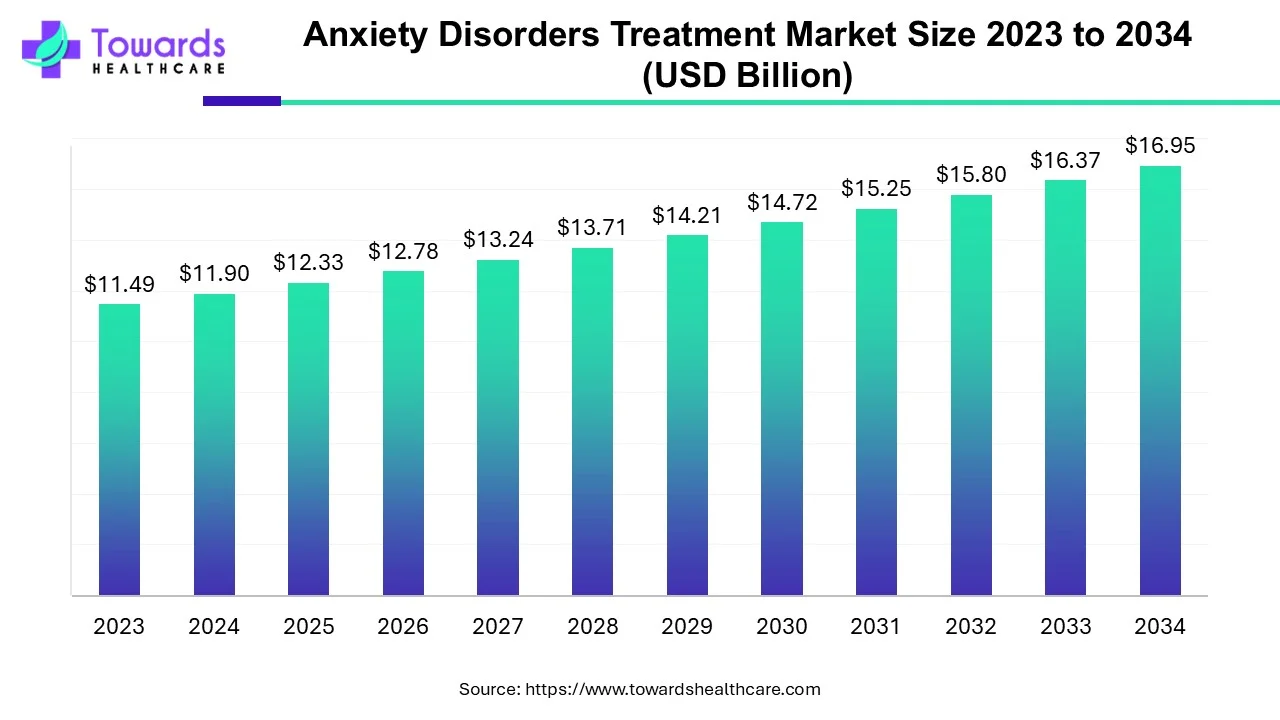

The global Anxiety Disorders Treatment market is forecast to grow from USD 12.33 billion in 2025 to USD 16.95 billion by 2034 — an increase of USD 4.62 billion over nine years, corresponding to a CAGR of 3.6% (2025–2034).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5145

Market size (point-wise)

Key headline figures

◉2025 market size: USD 12.33 billion.

◉2034 market size (forecast): USD 16.95 billion.

◉Absolute growth (2025→2034): USD 4.62 billion (16.95 − 12.33 = 4.62).

◉Average annual absolute increase: ≈ USD 0.51 billion/year (4.62 ÷ 9 ≈ 0.513).

◉Compound annual growth rate (CAGR): 3.6%.

Important 2022 baseline shares (market structure anchors)

◉Disorder type: Generalized Anxiety Disorder (GAD) held the largest share 34% in 2022.

◉Drug class (2022): SSRIs represented the largest drug-class share 32%.

◉Care setting (2022): Hospital outpatient settings dominated with a 71% share.

COVID-era & funding signals that affect market sizing and demand

◉Pandemic prescription spike: A 12% rise in Zoloft prescriptions was recorded in March 2020 (lockdowns, economic stress, social isolation cited as drivers).

◉Research funding (2015–2020): Approximately 76,000 grants from 345 funders across 38 countries — US$18.5 billion invested into mental-health research in that period (≈5% of registered grants; 4% of total research spend). 89% of these funds went to high-income countries and 39% of grants originated in the United States — this concentration shapes R&D and commercialization geography.

◉Digital adoption indicator: Global spending on wellness and mental-health apps rose markedly from 2019–2022 (user data in the brief points to rising investment and consumer spend in mobile/digital mental-health tools).

Market trends

1. Demand side trends

◉Post-COVID demand shock: The pandemic produced a measurable surge in anxiety and depression (e.g., March 2020 Zoloft prescriptions +12%), driving short-term and sustained demand for pharmacotherapy and remote therapy.

◉Growing mental-health awareness: Reduced stigma → more people seeking help → larger addressable market for meds, therapy and digital solutions.

◉Shift to outpatient care: Outpatient hospital settings held 71% of the market in 2022, reflecting preference for community-based and ambulatory management of anxiety (less inpatient care).

2. Treatment mix evolution

◉Pharmacotherapy still central: SSRIs (32% in 2022) retain the largest share among drug classes; benzodiazepines, SNRIs and others remain in use but face scrutiny (dependence risk, guideline shifts).

◉Therapy & hybrid models: CBT and other psychotherapies continue as first-line non-drug options; hybrid care (therapy + meds) grows, including combined digital CBT + pharmacotherapy programs.

◉Rise of digital therapeutics & apps: Investment and consumer spending on apps increased 2019–2022; pharma–digital partnerships (e.g., pharma working with digital CBT providers) are becoming common.

3. Supply side & industry structure

◉Competitive, multi-player landscape: Big pharma, generic manufacturers, specialty mental-health device/service firms, therapy clinic networks and digital-therapeutics startups all compete and collaborate.

◉R&D and M&A activity: Partnerships and consolidation—examples include pharma collaborations and corporate deals in 2020 (Neurocrine–Takeda; Big Rock Partners–NeuroRx). Regulatory approvals for new mechanisms (e.g., intranasal agents such as SPRAVATO) signal changing therapeutic mixes.

◉Funding concentration impacts innovation geography: 89% of mental-health grant funds went to high-income countries (2015–2020), skewing where R&D and clinical trials focus.

4. Access & workforce constraints

◉Shortage of mental-health professionals—especially child/adolescent specialists—constrains capacity, increases wait times, and boosts interest in telehealth and digital scaling solutions.

AI role and impact on the anxiety treatment market

1. Drug discovery & preclinical R&D

◉Role: Machine learning for target identification, compound screening and predicting molecule-target interactions.

◉Impact: Shortens early discovery timelines and reduces costs; increases the chance of novel anxiolytic mechanisms entering the pipeline (helps companies with limited R&D budgets punch above weight).

2. Clinical-trial optimization

◉Role: AI-driven patient-selection (predictive eligibility), adaptive trial designs, and digital biomarkers to improve signal detection.

◉Impact: Higher trial efficiency, lower drop-out, faster readouts — attractive in a market where new mechanisms (e.g., intranasal agents) are emerging and competition for trial participants is intense.

3. Screening, diagnosis & risk stratification

◉Role: Natural language processing (NLP) on clinical notes, voice/text analysis, and passive smartphone/ wearable data to flag anxiety patterns and predict escalation (e.g., panic attacks, suicidal ideation).

◉Impact: Earlier detection, triage prioritization (addresses workforce shortage), and personalization of care plans.

4. Personalized digital therapeutics & adaptive CBT

◉Role: AI personalizes CBT modules, pacing, and coping-strategy suggestions; reinforcement learning adapts content to engagement and symptom changes.

◉Impact: Better engagement, measurable outcomes from app-delivered therapy, potential to substitute or augment in-person CBT (scales access, fits outpatient dominance).

5. Virtual therapy assistants and clinician augmentation

◉Role: Conversational agents to provide between-session support, guided exposure exercises, or to assist clinicians with session notes and measurement-based care.

◉Impact: Reduces clinician burden, improves measurement frequency, and weakens the access bottleneck caused by professional shortages.

6. Remote monitoring & adherence

◉Role: Predictive models using passive sensor data (sleep, activity, social patterns) to trigger interventions or clinician alerts.

◉Impact: Improves medication adherence and therapy engagement, potentially lowering relapse/readmission and improving outpatient outcomes.

7. Real-world evidence & outcomes measurement

◉Role: Aggregate, anonymize and analyze patient-level outcome data from apps, EHRs and registries to demonstrate effectiveness for payers and regulators.

◉Impact: Facilitates reimbursement conversations for digital therapeutics and supports labeling claims for novel therapies.

8. Regulatory, ethical & operational constraints

◉Challenges: Data privacy, algorithmic bias, explainability, and clinical validation requirements. AI tools must meet clinical evidence thresholds to be accepted by clinicians, payers and regulators — this is a practical barrier to immediate, universal adoption.

9. Strategic market implication

Regional insights

North America

Urban concentration & outpatient leadership

◉Metro areas (NYC, LA, Toronto) concentrate specialists, research centers, and advanced clinics. This concentration reinforces outpatient dominance (71% share) and makes adoption of new treatments and digital programs faster in cities.

High funding & market liquidity

◉The U.S. accounted for 39% of mental-health grants (2015–2020), feeding R&D, trials and startup ecosystems (favors rapid commercialization).

Telehealth acceleration

◉Pandemic policy shifts made teletherapy widely accessible, reducing geographic access barriers and increasing the reach of digital therapeutics.

Europe

Regulatory complexity & opportunity

◉EMA pathways (e.g., acceptance of MAA filings such as Vyepti in neuro/neurology space) shape introduction of new products. National reimbursement variation creates both hurdles and pockets of rapid adoption.

Integrated community care models

◉Many European systems emphasize community/outpatient mental-health services, aligning with outpatient share dominance.

Asia Pacific

Cultural stigma & under-resourcing

◉Stigma around mental health in many countries depresses help-seeking, limiting market penetration despite rising need.

Rapid digital adoption but regulatory fragmentation

◉Mobile penetration and app use are high — ripe for digital therapeutics — but country-by-country regulation and reimbursement heterogeneity slow scale.

Workforce gap

◉Lower per-capita mental-health professionals intensifies demand for scalable AI and digital solutions.

Middle East & Africa

Infrastructure & access constraints

◉Limited specialist availability, patchy mental-health infrastructure and variable insurance coverage restrict market growth.

High unmet need

◉Stigma and resource constraints create an underserved opportunity for telehealth and low-cost digital interventions.

South America

Inequality in access

◉Urban centers have reasonable services; rural areas face shortages. Growth driven by private clinics, telehealth and regional generics producers.

Emerging payer interest

◉Growing recognition of productivity losses from untreated anxiety is prompting slow shifts toward coverage of outpatient care and digital tools.

Market dynamics

Key drivers

◉Rising prevalence and awareness — more patients seeking care.

◉Outpatient care preference — efficient, lower-cost care models (71% share).

◉Digital therapeutics & telehealth adoption — expands reach and reduces wait times.

◉Sustained pharma investment and collaborations — partnerships (e.g., pharma + digital CBT) accelerate combined offerings.

Principal restraints

◉Shortage of trained mental-health professionals — limits capacity for therapy and specialist consultations.

◉Funding concentration — heavy skew of research funding to high-income countries may limit innovation tailored for LMIC needs.

◉Regulatory hurdles & reimbursement gaps for digital therapeutics and newer drug classes.

Opportunities

◉AI & digital scaling — address workforce shortages and expand access to evidence-based therapy.

◉Novel mechanisms & regulatory openness — approval pathways for agents like intranasal therapies show regulators are receptive to new approaches for severe presentations.

◉Generics and cost-effective therapies — broadening access in price-sensitive markets (Teva and generics players).

Threats

◉Dependence and safety concerns with some drug classes (e.g., long-term benzodiazepine use).

◉Data privacy & trust issues around app/digital therapeutic data that could limit adoption.

◉Economic cycles — healthcare spending reprioritization could affect access and payer coverage.

Top companies

Pfizer Inc.

◉Products / relevance: Established presence in anxiolytic/antidepressant markets (Zoloft cited in content; March 2020 saw a 12% rise in prescriptions).

◉Overview: Global pharmaceutical leader with large commercial, regulatory and R&D capabilities.

◉Strengths: Massive distribution network; strong marketing and clinician relationships; capacity to pair drug launches with real-world evidence campaigns and digital partnerships.

Merck KGaA

◉Products / relevance: Broad life-science and specialty pharma activities that touch CNS therapeutic areas.

◉Overview: Diversified life-science and healthcare company with R&D focus.

◉Strengths: Integrated R&D and specialty manufacturing, enabling complex molecule development and supply.

Sanofi

◉Products / relevance: Established pharma with CNS and broad therapeutic interests.

◉Overview: Large multinational with global commercialization reach.

◉Strengths: Global market access, regulatory depth and experience managing large chronic-therapy portfolios.

Bristol-Myers Squibb (BMS)

◉Products / relevance: Major pharma player with substantial R&D and M&A firepower.

◉Overview: Focus on innovative medicines; ability to pursue strategic partnerships in psychiatry and neuroscience.

◉Strengths: Deep R&D, M&A track record, and access to specialty clinical trial networks.

Eli Lilly

◉Products / relevance: Strong neuroscience R&D track record.

◉Overview: Large biotech/ pharma with pipeline emphasis on CNS agents.

◉Strengths: Innovation culture, clinical development expertise, and capabilities to bring novel psychiatric agents to market.

Teva Pharmaceutical Industries

◉Products / relevance: Generic manufacturer supplying broad antidepressant/anxiolytic portfolios.

◉Overview: World’s leading generics firm with scale in off-patent CNS medicines.

◉Strengths: Cost leadership, manufacturing scale, and distribution—critical for affordability and access.

Bayer AG

◉Products / relevance: Diversified healthcare presence including CNS/neurology linkages.

◉Overview: Large pharma/chemicals conglomerate with global reach.

◉Strengths: Cross-discipline R&D, industrial scale, and strong commercialization channels.

Biocare Medical, LLC

◉Products / relevance: Niche medical/diagnostic technologies supporting mental-health diagnostics and clinic equipment.

◉Overview: Smaller, specialized firm (listed among market companies).

◉Strengths: Specialized product focus, agility to serve clinician workflows and diagnostic labs.

GSK plc.

◉Products / relevance: Global pharma with historical CNS product experience.

◉Overview: Major multinational working across pharmaceuticals and vaccines.

◉Strengths: Large global footprint, regulatory expertise, and established clinician relationships.

Mitsubishi Chemical Group Corporation

◉Products / relevance: Chemical and life-science capabilities with interest in specialty pharmaceuticals and materials used in formulations.

◉Overview: Large industrial group with life-science subsidiaries.

◉Strengths: Manufacturing and materials science strengths; potential to support drug formulation and delivery innovations.

Latest announcements

◉Janssen + Koa Health collaboration (November 2020): Partnership to research digital CBT combined with pharmacological therapy for treatment-resistant major depressive disorder — shows pharma interest in combining drugs with validated digital therapeutics to improve outcomes and target non-responders.

◉FDA label expansion for SPRAVATO (August 2020): Janssen’s intranasal SPRAVATO added to oral antidepressant therapy for adults with major depressive disorder and acute suicidal ideation/behavior — signals regulatory acceptance of novel delivery mechanisms and rapid-acting agents relevant to severe mood/anxiety presentations.

◉Neurocrine + Takeda agreement (June 2020): Joint development work on innovative psychiatric disorder treatments — highlights cross-company collaboration to build psychiatric pipelines.

◉MAA acceptance for Vyepti (December 2020): Lundbeck’s MAA for Vyepti (CGRP inhibitor for migraine prevention) accepted by EMA — while migraine-focused, acceptance demonstrates regulatory momentum in neuro/behavioral therapeutic categories and potential cross-learning for anxiety treatments.

◉Big Rock Partners Acquisition Corp. + NeuroRx merger (December 2020): Corporate-finance activity indicating investor appetite for psychiatric/neurological therapy companies and for strategies that combine biotech and financial sponsors.

Recent developments

◉Pandemic accelerated both demand (prescription rises) and acceptance of remote/digital models.

◉Drug class dominance remains with SSRIs, but new mechanisms and formulations (e.g., intranasal agents) are being integrated into practice for severe cases.

◉Pharma–digital partnerships are increasing, with digital CBT being trialed in combination with drugs to reach treatment-resistant populations.

◉Research capital is concentrated in high-income countries, shaping where innovations and clinical trials occur and creating an uneven innovation geography.

◉Workforce shortages have intensified interest in telehealth, AI and digital therapeutics as scalable care options.

Segments covered

By Disorder Type

◉Generalized Anxiety Disorder (GAD) 34% share in 2022. GAD represents the largest single disorder segment; chronic course and broad symptomatology drive consistent use of SSRIs, CBT, and long-term outpatient management.

◉Panic Disorder — episodic acute care needs; combination of meds and exposure-based therapy often used.

◉Agoraphobia — often co-occurs with panic disorder; treatment mixes CBT with pharmacotherapy and graded exposures.

◉Social Anxiety Disorder — increasing prevalence noted; therapy (group and CBT) and medications are common. Social-media and societal factors may be drivers.

Specific Phobia & Others — more niche but important in aggregate; exposure therapies are treatment mainstays.

By Treatment (deep subpoints)

◉SSRIs (32% share in 2022): First-line pharmacotherapy for many anxiety disorders — favorable safety profile relative to older classes.

◉SNRIs, TCAs, MAOIs, mixed antidepressants: Alternative antidepressant classes used when SSRIs fail or in comorbid depression; each has unique side-effect and monitoring profiles.

◉GABAergic drugs & benzodiazepines: Effective for short-term relief; dependence and tolerance concerns limit long-term use.

◉Antipsychotics / adjuncts: Used as augmentation in refractory cases.

◉Beta-blockers / antihistamines: Symptom-focused (e.g., somatic symptoms, performance anxiety).

◉Therapy (CBT and others): Evidence-based psychotherapies remain core; digital CBT scales access.

◉Other treatments: Digital therapeutics, mindfulness programs, and lifestyle interventions.

By Hospital Settings

◉Outpatient (71% share in 2022): Majority of care delivered here — aligns with chronic nature of many anxiety disorders and the suitability of outpatient therapy plus medication management.

◉Inpatient: Reserved for acute crises (e.g., suicidality, severe comorbidity) or complex cases requiring stabilization.

By Geography

◉North America / Europe / Asia Pacific / Middle East & Africa / South America — each region differs by care models, reimbursement, stigma levels, and workforce availability — explained previously in the Regional Insights section.

Top 5 FAQs

1) What is the expected market growth of the anxiety disorders treatment market?

Answer: The market is forecast to grow from USD 12.33 billion in 2025 to USD 16.95 billion by 2034, at a CAGR of 3.6% between 2025 and 2034.

2) Which disorder and drug class held the largest shares in 2022?

Answer: Generalized Anxiety Disorder (GAD) was the largest disorder segment at 34% (2022); SSRIs were the largest drug class at 32% (2022).

3) How did COVID-19 affect anxiety treatment demand?

Answer: COVID-19 increased anxiety prevalence and treatment seeking (e.g., a 12% rise in Zoloft prescriptions in March 2020). The pandemic also accelerated telehealth and digital therapeutics adoption.

4) Where is most research funding concentrated and why does that matter?

Answer: From 2015–2020, US$18.5 billion went to mental-health grants (76,000 grants); 89% of funding was directed to high-income countries and 39% originated in the U.S. This concentration shapes where R&D, clinical trials and product launches are focused.

5) How are shortages of mental-health professionals shaping the market?

Answer: Workforce shortages (notably child/adolescent specialists) increase wait times and limit capacity for therapy, driving the market toward telehealth, digital therapeutics and AI-enabled solutions to scale access.

Access our exclusive, data-rich dashboard dedicated to the therapeutic area sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5145

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest