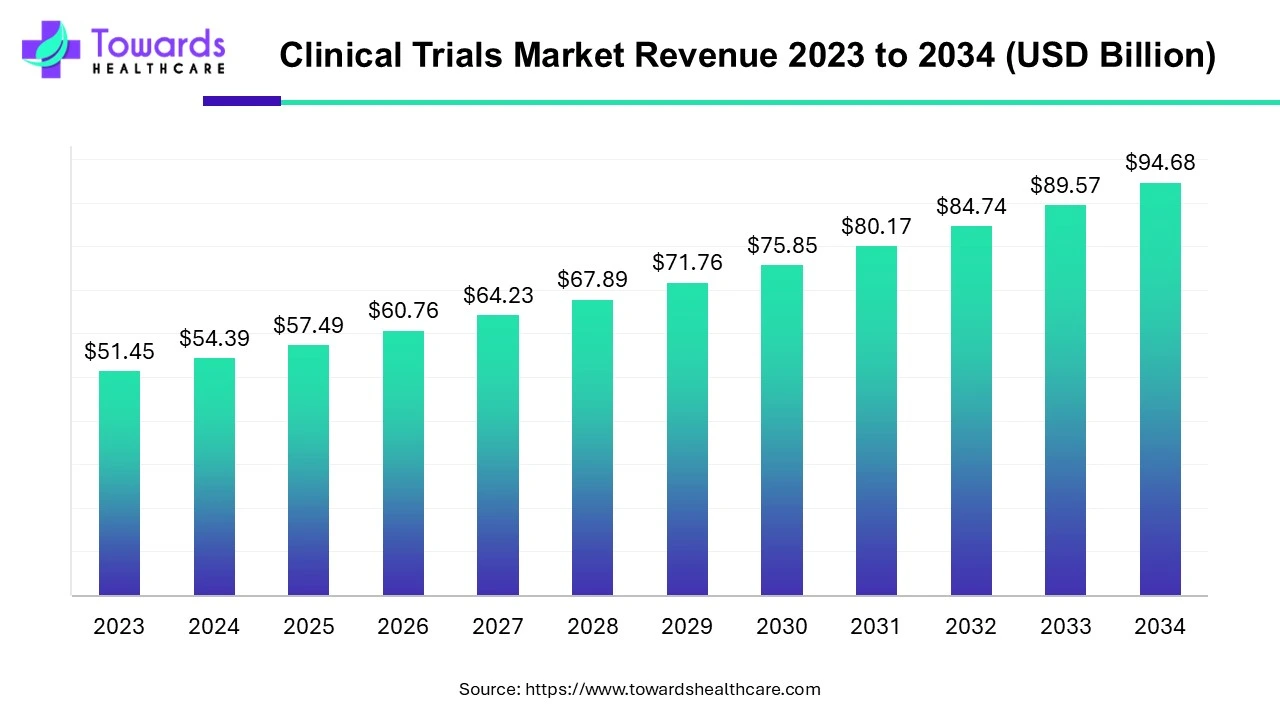

The global clinical trials market was USD 54.39 billion in 2024 and is projected to reach USD 94.68 billion by 2034 (CAGR 5.7% from 2024–2034), driven by rising R&D spend, personalized medicine, and rapid adoption of decentralized/virtual trials.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5029

Market size

◉Current base (2024): USD 54.39B (user data).

◉Forecast (2034): USD 94.68B (user data) — implies cumulative growth reflecting expanded trial activity, outsourcing and digital/remote models.

◉Compound annual growth rate: 5.7% (2024–2034) — growth driven by higher trial volumes (oncology, rare diseases), more complex biologics, and regulatory acceleration programs.

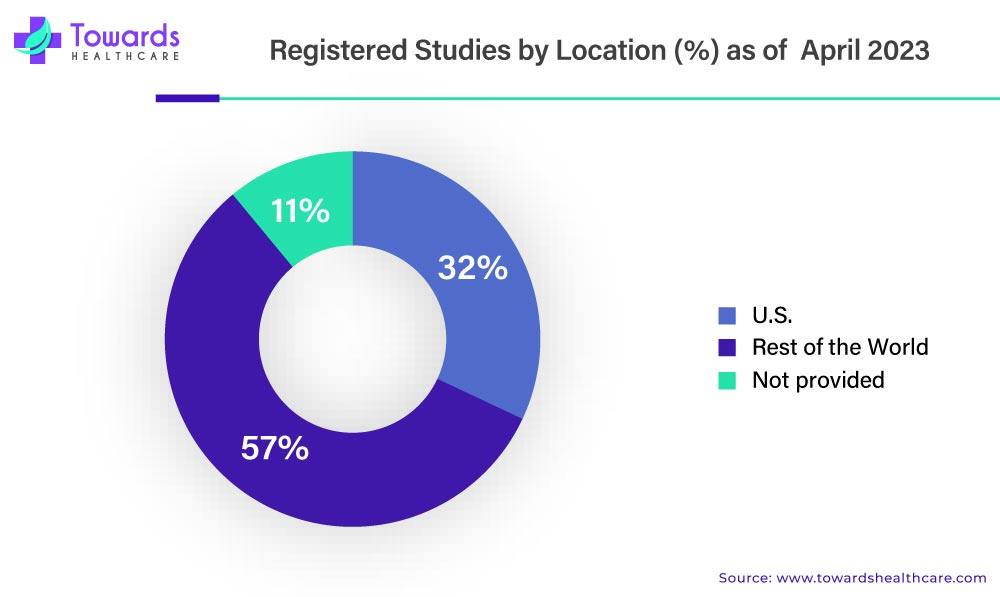

◉Registries as a proxy for activity: ClinicalTrials.gov and similar registries hold hundreds of thousands of records (ClinicalTrials.gov > 400k registered studies historically), indicating large and growing global trial throughput.

◉Market composition by spend (high-level): sponsor R&D budgets (largest), CRO services, site payments, patient engagement & retention services, decentralized trial platforms, data management/analytics, and regulatory/compliance services. (Detailed dollar splits vary by year and sponsor strategy.)

◉CapEx & technology investment: major portion of incremental spend is on data platforms (EHR/RWE integration), remote monitoring, eConsent/telemedicine, AI patient-matching and analytics, and logistics for decentralized trial kits (invested both by sponsors and CROs).

Market trends

◉Decentralized & hybrid trials (accelerated by COVID-19): rapid shift to remote visits, home nursing, ePROs, and device/wearable monitoring which reduces site burden and broadens recruitment. (User examples: Northwell famotidine trial; ACTIV partnership.)

◉Regulatory modernization & harmonization: many regulators introduced faster pathways (e.g., FDA CTAP during COVID) and the EU implemented CTIS/CTR to centralize submissions (CTIS launched 31 Jan 2022; mandatory use for new applications by Jan 31, 2023). This reduces administrative friction for multisite EU trials.

◉Rising trial counts & registry transparency: ClinicalTrials.gov lists hundreds of thousands of trials across 200+ countries (registry expansion improves visibility and post-study reporting mandates).

◉Patient-centricity as core design principle: co-design of protocols with patients; minimizing visits; reimbursement/transport support; broader inclusion criteria to capture diverse populations.

◉Personalized medicine & biomarker-led trials: smaller, richer cohorts (basket/umbrella trials) that target molecularly defined subpopulations — increases complexity but improves probability of success for targeted therapies.

◉Real-World Evidence (RWE) & hybrid endpoints: sponsors increasingly combine RWE (EHRs, registries, wearables) with traditional outcomes to supplement efficacy/safety evidence.

◉AI & advanced analytics: used for site selection, patient matching, synthetic control arms, anomaly detection in safety data and adaptive designs — improving speed and lowering screen-failure rates.

◉Globalization with localized complexity: more trials in Asia Pacific, Latin America and Eastern Europe to access patient pools and lower costs — but each region requires localization: language, regulatory and ethics approvals, data privacy compliance.

◉Commercial & operational consolidation: large CROs expand capability sets (end-to-end services), while niche vendors focus on decentralized tools, eConsent, and analytics — leading to strategic partnerships and M&A.

◉Supply chain/logistics sophistication: home delivery of investigational products, cold-chain for biologics, and virtual site monitoring demand resilient logistics and qualified courier networks.

AI impact & role

1 Pre-trial planning & feasibility

◉AI-driven site selection: ML models ingest historical recruitment, site performance, investigator profiles and local prevalence to rank sites by projected enrollment speed and retention. This reduces start-up cycles and screen-failure rates.

◉Synthetic feasibility modeling: generative and predictive models simulate enrollment scenarios under different inclusion/exclusion criteria to optimize protocol design and timelines.

2 Patient identification & recruitment

◉EHR mining & phenotyping: NLP + structured data pipelines scan EHRs to identify eligible patients faster while preserving PHI through federated learning/secure enclaves.

◉Digital advertising optimization: AI optimizes ad targeting (social, search) to reach likely candidates and improves conversion metrics through continuous learning.

3 Protocol design & adaptive trials

◉In silico trial simulations: Bayesian/AI models simulate arms, dosing, and adaptive decision rules to refine sample sizes and stopping boundaries prior to first patient in.

◉Adaptive randomization & response-adaptive strategies: real-time analytics inform arm allocation to increase probability of success and patient benefit.

4 Operational monitoring & risk-based monitoring (RBM)

◉Anomaly detection in EDC: unsupervised and supervised models flag outliers, data fabrication patterns, and safety signal anomalies for targeted source data verification, reducing monitoring cost.

◉Predictive site risk scores: models forecast which sites may underperform or have data quality issues enabling pre-emptive remediation.

5 Safety surveillance & pharmacovigilance

◉Signal detection across heterogeneous data: AI aggregates trial data, spontaneous reporting, and RWE to prioritize adverse event signals and speed safety committee reviews.

◉Automated SAE coding & narrative generation: NLP automatically maps verbatim text to MedDRA, creating structured case reports for regulatory submissions.

6 Endpoint measurement & digital biomarkers

◉Sensor / wearable analytics: CV, movement, sleep, and activity metrics are processed by deep learning to create objective endpoints (e.g., gait stability, seizure detection).

◉Composite digital endpoints: AI fuses multimodal streams (video, audio, sensor, ePRO) into validated outcome variables.

7 Patient engagement & retention

◉Personalized nudges & chatbots: conversational AI delivers medication reminders, symptom checkers and tailored retention interventions, improving adherence and reducing dropout.

◉Sentiment & risk scoring: models analyze patient interactions to predict attrition risk and trigger clinical outreach.

8 Data curation & regulatory submission

◉Automated datasets & submission packages: AI pipelines assemble ADaM/SDTM-like datasets, generate analysis shells, and preflight checks for common regulatory deficiencies.

◉Document summarization & translation: NLP creates investigator brochures, translations and patient-facing materials more rapidly while preserving key facts.

9 Analysis, modeling & interpretation

◉Accelerated statistical modeling: Bayesian/ML hybrids accelerate subgroup discovery and covariate adjustments; enables more efficient use of smaller personalized cohorts.

◉Explainability & audit trails: growing requirement to add interpretability layers (SHAP, LIME) so regulators and auditors can review model rationale.

10 Governance, privacy & bias mitigation

◉Federated learning / privacy-preserving ML: allows model training across institutions without moving PHI.

◉Bias detection frameworks: systematic checks to ensure models don’t exclude underrepresented groups — critical for regulatory acceptance and ethics boards.

Regional Insights

1 North America (U.S. & Canada)

Dominant spend & sponsor concentration

◉The U.S. is home to the largest number of top 20 global pharmaceutical and biotech firms.

◉CRO headquarters concentration: Many of the top global CROs (IQVIA, Parexel, PPD) are U.S.-based, anchoring sponsor-CRO collaborations.

◉This creates a scale effect: sponsors can run high-budget, multi-indication programs with integrated preclinical-to-commercial solutions in one geography.

Regulatory acceleration & transparency

◉FDA initiatives: Breakthrough Therapy Designation, Accelerated Approval, and Oncology Center of Excellence programs have cut timelines significantly for high-need therapies.

◉COVID-19-era reforms (CTAP, EUA pathways) set precedents for rapid data review and rolling submissions.

◉Net effect: U.S. trials often start first globally, with early access to novel modalities (cell/gene therapies, mRNA vaccines, precision oncology drugs).

High technology adoption

◉Broad adoption of decentralized trial technologies: eSource, remote monitoring, RBM (Risk-Based Monitoring), AI-driven feasibility.

◉U.S. sites are typically first adopters of advanced data capture systems, creating faster learning cycles for new tech.

◉Academic medical centers (e.g., MD Anderson, Mayo, Dana-Farber) anchor early-phase and high-complexity trial ecosystems.

Patient advocacy & diverse recruitment pressure

◉Patient advocacy groups (esp. in oncology, rare diseases, HIV) lobby regulators and sponsors for inclusion and accelerated access.

◉FDA mandates diversity plans for pivotal trials; recruitment incentives increasingly tied to socio-economic outreach.

◉Challenge: Persistent underrepresentation of minority and rural patients despite technology-enabled outreach.

2 Europe (EU / UK)

Harmonization via CTR & CTIS

◉Clinical Trials Regulation (CTR, Jan 2022) + CTIS platform centralize submissions across EU/EEA.

◉Benefits: Faster multi-country start-up, standardized documentation, improved transparency.

◉UK (post-Brexit) is pursuing MHRA fast-track models to remain competitive.

High regulatory standards & data privacy

◉GDPR = strictest global regime on patient data. Sponsors must build privacy-aware RWE/registry pipelines.

◉Data localization laws (Germany, France) complicate multinational data flows, requiring hybrid data architecture.

Strong academic networks

◉Pan-European cooperative groups in oncology, cardiology, and rare disease trials (e.g., EORTC) attract global partnerships.

◉Sponsors increasingly outsource to CROs for managing complex biologics/advanced therapies in EU markets, where regulatory documentation and GMP are highly demanding.

3 Asia-Pacific (China, India, Japan, Southeast Asia)

Rapid growth & patient access

◉Large treatment-naïve patient pools (esp. oncology, infectious diseases, metabolic syndromes).

◉Cost arbitrage: per-patient trial costs 30–50% lower vs. U.S./EU.

◉Sponsors use APAC for Phase III global recruitment acceleration and local bridging studies.

Regulatory modernization

◉China (NMPA reforms, ICH alignment, faster IND review timelines).

◉India (new NDCT rules, ethics harmonization, trial insurance mandates).

◉Japan: still slower but investing in regenerative medicine fast-tracks.

◉These reforms boost data credibility, encouraging global sponsors to include APAC data in pivotal filings.

Localization & capacity building

◉Need for cultural adaptation in informed consent, language-specific patient materials.

◉Investment in investigator training and infrastructure (biobanks, cold chain) critical for trial quality.

4 Latin America

Faster recruitment & diversity

◉Patient willingness is high, especially in oncology, infectious diseases, and vaccines.

◉Adds valuable ethnic and genetic diversity to global datasets.

◉Sponsors leverage this region to rescue slow-recruiting U.S./EU trials.

Regulatory variability

◉Brazil (ANVISA) and Mexico show increasing alignment with ICH, but timelines still inconsistent.

◉Country-by-country submission strategies often required, slowing multi-country trial launches.

◉Site infrastructure improving, especially in urban research centers.

5 Middle East & Africa (MEA)

Emerging markets with untapped populations

◉GCC nations (UAE, Saudi Arabia, Qatar) investing in trial hubs (precision medicine, oncology).

◉Africa: Large untapped patient pools in infectious diseases and chronic illness — but infrastructure gaps persist.

Infrastructure & ethics capacity building

◉Need for harmonized ethics committees and GCP-compliant trial centers.

◉Logistics challenge: cold chain for biologics and cell therapies.

◉Sponsors often partner with local ministries of health to build capacity before launching large-scale trials.

Market Dynamics

1 Drivers

◉Rising R&D budgets & complex pipelines → biologics, cell & gene therapies require longer, more costly trials.

◉Personalized medicine & biomarkers → precision subgroups require adaptive and stratified trial designs.

◉Decentralization & digital health → broader patient reach, reduces geographic/logistical barriers.

◉Regulatory reforms & accelerated pathways → faster approvals motivate early-phase investment.

2 Restraints

◉Operational complexity & data heterogeneity → integrating EHR, wearables, lab data = non-trivial.

◉Regulatory & privacy barriers → GDPR, HIPAA, national data sovereignty laws.

◉Recruitment & retention challenges → rare disease cohorts, fragile elderly populations, pediatric cases.

◉Rising trial costs → biologics manufacturing, hybrid monitoring, and supply logistics inflate budgets.

3 Opportunities

◉AI & analytics platforms → predictive recruitment, automated data cleaning, adaptive trial optimization.

◉RWE & synthetic controls → reduce control-arm burden, accelerate submissions.

◉Niche CRO services → home nursing, decentralized orchestration, telehealth endpoints.

◉Emerging geographies → faster recruitment, cost efficiencies, underrepresented genetic populations.

4 Other Dynamics

◉Consolidation & partnerships → top CROs expanding into digital platforms and AI alliances.

◉Investor & VC interest → funding in digital trial platforms, decentralized models, AI-powered analytics remains robust.

Top Companies

1 IQVIA

◉Overview: Largest global CRO + healthcare data powerhouse.

◉Capabilities: End-to-end CRO services, AI site feasibility, RWE products (claims/EHR databases).

◉Strengths: Integrated clinical-commercial lifecycle, unmatched data depth for trial optimization.

2 Parexel

◉Overview: Leading CRO with strong regulatory & late-phase expertise.

◉Capabilities: Clinical development, eClinical tools, regulatory/market access advisory.

◉Strengths: Deep EMA/FDA regulatory know-how, broad site relationships, strong in biologics.

3 Charles River Laboratories

◉Overview: Preclinical leader expanding into translational/early clinical support.

◉Capabilities: Safety/toxicology, biologics testing, IND-enabling studies.

◉Strengths: Accelerates bench-to-IND readiness, complements CRO partners in later phases.

4 PPD (Thermo Fisher Scientific subsidiary)

◉Overview: Full-service CRO with lab and supply chain capabilities.

◉Capabilities: Clinical development, central labs, supply packaging/logistics.

◉Strengths: Scale, lab depth, and operational excellence across multiple therapeutic areas.

5 Omnicare / Kendle / Chiltern (historical niche players)

◉Overview: Now absorbed into larger entities, but historically strong in specialized therapeutic areas.

◉Strengths: Long-term site relationships, niche service lines that shaped CRO evolution.

Latest announcements & developments

1) Melvin & Bren Simon Cancer Center — REGN5459 (Apr 2023)

◉What happened (summary): first-in-human multiple myeloma trial showing ~90.5% overall response rate at higher doses (early cohorts).

Why it matters

◉Clinical validation speed: such high early ORR shortens the evidence gap between preclinical promise and clinical signal — accelerates dose expansion & pivotal planning.

◉Investor & partner interest: strong early signals draw capital, licensing conversations, and faster CRO/supply commitments.

◉Regulatory attention: early high responses may justify Breakthrough Designation / accelerated pathways (if safety profile acceptable).

Operational implications

◉Rapid scale-up needs: need to expand sites, logistics for increased IMP supply, and central lab throughput.

◉Biomarker & companion diagnostics: likely requirement to standardize assays across sites — QC and cross-lab harmonization essential.

◉Safety surveillance: intensive pharmacovigilance and DSMB cadence during expansion; SAE workflows must be prepped.

KPIs to monitor

◉time from dose-expansion decision to first patient enrolled (target: weeks–months),

◉IMP manufacturing lead time and lot release rate,

◉protocol amendment turnaround time (regulatory + site activation).

Risks & mitigations

◉Risk: early signal not durable → Mitigation: implement robust, pre-specified durability endpoints and interim analyses.

◉Risk: supply bottlenecks for biologic drug product → Mitigation: multiple manufacturing slots and safety stock.

2) MD Anderson at AACR 2023 — multiple early oncology signals

Why it matters

◉Confirms oncology continues to be the innovation engine, with multiple academic centers rapidly translating biology into trials.

◉Universities accelerate first-in-human work which then moves to industry-sponsored registrational programs.

Operational implications

◉Academic-to-industry handoffs: standardized data formats and early engagement with sponsor regulatory teams accelerate IND-to-CTA transitions.

◉Site capacity management: top academic centers become bottlenecks — expand investigator network planning early.

3) EU CTIS adoption (Jan 2022/2023) — centralized EU submissions

Why it matters

◉Single portal reduces duplication but increases transparency and harmonization across member states.

◉Mandatory use changed submission lifecycles and resource planning.

Operational implications

◉Regulatory submission redesign: templates, translations, and country-specific annexes need central coordination.

◉Public disclosure planning: sponsors must manage communication strategy for trial registries & posted documents.

Practical checklist

◉map CTIS dossier structure to internal CTMS,

◉pre-plan translations and local investigator brochures,

◉assign a CTIS submission owner and QPPV (where applicable).

4) COVID-19 legacy — decentralized trials, telemedicine, remote monitoring

Why it matters

◉DCTs moved from pilot to standard — reduced patient burden, improved reach, and changed monitoring models.

Operational implications

◉Hybrid protocol design: mix site visits with home nursing, eConsent, wearable endpoints.

◉Supply & logistics: home delivery of IMPs, kit returns, chain-of-custody for samples.

◉Monitoring model: RBM + central monitoring dashboards replace some SDV; on-site visits targeted.

Key performance changes (typical, illustrative)

◉enrollment speed ↑, screen-failures ↓, monitoring travel costs ↓ — measure these per trial phase to quantify ROI.

Risks & mitigations

◉Data integrity concerns from decentralized capture → implement eSource validation, timestamped audit trails, and device calibration SOPs.

5) Rising registered trials — ClinicalTrials.gov ~400k+ entries

Why it matters

◉Reflects growing trial volume, transparency, and competition for patient recruitment.

◉Public registry density increases ability to plan global feasibility but also elevates need for differentiation in recruitment outreach.

Operational implications

◉Feasibility complexity: more competing trials in the same indications → sponsors must target under-served regions or adopt DCTs.

◉Competitive intelligence: continuous registry scanning to identify overlapping trials and avoid recruitment cannibalization.

6) Biotech-driven pipeline — cell & gene therapies, cold-chain logistics

Why it matters

◉ATMPs and personalized biologics demand specialist CROs/suppliers and logistics (chain-of-custody, cryopreservation).

◉Drives demand for centralized manufacturing, regional hubs, and cell therapy couriers.

Operational implications

◉Extended supply chain planning: manufacturing slots, release testing, and regional distribution must be booked much earlier.

◉Regulatory & quality: sterility assurance, lot comparability and chain-of-identity documentation become critical.

KPIs

◉turnaround time for apheresis → product infusion, percentage of shipments meeting temperature range, lot-release time.

Segments Covered

1 By Phase — operational depth & resource profile

Phase I (First-in-Human)

◉Focus: safety, tolerability, PK/PD.

◉Resource needs: specialized early-phase units, intensive PK sampling, bioanalytics, GMP IMP supply at small scale.

◉Operational notes: rapid protocol amendments common; adaptive dose escalation (3+3, Bayesian model) and cohort expansion require nimble monitoring and rapid lab turnaround.

Phase II (Proof-of-Concept)

◉Focus: efficacy signals, dose optimization, biomarker validation.

◉Resource needs: central labs for biomarker assays, imaging core labs, statisticians for interim analyses.

◉Operational notes: adaptive designs reduce sample size but require sophisticated DSMB and statistical plan.

Phase III (Confirmatory)

◉Focus: definitive efficacy/safety, regulatory submission data.

◉Resource needs: global site network, logistics for large IMP volumes, full pharmacovigilance infrastructure, data lock and submission teams.

◉Cost drivers: number of sites, duration, complexity of endpoints (event-driven trials can extend timelines).

◉Operational notes: long lead times for site activation and country approvals—start early in project timelines.

Phase IV (Post-Marketing)

◉Focus: long-term safety, label expansion, RWE.

◉Resource needs: registry management, claims/EHR data partnerships, long-term follow-up processes.

◉Operational notes: integration with health systems and payer data sources is key.

2 By Study Design — operational tradeoffs

◉Interventional (RCTs, Platform/Basket)

◉Complexity: high (randomization, blinding, DSMBs).

◉Advantages: gold standard for efficacy.

◉Operational needs: randomization systems, clinical endpoint committees, central adjudication.

Observational (Registries, RWE)

◉Complexity: moderate, but data heterogeneity high.

◉Advantages: cost-effective, large sample sizes, long follow-up.

◉Operational needs: data harmonization, ETL pipelines, cleaning & provenance.

Expanded Access

◉Complexity: regulatory & compassionate use procedures.

◉Operational needs: close safety reporting, ethical oversight, logistics for off-label distribution.

3 By Indication — key operational challenges & strategic levers

◉Oncology

◉Challenge: biomarker stratification, rapid standard-of-care changes, competition for patients.

◉Levers: basket/platform trials, centralized NGS testing, partnerships with academic centers.

CNS

◉Challenge: subjective endpoints, slow progression, high placebo effects.

◉Levers: digital biomarkers (speech, gait sensors), long-term passive monitoring, enriched enrollment strategies.

Cardio/Metabolic

◉Challenge: event-driven endpoints require long follow-up and large N.

◉Levers: surrogate biomarkers, pragmatic trial designs, EHR-based event capture.

Rare/Orphan

◉Challenge: tiny populations, variable natural history.

◉Levers: adaptive designs, n-of-1, external/synthetic controls, accelerated approvals & orphan incentives.

4 By Service Type — operational considerations & vendor selection criteria

◉CRO Services

◉What to evaluate: global footprint, therapeutic experience, data quality record, and regulatory inspection history.

◉Operational need: integrated CTMS/EDC, vendor oversight processes.

Site Network Management

◉What to evaluate: investigator productivity, patient registries, contracting speed.

◉Operational need: SLA for site activation, eTMF completeness.

◉eClinical Tech (EDC, eConsent, ePRO)

◉What to evaluate: compliance (21 CFR Part 11), integration capability with wearables/EHR, user adoption.

◉Operational need: validation plans, training programs, device management SOPs.

Supplies & Logistics

◉What to evaluate: cold-chain capabilities, regional distribution partners, comparator sourcing.

◉Operational need: temperature mapping, contingency routes, chain-of-identity documentation.

Analytics & RWE

◉What to evaluate: data provenance, methods for bias adjustment, regulatory acceptance track record.

◉Operational need: ETL standards, synthetic control development SOPs, explainability for ML models.

Top 5 FAQs

Q1: What is the current size and projected size of the global clinical trials market?

A: The market was estimated at USD 54.39 billion in 2024 and is projected to reach USD 94.68 billion by 2034, growing at a 5.7% CAGR (2024–2034). (User data)

Q2: How has COVID-19 affected clinical trial operations long-term?

A: COVID-19 accelerated decentralized/hybrid trial adoption, telemedicine, remote monitoring and digital endpoints. Many of these operational models persisted because they improve recruitment, retention and cost efficiency. (User data + examples such as ACTIV program.)

Q3: How many clinical trials/records exist in public registries?

A: Public registries like ClinicalTrials.gov report hundreds of thousands of registered studies across 200+ countries (ClinicalTrials.gov historically >440k entries), reflecting large global trial throughput.

Q4: What are the biggest growth drivers for the clinical trials market?

A: Key drivers include rising R&D investments (biologics, gene/cell therapies), personalized medicine demands (biomarkers), regulatory acceleration programs (e.g., FDA CTAP), and adoption of digital health and decentralized trial models. (User data)

Q5: Which company types are dominating the market and why?

A: Large full-service CROs (IQVIA, Parexel, PPD) dominate because they offer integrated global services, data assets, regulatory expertise and end-to-end capabilities; specialized niche vendors provide decentralized trial tech, digital endpoints and AI analytics.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5029

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest