Cell and Gene Therapy Isolator Market Trends, Growth, Shares and Forecast 2025

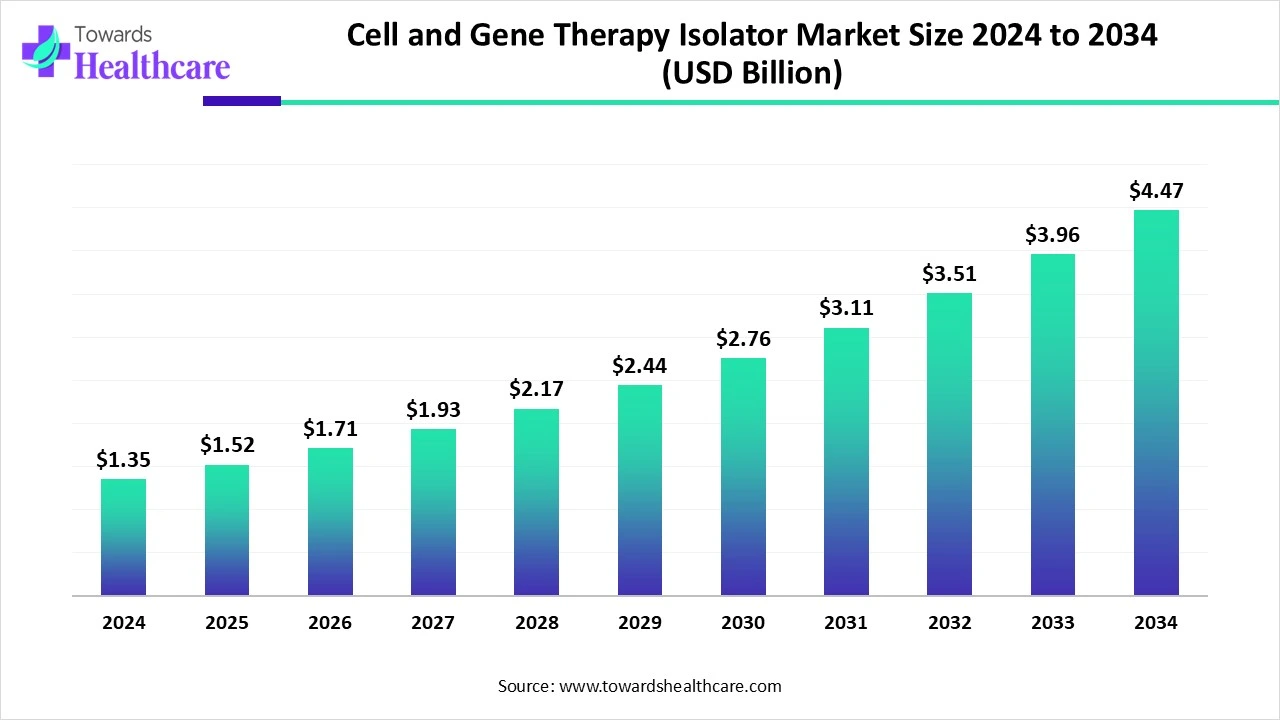

The global Cell and Gene Therapy Isolator Market was USD 1.35B in 2024, rose to USD 1.52B in 2025, and is forecast to reach USD 4.47B by 2034 (CAGR 12.54% from 2025–2034), driven by personalized-medicine demand, stricter aseptic requirements and rising viral-vector & cell-therapy manufacturing.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/6083

Table of Contents

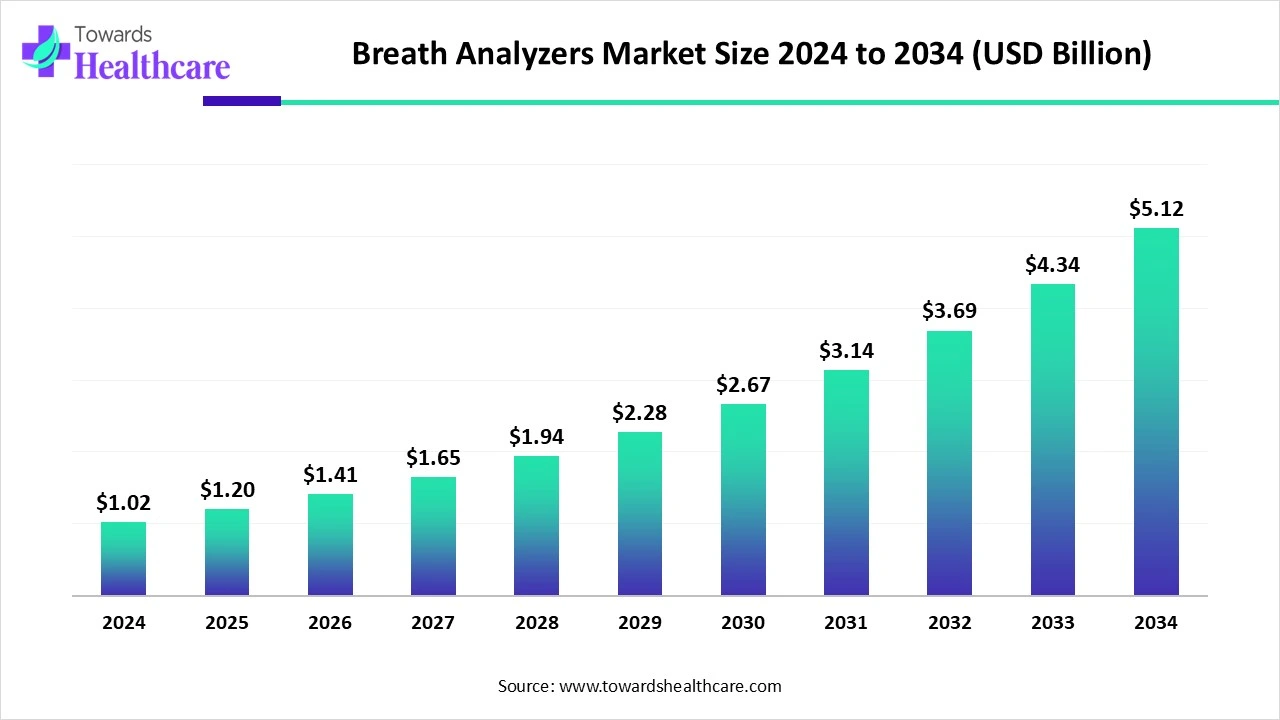

ToggleMarket size of Cell and Gene Therapy Isolator Market

Baseline & short-term growth

◉2024 actual: USD 1.35 billion (reported base year).

◉2025 actual/estimate: USD 1.52 billion 12.6% year-on-year increase (matches the longer CAGR directionality).

Long-term projection

◉2034 projected: USD 4.47 billion.

◉Implied absolute growth (2025→2034): USD 2.95 billion incremental market value.

Compound annual growth

◉Stated CAGR 12.54% (2025–2034). This indicates a multi-fold expansion (2.94× from 2025 to 2034: 1.52B × 2.94 ≈ 4.47B).

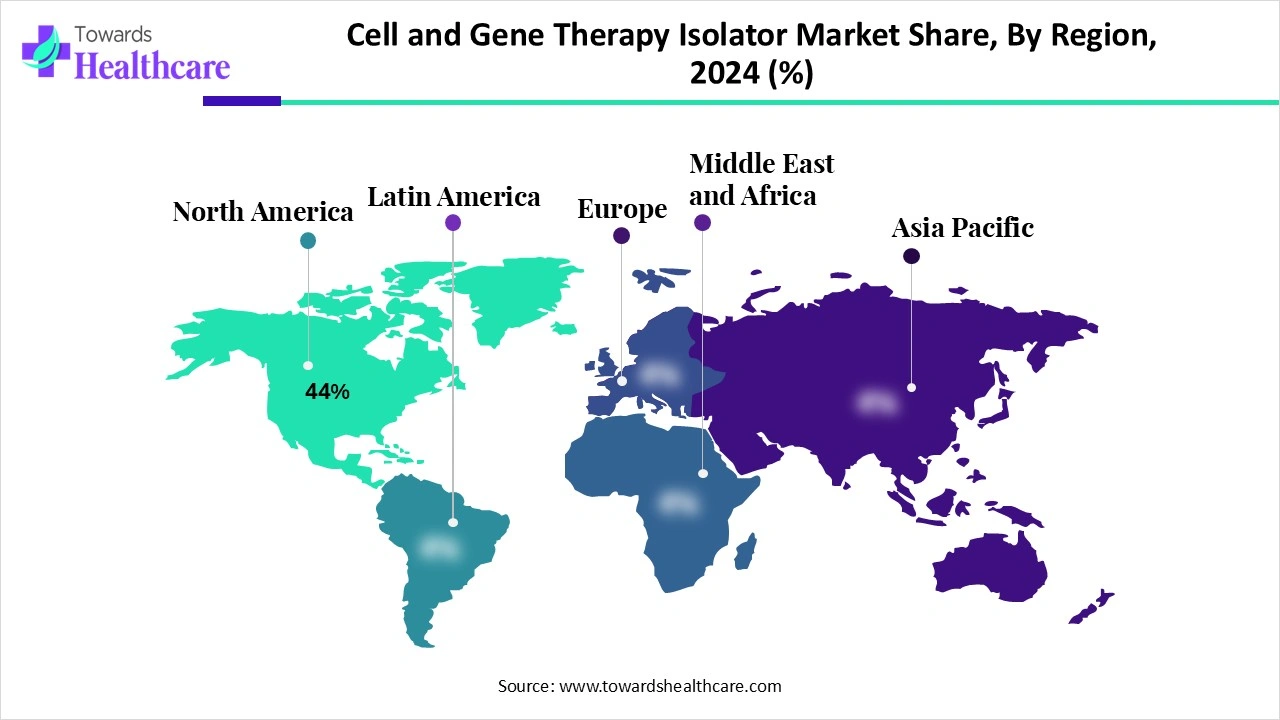

Regional concentration (top line)

◉North America accounted for 44% of 2024 revenues (implies USD 594M of the 1.35B in 2024).

◉Asia-Pacific flagged as the fastest-growing region over the forecast (high upside potential vs. established NA lead).

Market structure

◉Market is capital-intensive and concentrated among specialized equipment vendors, system integrators, and CDMO partners — value captured in hardware, automation/software integration, and validation/decontamination consumables/services.

Demand drivers (size implications)

◉Growing number of CGT clinical trials (961 registered as of Aug 2025) and approvals (43 CGTs in U.S. as of Jan 2025) create predictable demand for isolators across development → clinical → commercial scale.

Scalability constraints (size limiter)

◉Current limits on large-scale reproducibility and flexibility of isolators act as a moderating factor—affecting the pace at which volumetric demand translates into equipment spend.

Market trends

Personalized medicine & commercialization

◉Surge in CGT approvals and late-stage trials drives capital expenditure on validated, GMP-compliant isolators for aseptic processing and viral-vector manufacture.

Automation & digital integration

◉Collaborations (e.g., Multiply Labs + GenScript, Apr 2024) and platform adoptions (Trenchant BioSystems → Autolomous autoloMate) push isolators toward automated, closed, and integrated workflows — reducing human intervention and contamination risk.

Viral vector focus

◉Viral vector production identified as the fastest-growing segment — requirement for high-containment, decontaminable isolators (AAV, lentivirus, retrovirus) boosts demand for specialized containment and bio-decontamination systems.

Rise of bio-decontamination & consumables

◉Need for log-6 SAL and validated decontamination cycles (VHP, chlorine dioxide, peracetic acid, ozone, UV-C) increases spend on integrated decon systems and service contracts.

CDMO & outsourcing expansion

◉CDMOs expected to expand fastest among end-users — drives demand for midsized modular isolators and turnkey validated suites to serve multiple clients.

Regional manufacturing shifts

◉Asia-Pacific growth (lower operating costs, supportive policies) prompts global vendors to offer modular and scalable isolators tailored for emerging manufacturing hubs.

Capital & funding flows

◉VC and growth funding (e.g., Akadeum $20M, Jun 2025) support companies scaling isolator-adjacent capabilities (cell separation, GMP workflows) and indirectly increase isolator procurement.

Product innovation & speed-to-market claims

◉Industry messaging emphasizes cost/time reductions (Trenchant BioSystems platform: manufacturing timelines cut to 2.5 days and >80% cost reductions) — this positions isolator vendors to compete on throughput and total cost of ownership.

Regulatory & cGMP stringency

◉Tighter cGMP and regulatory expectations (sterility, containment, validation) raise the bar for isolator design, validation services, and ongoing compliance spend.

Integration of single-use & modular design

◉Demand for closed-system, small-batch and modular isolators to support personalized and autologous therapies.

AI role & impact on the CGT isolator market

Design optimization & customization

◉AI/ML models analyze historical contamination, airflow and process data to propose bespoke isolator geometries, filter placements and air-change strategies that maximize sterility while minimizing footprint and energy use.

◉Outcome: faster prototype cycles and lower R&D costs for custom isolators (especially valuable for CDMOs and specialized therapy makers).

Real-time process monitoring & anomaly detection

◉Continuous sensor streams (pressure, differential, particle counts, temp/humidity, process cameras) fed into AI detect deviations earlier than threshold alarms — enabling predictive interventions (e.g., adjust flow, pause operation, trigger decon cycle).

◉Outcome: fewer batch losses, higher first-pass yield and measurable reduction in contamination incidents.

Predictive maintenance & uptime

◉Predictive models forecast HEPA filter degradation, vacuum pump failures, glove port breaches and actuator wear based on subtle sensor trends.

◉Outcome: scheduled maintenance windows, reduced unplanned downtime, and higher overall equipment effectiveness (OEE).

Sterility assurance scoring

◉AI ensembles synthesize environmental, process, personnel and batch analytics to produce a probabilistic sterility score for each run—guiding QA decisions and release testing intensity.

◉Outcome: risk-based release strategies reduce unnecessary retesting and speed product release.

Process parameter optimization for viral vector & cell yields

◉ML models tune critical process parameters (mixing, shear, residence time, temp profiles) within isolators for maximal viral titer or cell viability, learning from prior runs across multi-site deployments.

◉Outcome: improved batch potency and reduced per-dose manufacturing cost.

Automated compliance & validation documentation

◉AI aides auto-generate traceable validation reports by correlating logs, sensor traces and operator inputs—accelerating regulatory submissions and inspections.

◉Outcome: lowers administrative burden and shortens time-to-market.

Digital twins for scale-up and training

◉Digital twin replicas of isolator systems simulate scale-up scenarios (small batch → commercial), enabling operators and engineers to validate workflows virtually before physical changes.

◉Outcome: lower risk during process transfer; training without consumable use.

Smart decontamination scheduling

◉AI schedules VHP/UV/chemical decon cycles based on predicted microbial risk and operational cadence to minimize downtime while ensuring log-6 SAL.

◉Outcome: improved throughput and reduced chemical overuse.

Supply chain & inventory optimization

◉AI forecasts consumable needs (filters, seals, single-use bags) based on utilization patterns across sites, enabling just-in-time supply and lower working capital.

Enhanced operator-machine interfaces

◉Natural language and model-based assistants guide operators through SOPs, deviations, and corrective actions in real time—reducing human error in complex aseptic operations.

New commercial models

◉AI enables remote monitoring services and performance-based isolator contracts (vendors provide “sterility-as-a-service”), shifting CapEx to Opex and promoting vendor lock-in for recurring revenues.

Constraints & risks of AI adoption

◉Data governance, validation of AI models under regulatory standards, and cybersecurity (protecting process IP and patient data) are essential. Poorly validated AI could increase risk rather than mitigate it.

Regional insights — deep points with subpoints & explanation

North America (dominant; 44% share in 2024)

Market characteristics

◉High concentration of leading vendors, advanced CDMOs, and deep pockets for capital investment.

◉Strong clinical trial infrastructure (≈489 of 961 global CGT trials are U.S.-based per provided data).

Demand drivers

◉High rate of CGT approvals (43 in U.S. as of Jan 2025) creates commercial demand for validated, scalable isolator systems.

Innovation environment

◉Rapid adoption of automation, AI integration, and validated decontamination protocols; early adopters push for higher throughput and digitalization.

Vendor advantages

◉Established supplier networks, proximity to pharma customers, and ability to offer turnkey validated solutions.

Challenges

◉Higher labor and facility costs; pressure to justify capital investments vs. outsourcing to CDMOs.

Asia-Pacific (fastest growth expected)

Market characteristics

◉Rapid capacity build-out, favorable government incentives (Make in India; selective FIE easing in China), and cost-competitive manufacturing.

Demand drivers

◉Foreign and domestic pharma companies establishing manufacturing footholds; expansion of local clinical trials and manufacturing hubs.

Opportunities

◉Large addressable market for modular, lower-CAPEX isolators and for vendors offering validation & training packages.

Risks

◉Variable regulatory harmonization and need for local service/support networks.

Europe

Market characteristics

◉Mature regulatory expectations; strong med-tech manufacturing base (Germany, UK, France, Italy, Sweden, Denmark, Norway).

Demand drivers

◉Stringent quality/regulatory environment favors vendors offering highly validated, EU-compliant isolator systems and lifecycle services.

Differentiators

◉Preference for energy-efficient designs, green decontamination chemistry and robust documentation for CE/MDR compliance.

Canada (notable but smaller)

Market characteristics

◉Smaller absolute market (12 CGTs approved as of Jun 2024); pockets of academic excellence and proximity to U.S. market.

Demand drivers

◉Specialized needs (academic hospitals, translational centers) and suppliers like Comecer, Miltenyi and Optima supplying to local firms.

Scale

◉Predominantly small to medium installations and collaborative CDMO projects.

China & India — country specifics

China

◉Regulatory liberalization in select zones and emergence as a CGT trials leader — attractive for vendors with modular systems and local partnerships.

India

◉National programs (Make in India / Atmanirbhar Bharat) and local success stories (IIT Bombay + Tata Memorial CAR-T launch) create demand for domestic isolator suppliers and for vendors that can localize service/support.

Market dynamics

Drivers

Demand for personalized medicines

◉Personalized CGTs (autologous/allogeneic cell therapies, gene therapies) require small-batch, high-sterility processing — directly increasing isolator demand.

Rising clinical activity and approvals

◉961 CGT trials (Aug 2025) and 43 U.S. approvals (Jan 2025) create predictable rails from R&D to commercial manufacturing.

Regulatory & quality pressures

◉cGMP and sterility requirements compel investment in validated isolators and decon technologies.

Outsourcing to CDMOs

◉Emerging biotech’s reliance on CDMOs expands demand for multi-client isolator suites and flexible, modular systems.

Technological innovation (automation/AI)

◉Automation and AI reduce contamination risk and labor costs — making isolators more attractive economically.

Restraints

Limited flexibility & scalability

◉Many current isolators aren’t easily scalable to large commercial volumes; complex processes limit rapid capacity expansion.

High capital & validation cost

◉Upfront cost and lengthy validation cycles (to satisfy log-6 SAL and regulatory audits) slow adoption, especially for smaller firms.

Fragmented standards across regions

◉Variation in regulatory requirements and qualification standards complicates multi-site deployments.

Supply chain & service dependency

◉Long lead times for custom components and need for local service engineers constrain rapid rollouts in emerging markets.

Opportunities

Bio-decontamination & consumables

◉Growth in decon-centric isolators and validated consumables (VHP systems, sealed gaskets, single-use assemblies).

AI-driven offerings & “sterility-as-a-service”

◉Vendors can monetize remote monitoring, predictive maintenance, and outcome-based service models.

CDMO partnerships & shared facilities

◉Offering flexible, certified modular suites to CDMOs reduces capital hurdles for therapy developers.

Emerging markets expansion

◉China and India represent large adoption pools for lower-cost, modular and service-based isolator solutions.

Implications for stakeholders

◉Manufacturers must prioritize modular, validated, and AI-enabled isolator platforms with strong service models.

◉CDMOs can scale faster by adopting standardized isolator stacks and remote QA tools.

◉Investors should evaluate vendors that combine hardware with software (AI/monitoring) and recurring service revenue.

Top companies (product, overview, strength)

SKAN AG

◉Product/Overview: Specialized isolators and containment solutions for aseptic processing.

◉Strengths: Deep expertise in bespoke isolator engineering; strong presence in aseptic isolator segment.

Getinge AB (and Lancer as Getinge Group)

◉Product/Overview: Broad sterile processing equipment portfolio; Lancer supplies isolator subsystems.

◉Strengths: Large global footprint, service network, and ability to integrate isolators into facility solutions.

Azbil Telstar

◉Product/Overview: Aseptic isolators and containment units for pharmaceutical and CGT manufacturing.

◉Strengths: Established engineering expertise and compliance with cGMP, making them suitable for high-regulation markets.

Comecer (ATS Automation)

◉Product/Overview: Modular isolators, containment lines, and automation for ATMPs.

◉Strengths: Known for modular platforms; notable presence in Canada and strong integration capabilities.

Germfree Laboratories

◉Product/Overview: Sterile enclosures and isolators focused on contamination control.

◉Strengths: Niche provider with emphasis on biological safety and operator protection.

Esco Aster

◉Product/Overview: Biosafety cabinets and isolator solutions for cell therapy and biopharma.

◉Strengths: Large product range tailored to both R&D and production scales.

MBRAUN

◉Product/Overview: Gloveboxes/isolators and containment systems for sensitive biological processing.

◉Strengths: Precision engineering and suitability for small-batch, high-containment work.

Tema Sinergie

◉Product/Overview: Technologically advanced isolators and containment solutions.

◉Strengths: Customization and modularity for ATMP manufacturing needs.

BioSpherix

◉Product/Overview: Isolators and specialized containment for cell culture and viral vector work.

◉Strengths: Focused on cell culture needs—valuable for cell-therapy manufacturing.

Fedegari Group

◉Product/Overview: Decontamination and sterilization equipment; likely partners for integrated isolator + decon solutions.

◉Strengths: Deep know-how in sterilization processes (critical for bio-decontamination isolators).

Vanrx (Cytiva)

◉Product/Overview: Filling and isolator systems for aseptic processing; now associated with Cytiva.

◉Strengths: Integration into larger life-science ecosystem (Cytiva) — access to downstream and upstream workflow customers.

WABO Isolator Systems / Extract Technology (Wabash)

◉Product/Overview: Containment isolators and related manufacturing systems.

◉Strengths: Specialty in customized isolator solutions.

Tofflon Science and Technology

◉Product/Overview: Aseptic filling and isolator products, especially for biologics.

◉Strengths: Strong manufacturing focus and cost-competitive positioning for APAC markets.

Nuaire Inc.

◉Product/Overview: Cleanroom and containment systems, including isolators.

◉Strengths: Broad portfolio for facility-level integration.

Hosokawa Micron Ltd., Skanfog Technologies, Carlo Erba Group, ITECO Engineering, etc.

◉Product/Overview: Various specialized components and systems (decon, sterility consumables, engineering).

◉Strengths: Niche capabilities (e.g., decon, filtration, engineering) that complement larger isolator platforms.

Note: Thermo Fisher Scientific appears in recent developments (product launches) and plays an adjacent role through consumables and cell isolation products (see Recent Developments).

Latest announcements

Multiply Labs + GenScript (April 2024)

◉Announcement: Strategic partnership to introduce automation in cell isolation for cell therapy manufacturing.

◉Detail: Combined Multiply Labs’ robotic cluster with GenScript’s GMP-grade CytoSinct 1000 to enable isolation of 120 × 10^9 cells per hour.

◉Implication: Demonstrates the shift toward high-throughput automated upstream processing; isolator vendors must integrate robotic and cell-isolation compatibilities into designs to capture this workload.

Akadeum Life Sciences — Funding (June 2025)

◉Announcement: US$20M funding to scale commercial operations and support customers entering clinical trials.

◉Detail: Akadeum’s product suite is GMP-compliant and advances next-gen cell therapies.

◉Implication: Funding flows into cell separation and GMP tools increase demand for compatible isolators and validated workflows.

Trenchant BioSystems — CEO Commentary & Platform selection

◉Announcement: Trenchant claims a manufacturing platform that reduces timelines to 2.5 days and costs by >80%, selecting Autolomous’ autoloMate as their digital platform.

◉Implication: Puts pressure on isolator providers to demonstrate throughput and TCO improvements; digital integration becomes a differentiator.

Thermo Fisher Scientific (Dec 2024)

◉Announcement: Launched Gibco™ CTS™ Detachable Dynabeads™ CD4 and CD8 — next-generation cell therapy isolation/activation products.

◉Implication: Consumable launches by large suppliers create integrated product ecosystems; isolator vendors benefit from compatibility with these consumables and from offering validated workflows.

Lifecore Biomedical (Sept 2024)

◉Announcement: Installed a high-speed, multi-purpose 5-head isolator filler to expand capabilities.

◉Implication: Demonstrates market demand for higher speed aseptic filling within isolators — an area vendors should prioritize.

Recent developments

Product launches & consumables

◉Thermo Fisher’s Detachable Dynabeads (Dec 2024) — addresses cell isolation and activation demands in GMP settings, increasing upstream isolator activity.

Equipment installations for throughput

◉Lifecore’s 5-head isolator filler (Sept 2024) — signals movement toward multi-head, high-speed isolator fillers for higher throughput aseptic filling.

Strategic partnerships for automation

◉Multiply Labs + GenScript (Apr 2024) — robotic automation of cell isolation increases the need for isolators that accommodate robotic clusters and high cell volumes.

Funding & scale-up activity

◉Akadeum $20M (Jun 2025) — more companies scaling to clinical/commercial stage increases demand for GMP-grade isolator suites and associated validation.

Digital platform adoption

◉Trenchant BioSystems selecting Autolomous autoloMate as CGT digital platform highlights trend to pair isolators with digital orchestration platforms to achieve faster, lower-cost manufacturing.

Clinical & regulatory momentum

◉Large number of clinical trials (961 as of Aug 2025) and approvals (43 U.S. CGTs as of Jan 2025) bolster a pipeline-driven equipment demand model.

CDMO capability expansion

◉Vendors and CDMOs are investing in flexible isolator and filling technologies to capture outsourced manufacturing demand.

Segments covered

By Technology / Type of Isolator

Aseptic Isolators

◉Purpose: Provide ISO Class 5 conditions for sterile processing and filling.

◉Why dominant: High preference due to strict sterility requirements for CGTs; accounted for 55% share in 2024.

Sterile Filling Systems

◉Purpose: Integrated filling heads, multi-head fillers (e.g., Lifecore 5-head) inside isolator shells for vial/closed vial filling.

◉Importance: Critical for final drug product filling and minimizes open-fill risk.

Cell Expansion & Processing Isolators

◉Purpose: Allow cell culture, expansion and manipulation in closed, aseptic conditions.

◉Importance: Supports autologous and allogeneic cell therapies where cell viability and contamination must be tightly controlled.

Bio-decontamination Isolators

◉Purpose: Integrated cycles (VHP, chlorine dioxide, ozone, peracetic acid, UV-C) to achieve log-6 SAL.

◉Growth: Expected to have fastest CAGR due to increasing viral-vector and containment needs.

Containment & High-potency Isolators

◉Purpose: Handle potent viral vectors, gene-editing reagents, high-potency APIs ensuring operator and environmental protection.

Closed-vial Filling & Finishing Isolators

◉Purpose: Final dose assembly in sealed containers to minimize post-fill contamination.

Small Batch vs. Large-scale Modular Systems

◉Small batch: Tailored for personalized/autologous therapies.

◉Large modular: For allogeneic or commercial batches; more CAPEX and footprint.

Customized Modular Isolators

◉Purpose: Vendor-tailored isolators combining multiple functionalities (e.g., cell isolation robot + decon + fill finish).

By Therapeutic Area

Oncology (largest share 47% in 2024)

◉Reason: CAR-T and other oncology CGTs are mature commercial opportunities requiring large isolator investments.

Neurological Disorders (fastest CAGR expected)

◉Reason: Emerging gene/cell therapies for Alzheimer’s, Parkinson’s and rare neurogenetic disorders increase demand for tailored isolators.

Hematologic & Rare Genetic Disorders

◉Require specialized containment and aseptic handling for sensitive cell products.

By End-User (explanations)

Pharmaceutical & Biotechnology Companies (largest share 52% in 2024)

◉Reason: They invest in in-house capabilities for control over IP and product quality.

CDMOs (fastest growth expected)

◉Reason: Outsourcing growth creates need for flexible multi-client isolator platforms and validated services.

Academic & Research Institutes / Hospitals

◉Often use small-batch or research isolators for translational manufacturing.

Viral Vector CDMOs / ATMP-focused CDMOs

◉Specialized isolators for vector production and high-containment requirements.

By Region

◉North America — market leader with highest revenue share due to approvals, capital and established players.

◉Asia-Pacific — fastest growth driven by policy support and cost arbitrage.

◉Europe/Latin America/MEA — varying maturity; Europe emphasizes regulatory compliance, LATAM/MEA are emerging opportunities.

Top 5 FAQs

-

Q: What is the current market size and growth outlook for CGT isolators?

A: The market was USD 1.35B in 2024, USD 1.52B in 2025, and is projected to reach USD 4.47B by 2034, growing at a CAGR of 12.54% from 2025–2034. -

Q: Which region led the market in 2024 and which region will grow fastest?

A: North America led with 44% revenue share in 2024; Asia-Pacific is expected to be the fastest-growing region during the forecast period. -

Q: Which isolator technologies are most important today?

A: Aseptic isolators dominated in 2024 (55% share), while bio-decontamination isolators are expected to register the fastest CAGR going forward due to viral-vector and containment needs. -

Q: Who are the main buyers of isolators?

A: Pharmaceutical & biotechnology companies were the largest end-users in 2024 (52% share). CDMOs are the fastest expanding end-user segment as more firms outsource CGT production. -

Q: How will AI and automation affect the isolator market?

A: AI and automation will accelerate adoption by enabling design optimization, real-time monitoring, predictive maintenance, sterility scoring, process optimization for viral vectors/cells, and digital twins—leading to higher yields, lower downtime and potential new service models (e.g., sterility-as-a-service).

Access our exclusive, data-rich dashboard dedicated to the biotechnology sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6083

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest