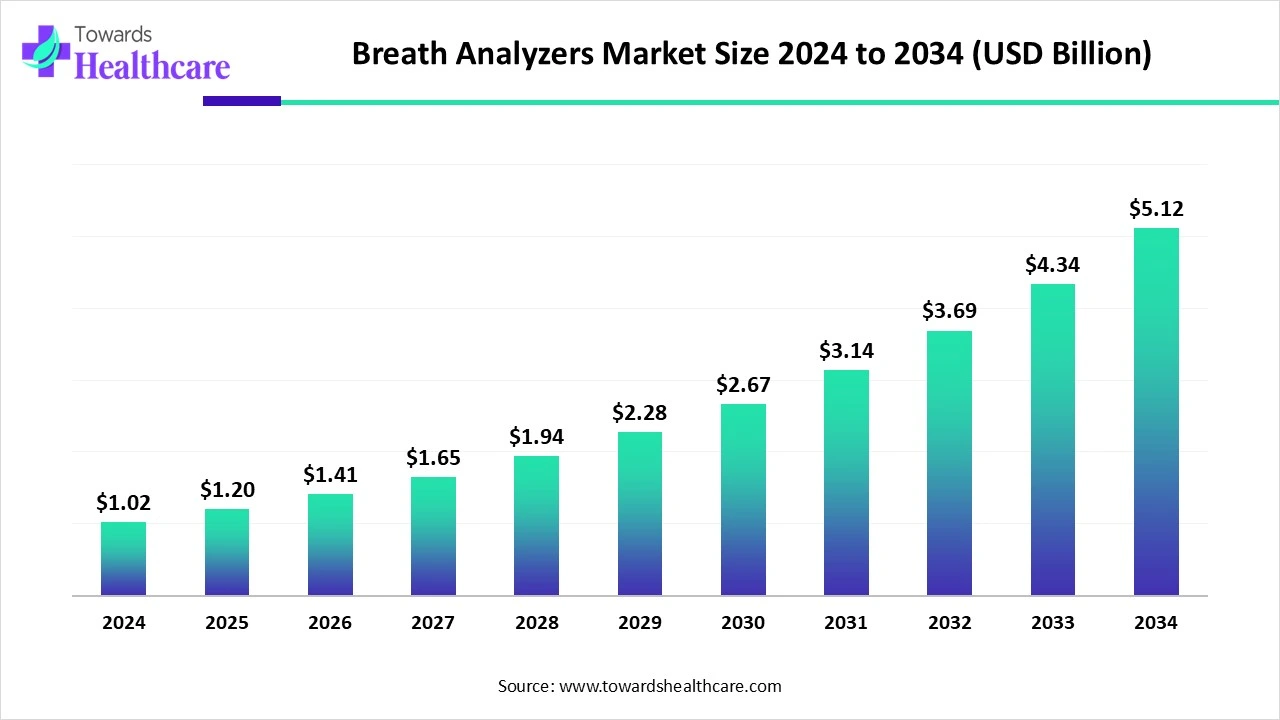

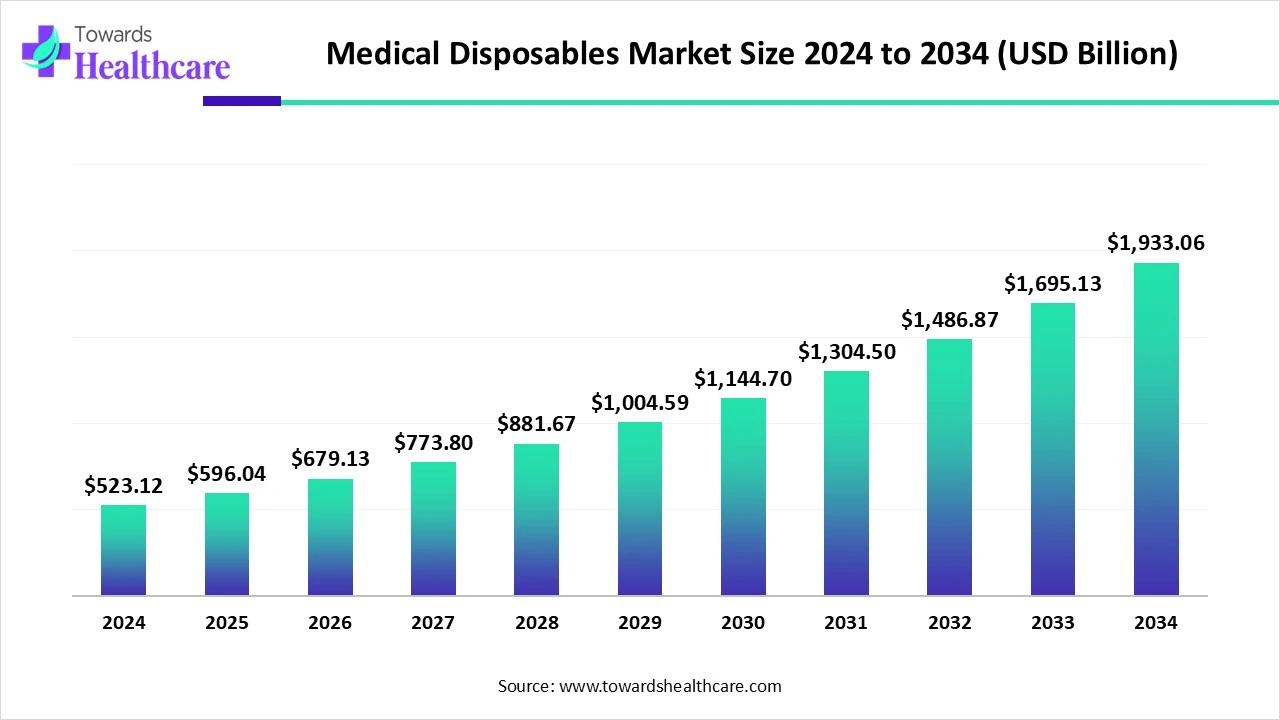

The global medical disposables market was USD 523.12 billion in 2024, is estimated at USD 596.04 billion in 2025 (a USD 72.92 billion increase year-on-year), and is projected to reach USD 1,933.06 billion by 2034 a forecast CAGR of 13.94% (2025–2034).

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/6086

Market size

Base / recent values

◉2024 market: USD 523.12B.

◉2025 estimate: USD 596.04B (increase of USD 72.92B vs 2024).

◉2034 projection: USD 1,933.06B.

Forecast growth rate

◉CAGR 2025–2034: 13.94% (implies a near-quadrupling of market value across the decade).

◉Implicit scale & composition indicators (2024 reference shares → implied values)

◉North America (38% of 2024) → ≈ USD 198.79B (2024).

◉PPE & infection-control consumables (28–32% share in 2024) → ≈ USD 146.47B–167.40B.

◉Single-use polymers/plastics (≈60% share in 2024) → ≈ USD 313.87B.

◉Hospitals & acute care (≈62% share in 2024) → ≈ USD 324.33B.

◉Sterile procedural consumables (≈48% share in 2024) → ≈ USD 251.10B.

◉GPO/direct OEM contracts (≈55% share in 2024) → ≈ USD 287.72B.

Interpretation

◉Large absolute base with concentration in a few high-value segment buckets (polymers, hospital use, sterile consumables) — meaning incremental demand or price shifts in those buckets materially change the market total.

◉Rapid projected expansion implies significant new product introductions, supply-chain scaling, and channel shifts (e-commerce, DTP, managed services).

Market trends

Infection-control and PPE remain foundational

◉PPE & infection-control consumables held 28–32% in 2024 — reflecting sustained infection-prevention priorities post-COVID and ongoing hospital infection control programs.

Shift to single-use plastics / polymers

◉Single-use polymers/plastics dominated (60% share in 2024) due to cost, sterilization logistics, and pre-sterilized packaging benefits.

Fastest growing product pockets

◉Catheters & vascular access expected to be the fastest growing product category (2025–2034) — driven by aging populations, more minimally invasive procedures, and rising chronic disease prevalence.

◉Advanced polymer dressings & hydrocolloids expected to register fastest material/technology growth — tied to wound-care performance and outpatient wound-management trends.

Care-setting shifts

◉Hospitals/acute care dominated in 2024 (62%) but ambulatory surgery centers/outpatient clinics are the fastest growing care settings as procedures migrate out of hospitals.

◉Sterile vs non-sterile dynamics

◉Sterile procedural consumables commanded the largest value (48%) in 2024, while non-sterile patient care consumables are forecast to grow fastest — reflecting scale in lower-complexity, high-volume items (gloves, basic disposables).

Distribution & commercial model evolution

◉GPO/direct OEM dominated in 2024 (55%) because of bulk purchasing and cost containment; e-commerce/B2B marketplaces expected to be the fastest growing channel as digital procurement penetrates healthcare.

Geographic shifts

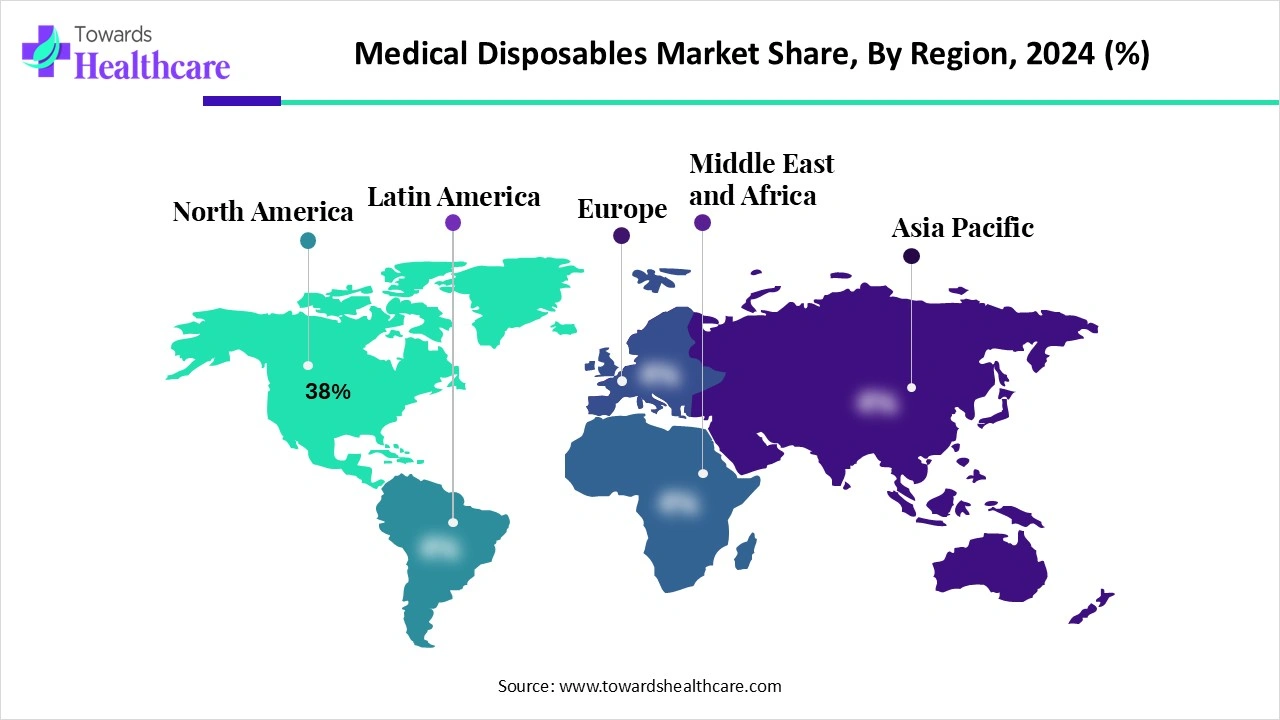

◉North America leads (38% in 2024) on advanced care, installed base, and reimbursement; Asia-Pacific is the fastest-growing region driven by rising healthcare spend, home healthcare adoption, and local manufacturing.

Policy & local manufacturing tailwinds

◉Government initiatives (example: India, Jan 2024) boosting local production of disposables, altering regional supply chains and costs.

Product-bundle and kit strategies

◉Increasing use of pre-assembled single-use kits (e.g., hysteroscopy kit examples) to simplify outpatient procedures and reduce set-up time.

AI role / impact on the medical disposables market

Demand forecasting & inventory optimization (operational AI)

◉AI models analyze historical utilization, seasonal trends, and epidemiological signals to reduce stockouts and overstocking for high-volume disposables (syringes, PPE).

◉Improved GPO and hospital forecasting reduces working capital and waste from expired disposables.

Design acceleration & materials discovery

◉Generative ML models and materials informatics speed development of next-gen polymers, biodegradable materials and advanced dressings (hydrocolloids) by predicting performance and manufacturability.

◉Shortens R&D cycles for product iterations and tailored wound-care dressings.

Quality control & defect detection (manufacturing AI)

◉Computer vision inspects molding, packaging seals, and sterility indicators at line-speed — lowering defect rates and ensuring compliance for sterile procedural consumables.

Process optimization & yield improvement

◉Reinforcement learning and advanced analytics tune extrusion, molding and sterilization processes to increase throughput for single-use plastics and lower per-unit costs.

Regulatory intelligence & submission automation

◉NLP systems help compile technical files, map requirements across jurisdictions, and track regulatory changes — accelerating approvals for disposables destined for multiple markets.

AI in product usage and clinical decision support

◉Embedded analytics for single-use diagnostic cartridges and point-of-care kits can triage results, reducing unnecessary consumable usage by guiding clinicians to high-value tests.

Smart disposables & traceability

◉Low-cost sensors + AI provide usage, temperature history, and chain-of-custody for sterile kits — enabling just-in-time usage and recall management.

Customer segmentation and commercial targeting

◉Predictive models identify high-value accounts (ASCs, large hospital systems) and customize contracting strategies (GPO/OEM vs DTP) to improve channel ROI.

Sustainability optimization

◉AI models evaluate life-cycle tradeoffs between disposable and reusables (energy, water, carbon footprints) to inform corporate sustainability strategies and product roadmaps.

Clinical outcomes & value demonstration

◉AI links real-world outcomes with disposable product usage (e.g., infection rates vs specific drape types), enabling better reimbursement and premium positioning for higher-value disposables.

Risks & governance

◉AI adoption also creates new risks: data privacy, black-box decisioning for clinical guidance, and need for validation/traceability — manufacturers must govern models used in clinical contexts.

Regional insights

North America (dominant 38% in 2024)

Market drivers

◉High procedural volumes, advanced hospital infrastructure, extensive adoption of new medical devices.

◉Strong reimbursement frameworks and higher per-procedure spend on disposables.

Supply-chain & commercialization

◉Large GPO presence drives centralized procurement (explains 55% GPO share).

◉Demand for integration with hospital ERP/EHR systems and traceability.

Innovation & regulatory environment

◉Fast uptake of advanced disposables (single-use endoscopes, advanced dressings) and rapid regulatory pathways for iterative improvements.

Value implication

◉High willingness to pay for convenience and infection-control, giving premium pricing potential.

Asia-Pacific (fastest growing)

Drivers

◉Expanding healthcare access, rising income, aging populations, and increased home healthcare adoption.

◉Government manufacturing incentives (e.g., India) increasing local production of disposables.

Market dynamics

◉Cost sensitivity pushes for local sourcing & private-label converters, but rising clinical standards push premiumization in urban centers.

Opportunities

◉Scale manufacturing and export hubs; targeted growth for catheters, single-use polymers, and wound dressings.

Europe

Drivers

◉Regulatory stringency, focus on sustainability, and high standards for infection control.

Market nuances

◉Growing interest in sustainable/biodegradable disposables and circular-economy pilots; payers challenge prices but value safety and environmental claims.

Latin America / MEA

Challenges & potential

◉Fragmented procurement, lower per-capita spend, but high unmet need in many markets.

◉Opportunity for low-cost disposables, local partnerships, and donor/NGO-supported programs.

Country-level callouts (examples from content)

◉U.S.: leadership in device approvals and high adoption, reliant partly on international suppliers but strong in innovation.

◉India: government initiatives (Jan 2024) to boost local device manufacturing—important for disposable categories (catheters, cannulas, syringes).

Market dynamics

Drivers (why the market expands)

◉Infection prevention priority — PPE & infection control largest product bucket (28–32%).

◉Higher procedure volumes & outpatient shift — drives need for pre-sterilized, single-use kits.

◉Aging population & chronic disease — fuels demand for catheters, vascular access, wound care.

◉Convenience & logistics — single-use avoids sterilization costs and reduces cross-contamination risk (single-use polymers ≈60%).

◉Commercial consolidation — GPOs and OEM contracts centralize purchases and bring scale.

Restraints (what limits growth)

◉Regulatory complexity — strict safety standards increase time-to-market and compliance costs (explicit restraint in provided content).

◉Environmental & sustainability pressure — single-use plastics face scrutiny; potential policy/regulatory headwinds or additional costs for biodegradable alternatives.

◉Price sensitivity in emerging markets — can limit adoption of higher-margin disposables unless local cost structures are optimized.

Opportunities (areas to capture upside)

◉Next-gen disposable instruments — disposable forceps, blades and single-use devices to replace reusable items where sterilization costs are high.

◉E-commerce & DTP channels — rapid growth opportunity as procurement digitizes.

◉AI & smart disposables — value capture via traceability, outcomes data and premium pricing.

◉Local manufacturing & private-label — countries with policy support (e.g., India) open scalable production and export potential.

Implications for stakeholders

◉Manufacturers: invest in scale, automation, and advanced materials; diversify channels (GPO + e-commerce).

◉Hospitals / GPOs: optimize inventory with predictive analytics; balance cost vs infection-control outcomes.

◉Policymakers: need to balance local manufacturing incentives with environmental regulations.

Top companies

3M

◉Products: Wide portfolio including wound care dressings, surgical tapes, sterilization products, adhesives, PPE.

◉Overview: Broad healthcare consumables and materials footprint.

◉Strengths: Diversified product mix, scale manufacturing, distribution relationships, strong R&D in materials.

Medline Industries

◉Products: Comprehensive disposables catalog — gowns, gloves, procedure kits, wound care, infection control.

◉Overview: Major medical distributor and manufacturer focused on consumables.

◉Strengths: Deep distribution, private-label capabilities, close hospital relationships, inventory/managed services.

Cardinal Health

◉Products: Surgical gloves, procedure kits, distribution and logistics services.

◉Overview: Large healthcare services & distribution platform with disposable offerings.

◉Strengths: Supply-chain scale, GPO contracts, logistics and managed inventory expertise.

Becton, Dickinson & Company (BD)

◉Products: Syringes, safety needles, IV sets, diagnostic disposables.

◉Overview: Leader in safety devices and diagnostic consumables.

◉Strengths: Clinical trust in safety devices, broad clinical adoption, regulatory experience.

Baxter International

◉Products: Infusion systems, IV/infusion sets, single-use components for renal and infusion care.

◉Overview: Focused on infusion and renal disposables and therapy solutions.

◉Strengths: Therapy-focused products, integrated solutions and service models.

B. Braun Melsungen

◉Products: Vascular access, infusion therapy, surgical disposables.

◉Strengths: Strong clinical portfolio, global presence in hospital consumables.

Kimberly-Clark Health / Halyard Health

◉Products: Surgical gowns, procedure packs, infection control PPE.

◉Strengths: Brand recognition in PPE and clinician apparel; scale in hygiene products.

Ansell

◉Products: Protective gloves and PPE.

◉Strengths: Specialty in protective wear and infection control.

Smiths Medical

◉Products: Vascular access, infusion systems, monitoring disposables.

◉Strengths: Niche specialty devices and clinical adoption in critical care.

Terumo Corporation

◉Products: Catheters, vascular access devices, infusion sets.

◉Strengths: Innovation in minimally invasive disposables and catheter technologies.

Mölnlycke Health Care

◉Products: Advanced wound dressings, single-use surgical products.

◉Strengths: Strong position in wound care, advanced dressing tech.

ConvaTec, Coloplast, Fresenius Kabi, Owens & Minor, Henry Schein, Nipro, Teleflex, Cook Medical

◉Products/Strengths: Mix of wound care, ostomy, infusion/renal consumables, distribution services, catheter and interventional disposables — each brings niche leadership, OEM relationships, or distribution strength.

Latest announcements

Coherent Corp. — June 2025

◉Announcement: Launch of a new line of disposable surgical fiber assemblies for precision medical applications; suitable for OEM integration and direct clinical use.

◉Implications: Entry of photonics/specialty components into disposables expands OEM supply options for single-use optical/laser assemblies used in precision surgery; may enable new disposable device classes and simplify OR logistics.

Microbot Medical Inc. — June 2025

◉Announcement: Expansion of commercial team in preparation for anticipated U.S. launch of the LIBERTY Endovascular Robotic System, with an expected FDA 510(k) decision in Q3 2025.

◉Implications: Robotic systems often require specific single-use disposables (catheters, sheaths) — increased commercialization activity signals potential near-term demand lift in endovascular disposables.

Johnson & Johnson — June 2025

◉Announcement: Launch of ACUVUE OASYS MAX 1-Day MULTIFOCAL for ASTIGMATISM — the first daily disposable contact lens addressing astigmatism + presbyopia.

◉Implications: Expands the daily disposable contact lens category and underlines growth in single-use ophthalmic disposables; potential to shift eye-care consumable spending patterns.

Minerva Surgical — May 2025

◉Announcement: HERizon Hysto-Kit launch — a single-use, pre-assembled kit for in-office hysteroscopy.

◉Implications: Illustrates trend toward procedure-specific single-use kits simplifying outpatient workflows and reducing setup time; directly targets ambulatory/outpatient growth.

Fresenius Medical Care (FME) — June 2025

◉Announcement: Revealed new FME Reignite strategy at Capital Markets Day (London).

◉Implications: Strategic repositioning by a dialysis/renal leader can affect consumable procurement for renal disposables and service bundles.

KYRA Medical, Inc. — April 2025

◉Announcement: Opening a UK subsidiary to strengthen presence in UK/Europe and improve supply-chain efficiency.

◉Implications: Regional expansion to reduce lead times and bolster European supply of positioning/OR disposable products.

Henry Schein — November 2024

◉Announcement: Agreement to acquire Acentus, a national medical supplier specializing in delivery of Continuous Glucose Monitors (CGMs).

◉Implications: Strengthens Henry Schein’s disposable/diagnostic portfolio and DTP distribution for diabetes monitoring consumables.

Recent developments

◉Pre-assembled single-use kits gaining traction (Minerva HERizon) — supports outpatient procedural growth and reduces clinical setup time and variability.

◉Specialized disposable components entering new domains (Coherent’s disposable fiber assemblies) — expands definition of disposables beyond plastics to include precision photonic assemblies.

◉Commercial launches tied to advanced systems (Microbot’s LIBERTY) — signals adjacent disposable demand (robotic system single-use interfaces).

◉Regional expansion and supply-chain localization (KYRA UK subsidiary; India policy moves) — improves resiliency and shortens lead times; supports cost optimization and export capability.

◉Consolidation and M&A in distribution & diagnostics (Henry Schein + Acentus) — expands access to DTP and chronic care consumables (CGMs), illustrating cross-pollination between disposables and diagnostics.

◉Strategic corporate repositioning (Fresenius Reignite) — large therapy providers aligning strategies that will change procurement patterns for disposables in renal and chronic care.

Segments covered

By Product Category

◉PPE & Infection-Control Consumables: gowns, masks, face shields, procedure packs; dominant due to infection control priorities and regulatory mandates.

◉Syringes, Needles & Safety Devices: single-use injection devices with safety features to prevent needlestick injuries; high volume, regulated.

◉IV / Infusion Sets & Accessories: infusion tubing, connectors — essential for inpatient and home infusion therapies.

◉Catheters & Vascular Access: peripheral/central catheters, introducers — fastest-growing due to aging and minimally invasive interventions.

◉Wound Care Dressings & Advanced Interfaces: foam, hydrocolloid, alginate, advanced polymer dressings — rising due to chronic wounds and outpatient wound management.

◉Surgical Consumables & Procedure Kits: drapes, staplers, single-use scopes, pre-assembled kits — enable OR efficiency.

◉Diagnostic & Sample Collection: swabs, collection tubes, cartridges — critical for POC testing and lab workflows.

◉Single-use Endoscopes & Procedure Scopes: disposable endoscopes reducing sterilization cost and cross-contamination risk.

◉Other disposables: cannulas, feeding tubes, catheters, specialty single-use instruments.

By Material / Technology

◉Single-use Polymers / Plastics: dominant; low cost, mass producible, pre-sterilizable.

◉Non-woven textiles: gowns, drapes—single-use comfort and barrier properties.

◉Advanced polymer dressings & hydrocolloids: higher performance wound care materials.

◉Specialty biocompatible materials: for catheters, implants in single-use form factor.

◉Sustainable/biodegradable disposables: nascent but growing as regulatory/environmental pressure rises.

By Care Setting / End User

◉Hospitals & Acute Care: major share due to procedure density and acute care needs.

◉Ambulatory Surgery Centers & Outpatient Clinics: fastest growth — migration of procedures out of hospitals.

◉Home Healthcare & Infusion at Home: rising demand for infusion sets, wound care, DTP.

◉Long-term Care & Nursing Homes: steady consumption of PPE and routine disposables.

◉Diagnostic & Reference Labs: high volume of sample collection disposables.

By Sterility / Application

◉Sterile Procedural Consumables: kits and items for sterile procedures—dominant value.

◉Non-sterile Patient Care Consumables: gloves, basic supplies—fastest growth in volume.

◉Single-use Diagnostic Cartridges & Test Kits: POC and lab cartridge-based growth.

By Distribution Channel & Commercial Model

◉GPO / Direct OEM Contracts: dominant procurement method for hospitals (bulk purchasing, cost containment).

◉Medical Distributors & Wholesalers: support reach into community hospitals and clinics.

◉E-commerce / B2B Marketplaces: fastest growing channel for convenience and reach.

◉Direct-to-Patient / Home Delivery: growth in chronic care and home infusion.

◉Managed Inventory / Device-as-a-Service bundles: outcome-based contracting and service models for disposables + devices.

Top 5 FAQs

Q1 : What is the market size and growth rate for medical disposables?

A: The market was USD 523.12B in 2024, is USD 596.04B in 2025, and is projected to reach USD 1,933.06B by 2034, implying a CAGR of 13.94% (2025–2034).

Q2 : Which product categories and materials dominated the market in 2024?

A: PPE & infection-control consumables led product categories

Q3 : Which regions are leading and which are fastest growing?

A: North America dominated in 2024 (38% share). Asia-Pacific is the fastest-growing region for the forecast period (2025–2034).

Q4 : What are the biggest commercial channels and shifts?

A: GPO/direct OEM contracts dominated (55% in 2024) due to bulk procurement; e-commerce/B2B marketplaces are expected to grow fastest over 2025–2034.

Q5 : How is AI affecting the medical disposables market?

A: AI impacts the market across demand forecasting, materials discovery, manufacturing quality control, inventory optimization, regulatory automation, smart disposables/traceability, and clinical decision support, enabling cost savings, faster innovation, and improved outcomes (see AI section above for deep points).

Access our exclusive, data-rich dashboard dedicated to the life sciences sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6086

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest