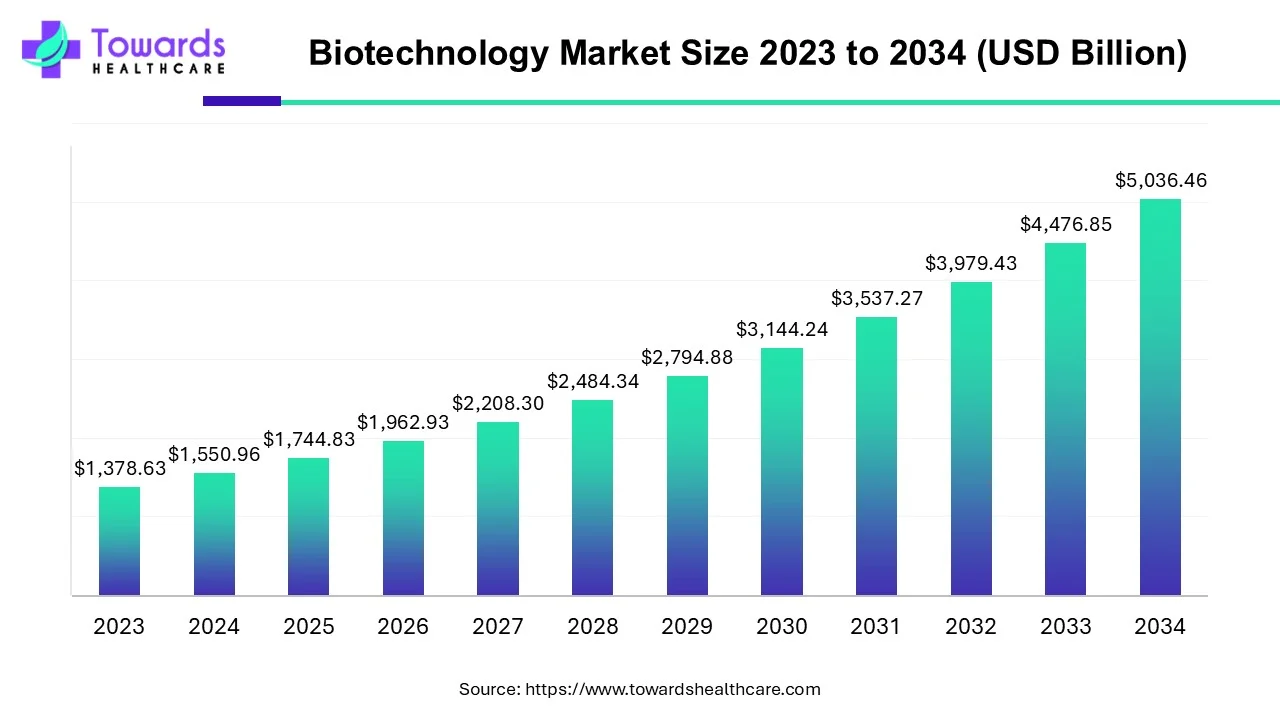

The global biotechnology market is projected to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034 a CAGR of 12.5% (2025–2034) — driven by rapid advances in DNA sequencing, biopharma innovation, nanobiotechnology, rising VC funding (≈$26B in 2024), large CDMO expansion (e.g., Lonza H1 2025 results) and accelerating government and regulatory programs worldwide.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5034

Market size

◉Headline projection (2025 → 2034): USD 1,744.83B → 5,036.46B; CAGR 12.5% (2025–2034). This is the principal market scaffold used throughout strategies and valuations.

◉Intermediate growth trajectory (illustrative milestones): the market more than doubles between 2025 and 2029–2030 and roughly triples by 2034 versus 2025, reflecting compounding R&D investment and commercialization of biologics, sequencing and platform technologies.

◉Capital flows supporting size: VC financing rose from $23.3B (2023) to ≈$26B (2024) (fewer rounds but larger deals), indicating concentration of capital in higher-value platform companies and later-stage scaleups — a funding dynamic that underpins the rising market totals.

◉Industrial scale indicator — CDMO growth: Lonza H1 2025 sales and margins (CHF figures cited) show manufacturing/contract services are scaling in parallel with therapeutics demand — this vertical (CDMO) materially contributes to the overall market size.

◉Revenue concentration by region (2024 baseline / direction): North America was the largest region in 2024 (37.76% share historically); Asia-Pacific is the fastest growing region and is projected to close the regional gap through the forecast period — regional expansion feeds the absolute market size.

◉Technology uplift multiplier: technologies such as DNA sequencing, PCR, chromatography, nanobiotech and automation amplify productivity — each technology’s adoption raises addressable market by enabling faster R&D, larger pipelines and new therapeutic classes.

◉Funding → commercialization loop: increased IPOs, late-stage private raises (e.g., Element Biosciences Series D, Spear Bio Series A) accelerate conversion of R&D into marketable products, enlarging near-term market value.

◉Services and infrastructure growth: growth in bio-services (research services, CROs, LLM-powered lab assistants) and bio-industries (biomanufacturing, CDMO) increases serviceable market and recurring revenue components.

◉Regulatory and policy tailwinds: new regulatory tools (e.g., joint USDA/EPA/FDA web tool) and national strategy reports (NSCEB in the U.S.; Nigeria GMO policy steps) reduce time-to-market friction in key subsegments, indirectly increasing realized market size.

◉Macro tail risks: talent shortages, regulatory pushback on certain GMO/biotech areas, geopolitical competition may slow growth in specific subsegments but are not expected to reverse the overall upward trajectory given current investment momentum.

Market trends

◉Funding concentration and larger rounds (2024–2025): 2024 saw $26B VC invested with fewer rounds than 2023 — trend toward larger, later-stage checks (Element Biosciences $277M Series D; Spear Bio $45M Series A). Result: deeper pockets for platform scaling and commercialization.

◉Personalized and neoantigen therapies advancing manufacturing partnerships: August 2024 NEC Bio Therapeutics × AGC Biologics collaboration to scale production of a DNA neoantigen vaccine (NECVAX-NEO1) highlights a trend: personalized oncology pushes partnerships between innovators and CDMOs.

◉CDMO expansion and outsized profitability: Lonza H1 2025 results (strong CHF sales and high CORE EBITDA margins) indicate outsourcing and large-scale biologics manufacturing are major revenue engines.

◉National strategic initiatives and competition for biotech leadership: NSCEB final report (April 2025) and country-level policy moves (Nigeria GMO policies; India stem-cell support) reveal governments aligning policy & funding to secure biotech competitiveness, affecting global R&D location decisions.

◉Convergence of biotech + AI/ML: investments in platforms (Element, Scientist.com’s LLM assistant Elisa) indicate AI is being embedded across research workflows from discovery to lab execution.

◉Platform commercialization (DNA sequencing & multi-omics): large equity injections (Element Biosciences) and sustained sequencing segment leadership (DNA sequencing led in 2024) point to sequencing & multi-omics platforms as core growth engines.

◉Nanobiotechnology & targeted delivery gaining traction: forecasts highlight nanobiotech as a fast-growing technology due to its role in targeted drug delivery, diagnostics and point-of-care devices.

◉Regulatory modernization to accelerate microbial biotech: USDA/EPA/FDA web tool (Oct 2024) streamlines approvals for microbial biotech, indicating regulators moving toward faster, clearer paths for novel products.

◉Infrastructure innovation (organ-on-chip, biochips): Boston Micro Fabrication’s April 2024 BMF Biotechnology initiative underscores growth in in-vitro tissue platforms accelerating translational research.

◉Talent gap & workforce upskilling imperative: the ‘talent dilemma’ is a persistent structural constraint; companies and academia are responding with targeted training, cross-disciplinary programs and hiring premiums, which will shape time-to-scale for many firms.

AI impacts / roles in the biotechnology market

◉Accelerated target discovery (genomics → validated targets): AI/ML models ingest vast sequencing and multi-omics datasets to prioritize causal genes and pathways, reducing months of wet-lab cycles to weeks for candidate identification. This increases pipeline throughput and lowers discovery cost per target.

◉Smart experimental design and automation orchestration: AI designs experiments (optimizing reagents, conditions) and integrates with lab automation platforms to run high-throughput cycles autonomously, improving ◉reproducibility and shrinking iteration times.

◉Sequence analysis & variant interpretation at scale: advanced models automate interpretation of sequencing runs (variant calling, clinical annotation), enabling DNA sequencing platforms to deliver clinically actionable reports faster and making population-scale genomics commercially viable.

◉Predictive protein engineering: generative and predictive models (structure & function) design proteins, antibodies and enzymes with desired properties — shortening lead optimization timelines and enabling novel biologics classes.

◉AI-driven biomarker & patient stratification for personalized medicine: models analyze multi-modal clinical and molecular data to segment patients for trials and therapies (e.g., neoantigen vaccine selection), increasing trial success probabilities and enabling higher-value precision therapeutics.

◉Clinical trial optimization and synthetic control arms: AI improves site selection, recruitment prediction and outcome modeling; synthetic control arms derived from real-world data reduce sample sizes and costs, speeding regulatory paths.

◉Manufacturing optimization and predictive maintenance for CDMOs: ML models optimize cell culture parameters, yields and predict equipment failure — resulting in higher throughput, better margins (contributing to companies like Lonza) and lower batch failure rates.

◉Regulatory dossier automation and evidence synthesis: AI curates literature, preclinical/clinical data and generates draft regulatory narratives and submission packages — reducing administrative friction and time to filing.

◉Drug repurposing and combinatorial prediction: AI mines existing drug and omics datasets to predict new indications and synergistic combinations, enabling faster entry into new markets with de-risked assets.

◉Workforce augmentation, training and knowledge management: LLMs and specialized assistants (e.g., Elisa-type research assistants) capture tacit lab knowledge, provide protocol recommendations and upskill new hires — partially mitigating the talent shortage and scaling institutional knowledge.

Regional insights

A. North America (lead market)

◉Market position & numbers: Largest contributor in 2024 and holds ~37.76% historical regional share; U.S. alone 47% of North America in 2022.

◉Ecosystem strengths: deep VC pools, mature regulatory agencies, world-class research institutions and dense biopharma clusters that drive rapid commercialization.

◉Policy & infrastructure: national strategies (e.g., NSCEB) and cross-agency tools (USDA/EPA/FDA web tool) reduce regulatory friction and spur microbial and biomanufacturing innovation.

◉Commercialization axis: strong CDMO presence (Lonza and others’ activity) enables North America to scale biologics manufacturing domestically, supporting large market value capture.

B. Asia-Pacific (fastest growth)

◉Growth drivers: large population, rising healthcare expenditure, increasing R&D investment and government allocation (example: India DBT budget allocation).

◉Country nuances: China and India leading scale and clinical trial volume; Japan, South Korea and Australia contribute advanced R&D and manufacturing capabilities.

◉Opportunity axis: lower cost of clinical studies, expanding academic ecosystems and targeted government incentives accelerate adoption of sequencing, biopharma and regenerative medicine.

C. Europe

◉Technological depth & regulation: strong academic-industry partnerships; countries like Germany and UK are innovation hubs.

◉Market drivers: supportive government programs, collaborative R&D networks (e.g., partnerships like Flagship/CUHP), and a focus on safety and regulatory robustness.

◉Commercial strengths: established pharma and biotech companies with global reach enable European players to capture high-value pipelines.

D. Latin America

◉Emerging demand: rising healthcare needs and growing adoption of biotech solutions in agriculture and industrial biotech.

◉Market constraints/opportunities: infrastructure gaps but growing investment in clinical trials and manufacturing; potential to become cost-effective trial and manufacturing base.

E. Middle East & Africa (MEA)

◉Growth initiation: government investment in R&D, targeted biotech hubs (Saudi Arabia, UAE).

◉Regional dynamics: early stage but accelerating due to rising disease burden and government support; biotech for agriculture and diagnostics is a high-value entry path.

◉Numbers caveat: some volatility in regional projections (table shows year-to-year swings) — indicates project-level investments and policy shifts strongly influence outcomes.

Market dynamics

Primary growth drivers

◉Technological innovation: DNA sequencing leadership (2024), nanobiotech growth, CRISPR/gene therapy advances.

◉Rising demand for personalized medicine & biopharma: bio-pharmacy dominance (USD 608.2B in 2024 and strong projected growth to 1,729.5B by 2034 in the provided application table).

◉Capital availability: VC growth (≈$26B in 2024) and large series rounds.

CDMO & manufacturing scale: Lonza H1 2025 performance validates high-margin manufacturing expansion.

Key restraints

◉Talent shortage: skills gap across R&D, regulatory and manufacturing slows scaling and increases labor costs.

◉Regulatory complexity & geopolitical risk: inconsistent global frameworks and strategic competition (e.g., U.S. policy push vs. other nations) can delay cross-border projects.

◉Capital concentration risk: fewer rounds but larger checks can reduce diversity of funded ideas and limit early-stage experimentation.

Major opportunities

◉AI/ML integration across the value chain (see AI section) — high leverage to cut time and cost.

◉Platform monetization (sequencing, multi-omics, organ-on-chip) — platform companies can generate recurring revenue and service models.

◉Regional manufacturing relocation & reshoring supported by policy (US & other governments) to secure supply chains.

Threats & risk factors

◉Ethical & social pushback on certain biotechnologies (GMO, gene editing) could tighten regulation in key markets.

◉Supply chain fragility for specialized reagents and equipment.

◉Competitive geopolitical strategies — nationalistic R&D policies may fragment collaboration and increase costs.

◉Structural market interplay (how components interact)

◉Funding → Platform scale → Manufacturing demand: larger rounds fund platform R&D → successful platforms need scaling via CDMOs → manufacturing scale produces revenue that inflates market size (observed in Lonza & CDMO data).

◉Regulation ↔ Commercialization speed: modernized regulatory tooling (USDA/EPA/FDA web tool) shortens time to market for microbial biotech, increasing realized market capture.

Top 10 companies

Lonza

Product / core activity: Large CDMO services for biologics, cell & gene therapy manufacturing.

Overview: Reported strong H1 2025 sales (CHF figures) with high CORE EBITDA margins; CDMO business significant contributor.

Strengths: World-class manufacturing scale, attractive margins, trusted partner for personalized/complex biologics — key to commercial scale-up pipelines.

AstraZeneca

Product / core activity: Global biopharma with therapeutics across oncology, rare disease, CVRM, V&I etc.

Overview: FY 2024 showed strong product sales growth; FY guidance points to continued revenue and EPS expansion (data above).

Strengths: Broad therapeutic portfolio, partnership/royalty revenue streams, strong commercial execution.

Pfizer Inc.

Product / core activity: Large diversified biopharma (vaccines, biologics, small molecules).

Overview: Listed as a strategic company in the biotechnology market — contributes substantially to region and global revenue.

Strengths: Global commercialization network, deep R&D and vaccine capabilities.

Gilead Sciences Inc.

Product / core activity: Biopharma with emphasis on antiviral, oncology and cell therapy areas.

Overview: Listed among strategic companies — plays a pivotal role in therapeutic innovation.

Strengths: Strong therapeutic franchises, experience in fast-moving infectious disease therapeutics and oncology pipelines.

F. Hoffmann-La Roche Ltd. (Roche)

Product / core activity: Diagnostics and therapeutics; heavy presence in oncology and diagnostics platforms.

Overview: Strategic biotech player — diagnostics capability aligns with market’s sequencing/diagnostic growth.

Strengths: Integrated diagnostics + therapeutics model; strong R&D pipeline and diagnostic market leadership.

Biogen

Product / core activity: Neurology and biotech therapeutics.

Overview: Identified as a strategic company in the field.

Strengths: Specialized R&D focus in neurological disease — high clinical value potential.

CELGENE Corporation

Product / core activity: Biopharma focused on oncology and immunology (included in list).

Overview: Historically a major oncology biotech; listed among strategic companies.

Strengths: Deep oncology expertise and product legacy that supports biotech market value.

Sanofi

Product / core activity: Multi-therapeutic global biopharma with vaccine and rare disease activities.

Overview: Named as a strategic company contributing to market growth.

Strengths: Global manufacturing footprint and diverse product portfolio.

Abbott

Product / core activity: Diagnostics, devices and nutrition as part of broader biotech/healthcare ecosystem.

Overview: Strategic company whose diagnostic and device capabilities complement biotech market expansion.

Strengths: Diagnostic platforms, wide commercial reach, strong presence in point-of-care testing.

Novartis AG

Product / core activity: Large pharma/biotech with varied pipelines and focus areas.

Overview: Included among strategic companies driving market growth.

Strengths: Strong R&D, global commercialization, capability to partner/scaffold emerging biotech assets.

Latest announcements

Lonza (H1 2025 results, July 2025): strong sales (CHF 3.6B reported with 19% growth CER1) and robust CORE EBITDA (CHF 1.1B) with CDMO sales growth and margins (CDMO: CHF 3.1B sales with 23.1% CER growth; 30.2% CORE EBITDA margin). Implication: CDMO economics are excellent and underpin market monetization for biologics scale.

AstraZeneca FY 2024 results (Feb 2025): 19% product sales rise; total revenue $54,073m; growth across oncology (24%), Rare Disease (16%), CVRM (20%) and R&I (25%). Implication: large biopharma is continuing to expand revenue and drive value capture in biopharma segments.

Flagship Pioneering partnership (Jan 2025): Flagship partnered with Cambridge University Health Partners and Milner Therapeutics Institute to deepen UK research collaboration. Implication: academic-industry partnerships accelerate translational research and regional innovation clusters.

NSCEB final report and action plan (April 2025): U.S. push to mobilize national innovation for biotech leadership — includes consultations and policy recommendations to strengthen U.S. competitiveness vs. other nations. Implication: potential legislative/actionable funding & policy changes to accelerate biotech commercialization.

India stem cell sector expansion (April 2025): government support plus private investment and growing clinical trials reported by Cryoviva Life Sciences. Implication: India emerges as a significant growth node for regenerative and personalized therapies.

Nigeria GMO policy pledge (April 2025): federal commitment to safe GMO transfer & regulatory frameworks. Implication: emerging markets formalizing biotech governance to enable adoption.

USDA/EPA/FDA web tool (Oct 2024): new web-based regulatory tool to streamline microbial biotech regulation. Implication: easier, faster pathways for microbial product developers.

NEC Bio Therapeutics × AGC Biologics (Aug 2024): collaboration to scale personalized DNA vaccine production. Implication: exemplifies the personalization → manufacturing partnership model.

Element Biosciences Series D (July 2024): $277M raised to expand sequencing/multi-omics reach. Implication: substantial capital directed at sequencing platforms.

Spear Bio Series A (July 2024): $45M to accelerate protein research and diagnostics commercialization.

Scientist.com’s LLM assistant (Elisa, June 2024): LLM-powered R&D assistant to accelerate drug research workflows.

Boston Micro Fabrication launches BMF Biotechnology (April 2024): organ-on-chip / biochip commercialization push.

Recent developments

Funding acceleration to platforms: Element Biosciences ($277M) and Spear Bio ($45M) marks increased investor appetite for platform tech (sequencing, protein research).

Platform → manufacturing partnerships: NEC Bio × AGC Biologics shows trend where personalized therapeutics require bespoke manufacturing partnerships early.

AI tools entering the lab: Scientist.com’s Elisa LLM assistant and similar AI initiatives are reducing friction in research translation.

Regulatory modernization: USDA/EPA/FDA tool and national action plans (NSCEB) reflect regulators prioritizing speed & safety frameworks for new biotech.

Geographic policy shifts expanding markets: India’s stem cell support and Nigeria’s GMO policy pledge enlarge market opportunity in their regions.

Advanced in-vitro platforms commercializing: Boston Micro Fabrication’s organ-on-chip push supports de-risking of preclinical pipelines.

CDMO financial strength validated: Lonza’s H1 2025 shows manufacturing profitability and robust demand from advanced therapy pipelines.

Large biopharma continued topline growth: AstraZeneca’s FY 2024 performance signals big pharmas continuing to monetize biologics and partner with smaller biotech.

Investor concentration but elevated capital totals: VC totals increasing while rounds decreased — means bigger bets, more pressure on scale and exits.

Emerging market regulatory clarity: country-level regulatory moves reduce uncertainty that previously hampered adoption in some regions.

Segments covered

1. By Application (listed for completeness & explained)

Bio-pharmacy — dominant segment (2024 value in table USD 608.2B) driven by biopharmaceuticals, personalized therapy, monoclonal antibodies, gene & cell therapies. Implication: highest revenue share and fastest growth, attracting most R&D and capital.

Bio-industries — industrial biotech for chemicals, materials and biofuels; benefits from process fermentation and scaling technologies.

Bio-services — CROs, research services, sequencing services and lab-as-a-service; high recurring revenue potential.

Bio-agriculture — GMO crops, precision agriculture biotech; large addressable markets in APAC/Latin America.

Bio-informatics — computational tools, LLM assistants, data platforms underlying sequencing and precision medicine.

2. By Technology (major areas listed & deep explanations)

DNA sequencing / Deoxyribonucleic Acid sequencing — leadership tech for diagnostics, precision medicine; platform business models enable recurring revenue (consumables + instruments + software).

Polymerase Chain Reaction (PCR) — core diagnostic and lab technique enabling rapid detection and research assays.

Fermentation — backbone for biologics and industrial biotech; scale economics critical for bio-industries.

Tissue engineering & regeneration — organoids, stem cells and regenerative therapies addressing chronic disease and surgical repair.

Nanobiotechnology — targeted delivery, nano-diagnostics and point-of-care innovations with strong growth potential.

Chromatography & cell-based assays — essential for purification and preclinical/clinical testing workflows.

Others — supportive lab technologies and consumables that sustain R&D workflows.

3. By Geography

Regions and countries listed in your content (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa; plus country sublists) — each has unique policy, funding and infrastructure implications (covered earlier in Regional Insights).

Top 5 FAQs

Q1 — What is the projected biotech market size and growth rate?

A1 — The biotechnology market is forecast to grow from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, at a CAGR of 12.5% (2025–2034).

Q2 — Which region led the market in 2024 and which region will grow fastest?

A2 — North America was the largest contributor in 2024 (historically 37.76% regional share); Asia-Pacific is projected to exhibit the fastest growth through the forecast period.

Q3 — Which technology and application led the market in 2024?

A3 — By technology, DNA sequencing led the global market in 2024. By application, bio-pharmacy was dominant in 2024 (bio-pharmacy value: USD 608.2B in 2024 as shown).

Q4 — How is funding trending for biotech?

A4 — VC funding increased from $23.3B (2023) to $26B (2024), albeit with fewer rounds (416 rounds in 2024 vs. 462 in 2023), indicating larger, more concentrated investments.

Q5 — What major policy or regulatory developments could affect the market?

A5 — Several developments: (i) U.S. NSCEB final report & action plan (April 2025) urging Congressional action to strengthen U.S. biotech leadership; (ii) USDA/EPA/FDA launched a web-based regulatory tool (Oct 2024) to streamline microbial biotech approvals; (iii) national policy moves in India and Nigeria to support stem cell development and safe GMO handling (April 2025) — all reduce friction and open new market opportunities.

Access our exclusive, data-rich dashboard dedicated to the biotechnology sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5034

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest