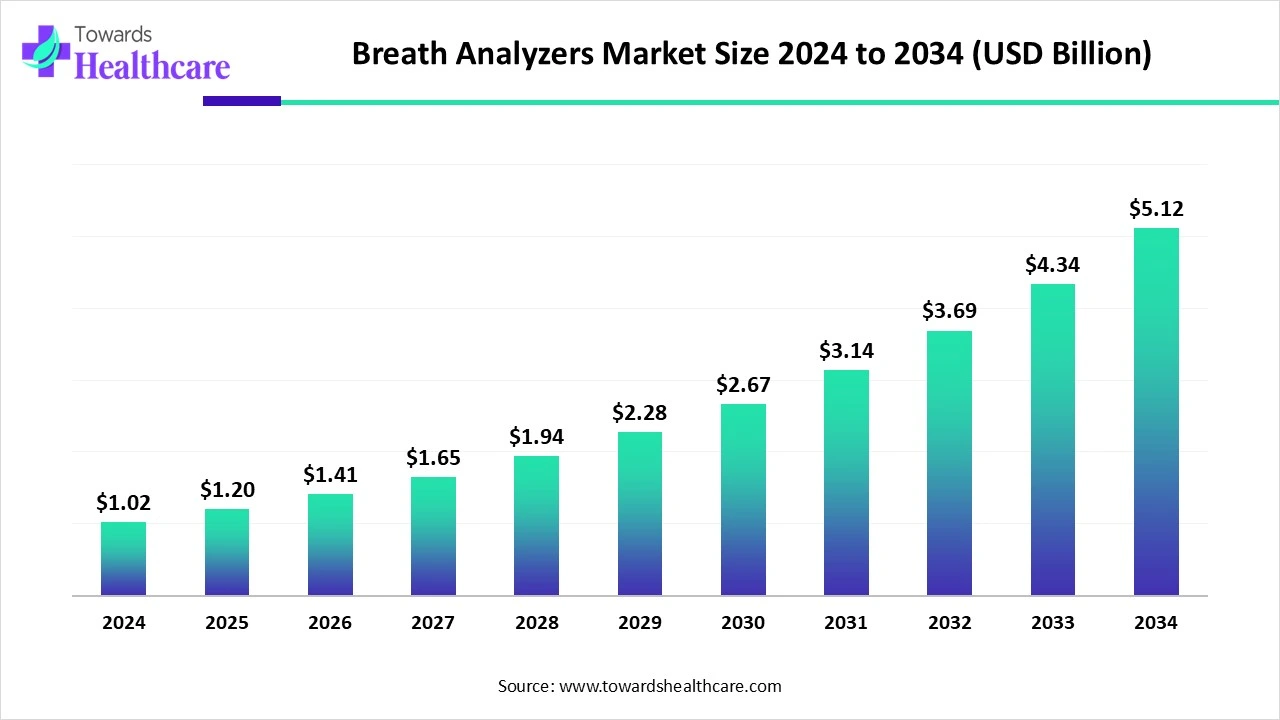

The global breath analyzers market reached US$ 1.022 billion in 2024, grew to US$ 1.2 billion in 2025, and is forecast to expand to US$ 5.12 billion by 2034 (CAGR 17.44% from 2025–2034), driven by law-enforcement demand, rising consumer adoption of portable devices, and expanding clinical breath-diagnostic use cases.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6084

Market size

Historical / baseline values (anchor points)

●2024 market size: US$ 1.022 billion (reported).

●2025 market size: US$ 1.2 billion (reported).

●2034 projected market size: US$ 5.12 billion (reported).

Growth trajectory & compound growth

●Reported CAGR (2025–2034): 17.44%.

●Implication: a ~4.27× increase from 2025 to 2034 (1.2 → 5.12). This implies strong reinvestment, adoption, and price/ASP expansion across device tiers and services.

Share concentration by product/technology (2024 snapshots — concentration metrics)

●Portable/handheld devices: 58% share of the market by product type (2024). This indicates majority volume and revenues come from consumer and low-cost professional units.

●Electrochemical fuel-cell sensors: 52% share by sensing principle (2024). This indicates fuel-cell tech is the revenue/volume leader among sensing technologies.

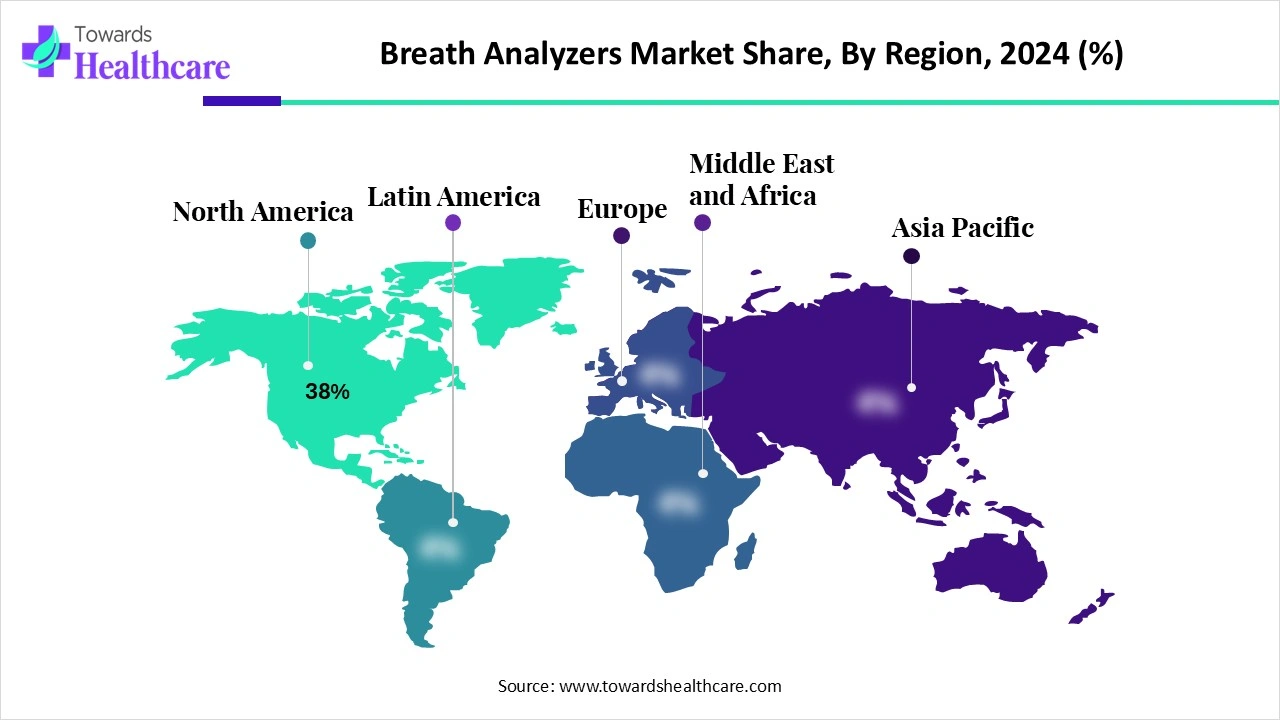

Geographic concentration (2024)

●North America: 38% of global market (2024). This is the single largest regional share and suggests a mature, high-value installed base and institutional procurement.

Channel concentration

●Government & institutional procurement dominated distribution channels in 2024 — signalling that public budgets and institutional buying (law enforcement, fleet programs, ignition-interlock) are major demand drivers and stabilize base revenues.

High-growth subsectors embedded in the size

●Ignition interlock systems (product type) are flagged as the fastest growing segment during the forecast period — these tend to be higher ASP, recurring-service businesses (installation, monitoring, compliance), and will contribute disproportionately to future revenue growth versus their 2024 share.

Market trends

Mass consumerization of portable devices

●Portable/handheld devices held 58% (2024). Trend: increased retail & e-commerce penetration and affordability are converting casual buyers (safety/party use) into repeat owners; smartphone integration expands user experience and retention.

Institutionalisation via law enforcement and ignition-interlock

●North America’s 38% share and domination by government procurement implies institutional budgets and mandated programs (ignition interlock, roadside testing) continue to institutionalize device use. Growth in ignition interlocks increases lifetime value and after-sales revenue (monitoring).

Shift to clinical and non-alcohol VOC applications

●Clinical breath analyzers and VOC analysis (disease biomarkers) are maturing: research and pilot clinical studies (e.g., breath tests adjunct to mammography; acetone for diabetes monitoring; electronic-nose lung cancer work) indicate diversification beyond alcohol testing.

Sensor diversification & cost-performance tradeoffs

●Electrochemical fuel-cell sensors dominate (52% in 2024) for accuracy/selectivity in alcohol detection, while MOx (semiconductor metal-oxide) sensors are highlighted as the fastest-growing technology due to low cost and portability—this creates a two-track market: high-accuracy evidential devices vs. low-cost consumer/IoT devices.

AI & analytics integration

●AI is being used to improve accuracy, sensitivity and to detect complex VOC signatures. Integration with smartphone apps and cloud analytics enables pattern recognition, device calibration, and remote monitoring — increasing device utility and data monetization opportunities.

Channel evolution: retail & e-commerce acceleration

●While government procurement dominated 2024, retail & e-commerce is expected to be the fastest growing channel — this accelerates consumer adoption and supports lower unit costs via scale.

Regulatory tightening and supportive programs

●Stricter DUI enforcement and ignition interlock mandates boost demand for certified devices. Conversely, regulatory barriers for clinical adoption slow some diagnostics products, creating a mixed regulatory trend.

Partnerships, M&A, and cross-sector collaborations

●Examples in your brief (Cannabix and Alco Prevention Canada; Cannabix + Omega Labs announcement) show market players are forming partnerships to expand drug testing coverage (cannabis) and broaden addressable markets.

AI impact / role

Signal processing & sensor fusion

●AI enables combining multiple sensor channels (MOx arrays, fuel-cell output, NDIR signals, PTR-MS signatures) to improve discrimination between ethanol and confounders (e.g., ketones, mouth alcohol, other VOCs). This reduces false positives and increases forensic/consumer confidence.

Pattern recognition for disease biomarkers

●Machine-learning models trained on VOC profiles (breathprints) can classify complex disease signatures (e.g., lung cancer, diabetes acetone patterns). AI helps move breath testing from single-analyte detection to multi-marker diagnostics.

Adaptive calibration & drift compensation

●Sensors (especially MOx) suffer drift and environmental sensitivity; AI models running locally or in the cloud can learn correction factors from population data and device history to maintain accuracy without frequent hardware recalibration.

Edge AI for privacy & latency

●For consumer and roadside devices, edge AI (on-device inference) allows immediate results and reduced data transmission, addressing privacy and latency while still benefitting from ML models for decisioning.

Anomaly detection and tamper/fraud detection

●AI models can flag suspicious patterns in breath samples that indicate tampering (e.g., mouth alcohol, spiking) or device misuse. For ignition-interlock and forensic devices this increases evidentiary value.

Biomarker discovery & research acceleration

●Unsupervised and semi-supervised learning on large breath datasets can reveal previously unknown VOC combinations correlated with disease states — enabling new diagnostic product pipelines.

Integration with smartphone ecosystems & user engagement

●AI-driven user coaching, risk predictions, and personalized alerts increase consumer engagement (e.g., predicting impairment risk beyond a single BAC number based on historical patterns).

Regulatory analytics & quality auditing

●For institutional procurement, AI can automate quality control of fleets of devices, traceability logs, and produce audit-ready reports—facilitating compliance.

Service & operational optimization

●Predictive maintenance models for fleet devices and ignition interlock installations reduce downtime and operating costs for monitoring platforms.

Ethical and explainability considerations

●As AI influences forensic or clinical decisions, explainability and model validation become central for regulatory acceptance — explainable AI and validated datasets will be a gating factor for clinical and legal use.

Regional insights

North America (dominant 38% share in 2024)

Large law-enforcement fleets & budgets

●Explanation: The U.S. and Canada maintain extensive roadside enforcement programs and established ignition interlock programs; this institutional buying underpins consistent procurement volumes.

Mature ignition-interlock market

●Explanation: Mandates and monitoring programs generate recurring service revenue (installation, monitoring, violations management), creating a stable and higher-ASP revenue stream.

R&D and clinical pilot leadership

●Explanation: U.S. academic centers and hospitals participate in clinical breath studies (e.g., multi-center mammography adjunct study) — accelerating clinical use cases.

Market dynamics

●Explanation: High public-sector procurement but also strong consumer market via e-commerce and safety campaigns; regulatory clarity improves evidential device adoption.

Asia Pacific (fastest growing region 2025–2034)

Vehicle fleet expansion & urbanization

●Explanation: Rapidly growing vehicle fleets and congestion lead governments to enact stricter road safety programs — increasing demand for roadside and fleet breath testing.

Regulatory catch-up & policy adoption

●Explanation: Countries introducing new DUI/road-safety mandates create greenfield markets for ignition interlocks and evidential devices.

Local OEM growth & cost competition

●Explanation: China-based OEMs and regional manufacturers supply low-cost MOx and portable devices, enabling faster penetration in price-sensitive markets.

Clinical & research investments

●Explanation: Growing healthcare investments (e.g., Suzhou Institute acetone work) point to fast adoption of clinical breath applications in Asia.

Europe

Regulatory stringency & adoption heterogeneity

●Explanation: Western Europe shows mature forensic standards and selective adoption of clinical breath diagnostics; some countries favor evidential, certified fuel-cell devices.

Public health programs

●Explanation: Workplace safety programs and fleet regulations sustain demand for certified monitoring equipment.

Latin America, MEA

Opportunistic growth via fleet/commercial programs

●Explanation: As regulations tighten and enforcement capacity grows, demand for affordable portable and fleet systems will likely rise.

Price sensitivity & need for low-cost sensors

●Explanation: MOx and hybrid sensor platforms can capture large addressable markets due to lower cost of ownership.

Market dynamics

Drivers

Rising alcohol consumption & impaired driving incidents

●Direct effect: Increased roadside testing, workplace policies, and ignition interlock mandates lead to higher device procurement.

●Evidence: The brief cites growing alcohol consumption as a primary driver of breath analyzer use.

Mandates and government enforcement programs

●Direct effect: Institutions buy certified devices at scale; ignition interlock programs drive recurring revenues (installation + monitoring).

Consumer safety awareness & e-commerce access

●Direct effect: Retail availability of portable devices (58% share) increases household penetration and repeated use.

Advances in sensors and AI

●Direct effect: Improved accuracy and new clinical capabilities expand addressable markets (disease detection, wellness monitoring).

Restraints

Regulatory barriers & approval timelines

●Explanation: Clinical breath diagnostics require trials/approvals; noncompliant devices may face recall, delaying launches and increasing cost.

Evidentiary standards and forensic acceptance

●Explanation: Law enforcement requires high accuracy and chain-of-custody features; devices that fail to meet standards cannot be used, limiting market entrants.

Sensor trade-offs

●Explanation: Low-cost sensors (MOx) sacrifice some specificity; fuel-cell devices are costlier — balancing cost vs. accuracy restrains some segments.

Opportunities

Clinical breath diagnostics & non-invasive health monitoring

●Example evidence: Breath tests for diabetes (acetone), lung cancer electronic nose (80–92% accuracy in study cited), and breath tests adjunct to mammography. These open high-value clinical market opportunities.

Ignition interlock expansion & fleet telematics

●Explanation: Integration with vehicle telematics and remote monitoring platforms creates recurring revenue and higher lifetime value.

AI-enabled platform services

●Explanation: Subscription data services, remote calibration, and analytics for fleets/labs can create SaaS revenue on top of device sales.

New analytes & drug detection (cannabis, drugs)

●Evidence: Cannabix collaborations and cannabis breath testing developments indicate drug detection is an expanding category beyond ethanol.

Value-chain levers

●R&D and sensor module specialization — suppliers and OEMs focusing on sensor modules can capture high margins supplying device manufacturers.

●Packaging & UDI traceability — packaging suppliers and compliance partners (DuPont, Amcor, etc.) add value for regulated sales.

●Patient support & services — user instructions, customer support, and calibration services are differentiators for clinical and consumer loyalty.

Top companies

Dräger / Drägerwerk

●Product: Evidential breath testing equipment, professional analyzers, clinical respiratory devices.

●Overview: Longstanding industrial/medical device maker with global law-enforcement footprint.

●Strengths: Regulatory credibility, durable professional equipment, enterprise sales channels.

Lifeloc Technologies

●Product: Handheld and evidential breath analyzers; calibration and service support.

●Overview: Specialist in professional breath testing with established service network.

●Strengths: Field-proven devices, strong aftermarket service and calibration capabilities.

Lion Laboratories / LION

●Product: Evidential instruments and fuel-cell based breathalyzers.

●Overview: History in forensic devices and interlock markets.

●Strengths: Certification track record, ignition-interlock integration expertise.

BACtrack

●Product: Consumer/portable breathalyzers and smartphone-linked devices.

●Overview: Consumer brand with strong retail/e-commerce presence.

●Strengths: Brand recognition in consumer market, app integration, low-cost devices for mass adoption.

Intoximeters, Inc.

●Product: Evidential and desktop breath testing systems.

●Overview: Focus on forensic accuracy and institutional sales.

●Strengths: Laboratory and law-enforcement acceptance, instrument robustness.

Intoxalock / Smart Start / LifeSafer (Ignition interlock ecosystem)

●Product: Ignition interlock devices, monitoring platforms, program management.

●Overview: Providers of installation, monitoring, and compliance software for interlock programs.

●Strengths: Recurring revenue model, large installed base, program management capabilities.

AlcoPro / AlcoHAWK / Alcohawk

●Product: Mix of consumer and professional handheld devices.

●Strengths: Price competitiveness, distribution breadth.

Bedfont Scientific / Owlstone Medical / Picarro / PTR-MS / Ionicon

●Product: Advanced clinical and laboratory breath analysis platforms, PTR-MS and GC-MS solutions.

●Overview: Focused on research/clinical VOC detection rather than consumer alcohol devices.

●Strengths: High sensitivity instrumentation, research partnerships, applications in medical diagnostics.

Sensit / Figaro Engineering / City Technology / Sensirion / Bosch

●Product: Sensor modules (MOx, electrochemical), components for OEMs.

●Overview: Component suppliers powering device makers.

●Strengths: Scale manufacturing, low-cost sensors, integration expertise.

Regional OEMs / China-based device makers / Contract manufacturers

●Product: Low-cost portable units and sensor modules.

●Strengths: Cost advantage, rapid manufacturing scale, local market penetration.

Latest announcement

Cannabix Technologies — non-exclusive distribution agreement with Alco Prevention Canada (April 2025)

●Announcement details: Cannabix announced a non-exclusive distribution deal with Alco Prevention Canada. CEO Rav Mlait framed the development as supply of “truly innovative new technologies” for breath testing. The focus is on breath testing for marijuana AND alcohol, and Cannabix emphasized that breath testing for marijuana/alcohol will be a major focus in 2025.

Strategic implications:

●Product expansion: Cannabix is positioning breath testing for drugs (cannabis) as a complementary market to alcohol, enlarging TAM.

●Distribution scaling: Non-exclusive agreements permit fast geographic rollouts via regional partners.

●Market messaging: By emphasizing innovation and “disruptive technologies,” Cannabix intends to differentiate from legacy alcohol-only devices.

●Potential downstream effects: increased competitive pressure on incumbents to develop drug detection capability; more cross-sector partnerships (labs, monitoring platforms).

Recent developments

Clinical breath diabetes monitoring (June 2025)

●Development: Chinese researchers (Suzhou Institute of Biomedical Engineering and Technology, Chinese Academy of Sciences) developed a breath analyzer capable of measuring acetone for diabetes monitoring.

●Implication: Demonstrates the viability of non-invasive metabolic monitoring and opens consumer and clinical pathways for continuous glucose/ketone monitoring alternatives.

Electronic nose detection for lung cancer (April 2025)

●Development: Study achieved 80–92% accuracy for lung cancer detection using electronic nose breath analysis; accuracy was stable across tumor and clinical variables.

●Implication: Strong proof-of-concept for breath VOC signatures as diagnostic markers; potential to accelerate clinical validation and regulatory pathways for oncology screening adjuncts.

Cannabix / Omega / Alco Prevention partnership activity (2025 examples)

●Development: Partnerships targeting cannabis breath detection and lab services (Cannabix + Omega labs), and distribution (Cannabix + Alco Prevention Canada).

●Implication: Market moves beyond ethanol to multi-analyte breath testing; commercial networks expanding to support drug detection.

Sensor & AI convergence

●Development: Multiple references to AI improving specificity and sensitivity; hybrid sensor arrays + ML pattern recognition flagged in segment list.

●Implication: Commercial products increasingly combine hardware + software, making device manufacturers also software/data companies.

Segments covered

By Product Type

Portable/Handheld Breathalyzers

●Role: Mass consumer and point-of-use professional testing.

●Implication: High volume, low ASP; dominant market share (58% in 2024). Primary channel: retail & e-commerce. Quick innovation cycle.

Desktop / Evidential Breath Testers

●Role: Stationary, high-accuracy devices used in police stations and forensic labs.

●Implication: Higher ASP, certification needs, long replacement cycles, high margins for certified vendors.

Ignition Interlock Systems

●Role: Vehicle-installed breath testing systems for convicted DUI offenders and fleet safety.

●Implication: Recurring revenue (monitoring), policy-driven growth; high margins on installation & services.

Medical / Clinical Breath Analyzers

●Role: VOC detection for disease diagnostics (e.g., cancer, diabetes).

●Implication: High regulatory hurdles, higher ASP, potential for integration with clinical workflows and payers.

Industrial / Workplace Breath Alcohol Monitors & Fixed Sensors

●Role: Facility safety monitors for onboarding and shift testing.

●Implication: Enterprise procurement, integration with access control systems, service contracts.

Sensor Modules & OEM Breath-sensor components

●Role: Component suppliers enabling device makers to scale.

●Implication: Opportunity for suppliers to capture margins; commoditization pressure lowers device cost.

By Technology / Sensing Principle

Electrochemical Fuel-Cell Sensors

●Characteristics: High selectivity and accuracy for ethanol; evidential acceptance.

●Business: Preferred for forensic/evidential devices; higher cost and certification pathways.

Semiconductor Metal-Oxide (MOx) Sensors

●Characteristics: Low cost, portable, sensitive to many VOCs; prone to drift and environmental effects.

●Business: Fastest growing tech for consumer and low-cost devices; requires AI for specificity.

Infrared / NDIR (nondispersive infrared)

●Characteristics: Good specificity for certain gases; used in higher-end devices.

●Business: Often used in desktop and vehicle systems.

Mass-Spectrometry / GC-MS & PTR-MS / IMS

●Characteristics: Gold standard for research and clinical detection; high sensitivity and multi-analyte capability.

●Business: High CAPEX instruments for labs, research centers, and clinical diagnostic development.

Hybrid sensor arrays + ML pattern recognition

●Characteristics: Multiple sensor types combined with ML to classify complex breathprints.

●Business: Enables disease detection use cases and multi-analyte screening in one platform.

By Distribution Channel

Government & Institutional Procurement

●Role: Bulk procurement for law enforcement, military, public health programs.

●Implication: Large contracts, long procurement cycles, stability.

Medical/Distribution channels for clinical platforms

●Role: Hospitals, clinical labs, and specialty distributors.

●Implication: Requires regulatory clearances, service contracts, clinical validation.

Retail & E-commerce

●Role: Direct-to-consumer channels for portable devices.

●Implication: Rapid growth; supports consumer adoption and brand play.

Fleet & B2B direct sales

●Role: Commercial fleets and corporate safety programs.

●Implication: Recurring revenue potential via monitoring contracts and integration.

Top 5 FAQs

-

Q: What is the market size and expected growth for breath analyzers?

A: The market was US$ 1.022 billion in 2024, US$ 1.2 billion in 2025, and is projected to reach US$ 5.12 billion by 2034, expanding at a 17.44% CAGR from 2025–2034. -

Q: Which product or technology dominated the market in 2024?

A: By product type, portable/handheld breathalyzers held approximately 58% share in 2024; by technology, electrochemical fuel-cell sensors held about 52% share in 2024. -

Q: Which regions are leading and which are fastest growing?

A: North America was the leading region with about 38% share in 2024 (large law-enforcement fleets & mature ignition-interlock programs). Asia Pacific is expected to be the fastest-growing region during the forecast period due to expanding vehicle fleets, new regulations, and healthcare investments. -

Q: What are the main drivers and restraints for market growth?

A: Main drivers: rising alcohol consumption leading to more drunk-driving incidents, strict enforcement/regulations, ignition-interlock mandates, and growing personal use. Main restraint: regulatory barriers and lengthy approval processes (especially for clinical diagnostics), which can delay launches and increase costs. -

Q: How is AI changing the breath analyzers market?

A: AI improves accuracy, specificity, and sensitivity by analyzing full breath data, enabling biomarker detection (disease diagnostics), sensor fusion, adaptive calibration, and smartphone integration — expanding both consumer and clinical use cases.

Access our exclusive, data-rich dashboard dedicated to the medical devices sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6084

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest