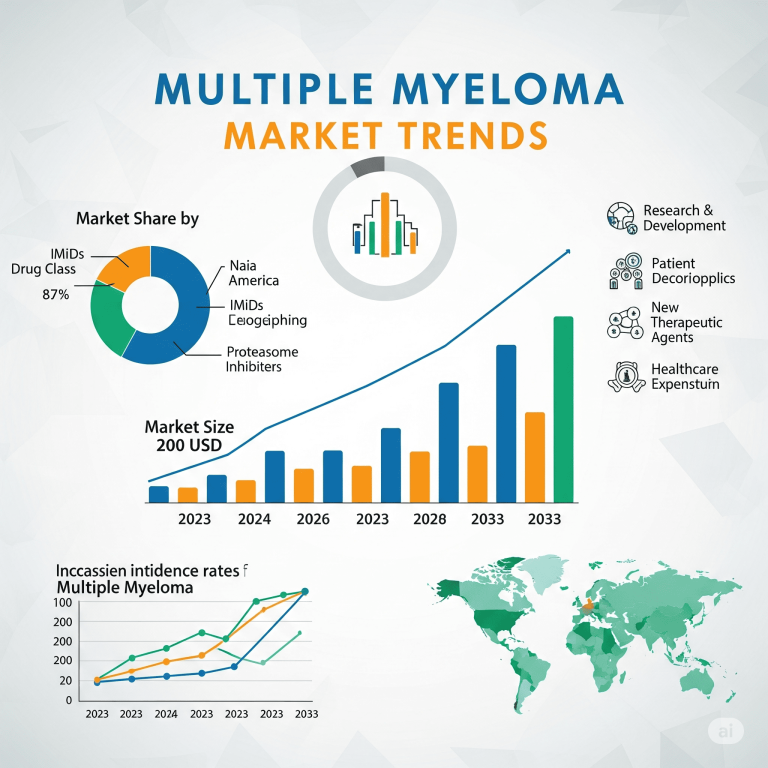

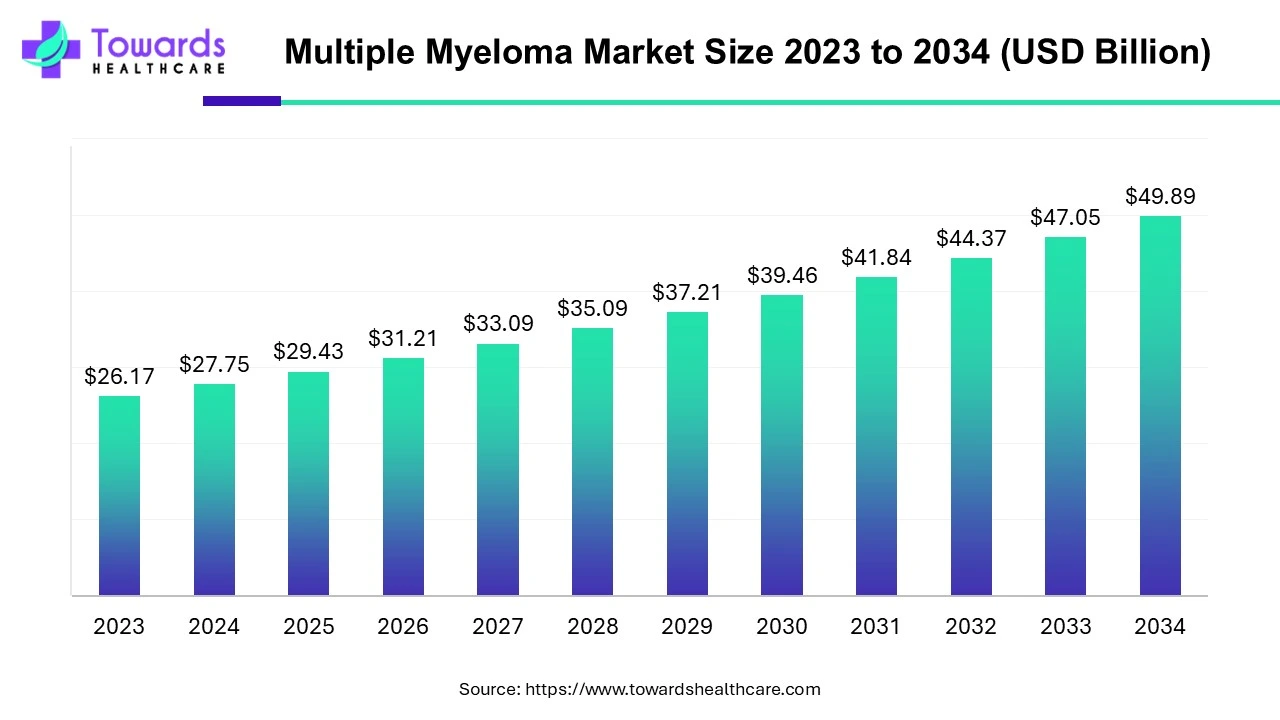

The global multiple myeloma market is large and growing, driven by an aging population, rising incidence, and rapid advances in targeted therapies (immunomodulators, proteasome inhibitors, anti-CD38 antibodies) and cell therapies (CAR-T). Market estimates put the 2024 value in the high-$20B range with steady mid-single-digit CAGRs into the 2030s as new approvals, expanded indications, and a busy clinical-trial pipeline increase treatment options — though high treatment costs and access remain key restraints.

Download the free sample and get the full report for complete insights and forecasts on this market @ https://www.towardshealthcare.com/download-sample/5489

Market Trends

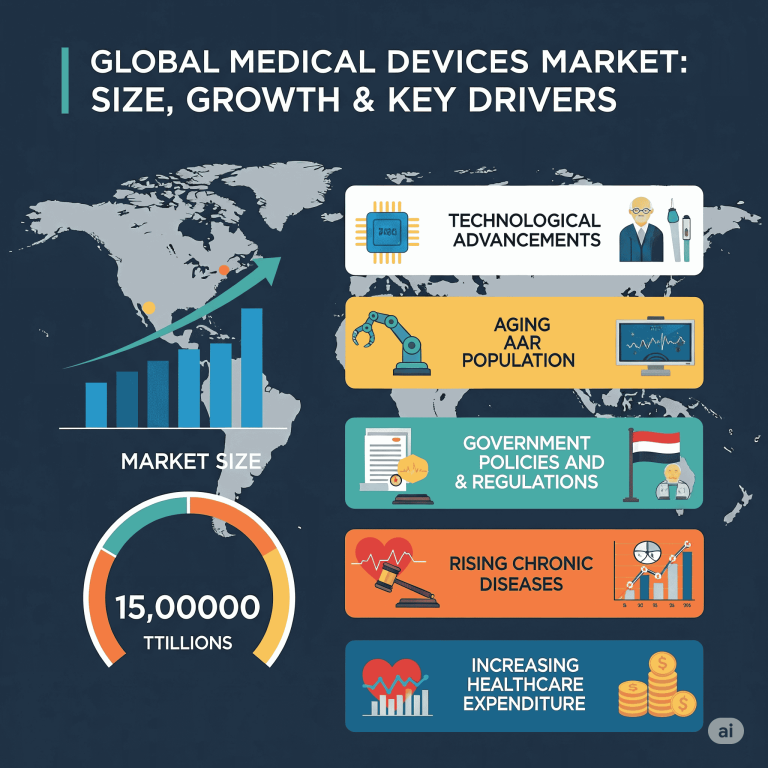

Shift to Minimally Invasive & Remote Solutions

Demand for wearable devices and home-based care equipment increasing.

Integration of Digital Health Technologies

IoT-enabled devices and real-time monitoring systems becoming standard.

Personalized & Patient-Centric Care Models

Devices designed for individual health needs and tailored treatments.

Market Consolidation Through Partnerships & Acquisitions

Companies merging to expand product portfolios and global reach.

Market Insights

Rising Demand from Aging Populations

Growing geriatric demographics require more diagnostic, monitoring, and treatment devices.

Technological Advancements Driving Innovation

AI, robotics, and advanced sensors are improving device precision and reliability.

Government Policies Supporting Market Growth

Regulatory approvals and subsidies accelerating adoption in healthcare facilities.

Emerging Markets Offering Untapped Potential

Higher healthcare spending in Asia-Pacific, Latin America, and Africa creating opportunities.

Market Dynamics

Drivers

◉Aging population and rising incidence increasing therapy demand worldwide

◉Ongoing treatment innovations (CAR-T, bispecific antibodies, optimized drug combinations) improving outcomes and expanding market reach

Restraints

◉Very high cost of advanced therapies and ongoing maintenance drugs limiting affordability

◉Regulatory, manufacturing, and distribution complexity slowing access to cell therapies

Opportunities

◉Large clinical trial pipeline with multiple therapies in late-stage development

◉Orphan drug designations and strategic partnerships accelerating development and access

Regional Segments

North America (Dominant) – Advanced healthcare infrastructure, high uptake of novel therapies, frequent FDA approvals driving growth

Asia-Pacific (Fast Growth) – Aging populations, expanding therapy approvals, and increased oncology investment boosting adoption

Europe – Strong reimbursement frameworks and active clinical research supporting steady adoption of new standards of care

Latin America & MEA – Slower uptake due to access and funding constraints, but growing need and local initiatives increasing penetration

Segment Highlights (By Category)

By Drug Class

◉Immunomodulators (IMiDs) – Leading share driven by widespread lenalidomide use for induction and maintenance

◉Proteasome Inhibitors – Growth expected with the rise of oral agents improving convenience

◉Anti-CD38 Monoclonal Antibodies – Expanding into frontline combinations and transplant-ineligible regimens

By Distribution

◉Hospital Pharmacies – Primary channel for infusions, CAR-T therapy, and monitored regimens

◉Retail & Online Pharmacies – Fastest growth due to demand for oral maintenance therapies and improved convenience

Top Companies

Bristol Myers Squibb Company

Janssen Pharmaceuticals

Sanofi SA

Novartis

Amgen Inc

Takeda Pharmaceutical

AbbVie

AstraZeneca

Pfizer

Johnson and Johnson

FAQs

Q1: How big is the multiple myeloma market today and how fast is it growing?

A: Estimated 2024 market value in the high-$20 billion range, with mid-single-digit CAGR through the 2030s.

Q2: Which therapies are shaping the near-term future of myeloma care?

A: CAR-T therapies, bispecific antibodies, anti-CD38 combinations, oral proteasome inhibitors, and novel small molecules.

Q3: Is cost a major barrier to patient access?

A: Yes — high upfront and ongoing costs remain a significant challenge, prompting risk-sharing and value-based pricing models.

Q4: Are there important regulatory or commercial updates to watch?

A: Yes — recent approvals, label expansions, and regulatory actions are influencing market positioning and adoption.

Q5: Where should pharma/biotech invest for the biggest near-term returns?

A: Next-gen CAR-T, allogeneic platforms, bispecific antibodies, oral targeted agents, and AI-enabled diagnostics with payer-aligned pricing models.

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5489

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com