs, biologics, and contract manufacturing solutions.

◉Overview: Privately held large pharma with strong R&D.

◉Strengths: Advanced biologics capabilities, integrated development pipelines.

Sun Pharmaceutical Industries Ltd.

◉Products: Generics, complex APIs, and specialty branded products.

◉Overview: Large Indian pharma with global distribution.

◉Strengths: Manufacturing scale for generics, cost competitiveness.

◉Other significant players (examples from list): Lonza, BASF, Teva, Dr. Reddy’s (detailed above), plus many regional CDMOs and specialized biotech manufacturers.

Latest announcements

Touchlight — GMP certification (Hampton, UK) — Jan 2025

◉What: First synthetic DNA manufacturer to receive GMP for API production; capacity >8 kg/year.

◉Why it matters: Validates gene-synthesis routes as regulated API sources; opens synthetic biology pathways for certain APIs (novel nucleic acid modalities), reduces reliance on traditional biologics manufacturing in some niches.

Eli Lilly — $9B investment in Lebanon, Indiana — May 2024

◉What: Doubling of investment to expand domestic API capacity for tirzepatide (Zepbound, Mounjaro).

◉Implication: Example of onshoring high-demand API capacity for blockbuster biologic drugs — signals incentive alignment for domestic manufacture and supply security.

Clariant — portfolio launch for pharmaceutical ingredient solutions — Oct 2023

◉What: Functional excipients family to support API delivery & bioavailability.

◉Implication: Excipient innovation reduces formulation bottlenecks and can uplift lower-solubility APIs.

Lonza — extended ADC production collaboration — Oct 2024

◉What: Long-term commercial scale commitment for ADC bioconjugation.

◉Implication: Confirms rising ADC demand and the strategic value of contract partnerships for complex APIs.

APIIC / ASPR IBMSC funding — Sept 2024

◉What: USD 14M + APIIC USD 2.4M funding for domestic manufacturing of three APIs (asthma, diabetes, anxiety).

◉Implication: Public funding to shore up domestic essential medicines manufacturing — shortens time to market for prioritized domestic API projects.

HAS Healthcare Advanced Synthesis SA — planned acquisition of Cerbios — Mar 2025

◉What: Acquisition to expand APC and ADC capabilities.

◉Implication: Consolidation to build scale in anticancer compounds & high-potency APIs.

Regulatory approvals — GSK (Blujepa, gepotidacin) approved Mar 2025; Deciphera (Romvimza) Feb 2025; other 2023/2024 approvals

◉What: New drug approvals continue to create API demand spikes.

◉Implication: Each approval generates API quantities (clinical and commercial) and often necessitates scale-up or new supplier qualification.

Willow & Laurus Labs partnership (comment by Dr. Chris Savile)

◉What: A technology-integration collaboration to commercialize sustainable, cost-effective API production.

◉Implication: Strategic alliances targeting sustainability and techno-economic differentiation.

Recent developments

◉Funding & policy interventions (APIIC, US government reviews, Brazil investments) — strategic move to localize and secure critical API supplies.

◉Capacity & M&A activity (Eli Lilly capex, Lonza ADC extensions, HAS/Cerbios acquisition plans) — shift toward capacity expansion in biologics and high-potency APIs.

◉Regulatory approvals & launches — pipeline continues to feed demand for both innovative APIs and their contract manufacturing.

◉Technological validation (Touchlight GMP) — shows synthetic biology/novel modalities entering regulated manufacturing.

◉Commercial performance snapshots (Teva, Dr. Reddy’s data provided) — indicate revenue momentum but check anomalous numbers before external distribution.

◉Sustainability & biomass discussions — nascent but growing focus on circular economy solutions for API feedstocks and waste handling.

Segments covered

By synthesis type

◉Synthetic (small molecules) — multi-step chemistries; scale benefits; dominant share (2024). Lower molecular weight → easier absorption/distribution and well-established supply chains.

◉Biotech (biologics) — includes monoclonal antibodies, recombinant proteins, hormones, cytokines, therapeutic enzymes, vaccines, blood factors, etc. More complex scale-up, higher regulatory scrutiny, high value per kg, fastest growth due to therapeutic demand.

By manufacturer type

◉Captive APIs — vertically integrated pharma companies manufacturing for in-house products. Benefits: IP control, supply security. Limits: higher CAPEX, less flexibility.

◉Merchant (CMO/CDMO) — third-party manufacturers offering scale, specialized capabilities (HPAPI, sterile fill, ADC suites). Benefit: lower capex for pharma sponsors; risk: reliance on third parties for supply continuity.

By type (product commercial nature)

◉Innovative APIs — new molecular entities produced for proprietary drugs; higher margin but higher R&D and regulatory risk.

◉Generic APIs — off-patent molecules, high volume, price-sensitive. Increasing generic share due to patent expiries.

By drug type

◉Prescription — complex molecules, higher margins, dominated the 2024 market.

◉OTC — high volume low margin, fast growth due to self-care trends.

By biotech product subtypes (deep)

◉Monoclonal antibodies (mAbs) — targeted therapies, large quantities required per dose, complex downstream purification.

◉Antibody-drug conjugates (ADCs) — require both biologic and chemical conjugation capabilities; high technical barrier to entry.

◉Recombinant proteins & enzymes — require cell line development, fermentation/bioreactor scale-up.

◉Vaccines & blood factors — batch production, cold-chain considerations.

By geography

Regions and their regional competitive factors (cost, regulation, scale, innovation hubs) — see Regional Insights.

Top 5 FAQs

-

Q: What is the current size and growth outlook of the global APIs market?

A: Market size was USD 205.98B in 2024, USD 219.7B in 2025, projected to reach USD 392.5B by 2034 at a 6.66% CAGR (2025–2034) — total 78.6% growth over the forecast window. -

Q: Which segments dominate and which are growing fastest?

A: Dominant (2024): Synthetic APIs (by synthesis type), Captive manufacturers (by manufacturer type), Innovative APIs (by type), Prescription drugs (by drug type). Fastest growth: Biotech synthesis, Merchant APIs (CMO/CDMO), Generic APIs, OTC drug segment. -

Q: Which regions should industry players watch most closely?

A: North America (market leader; regulatory action) and Asia-Pacific (fastest growth; China 20% world API production; India 8% global share and 57% of WHO-prequalified APIs). Europe remains innovation-rich; Latin America and MEA are emergent regional markets. -

Q: How will AI change the API industry in practical terms?

A: AI speeds discovery and synthetic route design, optimizes bioprocess yields, enables real-time QC and PAT, reduces batch failures via predictive maintenance, automates regulatory documentation, and strengthens supply-chain forecasting — collectively lowering time-to-market and unit costs (especially for complex APIs). -

Q: What are the major risks the API market faces?

A: High cost of compliance (GMP/GLP and inspection burden), supply-chain concentration (heavy reliance on China/India), raw-material volatility, and high CAPEX/skill needs for biologics — all of which can constrain supply or increase prices.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5091

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest