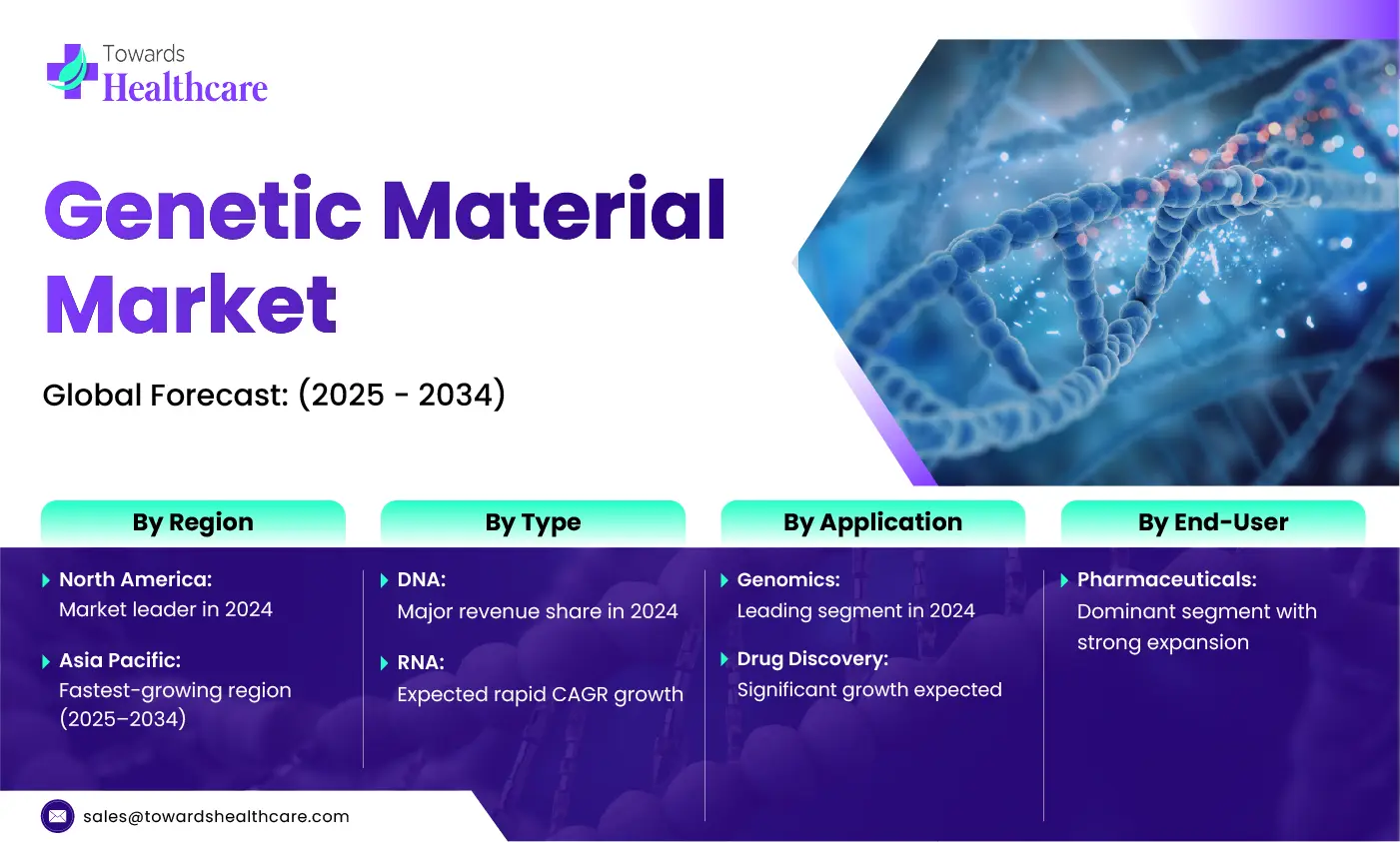

The global genetic material market driven by DNA’s largest market share in 2024 and a fast-growing RNA segment — is accelerating from 2025–2034 as investments (for example, NIH’s $140M program and multiple venture rounds such as Coave’s €32M in Jan 2025) and government support expand genomic research, gene editing (CRISPR, prime/base/PGI), personalized medicine, and biomanufacturing across healthcare, agriculture and biotech.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5470

Market size

Relative market positioning (2024 baseline)

◉DNA held the largest share of the market in 2024 (dominant incumbent segment).

◉RNA was the fastest-growing type segment projected over the forecast period (2025–2034).

Regional market scale indicators

◉North America: Market leader in 2024 (largest share) driven by a mature biotech ecosystem and large R&D spend.

◉Asia-Pacific: Fastest projected growth during the forecast period owing to rising healthcare spend, scale, and government initiatives in China, India, Japan.

End-user concentration and scale signals

◉Pharmaceuticals represented the major end-user share in 2024, reflecting biopharma dependence on genetic material for biologics, plasmid DNA, and advanced therapies.

Notable investment & funding datapoints (market scale proxies)

◉NIH invested $140M (May 2023) for genetic diversity research — a public funding signal of market importance.

◉Coave Therapeutics Series A: €32M (US$33M) in Jan 2025 (industry investment into delivery/vector platforms).

◉Tome Biosciences raised $213M VC (Dec 2023) to commercialize a novel gene editing approach (shows large private capital availability).

◉Concinnity Genetics seed: £3M (Dec 2024); MRC CoRE awards: up to £50M each over 14 years (Dec 2024) — institutional backing for long-term R&D.

◉India: bioeconomy projected from US$137B (2022) → US$300B by 2030 (country-level scale growth supporting regional market expansion).

Qualitative scale conclusion

◉The market is large and expanding rapidly in monetary terms (significant public & private capital flows), with DNA as the incumbent revenue base and RNA as the high-growth opportunity that will capture rising share across therapeutics, diagnostics and synthetic biology.

Market trends

Shift from generic to novel biologics & gene-based therapeutics

◉Countries (e.g., China) transitioning from generic manufacturing to novel drug development (you cited pipeline growth 2,251 → 4,390 novel drugs by early 2024), fueling demand for plasmids, synthetic genes and tooling.

RNA renaissance

◉RNA segment fastest growing — driven by mRNA vaccines/therapeutics learnings and expanded interest in oligonucleotides, siRNA, antisense, and delivery chemistries.

Continued dominance of DNA

◉DNA remains the largest revenue contributor (plasmids, rDNA used across biomanufacturing, research reagents, and diagnostics).

Integration of gene editing innovations

◉Emergence of new editing platforms (e.g., PGI / prime-guided insertion claims such as Tome’s approach) expanding the types of edits feasible (large insertions, safer editing), enabling new product classes.

Public funding and centers of excellence

◉Large public programs (NIH $140M; MRC CoRE £50M awards) are accelerating basic research and translational capacity, de-risking the pipeline for private capital.

Scale-up & biomanufacturing push

◉Governments investing in domestic manufacturing (Canada’s $2.3B for biomanufacturing & vaccines initiatives) — increasing demand for high-quality genetic material at scale (e.g., plasmid DNA for biologics).

Consolidation & vertical integration by large instrumentation and reagent players

◉Established instrument and reagent companies (Illumina, Thermo Fisher, Roche, Danaher, QIAGEN, etc.) expand portfolios to capture upstream sample prep, sequencing, and downstream analytics.

Geographic rebalancing

◉Faster growth in Asia Pacific and strong European and North American hubs—research intensity and regulatory ecosystems shape where value capture concentrates.

Data & interpretability bottlenecks

◉As volumes grow, the complexity of interpreting genetic data emerges as a key limiting factor unless solved by bioinformatics and AI.

AI impact / role in the genetic material market

High-throughput data processing & variant calling

◉AI models accelerate alignment, variant calling and filtering from NGS output, reducing false positives, and enabling real-time QC of sequencing runs.

◉Impact: lowers bioinformatics labor, speeds time-to-insight for discovery and diagnostics.

Interpretation & clinical annotation

◉ML/NLP systems curate literature and clinical databases to annotate variants (pathogenicity scoring, evidence synthesis).

◉Impact: translates raw sequence data into clinically actionable reports, addressing the “complexity in data interpretation” restraint you listed.

Target discovery & prioritization for drug discovery

◉AI integrates genomic, transcriptomic and proteomic datasets to propose novel targets and predict drug-gene relationships, increasing hit rates for therapeutic hypotheses.

◉Impact: improves success probability in preclinical selection and reduces costly failures in the clinic.

Design of genetic constructs & sequence optimization

◉Generative models and constrained optimization tools design codon-optimized genes, mRNA UTRs, and plasmid backbones for improved expression/stability.

◉Impact: accelerates construct generation, improves yields in biomanufacturing and shortens R&D cycles.

Predictive modeling for delivery & editing outcomes

◉AI predicts guide RNA efficiency, off-target risk (CRISPR), and vector tropism; also models nanoparticle and LNP delivery kinetics.

◉Impact: increases safety and efficacy of gene therapies and RNA therapeutics; reduces wet-lab trial/error.

Synthetic biology and pathway engineering

◉ML helps design metabolic pathways, optimize enzyme variants and predict flux, enabling synthetic production of complex biomolecules.

◉Impact: expands use cases for genetic material in bio-manufacturing and agricultural engineering.

Automation, robotics and laboratory workflows (AI orchestration)

◉AI coordinates automated liquid handlers and sequencing pipelines (experiment design to data QC), enabling scale and reproducibility.

◉Impact: reduces cost per data point and makes large cohort studies tractable.

Regulatory & quality evidence generation

◉AI supports standardized analysis pipelines that help generate reproducible QC and validation metrics required by regulators.

◉Impact: smooths regulatory submission pathways for gene therapies and diagnostics.

Population genetics & risk stratification

◉AI synthesizes large population datasets (such as NIH programs) to improve polygenic risk scores and identify population-specific allele effects.

◉Impact: expands precision medicine and target selection informed by human genetics.

Ethics, bias detection and governance

◉AI tools flag potential biases in training data (ancestry skew), aiding more equitable genomic interpretations and better generalization across populations.

◉Impact: reduces health disparities and strengthens scientific validity.

Commercial productization of AI-driven services

◉Startups and incumbents use AI as a product differentiator (faster annotation, superior variant prioritization) — driving value capture beyond raw reagents/instruments.

Regional insights

1 North America (U.S. & Canada)

Market leadership & innovation density

◉Explanation: Concentration of biotech companies, venture capital, top academic centers; this underpinned North America’s dominance in 2024.

Capital markets & commercialization

◉Data point: U.S. biotech IPOs (2024) generated $6.6B and 23% of IPO proceeds — signaling deep capital markets for scale-up.

◉Explanation: Strong public/private exit environment incentivizes R&D investments in genetic material technologies.

Regulatory infrastructure

◉Explanation: FDA, EPA, USDA oversight creates clear regulatory pathways (albeit strict), enabling high-value product development but requiring clinical evidence and validation.

2 Asia Pacific (China, India, Japan, South Korea)

Fastest growth dynamics

◉Explanation: Rapid healthcare spending increases, large patient populations, and policy emphasis on biotech.

China

◉Data: Pipeline growth to 4,390 novel medicines by early 2024 — explanation: government prioritization and strong R&D support transitioning toward novel therapeutics.

India

◉Data: Large manufacturing base (≈10,500 plants, 3,000 companies), bioeconomy projected US$300B by 2030 from US$137B (2022).

◉Explanation: India’s low-cost manufacturing and growing biotech capability create opportunities for contract manufacturing of genetic material (plasmids, oligos) and scale production.

Market implications

◉Explanation: APAC offers cost advantages for manufacturing and massive patient cohorts for trials; regulatory harmonization and IP frameworks vary, affecting market entry.

3 Europe (UK, Germany, France, etc.)

Science & funding strength

◉Data: UK spends high proportion on health R&D (second after US in your summary), MRC funding (CoRE up to £50M) demonstrates long-horizon commitment.

◉Explanation: Strong translational research ecosystems produce spinouts and attract venture capital and public funds.

Industrial investments

◉Example: Germany attracting billion-dollar investments by multinationals (Eli Lilly, Roche, Sanofi investments cited) reflects on-shore production and high-skill workforce.

4 Latin America & MEA (summary)

Emerging markets

◉Explanation: Lower current share but rising interest in genomic diagnostics and agricultural biotech; regulatory and infrastructure limitations remain gating factors.

Opportunities

◉Explanation: Contract research and partnerships with multinationals to expand local capacity.

Market dynamics

Drivers

Rising demand for gene & cell therapies (CGTs)

◉Explanation: Novel allogeneic cell treatments and gene therapies drive demand for high-quality plasmid DNA, viral vectors, mRNA, and synthetic constructs.

Public & private investment

◉Examples: NIH $140M; Coave €32M; Tome $213M — capital fuels platform development and scale-up.

Regulatory & policy support for domestic capacity

◉Example: Canada’s $2.3B investment into biomanufacturing and vaccines ecosystem increases local demand and resilience.

Technological convergence (sequencing, editing, AI)

◉Explanation: Improvements in throughput and cost per base for sequencing, plus editing and AI, increase utility and commercial applications.

Restraints

Complexity in data interpretation

◉Explanation: Need for bioinformatics, statistical genetics expertise is a bottleneck for unlocking value from raw genetic material datasets.

Regulatory and safety hurdles

◉Explanation: Gene therapies and edited organisms face stringent safety/regulatory pathways that extend time to market and increase costs.

Manufacturing scale & quality control

◉Explanation: High-purity plasmids, GMP-grade material and vector manufacturing are capital and skill intensive.

Opportunities

Collaborative research & tech breakthroughs

◉Explanation: Centers of excellence (MRC CoRE) and public programs (NIH) create translational hubs that reduce technical and financial risks.

RNA therapeutics expansion

◉Explanation: RNA’s rapid growth opens new therapeutic classes (intracellular targets previously undruggable).

Bio-manufacturing and vertical integration

◉Explanation: On-shoring capacity and contract manufacturing partnerships create market opportunities across regions.

Top companies (product, overview, strength)

1 Illumina, Inc.

◉Product/Offerings: Next-generation sequencing (NGS) platforms, consumables and library prep kits.

◉Overview: Market leader in high-throughput sequencing systems used in genomics research and clinical sequencing.

◉Strengths: Dominant platform footprint, extensive reagent consumable ecosystem, strong R&D pipeline and installed base enabling recurring consumables revenue.

2 Thermo Fisher Scientific Inc.

◉Product/Offerings: Sequencing instruments (through acquisitions), sample prep, reagents, lab automation and life-science tools.

◉Overview: Broad life-science tools conglomerate serving discovery-to-production workflows.

◉Strengths: Broad product breadth across the genetic material value chain, global distribution and GMP manufacturing capacity.

3 QIAGEN

◉Product/Offerings: Sample prep kits, nucleic acid isolation, PCR/qPCR and molecular diagnostic platforms.

◉Overview: Specialist in upstream sample integrity and molecular diagnostics enabling downstream sequencing and analysis.

◉Strengths: Market penetration in clinical diagnostics, trusted sample prep workflows, and strong partnerships with instrument vendors.

4 F. Hoffmann-La Roche Ltd (Roche Diagnostics / Sequencing)

◉Product/Offerings: Molecular diagnostics, sequencing solutions (through subsidiaries), clinical assays.

◉Overview: Large pharma/diagnostics player with integrated diagnostic pipelines supporting clinical adoption of genetic testing.

◉Strengths: Clinical validation expertise, regulatory experience, and strong relationships with hospitals and clinical labs.

5 Danaher Corporation

◉Product/Offerings: Instruments and consumables through subsidiaries (e.g., Beckman Coulter, Leica, Pall) across sample prep, cell analysis and purification.

◉Overview: Instrumentation powerhouse with diversified life-science portfolio.

◉Strengths: Operational excellence, broad customer base, ability to commercialize across discovery and manufacturing.

6 Thermo Fisher / Agilent / PerkinElmer / Bio-Rad / Abbott / Eurofins / Sysmex / FUJIFILM Irvine Scientific / Empire Genomics (grouped highlights)

◉Product/Offerings: Ranging from analytical instrumentation, reagents, clinical diagnostics, sequencing services, and contract genomics.

◉Overview: Each plays a role in either providing instruments, consumables, diagnostic assays or services that rely on high-quality genetic material.

◉Strengths: Brand recognition, distribution networks, and domain expertise — enabling them to integrate into genomics pipelines.

7 Myriad Genetics, Inc.

◉Product/Offerings: Genetic tests and diagnostics (clinical risk panels).

◉Overview: Focused on genetic testing and interpretation for hereditary conditions and oncology.

◉Strengths: Clinical test portfolios and experience in variant interpretation for diagnostics.

8 Novartis AG

◉Product/Offerings: Therapeutics leveraging genetic insights (gene therapy programs via affiliates/partnerships).

◉Overview: Pharma company using genetic material technologies to create advanced therapeutics.

◉Strengths: Drug development expertise, scale, and ability to commercialize complex biologics/gene therapies.

Latest announcements

Coave Therapeutics — Series A (€32M / US$33M) — January 2025

◉Summary: Raised €32M to develop ALIGATER (Advanced Vectors-Ligand Conjugates) platform.

◉Significance: Investment signals strong interest in next-generation vector platforms for targeted gene delivery; ALIGATER suggests a vector+ligand conjugate strategy to improve tissue targeting and reduce off-target effects. Financial scale indicates investor confidence in delivery improvements.

NIH Common Fund — $140M investment — May 2023

◉Summary: Funding genetic diversity studies in healthy human tissues and cells.

◉Significance: Enables large population-scale reference data which supports target discovery, reference allele frequency resources, and improved disease/aging research; directly benefits companies building interpretive AI and variant annotation services.

Tome Biosciences — $213M VC — December 2023

◉Summary: Came out of stealth with funding to commercialize a method (PGI) for sequence insertion — claim that it allows insertion of any sequence of any size into any programmed location.

◉Significance: If validated, this represents a potentially paradigm-shifting editing capability (beyond small base edits), enabling new gene therapy modalities and complex genomic engineering.

Concinnity Genetics — Seed £3M — December 2024

◉Summary: University of Edinburgh spin-out securing seed funding.

◉Significance: Example of academic spinouts translating gene regulation/control technologies; seed funding supports early commercialization of control-based genetic tech.

MRC Centres of Research Excellence (MRC CoRE) — Up to £50M each over 14 years — December 2024

◉Summary: Two first MRC CoRE awards to develop cutting-edge treatments for previously incurable diseases.

◉Significance: Long-term public funding to create deep translational research hubs — will catalyze new therapeutics and boost talent/technology pipelines.

Recent developments

Academic ↔ Industry translation increasing

◉Examples: Concinnity spinout, MRC CoRE — academic innovations are spinning into startups and long-term funded centers.

◉Implication: Pipeline for new genetic technologies (control, editing, delivery) is strengthening.

Large private capital flows into editing platforms

◉Examples: Tome ($213M), Coave (€32M) — venture capital targets platform technologies (editing, delivery) rather than only end therapeutics.

Public programs generating large datasets

◉Example: NIH $140M genetic diversity program — these datasets will become foundational for drug discovery, variant interpretation, and population-specific medicine.

National strategies for self-sufficiency in biomanufacturing

◉Example: Canada’s $2.3B in bio/manufacturing & vaccine ecosystem — supporting domestic manufacturing of genetic materials and biologics.

Shifts in pharmaceutical R&D & market composition

◉Example: China’s expanded novel drug pipeline (2,251 → ~4,390) underscores global R&D redistribution toward novel modalities, increasing demand for genetic material inputs.

Segments covered

By Type

DNA

◉Subpoints: Plasmid DNA for biologics, rDNA constructs for research, genomic DNA for sequencing and diagnostics.

◉Explanation: DNA is foundational for recombinant protein expression, vaccine backbones, diagnostic assays and genomic reference materials — hence largest share in 2024.

RNA

◉Subpoints: mRNA therapeutics/vaccines, siRNA/miRNA therapeutics, antisense oligonucleotides, non-coding RNA research reagents.

◉Explanation: Rapid growth due to mRNA vaccine success and expanding therapeutic formats targeting intracellular pathways.

Genes

◉Subpoints: Synthesized gene cassettes, codon-optimized ORFs, therapeutic transgenes for gene therapy.

◉Explanation: Custom gene sequences are used for therapeutic payloads and research constructs.

Chromosomes

◉Subpoints: Artificial chromosomes for complex gene delivery, large sequence engineering for synthetic biology.

◉Explanation: Emerging area for delivering large, multi-gene circuits in cell therapies and advanced synthetic biology.

By Application

Genomics

◉Subpoints: Whole genome/exome sequencing, large cohort studies, population genetics resources.

◉Explanation: Drives demand for high-quality reference DNA/RNA and sequencing consumables.

Drug Discovery

◉Subpoints: Target ID, functional genomics screens, CRISPR screens, synthetic gene libraries.

◉Explanation: Genetic materials enable target validation and screening modalities.

Proteomics

◉Subpoints: Constructs for recombinant protein expression, tagged genes for mass spec workflows.

◉Explanation: DNA/RNA constructs are inputs for producing proteins used in proteomics assays.

Bioinformatics

◉Subpoints: Data pipelines, annotation databases, variant interpretation tools.

◉Explanation: Complementary segment enabling interpretation of genetic data.

Synthetic Biology

◉Subpoints: Metabolic pathway engineering, engineered microbes/plants, agricultural trait modification.

◉Explanation: Genetic materials are the building blocks for engineered organisms used in bio-manufacturing and crop improvement.

By End User

Pharmaceuticals

◉Subpoints: Biologics, gene therapies, mRNA vaccines — largest end-user share in 2024.

Medicines (broader)

◉Subpoints: OTC/companion diagnostics, biologic generics, advanced therapeutics.

Agriculture

◉Subpoints: GMO crops, trait engineering, veterinary biotech.

Others

◉Subpoints: Academic research, contract research organizations, forensics.

By Region

◉North America, Asia-Pacific, Europe, Latin America, MEA — each with differing growth drivers noted above.

Top 5 FAQs

Q1 : Which segment held the largest share of the genetic material market in 2024?

A: The DNA segment held the largest share in 2024 (DNA remains the incumbent revenue base across biotech, diagnostics and biomanufacturing).

Q2 : Which segment is growing fastest and why?

A: RNA is the fastest-growing segment (driven by mRNA therapeutics/vaccines, oligonucleotide drugs, and increased research interest in RNA biology and delivery technologies).

Q3 : Which region dominated the market in 2024 and which region is projected to grow fastest?

A: North America dominated in 2024; Asia-Pacific is projected to grow fastest during the forecast period due to rising healthcare spend and large market opportunities in China, India and Japan.

Q4 : What are the main drivers and restraints for market growth?

A: Drivers include rising demand for gene and cell therapies, strong public/private funding (e.g., NIH $140M, Coave €32M), and technological advances. Restraints include complexity of genetic data interpretation and manufacturing/regulatory hurdles.

Q5 : Which companies and developments should stakeholders watch?

A: Watch instrument/reagent leaders Illumina, Thermo Fisher, QIAGEN, Roche, Danaher, and new platform startups (e.g., Tome Biosciences’ $213M venture raise and Coave’s €32M) because they indicate both technological direction (editing/delivery) and capital flows.

Access our exclusive, data-rich dashboard dedicated to the biotechnology sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5470

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest