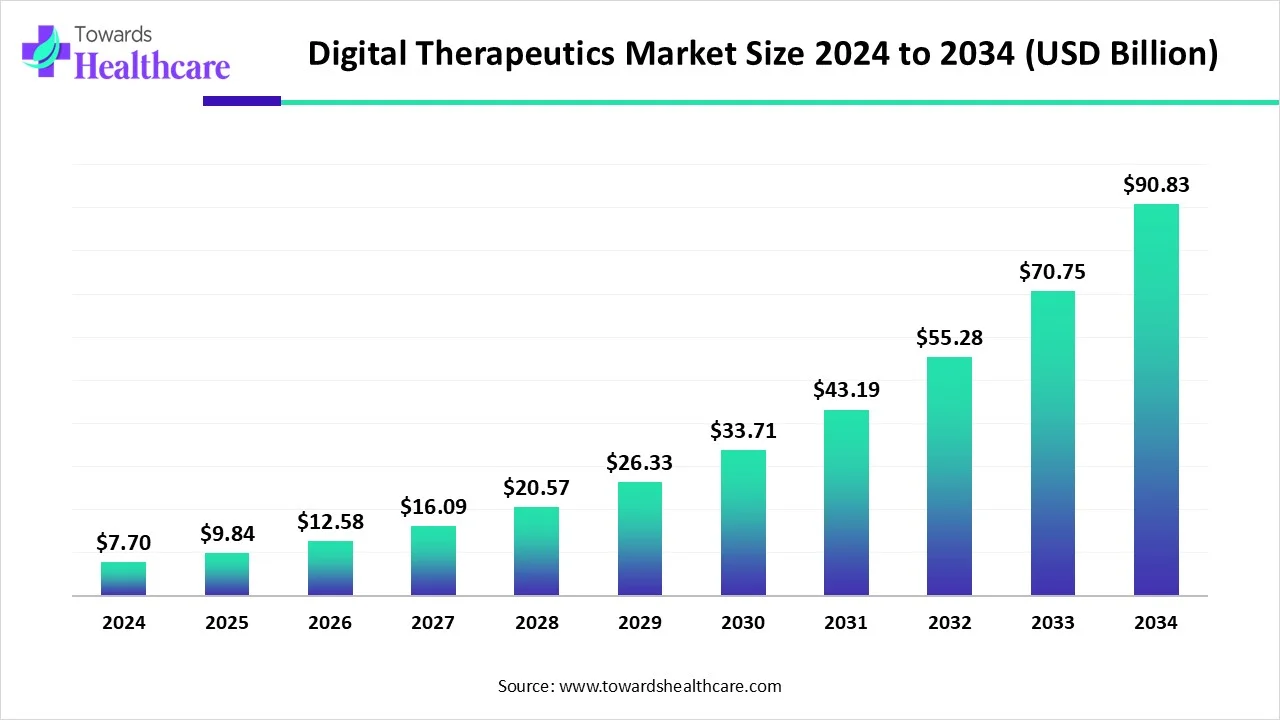

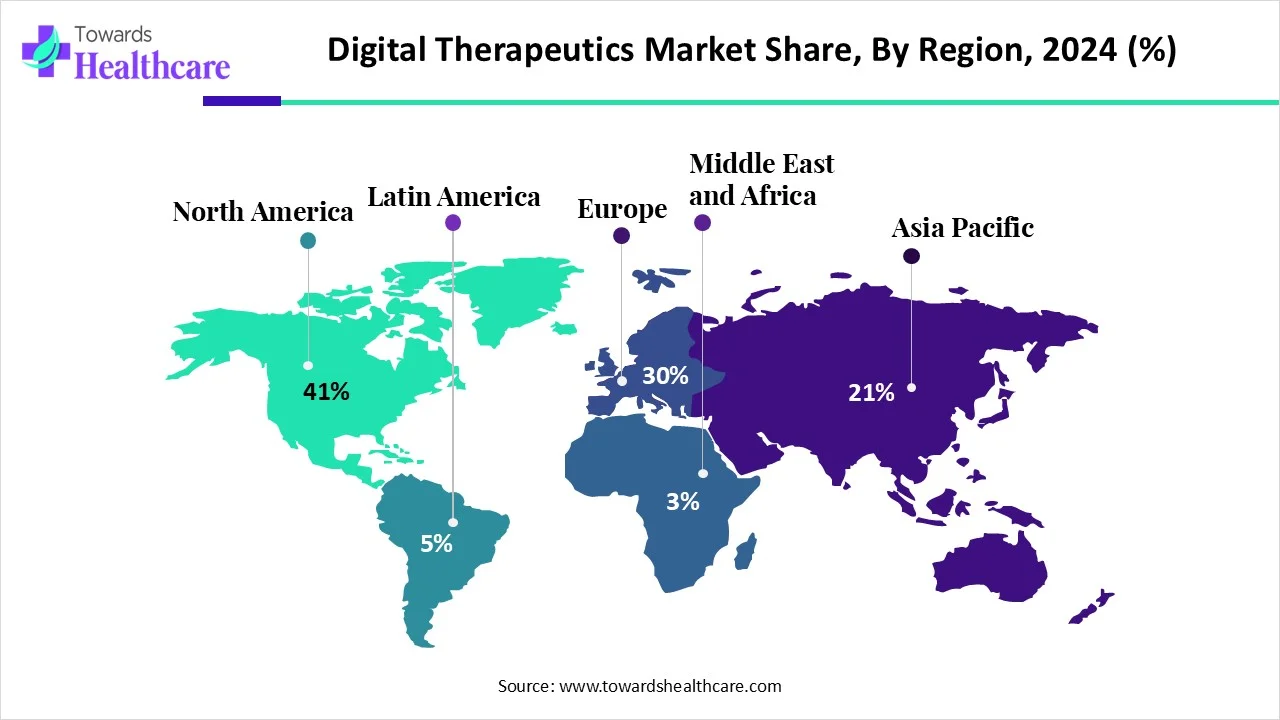

The global digital therapeutics market (DTx) market is USD 7.7 B (2024) → USD 9.84 B (2025) → USD 90.83 B (2034) at 27.8% CAGR (2025–2034), led by North America (41% share, 2024), with APAC the fastest-growing region.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/insights/digital-therapeutics-market-sizing

Market size

◉2024 base size: USD 7.7 B; inflection driven by smartphone ubiquity and validated software interventions.

◉2025 near-term size: USD 9.84 B; momentum from payer/provider pilots and early reimbursement footholds.

◉2034 long-term size: USD 90.83 B; ~11.8× 2025 level, reflecting scale-up of PDTs/SE software and broader regulatory comfort.

◉Absolute growth (2024→2034): +USD 83.13 B; majority contributed by chronic-care and behavioral health use cases (per your notes).

◉Growth velocity: 27.8% CAGR (2025–2034) sustained by AI-enabled personalization, wearables integration, and rising preventive-care budgets.

◉Regional revenue mix (2024): North America 41%; APAC fastest trajectory through 2034 (government digital health pushes).

◉Access tailwinds: Addressable population expanding with 5.6 B mobile subscribers (2023) projected to 6.3 B by 2030 (GSMA).

◉Care-gap pull: Large undiagnosed/undertreated cohorts (e.g., India: 42.3% undiagnosed hypertension; BMC 2023) increase DTx TAM.

Market trends

◉Software-enhanced therapeutics (SE) & PDTs rise: Click Therapeutics’ Click SE (Oct 2024) aligns with FDA PDURS focus; Dassault Systèmes investment in Click (Mar 2025) targets engagement and real-world evidence (RWE).

◉AI-first disease management: Propeller Health (Feb 2025) launched AI-powered respiratory platform for asthma/COPD monitoring and prediction.

◉Policy/advocacy consolidation: ATA Action + Digital Therapeutics Alliance (Mar–Apr 2025) to form a unified policy voice and reimbursement push.

◉EHR/diagnostics stack integration: ResMed’s Somnoware acquisition (Jul 2023) strengthens sleep/respiratory diagnostic-to-therapy workflows.

◉Retail health channels: Omada × Amazon Health Services (Jan 2024) expands access via consumer-scale platforms.

◉Regulatory acceleration signals: Better Therapeutics (Feb 2024) received FDA Breakthrough for CBT-based MASH treatment.

◉Ubiquitous sensors & wearables: Rising shipments (e.g., Brazil wearables growth, IDC 2023) bolster continuous monitoring and adherence loops.

◉Global policy scaffolding: National initiatives (e.g., India’s digital health missions; China’s Healthy China 2030) normalize DTx in care pathways.

◉Population risk surge: WHO 2024 obesity escalation and IHME 2023 diabetes >500 M reinforce demand for scalable digital interventions.

AI’s Role in Digital Therapeutics Market

1. Personalized Care Plans

◉Multimodal fusion: AI integrates wearables, app interactions, EHRs, and even environmental/contextual signals (weather, pollution, mobility).

◉Adaptive goal-setting: Nudges and targets shift dynamically (e.g., HbA1c reduction pace, exercise increments).

◉Adherence reinforcement: Precision nudges (gamification, reminders) optimized per patient’s motivation type.

◉Clinical impact: Higher engagement → improved biomarkers (HbA1c, BP, weight loss).

2. Risk Prediction & Early Intervention

◉Predictive analytics: Identifies impending exacerbations (asthma, COPD, CHF).

◉Biomarker proxies: AI derives digital biomarkers (e.g., cough sound analysis, gait irregularity).

◉Intervention orchestration: System auto-triggers provider alerts, med titration, or behavioral nudges.

◉Impact: Reduced ER visits, hospitalizations, payer costs.

3. Dynamic Dose/Behavior Titration

◉Adaptive therapy: ML adjusts intensity/frequency of CBT modules or dietary challenges.

◉Closed-loop feedback: Like insulin pumps, but for behavior/therapy modules.

◉Precision delivery: Avoids fatigue (over-prescription) or underdose (low-intensity, ineffective).

◉Example: AI ups CBT frequency during depressive relapse signals.

4. Engagement Optimization

◉Reinforcement learning: Optimizes message timing, tone, and channel (push vs SMS vs email).

◉Gamified loops: AI balances short-term engagement vs long-term retention.

◉Micro-segmentation: Personalizes by circadian rhythms, demographics, emotional states.

◉Result: Higher daily active users, reduced churn.

5. RWE (Real-World Evidence) at Scale

◉Automated phenotyping: Identifies patient subtypes from real-world cohorts.

◉Causal inference engines: Simulate outcomes vs comparator groups.

◉Regulatory use: RWE supports FDA/EMA dossiers, payer negotiations, HTA submissions.

◉Commercial impact: Speeds reimbursement, broadens prescriber adoption.

6. Population Stratification

◉Unsupervised clustering: Finds hidden subgroups (e.g., high-friction adherence, relapse-prone).

◉Resource allocation: Human coaching prioritized for “at-risk” cohorts.

◉Equity dimension: Stratification ensures underserved populations get tailored pathways.

◉ROI: Optimized cost per outcome.

7. Safety Monitoring

◉Anomaly detection: Continuous surveillance of device/app signals (abnormal BP spikes, missed meds, sensor drift).

◉Predictive pharmacovigilance: Early flagging of safety signals in PDT–drug combinations.

◉Audit trails: Blockchain/NLP ensures traceability for regulators.

◉Trust-building: Encourages payer/provider adoption by lowering risk perception.

8. Clinical Workflow Assistance

◉AI triage bots: Pre-screens patients → clinician time saved.

◉Summarization engines: Convert longitudinal patient data into 1-page dashboard insights.

◉Decision support: Recommends care escalations, specialist referrals.

◉Impact: Lower clinician burnout, improved throughput.

9. Cost-Effectiveness Modeling

◉Digital twins: Patient-level simulations project long-term outcomes, costs saved.

◉Value-based contracts: AI-derived metrics inform payer deals (outcomes-linked reimbursement).

◉Population-level forecasts: Budgets modeled for 5–10 yr horizons → strengthens payer buy-in.

10. Scalability & Localization

◉Multilingual NLP: Converts CBT/educational modules into 20+ languages.

◉Cultural tailoring: Adapts tone, dietary modules, mental-health stigma sensitivity.

◉Mobile-first UX: Lightweight apps for low-bandwidth environments.

◉Equity lever: Expands reach to APAC/LatAm, Africa.

Regional Insights

North America (41% share, 2024)

Drivers:

◉Mature reimbursement pilots (CMS, employer adoption).

◉High chronic disease prevalence (obesity, diabetes, CVD).

Ecosystem moves:

◉Omada–Amazon distribution deal → mainstream visibility.

◉ATA–DTA merger → unified lobbying.

Regulatory path:

◉FDA Breakthrough Device designations accelerate PDT adoption.

◉Postmarket surveillance drives RWE infrastructure.

Asia-Pacific (fastest growth)

Macro enablers:

◉1B+ smartphone users; cheap data plans.

◉National digital-health pushes (India’s ABDM, China’s Healthy China 2030).

Clinical need:

◉Hypertension: 200M+ untreated in India.

◉Obesity & diabetes epidemic across SE Asia.

China specifics:

◉NMPA approvals (e.g., NERVTEX for movement disorders).

◉Local AI-first DTx startups scaling fast.

Europe

Policy leadership:

◉Germany’s DiGA sets precedent → reimbursement pathway.

◉France, UK piloting similar “app prescription” models.

HTA rigor:

◉NICE, IQWiG frameworks force robust clinical/RWE evidence.

◉Companies required to prove outcomes + cost savings.

Latin America

Adoption levers:

◉Wearables booming (Brazil’s 2023 volume growth).

◉COFEPRIS (Mexico) clearing AI DTx → precedent.

Public sector:

◉Ministries forming digital-health secretariats.

◉Opportunity for population-scale pilots in diabetes/obesity.

Middle East & Africa

Focus markets:

◉GCC (UAE, KSA) digitization + AI health pilots.

◉South Africa → first mover in Sub-Saharan.

Enabler:

◉Mobile-first, app-based programs critical.

◉AI localization → Arabic, African dialects.

Market dynamics

1) Driver — Preventive healthcare

Mechanisms

◉Home-first care pathways: continuous remote monitoring + automated nudges replace routine clinic visits for stable chronic patients, shifting spend away from episodic acute care.

◉Data-driven early detection: passive sensor-derived digital biomarkers (sleep, gait, activity, glucose trends) surface deterioration weeks earlier than symptom-driven care.

Commercial levers

◉Value-based contracts with payers: outcome clauses (reduced ER visits/hospital days) justify subscription/per-member-per-month (PMPM) pricing.

◉Employer roll-outs for population health (cardiometabolic programs sold as part of benefits).

Operational implications

◉Build closed-loop escalation rules (when to notify a nurse, when to route to teleconsult).

◉Invest in 24/7 triage and clinical oversight to sustain home-first safety.

KPIs to track

◉Reduction in acute events (ER visits/hospitalizations), change in key biomarker (e.g., mean HbA1c), program retention beyond 6–12 months.

2) Restraint — Adoption frictions

Regulatory fragmentation

◉Multijurisdictional product labeling complexity: one product may require different evidence packages per country/region.

◉Mitigation: modular regulatory strategy — seek one high-quality clearance (e.g., FDA/CE) and translate the dossier for other markets.

Evidence gap

◉Limited RCTs in niche indications reduce payer confidence. RCTs are expensive and long.

◉Mitigation: progressive evidence pathway — start with strong single-arm real-world cohorts + propensity-matched analyses, then confirm with pragmatic RCTs.

Privacy/security

◉Data residency and interoperability constraints (GDPR/HIPAA mindset) increase implementation friction.

◉Mitigation: privacy-by-design, on-prem/cloud hybrid options, transparent data-use consent flows.

Provider/patient hesitancy

◉Clinician workflow disruption and patient digital literacy limit uptake.

◉Mitigation: embed clinician-facing dashboards with concise actionable insights and low-friction patient onboarding (SMS-first, low-bandwidth modes).

3) Opportunity — Undiagnosed / untreated base

TAM mechanics

◉Large undiagnosed pools (e.g., hypertension, diabetes) represent high-ROI screening + low-cost intervention flows.

◉Monetization: screening-as-a-service to employers/payers; follow-on DTx subscription for newly diagnosed.

Operational playbook

◉Use mobile-first, low-friction screening (questionnaires, selfie vitals, simple device pairings) → triage → enrollment into DTx path.

Impact

◉Lower marginal cost per new patient vs clinic-based detection, rapid scalability in APAC/LatAm via mobile reach.

4) Threats & systemic risks

◉Reimbursement reversals: If evidence lags, payers could withdraw coverage — design contracts with phased guarantees and shared risk.

◉Adversarial AI risks: Model drift or bias could reduce efficacy — implement continuous validation and fairness audits.

◉Market crowding: Many narrow DTx apps could fragment attention; differentiation via clinical outcomes and provider integration is critical.

Top companies

Omada Health

◉Product focus: Scalable cardiometabolic programs (diabetes prevention/management, hypertension).

◉Business model: Employer and payer contracts (PMPM or per-enrollee pricing); enterprise deployments.

◉Evidence/strengths: Outcomes-driven programs with employer case studies; strong channel expansion (Amazon).

◉Go-to-market levers: Employer wellness programs, pay-for-outcomes pilots, retail health integrations.

◉Risk: Reliant on employer/payer procurement cycles — slow but high-value sales.

Welldoc (BlueStar)

◉Product focus: Prescription-grade diabetes self-management platform.

◉Business model: Prescriber/payer partnerships and licensing to health systems.

◉Evidence/strengths: FDA cleareances / clinical validation (heritage in diabetes).

◉Go-to-market: Clinical integration with endocrinology clinics, payers targeting composite glycemic outcomes.

◉Risk: Competes with device + CGM ecosystems; needs deep integrations.

Livongo (Teladoc)

◉Product focus: Connected monitoring devices + coaching across chronic conditions.

◉Business model: Employer/payer subscriptions; telehealth integration upsell.

◉Strengths: Large installed base; cross-sell into telehealth services.

◉Risk: Integration complexity post-acquisition and margin pressures.

Propeller Health (ResMed)

◉Product focus: Sensor-enabled respiratory disease management with AI analytics.

◉Business model: Device + platform licensing to health systems/payers; outcomes partnership with pharma/device makers.

◉Strengths: Clinical domain expertise, evidence of reduced exacerbations, Feb 2025 AI upgrade.

◉Risk: Hardware dependence may limit low-cost scale in LMICs.

Pear Therapeutics

◉Product focus: Prescription digital therapeutics (SUD/OUD, insomnia historically).

◉Business model: Prescription model with prescriber workflow; attempts at payer reimbursement.

◉Strengths: Trailblazer regulatory experience; PDT commercialization know-how.

◉Risk: High evidence bar and reimbursement complexity.

Noom

◉Product focus: Behavior-change weight management with coaching.

◉Business model: Consumer subscriptions + employer/payer offerings.

◉Strengths: Brand recognition, strong consumer engagement.

◉Risk: Consumer churn; needs clinical anchors for payer uptake.

Akili Interactive

◉Product focus: Prescription game-based DTx for attention disorders.

◉Business model: Prescription model licensed to providers/payers.

◉Strengths: Unique modality, high engagement.

◉Risk: Narrow indication focus; payer skepticism on long-term benefits.

Gaia AG, Big Health, Dario, Hygieia, Mango Health, Canary, Limbix

Shared themes:

◉Niche clinical specialization (mental health, sleep, insulin dosing, medication adherence).

◉Business models mix of employer/payer deals, direct-to-consumer, and prescriber-led prescriptions.

◉Differentiation if they offer strong RCTs/RWE and provider integrations.

◉Common risks: Evidence scale-up costs; navigating reimbursement and clinician adoption.

Segments covered

A) Diabetes (largest share in 2024)

◉Market drivers: High prevalence (>500M), continuous glucose monitoring uptake, clinical need for remote titration and adherence.

◉Clinical endpoints payers care about: HbA1c reduction, hypoglycemic event reduction, med adherence, hospitalizations avoided.

◉AI role: Pattern detection in CGM data, personalized insulin-dose suggestion engines (with clinician oversight), adherence nudges.

◉Commercialization: Payer & employer contracts; integration with diabetes clinics and device manufacturers (CGM/insulin pumps).

◉Evidence needed: RCTs showing clinically meaningful HbA1c reductions (often ≥0.5% accepted), and cost-effectiveness analyses.

Scaling challenges: Device compatibility, regulatory oversight for dosing algorithms, liability frameworks.

B) Obesity (fastest CAGR 2025–2034)

◉Market drivers: Rising obesity prevalence (WHO); consumer interest in weight programs; employer wellness budgets.

◉Clinical endpoints: Weight reduction (%) at 6–12 months, sustained weight loss at 1 year, cardiometabolic improvements.

◉AI role: Personalized meal/exercise plans, behavior-prediction nudges, relapse prevention modeling.

◉Commercialization: Direct-to-consumer subscriptions, employer-sponsored plans, integration with bariatric care pathways.

◉Evidence required: Demonstrations of clinically significant weight loss, long-term maintenance, impact on comorbidities.

◉Scaling challenges: Sustained engagement beyond 12 months; reimbursement largely fragmented.

C) Cardiovascular Disease (CVD) & Hypertension

◉Market drivers: Large modifiable risk pool; clear cost savings from BP control.

◉Endpoints: BP reduction, MACE (major adverse cardiac events) downstream, medication adherence.

◉AI role: Salt/smoking/alcohol behavior modification models; remote BP trend prediction for titration.

◉Commercialization: Payer pilots for high-risk cohorts; primary-care integrations.

◉Evidence: BP control vs usual care, reduction in hypertensive emergencies.

D) Respiratory (Asthma/COPD)

◉Market drivers: High exacerbation costs; adherence to inhaler technique is low.

◉Endpoints: Exacerbation frequency, ER visits, medication adherence, symptom-free days.

◉AI role: Inhaler sensor analytics, cough/sound analysis, exacerbation prediction alerts (Propeller example).

◉Commercialization: Partnerships with payers, device makers, and pulmonology clinics.

◉Evidence: Demonstrated reductions in exacerbations and hospital admissions.

E) Mental Health & CNS (Depression, Insomnia, ADHD)

◉Market drivers: High unmet need, shortage of mental-health clinicians, stigma reduction via apps.

◉Endpoints: Symptom-score reduction (e.g., PHQ, GAD), sleep efficiency, functional outcomes.

◉AI role: Adaptive CBT dosing, relapse prediction, sentiment-aware engagement.

◉Commercialization: Employer EAPs, health-plan coverage, prescription models for severe indications.

◉Evidence: RCTs or real-world comparative effectiveness showing durable symptom improvement.

F) Smoking Cessation & Others

◉Market drivers: Chronic disease prevention, high ROI for payers.

◉Endpoints: Cessation rates at 6–12 months, relapse rates.

◉AI role: Trigger identification, craving-prediction and tailored interventions.

By End-Use

Patients (largest share)

◉User journey: Awareness → Screening/Onboarding → Active program → Maintenance.

◉Adoption levers: Low-friction onboarding, human coaching tiers, device pairing support.

◉Retention tactics: Personalized content cadence, social/community features, measurable biomarker feedback.

Providers (fastest growth)

◉Integration needs: EHR interoperability, concise dashboards, escalation rules.

◉Reimbursement impetus: Integration with value-based care contracts and care-pathway standardization.

◉Sales motion: Clinical evidence + clinician champions + hospital system pilots.

Payers/Employers

◉Contract structures: PMPM subscription, outcomes-based rebates, pilot-to-scale agreements.

◉Decision criteria: Demonstrated ROI (reduced claims), population fit, user engagement levels.

◉Scaling playbook: Start high-risk pilot cohorts, then broaden to entire covered populations.

Top 5 FAQs

1 What’s the market size and growth?

2024 USD 7.7 B → 2025 USD 9.84 B → 2034 USD 90.83 B at 27.8% CAGR (2025–2034).

2 Which region leads today and which grows fastest?

North America leads with 41% (2024) share; Asia-Pacific grows fastest through 2034.

3 What’s driving adoption?

Preventive-care focus, smartphone/wearable penetration (5.6 B mobile users 2023 → 6.3 B by 2030), large undiagnosed/untreated populations (e.g., India hypertension gaps), and policy tailwinds.

4 How is AI changing DTx?

Personalized plans, risk prediction, dynamic content dosing, engagement optimization, scalable RWE generation, workflow integration, and value-based ROI analytics.

5 What recent moves matter most?

ATA×DTA (2025) policy consolidation; Dassault→Click (2025) RWE and approvals push; Propeller AI platform (2025); Click SE (2024); Omada×Amazon (2024); Better Tx Breakthrough (2024); ResMed–Somnoware (2023); Mexico COFEPRIS (2025); China NERVTEX (2023).

Access our exclusive, data-rich dashboard dedicated to the therapeutic area sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5664

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest