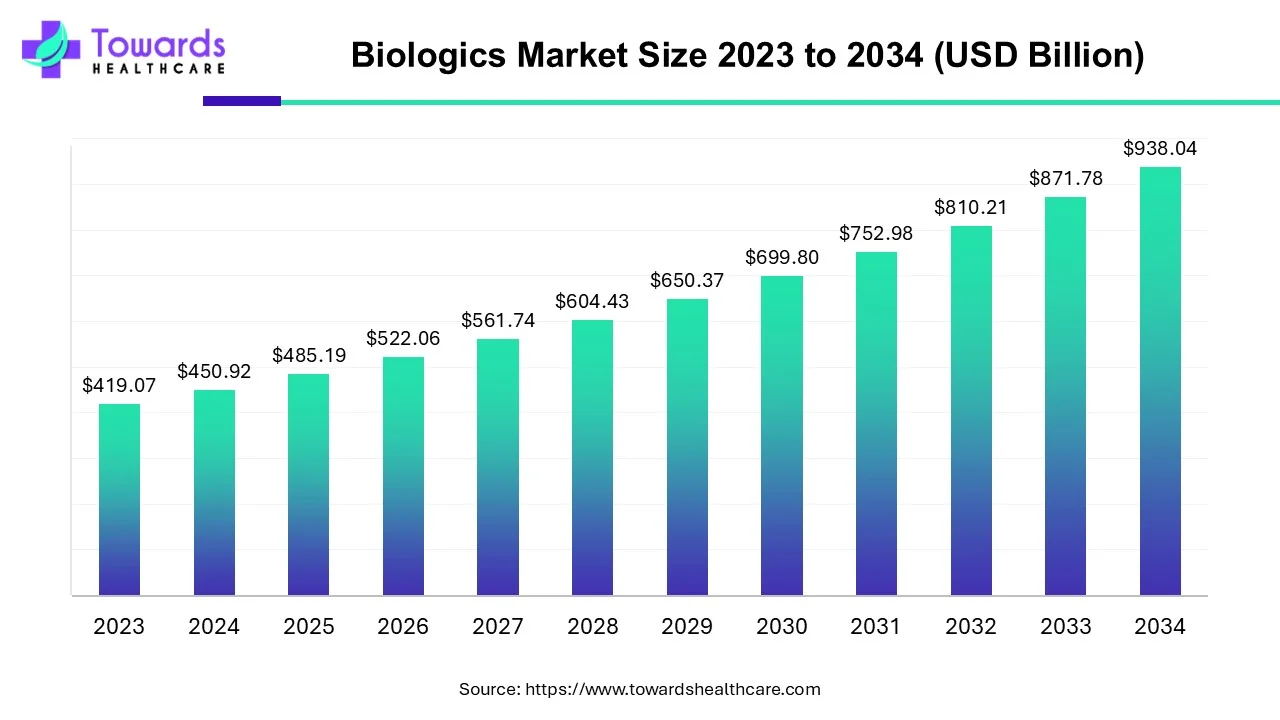

The global biologics market is projected to grow from USD 485.19 billion in 2025 to USD 938.04 billion by 2034 (CAGR 7.6%, 2025–2034), driven by large-volume blood & blood products (66% market share in 2023), oncology demand (36% share in 2023), rapid APAC capacity growth, and expanding use of monoclonal antibodies, cell & gene therapies and biosimilars.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/5108

Market size

1. Baseline and forecast

1.1. 2025 baseline: USD 485.19B (reference year provided).

1.2. 2034 forecast: USD 938.04B — near doubling of market value over the forecast horizon.

1.3. Compound Annual Growth Rate (CAGR): 7.6% from 2025–2034.

2. Key volume/value drivers behind the headline figures

2.1. High-value product mix: large share of market value concentrated in blood & blood products and biologics with premium pricing (e.g., monoclonal antibodies, cell & gene therapies).

2.2. Biosimilars & competitive pricing: growing biosimilar approvals (63 biosimilars approved in the U.S. across 17 reference products as of 2024) compress margins but expand patient access and volumes.

2.3. Geographic capacity expansion: APAC capacity buildouts (China and India production capacities measured in hundreds of thousands of liters) increase manufacturing throughput, enabling revenue growth.

2.4. Innovation premium: novel modalities (mRNA, ADCs, bispecifics, T-cell engagers) command elevated prices during initial uptake.

2.5. Regulatory throughput: sustained biologics approvals (e.g., 17 biologics among 55 new drugs in 2023) maintain a steady stream of new, revenue-generating products.

3. Structural composition of value (high level)

3.1. Concentration effect: a small number of product classes (blood & blood products) and indications (oncology) account for a disproportionate share of market revenue (66% and 36% reported shares respectively).

3.2. Lifecycle impacts: patent expiries of >55 blockbuster drugs over the next decade will re-allocate revenue between originators and biosimilar entrants.

Market trends

1. Dominant therapeutic & product trends

1.1. Oncology leadership: oncology represented 36% share in 2023 and remains the focal R&D and commercial area (mAbs, ADCs, bispecifics, T-cell engagers).

1.2. Blood & blood products dominance: 66% market share in 2023 — large, recurring revenue base driving steady cash flows.

2. Technology & modality trends

2.1. Rise of novel modalities: mRNA, gene therapies, RNAi, cell therapies and engineered proteins expand the product set beyond traditional mAbs.

2.2. Complex biologics & combined modalities: combinatorial products (e.g., antibody-drug conjugates, bispecifics) grow as developers target difficult oncology and autoimmune targets.

3. Commercial & economic trends

3.1. Biosimilar market acceleration: biosimilars are increasing access and applying pricing pressure; forecasted biosimilar uptake significantly alters originator revenue trajectories.

3.2. M&A and partnerships: active consolidation and partnering to acquire capabilities (manufacturing, novel modalities, distribution).

3.3. Manufacturing decentralization: capacity expansion in APAC (China, India) to reduce cost and improve supply security.

4. Regulatory & policy trends

4.1. Robust approval activity: examples include dozens of biologic approvals and CBER activity (23 new BLAs added in 2023) — regulators remain active in evaluating novel biologics.

4.2. Adaptive authorizations for vaccines: e.g., COVID vaccine updates by major mRNA players in 2023–2024 demonstrate regulatory pathways for variant-targeted updates.

5. Market demand & epidemiology drivers

5.1. Chronic disease burden: large and growing NCD burden (WHO figures: 41M deaths/year; cancers major share) increases long-term demand for biologics.

5.2. Patient preference for targeted, personalized therapies leading to higher uptake and willingness to pay.

AI’s impact/role in the biologics market

1. Target identification & in-silico candidate discovery

◉AI models screen large omics and structural datasets to predict target–disease linkages and prioritize biologic candidates (antibodies, engineered proteins).

◉Outcome: reduced discovery timelines, higher hit rates for lead biologics.

2. Antibody design and protein engineering

◉Generative models propose sequence variants with improved binding, stability or manufacturability; in-silico screening predicts developability flags (immunogenicity, aggregation).

◉Outcome: fewer failed leads in preclinical development, lower protein engineering cycles.

3. Predictive preclinical modeling

◉AI integrates multi-omics, cell assay and in-vivo data to predict efficacy/toxicity profiles, guiding candidate selection and de-risking programs.

4. Clinical trial optimization (design & enrollment)

◉AI accelerates patient matching using EHRs/genomics, predicts enrollment rates and optimizes inclusion/exclusion criteria to reduce delays and improve statistical power.

◉Outcome: lower trial costs and faster readouts.

5. Bioprocess optimization & digital twins

◉Machine learning models create process digital twins for fermentation/cell culture steps, enabling real-time adjustments to improve yield and consistency.

◉Outcome: higher yields, lower batch failures, predictable scale-up.

6. Quality control & anomaly detection

◉AI monitors sensor streams during biomanufacturing to detect deviations (pH, metabolite levels) before product quality is impacted.

◉Outcome: improved compliance, reduced waste.

7. Supply chain forecasting & demand planning

◉Predictive analytics optimize inventory of critical biologic raw materials (cell lines, media, cold-chain), and forecast demand across geographies to prevent shortages.

8. Regulatory submission support & evidence generation

◉NLP systems extract and summarize relevant literature, generate data tables and support evidence packages for regulators; AI can help identify precedent approvals (fast-track analogues).

◉Outcome: accelerated and more robust regulatory dossiers.

9. Post-market safety surveillance & real-world evidence

◉AI mines claims, EHR and spontaneous reporting to detect safety signals or effectiveness trends earlier and to stratify responders vs non-responders for lifecycle management.

10. Personalized treatment optimization

◉AI integrates patient genomics, biomarkers and outcomes to recommend biologic selection/dosing, enabling precision therapy and improved patient outcomes.

Regional insights

North America

1. Ecosystem & capabilities

◉Hubs: Boston, San Francisco, San Diego — dense R&D, venture capital, clinical trial networks.

◉Reimbursement environment: generally favorable, enabling uptake of high-cost biologics.

2. Regulatory dynamics

◉FDA/CBER activity: continued approvals (FDA reported biologic approval counts: 17 in 2023, 18 in 2024 per table), active guidance for novel modalities.

3. Commercial implications

◉High ASPs (average selling prices): market supports premium pricing for first-in-class biologics, but biosimilar competition is increasing.

Europe

1. Regulatory & payer nuance

◉EMA role: centralized approvals; strong HTA processes in several countries drive price negotiation and value demonstration.

◉Manufacturing footprint: strong biologics manufacturing base; emphasis on quality and compliance.

2. Market dynamics

◉Biosimilar adoption: earlier biosimilar acceptance in some European markets drives rapid originator price erosion post-loss of exclusivity.

Asia-Pacific (APAC)

1. Capacity & scale

◉China: 870,000 liters active production capacity; 209 manufacturing facilities — rapid scale-up of biomanufacturing.

◉India: 941,000 liters capacity; a large supplier of biogenerics/biogenerics exports; domestic turnover Rs 4.17 lakh crore (FY2024) and export growth target $65B by 2030 (from $27B in 2023).

2. Market implications

◉Cost advantages: lower manufacturing costs and large contract-manufacturing capacity encourage global partners to outsource production.

◉Domestic biosimilar push: governments and private industry support biosimilar R&D to improve access.

China (specific)

◉Manufacturing scale: one of the largest capacity increases globally; regulatory reforms encourage local innovation and approvals.

India (specific)

◉Biogenerics leadership: strong in biosimilar development and cost-effective manufacturing; favorable policy & manufacturing investments.

Latin America, Middle East & Africa

◉Emerging demand: growing chronic disease burden, but market penetration constrained by pricing/reimbursement; opportunity for biosimilars to increase access.

Market dynamics

1. Market drivers

1.1. Epidemiology: rising NCDs and cancer incidence (WHO/Global Cancer Observatory data) drive chronic biologic therapy demand.

1.2. Technological innovation: mRNA, ADCs, bispecifics, CAR-T and gene therapies create new high-value markets.

1.3. Manufacturing scale-up in APAC: capacity growth enables global supply and price competitiveness.

2. Market restraints

2.1. High development & manufacturing cost: biologics are expensive to develop and manufacture (complex cell culture, cold chain).

2.2. Regulatory complexity: biologics require rigorous comparability studies; path for biosimilars remains costly and technically demanding.

3. Competitive dynamics

3.1. Biosimilar competition: expected loss of exclusivity for >55 blockbusters will intensify price competition.

3.2. Originator responses: lifecycle management (new formulations, novel indications), value-based contracting, and patient support programs.

4. Opportunities

4.1. Biosimilar market capture: lower-cost biosimilars expand reach and volumes.

4.2. AI and process improvements: efficiency gains across discovery, development and manufacturing.

4.3. Geographic expansion: APAC growth offers both market and manufacturing opportunities.

5. Threats & risks

5.1. Supply chain fragility: biologics require cold chain; disruptions have outsized impact.

5.2. Reimbursement pressure: payers push for cost containment and favor biosimilars once available.

5.3. IP and litigation risks: patent challenges and litigation around interchangeability and reference products.

Top 10 companies

1. Amgen

Products/Focus: monoclonal antibodies, oncology and inflammation biologics, biosimilars.

Overview: Large biotech pioneer with deep biologics R&D and manufacturing capability.

Strength: Strong biologics pipeline, scale manufacturing, commercial reach in biologic therapeutic categories.

2. Merck & Co.

Products/Focus: oncology biologics (immuno-oncology), vaccines and antibody therapies.

Overview: Major pharma with integrated R&D and commercial infrastructure.

Strength: Clinical development expertise in oncology and broad global commercialization network.

3. F. Hoffmann-La Roche Ltd. (Roche)

Products/Focus: oncology biologics, diagnostics-linked biologics.

Overview: Leader in oncology biologics with companion diagnostics integration.

Strength: Diagnostic + therapeutic integration gives competitive edge in targeted therapy development.

4. Bristol-Myers Squibb

Products/Focus: oncology biologics, immunology biologics.

Overview: Large pharma with strong oncology portfolio and biologics R&D focus.

Strength: Robust late-stage pipeline and experience in complex biologic trials and launches.

5. Sanofi

Products/Focus: vaccines, immunology biologics, specialty biologics.

Overview: Global biologics presence with vaccine manufacturing and established R&D in immunology.

Strength: Large vaccine manufacturing footprint and broad immunology pipeline.

6. Bayer AG

Products/Focus: biologics through certain therapeutic areas; historically manufacturing collaborations.

Overview: Diversified life sciences group with biologics interests and manufacturing assets.

Strength: Manufacturing scale and distribution channels in multiple therapy areas.

7. AstraZeneca

Products/Focus: oncology biologics, targeted biologic therapies.

Overview: Strong oncology focus with recent biologic and molecular modality investments.

Strength: Clinical development strength in oncology and global commercialization.

8. GlaxoSmithKline (GSK)

Products/Focus: vaccines, antibody therapeutics, respiratory biologics.

Overview: Large vaccines and biologics portfolio; strategic biologics collaborations.

Strength: Vaccine production scale and strong public health partnerships.

9. Novartis

Products/Focus: cell & gene therapies, biologics (incl. oncology).

Overview: Heavy investment in advanced biologics and gene therapies.

Strength: Operational experience in cell & gene therapy commercialization and complex manufacturing.

10. Eli Lilly and Company

Products/Focus: monoclonal antibodies across oncology, immunology and metabolic disease.

Overview: Expanding biologics pipeline with targeted protein therapeutics.

Strength: Strong late-stage pipeline and commercial infrastructure across major markets.

Latest announcements

1. COVID-19 vaccine updates (2023–2024)

Who: ModernaTX Inc. and Pfizer Inc.

What: Variant-targeted vaccine updates authorized for emergency use to better match circulating strains; objective to reduce severe outcomes (hospitalization, death).

Implication: Demonstrates regulatory pathways for rapid antigenic updates and manufacturer agility for vaccine variant adaptation.

2. Commit Biologics (May 2024)

What: €16M seed funding; developing bispecific complement engaging (BiCE) antibody therapies for cancer and autoimmune disease.

Implication: Investor interest in bispecific architectures and complement modulation; fuels early-stage biologics innovation in Europe.

3. Bone Biologics IPO (March 2024)

What: $2M IPO to fund spine fusion implant R&D and patent portfolio progression.

Implication: Small-cap biologics/biomaterials companies actively accessing public markets for capital.

4. Sandoz & Coherus acquisition (Jan 2024)

What: Acquisition of biosimilar ranibizumab (Cimerli) for $170M upfront, including commercial tools and staff.

Implication: Strategic consolidation in ophthalmic biosimilars and faster route to markets via acquired infrastructure.

5. TORL BioTherapeutics Series B (Apr 2023)

What: $158M Series B for ADCs and mAbs discovery; scientific backing includes discovery in UCLA labs.

Implication: Large private financing rounds continue to fuel ADC and mAb innovation.

6. WuXi Biologics acquisition (Oct 2020)

What: Bought Bayer’s German manufacturing facility to expand European production.

Implication: Contract development and manufacturing organizations (CDMOs) investing in global capacity.

7. Cadila launches (Oct 2020)

What: Introduced two biosimilars (NuPTH, Cadalimab) in India to expand regional product footprint.

Implication: Emerging market firms leveraging domestic regulatory routes to commercialize biosimilars.

Recent developments

Shifts in financing & startup activity: Commit Biologics (May 2024) and TORL (Apr 2023) signal continued VC and private funding interest in novel biologic modalities (bispecifics, ADCs).

Strategic M&A to accelerate biosimilar commercialization: Sandoz/Coherus acquisition of Cimerli (Jan 2024) illustrates larger biosimilar players acquiring marketed products to expedite revenue generation.

CDMO capacity consolidation and expansion: WuXi Biologics’ 2020 purchase of European manufacturing real estate illustrates CDMO moves to globalize capacity.

Public market access by small biotech: Bone Biologics IPO (Mar 2024) shows small specialized biologics/implant companies accessing public markets for R&D funding.

Product diversification in emerging markets: Indian firms (Cadila) bringing biosimilars to local markets to broaden accessibility.

Regulatory activity on vaccines: 2023–2024 regulatory approvals for updated COVID vaccines showcase regulatory responsiveness to variants.

Segments covered

By Product

Blood & Blood Products: Largest product revenue driver (66% share in 2023). High volume, repeatable therapies (plasma-derived factors, blood components).

Cell & Gene Therapy Products: High R&D and clinical costs, but potential for one-time curative pricing.

Tissue & Tissue Products: Regenerative medicine, implants and grafts for surgical repair.

Vaccines: Preventive biologics with public health and commercial value; seasonal and pandemic-response products (e.g., COVID vaccine updates).

Other Types: Enzyme replacement therapies, therapeutic proteins, peptides and allergenics.

By Indication

Oncology: Leading indication (36% share in 2023); includes mAbs, ADCs, T-cell engagers.

Immunology: Biologics for autoimmune diseases and inflammation (TNF inhibitors, IL-targeted agents).

Infectious Disease: Vaccines and therapeutic antibodies.

Other Indications: Rare diseases, metabolic and neurological conditions.

By Application

Diagnosis: Companion diagnostics and biomarker-driven patient stratification.

Treatment: Therapeutic biologics across chronic and acute conditions.

By Manufacturing Facility

Outsourced (CDMO): Companies outsource biologic production to reduce CAPEX and scale quickly.

In-house: Integrated manufacturers retain control over CMC and supply chains.

By Geography

North America, Europe, APAC, Latin America, MEA: Distinct regulatory, manufacturing and payer dynamics shape adoption and pricing.

Top 5 FAQs

1. What is the expected market size of the biologics industry by 2034?

Answer: USD 938.04 billion by 2034 (from USD 485.19 billion in 2025), at a 7.6% CAGR (2025–2034).

2. Which product category led the market in 2023?

Answer: Blood and blood products — they held a 66% market share in 2023.

3. Which therapeutic area is the single largest application for biologics?

Answer: Oncology, accounting for 36% of the application share in 2023.

4. How many approved biologics exist (DrugBank figure) and how many biosimilars has the FDA approved?

Answer: 1,726 approved biologics listed in DrugBank (proteins, peptides, vaccines, allergenics); the FDA had approved 63 biosimilars across 17 reference products as of 2024.

5. What regional capacity facts should I know about China and India?

Answer: China: 870,000 liters active biopharma capacity and 209 facilities. India: 941,000 liters capacity; FY2024 pharmaceutical turnover Rs 4.17 lakh crore; exports $27B (2023) with an expectation to reach $65B by 2030.

Access our exclusive, data-rich dashboard dedicated to the biotechnology sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5108

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest