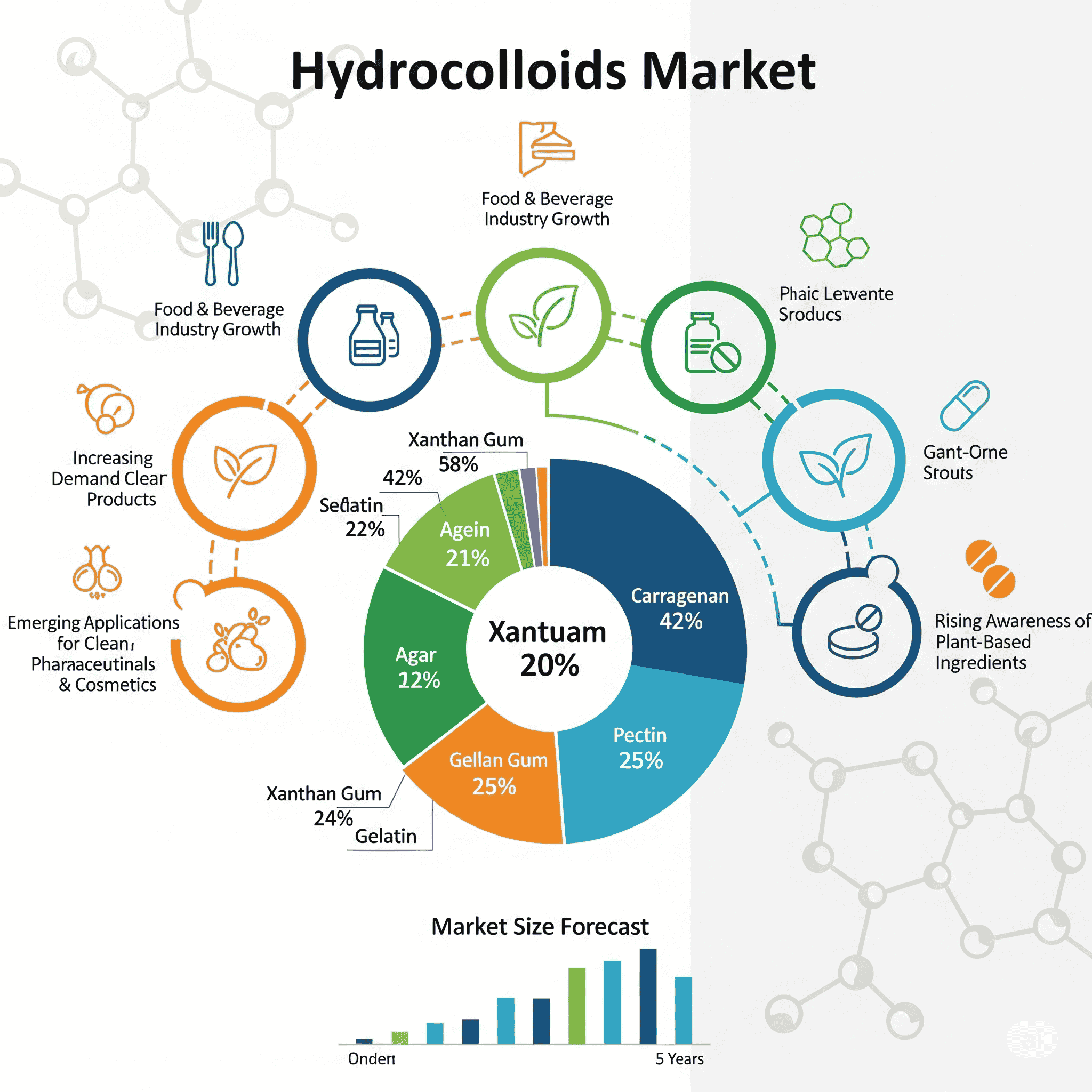

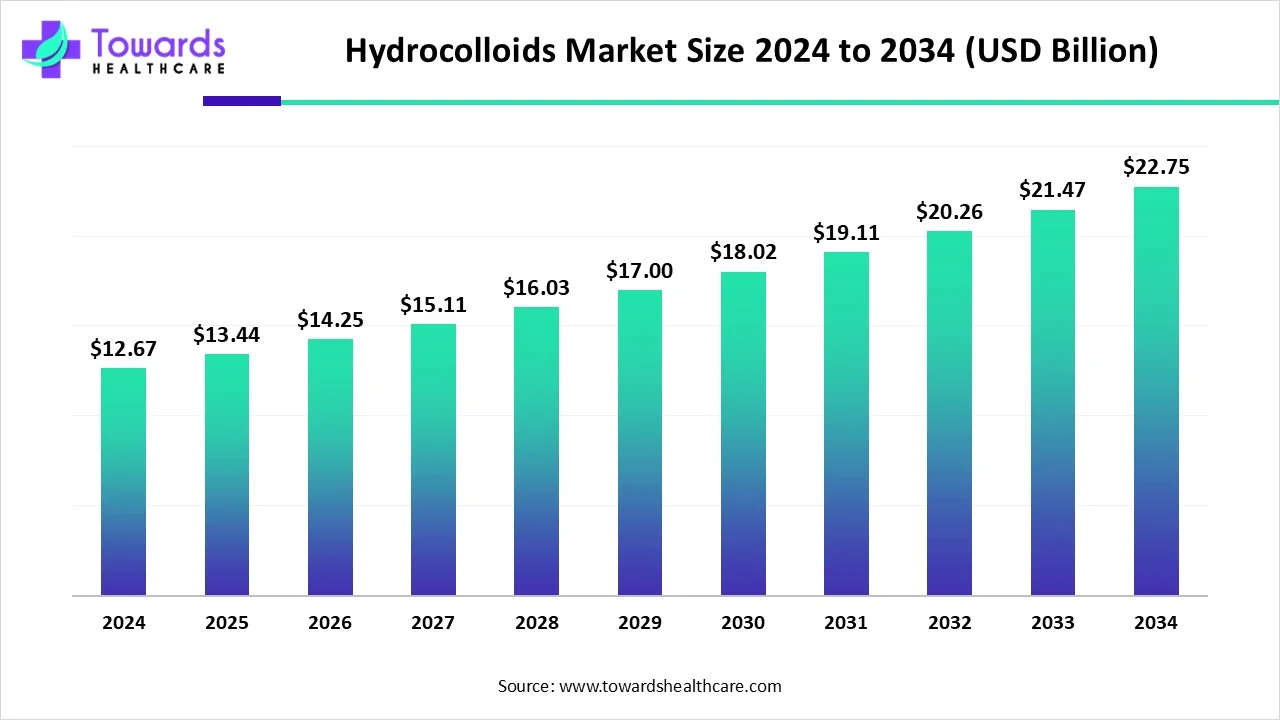

The global hydrocolloids market size stood at USD 12.67 billion in 2024, expanded to USD 13.44 billion in 2025, and is projected to reach around USD 22.75 billion by 2034. This reflects a strong CAGR of 6.04% from 2025 to 2034. Hydrocolloids, which include proteins and polysaccharides derived from plants, algae, bacteria, and animals, are primarily utilized as gelling and thickening agents. Increasing demand in pharmaceutical, cosmetic, and personal care industries, alongside expanding applications in dermatology and wound care, are key growth drivers. Europe dominated the market in 2024, while Asia Pacific secured the second-largest share, showing strong momentum due to food processing and personal care expansion.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5592

Market Size

-

In 2024, the hydrocolloids market size was valued at USD 12.67 billion, supported by rising pharmaceutical and food applications.

-

In 2025, the market expanded to USD 13.44 billion, driven by growing investments in pharmaceuticals and personal care segments, coupled with increasing regulatory compliance in Europe.

-

By 2034, the market is forecasted to reach USD 22.75 billion, propelled by sustained innovation, biotechnological research, and AI-driven product development.

-

The CAGR (2025–2034) is calculated at 6.04%, highlighting steady and sustained demand across industries rather than sporadic growth spikes.

-

Market expansion is supported by increasing usage in dermatology and cosmetics, growing nanocarrier applications in pharmaceuticals, and investments in sustainable production of hydrocolloids.

Market Trends Mergers and Acquisition Activity

◉In December 2024, Ashok Matches & Timber Industries and Pioneer Jellice India (PJIP) launched an open offer to acquire 26% stake (1.84 million equity shares) in India Gelatine & Chemicals (IGCL) worth ₹75 crore at ₹408.90 per share.

◉This reflects a rising trend of consolidation and equity participation in gelatin-focused companies.

Strategic Expansion in Gelatin Production

◉In May 2024, Nitta Gelatin Inc. Japan partnered with Kerala State Industrial Development Corporation (KSIDC) to expand operations in Kerala, with a ₹60 crore expansion project.

◉This aligns with Japan’s commitment of ₹200 crore investment in Kerala to boost gelatin production capacities.

Sustainability-Oriented Investments

◉In September 2024, Jungbunzlauer announced a USD 200 million investment in its Port Colborne, Ontario facility to set up Canada’s first xanthan gum plant.

◉This reflects the global push toward sustainable, locally sourced hydrocolloid production.

Growing Role of Hydrocolloids in Dermatology & Cosmetics

◉Increasing popularity of hydrocolloid dressings for wound healing, burns, acne treatment, and controlled drug release is shaping a new growth trend.

◉Personal care and cosmetics are emerging as fastest-growing applications due to consumer demand for natural texturizers and hydrating agents.

AI Integration and Role in Hydrocolloids Market (Deep Insights)

AI in Research & Development

◉AI and machine learning (ML) are increasingly used to predict chemical properties of new hydrocolloids based on composition and molecular structure.

◉This reduces the time-to-market for innovative hydrocolloid applications in pharma and cosmetics.

Optimizing Manufacturing

◉AI-driven simulations are helping in sustainable hydrocolloid production by minimizing energy use, predicting process efficiency, and identifying optimal raw material sources.

Enhancing Drug Delivery Systems

◉AI models are being applied to design hydrocolloid-based nanocarriers that improve drug encapsulation, prevent degradation, and optimize controlled release.

◉Hydrocolloids like guar gum, xanthan gum, and pectin are already tested in AI-guided drug delivery modeling.

Market Forecasting & Consumer Behavior

◉AI systems analyze regulatory frameworks, demand forecasting, and consumer usage patterns, guiding companies in entering new regional markets or adjusting to changing compliance rules.

Regional Insights (Point-wise, Deep with Sub-points)

1 Europe – Market Leader (2024)

Dominance: Europe held the largest share due to strong R&D, strict regulations, and high consumer demand for natural, clean-label hydrocolloids.

Germany: Third-largest exporter of gelatin in 2023, worth USD 256 million, with exports to France, Japan, Italy, Switzerland, and the US.

UK: Ranked 13th in gelatin exports (USD 62.7 million in 2023), requiring strict HACCP certification and health approvals for exports.

Drivers: Pharma innovation, food ingredient demand, and regulatory emphasis on safety.

2 Asia Pacific – Fast-Growing Region

Second-largest share in 2024, fueled by China, India, Japan, and South Korea.

China: Exported USD 245 million worth of gelatin in 2024, with major markets including India, US, and Vietnam.

Japan: Among top global gelatin exporters with USD 139 million exports in 2023, led by Nitta Gelatin Inc.

Key Growth: Rising demand in personal care and cosmetics, coupled with food processing and pharma expansion.

3 North America – Driven by Major Players

Growth Expectation: Projected strong expansion, supported by R&D from companies like DuPont, Cargill, DSM, and CP Kelco.

US Exports: Valued at USD 85.1 million in 2024, with top destinations including Canada, Mexico, Germany, and India.

Canada: Government invested USD 89.5 million over 5 years to establish the Canadian Drug Agency (CDA), promoting pharmaceutical integration of hydrocolloids.

4 Middle East & Africa – Burgeoning Pharma Growth

Saudi Arabia: Largest pharmaceutical market in MEA, with 40+ registered factories covering 36% of local needs, aligned with “Vision 2030”.

UAE: Investing AED 10 billion under the Abu Dhabi Industrial Strategy to strengthen pharmaceuticals and biotech, boosting hydrocolloid demand in drug delivery and wound care.

Market Dynamics

Driver – Rising Usage in Dermatology

◉Hydrocolloid dressings are widely used for acute, chronic, and surgical wounds.

◉Expanding usage in acne treatment, burn therapy, and drug-delivery patches adds long-term growth potential.

Restraint – Strict Regulations

◉Each region enforces unique standards on hydrocolloid usage in foods and drugs, raising compliance costs.

◉This regulatory complexity hampers global scalability and makes localized production more expensive.

Opportunity – Rising Demand in Pharmaceuticals & Cosmetics

◉Hydrocolloids show strong moisture retention, controlled release, and biocompatibility, making them suitable for drug delivery and wound care.

◉Cosmetics use hydrocolloids for hydrating, anti-aging, and soothing properties, creating significant growth momentum.

Top Companies (Deep Insights with Products & Strengths)

1 DuPont de Nemours, Inc.

Products: Organic and amino acids, used in food & beverage, personal care, pharmaceuticals.

Strength: Large global network, strong biotech R&D capabilities.

Performance: Q4 2024 sales USD 3.1 billion, annual USD 12.4 billion.

2 Kerry Group

Products: Nutrition, food and beverage hydrocolloids.

Strength: Focus on nutritional renovation and clean-label solutions.

Performance: 2024 revenue €8.0 billion, EBITDA €1,251 million (+7.4%).

3 Cargill Incorporated

Products: Wide range of hydrocolloids for food and pharma.

Strength: Strong global supply chain integration and investments in sustainable sourcing.

4 CP Kelco U.S. Inc.

Products: Specialized hydrocolloids (pectin, xanthan gum).

Strength: Expertise in food-grade and pharma-grade biopolymers.

5 Koninklijke DSM N.V.

Products: Hydrocolloid-based solutions in pharma and nutrition.

Strength: Heavy investment in biotech innovation and R&D.

Strategic Role of the Hydrocolloids Market

1. Strategic Role in the Global Economy

◉Hydrocolloids represent a USD 12.67 billion market in 2024, projected to expand to USD 22.75 billion by 2034, with a 6.04% CAGR.

◉This growth makes hydrocolloids strategically important as a high-value specialty chemical sector.

◉They act as functional polymers that cross multiple high-demand industries (pharmaceuticals, food & beverages, personal care, cosmetics, biotechnology), making them indispensable.

◉As the market diversifies, hydrocolloids secure strategic resilience by ensuring supply chains for essential products like drugs, wound dressings, and functional foods.

2. Strategic Role in Pharmaceuticals and Healthcare

◉Hydrocolloids are strategically used as drug delivery excipients.

◉Provide controlled release, improved bioavailability, and protection from degradation.

◉Used in capsules, suspensions, ointments, wound care patches, and dental fixatives.

◉In dermatology, hydrocolloid dressings are critical in chronic and acute wound healing, post-surgical recovery, and skin-friendly acne patches.

◉This positions hydrocolloids as strategic medical biomaterials.

◉As global pharma expands, hydrocolloids strengthen their role as a bridge material between biotechnology and drug delivery innovation.

3. Strategic Role in Personal Care & Cosmetics

◉Hydrocolloids provide hydration, anti-aging, and soothing properties.

◉Growing demand in natural skincare enhances their positioning as clean-label cosmetic stabilizers.

◉They act as texturizers and stabilizers, supporting the clean beauty movement and consumer shift toward organic and natural personal care.

◉Their multifunctionality (thickening, moisturizing, gelling) makes them strategically valuable in a fastest-growing segment where consumer expectations are evolving.

4. Strategic Role in Food & Beverage Security

◉Hydrocolloids are crucial for food stabilization, thickening, gelling, and texture enhancement.

◉As global demand for plant-based, vegan, and functional foods rises, hydrocolloids act as key enablers of texture and stability in alternative products.

◉Europe’s focus on clean-label natural ingredients shows hydrocolloids’ strategic role in aligning food industry output with consumer health priorities.

5. Strategic Role in Regional Growth & Trade

Europe dominates due to strong regulations and R&D, making it the innovation hub for hydrocolloids.

Asia Pacific is strategically important for production capacity (China, India, Japan) and cosmetics-driven demand.

North America leverages hydrocolloids strategically through R&D investments, biotech applications, and supply chain leadership (DuPont, Cargill, DSM).

Middle East & Africa uses hydrocolloids strategically for pharmaceutical localization (Saudi Vision 2030, UAE pharma investment).

6. Strategic Role in Innovation & AI Integration

◉Hydrocolloids are strategically positioned in biotechnological innovation:

◉Development of animal-free, sustainable substitutes.

◉Expansion into biomedical solutions via institutes like GELITA Pharma Institute.

AI and machine learning transform their strategic value:

◉Predict new hydrocolloid properties.

◉Optimize sustainable manufacturing.

◉Enhance drug delivery modeling.

◉AI integration ensures cost-effective R&D, making hydrocolloids a future-proof segment in biotechnology and material sciences.

7. Strategic Role for Companies and Competitive Positioning

◉Top companies (DuPont, Kerry, Cargill, DSM, CP Kelco, BASF, Tate & Lyle) use hydrocolloids to:

◉Expand portfolios into food, pharma, and cosmetics.

◉Position themselves as leaders in sustainable and biotech-driven innovation.

◉M&A activities and expansions (PJIP’s investment in IGCL, Nitta Gelatin’s expansion in India, Jungbunzlauer’s $200M facility) demonstrate hydrocolloids’ role in global trade consolidation.

◉Corporate strategies align hydrocolloids as competitive differentiators, enabling companies to capture premium markets in pharma and personal care.

8. Strategic Role in Sustainability & Future Markets

Hydrocolloids align with global sustainability needs:

◉Plant-based and algae-derived sources reduce reliance on synthetic stabilizers.

◉Biodegradable and biocompatible polymers match sustainability mandates.

◉Strategic shift toward animal-free hydrocolloids reflects consumer, regulatory, and environmental priorities.

◉As bioplastics and functional biomaterials grow, hydrocolloids will play a critical bridging role in sustainable material ecosystems.

Mergers & Acquisitions in the Hydrocolloids Market

1. Strategic Importance of M&A in Hydrocolloids

◉The hydrocolloids market is highly fragmented, with both multinational giants (DuPont, Cargill, Kerry, DSM, BASF) and specialty local producers (Nitta Gelatin, Jungbunzlauer, IGCL).

M&A activity plays a strategic consolidation role to:

◉Secure raw material supply chains (algal, plant, microbial, and gelatin-based sources).

◉Expand into high-growth regions like Asia Pacific and the Middle East.

◉Broaden portfolios to cover pharmaceutical excipients, personal care biomaterials, and food stabilizers.

◉Since the market CAGR is 6.04% (2024–2034), acquisitions serve as a fast-track entry for companies aiming to capture emerging demand in pharma, cosmetics, and functional food.

2. Key M&A Deals and Expansions (Recent Developments)

a) India Gelatine & Chemicals Ltd. (IGCL) – PJIP’s Investment (2024)

◉Event: Prathamesh JP Investment (PJIP) acquired shares in IGCL.

Strategic Goal: Strengthen collagen and gelatin-based hydrocolloid production in India.

Outcome:

◉Expanded PJIP’s stake in a growing pharmaceutical-grade gelatin market.

◉Positioned India as a strategic hydrocolloid manufacturing hub for pharma and nutraceuticals.

b) Nitta Gelatin India Ltd. (Subsidiary of Nitta Gelatin Inc., Japan) Expansion (2024)

◉Event: Large-scale expansion of gelatin and collagen hydrocolloid operations in India.

Strategic Goal:

◉Strengthen global footprint in Asia-Pacific.

◉Meet rising demand for medical-grade hydrocolloids (capsules, wound dressings, nutraceuticals).

◉Outcome: Enhances Nitta’s role as a leading gelatin hydrocolloid supplier, strategically balancing Japan’s R&D with India’s low-cost manufacturing base.

c) Jungbunzlauer’s $200 Million Facility Expansion (Austria, 2023–2024)

◉Event: Investment in expanding hydrocolloid and biopolymer production facilities.

Strategic Goal:

◉Secure European dominance in natural hydrocolloids.

◉Support clean-label and sustainable product innovation.

◉Outcome: Strengthened Europe’s status as an innovation hub, supporting both food and pharmaceutical-grade hydrocolloids.

d) DuPont – IFF Merger Legacy (2021)

◉Event: DuPont Nutrition & Biosciences merged with International Flavors & Fragrances (IFF).

Strategic Goal:

◉Create one of the largest bioscience & ingredients giants.

◉Strengthen portfolio in texturants, stabilizers, and hydrocolloid systems.

Outcome:

◉Positioned IFF-DuPont as a global leader in hydrocolloids.

◉Enhanced innovation in food texture systems and pharma excipients.

e) Kerry Group Acquisitions (2021–2023)

◉Event: Kerry acquired multiple specialty ingredient firms.

◉Strategic Goal:

◉Strengthen functional food & beverage hydrocolloid applications.

◉Expand in nutritional and clean-label segments.

◉Outcome: Diversified Kerry’s hydrocolloid footprint into high-value functional nutrition markets.

f) Cargill’s Expansion and Partnerships

◉Event: Cargill has engaged in regional acquisitions and JV partnerships in food ingredients.

Strategic Goal:

◉Secure raw material supply for pectin, carrageenan, and guar gum.

◉Expand Asia-Pacific distribution networks.

◉Outcome: Reinforced Cargill’s role as a global supplier of plant-based hydrocolloids.

3. Regional M&A Dynamics

◉Asia Pacific (India, China, Japan):

◉Dominant in production and low-cost manufacturing.

◉M&A focus: capacity expansion (Nitta, IGCL).

Europe (Germany, Switzerland, Austria):

◉M&A driven by sustainability, biotech, and clean-label demand.

◉Example: Jungbunzlauer expansion aligns with green innovation.

North America (US):

◉M&A centered around AI-driven biotech innovation.

◉DuPont-IFF merger creates a consolidated powerhouse.

Middle East & Africa:

◉M&A and JV activity tied to pharma localization (Saudi Vision 2030, UAE pharma sector).

◉Companies explore acquisitions to localize hydrocolloid supply chains.

4. Strategic Outcomes of M&A in Hydrocolloids

Portfolio Diversification: Companies extend into pharma, personal care, and biotech applications, not just food.

Supply Chain Security: M&A helps secure raw material inputs like algae, guar, carrageenan, and collagen.

Regional Market Penetration: Faster entry into emerging markets through local acquisitions.

Innovation & R&D Boost: M&A consolidates AI, biotech, and sustainable hydrocolloid R&D.

Competitive Positioning: Large players like DuPont, Kerry, Cargill, BASF, Tate & Lyle use acquisitions to strengthen global leadership.

Latest Announcements

◉In January 2025, GELITA (via Pharma Institute and Biotech R&D Hub in Frankfurt) announced a biotechnological focus to develop animal-free hydrocolloid substitutes with higher sustainability and efficiency.

◉This move highlights a shift toward biotech-driven hydrocolloids to meet regulatory and consumer sustainability expectations.

Recent Developments

◉April 2025 – Bonyf NV advanced to Phase 3 clinical trials for its Alginate-Olive Oil based Denture Fixative Cream, following successful dermatological studies by Dermatest GmbH.

◉September 2024 – Jungbunzlauer invested USD 200 million in expanding Ontario operations, establishing Canada’s first xanthan gum production facility, reinforcing supply chain localization and sustainability goals.

Segments Covered in the Hydrocolloids Market

1. By Product

◉Hydrocolloids are segmented by source-based derivatives with distinct functionalities.

Gelatin (Dominant in 2024)

◉Widely used in pharmaceuticals for capsules, binders, and excipients.

◉Flexible due to film-forming capacity, thermo-reversible gelation, and adhesive properties.

◉Applied in haemostatic sponges, vaccines, plasma expanders, and coatings.

Xanthan Gum (High Growth Segment)

◉Functions as a suspending agent, emulsion stabilizer, foam enhancer.

◉Growing adoption in drug delivery systems (oral, topical, buccal formulations).

◉Significant demand expected due to food, cosmetic, and pharmaceutical usage.

Carrageenan

◉Derived from red seaweed, used in thickening and gelling food, beverages, and pharmaceuticals.

◉Plays a strong role in stabilizing dairy and non-dairy products.

Alginates

◉Extracted from brown algae, used as wound dressings, dental impressions, and food stabilizers.

◉Recognized for biocompatibility and gel-forming abilities.

Pectin

◉Derived from citrus peels and apple pomace, popular as gelling and stabilizing agent.

◉Broad use in pharma excipients and dietary supplements.

Guar Gum

◉Plant-derived, mainly used as a thickening and stabilizing agent.

◉Important in personal care products and oil recovery processes.

Gum Arabic

◉Natural gum sourced from acacia trees.

◉Functions in emulsification, encapsulation, and flavor stabilization.

Carboxy Methyl Cellulose (CMC)

◉Modified cellulose derivative, acts as a binder and viscosity enhancer.

◉Widely used in pharma excipients, suspensions, and food processing.

Agar

◉Extracted from red algae, functions as gelling agent.

◉Used in pharmaceutical culture media, food applications, and cosmetics.

Locust Bean Gum

◉Derived from carob tree seeds, works as a thickener and stabilizer.

◉Key usage in dairy, bakery, and pharmaceutical stabilizations.

2. By Function

◉Hydrocolloids are categorized by the role they play in formulations.

Thickening (Dominant in 2024)

◉Hydrocolloids absorb water to form gel-like structures.

◉Enhance consistency, viscosity, and flow properties of pharmaceutical suspensions and ointments.

Gelling (High-Growth Function)

◉Critical for oral dosage forms, topical applications, and wound-care formulations.

◉Provides drug stability, encapsulation, and smooth texture.

Stabilizing

◉Hydrocolloids prevent separation in emulsions and suspensions.

◉Applied in food processing, beverages, and personal care formulations.

Others

◉Includes roles in film formation, encapsulation, adhesion, and moisture retention.

3. By Application

◉Hydrocolloids are widely used across different end-use industries.

Food & Beverage (Large share contributor)

◉Used in bakery, dairy, beverages, confectionery, and meat products.

◉Ensure texture stability, shelf-life extension, and sensory appeal.

Pharmaceutical (Dominant in 2024)

◉Used as binders, excipients, controlled-release agents.

◉Applications in drug delivery, wound healing, and capsule production.

Personal Care & Cosmetics (High Growth Rate)

◉Increasing demand for natural texturizers, moisturizers, and anti-aging components.

◉Hydrocolloids are key in skincare formulations, creams, and hair products.

Others

◉Includes industrial applications, biotechnology, and packaging.

4. By Region

◉Hydrocolloid demand is highly region-specific with different growth drivers.

◉North America: R&D-led market, strong pharma and cosmetics industry.

◉Europe: Largest market, regulatory-driven, high demand for natural & clean-label.

◉Asia Pacific: Fastest growth, major role of China, India, Japan in production and consumption.

◉Latin America: Rising processed food industry, particularly Brazil and Mexico.

◉Middle East & Africa: Pharma expansion in Saudi Arabia and UAE drives usage.

5 Key FAQs on the Hydrocolloids Market

Q1. What is the size of the global hydrocolloids market and its growth outlook?

The global hydrocolloids market was valued at USD 12.67 billion in 2024, increased to USD 13.44 billion in 2025, and is projected to reach USD 22.75 billion by 2034, expanding at a CAGR of 6.04% between 2025 and 2034.

Q2. Which region dominated the hydrocolloids market in 2024?

Europe dominated in 2024, backed by its strong regulatory framework, consumer demand for clean-label products, and high R&D activity. Asia Pacific held the second-largest share, driven by pharmaceuticals, cosmetics, and food processing industries.

Q3. Which product and function segments are leading the market?

By product, gelatin dominated in 2024 due to its broad medical and pharmaceutical usage. However, xanthan gum is projected to grow significantly. By function, thickening dominated in 2024, while gelling is expected to grow strongly during the forecast period.

Q4. What are the key drivers and restraints for the market?

Drivers: Expanding usage in dermatology, wound care, pharmaceuticals, and cosmetics, supported by demand for natural polymers.

Restraints: Strict regulations and lack of unified global standards increase production costs and hinder scalability.

Q5. Which companies are the major players in the hydrocolloids market?

Key players include DuPont, Kerry, Cargill, CP Kelco, DSM, BASF, Tate & Lyle, Ashland, ADM, and Glanbia Nutritionals. DuPont reported USD 12.4 billion full-year sales in 2024, while Kerry achieved €8.0 billion in revenues with 7.4% EBITDA growth, reflecting strong industry leadership.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5592

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest