The global life science market was about USD 88.2 billion in 2024, grew to USD 98.63 billion in 2025, and is projected to reach USD 269.56 billion by 2034 — a 2.73× increase (USD +170.93B) from 2025 to 2034 at a CAGR of 11.82% (2025–2034).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5711

Market size

Key headline numbers & math

Reported values (source):

◉2024: USD 88.2 billion (reported as “US$ 88.2” in the source — interpreted as billion).

◉2025: USD 98.63 billion.

◉2034 (projection): USD 269.56 billion.

◉Absolute change (2025 → 2034): USD +170.93 billion (269.56 − 98.63).

◉Multiple (2025 → 2034): 2.73× (269.56 / 98.63 ≈ 2.733).

◉Annualized growth: CAGR ≈ 11.82% (the source-stated CAGR for 2025–2034; when applied, it reproduces the 2034 projection).

◉Single-year growth (2024 → 2025): 11.83% ((98.63 / 88.2) − 1).

◉Implication: the market more than doubles in a decade (2025–2034) driven by biotech/AI adoption, higher R&D spend, and faster product approvals in several segments.

Concentration & scale notes

◉The market figures represent a broad ecosystem (pharma, biotech, devices, tools, digital health, AI). The headline total therefore aggregates high-margin biologics alongside volume-driven reagents & consumables.

◉Because the life science market mixes product (devices, drugs) and services/platforms (CDMOs, CROs, analytics), value creation is uneven: high-value biologics and platform/software segments grow faster (% terms) than commoditized consumables.

Market trends

Macro-level structural trends

Rising R&D intensity

◉R&D investments and new drug discovery are primary growth engines; CRO/CDMO R&D spending grew ~12–13% annually (2014–2022, per cited McKinsey data in your content).

◉NIH (U.S.) remains a major public funder (USD 48 billion annually), supporting translational research pipelines.

Consolidation of biotech & startup momentum

◉Venture flows: India VC USD 13.7B into life sciences (2025 data), Canada recorded USD 12B across 65 deals in 2023 — strong VC activity is fueling startups and scale-ups.

Regulatory evolution & incentives

◉China’s Dec 2024 policy incentives to ease market access and clinical trial pilots — these accelerate launches in Asia.

◉The European Commission planning a “Strategy for European Life Sciences” to foster green/digital transitions.

Clinical trial expansion

◉Clinical trials footprint large: 540,338 trials registered on ClinicalTrials.gov (as of June 2025) — more trials equals larger demand for services, analytics, trial tech, CRO capacity.

Technology & commercialization trends

AI & data platforms rising rapidly

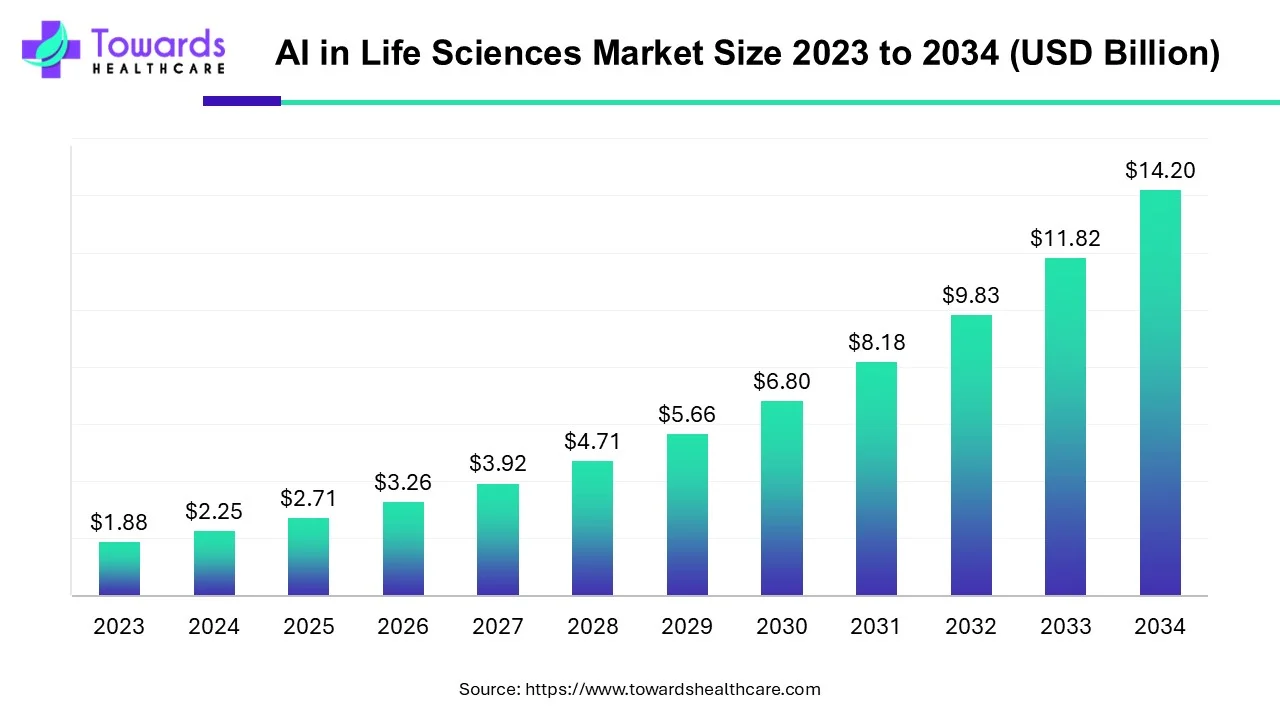

◉AI in life sciences market: USD 2.25B (2024) → USD 2.71B (2025) → USD 14.20B (2034); CAGR 20.21% (2024–2034).

◉Corporate examples: Accenture + 1910 Genetics (Oct 2024) to accelerate target ID; Axtria developing GenAI for commercial/clinical optimization.

Digital manufacturing & operations

◉Honeywell’s April 2025 TrackWise Manufacturing (AI-assisted, cloud-native) shows focus on bridging digital/physical manufacturing for life sciences — operational AI for compliance & throughput.

Cross-border partnerships & national trade pushes

◉Austrade + AusBiotech (June 2025) and BIOQuébec + Life Sciences BC (May 2025) are formalizing export/growth channels — national trade & cluster diplomacy is a clear trend.

Regulatory & reimbursement pressure

◉With more products and companion diagnostics (188 FDA companion diagnostics approved as of March 2025), payers and regulators are tightening evidence requirements and lifecycle management.

Product approvals supporting momentum

◉50 new drug approvals in 2024 (32 NCEs + 18 biologics); 21 devices approved by FDA January–October 2024; 43 cell & gene therapies approved by Jan 2025 — all indicate active innovation-to-approval pipelines.

AI impact & role in the life-science market

1) Drug discovery & lead identification (core)

◉Value proposition: accelerate target ID, reduce candidate attrition, shorten discovery cycles, prioritize molecules with optimal ADMET profiles.

◉Mechanics: multi-omics integration (genomics, proteomics), structure-based models (physics-informed + ML), generative chemistry for novel scaffolds.

◉Industrial metrics: time-to-hit, number of prioritized leads, predicted vs. observed assay hit rate.

◉Real example from source: 1910 Genetics platform — targeted to accelerate drug target identification and cut costs (Accenture partnership).

2) Preclinical modelling & in-silico experiments

◉Use: simulate biological pathways, toxicity prediction, and virtual screening — reduces animal studies and early lab costs.

◉Risk/validation: needs robust external validation; regulatory acceptance requires clear model transparency.

3) Clinical trials (design, recruitment, monitoring)

◉Use-cases: adaptive trial design optimization, site selection using real-world data (RWD), patient recruitment predictions, remote monitoring via wearables.

◉Impact: higher enrollment speed, fewer protocol amendments, improved retention.

◉Scale indicator: with 540k trials registered, incremental AI adoption in trial operations generates sizeable efficiency gains.

4) Diagnostics & companion diagnostics

◉Role: AI-enabled image analysis, multi-modal biomarker interpretation, and predictive diagnostics that enable earlier detection and precision therapy selection.

◉Companion diagnostics: supporting targeted oncology approvals (188 companion diagnostics approved by FDA as of March 2025).

5) Manufacturing, quality & supply chain (operational AI)

◉Capabilities: predictive maintenance, batch quality prediction, anomaly detection, and regulatory traceability.

◉Example: Honeywell TrackWise Manufacturing — AI-assisted platform to align digital operations with physical manufacturing, reducing compliance burden and improving throughput.

6) Commercial & market access (GenAI)

◉Use: personalized HCP engagement, market segmentation, demand forecasting, and promotional optimization.

◉Example: Axtria’s GenAI solutions for outreach personalization and analytics-driven commercial strategies.

7) Post-market surveillance & pharmacovigilance

◉Use: NLP on EHRs / social media to detect safety signals faster, automated case processing, signal prioritization.

◉Regulatory note: PV algorithms must satisfy auditability and traceability.

8) Data infrastructure & ecosystems

◉Need: federated learning and privacy-preserving methods to unlock multi-center datasets while preserving patient privacy.

◉Constraint: data privacy and regulatory compliance are major bottlenecks.

9) Risks & mitigation

◉Risk: data bias, reproducibility, black-box models, regulatory acceptance, cybersecurity.

◉Mitigation: explainable AI, model registries, validation datasets, third-party auditing, and alignment to GxP.

10) KPIs for AI programs (what companies should measure)

◉time-to-insight, reduction in experimental cycles, predicted vs. actual validation hit rates, per-project cost savings, model explainability score, regulatory acceptance rate.

Regional insights

North America (lead region)

◉Why leading: deep VC ecosystems, world-class academic research, dense pharma/biotech clusters, and significant public funding (NIH ≈ USD 48B/year).

U.S. specifics:

◉R&D intensity: >45,000 life science companies in the U.S. (early 2024).

◉Approvals: 50 new drugs in 2024 (32 NCEs + 18 biologics) — accelerates commercial pipeline value.

◉Implication: Concentration of capital + regulatory proximity to FDA means faster commercialization and higher valuations for U.S. innovators.

Canada:

◉Scale: >2,000 life science companies; USD 25.9B invested (2019–2023); USD 12B in 65 deals in 2023 — strong niche VC/cluster momentum.

Asia-Pacific (fastest growth)

◉Drivers: expanding domestic markets, government incentives (China), increasing VC flows (India).

China:

◉Ecosystem: >3,000 life science companies; ~270k employees.

◉IP push: patent activity up (379% growth from 2014 per source); Shanghai & Beijing active VC centers (USD 1.7B VC activity in 2024).

◉Policy: Dec 2024 State Council incentives to cut regulatory hurdles and pilot clinical trial authorizations.

India:

◉Startups: from 5,365 → 8,531 (2021–2023).

◉VC: USD 13.7B life science VC (2025 report).

◉Implication: lower-cost clinical/research capabilities + growing domestic manufacturing make India both a growth and cost arbitrage hub.

Europe (steady, policy-driven)

◉Policy: European Commission strategy planning to boost green/digital transitions in life sciences.

◉Country notes: Germany — strong medtech innovation and per-capita healthcare spend (€5,832). UK — £21.7B pharma exports in 2024; LSIMF commitment £520M for manufacturing.

◉Implication: Europe attracts R&D and manufacturing investment when policy, talent, and incentives align.

Latin America

◉Clinical trials growth: Brazil leads region; 1,723 active/recruiting trials (as of June 6, 2025).

◉Implication: attractive for multi-site trials (cost + patient diversity), growing startup scene, regulatory harmonization remains a driver.

Middle East & Africa (emerging)

◉Funding & M&A: MEA governments allocating ~USD 10B for R&D; Q3 2024 M&A ~USD 1.8B (big Q-over-Q spike reported).

◉Implication: partnerships and capacity building (manufacturing/clinical) are the main near-term growth vectors.

Market dynamics

Drivers

◉New drug discovery & pipeline expansion — major responsible factor for market growth; high-value novel therapeutics (biologics/cell-gene) increase market value per product.

◉Increasing R&D spend — public (NIH ~USD 48B) and private capital fueling translational and clinical phases.

◉Advances in enabling technologies — genomics, proteomics, AI, digital health and manufacturing tech (e.g., Honeywell TrackWise) raise productivity.

◉VC & M&A — billions flowing into startups (India USD 13.7B; Canada USD 12B in 2023); M&A spikes (MEA example) signal consolidation and scale.

Restraints / headwinds

◉Regulatory compliance complexity — changing rules increase time-to-market and compliance costs across markets.

◉Data privacy & cybersecurity — digitization introduces breach risk and regulatory scrutiny.

◉Reimbursement pressure & payer evidence requirements — more companion diagnostics and precision therapies require stronger real-world evidence.

◉Talent and infrastructure mismatch in emerging regions — scale-up barriers despite VC inflows.

Opportunities

◉Genetic engineering & precision medicine — CRISPR & RNA therapeutics open up high-value rare disease and oncology opportunities.

◉AI-first products & platforms — AI market growth (CAGR ~20.21%) indicates commercializable platform opportunities across discovery, trials, and ops.

◉Telemedicine & digital therapeutics — >320 million users of health apps (2024) signals consumer adoption and commercial TAM for software-based interventions.

◉Geographic arbitrage & nearshoring — Asia-Pacific manufacturing & trial capacity grows; China/India policy pushes improve access.

Top companies

AstraZeneca

◉Overview: Global pharmaceutical company with core strengths in oncology, cardiovascular, metabolic, respiratory, and immunology.

◉Products: Branded therapeutics across oncology and biologics.

◉Strengths: Large late-stage pipelines, global commercialization reach, strong oncology franchise.

Baker Tilly

◉Overview: Professional services and consulting; Life Sciences consulting practice noted in your content.

◉Products/offerings: StewardshipNOW (new program), compliance & funding strategy services.

◉Strengths: Compliance expertise, partnerships (e.g., with MediSpend) to streamline external funding and reduce administrative burdens.

BIOQuébec

◉Overview: Industry association supporting Quebec life science ecosystem.

◉Strengths: Regional cluster development, facilitating MoUs and cross-border collaborations (e.g., with Life Sciences British Columbia).

Clarivate plc

◉Overview: Data & analytics provider for life sciences.

◉Product: DRG Fusion (commercial analytics platform).

◉Strengths: Deep data assets, analytics for commercial strategy and market intelligence; reduces raw data complexity for product positioning.

Eli Lilly & Company

◉Overview: Major global pharma, strong in diabetes, oncology, immunology.

◉2024 figures (source): Q4 2024 revenue USD 13.53B; FY 2024 revenue USD 45.042B.

◉Strengths: Robust clinical pipeline, strong commercial execution, recent revenue growth noted in source.

GlaxoSmithKline (GSK)

◉Overview: Broad pharmaceutical and vaccine portfolio; strong presence in vaccines and consumer healthcare (historically).

◉Strengths: Vaccine pipeline, global manufacturing footprint, established commercial channels.

Honeywell

◉Overview: Industrial technology conglomerate; moving into life sciences operational software.

◉Product: TrackWise Manufacturing (AI-assisted, cloud native).

◉Strengths: Industrial controls and compliance expertise, ability to scale manufacturing-quality systems.

Merck KGaA (The Merck Group)

◉Overview: German multinational active in life science tools, pharma, and performance materials.

◉2024 figures (source): Q4 2024 net sales USD 15.6B; FY 2024 USD 64.2B.

◉Strengths: Broad portfolio spanning tools & reagents to pharma, strong European base.

Novartis

◉Overview: Global pharma with big oncology and innovative therapy footprints.

◉Strengths: Strong R&D, scale manufacturing, and commercialization.

Novo Nordisk

◉Overview: Leader in diabetes/GLP-1 therapies.

◉Strengths: Market leadership in metabolic disease therapeutics and scale in global supply chains.

Pfizer

◉Overview: Broad pharma with recent high visibility (vaccines) and strong commercial muscle.

◉Strengths: Global reach, manufacturing, established regulatory relationships.

Roche

◉Overview: Diagnostics + pharma integrated model; leader in oncology diagnostics and therapeutics.

◉Strengths: Companion diagnostics leadership (complements therapeutic approvals).

Schrödinger, Inc.

◉Overview: Software & platform company for chemical simulation targeting drug discovery.

◉2024 figures (source): Q4 2024 revenue USD 88.3M; FY 2024 revenue USD 207.5M.

◉Strengths: Physics-informed molecular simulation, tooling used by pharma for computational chemistry.

Thermo Fisher Scientific

◉Overview: Market leader in life-science instruments, consumables, and services.

◉Strengths: Instrumentation scale, reagent & consumables leadership, global service networks — strong position in research and manufacturing workflows.

Latest announcements

Austrade + AusBiotech (June 2025)

◉What: Collaboration to accelerate international expansion of Australian life science firms; creation of a National TradeStart Adviser.

◉Impact: improves export readiness, connects firms to trade programs, and boosts cluster internationalization.

BIOQuébec + Life Sciences British Columbia (May 2025)

◉What: MoU to accelerate cross-regional life science innovation, investment, and commercialization.

◉Impact: cross-province resource exchange, joint commercialization pathways, boosted investor networks.

Prudentia Sciences funding (Jan 2025)

◉What: USD 7M raised to provide data-driven decision platforms for biopharma portfolio and pipeline acceleration.

◉Impact: supports investor decision-making and portfolio strategies to de-risk investments in drug pipelines.

Accenture × 1910 Genetics (Oct 2024)

◉What: Partnership & investment to provide tailored solutions + scalable infrastructure for target identification.

◉Impact: Shortens discovery timelines; brings enterprise IT scale to genomics-driven discovery.

Baker Tilly — stewardshipNOW launch

◉What: Platform to help life science companies manage external funding in a compliant, ethical way (in partnership with MediSpend).

◉Impact: reduces administrative overhead and mitigates compliance & risk for funded programs.

Honeywell — TrackWise Manufacturing (Apr 2025)

◉What: AI-assisted, cloud-native platform for manufacturing & compliance workflows.

◉Impact: bridges digital/physical manufacturing, streamlines regulatory documentation, increases production flexibility.

Clarivate — DRG Fusion (Jan 2025)

◉What: New commercial analytics platform for biopharma & medtech to simplify disease and competitive landscapes.

◉Impact: helps identify product positioning gaps and commercialization opportunities.

Recent developments

Policy & regulation changes

◉China (Dec 2024) incentivizing life sciences — immediate effect: accelerating local launches and foreign access.

◉WHO Technical Advisory Group on responsible life sciences use — indicates elevated global governance focus on dual-use/biorisk.

Platform & software launches

◉Honeywell TrackWise and Clarivate DRG Fusion signal a move toward end-to-end digital workflows (manufacturing compliance → commercial analytics).

Funding & partnerships

◉Prudentia $7M and Accenture’s engagement with 1910 Genetics indicate private capital targeting tools to accelerate discovery & investment decisions.

Clinical & approval momentum

◉FDA and approvals data (50 new drugs in 2024; device approvals; 43 cell/gene approvals by Jan 2025) indicate sustained regulatory throughput; companion diagnostics (188 approvals as of Mar 2025) show precision medicine commercial integration.

Regional trade & cluster strengthening

◉Austrade/AusBiotech and BIOQuébec collaborations show policy-level cluster support to convert R&D into exports; expect faster market entry for partnered firms.

Segments covered

By Type

Pharmaceuticals

◉Subsegments: branded drugs, generic drugs, biosimilars.

◉Explanation: high-value prescription drugs dominate revenue; generics/biosimilars add volume-based revenue and pricing pressure.

Biotechnology

◉Subsegments: genomics, proteomics, metabolomics, bioinformatics.

◉Explanation: driving biologics, cell & gene therapies, and enabling precision therapeutics via omics.

Medical Devices

◉Subsegments: diagnostics, therapeutic devices, wearables.

◉Explanation: device evolution (AI-enabled diagnostics, wearables) increases recurring data + device-as-platform revenue.

Life Science Tools

◉Subsegments: instruments, reagents & consumables, analytical tools.

◉Explanation: backbone of laboratory workflows — predictable recurring revenue, margin variability.

Digital Health Solutions

◉Subsegments: AI in life sciences, cloud platforms, health informatics.

◉Explanation: platform economics, scalable software margins, and cross-selling into R&D/commercial ops.

By Application

Therapeutics

◉Explanation: largest revenue contributor because approved therapies command high price points and long-term use.

Drug Discovery & Development

◉Explanation: fastest CAGR — demand for discovery platforms, CRO/CDMO services, and AI-enabled tools.

Diagnostics & Clinical Trials

◉Explanation: diagnostics growth driven by screening programs, companion diagnostics growth; trials growth increases demand for trial tech and CRO services.

By Therapeutic Areas

Oncology (dominant in 2024)

◉Explanation: intensity of R&D, high-value biologics, and companion diagnostics drive revenue.

Infectious Diseases (fastest growth forecast)

◉Explanation: renewed emphasis on pandemic preparedness, vaccine innovation, and antivirals.

Cardiology, Neurology, Immunology, Rare Diseases

◉Explanation: demographic trends (aging) and biologic innovation drive investment.

By Region

Detailed in the Regional Insights section above.

Top 5 FAQs

1) What is the current size and projected size of the global life science market?

◉Answer: The market was USD 88.2B in 2024, USD 98.63B in 2025, and is projected to reach USD 269.56B by 2034 (CAGR 11.82% from 2025–2034).

2) Which region led the market in 2024 and which will grow fastest?

◉Answer: North America led in 2024 (U.S. strength, NIH funding USD 48B). Asia-Pacific is expected to be the fastest-growing region over the forecast period driven by China and India.

3) How big is AI in the life sciences and why does it matter?

◉Answer: AI in life sciences was USD 2.25B in 2024, USD 2.71B in 2025, and is projected at USD 14.20B by 2034 (CAGR 20.21%). AI shortens discovery cycles, automates trials, improves diagnostics, and optimizes manufacturing & commercial functions — so it multiplies productivity across the value chain.

4) What are the principal market restraints?

◉Answer: Major restraints include regulatory compliance complexity, data privacy & cybersecurity, and payer/reimbursement pressures. These increase cost and time-to-market for products and digital solutions.

5) Who are the top players and what are their strengths?

◉Answer: Top players listed in your content include AstraZeneca, Eli Lilly, Merck KGaA, Novartis, Pfizer, Roche, Thermo Fisher, Schrödinger, and others. Strengths vary from large-scale R&D & commercial channels (big pharmas) to platform/software specialization (Schrödinger) and instrumentation & consumables scale (Thermo Fisher). Example financial anchors: Merck Group FY 2024 sales USD 64.2B, Eli Lilly FY 2024 USD 45.042B, Schrödinger FY 2024 USD 207.5M.

Access our exclusive, data-rich dashboard dedicated to the life science sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5711

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest