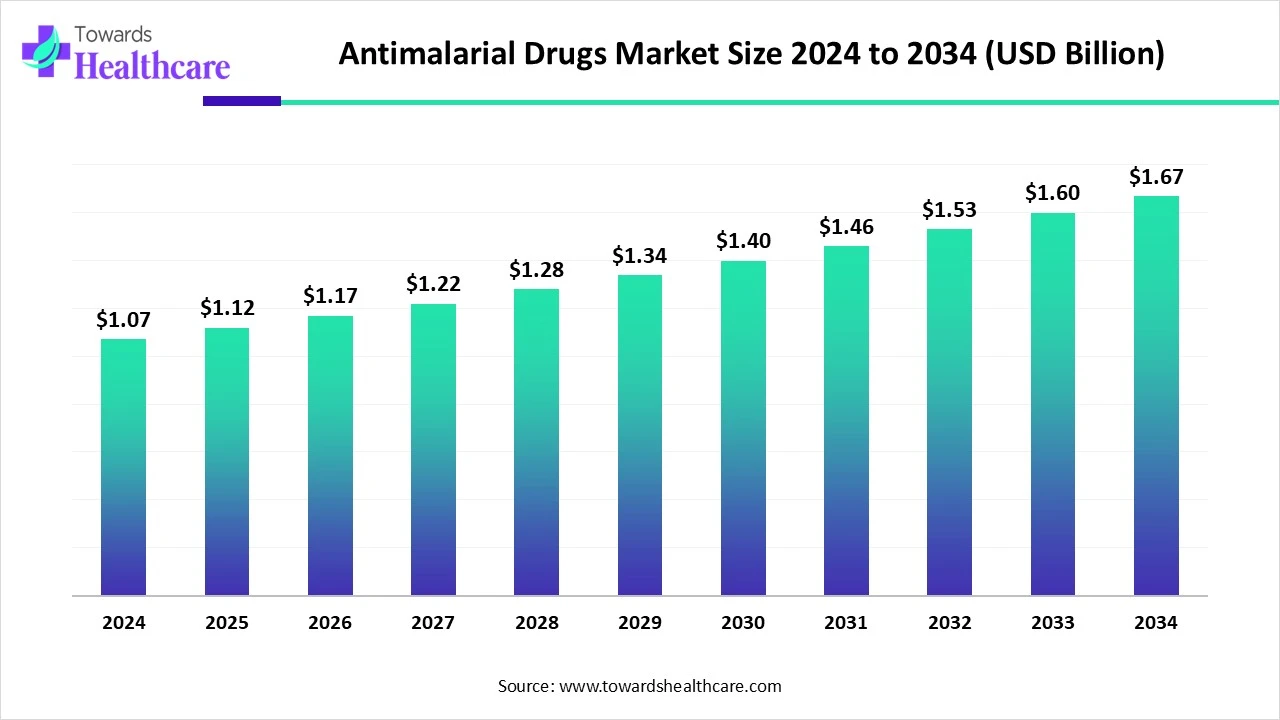

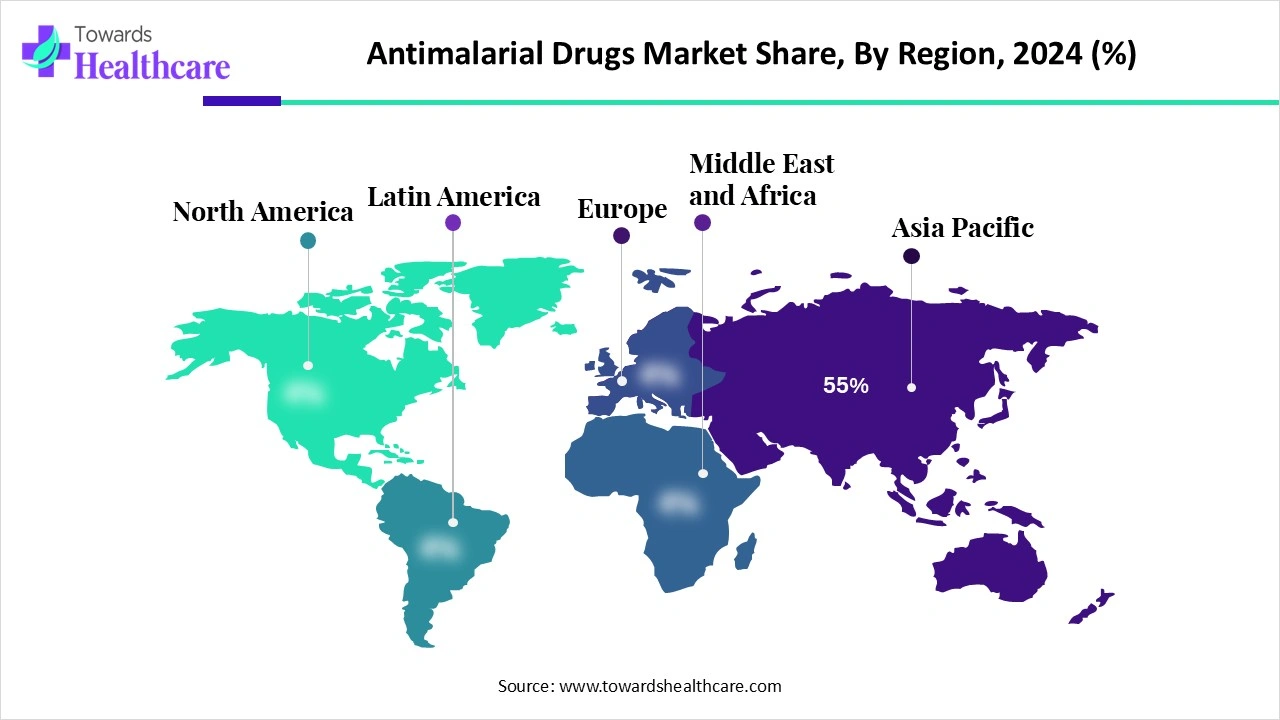

The global antimalarial drugs market was valued at USD 1.07 billion in 2024, grew to USD 1.12 billion in 2025, and is projected to reach USD 1.67 billion by 2034, expanding at a CAGR of 4.57% during 2025–2034, with Africa holding 55% share in 2024.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6044

Market Size

◉2024 – USD 1.07 billion (baseline year).

◉2025 – USD 1.12 billion (initial growth phase).

◉2034 – USD 1.67 billion (long-term projection).

◉CAGR (2025–2034) – 4.57%, indicating steady expansion rather than exponential.

Regional contribution (2024):

◉Africa – 55% share (largest, due to high malaria burden).

◉Asia Pacific – fastest-growing region (R&D + resistance control strategies).

◉North America & Europe – smaller shares, but steady demand from travelers & military prophylaxis.

Market Trends

R&D Acceleration –

◉Development of next-gen therapies & vaccines.

◉Example: ICMR developed Adfalsvax (2025), a recombinant multi-stage malaria vaccine.

Rising Drug Resistance –

◉African leaders and global partners (May 2025) collaborated to counter ACT resistance.

Strategic Collaborations –

◉Aurigene Pharma + Kainomyx (2024) for low-cost drug development.

WHO & Government Initiatives –

◉Ongoing eradication programs and public-private partnerships.

Shift Toward Combination Therapies –

◉Artemisinin-based Combination Therapies (ACTs) are fastest-growing due to WHO’s first-line recommendation.

Expansion of Vaccine Adoption –

◉Guinea (Aug 2025) added malaria vaccine to EPI.

◉South Sudan (2025) launched R21 vaccine phase II.

AI Integration in Drug Discovery –

◉DeepMalaria (AI model) predicts anti-Plasmodium activity using chemical SMILES.

◉Adnexus Biotech’s Trapicolast (2025) developed via AI-driven Sutra platform.

AI Role & Impact

Drug Discovery Acceleration

◉AI platforms reduce screening time of millions of compounds.

◉DeepMalaria predicts inhibitory potential of molecules against Plasmodium falciparum.

Molecule Design & Resistance Prediction

◉AI models simulate resistance pathways → support design of ACTs with improved resistance profiles.

Personalized Therapy & Drug Optimization

◉AI-driven analytics can tailor treatment strategies based on patient’s parasite strain, drug tolerance, and regional resistance data.

Vaccine R&D Support

◉AI-enabled immunoinformatics aids multi-stage vaccine design (Adfalsvax case).

Epidemiological Forecasting

◉AI supports malaria transmission prediction (climate, mosquito density, travel patterns), guiding drug stockpiling & distribution.

Cost-Effective Development

◉AI shortens preclinical trial durations, lowering costs → critical for LMICs where malaria burden is highest.

Regional Insights

1 Africa (55% market share, 2024)

◉High disease burden — what it means in practice

◉Scale & epidemiology: Millions of clinical malaria episodes annually (predominantly Plasmodium falciparum), concentrated in sub-Saharan countries. High incidence drives continuous, year-round demand for curative drugs (especially blood-stage agents) and for preventative chemoprophylaxis in specific populations (pregnant women, infants, seasonal chemoprevention in children).

◉Clinical consequences: More severe cases (including cerebral and severe anaemia) increase the need for injectable antimalarials and hospital care — which raises market spend per severe case compared with uncomplicated outpatient treatments.

◉Supply pressure: High case volume creates persistent pressure on supply chains (stockouts, frequent procurement cycles), which favors manufacturers who can supply high volumes at low cost (generics) and organizations that coordinate bulk procurement (donors, government tenders).

Government & NGO role — operational impacts

◉Financing & procurement: Donor-funded procurement (Global Fund, Gavi in vaccine rollouts, bilateral aid) and government tenders dominate large purchases — this concentrates revenue into a few procurement channels and pushes prices down through competitive tenders.

◉Program design & guidelines: WHO/WHO-partner recommendations (e.g., ACTs as first-line) and national treatment guidelines directly determine which products are purchased at scale — influencing R&D priorities and commercial strategy for manufacturers.

◉Surveillance & stewardship: NGOs and CDC-type agencies run resistance surveillance and pharmacovigilance; data from these programs can trigger shifts in formulary choices (e.g., move away from failing partner drugs).

Country-specific — implications and nuances

◉South Africa

◉Market character: Relatively stronger healthcare systems in urban areas but pockets of high burden; mix of public procurement and private/community NGOs.

◉Product mix: Higher demand for affordable generics for wide distribution; at the same time, specialty hospitals may procure branded ACTs or injectables for severe cases.

◉Procurement behavior: NGOs and provincial health departments often procure through centralized tenders; quality assurance requirements can favor larger reputable generic manufacturers.

Nigeria

◉Policy & uptake: Federal Ministry of Health-led shifts toward quality-assured ACTs reduce use of ineffective monotherapies and counterfeit or substandard drugs.

◉Market channels: Large informal private market presence (patent medicine vendors) means urban/rural split — institutional procurement for public clinics vs. OTC sales in private outlets.

◉Market implication: Strong demand for WHO-prequalified generics and for programs that improve access in rural areas.

Operational takeaways for firms & programs

◉Manufacturers must combine high-volume capacity, cost-competitiveness, and quality assurance to win tenders.

◉Donors prefer suppliers who can demonstrate track record, regulatory compliance, and cold-chain/logistics capability (for some injectables and vaccines).

2 Asia-Pacific (Fastest Growing, 2025–2034)

India & Southeast Asia — drivers of faster growth

◉R&D pipeline & manufacturing scale: India’s pharma ecosystem produces both generics and active pharmaceutical ingredients (APIs) at scale; Southeast Asia has centers of research (academic + industry) exploring novel combinations and localized formulations.

◉Market sophistication: Growing private-sector healthcare, expanding insurance, and higher urban healthcare access increase willingness/ability to pay for newer therapies and combination regimens.

◉Regulatory modernization: Faster regulatory review and product registration pathways in some countries accelerate market entry for innovations (e.g., new ACT formulations).

China — policy & funding dynamics

◉Centralized funding for elimination: Large state investments to achieve elimination objectives encourage mass campaigns, surveillance upgrades and vaccine adoption pilots — translating into targeted procurement.

◉Local innovation: Domestic biotech capacity supports vaccine and novel drug R&D that can be scaled locally or exported.

Focus on surveillance + resistance management

◉Integrated approach: Countries are investing in laboratory networks, molecular surveillance (to detect artemisinin resistance markers), and real-time data systems to guide switching of first-line treatments.

◉Market impact: Surveillance drives demand for next-generation partner drugs when resistance emerges; it also catalyzes combination therapy development.

Commercial implications

◉Asia-Pacific growth attracts multinational pharmaceutical investment in clinical trials, local manufacturing, and partnerships with regional CROs/CRDMOs.

3 North America & Europe

Lower prevalence but specific demand niches

◉Travel & military prophylaxis: Main market drivers are chemoprophylactic products for travelers and military personnel; purchases are smaller in volume but often higher margin (combination drugs like atovaquone-proguanil).

◉Regulatory & safety expectations: High regulatory bar (FDA, EMA) means products sold here must meet stringent clinical and manufacturing standards — a reputation signal that helps companies win donor tenders in endemic regions.

◉R&D hubs: Many large pharma and biotech R&D centers (GSK, Sanofi, Roche) are in Europe and North America; although domestic clinical need is small, innovation and clinical trials are concentrated here.

◉Market nuance: Demand for vaccines, monoclonals, and novel therapeutics is driven by strategic public health stockpiling and travel medicine markets rather than endemic treatment needs.

4 Latin America

Amazon border regions — epidemiology & operational challenges

◉Cross-border transmission: Remote, transboundary areas (Amazon basin) complicate surveillance and distribution; outbreaks require coordinated procurement across countries.

◉Public health initiatives: PAHO partnerships and regional development bank support (e.g., CAF) fund cross-border control programs and targeted procurement of medicines and diagnostics.

◉Market structure: Public sector procurement dominates; private retail is smaller, but could be significant in urban centers; logistics costs for remote areas increase unit cost of treatment distribution.

PAHO + CAF (2025) MoU — implications

◉Scale-up of coordinated procurement & interventions in Amazon frontier will increase demand for treatment courses, supply chain investments, and community-level preventive therapies (e.g., chemoprevention campaigns).

5 Middle East & North Africa (beyond Sub-Saharan)

Traveler-linked demand & health system differences

◉Low endemicity: Routine local transmission is limited; most antimalarial demand is for imported cases, military, and expatriate travel groups.

◉Private healthcare growth: Wealthier GCC states (UAE, Saudi Arabia) rely on private healthcare procurement for traveler prophylaxis and hospital stock of injectables for rare severe cases.

◉Market effect: These countries are not volume drivers but are important for premium products, specialized formulations, and regulatory market access.

Market Dynamics

Drivers (expanded)

Public awareness campaigns

◉Effect: Increases early treatment seeking and uptake of prophylaxis; shifts demand from informal monotherapies toward WHO-recommended ACTs and safety-assured products.

◉Commercial outcome: Larger, more predictable public sector tenders and higher outpatient volumes.

Government initiatives + WHO support

◉Effect: Guideline changes and immunization additions (vaccine rollouts) create new, high-value procurement streams.

◉Commercial outcome: Manufacturers aligned with WHO prequalification gain preferential access to large donor-funded contracts.

Increasing vaccine adoption (R21, Adfalsvax, Mosquirix)

◉Effect: Adds a preventative product line to market demand; may reduce case burden over time but drives near-term procurement for mass immunization campaigns.

◉Commercial outcome: Creates cross-market opportunities for companies able to supply both vaccines and therapeutics.

Expansion of ACTs as first-line therapy

◉Effect: Sustained demand for artemisinin derivatives and partner drugs; emergence of new ACT formulations accelerates market turnover.

◉Commercial outcome: Firms producing validated ACTs capture majority of treatment market share; resistance pressures can force tactical portfolio changes.

Restraints (expanded)

Weak healthcare infrastructure

◉Effect: Limits access in rural/remote regions, causing treatment delays and reliance on informal markets.

◉Commercial outcome: Fragmented demand patterns; difficulty in achieving reliable last-mile distribution for newer, more expensive therapies.

Limited diagnostics & shortage of trained professionals

◉Effect: Over-treatment or misuse of antimalarials where diagnostics are absent; improper dosing drives resistance.

◉Commercial outcome: Market for point-of-care diagnostics and training programs rises; manufacturers may be pressured to include diagnostics and training in tenders.

Opportunities (expanded)

Novel ACTs & combination therapies

◉Why: To overcome partner-drug resistance and extend therapeutic lifetime of artemisinin backbones.

◉Commercial implication: High-value market niche; opportunities for new IP and premium pricing in early adoption markets.

Drugs for pregnant women & children

◉Why: High-risk groups require safe, effective regimens and intermittent preventive therapy (IPTp, IPTi).

◉Commercial implication: Specialized formulations (e.g., pediatric dispersible tablets) and dedicated safety data become differentiators.

Online pharmacies & digital health adoption

◉Why: Urbanization and internet access create demand for convenient drug ordering, adherence tools and tele-consultation.

◉Commercial implication: Alternative channels open — require digital compliance, supply chain integrity (authenticity checks), and new marketing strategies.

Top Leading Companies

Novartis AG

◉Key product: Coartem (artemether-lumefantrine) — flagship ACT.

◉Overview: Longstanding market leader for ACTs with global distribution contracts; strong involvement in public-sector tenders.

◉Strengths: WHO prequalification, deep experience in mass procurement, strong supply chain and manufacturing scale, robust safety/efficacy data.

Sanofi

◉Product range: Multiple antimalarial offerings (brand and generics) and broad global distribution.

◉Overview: Large multinational with capacity for global tender participation and vaccine/therapeutic integration.

◉Strengths: Global commercial footprint, strong regulatory track record, logistical reach into developing country markets.

Cipla Ltd.

◉Product range: Generics and affordable ACTs.

◉Overview: Indian generic specialist with strong distribution networks in Africa and Asia.

◉Strengths: Cost competitiveness, local regulatory experience in emerging markets, flexible manufacturing for high volumes.

Ipca Laboratories Ltd.

◉Product range: Chloroquine, ACT formulations, API supply.

◉Overview: Major Indian supplier with emphasis on volume production and exports.

◉Strengths: API manufacturing, low-cost production, long relationships with public sector buyers.

GSK (GlaxoSmithKline)

◉Products: Mosquirix (RTS,S) vaccine involvement, R&D collaborations on vaccines; cooperation with MMV on tafenoquine.

◉Overview: Significant vaccine R&D capabilities and historical presence in malaria vaccine development.

◉Strengths: Vaccine development experience, clinical trial expertise, partnerships with global health agencies.

Sun Pharma, Lupin, Zydus, Glenmark, Ajanta Pharma

◉Product range: Broad portfolios of generics, ACTs, and partner drugs.

◉Strengths: Manufacturing scale, cost structures that support large public tenders, regional distribution networks.

Mylan/Viatris, Teva, Amneal, Strides, Hetero, Dr. Reddy’s, Alkem, Macleods

◉Product range: Generic antimalarials, injectables, APIs.

◉Strengths: Global generic reach, regulatory experience in multiple markets, ability to meet tender specifications.

F. Hoffmann-La Roche Ltd.

◉Product/overview: Strong R&D and diagnostics/pharmaceutical capabilities but limited presence in frontline antimalarial therapeutics.

◉Strengths: Advanced research capability, potential to move into adjunct diagnostics or novel therapeutics if strategic shift occurs.

Commercial strategies that drive success

◉WHO prequalification & regulatory compliance — mandatory to access donor-funded tenders.

◉Cost & volume capability — essential in Africa where volume and price determine procurement.

◉R&D partnerships — vaccine and novel drug development often requires collaboration with MMV, DNDi, or academic centres.

Latest Announcements

Guinea (Aug 2025): Malaria vaccine added to EPI

◉Program detail: Integration into national Expanded Programme on Immunization (EPI) implies routine, nationwide immunization schedules for infants/children.

◉Operational implication: Large, recurring procurement cycles for vaccine doses; need for cold chain expansion, training of immunization staff, and long-term monitoring of vaccine impact.

◉Market effect: Creates demand for vaccine manufacturers and supporting commodity supply (syringes, cold boxes) and could reduce treatment demand over medium-term if coverage is effective.

PAHO + CAF (Apr 2025): MoU for Amazon region

◉Program detail: Cross-border coordination to strengthen surveillance and control in Amazon borderlands.

◉Operational implication: Combined procurement and distribution programs, funding for localized stockpiles, investment in vector control and diagnostics.

◉Market effect: Short-term spike in demand for drugs in the region; longer term, improved surveillance can shift product choices based on local parasite species and resistance patterns.

South Sudan (Aug 2025): Phase II rollout of R21

◉Program detail: Implementation in 52 counties indicates large scale immunization aimed at children.

◉Operational implication: Massive logistical rollout, community engagement, and monitoring systems — similar to Guinea’s adoption but in fragile settings.

◉Market effect: Demand for associated antimalarial drugs may fall in target age groups over time; immediate procurement needs for vaccines and associated supplies rise.

Recent Developments

July 2024 — GSK + MMV: tafenoquine for P. vivax

◉Scientific context: Tafenoquine offers single-dose radical cure potential for P. vivax relapse prevention vs. multi-day primaquine regimens.

◉Market impact: Creates new product segment (relapse prevention) with potential to reduce long-term morbidity; regulatory approvals in endemic countries open new procurement channels and alter prophylaxis/treatment mixes.

Oct 2024 — AMIVAS: Artesunate AMIVAS launched in Europe & UK

◉Clinical context: Artesunate is the WHO-recommended treatment for severe malaria; formal launches in EU/UK are for hospital use in imported severe cases.

◉Market impact: Strengthens availability of high-quality artesunate in high-regulatory markets; limited volume but important for hospital formularies and academic clinical use.

Aug 2025 — South Sudan R21 expansion

◉Context & effect: Scaling R21 means more public procurement, training, and concurrent adjustments to treatment and surveillance strategies; potential to reduce pediatric malaria burden in rollout areas.

Segments Covered

By Drug Class — deeper explanation

Aminoquinolines (Chloroquine, Hydroxychloroquine, Primaquine)

◉Use cases: Historically first-line for many forms; today, chloroquine is effective only where sensitive strains persist. Primaquine is critical as a tissue/gametocytocidal agent for P. vivax relapse prevention and transmission blocking.

◉Commercial note: Lower cost, widely available generics; but use limited by resistance and safety (e.g., G6PD deficiency concerns with primaquine).

Artemisinin-based Combination Therapies (ACTs)

◉Use cases: First-line for uncomplicated P. falciparum malaria; combinations (artemisinin + partner drug) reduce resistance risk.

◉Commercial note: High demand across endemic countries; partner-drug resistance can necessitate switching combinations.

Quinine & related agents

◉Use cases: Older blood schizonticide still used in some severe or complicated settings, or when ACTs are unavailable/contraindicated.

◉Commercial note: Injectable formulations needed in severe cases; side effect profiles drive preference for artesunate where available.

Antibiotics (Doxycycline, Clindamycin)

◉Use cases: Used as partner drugs in combination regimens or for prophylaxis in travellers (doxycycline). Clindamycin used in combination with quinine in certain populations (e.g., pregnancy).

◉Commercial note: Often adjunctive, smaller revenue pools but essential in treatment algorithms.

◉Others (Atovaquone–Proguanil, Sulfadoxine–Pyrimethamine)

Use cases: Atovaquone-proguanil used for travellers and in specific treatment contexts; SP used in IPTp (intermittent preventive therapy in pregnancy) though resistance constrains use in some regions.

◉Commercial note: Strategic uses in prophylaxis programs and in pregnancy-related prevention policies.

By Mode of Action — deeper explanation

◉Blood schizonticides (target asexual blood stages)

◉Importance: Address clinical disease and immediate transmission potential; includes artemisinins and quinolines — mainstay of therapy.

Tissue schizonticides (target hepatic stages)

◉Importance: Prevent relapse from hypnozoites (P. vivax/P. ovale) — primaquine and tafenoquine are critical to radical cure strategies.

◉Gametocytocidal agents (kill sexual stages)

◉Importance: Reduce onward transmission to mosquitoes; primaquine is the primary WHO-recommended gametocytocide.

By Route of Administration — deeper explanation

Oral (70% share, 2024)

◉Reason for dominance: Convenience, suitability for outpatient treatment, cost advantages; most ACTs and prophylactics are oral formulations.

◉Formulation trends: Pediatric dispersibles, single-dose tablets for adherence, fixed-dose combinations to simplify dosing.

Injectable (fastest-growing)

◉Drivers of growth: Need for parenteral artesunate in severe malaria; increasing hospital capacity in some regions; improved formulations that simplify administration (intramuscular options).

◉Operational challenge: Requires trained staff, sterile supplies and hospital infrastructure — constrains uptake in low-resource settings.

By Distribution Channel — deeper explanation

Hospital pharmacies (46% share, 2024)

◉Why dominant: Hospitals handle severe cases and inpatient management; high usage of injectable artesunate and hospital-managed supplies.

◉Implication: Hospital procurement cycles, formularies and clinical guidelines heavily influence national demand patterns.

Retail pharmacies

◉Role: Point-of-sale for outpatients and travellers; important for urban access but vulnerable to variable quality and unregulated sales.

Online pharmacies (fastest-growing)

◉Drivers: Urban internet penetration, convenience, telemedicine linkages.

◉Risks & requirements: Need to ensure product authenticity, adherence to local prescription rules, and regulated distribution to avoid substandard products.

By Region — deeper explanation

◉Africa — dominant share (55%): highest treatment volumes, programmatic procurement.

◉Asia-Pacific — fastest growth: R&D, surveillance investments, and diversified product demand.

◉North America & Europe — niche high-regulation markets for travel/military.

◉Latin America — targeted Amazon interventions and mixed urban/rural needs.

◉MEA — traveler and expatriate markets; lower endemic burden but strategic stockpiling.

Top 5 FAQs (With Data)

Q1. What is the current size of the antimalarial drugs market?

A – USD 1.07 billion (2024), projected to reach USD 1.67 billion by 2034.

Q2. Which region dominates the market?

A – Africa with 55% share (2024) due to high malaria burden.

Q3. Which drug class is growing fastest?

A – Artemisinin-based Combination Therapies (ACTs) (WHO-recommended).

Q4. Which route of administration is most common?

A – Oral drugs (70% share, 2024); injectables grow fastest for severe malaria.

Q5. What are the latest advancements?

A – ICMR’s Adfalsvax vaccine (2025), GSK/MMV’s tafenoquine (2024), South Sudan’s R21 rollout (2025).

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6044

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest