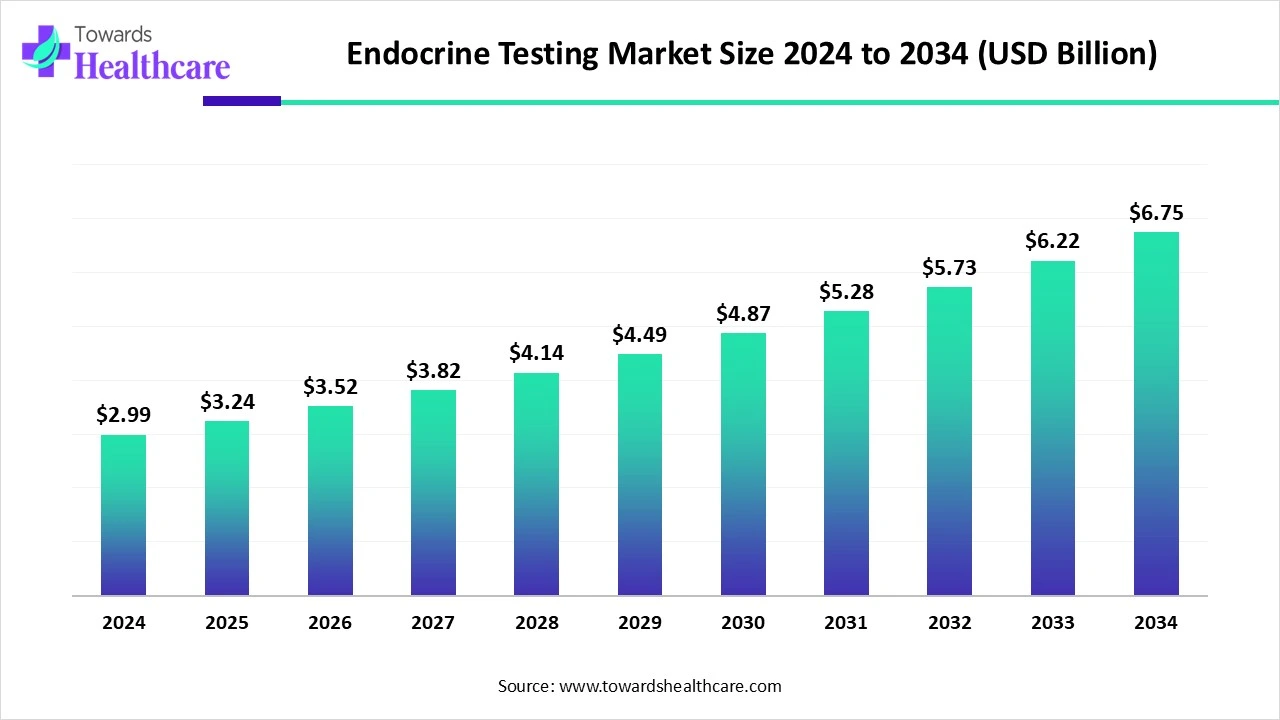

The global endocrine testing market was valued at USD 2.99 billion in 2024, grew to USD 3.24 billion in 2025, and is projected to reach about USD 6.75 billion by 2034, expanding at a CAGR of 8.54% (2025–2034) driven by rising endocrine disorders (diabetes, thyroid disease, infertility), expanded screening programs, and adoption of automated immunoassays and LC-MS/MS technologies.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6077

Market size

Base and near-term values

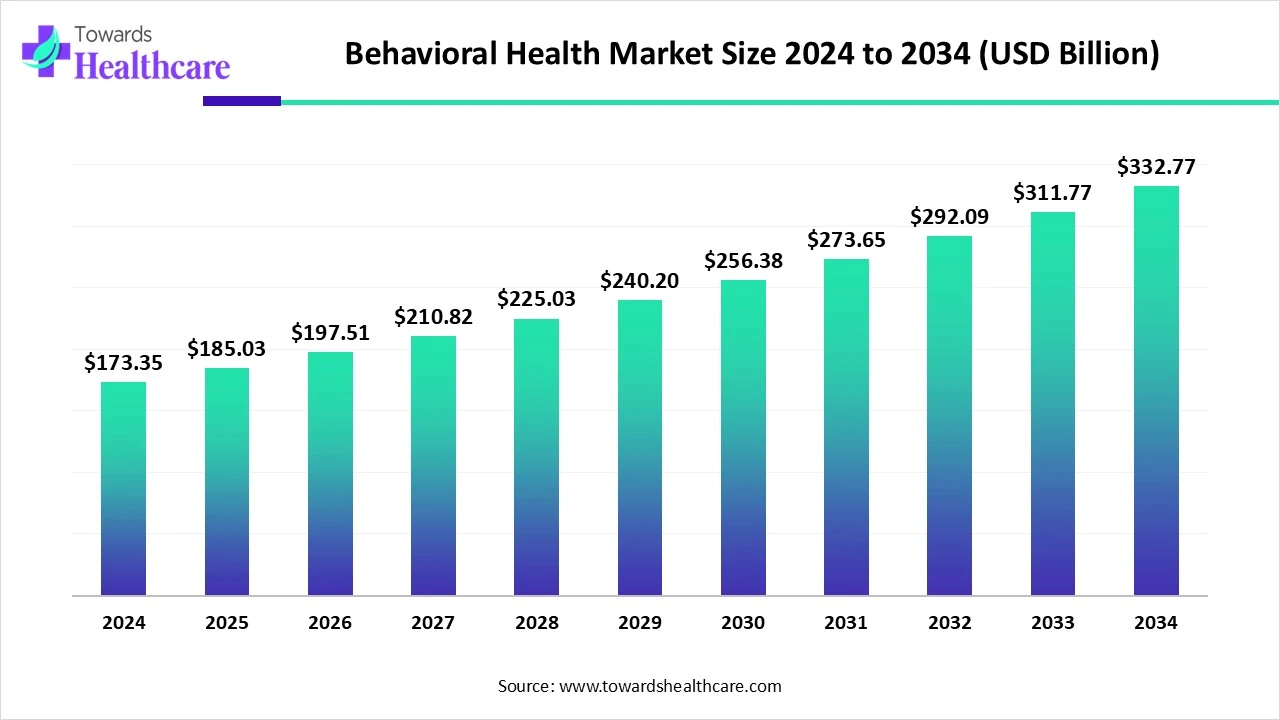

●2024 market size (reported): USD 2.99 billion.

●2025 market size (reported): USD 3.24 billion.

Long-term projection

●Projected 2034 market size (reported): USD 6.75 billion.

Growth metrics

●Reported CAGR for 2025–2034: 8.54%.

●Absolute projected increase from 2025 to 2034: USD 6.75B − USD 3.24B = USD 3.51 billion additional market value over that period.

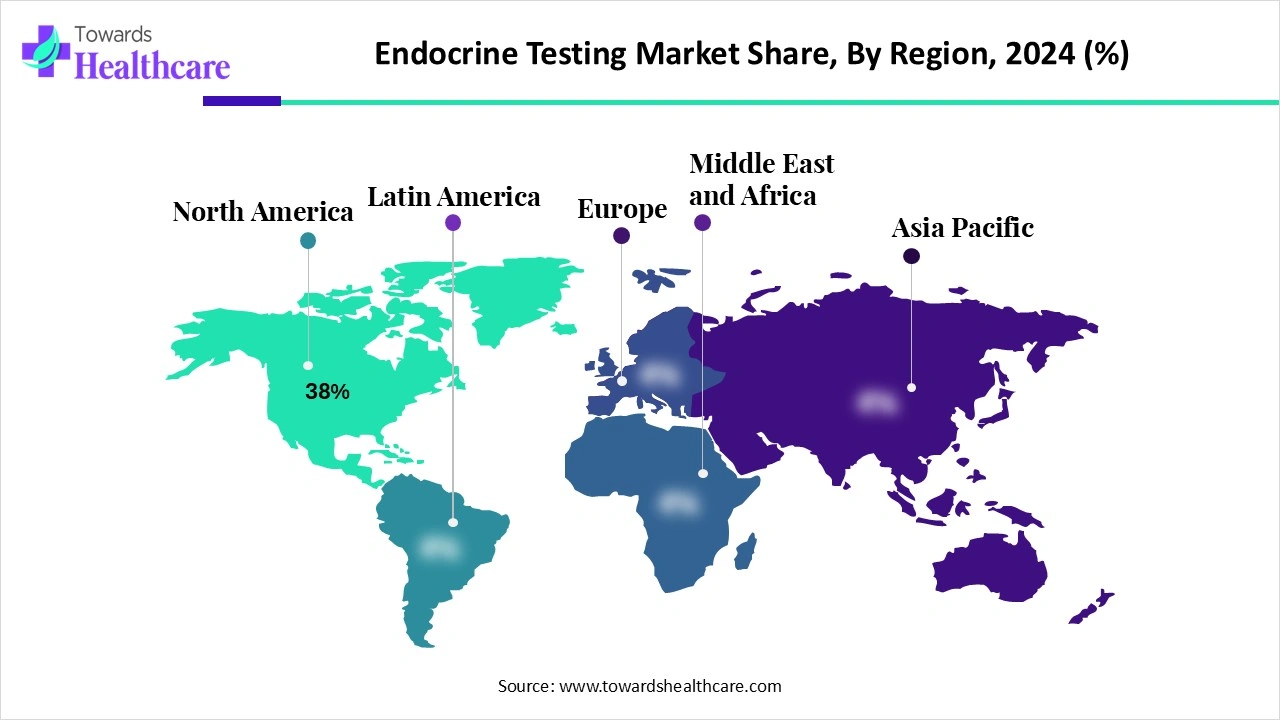

Regional weighting (scale & concentration)

●North America: 38% of global revenue in 2024 (dominant single region).

●Asia-Pacific: fastest growing region (no single % provided, but called out as highest CAGR region).

Major revenue drivers inside headline numbers

●Instruments & reagents accounted for 65% of market revenue in 2024 (largest revenue stream).

●Clinical & hospital laboratories accounted for 58% of end-user revenue in 2024 (largest end-user channel).

●Automated immunoassays comprised 52% of assay/platform revenues in 2024 (largest technology share).

●Diagnostic & monitoring of thyroid & diabetes comprised 60% of indications revenue in 2024 (largest indication group).

●Thyroid function tests alone were 38% of test-type share in 2024 (single most dominant test family).

Concentration / structure

●The market shows high instrument + reagent dependency (65% revenue share) — implying recurring consumable sales dominate monetization.

●Large labs/hospitals are primary buyers (38% regional + direct OEM sales dominance), indicating centralized procurement and long OEM relationships.

Market trends

Rising disease prevalence and screening expansion

●Diabetes and thyroid disease continue to drive baseline testing volumes (cited IDF 2025: 11.1% of adults 20–79 have diabetes; many undiagnosed), which supports routine testing demand and chronic monitoring volumes.

Shift to automation and high-throughput platforms

●Automated immunoassays held 52% share in 2024 — labs are consolidating around automated analyzers to handle large volumes, reduce TAT, and standardize results.

LC-MS/MS adoption for specialty assays

●Laboratory mass spectrometry (LC-MS/MS) marked as the fastest-growing assay platform, driven by demand for high specificity in steroid and low-level hormone panels.

Commercial models moving toward services

●Growth in contract testing/reference lab services and lab-as-a-service/send-outs—these service models are the fastest-growing revenue streams and distribution channels, allowing smaller clinics to access advanced assays without capital spend.

POC and at-home testing emergence

●Point-of-care glucose and at-home hormone tests (examples in the content) are expanding the testing universe beyond the lab and creating new consumer revenue channels.

Inorganic growth and partnerships

●M&A and partnerships (e.g., the Norman Parathyroid Center partnership) are being used to expand test access and referral flows quickly.

Funding into consumer/remote hormone testing

●Startups raising seed and pre-seed rounds (Hormona, Level Zero Health, Eli Health) show investor interest in remote monitoring, DNA/sensor technologies, and consumer-facing hormone tools.

Regulatory activity enabling new tests

●FDA 510(k) clearances (example: chemiluminescence free testosterone assay) enable faster clinical uptake of newer, faster assays.

Reimbursement and policy remain pivotal

●Favorable reimbursement in developed markets (cited for North America) continues to sustain higher per-test revenue and tech adoption.

AI impact / role

AI-assisted result interpretation and decision support

●Subpoint: Algorithms can analyze multi-analyte patterns (e.g., combinations of TSH, free T4, antibodies) to flag likely disease states or borderline results.

●Explanation: This reduces clinician diagnostic uncertainty, creates standardized interpretative comments, and minimizes follow-up testing due to ambiguous reports.

Automated QC and anomaly detection

●Subpoint: AI monitors instrument telemetry and assay performance to detect drift, lot issues, or pipetting anomalies in real time.

●Explanation: Proactive QC reduces false results, lowers repeat testing rates (cost saving), and supports laboratory accreditation efforts.

High-throughput data processing for LC-MS/MS

●Subpoint: Machine learning accelerates deconvolution of complex spectral data and improves peak integration for low-abundance hormones.

●Explanation: Improves sensitivity/specificity of steroid panels and reduces manual review time for mass spec results.

Predictive analytics for population screening

●Subpoint: AI models can combine historical lab data, demographic risk, and clinical notes to prioritize patients for targeted endocrine screening (e.g., undiagnosed diabetes or hypothyroidism).

●Explanation: In public health programs, this increases yield per screening dollar and helps allocate resources more efficiently.

Workflow orchestration & lab automation

●Subpoint: AI optimizes sample routing between automated analyzers, LC-MS/MS instruments, and send-out labs to minimize TAT and reagent wastage.

●Explanation: Especially valuable for labs operating hybrid automated + specialty workflows.

Personalized reference ranges & longitudinal trend detection

●Subpoint: AI builds individualized baselines from longitudinal hormone data (e.g., cyclical reproductive hormones) and flags meaningful deviations.

●Explanation: Reduces false alarms from single point testing and improves infertility or endocrine disorder management.

Integration with wearables and remote monitoring

●Subpoint: AI fuses periodic lab tests with continuous physiologic streams (sleep, HR variability, activity) to infer endocrine stressors (e.g., cortisol dynamics).

●Explanation: Enables novel remote monitoring services and chronic disease management products.

Clinical trial support & biomarker discovery

●Subpoint: Unsupervised learning to discover new endocrine biomarkers or composite indices predictive of disease progression or therapy response.

●Explanation: Creates upstream R&D value, boosting assay development pipelines.

Revenue & business model transformation

●Subpoint: AI enables value-based testing (predictive algorithms that reduce downstream costs) and subscription/monitoring services tied to automated interpretative reporting.

●Explanation: Shifts some spend from one-time tests to ongoing analytics services—aligns with instruments & reagents dominance (consumables) plus software/licensing revenue.

Regulatory, validation, and explainability challenges

●Subpoint: AI models used clinically need documented performance, transparency, and post-market monitoring—regulatory pathways are evolving.

●Explanation: Labs and vendors must invest in clinical validation, explainability tools, and data governance to deploy AI at scale.

Data privacy & interoperability concerns

●Subpoint: Combining lab results with EHR and wearables requires secure data exchange, consent models, and standardized APIs.

●Explanation: Failure to address privacy impedes adoption and may limit payer reimbursement for AI-enabled services.

Operational risk reduction

●Subpoint: AI can predict supply chain shortages (e.g., critical reagents) and recommend substitutions or schedule changes.

●Explanation: Helps labs avoid downtime and ensures continuity for high-volume endocrine tests.

Regional insights

North America (dominant; 38% share in 2024)

Market structure & drivers

●Large hospital systems and clinical labs with centralized procurement favor OEM direct sales and long-term service contracts.

●Reimbursement frameworks and public health programs (e.g., diabetes screening programs) sustain high per-capita test volumes.

Technology adoption

●High penetration of automated immunoassay platforms (52% share) and rapid adoption of LC-MS/MS for specialty assays.

Commercial implications

●Vendors prioritize instrument availability, on-site service, and reagent contracts; reference labs (LabCorp, Quest, ARUP) absorb complex send-outs.

Regulatory/innovation environment

●FDA clearances (example: free testosterone chemiluminescence assay) speed clinical adoption.

Asia-Pacific (fastest growth region)

Demand drivers

●Rising diabetes and thyroid disease prevalence, expanding healthcare infrastructure, and greater disposable income.

Market dynamics

●Significant upside for OEMs through distributorships and localized service networks; labs move from manual to automated platforms.

Country subpoints

●India and China: large addressable populations and increasing screening programs; early adopter hospitals in metros drive premium test uptake.

Challenges

●Variable reimbursement, fragmented lab networks, need for training & workforce development.

Europe

Health system diversity

●Mix of public and private provision; centralized procurements in some countries (e.g., NHS in UK).

Technology & R&D

●Strong clinical research networks and adoption of high-specificity assays; emphasis on quality and interoperability.

Latin America and MEA

Access & growth

●Lower baseline per-capita testing but high growth potential where screening programs are scaled.

Barriers

●Infrastructure, reimbursement limits, and workforce shortages slow adoption of advanced assay platforms.

Country specifics highlighted in content

United States

●High disease burden (CDC figures cited in content) and supportive programs such as NDPP; major purchasing power and high lab automation.

Canada

●Rapid expansion of POC and digital health tools; provincial health programs support preventive screening.

Market dynamics

Drivers

High prevalence of endocrine disorders

●Diabetes prevalence (IDF 2025: 11.1% of adults 20–79) and large numbers with thyroid disease support sustained testing demand.

Government screening & preventive programs

●Screening programs push routine testing volumes (noted as a key driver).

Technology advancements

●Automated immunoassays and LC-MS/MS increase throughput and diagnostic accuracy.

Recurring consumable revenue

●Instruments & reagents account for 65% of revenue, creating stable vendor cash flow.

Restraints

Shortage of skilled laboratory operators

●Limits capacity to adopt complex assays and to scale LC-MS/MS despite technical need.

Regulatory hurdles

●Lengthy approvals delay commercialization of new assays and AI tools.

Reimbursement limitations in some countries

●Limits patient access and dampens demand growth in markets without favorable coverage.

Opportunities

Reference/Contract testing growth

●Outsourcing provides access to advanced assays without heavy capital outlay; fastest growing end-user segment.

Infertility & reproductive endocrinology

●Reproductive hormone tests are fastest-growing test type due to infertility trends and ART uptake.

AI-enabled services and remote monitoring

●Creates new service layers (analytics/subscriptions) and improved disease monitoring.

Point-of-care and consumer testing expansion

●At-home cortisol/progesterone and POC HbA1c/glucose broaden market reach.

Top companies

Roche Diagnostics

●Product: Automated immunoassay analyzers, reagent kits, integrated lab automation.

●Overview: Market leader in high-throughput immunoassays; large installed base in hospitals and reference labs.

●Strengths: Strong reagent lifecycle (recurring revenue), global service network, broad assay menu (thyroid, diabetes, reproductive panels).

Abbott Diagnostics

●Product: Lab and point-of-care platforms (immunoassays, POC glucose/HbA1c), reagents.

●Overview: Dual strength in lab systems and POC solutions; strong presence in decentralized testing.

●Strengths: POC leadership, established reagent supply chain, diversified diagnostics portfolio.

Siemens Healthineers

●Product: Clinical chemistry and immunoassay analyzers, connectivity solutions.

●Overview: Major supplier to hospital labs; strong systems integration and service offerings.

●Strengths: Enterprise contracts, integration with hospital IT and LIS.

Beckman Coulter

●Product: Immunoassay analyzers and diagnostics reagents.

●Overview: Focus on clinical lab instrumentation and assay chemistry.

●Strengths: Robust analyzer platforms, built for high throughput labs.

Ortho Clinical Diagnostics

●Product: Immunoassay systems and reagents.

●Overview: Known for chemiluminescence and immunoassay test menus.

●Strengths: High throughput workflows and trusted assays for endocrine analytes.

Thermo Fisher Scientific

●Product: LC-MS/MS instrumentation, sample prep solutions, lab supplies.

●Overview: Strong in mass spectrometry and specialty testing instrumentation.

●Strengths: Technical leadership in LC-MS/MS (key for steroid and low-abundance hormone assays).

Agilent Technologies

●Product: Mass spectrometers, chromatography systems, lab consumables.

●Overview: Supplier to labs requiring high-sensitivity mass spec and separation technologies.

●Strengths: Analytical performance and support for research/clinical labs.

Waters Corporation

●Product: LC and mass spec systems optimized for clinical and research mass spec assays.

●Overview: Specialist in separations and MS workflows for endocrinology assays.

●Strengths: High-quality LC-MS workflows for steroid panels and specialty assays.

Bio-Rad Laboratories

●Product: Controls, calibration materials, some immunoassay reagents and QC products.

●Overview: Supplies many labs with QA/QC and reagent products that support endocrine testing reliability.

●Strengths: Strong reputation for controls and quality materials.

Other important players

●Tosoh Bioscience, Snibe/Mindray, Fujirebio, QuidelOrtho (assay suites), LabCorp, Quest Diagnostics, ARUP — collectively create the testing & reference lab backbone.

Latest announcements

EUROIMMUN (Revvity) — Jan 2025

●Announcement: FDA 510(k) clearance and CE marking for a chemiluminescence-based immunoassay that measures free testosterone with results in under 48 minutes.

●In-depth implication:

●Enables clinicians to get faster free testosterone results for hypogonadism workups.

●Validated CE/FDA status reduces barriers to clinical adoption in key markets.

●Competes in rapid immunoassay space — may capture send-out volumes currently performed by specialized labs.

IDEXX Laboratories — June 2025

●Announcement: Launch of Catalyst Cortisol Test (veterinary) — quantitative cortisol for on-site diagnosis of Cushing/Addison in dogs.

●Implication:

●Expands endocrine testing into veterinary POC domain; demonstrates cross-sector assay demand.

●Shows platform expansion strategy (adding cortisol to Catalyst menu).

Level Zero Health — March 2025

●Announcement: US $8.4M pre-seed to develop DNA-based sensor technology for remote continuous hormone monitoring.

Implication:

●Signifies investor interest in continuous/remote hormone data and novel biosensing approaches.

●If successful, could create new recurring monitoring revenue and change sampling paradigms.

Eli Health — January 2025 (CES debut)

●Announcement: At-home saliva + smartphone hormone test (cortisol, progesterone initially); beta in US & Canada, pricing ~US$8/month with yearly commitment.

Implication:

●Moves endocrine assessment into subscription, consumer-facing monitoring models.

●If clinically validated, may divert some wellness testing away from clinical labs to DTC channels.

Hormona (London) — May 2025

●Announcement: $6.7M seed financing for women’s hormone monitoring app + tests.

Implication:

●Highlights niche consumer health and female endocrine monitoring market opportunity.

Merck (August 2025 guideline adoption — noted in content)

●Announcement: New expert guidelines standardizing pediatric endocrine tests in Australia/New Zealand.

Implication:

●Guidelines increase standardized testing uptake and can change test mix and volumes in regional markets.

Norman Parathyroid Center & Any Lab Test Now (July 2025 partnership)

●Announcement: Nationwide partnership to expand hyperparathyroidism testing access.

Implication:

●Example of clinical center + retail lab collaboration to improve access and awareness for underdiagnosed endocrine disorders.

Recent developments

Funding & startups

●Hormona ($6.7M seed), Level Zero Health ($8.4M pre-seed), Eli Health (product launch + beta) — capital flowing into consumer and remote hormone testing.

Regulatory approvals enabling faster assays

●EU/US clearances for chemiluminescence testosterone assay (EUROIMMUN) — supports clinical adoption of faster, automated endocrine assays.

Veterinary test expansion

●IDEXX Catalyst cortisol launch — demonstrates veterinary endocrine testing evolution and platform menu extension.

Partnerships expanding reach

●Norman Parathyroid Center + Any Lab Test Now — clinical partnerships to expand diagnostic reach for specific endocrine disorders.

Guideline standardization

●New pediatric endocrine test guidelines in Australia/New Zealand (Merck-supported) — standardized testing triggers greater uptake and uniformity across labs.

Emerging business models

●At-home subscription services and lab-as-a-service/send-out models are scaling; reference labs and specialized contract testing are capturing complex assays.

Segments covered

By Test Type

Thyroid Function Tests (TSH, free T4, free T3, antibodies)

●Dominant (≈ 38% of test-type share). Essential for broad screening and chronic monitoring; high repeat frequency; automation friendly.

Diabetes Monitoring & Glycemic Tests (HbA1c, glucose, fructosamine)

●High volume, recurring tests for chronic disease management; many performed in POC and central labs.

Reproductive / Sex Hormone Tests (estrogen, progesterone, testosterone, LH, FSH)

●Fastest-growing due to fertility care demand and delayed parenthood trends.

Adrenal (Cortisol/ACTH), Bone & Calcium Metabolism, Pituitary Panels, Steroid/Androgen LC-MS/MS

●Specialty tests with higher per-test value and increasing LC-MS/MS adoption.

Pediatric & Newborn Screening

●Public health programs (congenital hypothyroidism, CAH) lead to stable baseline volumes.

By Technology / Assay Platform

●Automated Immunoassays (Chemiluminescence, ECLIA) — largest 52% share. Strengths: throughput, standardization.

●LC-MS/MS (Laboratory Mass Spectrometry) — fastest-growing for specificity.

●POC Platforms & At-home Tests — extend market reach; important for diabetes and some hormone monitoring.

●ELISA & Manual Assays — niche/low volume.

●Multiplex / Microarray — emerging for panel testing and research use.

By Indication / Clinical Use

●Diagnostic & Monitoring of Thyroid & Diabetes (60% share) — core revenue engine; frequent monitoring.

●Infertility / Reproductive Endocrinology — fastest growth as ART and fertility care expand.

●Adrenal / Osteoporosis / Pediatric — specialty but important clinical niches.

By End User / Buyer

●Clinical & Hospital Laboratories (58% share) — dominant end users with in-house testing capacity.

●Reference & Specialty Laboratories — fastest-growing for complex assays.

●Physician Office Labs, POC Settings, DTC/Wellness Providers — important for decentralized testing.

By Revenue Stream / Business Model

●Instruments & Reagents (65% revenue share) — primary monetization (hardware + recurring consumables).

●Contract Testing / Reference Lab Services — expanding as send-out demand rises.

●Calibration, Controls, Service & Maintenance — critical recurring revenue for installed bases.

●Software & Connectivity (LIS, cloud reporting, assay algorithms) — growing as value-add differentiator.

By Distribution Channel

●Direct OEM Sales to Large Labs & Hospitals — biggest revenue share in 2024; emphasizes relationship selling and on-site service.

●Distributors & Regional Partners — enable SME labs and clinics.

●Lab-as-a-Service / Send-outs — fastest growth; reduces capital barriers for smaller providers.

●Retail / POC Channels (glucometers, home HbA1c) — consumer access and recurring supplies.

Top 5 FAQs

Q1: What is the current size and expected growth of the endocrine testing market?

A: The market was USD 2.99B in 2024, USD 3.24B in 2025, and is projected to reach USD 6.75B by 2034, growing at a CAGR of 8.54% (2025–2034).

Q2: Which region leads the endocrine testing market and what share does it hold?

A: North America led in 2024 with roughly 38% of global revenue, driven by established healthcare infrastructure, reimbursement, and high adoption of automated immunoassays and LC-MS/MS.

Q3: Which test types and technologies dominate the market?

A: Thyroid function tests dominated test-type share (≈38% in 2024). Automated immunoassays were the largest technology platform (52%), while LC-MS/MS is the fastest-growing technology for specialty hormone assays.

Q4: Who are the major buyers and what revenue streams matter most?

A: Clinical & hospital laboratories were the largest end-user reflecting recurring consumable demand.

Q5: What are the main market restraints and opportunities?

A: Restraints: shortage of skilled lab operators and regulatory hurdles limiting new assay adoption; reimbursement gaps in some markets. Opportunities: rising prevalence of hormonal disorders (e.g., diabetes at 11.1% of adults 20–79 per IDF 2025), growth in reproductive hormone testing, expansion of reference lab services, and AI-enabled diagnostics and remote monitoring.

Access our exclusive, data-rich dashboard dedicated to the diagnostics sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/download-sample/6077

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest