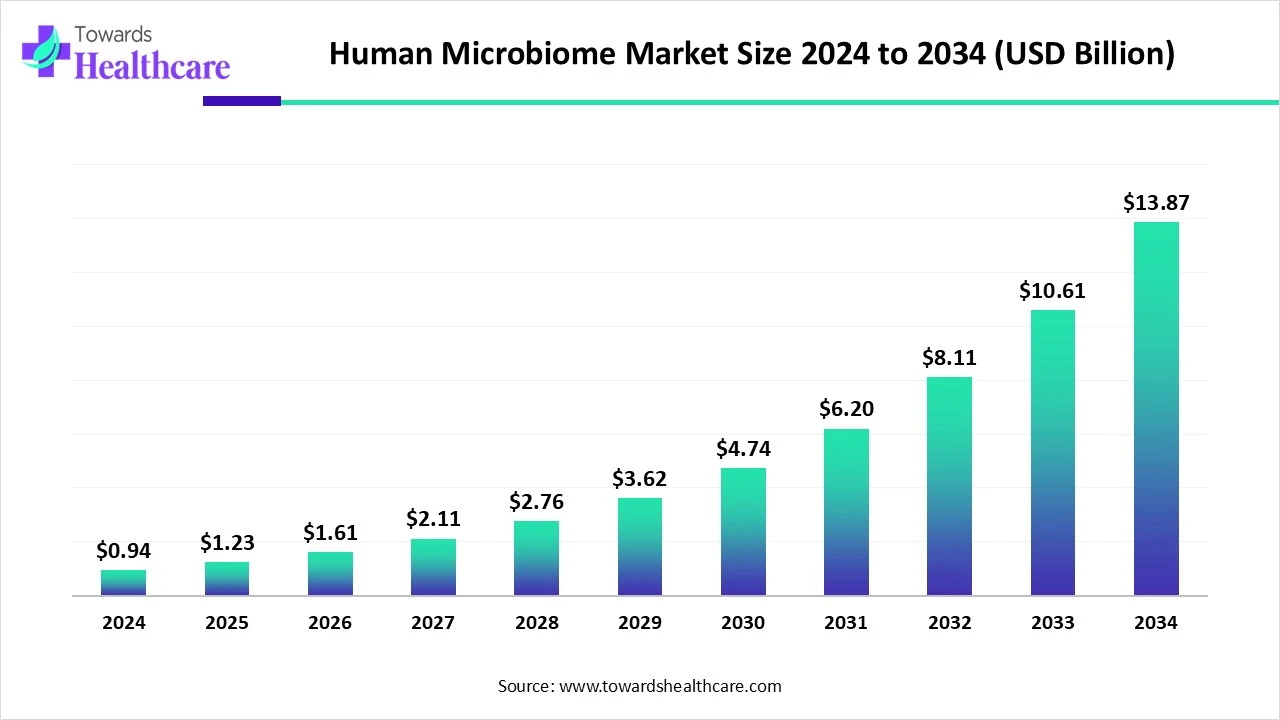

The global human microbiome market was valued at USD 0.94 billion in 2024, projected to reach USD 1.23 billion in 2025, and expected to surge to USD 13.87 billion by 2034, growing at a CAGR of 30.97%.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6042

Market Size

◉2024 Market Size: USD 0.94 billion.

◉2025 Market Size: USD 1.23 billion (approx. 30% YoY growth).

◉2034 Forecast: USD 13.87 billion, driven by expansion in therapeutics, diagnostics, and probiotics.

◉Growth Rate: CAGR of 30.97% (2025–2034), one of the fastest-growing healthcare markets globally.

Regional Share (2024):

◉North America: ~40–55% market dominance.

◉Asia-Pacific: Fastest CAGR (driven by China, India, Japan).

Key Segment Leaders (2024):

◉Oncology: Largest therapeutic segment.

◉Pharma & biotech firms: Dominant end-user with maximum revenue contribution.

Market Trends

◉Rising Awareness of Gut Health → Consumers increasingly link gut microbiome to immunity, metabolic health, and mental wellness.

R&D Collaborations Growing

◉Feb 2025: GluCare.Health + Pendulum Therapeutics partnership on probiotics for metabolic health.

◉Aug 2024: Pendulum Therapeutics + BiomeSense for continuous gut microbiome monitoring.

Expansion of Microbiome Startups

◉Sept 2024: Nestlé Health Science launched Boost Gut+, a probiotic-rich supplement.

◉Technological Advancements → Next-generation sequencing (NGS), metabolomics, culturomics, AI-driven predictive algorithms.

◉Shift to Personalized Medicine → Probiotics, synbiotics, and nutrition tailored to individual microbiome profiles.

◉Pharma Investments Surging → Clinical trials in oncology, gastrointestinal diseases, and metabolic disorders.

◉Integration of Consumer Health & Therapeutics → Probiotics, supplements, and microbiome-based wellness products bridging clinical & consumer markets.

Role of AI in the Human Microbiome Market

Data Processing at Scale

◉AI enables rapid interpretation of metagenomics, transcriptomics, and metabolomics data.

◉Helps map trillions of microbial interactions across individuals.

Precision Medicine Enablement

◉AI predicts personalized responses to probiotics, drugs, and dietary interventions.

◉Facilitates tailored microbiome therapies for cancer, metabolic, and neurological disorders.

Drug Discovery Acceleration

◉AI-driven platforms identify novel bacterial strains, biomarkers, and therapeutic targets.

◉Reduces R&D cycle time, cost, and clinical trial failure rates.

Clinical Trial Optimization

◉AI designs adaptive trials, predicting patient cohorts most likely to respond to microbiome interventions.

◉Enhances trial recruitment and success rates.

Predictive Analytics in Wellness & Consumer Health

◉AI integrates microbiome + diet + lifestyle data → predictive health models.

◉Supports direct-to-consumer (D2C) personalized nutrition and probiotics.

Microbiome-Based Diagnostics

◉Machine learning enables early disease detection (oncology, IBD, metabolic disorders) from gut microbial signatures.

Bioinformatics Platforms for Researchers

◉AI enhances visualization and integration of metagenomics + metabolomics data.

◉Example: Metabolon (Apr 2025) launched AI-integrated bioinformatics platform combining metagenomics and metabolomics.

Regional Insights

1 North America (40–55% share, 2024)

◉North America held the largest revenue share in 2024, dominating the human microbiome market.

Strong R&D Infrastructure

◉Home to world-leading research institutions, clinical trial centers, and biotech hubs.

◉Heavy investment in genomics, next-generation sequencing (NGS), and microbiome therapeutics.

U.S.

◉Market leader due to high prevalence of gastrointestinal diseases (IBD, Crohn’s, ulcerative colitis), oncology needs, and metabolic disorders.

◉Robust FDA-backed clinical trials in microbiome-based therapies.

◉Strong presence of companies like Seres Therapeutics, Finch Therapeutics, Vedanta Biosciences.

◉Increasing consumer adoption of personalized probiotics and nutrition supplements.

Canada

◉Rising consumer awareness of gut health → expanding probiotics and functional food consumption.

Government & private R&D funding for microbiome diagnostics and therapeutics.

◉Strong academic collaborations with U.S. biotech firms.

2 Asia-Pacific (Fastest CAGR)

◉The Asia-Pacific market is projected to expand at the fastest CAGR (2025–2034), fueled by rising healthcare investments and consumer adoption.

China & India

◉Rapid adoption of functional foods, probiotics, and synbiotics.

◉Strong local manufacturing base for supplements and nutraceuticals.

◉Government-backed investments in precision healthcare and biotechnology research.

Japan & South Korea

◉Pioneers in precision nutrition, microbiome sequencing, and therapeutic R&D.

◉Early adoption of microbiome-driven personalized healthcare solutions.

◉Growing demand for anti-aging probiotics and gut-brain axis therapies.

Overall Drivers

◉Urbanization and lifestyle disorders (diabetes, obesity, stress-related conditions).

◉Increasing international collaborations with global pharma & biotech firms.

3 Europe

◉Europe is a strong hub for clinical research, regulation, and biotech innovation in the microbiome industry.

◉Key Markets: Germany, UK, France, Italy, Spain.

◉Strong Clinical Trial Landscape: Leading universities and biotech firms actively conducting oncology and GI-focused microbiome studies.

◉Regulatory Strength: EMA (European Medicines Agency) ensures safety, ethical trials, and standardization, supporting credibility of therapies.

◉Innovation Hotspot: High concentration of microbiome startups, phage therapy development, and biotherapeutic research.

4 Latin America & Middle East & Africa (MEA)

◉Emerging but smaller markets compared to NA, APAC, and Europe.

Latin America

◉Brazil & Mexico: Increasing awareness and consumption of probiotics and functional foods.

◉Still in early stages of therapeutic R&D but expanding consumer markets.

5 Middle East & Africa (MEA)

◉South Africa: Rising demand for microbiome-based supplements targeting immunity and gut health.

◉UAE & Saudi Arabia: Gradual integration of microbiome testing and probiotic health products into urban healthcare systems.

◉Overall growth slowed by lower research infrastructure and regulatory maturity compared to other regions.

Market Dynamics

Drivers

Rising Awareness of Gut Health

◉Consumers recognize links between gut bacteria and immunity, metabolism, mental health, and chronic disease prevention.

◉Growing demand for functional foods, supplements, and probiotics.

Pharma & Biotech Investments

◉Surge in clinical trials targeting cancer, gastrointestinal disorders, metabolic diseases.

◉Big pharma and biotech collaborations accelerating microbiome R&D.

Consumer Health Segment Growth

◉Widespread adoption of direct-to-consumer probiotics, synbiotics, and personalized wellness kits.

◉Expanding demand in retail pharmacies, hospitals, and online markets.

Restraints

High Research & Development Costs

◉Microbiome studies require advanced sequencing platforms, bioinformatics expertise, and large-scale clinical testing.

◉Financial barriers limit smaller biotech and startups.

Complex Host-Microbiome Interactions

◉The microbiome is highly diverse and individualized, making clinical translation slower.

◉Regulatory uncertainties and long approval timelines challenge commercialization.

Opportunities

Microbiome-Based Therapies

◉Promising pipeline for oncology, metabolic diseases, infectious disorders, and neurology (gut-brain axis).

◉Potential to transform precision healthcare and preventive medicine.

AI-Driven Innovation

◉AI accelerates microbiome drug discovery, diagnostics, and clinical trial optimization.

◉Supports personalized probiotics and nutrition solutions.

CRO/CDMO Partnerships

◉Outsourcing to specialized microbiome CROs/CDMOs reduces time-to-market and R&D costs.

◉Enables small biotechs to commercialize without heavy infrastructure investment.

Top Companies

Seres Therapeutics

◉Product Focus: Live microbiome therapeutics for recurrent C. difficile infection.

◉Strength: Clinical trial leadership, strong FDA approvals pipeline.

Nestlé Health Science

◉Product Focus: Consumer nutrition & probiotics; launched Boost Gut+ in Sept 2024.

◉Strength: Massive distribution network & strong research collaborations.

Finch Therapeutics

◉Focus: GI disorder therapies.

◉Strength: Large clinical-stage pipeline in microbiome therapeutics.

Vedanta Biosciences

◉Focus: Oncology-related microbiome interventions.

◉Strength: Strong IP in immunotherapy + gut microbiome linkages.

Ferring Pharmaceuticals

Focus: Live biotherapeutics for infections and GI health.

Strength: Experience in reproductive health and microbial therapies.

MaaT Pharma

◉Focus: Oncology microbiome therapies.

◉Strength: Reported positive Phase 3 trial results (2025) → credibility boost.

BiomX Inc.

◉Focus: Phage therapies to target specific harmful bacteria.

◉Strength: Specialized precision microbiome approach.

4D Pharma plc

◉Focus: Live biotherapeutics for oncology & immune disorders.

◉Strength: Clinical development across multiple disease areas.

Synlogic

◉Focus: Engineered bacteria for rare metabolic diseases.

◉Strength: Synthetic biology-driven innovation.

Microba Life Sciences

◉Focus: Microbiome diagnostics for clinical and consumer health.

◉Strength: Advanced sequencing and analytics platform.

Viome

◉Focus: Direct-to-consumer microbiome testing & personalized nutrition.

◉Strength: Data-driven AI platform for consumer health.

Pendulum Therapeutics

◉Focus: Probiotics for metabolic health & diabetes management.

◉Strength: Strong consumer health positioning with scientific validation.

Latest Announcements

Apr 2025 – Metabolon

◉Launch of AI-powered microbiome research platform: Introduced a combined metagenomics and metabolomics platform, integrating host and microbial data for a holistic systems biology view.

◉Single-source solution: Helps researchers avoid fragmented datasets by consolidating sequencing, metabolite profiling, and computational analysis.

◉Impact: Enables discovery of novel biomarkers, therapeutic targets, and precision nutrition insights, accelerating microbiome drug discovery and diagnostics.

Feb 2025 – GluCare.Health + Pendulum

◉Collaboration focus: Studying the Pendulum Glucose Control probiotic in a clinical setting.

◉Target areas: Blood sugar regulation, weight management, insulin sensitivity, and broader metabolic health.

◉Significance: Bridges clinical healthcare with consumer probiotics, paving the way for evidence-based supplementation in diabetes and obesity management.

Recent Developments

Jan 2025 – MaaT Pharma

◉Positive Phase 3 results: Maat013 demonstrated clinical efficacy in patients with GI acute Graft-versus-Host Disease (GVHD).

◉Strategic importance: Positions MaaT Pharma as a front-runner in oncology microbiome therapeutics, particularly in allogeneic stem cell transplant support.

◉Pipeline impact: Boosts investor confidence and accelerates regulatory approval prospects in EU and U.S.

Aug 2024 – Pendulum Therapeutics + BiomeSense

◉Exploratory study: 14-week investigation leveraging GutLab’s continuous microbiome tracking system.

◉Focus strain: Akkermansia muciniphila, a keystone gut microbe linked to metabolic health, obesity prevention, and insulin regulation.

◉Novelty: First large-scale trial to use real-time microbiome monitoring, potentially revolutionizing microbiome clinical studies by shifting from point-in-time samples to dynamic ecosystem tracking.

Sept 2024 – Nestlé Health Science

◉New product launch: Boost Gut+, a probiotic-enriched nutritional supplement.

◉Market strategy: Expands Nestlé’s functional food portfolio, addressing consumer demand for digestive wellness, immune health, and gut–brain axis support.

◉Positioning: Strengthens Nestlé’s consumer-facing dominance while complementing its investments in clinical nutrition and microbiome R&D.

Segments Covered

By Therapeutic Indication

Gastrointestinal Disorders:

◉Includes IBD, Crohn’s disease, ulcerative colitis.

◉Microbiome therapies aim to restore gut microbial balance, reduce inflammation, and promote mucosal healing.

◉Clinical trials are focused on FMT (fecal microbiota transplantation) alternatives, live biotherapeutics, and engineered microbial consortia.

Oncology:

◉Microbiome interventions shown to enhance response rates to checkpoint inhibitors (anti-PD-1, anti-CTLA-4 therapies).

◉Research on microbial signatures predicting patient response to immunotherapy.

◉Companies like Vedanta Biosciences, MaaT Pharma, and 4D Pharma are pioneering this space.

Metabolic & Cardiometabolic Disorders:

◉Targeting obesity, diabetes, insulin resistance, dyslipidemia.

◉Probiotics and live therapeutics influencing short-chain fatty acids (SCFAs) production and glucose metabolism.

◉Growing demand in Asia-Pacific, given high diabetes prevalence in India and China.

Dermatology:

◉Focus on microbiome-based treatments for acne, eczema, psoriasis, and wound healing.

◉Development of topical live biotherapeutics that modulate skin microbiota to reduce inflammation.

Women’s Health:

◉Vaginal microbiome modulation for bacterial vaginosis (BV), yeast infections, fertility support, and pregnancy outcomes.

◉Probiotic formulations with Lactobacillus species under clinical evaluation.

Neurology / CNS Disorders:

◉Early research into gut-brain axis links with autism spectrum disorder, Parkinson’s disease, depression, and anxiety.

◉Potential for psychobiotics (probiotics targeting neurological outcomes).

◉Still in preclinical and Phase 1–2 trials, but gaining momentum with academic–biotech collaborations.

By End-User / Buyer

Pharma & Biotech Firms

◉Primary revenue generators due to clinical microbiome therapeutics development.

◉Heavy investments in oncology, GI, and metabolic disorder pipelines.

CROs/CDMOs

◉Fastest-growing segment, enabling outsourced drug development, GMP manufacturing, and trial execution.

◉Key role in cost optimization and accelerating time-to-market.

Clinical Labs & Hospitals

◉Expanding use of microbiome diagnostics, companion diagnostics, and patient microbiome profiling.

◉Increasing adoption for personalized treatment strategies.

Direct-to-Consumer Wellness

◉Includes probiotics, synbiotics, at-home microbiome testing, and personalized nutrition solutions.

◉Companies like Viome, Pendulum Therapeutics, and Microba Life Sciences leading in consumer space.

By Region

North America

◉Largest market share (~40–55%).

◉U.S. leads due to strong biotech ecosystem, GI/oncology disorder prevalence, and FDA-regulated clinical trials.

◉Canada growing through consumer adoption of probiotics and federal research grants.

Asia-Pacific

◉Fastest CAGR due to urbanization, rising chronic disease burden, and functional food adoption.

◉China & India: Growing nutraceuticals and probiotics markets.

◉Japan & South Korea: Early adoption of precision microbiome therapies and advanced sequencing technologies.

Europe

◉Strong in clinical trials, biotech innovation, and regulatory oversight.

◉Countries like Germany, UK, and France driving adoption of microbiome therapeutics.

◉EMA’s evolving guidelines ensure safety and efficacy in live biotherapeutics.

Latin America

◉Brazil & Mexico: Rapidly increasing consumer probiotic demand.

◉Market still less developed compared to NA & APAC, but projected to expand through supplement adoption.

Middle East & Africa (MEA)

◉South Africa & UAE: Emerging markets with growing gut health supplement adoption.

◉Market still nascent, but healthcare modernization and rising chronic diseases are driving uptake.

Top 5 FAQs

Q1: What is the size of the human microbiome market in 2024 and forecasted 2034?

A1: USD 0.94 billion in 2024, projected to reach USD 13.87 billion by 2034 at a 30.97% CAGR.

Q2: Which region leads the human microbiome market?

A2: North America (40–55% share in 2024), while Asia-Pacific is the fastest-growing.

Q3: Which therapeutic segment dominates the market?

A3: Oncology leads due to microbiome’s role in enhancing immunotherapy outcomes.

Q4: Who are the top players in this market?

A4: Seres Therapeutics, Nestlé Health Science, MaaT Pharma, Vedanta Biosciences, Pendulum Therapeutics, Viome, BiomX, 4D Pharma, among others.

Q5: How is AI transforming the human microbiome market?

A5: AI supports drug discovery, diagnostics, clinical trial design, and personalized nutrition, making microbiome interventions faster, more accurate, and cost-efficient.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6042

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest