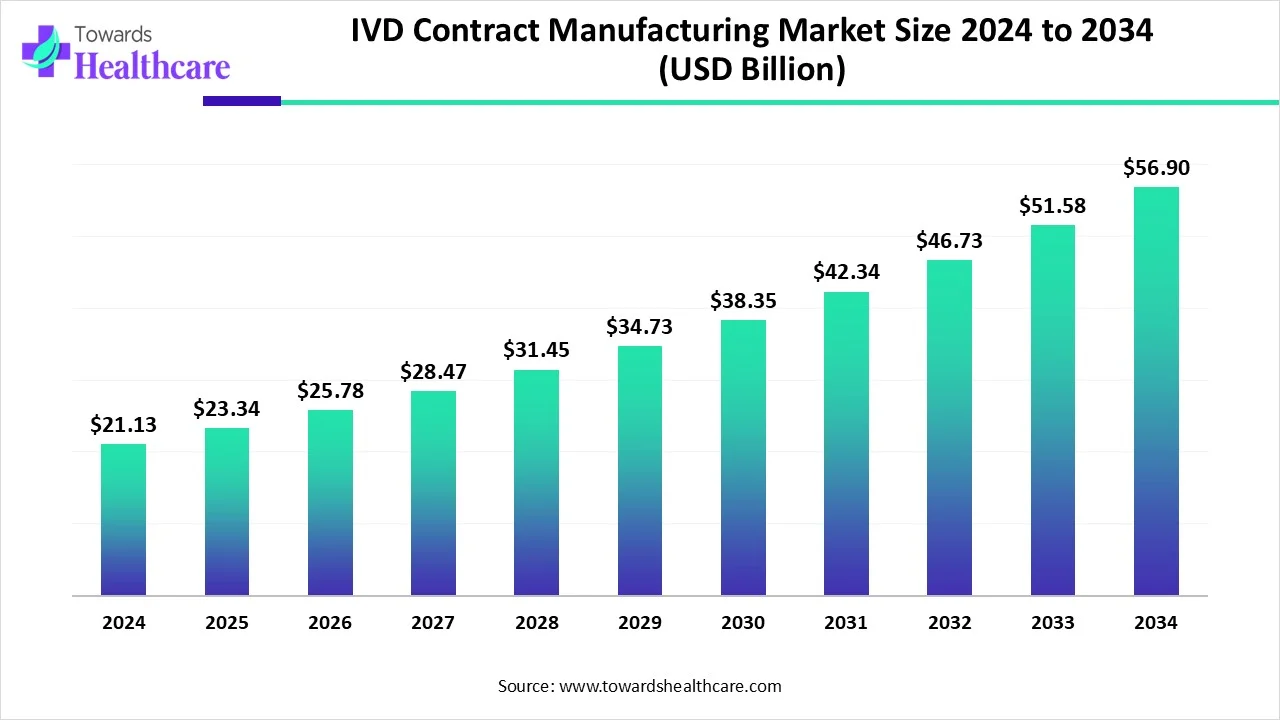

The global In Vitro Diagnostics (IVD) contract manufacturing market is poised for exceptional growth, with projections showing an increase from USD 21.13 billion in 2024 to USD 56.9 billion by 2034, expanding at a CAGR of 10.44%. This surge is largely driven by the demand for advanced diagnostic tools, cost-effective manufacturing processes, and a growing preference for outsourcing among healthcare providers.

What’s Driving the Market Growth?

One of the primary growth drivers is the technological evolution in diagnostic devices, pushing the need for integrated and automated solutions. Healthcare facilities and diagnostic laboratories are increasingly looking for “one-stop-shop” manufacturing solutions that streamline production and reduce turnaround time.

Additionally, the leasing of IVD equipment has emerged as a popular strategy, enabling smaller laboratories and clinics to access high-end diagnostic tools without large capital investments.

Invest in Our Premium Strategic Solution: https://www.towardshealthcare.com/download-databook/5797

Regional Outlook: North America Leads, Asia Pacific Surges

In 2024, North America held a commanding 42% share of the global market, fueled by an advanced healthcare ecosystem, a strong base of major players, and significant R&D investment. The United States continues to lead in innovation, with growing regulation around diagnostic tests and LDTs (Laboratory Developed Tests) creating further demand for expert contract manufacturing.

Asia Pacific, meanwhile, is expected to register the fastest CAGR, thanks to increased disease prevalence, higher diagnostic awareness, and rising investments from private companies. Countries like India and Nepal are investing heavily in diagnostics infrastructure, further propelling the regional market.

Product and Service Insights

-

Reagents & Consumables dominated the market in 2024. These are critical components in test kits and are governed by strict regulatory standards like those set by the U.S. FDA.

-

Instruments are set to grow rapidly, driven by demand for NGS (Next-Generation Sequencing) tools and integrated platforms.

-

In terms of services, manufacturing services led the market due to the availability of ISO-certified facilities, while assay development is predicted to experience robust growth in the coming years.

Technological Trends: The Role of Artificial Intelligence

AI integration in IVD is revolutionizing clinical diagnostics. AI and machine learning are enabling better data analysis, reducing manual errors, and improving decision-making for medical professionals. Diagnostic companies are increasingly partnering with AI firms to bring cutting-edge innovations to the market.

Get All the Details in Our Solutions – Access Report Preview: https://www.towardshealthcare.com/download-sample/5797

Strategic Partnerships and Industry Movements

The industry has seen several impactful collaborations:

-

Grifols and IBL International GmbH teamed up in April 2025 to deliver high-sensitivity multiplex diagnostics.

-

In January 2024, Agappe Diagnostics and Fujirebio Holdings formed a CDMO partnership for producing cartridge-based CLIA reagents.

-

Fujirebio’s acquisition of Plasma Services Group in June 2025 further strengthened its raw material capabilities.

Other notable developments include Nepal’s launch of the National Essential In-vitro Diagnostics List (NEIDL) with WHO funding, and the UK’s establishment of 160 Community Diagnostic Centres (CDCs) to improve early diagnosis.

If you have any questions, please feel free to contact us at sales@towardshealthcare.com

FAQs

Q. What is IVD contract manufacturing?

IVD contract manufacturing refers to the outsourcing of the production of diagnostic instruments, reagents, and assay kits to third-party manufacturers who offer regulatory expertise, scalability, and cost efficiency.

Q. Which region is currently leading the global IVD contract manufacturing market?

North America is the leading region, accounting for 42% of the market share in 2024. This dominance is due to its robust healthcare infrastructure, strong industry presence, and regulatory framework.

Q. What are the key drivers of market growth?

Key growth drivers include:

-

Rising demand for rapid diagnostic solutions

-

Technological advancements in IVD instruments

-

Increasing adoption of outsourcing by healthcare companies to reduce costs and manage regulatory compliance

Q. How is AI impacting the IVD contract manufacturing industry?

AI is enhancing the accuracy, speed, and consistency of diagnostic processes. It assists in data interpretation, standardizes test results, and helps healthcare professionals make informed decisions quickly.

Q. Which product and service segments are growing the fastest?

The reagents & consumables segment holds the largest share, while the instruments segment is expected to grow rapidly. On the service side, manufacturing services lead today, but assay development is projected to witness strong growth during 2025-2034.

To access the full market report : https://www.towardshealthcare.com/price/5797