The global nurse call systems market was USD 2.2 billion in 2024, grew to USD 2.47 billion in 2025, and is forecast to reach ~USD 6.93 billion by 2034 (CAGR 12.15% from 2025–2034), driven by aging populations, rising hospitalizations, and rapid tech integration (AI, IP, wireless).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5555

Market size

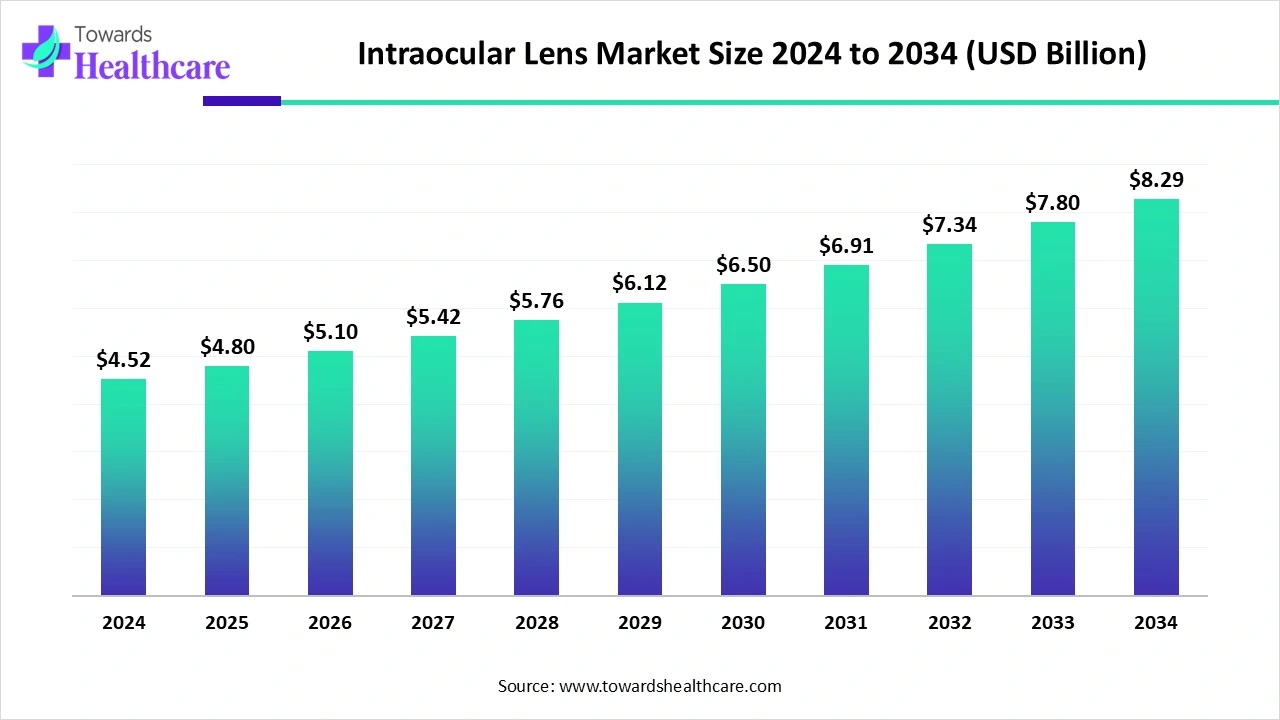

◉Base figures: USD 2.20B (2024) → USD 2.47B (2025) (reported).

◉Forecast: USD ~6.93B by 2034 (implies CAGR 12.15% between 2025–2034).

◉Technology split (2024 reported): wired ≈ USD 1.20B, wireless ≈ USD 1.00B (wired held lead in 2024).

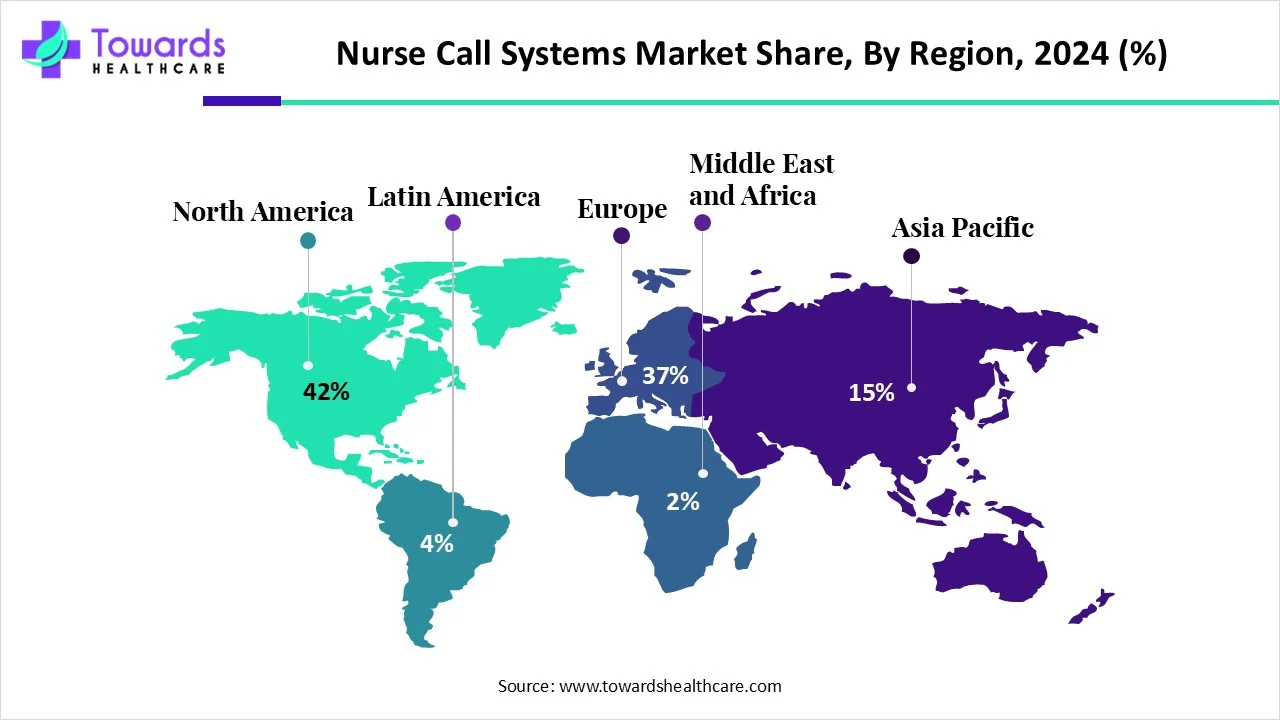

◉Regional split (2024 reported): North America USD 0.80B (≈42% market share); Europe USD 0.56B; APAC USD 0.54B; Latin America USD 0.17B; MEA USD 0.14B.

◉Technology trajectory: wired rises from 1.20B (2024) to 3.81B (2034); wireless grows from 1.00B (2024) to 3.11B (2034) — showing persistent dominance of wired in absolute terms but faster relative growth for wireless.

Type and end-use scale (2024 as anchor): integrated communication systems and hospitals are the largest buckets today; mobile systems and ASCs/clinics are the fastest-growing subsegments by rate.

Market sizing methodology note (implied by figures): combines hardware (patient stations, consoles, dome lights), software/firmware (integrations, middleware), services (installation, maintenance) and increasingly recurring software/AI services.

Market trends

◉Consolidation & M&A / strategic acquisitions: Example: Stryker’s acquisition of care.ai (Aug 2024) to expand AI and wirelessly connected medical-device portfolio — signals larger medtech players moving into nurse-call/ambient intelligence space.

◉Feature granularity & patient-centred calls: e.g., Orlando Health installed nurse-call with dedicated buttons (water, pain, toilet) to capture request-type data and prioritize workflow.

◉Integration with virtual care & AI vendors: partnerships like West-Com × VitalChat (May 2023) show convergence of nurse call, virtual visits and e-sitter/virtual care features.

◉Product launches & next-generation platforms: launches such as Ascom Telligence 7 and Fanvil Nurse Call System V1.0 Beta (Aug 2024) show emphasis on clinical workflow analytics and emergency handling.

◉Voice & ambient tech: Alexa Smart Properties collaboration (Lifeline Senior Living / Connect America, Jul 2023) highlights voice-enabled resident safety as an add-on/adjacent capability.

◉Wireless & mobile momentum: mobile systems and wireless equipment reported as fastest-growing — driven by smartphones, 5G/6G readiness and staff mobility needs.

◉Regulatory & reimbursement tailwinds: favorable policies and hospital environment mandates (e.g., CMS/OSHA references) in North America accelerate adoption for compliance and patient safety.

◉Workforce pressure & workflow optimization demand: rising nurse workloads and shortage scenarios create urgency for solutions that reduce low-value interruptions and optimize routing/response.

◉Aging population & chronic disease prevalence: demographic tailwind increases demand for wanderer control, fall detection and continuous monitoring features.

◉Cost constraint tension: high upfront costs for advanced systems remain a restraint for many low/middle-income providers — presenting an opportunity for SaaS/lease models.

AI’s role & impact of Nurse Call Systems Market

Call prioritization & triage

◉AI models analyze call metadata (time, location, patient history) + voice/text content to score urgency (e.g., “pain” vs “toilet”) and route highest-risk events first.

◉Benefit: reduces missed critical calls, improves response times for high-acuity needs.

Voice-based intent recognition & NLP

◉NLP on bedside intercoms or voice-enabled devices converts free-text/verbal patient requests into structured tasks (medication, toileting, pain).

◉Benefit: lowers false alarms and prevents unnecessary room visits; helps non-verbal or low-literacy patients communicate needs.

Prediction & proactive care

◉ML on call patterns, vitals (if integrated), and historical outcomes predicts deterioration risk or likely needs (e.g., patients who call frequently at night may need repositioning or pain reassessment).

◉Benefit: enables preemptive rounding, reducing emergent events and improving satisfaction.

Intelligent alarm filtering (alarm fatigue reduction)

◉AI clusters/filters repetitive or non-actionable alerts (e.g., repeated accidental pulls), surfaces probable false alarms, and flags genuine ones.

◉Benefit: reduces nurse desensitization and improves meaningful signal-to-noise ratio.

Workflow automation & intelligent routing

◉AI maps staffing schedules, nurse locations (RTLS), patient acuity and routes alerts to the right caregiver (charge nurse vs aide) automatically.

◉Benefit: optimizes resource allocation and decreases handoffs.

Contextual multimodal analysis

◉Combining audio, call metadata, RTLS, and EHR signals to form a richer context for automated decisions (e.g., a fall sensor + call from bathroom + older patient → highest priority).

◉Benefit: better sensitivity/specificity for critical events.

Operational analytics & capacity planning

◉Aggregate AI analytics identify bottlenecks (units with chronic high response times) and recommend staffing changes or physical layout improvements.

◉Benefit: measurable efficiency improvements and staffing ROI justification.

Personalized patient interaction

◉AI-driven suggestions for standard responses or scripts for staff or voice assistants to deliver routine instructions (e.g., “I’ll be there in 3 minutes”), improving patient perception of responsiveness.

Privacy, bias & safety considerations

◉Risks: voice/NLP models must protect PHI, avoid bias in triage scores, and be auditable. Any AI triage that influences care must have human-in-the-loop and clear fail-safes.

Monetization shift

◉AI features open SaaS/subscription revenue (analytics, predictive modules) on top of hardware sales — shifting business models to recurring revenue.

Regulatory & validation need

◉Clinical validation required for AI models that affect prioritization; potential regulatory oversight (depending on jurisdiction) if algorithms affect clinical decisions.

Regional Insights of Nurse Call Systems Market

North America

Market Leadership

◉Accounts for 42% of the global market in 2024 (USD 0.80 billion).

◉The U.S. leads the region, followed by Canada, due to advanced hospital networks.

Key Growth Drivers

Large Hospital Base & Stringent Regulations

◉The U.S. has one of the world’s largest clusters of acute-care hospitals.

◉Regulatory oversight from CMS, OSHA, and Joint Commission mandates communication and safety systems.

Funding & Reimbursement Policies

◉Federal and state-level funding allocated to hospital IT modernization.

◉Reimbursement models emphasize improved patient outcomes, incentivizing hospitals to adopt real-time communication systems.

Strong Healthcare IT Spending

◉Per-capita spending on healthcare IT in North America surpasses Europe and Asia-Pacific.

◉Supports faster adoption of digital nurse call and integrated platforms.

Technology Trends

Integrated & IP-based Nurse Call Systems

◉Rapid shift from legacy wired models to IP-enabled systems.

◉These allow integration with hospital networks, mobile devices, and centralized command centers.

AI & Real-Time Location Systems (RTLS)

◉AI is used for predictive alerts, workload management, and workflow automation.

◉RTLS tracks staff, patients, and equipment to optimize resource allocation.

◉Example: Hill-Rom piloting High Precision Locating (HPL) solutions.

Competitive Landscape

Dominance of Established Vendors

◉Stryker, Hill-Rom, Rauland-Borg, and Ascom dominate the market.

M&A and Partnerships

◉Example: Stryker’s acquisition of care.ai to integrate ambient intelligence into nurse call solutions.

Challenges

Lengthy Procurement Cycles

◉Hospitals operate on 3–7 year budget cycles, delaying adoption.

Interoperability Demands

◉New systems must integrate with existing legacy platforms, which increases complexity.

Europe

Market Position

◉Second-largest regional market after North America.

◉Strong adoption in Western Europe, with Germany, France, and the U.K. as key hubs.

Key Growth Drivers

National Digitization Programs

◉EU-wide initiatives for digital health infrastructure.

◉Germany’s Digital Act (March 2024) mandates communication digitization in hospitals and long-term care.

Healthcare Workforce Challenges

◉Europe faces a persistent shortage of nurses and medical staff.

◉Nurse call systems reduce staff workload and support safer patient monitoring.

Technology Trends

Preference for Integrated Communication Platforms

◉Hospitals prefer solutions that centralize alarms, staff communication, and patient requests.

Adoption Momentum in Germany

◉Regulatory push creates demand for advanced nurse call and hospital communication systems.

Compliance with Interoperability Standards

◉Emphasis on open standards to ensure integration with EHR and telehealth platforms.

Opportunities

Cross-border Collaboration

◉Vendors can leverage EU frameworks for multi-country rollouts.

Integration with Telehealth

◉Potential to embed nurse call with virtual consultations and digital monitoring systems.

Challenges

Fragmented Healthcare Systems

◉Each country has unique procurement and regulatory requirements.

Budget Constraints in Eastern Europe

◉Lower adoption due to limited capital investment in hospitals.

Asia-Pacific

Market Growth

◉Fastest-growing region, expanding at double-digit CAGR.

◉Market size in 2024: USD 0.54 billion, expected to surpass Europe by 2030.

Key Growth Drivers

Healthcare Infrastructure Expansion

◉Massive hospital construction and modernization in China, India, and Southeast Asia.

◉Governments allocating funds for hospital digitization.

Demographic Shifts

◉Aging population in Japan, South Korea, and China increasing demand for long-term and acute care.

◉Rising chronic diseases creating higher inpatient volumes.

Medical Tourism

◉Countries like Thailand, Singapore, and India developing advanced private hospitals to attract global patients.

Country-Specific Highlights

China

◉Government-led push for digital health ecosystems.

◉Nurse call systems integrated into national smart hospital frameworks.

India

◉70,000 hospitals across urban and rural areas.

◉Strong procurement momentum — >300 nurse call tenders published by April 2025.

Japan & South Korea

◉Rapid adoption of wireless nurse call systems in elder care facilities.

Technology Trends

Wireless & Mobile Solutions

◉Preferred due to cost-effectiveness, scalability, and ease of installation.

Localized Customization

◉Vendors adapting systems to local languages and cultural needs.

Opportunities

Low-cost Wireless Models

◉Huge potential in India, Indonesia, and rural China.

Government Partnerships

◉Public-private collaborations in digital health projects.

Challenges

High Price Sensitivity

◉Hospitals in emerging markets often demand budget-friendly solutions.

Regulatory Diversity

◉Lack of harmonized standards across countries slows multinational rollouts.

Latin America

Market Position

◉Smaller compared to North America, Europe, and Asia-Pacific, but growing steadily.

◉Brazil and Mexico are leading markets.

Key Growth Drivers

Urban Healthcare Expansion

◉New hospitals in metropolitan cities drive demand.

Private Healthcare Investment

◉Private hospital chains are investing in modern communication systems to differentiate themselves.

Challenges

Budgetary Limitations

◉Public hospitals operate under restricted budgets, slowing large-scale adoption.

Technology Refresh Delays

◉Many facilities extend the use of outdated systems.

Opportunities

Wireless Deployment

◉Cost-effective wireless models appeal to mid-sized hospitals.

Service-based Business Models

◉Managed services or leasing models can increase affordability.

Middle East & Africa

Market Position

◉Smallest market share but high growth potential in select countries.

Major adoption in Gulf Cooperation Council (GCC) countries; slower in Africa.

Key Growth Drivers

High-Spend Gulf Economies

◉Saudi Arabia, UAE, and Qatar investing heavily in mega-hospital projects.

Private Hospital Development

◉Ambitious plans for luxury and specialized hospitals to attract medical tourism.

Challenges

Market Fragmentation

◉Stark contrast between advanced Gulf hospitals and underfunded African facilities.

Localization Needs

◉Vendors often need regional partners for regulatory compliance and cultural adaptation.

Opportunities

Premium Systems in Gulf

◉High demand for advanced, integrated platforms in Saudi Arabia and UAE.

Affordable Solutions in Africa

◉Wireless and mobile systems can address low-resource environments.