The global blockchain in clinical trials market is transitioning from pilots to scaled deployments—projected to reach the high-hundreds of millions in revenue through 2025–2034—driven by data integrity, faster drug development, patient-centric eConsent/recruitment, and cloud-first rollouts, with North America leading in 2024 and Asia Pacific posting the fastest CAGR.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6073

Market size

◉Baseline & trajectory (2025–2034): Industry consensus from the provided brief indicates a high-hundreds-of-millions revenue opportunity across the forecast window, aligned to scaling from early pilots (pre-2024) to multi-site programs (2025+).

◉Growth profile: Double-digit adoption curve implied by rapid movement from proofs-of-concept to production (e.g., 2024–2025 program announcements), reinforced by cloud deployments and CRO uptake.

◉Mix shift: Revenue ramps concentrate in platform subscriptions (cloud), validation/notarization, audit-trail modules, consent/recruitment tooling, and integration services.

◉Buyer concentration: Large pharma/biotech and global CROs dominate near-term spend; SMEs accelerate as cloud offerings lower capex and compliance burden.

◉Deal sizes: Typical initial contracts remain six-figure with expansion to multi-region trials as regulatory comfort grows (EMA dialogue, FDA engagement noted).

◉Conversion catalyst: Demonstrated time/cost savings (e.g., ~30% administrative reduction reported in a 2024 collaboration) unlock multi-trial, multi-indication rollouts.

Market trends

◉Decentralized, multi-stakeholder data exchange becomes default: Sponsors/CROs adopt permissioned ledgers to eliminate data bottlenecks and improve cross-site transparency; pilots are graduating to real trials.

◉Example: June 2024—LabTrace + King’s College London: completed first experimental medicine study using Algorand-based notarization for Parkinson’s research, strengthening data authentication.

◉Patient-centric operations at scale: eEnrollment/eConsent on chain improves transparency, drives higher participation and lower dropout.

◉Example: March 2024—PharmaLedger Association launched Decentralized Trials Project for eEnrollment, eConsent, IoT integration.

◉AI + blockchain convergence: AI runs analytics on tamper-proof datasets, enabling anomaly detection, quality flags, and outcome forecasting with full auditability for regulators—emerging as “two-tiered governance” in 2025.

◉Enterprise cloud first: Cloud-based deployments held the largest 2024 share as sponsors favor scalability and faster integrations; on-prem grows where data-residency or sovereignty is strict.

◉Operational wins become measurable: Reported ~30% admin task reduction (2024) for oncology processes via ledger-mediated consent/data sharing.

◉Ecosystem broadens beyond record-keeping: Integration with IoT (supply chain authentication, cold-chain), remote monitoring, smart-contract payments (e.g., milestone disbursements) moves the stack into end-to-end trial orchestration.

◉Regulatory conversations intensify: July 2024—EMA noted potential but highlighted governance/standards gaps, pushing for harmonized frameworks before mass adoption.

AI’s role & impact

◉Regulatory-grade data lineage: AI explains why data were accepted/flagged using on-chain provenance (who/what/when) → strengthens inspection readiness and submission narratives.

◉Anomaly & fraud detection: ML models run continuously on immutably hashed eCRFs, wearables, labs to detect protocol deviations, outliers, site behaviors; all alerts are notarized for transparent adjudication.

◉Adaptive trial governance: Policy agents (AI) can trigger smart-contract events on threshold breaches (e.g., halt randomization, request re-consent) with full audit trails.

◉Patient recruitment intelligence: AI matches eligibility criteria to tokenized patient datasets (privacy-preserving) and writes proofs on chain—improving screen-fail rates and diversity tracking.

◉Endpoint quality scoring: AI computes quality/confidence for endpoints (e.g., digital biomarkers), referencing immutable device telemetry and site performance hashes.

◉Protocol optimization: Generative/analytical AI proposes simplifications that reduce burden, and its recommendations are version-controlled on chain (who approved, when, why).

◉Supply-chain assurance: AI predicts IMP shortages and synchronizes with blockchain traceability (lot, temp, custody), preventing site stockouts and temperature excursions.

◉Payments & incentives: Smart contracts release site/patient payments when AI-verified milestones (visit completion, clean data lock) are met—reducing disputes.

◉Privacy-preserving analytics: Federated learning with on-chain access policies allows insights without moving PII; access logs are immutable, easing audits.

Regional insights

North America (2024 leader)

◉Why it leads: Concentration of top pharma, CRO majors, and tech vendors; mature compliance ops and venture funding.

◉Adoption pattern: Cloud-first pilots maturing to multi-indication portfolios; strong FDA dialogue and CRO-sponsor consortia.

◉Focus areas: Consent/audit trails, data provenance, smart-contract payments, and decentralized trial tooling.

United States (within NA)

◉Growth engine: Demand for data integrity & transparency, robust R&D spend, and integration with AI and DCT (decentralized clinical trials) models for recruitment/retention.

◉Operational impact: Improved stakeholder coordination (sponsor-CRO-site-IRB) and immutable patient data management.

Asia Pacific (fastest CAGR)

◉Why fastest: Outsourcing momentum, digitization, and government support; attractive cost-to-scale profile for multi-site trials.

◉Adoption motion: Pharma-academia partnerships, blockchain-based recruitment tools, strong cloud uptake.

Sub-region priorities:

◉China/Japan/Korea: tech-forward pilots with strict data locality → selective on-prem/sovereign cloud.

◉India/SEA (Thailand): rapid CRO-led deployments, recruitment at scale, and cost-efficient site networks.

India (steady expansion)

◉Drivers: Growing clinical research footprint, health-tech digitization, and need for trust/transparency in DCTs.

◉Barriers: Implementation costs, infrastructure gaps, specialized skills; mitigated by cloud offerings and public-private digital initiatives.

◉Use cases: Recruitment across diverse demographics, immutable consent tracking, and faster data sharing to sponsors.

Europe

◉Regulatory stance: EMA (July 2024) recognizes potential yet highlights standards/governance gaps, slowing broad production rollouts until harmonization.

◉Focus: Strong on compliance proofs, GDPR-aligned consent, data-residency architectures.

Latin America & MEA (emerging)

◉Entry path: CRO-led deployments for auditability, leveraging cloud while navigating data-transfer rules.

◉Value prop: Immutable audit trails for regulators and supply-chain authentication for distributed sites.

Market dynamics

Drivers

Data transparency & integrity: Immutable ledgers prevent tampering/retroactive edits, enhancing trust of published results and accelerating regulatory reviews.

Evidence: LabTrace + KCL (June 2024) authenticated Parkinson’s study data on Algorand.

Speed & efficiency: Admin burden drops (e.g., ~30% reduction reported in 2024 collaboration) via automated consent tracking, data sharing, audit preparation.

Patient-centricity: On-chain eConsent and self-sovereign data improve recruitment/retention.

Restraints

Regulatory uncertainty & lack of standards: EMA (July 2024) calls for harmonized frameworks, slowing large-scale commitments; sponsors fear review delays without clear guidance.

Change management & skills: Need for blockchain + GxP talent, integration with CTMS/EDC/RTSM.

Opportunities

End-to-end provenance: Extend beyond records to supply-chain authentication, site monitoring, adverse event trails.

SME access via cloud: Lower capex opens long tail of sponsors and research institutes.

AI-anchored compliance: Two-tiered governance (AI analytics on immutable data) becomes a differentiator for inspection-ready trials.

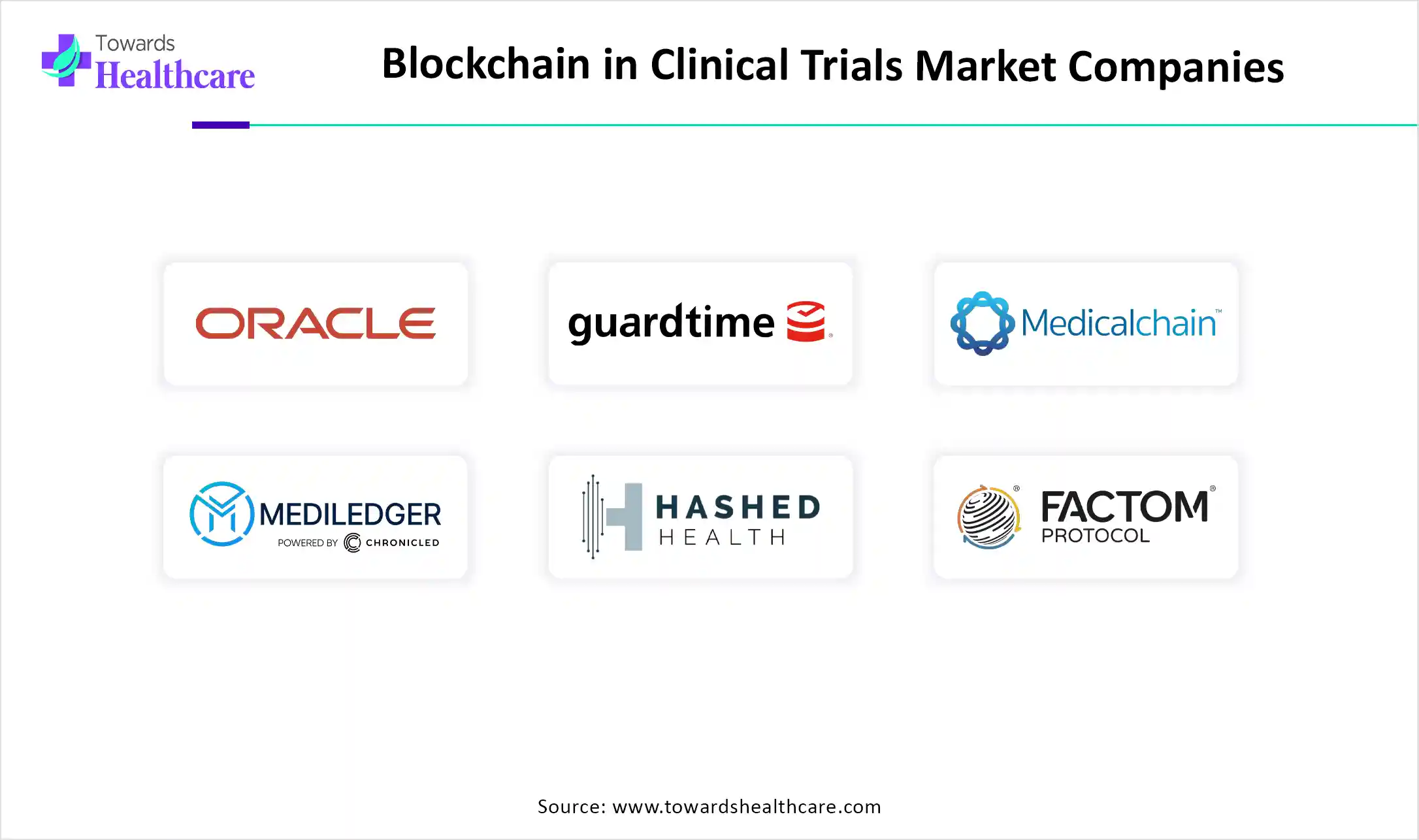

Top companies — product, overview, strengths

Oracle Corporation

◉Product/overview: Enterprise cloud data platforms; integrations with clinical data stacks (EDC, CTMS, analytics).

◉Strengths: Global pharma footprint, scalable cloud, deep trial data integrations → fast path to ledger-backed modules.

Guardtime

◉Product/overview: KSI® blockchain for data integrity/notarization across regulated industries.

◉Strengths: Provable integrity at scale, low latency, government-grade deployments; credibility in audit trails.

Medicalchain

◉Product/overview: Patient-centric blockchain solutions; consent and health-data control.

◉Strengths: eConsent UX and data sovereignty—useful for patient-first trials.

Triall

◉Product/overview: Blockchain tooling for clinical workflows (documentation, audit, consent).

◉Strengths: Trial-specific modules, sponsor/CRO collaboration features, regulatory-aligned auditability.

Chronicled (MediLedger)

◉Product/overview: Life-sciences blockchain network; expanding from DSCSA supply-chain into audit trails for trials.

◉Strengths: Consortium reach (manufacturers/wholesalers), proven track-and-trace pedigree, interoperability.

Hashed Health

◉Product/overview: Healthcare blockchain ventures (provider, supply chain, identity).

◉Strengths: Consortium building, identity/credentialing know-how applicable to site/staff verification.

Factom

◉Product/overview: Data anchoring/notarization (historically) for regulated records.

◉Strengths: Immutable proofs and time-stamping—fit for eCRF locking, protocol versions.

Latest announcements

April 2025 — Netra Mark Holdings Inc. × Worldwide Clinical Trials

◉What’s new: Global agreement to embed NetraAI into trial design/optimization.

◉Relevance here: Strengthens the AI layer that benefits most from on-chain provenance (reducing placebo variability, improving regulatory success probability) when combined with immutable data trails.

August 2025 — Wellgistics launches XRP Ledger-based payments for U.S. independent pharmacies

◉Relevance to trials: Demonstrates blockchain settlement for healthcare transactions; the same pattern underpins smart-contract milestone payments to sites/patients in clinical programs.

Recent developments

2025 — Magnifico insights roundup

◉MediLedger expanding into clinical-trial audit trails, signaling cross-over from supply chain to GxP data integrity.

◉Trials.ai automating protocol and data capture, a natural AI+blockchain touchpoint for versioned, notarized protocol governance.

◉Pfizer & Roche piloting consent/data provenance on chain—blueprints for large-cap rollouts.

2024 — AstraZeneca & IBM Collaboration

◉Deployed decentralized ledger for oncology trial consent and data sharing, ~30% administrative task reduction reported—evidence of tangible operational ROI.

Segments covered

By Application

◉Clinical Trial Management (Dominated): Single source of truth for documents, versions, and milestones, minimizing tamper risk and review delays.

◉Patient Recruitment & Retention (Fastest): eConsent, incentives via smart contracts, transparent data use → lower dropout, better diversity.

◉Informed Consent Management: Immutable consent states, re-consent triggers, audit-ready trails.

◉eCRF Locking: Hashing/time-stamping of forms at lock to prevent post-hoc edits.

◉Audit Trail & Data Provenance: End-to-end who/what/when/where for every datum.

◉Drug Traceability & Supply Chain Tracking: Lot/cold-chain integrity tied to visit dosing events.

◉Site Verification & Monitoring: On-chain staff credentials/site readiness; remote SDV evidence anchoring.

◉Adverse Event Reporting: Immutable signal timelines and causality review records.

◉Protocol Management: Versioned protocol/SAP with notarized approvals.

◉Smart Contracts (Payments/Milestones): Auto-release site/patient funds upon verified events.

By Deployment Mode

◉Cloud-Based (Dominated 2024): Scalability, lower capex, faster integration across geographies.

◉On-Premises (Growing): For data-sovereignty/sovereign-cloud needs; higher control for high-stakes programs.

By End User

◉Pharma & Biotech (Dominated): Primary sponsors seeking faster approvals, cost control, and compliance proofs.

◉CROs (Fastest): Competitive need to provide audit-ready, transparent multi-country operations.

◉Hospitals/Clinics; Research Institutes; Regulators; Ethics Committees: Increasing participation via consent/audit modules and oversight dashboards.

By Organization Size

◉Large Enterprises (Dominated): Resources for infrastructure + partnerships; global multi-trial portfolios.

◉SMEs (Fastest): Cloud lowers entry barriers; transparency boosts sponsor and regulator trust.

By Region

◉North America: 2024 market leader.

◉Asia Pacific: Fastest CAGR with outsourcing and digitization.

◉Europe: Progressing with standards/regulatory engagement.

◉Latin America, MEA: Early-stage, CRO-led proofs expanding.

Top 5 FAQs

1 Why is blockchain gaining traction in clinical trials?

◉Because it provides an immutable, transparent ledger that enhances trust, data integrity, and compliance, speeds verification, supports eConsent/recruitment, and integrates with AI/IoT for monitoring and supply-chain authentication.

2 Which region led in 2024, and which grows fastest?

◉North America led in 2024; Asia Pacific is projected to grow at the fastest CAGR through 2025–2034.

3 What deployment model dominates and why?

◉Cloud-based dominates due to scalability, lower cost, rapid integration across multi-site, multi-country trials; on-prem grows where data sovereignty or security is paramount.

4 What concrete evidence shows operational benefit?

◉A 2024 AstraZeneca–IBM deployment for oncology trials reported ~30% administrative task reduction via ledger-based consent and data-sharing.

5 What recent pilots/rollouts validate data integrity claims?

◉LabTrace + King’s College London (June 2024) notarized Parkinson’s study data on Algorand; PharmaLedger (March 2024) launched decentralized trials tooling; Pfizer/Roche piloted consent/data provenance; MediLedger expanded into trial audit trails.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6073

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest