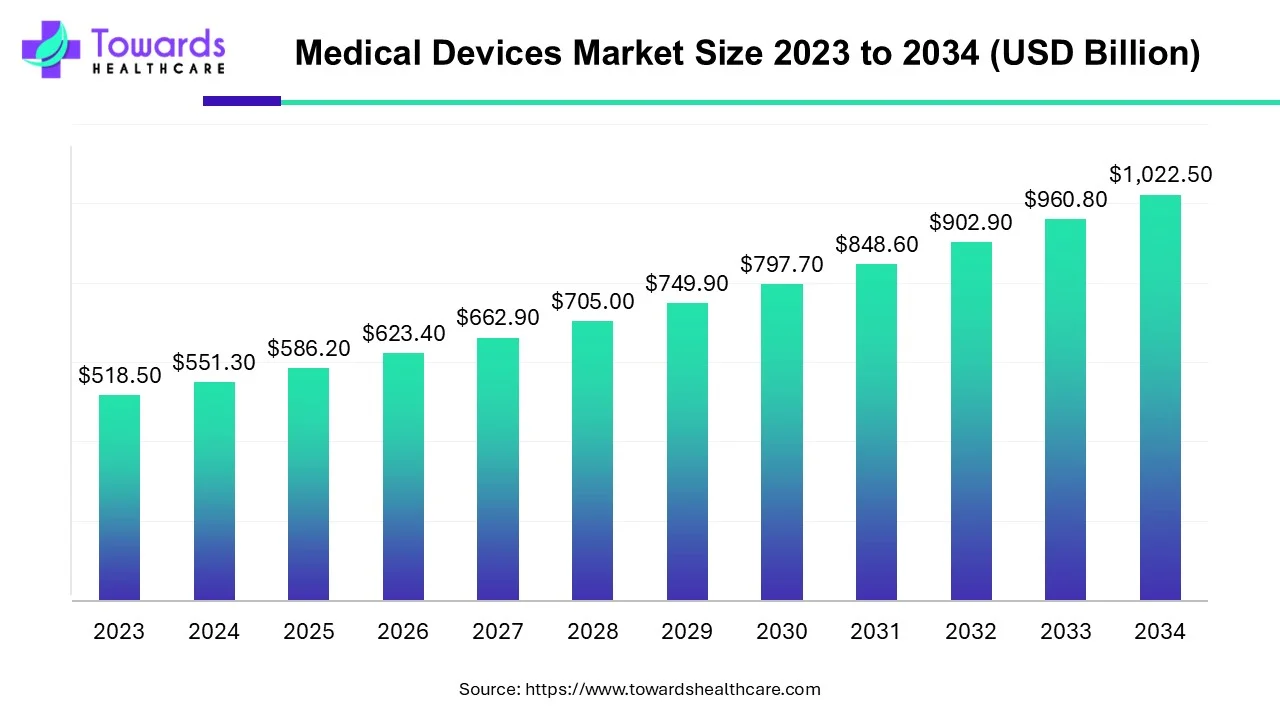

The global Medical Devices Market was USD 551.3 billion in 2024, is estimated at USD 586.2 billion in 2025, and is projected to reach USD 1,022.5 billion by 2034 (market expansion supported by a 6.34% CAGR between 2025–2034).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5487

Market size

Key headline figures

◉Global (total): USD 551.3B (2024) → USD 586.2B (2025) → USD 1,022.5B (2034).

◉The provided forecasted CAGR (2025–2034) = 6.34% (user data).

◉If measured 2024 → 2034, the CAGR implied by the 2024 and 2034 figures ≈ 6.37% (10-year basis).

◉Device-type traction (selected 2024 → 2034) (figures from the provided type table):

◉In vitro Diagnostics: USD 88.0B (2024) → USD 144.4B (2034) (implied 10-yr CAGR ≈ 5.08%).

◉Cardiovascular Devices: USD 67.3B → USD 120.4B (CAGR ≈ 5.99%).

◉Diabetes Care: USD 58.0B → USD 97.3B (CAGR ≈ 5.31%).

◉Orthopedic Devices: USD 56.0B → USD 100.5B (CAGR ≈ 6.02%).

◉Dental Devices: USD 39.8B → USD 69.4B (CAGR ≈ 5.72%).

◉End-user split (2024 — absolute):

◉Hospitals & ASCs: USD 307.53B (2024) — largest end-user by far.

◉Clinics: USD 165.01B (2024).

◉Others: USD 78.76B (2024).

◉Regional totals (2024) — these sum to the global total:

◉North America: USD 197.8B

◉Europe: USD 139.8B

◉Asia-Pacific: USD 138.7B

◉Latin America: USD 40.9B

◉Middle East & Africa: USD 34.1B

◉Regional implied growth (2024 → 2034, 10-yr CAGRs) from the provided regional tables:

◉North America: 197.8 → 348.4 (CAGR ≈ 5.82%).

◉Europe: 139.8 → 251.4 (CAGR ≈ 6.04%).

◉Asia-Pacific: 138.7 → 253.4 (CAGR ≈ 6.21%).

◉Latin America: 40.9 → 87.1 (CAGR ≈ 7.85%).

◉Middle East & Africa: 34.1 → 79.2 (CAGR ≈ 8.79%).

→ Takeaway: faster relative expansion is expected in LATAM and MEA (from smaller bases), while North America remains the largest single market.

Market trends

Macro trends and facts

◉MedTech revolution & technological pull: AI, robotics, wearables, telemedicine, 3D printing, nanotech, AR/VR, and smart implants are repeatedly highlighted as market accelerants.

◉Screening & IVD dominance: IVD is the single largest type segment in 2024 (USD 88.0B) driven by screening programs, point-of-care adoption, and public health screening policies (estimated 40,000 IVDs available).

◉Fastest growth area: Diabetes care devices are flagged as the fastest-growing type segment (rising adoption of CGM, insulin pumps, smart pens and connected systems).

◉Hospitals & ASCs leadership: Hospitals and ambulatory surgery centers dominated end-user spend in 2024 (USD 307.53B) due to infrastructure and reimbursement incentives.

◉Regulatory & approval activity:

◉FDA approvals: 33 medical devices were approved in 2024 (user data).

◉AI approvals: the U.S. FDA has approved 1,000 AI-powered medical devices from 1995 through Aug 2024 (user data), indicating rapid adoption of algorithmic tools.

Global trade & manufacturing shifts:

◉China exported USD 11.6B of medical instruments from Mar 2024 → Feb 2025; Feb 2025 alone = USD 688M (user data).

Policy & events:

◉Japan launched “Japan Health” (Aug 2023), starting at EXPO 2025 Osaka and annual thereafter — a marker of national strategic emphasis on MedTech.

Concrete company / product developments (selected items from your supplied content)

◉Jan 2025 – SpineGuard: strengthened partnership with Omnia Medical to expand product collaboration, reallocate SpineGuard resources to support Omnia’s U.S. product launches (e.g., PsiFGuard).

◉Jan 2025 – Harsoria Healthcare Pvt. Ltd.: raised USD 20M (led by Tata Capital Healthcare Fund II) to scale manufacturing and R&D.

◉Feb 2025 – FDA approvals: SPN-830 (subcutaneous apomorphine infusion device for advanced Parkinson’s) — availability expected Q2 2025 (linked to the TOLEDO trial).

◉Feb 2025 – Chinese NMPA: MediBeacon TGFR Monitor and TGFR Sensor approved for kidney-function assessment (user data).

◉Jan 2025 – Sequana Medical NV: PMA granted for Alfapump for recurrent/refractory ascites; U.S. patient base estimated 70,000 and an addressable market opportunity > USD 2B in 2025 (user data).

◉Mar 2025 – Archimedic: launched OpenQMS, an open-access web platform to help companies with Quality Management through the device life cycle.

◉Dec 2024 – University Medical Devices: launched MicroWash, a less-invasive nasal lavage specimen collection device (pilot rollout planned).

AI role & impact in the medical devices market

Diagnostic intelligence

◉Faster detection and triage: AI models integrated into IVD and imaging streamline interpretation, flag urgent findings, and triage patients faster — amplifying the clinical value of the large IVD installed base (IVDs = USD 88.0B in 2024).

◉Point-of-care AI: on-device ML for POCT (point-of-care tests) reduces lab turnaround; this increases adoption in clinics and decentralized settings.

Therapeutic automation & closed-loop devices

◉Closed-loop insulin systems & implant adjustment: AI/ML algorithms embedded in insulin pumps and implant firmware allow automated dosing adjustments (the provided content explicitly cites automatic dose adjustments from implants as a use case). This drives demand in Diabetes Care (fastest-growing segment).

◉Infusion devices with smarter control: devices such as the SPN-830 class (infusion devices) can incorporate smarter dosing schedules and predictive alerts.

Surgical assistance & robotics

◉Precision augmentation: AI augments robotic systems and navigation devices to reduce human error and improve outcomes in cardiovascular, orthopedic, and minimally invasive surgery segments.

◉Decision support in OR: real-time analytics (anomaly detection, blood-loss prediction) can be fused with surgical consoles.

Device lifecycle, safety & regulatory pipelines

◉Automated QA/QC & QMS: AI tools are being integrated to streamline quality management (example: Archimedic’s OpenQMS addresses regulatory/QMS workflow — AI could augment defect detection and documentation).

◉Regulatory acceleration: a rising wave of AI-enabled submissions is reflected in the historical approval tally (1,000 AI devices approved to Aug 2024). Regulators are evolving pathways for “adaptive” algorithm updates — this is both an enabler and a complexity for manufacturers.

Real-time monitoring, remote care & value-based care

◉Continuous remote monitoring: AI converts continuous telemetry (wearables, CGM, implant signals) into actionable alerts and predictive care pathways, lowering hospital readmissions and improving chronic disease management.

◉Reimbursement & outcomes measurement: AI enables more precise outcomes metrics which payers can use for reimbursement models tied to performance and value.

R&D acceleration and synthetic data

◉Faster product design: AI accelerates prototyping (simulation, in silico trials), reduces bench cycles, and helps optimize materials and device ergonomics.

◉Synthetic datasets: used to train ML when clinical datasets are scarce — helpful for rarer conditions (e.g., advanced Parkinson’s infusion systems).

Economic & operational impacts

◉Cost reduction: automation reduces manual interpretation labor and increases throughput (IVD & diagnostic imaging).

◉Revenue expansion: value-added AI features (subscription updates, analytics dashboards) open recurring revenue models for device vendors.

Risks & constraints (AI-specific)

◉Bias & validation: real-world performance must be validated across populations—critical in global markets with diverse patient profiles.

◉Cybersecurity & data privacy: connected AI devices increase attack surface — lifecycle security and secure OTA updates are essential.

◉Regulatory burden for adaptive algorithms: continuous learning systems raise oversight complexity.

Regional insights — deep points with subpoints & explanation

North America (overview + subpoints)

◉Market size & role: largest market in 2024 (USD 197.8B) — home to advanced R&D, deep reimbursement frameworks, and large MedTech adoption.

Drivers:

◉State-of-the-art R&D centers and venture/PE funding.

◉Favorable reimbursement and high public/private healthcare spend accelerate uptake of advanced devices (hospitals lead adoption).

Regulatory & approvals:

◉The U.S. FDA’s heavy approval pipeline (including 1,000 AI device approvals historically) drives commercialization and global regulatory leadership.

◉Implication: companies that secure U.S. regulatory approval get market credibility and export advantage.

U.S. specifics

◉Exports & trade: U.S. is the largest exporter of medical instruments in 2023 (USD 34.8B per user data) — testament to manufacturing and high-value device exports.

◉Clinical pipeline: presence of NCI-designated cancer centers (72 in the U.S.) creates a strong market for diagnostic and oncology-related devices.

Canada specifics

◉Strengths: cluster of ~89 MedTech firms and rising healthcare spend (USD 344B in 2023 — user data) supports clinical adoption; public funding enables scale.

Asia-Pacific

◉Rising manufacturing hub: manufacturing infrastructure and incentives encourage foreign OEMs to set up plants in the region — cost advantage and scale.

◉Growth trajectory: Asia-Pacific shows rapid growth (138.7 → 253.4 by 2034) and is forecast to be one of the fastest-growing regional markets.

Country notes:

◉China: NMPA reforms and export strength (USD 11.6B mar-2024→feb-2025) make China both a manufacturing powerhouse and an increasingly innovative market (e.g., MediBeacon approval in China).

◉India: “Make in India” + 100% FDI in medical devices + PLI scheme (Rs 3,420 crore) support domestic manufacturing ramp-up and import substitution.

◉Japan: aging population (36.25M aged 65+) makes Japan a high-demand market for diagnostic, chronic care and high-end devices; national events (Japan Health) promote MedTech competitiveness.

Europe

◉Market maturity & innovation: strong presence of major OEMs (Siemens Healthineers, etc.), EU regulatory framework (EU MDR) shapes compliance and market access.

◉Germany: third-largest MedTech market globally — major patent activity and large device & IVD catalog (500,000 types estimated in Germany).

◉Implication: Europe is a mix of high-value demand and complex regulation — attractive for mid/late-stage MedTech players.

Latin America

◉Faster relative growth: higher percentage CAGRs (≈7.85%) from smaller bases — growth driven by rising access, increasing healthcare spend, and expanding private clinics.

◉Challenges: affordability and heterogenous regulation across countries.

Middle East & Africa (MEA)

◉High relative growth (≈8.8% CAGR): driven by investments, public health initiatives, and rising chronic disease burden.

Country highlights:

◉UAE: significant public budgets for health (e.g., AED 71.5B Federal Budget for health in 2025) and high chronic disease prevalence (1 in 3 people with chronic conditions).

◉South Africa: large disease burden (e.g., diabetes prevalence) but reliance on imports — creates opportunities for local manufacturing incentives.

Market dynamics (drivers, restraints, opportunities; point-wise)

Drivers

◉Rising prevalence of chronic & acute disorders → steady demand for diagnostic and therapeutic devices (aging populations amplify this).

◉Increasing accessibility & policy support: WHO priority programs and national policies to expand device access.

◉Technological convergence: AI, connected devices, and minimally invasive tools boost value-per-device and willingness to pay.

◉Investments & partnerships: public and private capital inflows (VC, PE, government PLI schemes) accelerate product development.

Restraints

◉Regulatory gaps in developing markets: many regions (notably parts of Africa) lack robust regulatory frameworks, increasing compliance uncertainty and risk.

◉High compliance & reimbursement complexity: cost of clinical validation and regulatory approval is high — slowing smaller company entry.

◉Supply chain & manufacturing constraints: localization needs, quality control, and geopolitical trade issues can create friction.

Opportunities

◉Technological advances (AI, robotics, point-of-care) create new device classes and recurring-revenue services (analytics/subscriptions).

◉Localization of manufacturing: India/China incentives and LATAM/MEA growth spur onshore production and export hubs.

◉Unmet clinical needs: devices addressing chronic disease management (diabetes, cardiovascular, renal) have large addressable markets (Sequana Alfapump, kidney TGFR sensors, diabetes care devices).

Top companies

Medtronic

◉Overview & product focus (from provided data): Leading global device company with strong presence in cardiovascular and neuroscience markets.

◉Financials (user data): Q4 2024 revenue USD 8.6B; FY2024 revenue USD 32.4B (cardiovascular: USD 11.8B; neuroscience: USD 9.4B).

◉Strengths: Scale, deep clinical relationships, broad installed base in high-value therapeutic areas, and regulatory track record.

Stryker Corporation

◉Overview: Large multinational MedTech firm (user data gave sales figures).

◉Financials: Q4 2024 net sales USD 6.4B; FY2024 net sales USD 22.6B.

◉Strengths: Strong sales growth, diversified portfolio, surgical and orthopedic market penetration.

Siemens Healthineers

◉Overview: Listed among top players — major presence in diagnostic imaging and IVD markets (as per user list).

◉Strengths: Strong imaging & diagnostics offerings, global lab & hospital reach, innovation pipeline.

GE Healthcare

◉Overview: Major global player in imaging, monitoring, and hospital solutions (listed in your key players).

◉Strengths: Large installed base in hospitals; end-to-end imaging and enterprise IT solutions.

Johnson & Johnson

◉Overview: Global healthcare conglomerate with device divisions (listed).

◉Strengths: Broad product range, global distribution, brand trust.

Baxter International, Becton Dickinson (BD), Cardinal Health, Fresenius Medical Care

◉Overview: Large legacy players (listed).

◉Strengths: Scale in consumables, supply chain, renal care (Fresenius), and hospital logistics & distribution.

SpineGuard & Omnia Medical

◉Overview: SpineGuard expanding collaboration with Omnia to support product launches (Jan 2025).

◉Strengths: Niche spinal device expertise and strategic partnerships to scale product access.

Harsoria Healthcare Pvt. Ltd.

◉Overview: Vascular access devices manufacturer.

◉Recent move: USD 20M investment (Jan 2025) to expand manufacturing & R&D.

◉Strengths: Focused device category, capital for scaling.

Archimedic

◉Overview: Announced OpenQMS (Mar 2025) — a regulatory/QMS enablement platform.

◉Strengths: Focus on regulatory enablement and digital tools for device developers.

University Medical Devices

◉Overview: Launched MicroWash (Dec 2024) — an alternative specimen collection method.

◉Strengths: Novel sampling technology, pilot deployment strategy.

Dr Morepan

◉Overview: Announced LightLife weight-management product; aims for brand building in wellness.

◉Management note: CEO Varun Suri noted revenue target Rs 200 crore by 2030.

◉Strengths: Consumer wellness push, brand ambitions.

Latest announcements

SpineGuard–Omnia expansion (Jan 2025)

◉What happened: Strategic partnership scaling to new products & geographies; SpineGuard reallocates resources to support Omnia launches (PsiFGuard in U.S.).

◉Why it matters: Demonstrates consolidation strategy in spinal devices — collaborative commercialization reduces time-to-market and leverages complementary strengths.

Harsoria funding (Jan 2025, USD 20M)

◉What happened: Fundraise led by Tata Capital Healthcare Fund II.

◉Why it matters: Capital enables capacity ramp and product R&D—important for supply security in vascular access devices.

Sequana Alfapump PMA (Jan 2025)

◉What happened: FDA granted PMA for Alfapump for recurrent ascites. Market opportunity estimated >USD 2B in 2025 (70,000 U.S. patients).

◉Why it matters: PMA opens U.S. commercialization for a high-value therapeutic implant and illustrates market opportunity for implantable therapeutic devices.

SPN-830 FDA approval (Feb 2025)

◉What happened: Approval of subcutaneous apomorphine infusion device for advanced Parkinson’s; commercialization expected Q2 2025.

◉Why it matters: Shows continued appetite for advanced infusion & neurology devices.

MediBeacon TGFR Monitor (Feb 2025, China NMPA)

◉What happened: China NMPA approval for a fluorescent clearance kidney-function monitor.

◉Why it matters: New diagnostics for renal monitoring expand point-of-care renal care options and reflect cross-market device approvals.

Archimedic OpenQMS (Mar 2025)

◉What happened: Launch of an open web QMS platform for medtech regulatory workflows.

◉Why it matters: Addresses regulatory cost & complexity — particularly useful for smaller OEMs and startups.

University Medical Devices — MicroWash (Dec 2024)

◉What happened: Launch of less-invasive nasal lavage specimen collection device for pilot use.

◉Why it matters: Innovation in specimen collection can improve patient comfort and sample quality for respiratory/viral testing.

Recent developments

◉Device availability & scale: WHO estimate 2 million medical devices globally across >7,000 generic groups (user data).

◉Regulatory throughput: 33 FDA medical device approvals in 2024 and many AI approvals historically (~1,000 through Aug 2024).

◉Trade flows: China’s medical instrument exports (Mar 2024 → Feb 2025) total USD 11.6B.

◉New PMAs and approvals (2024–25): Sequana Alfapump PMA, SPN-830 approval, MediBeacon TGFR approval — indicating active 2024-25 approval environment for both therapeutic and diagnostic devices.

◉Financing & platform launches: Harsoria’s $20M raise; Archimedic’s OpenQMS platform show investment into both physical device manufacturing and regulatory/digital infrastructure.

Segments covered

By Type — explained

In vitro Diagnostics (IVD)

◉What’s included: reagents, test kits, POCT devices and lab automation.

◉Why it’s dominant: Screening policies, early-detection programs, high volume across care settings. 2024 value = USD 88.0B; projected USD 144.4B by 2034.

Diabetes Care

◉What’s included: SMBG devices, CGMs, insulin pumps, smart pens, connected diabetes ecosystems.

◉Why fast-growing: Rising diabetes prevalence + tech innovation (connected CGM + pumps) → convenience and outcomes improvements.

Cardiovascular Devices

◉What’s included: pacemakers, stents, catheters, monitoring systems. 2024 value = USD 67.3B. Aging populations and procedural volumes maintain demand.

Orthopedic Devices

◉What’s included: joint implants, fixation devices, spinal hardware — driven by orthopedics surgeries and aging demographics.

Dental Devices

◉What’s included: dental implants, imaging, consumables; steady growth from elective care resumption.

Diagnostic Imaging

◉What’s included: CT, MRI, ultrasound, X-ray systems — capital intensive but essential for high acuity care.

Minimally Invasive Surgery

◉What’s included: laparoscopic tools, endoscopes, robotics accessories — positioned for efficiency and faster recovery.

Nephrology, Ophthalmic, Wound Management, General Surgery, Others

◉What’s included: organ-specific device groups that respond to disease prevalence, reimbursement, and technology shifts.

By End-User — explained

◉Hospitals & ASCs: highest value procurement, capital equipment and specialty devices (dominant share in 2024).

◉Clinics: expanding adoption of diagnostic/POC devices, ambulatory treatments, and outpatient surgery devices.

◉Others: includes long-term care, homecare, labs — growing with remote care & home diagnostics.

By Region — explained

Each region presents a different mix of maturity, regulation, and growth potential; see the Regional Insights section above.

Top 5 FAQs

Q1: What was the global medical devices market size in 2024 and how fast will it grow?

A1: The global medical devices market was USD 551.3B in 2024, forecast to reach USD 1,022.5B by 2034, expanding at about 6.34% CAGR (2025–2034) per the provided data.

Q2: Which device segments are largest and which are fastest-growing?

A2: Largest (2024) — In Vitro Diagnostics (USD 88.0B). Fastest-growing — Diabetes care (projected strong CAGR; diabetes care grows from USD 58.0B (2024) to USD 97.3B (2034)).

Q3: Which region is the largest and which regions are growing fastest?

A3: Largest (2024) — North America (USD 197.8B). Fastest relative growth — Middle East & Africa and Latin America show the highest percentage CAGRs (≈8.8% and 7.9% respectively) from 2024 → 2034 (from smaller bases).

Q4: How important is AI in this market?

A4: Very important — AI is embedded across diagnostics, implants, continuous monitoring, surgical robotics and QMS. The FDA has approved 1,000 AI-powered devices (1995–Aug 2024), underscoring AI’s rising regulatory footprint and commercial traction.

Q5: What are current regulatory and commercialization signals to watch?

A5: Watch PMA/FDA approvals (e.g., Sequana’s Alfapump PMA, SPN-830 approval), NMPA approvals (e.g., MediBeacon TGFR in China), and platforms that reduce compliance cost (e.g., Archimedic’s OpenQMS). Funding rounds (e.g., Harsoria’s USD 20M) also signal scaling and capacity building.

Access our exclusive, data-rich dashboard dedicated to the medical devices sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5487

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest