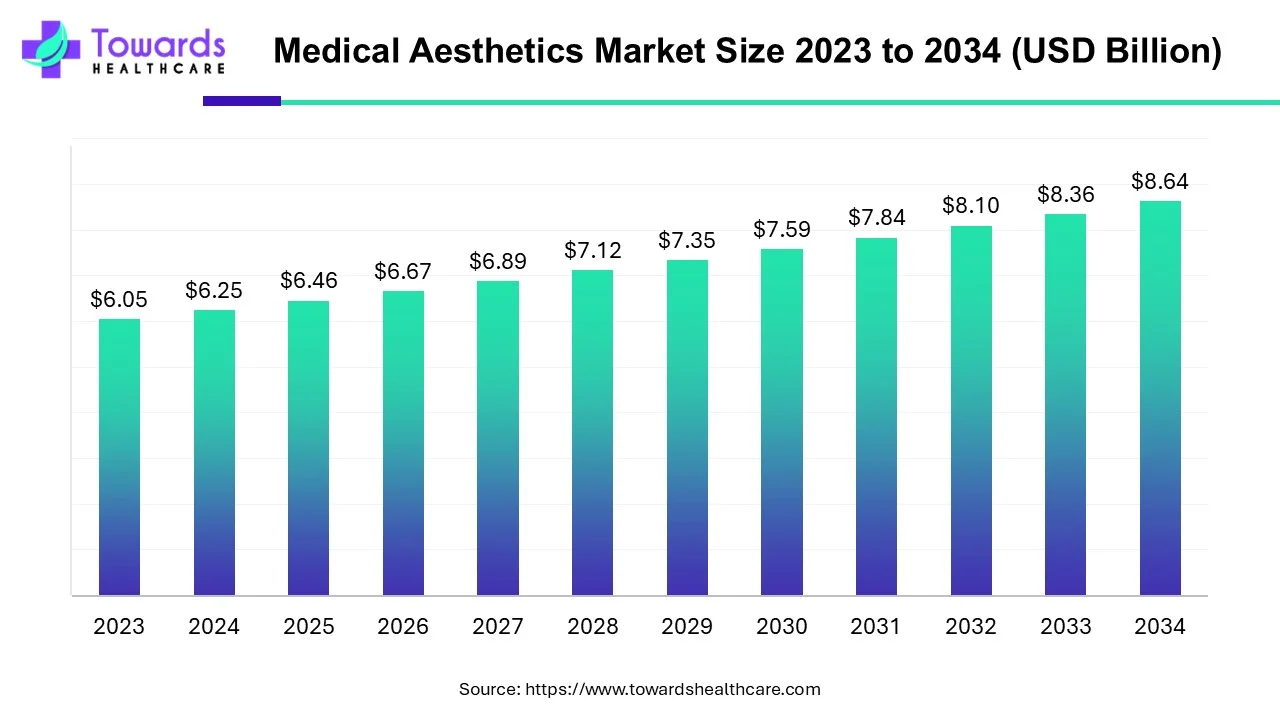

The global medical aesthetics market was valued at USD 6.25 billion in 2024 and is forecast to reach USD 8.64 billion by 2034 (CAGR 3.29% from 2025–2034), driven by rising procedure volumes, technology (lasers, energy-based devices), non-invasive demand and expanding medical tourism.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5013

Market Size

Total market (2024 baseline & forecast)

◉2024 revenue: USD 6.25B; 2034 projection: USD 8.64B; CAGR 3.29% (2025–2034). (Your supplied numbers.)

Revenue pools (how the USD 6.25B breaks down conceptually)

◉Devices & equipment: lasers, RF, ultrasound (energy-based devices) — large upfront sales + recurring consumables (handpieces, cartridges).

◉Injectables & biologics: botulinum toxins, dermal fillers — high-margin, recurring revenue from repeat treatments.

◉Clinic & service revenue: procedural fees, consults, follow-ups (hospitals, clinics, med-spas).

◉Software & training: simulation/diagnostic AI, provider training centers — emerging but fast-growing share.

Unit economics & average ticket

◉Non-invasive procedures have lower per-case prices but much higher volume → major contributor to revenue growth.

◉Invasive procedures command higher ticket sizes and longer recovery, so they account for significant share of device and hospital revenue despite lower volumes.

Addressable market drivers (demand side)

◉Aging populations in developed markets and rising disposable incomes in APAC/ME drive both elective and reconstructive demand.

◉Medical tourism shifts some procedure volumes to lower-cost geographies, amplifying APAC & ME growth.

Supply side & capital intensity

◉Device manufacturers’ revenues are tied to product cycles, FDA/EU approvals and clinician adoption; R&D + regulatory costs are important constraints.

Market concentration & fragmentation

◉Several large global companies (Merz, AbbVie/Allergan, Galderma, Cutera, Lumenis, etc.) lead device and injectable segments; a long tail of clinic operators and regional device makers exist—industry is oligopolistic for some product classes and fragmented for service providers.

Market Trends

Shift to non-invasive/minimally invasive procedures

◉Patient preference for less downtime, lower pain & visible recovery → non-invasive segment dominates market share.

Energy-based technologies rising

◉Lasers, RF, HIFU and ultrasound devices increasingly adopted for skin tightening, fat reduction and scar treatments.

Procedural training & provider enablement

◉Allergan Aesthetics opened three U.S. training centers (Feb 2025) to upskill licensed providers and standardize outcomes. (from provided content)

Medical tourism & translation/UX innovations

◉Growth in medical tourism fuels clinic expansion; Shonan Beauty Clinic launched a proprietary translation app (Jan 2025) to serve international patients.

M&A and consolidation

Clinic networks and platforms (e.g., Faceland acquiring Juneco, Faceland expansion moves) show capital flow into roll-ups and chain models.

Regulatory tightening (device focus)

◉EU MDR (Regulation 2017/745) widened scope and raised compliance costs for aesthetic devices — affecting market entry timelines and costs.

Pricing dynamics & promotions

◉While technology and consumables are costly, clinics use promotions and loyalty programs (noted in US) to stimulate demand.

Product launches & approvals shaping demand

◉Merz’s Ultherapy PRIME® launch in Europe (Jan 2025) and Merz’s role at IMCAS 2025 indicate continual product innovation and scientific positioning.

AI role & impact

Pre-procedure patient selection & personalization

◉AI models analyze photos, 3D scans and patient history to recommend optimal treatment pathways (device choice, injectable volumes, staging of procedures). This reduces clinician trial-and-error and improves consent quality.

Outcome simulation & realistic expectations

◉Generative/visualization tools create before/after simulations (face morphing, volumetric change) that improve shared decision-making and conversion rates; helps manage expectations and reduce post-procedure dissatisfaction.

Treatment planning & dosing optimization

◉ML models predict optimal injection sites, volumes and device settings from aggregated outcome datasets—leading to fewer complications, improved symmetry, and more predictable longevity.

Image-based diagnostics & monitoring

◉Computer vision analyzes skin texture, vascularity, pigmentation and scar depth to choose laser wavelengths or RF parameters and to quantify objective improvement over time (ROI tracking).

Predictive outcome and risk stratification

◉Predictive analytics flag patients at higher risk of adverse events (poor wound healing, hypertrophic scarring) using pre-op variables, enabling tailored peri-procedural care.

Operations, scheduling & revenue optimization

◉AI automates appointment scheduling by predicting no-show risk, optimizing device utilization and assigning clinicians by skill set — increasing throughput and per-clinic profitability.

Marketing, social listening & trend forecasting

◉NLP monitors social platforms to detect emerging consumer trends (e.g., rising interest in lip augmentation), feeding R&D and marketing decisions.

Regulatory & quality compliance automation

◉AI assists with device performance monitoring, adverse event signal detection and automated report generation needed under stricter MDR/FDA regimes.

Training & simulation for clinicians

◉Virtual reality + AI tutors replicate procedures for trainees (force feedback, outcome scoring), shortening the learning curve—aligns with industry training center investments (e.g., Allergan).

Ethics & explainability needs

◉Widespread AI use raises consent-and-privacy issues (facial data), require explainable models and robust data governance to preserve trust.

Commercial productization opportunities

◉Vendors can bundle AI diagnostics with device sales (hardware + software + subscription), creating recurring SaaS revenue and stickier customer relationships.

Data network effects & competitive moat

◉Larger clinic networks and device vendors that capture interoperable outcome data can build superior ML models—strengthening their commercial advantage and potentially raising barriers for smaller players.

Regional insights

North America (lead region)

◉Market leadership factors: advanced infrastructure, high procedure volumes, earlier adopter culture for technology and injectables.

◉Clinical ecosystem: abundant board-certified cosmetic surgeons + med-spa proliferation → wide access points for consumers.

◉Business dynamics: higher average ticket sizes, strong private pay market, sophisticated marketing and loyalty programs.

◉Regulatory & reimbursement: largely private-pay environment; limited reimbursement for elective aesthetics → consumer affordability is critical (promotions, financing).

◉Implication: North America remains R&D and product-adoption hub; device approvals here shape global rollouts.

Europe

◉Drivers: aging populations and high disposable incomes in certain countries (Germany, France, UK).

◉Regulatory environment: EU MDR increases compliance burden — favors established vendors who can absorb regulatory cost.

◉Clinical preference: mix of non-invasive procedures and reconstructive demand.

◉Implication: steady growth; product launches (Merz’s Ultherapy PRIME®) and scientific conferences (IMCAS) shape clinician adoption.

Asia-Pacific (fastest expansion)

◉Growth drivers: rising incomes, large addressable populations (China, India, Japan, S-Korea), medical tourism, cultural acceptance of aesthetic procedures.

Country nuances:

◉South Korea: high per-capita procedure rates, strong culture of cosmetic procedures and robust clinic density.

◉Japan: rapidly growing clinic network (noted +43.6% clinic growth 2020→2023) and significant surgical volumes.

◉China & India: scale opportunity; rising middle class and medical tourism flows.

◉Implication: heavy investment opportunity; specialized localized products and language/UX solutions (e.g., translation apps) add value for international patients.

Middle East & Africa

◉Drivers: medical tourism hubs (Dubai), growing private healthcare investment, affluent segments seeking elective procedures.

◉Business models: flagship clinics and high-end med-spa chains; cross-border patient flows.

◉Implication: strategic expansion target for clinic chains (e.g., Este Medical Group investment in Dubai).

Latin America

◉Drivers: culturally high acceptance of cosmetic procedures, competitive pricing relative to the US, growing domestic clinic networks.

◉Constraints: variable regulatory frameworks and reimbursement landscapes.

Market dynamics

Key growth drivers

◉Rising procedure volumes (ISAPS: 35 million aesthetic procedures in 2023 — per your content).

◉Technology advances (lasers, energy devices) enabling non-invasive options.

◉Aging populations and social drivers (social media, image consciousness).

◉Medical tourism and clinic network expansion.

Major restraints

◉High cost of procedures and devices → affordability barrier in price-sensitive markets.

◉Low/no reimbursement for elective aesthetics in many systems.

◉Device adverse events & malfunction risk → reputation, regulatory scrutiny.

Regulatory impacts

◉EU MDR and similar rules raise compliance costs and time-to-market risk for devices.

Opportunities

◉AI & digital health integration for personalization and retention.

◉Consumables & repeatable treatments (injectables) offer recurring revenue.

◉Clinic roll-ups / franchising to scale service offerings and capture network effects.

◉Medical tourism services (multilingual platforms, bundled care) to expand patient flows.

◉Market elasticity & pricing levers

◉Clinics use promotions, financing and loyalty programs to reduce sticker shock and increase procedure uptake.

Technology substitution

◉Non-invasive modalities cannibalize some surgical volumes but also create new volume by lowering barrier to entry for patients.

Top companies

Merz Pharma / Merz Aesthetics

◉Products: Ultherapy (Ultherapy PRIME®), injectable brands (medical aesthetics portfolio incl. neurotoxins like XEOMIN).

◉Overview: Global aesthetic pharma/device player with a balanced portfolio of devices and injectables.

◉Strengths: Clinical evidence focus (IMCAS abstracts), product innovation (Ultherapy PRIME®), regulatory approvals (e.g., XEOMIN US FDA approvals noted), global distribution. (from provided content)

Anika Therapeutics, Inc.

◉Products: Biologics, regenerative biomaterials (often used for soft-tissue/orthopaedic aesthetic overlaps).

◉Strengths: Specialty biomaterials expertise and B2B relationships with clinics/hospitals.

Johnson & Johnson Services, Inc. (Allergan Aesthetics)

◉Products/Units: Leading injectables historically (Allergan Botox family), device partnerships.

◉Strengths: Brand equity, global salesforce, investments in training (e.g., 3 U.S. training centers, Feb 2025), large commercial scale.

AbbVie

◉Products: A portfolio including injectables following Allergan acquisition (injectables + aesthetics R&D).

◉Strengths: Deep pharma & commercialization capabilities.

Lumenis

◉Products: Laser and energy-based devices for dermatology and aesthetic indications.

◉Strengths: Device technology expertise and clinician penetration in energy-based categories.

Solta Medical

◉Products: Aesthetic lasers and device systems.

◉Strengths: Established device brand, product breadth across skin tightening and resurfacing.

Syneron Candela

◉Products: A broad array of aesthetic lasers and platform devices.

◉Strengths: Global device distribution and product innovation across multiple indications.

Alma Lasers

◉Products: Laser and light-based devices; aesthetic & surgical indications.

◉Strengths: Clinical breadth and multi-indication platforms.

Hologic

◉Products: Medical device portfolio with some relevance to aesthetic and women’s health overlaps.

◉Strengths: Device R&D and regulatory experience.

Cutera, Inc.

◉Products: Dermatology & aesthetic devices (acne, body sculpting, hair removal, skin revitalization).

◉Strengths: Focused dermatology device range; noted revenue (Q3 2024 consolidated revenue $32.5M — from provided content).

Galderma

◉Products: Injectables, skincare, therapeutic dermatology.

◉Strengths: Strong commercial injectable sales (H1 2025 net sales $2.448B; injectable growth 9.8% — provided data), global dermatology presence.

◉Other notable players: Cynosure, El.En S.p.A., Medytox, Fotona, Sisram Medical — each strengthens the ecosystem with device or biologic specialties (lasers, injectables, clinic networks).

Latest announcements

Allergan Aesthetics — U.S. training centers (Feb 2025)

◉Opened three state-of-the-art centers to expand access to high-quality, tailored training for licensed aesthetic providers. Impact: improves provider competency, standardizes clinical outcomes, and supports product adoption. (provided)

Shonan Beauty Clinic — proprietary translation app (Jan 2025)

◉Launched to improve communication for international patients as medical tourism grows. Impact: better patient onboarding, fewer miscommunications, higher conversion and satisfaction for foreign patients. (provided)

Merz Aesthetics — Ultherapy PRIME® launch (Jan 2025, Europe)

◉Non-invasive lifting product rollout; Merz also presented six abstracts at IMCAS 2025. Impact: bolsters Merz’s device portfolio and thought leadership in regenerative aesthetics.

Galderma H1 2025 results (reported)

◉Net sales: $2.448B (H1 2025); injectable aesthetics +9.8% growth; therapeutic dermatology +26.9% — indicates healthy momentum in injectables and medical dermatology. Impact: validates demand for injectable and skincare lines. (provided)

Merz — XEOMIN FDA approval (July 2024)

◉XEOMIN approved as the first neurotoxin for simultaneous treatment of multiple upper facial lines. Impact: expands injectable product indications and market share potential. (provided)

M&A — Faceland and Juneco (June 2024)

◉Faceland acquired a majority stake in Italian network Juneco to expand European footprint; strategic M&A for clinic network scale. Impact: consolidation trend in clinic networks. (provided)

Este Medical Group — Dubai flagship

◉Announced investment and flagship clinic launch in Dubai to capture medical tourists and affluent regional patients. Impact: accentuates Middle East as strategic expansion area. (provided)

Recent developments

◉Oct 2024 — Allergan Aesthetics & Girls, Inc. collaboration via SkinSpirit to inspire girls for STEM/career paths (CSR & workforce pipeline).

◉Jul 2024 — Merz received FDA approval for XEOMIN for simultaneous upper facial lines (product regulatory milestone).

◉Jun 2024 — Faceland majority stake in Juneco (European clinic consolidation).

◉Ongoing — Clinic growth metrics: Japan saw ~2,016 cosmetic surgery clinics in 2023 (+43.6% vs 2020); South Korea ~132 clinics and ~2,808 surgeons (ISAPS data referenced in your content). These underline APAC clinic expansion.

Segments covered

By Type

a. Non-invasive Procedures

◉Technologies covered:

◉Lasers & Light-Based Systems – hair removal, pigmentation, skin resurfacing.

◉Radiofrequency (RF) – skin tightening, wrinkle reduction, cellulite treatment.

◉High-Intensity Focused Ultrasound (HIFU) – lifting, contouring, collagen stimulation.

◉Ultrasound & Cryolipolysis – fat reduction, body sculpting.

Market Characteristics:

◉Account for the largest share due to reduced downtime, safety profile, and broader patient acceptance.

◉Can be repeated multiple times, driving recurring revenues for providers.

◉Strong adoption in younger demographics seeking preventive or “maintenance” aesthetics.

◉Key Trend: Democratization of access — even mid-tier beauty centers and med-spas are adopting these systems.

b. Invasive Procedures

Examples:

◉Implants – breast, facial, chin, buttock.

◉Surgical lifts – facelift, blepharoplasty, brow lifts.

◉Liposuction & fat grafting – permanent fat removal and redistribution.

Market Characteristics:

◉Higher ticket size per procedure.

◉Typically performed in hospitals/clinics by certified surgeons.

◉Growing due to unmet demand in cases where non-invasive methods fail (e.g., structural deformities, advanced aging).

Key Trend: Hybrid approach — combination of surgical + non-invasive for optimal outcomes.

📌 Explanation:

◉Non-invasive drives access & volume (mass-market, recurring).

◉Invasive retains premium value for structural/permanent corrections, ensuring both segments co-exist.

2. By End-User

a. Hospitals & Specialty Clinics

Characteristics:

◉Largest market share due to comprehensive infrastructure.

◉Handle invasive surgeries and complex procedures requiring anesthesia and post-care.

◉Patients trust hospitals for safety, accreditation, and presence of qualified surgeons.

◉Revenue Profile: Higher revenue per patient due to full-suite offerings.

b. Beauty Centers / Med-Spas

Characteristics:

◉Specialize in injectables (fillers, neurotoxins) and energy-based non-invasive devices.

◉Offer affordable, quick-turnaround treatments with minimal downtime.

◉Attractive to middle-income groups and millennials.

◉Revenue Profile: Higher patient footfall, smaller ticket size but rapid repeat visits (botox/filler cycles every 6–12 months).

c. Home Care / OTC

Products covered:

◉Topical cosmeceuticals (anti-aging serums, skin brighteners).

◉At-home devices (LED masks, microcurrent, RF hand-helds).

Characteristics:

◉Fast-growing but still a modest share.

◉Limited efficacy compared to professional treatments.

◉Drives awareness and funnels patients into clinical settings once OTC solutions plateau.

📌 Explanation:

Hospitals dominate invasive/high-risk space.

Med-spas capture convenience and volume seekers.

Home care expands entry-level access but feeds into clinical demand.

3. By Product Class

a. Devices (Capital Equipment)

◉Examples: Lasers, RF platforms, cryolipolysis systems, HIFU devices.

Market Traits:

◉High upfront cost, lumpy sales cycle.

◉Revenue depends on innovation cycles and replacement demand.

b. Consumables

◉Examples: RF cartridges, laser tips, microneedles, dermal filler syringes.

Market Traits:

◉Provide recurring revenue tied to procedure volumes.

◉Key driver of profitability for device OEMs.

c. Biologics

◉Examples: Dermal fillers, botulinum toxins, platelet-rich plasma (PRP).

Market Traits:

◉High repeat demand (maintenance every few months).

◉Strong growth driver due to rising adoption of injectables worldwide.

d. Software & Services

◉Examples: AI-driven skin analysis, treatment planning platforms, AR-based patient visualization, training & certification services.

Market Traits:

◉Enhances procedure precision and personalization.

◉Growing relevance in digital aesthetics + patient engagement.

📌 Explanation:

◉Devices = one-time sales.

◉Consumables & injectables = recurring revenue, high margins.

◉Software/services = value-add and differentiation in competitive markets.

4. By Region

◉North America: Largest share; advanced infrastructure, high disposable incomes, strong presence of leading vendors.

◉Europe: Mature market with regulatory strictness, high adoption of injectables and surgical aesthetics.

◉Asia-Pacific: Fastest-growing region; rising middle-class, cultural shifts, and medical tourism hubs (South Korea, Thailand, India).

◉Latin America: Strong in Brazil & Mexico (cosmetic surgery hotspots).

◉Middle East & Africa: Growing high-net-worth demand, especially in UAE and Saudi Arabia.

Top 5 FAQs

-

Q: What is the market size and expected growth?

A: The market was ~USD 6.25B in 2024 and is expected to reach ~USD 8.64B by 2034 — a 3.29% CAGR (2025–2034). (provided) -

Q: Which segment currently dominates — non-invasive or invasive?

A: Non-invasive leads the market by share due to patient preference for minimal downtime and repeated procedures; invasive is expected to grow because of longer-lasting outcomes. (provided) -

Q: Which regions show the strongest near-term growth?

A: Asia-Pacific is projected to expand fastest (Japan, South Korea, China, India) driven by surgeries, tech adoption and medical tourism; North America remains largest in absolute terms. (provided) -

Q: How is AI changing the market?

A: AI improves patient selection, outcome simulations, dosing & device parameter optimization, operational efficiency and safety monitoring — creating both clinical and commercial upside. (Detailed AI section above.) -

Q: What are the biggest risks to growth?

A: High procedure/device costs, low reimbursement, device adverse events, and stricter regulations (e.g., EU MDR) that raise compliance costs and slow new product introductions. (provided)

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5013

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest