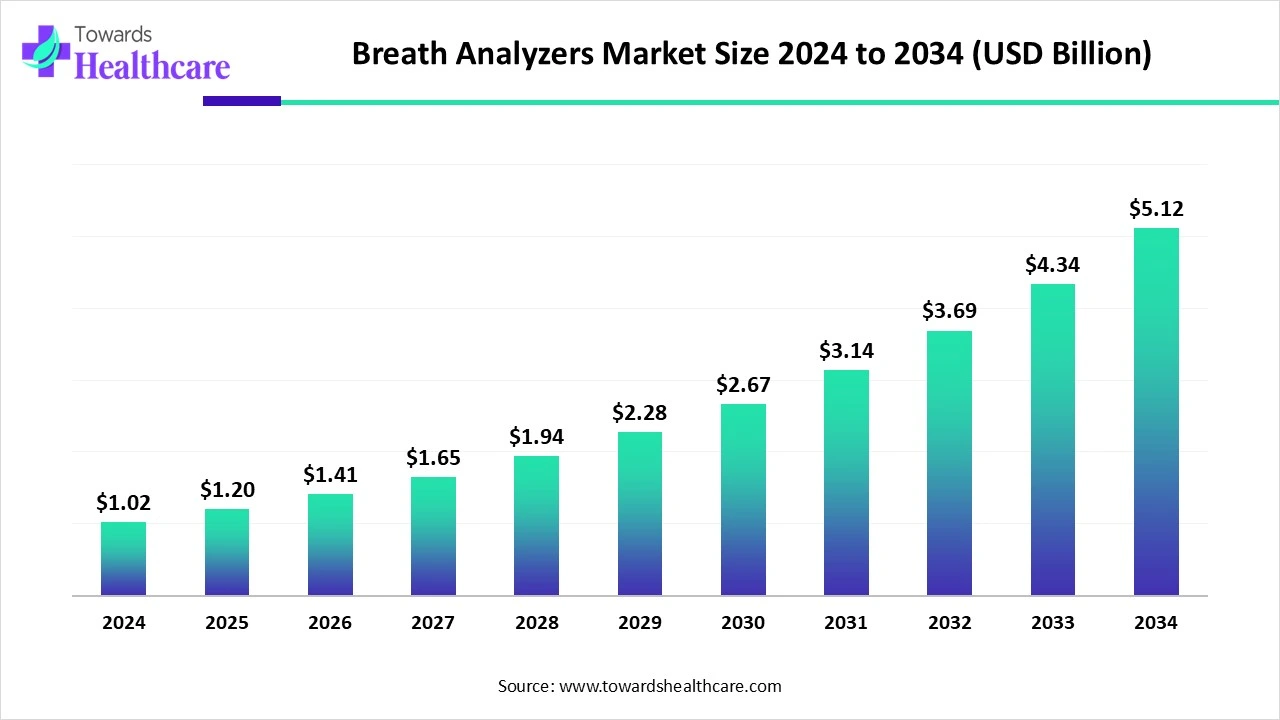

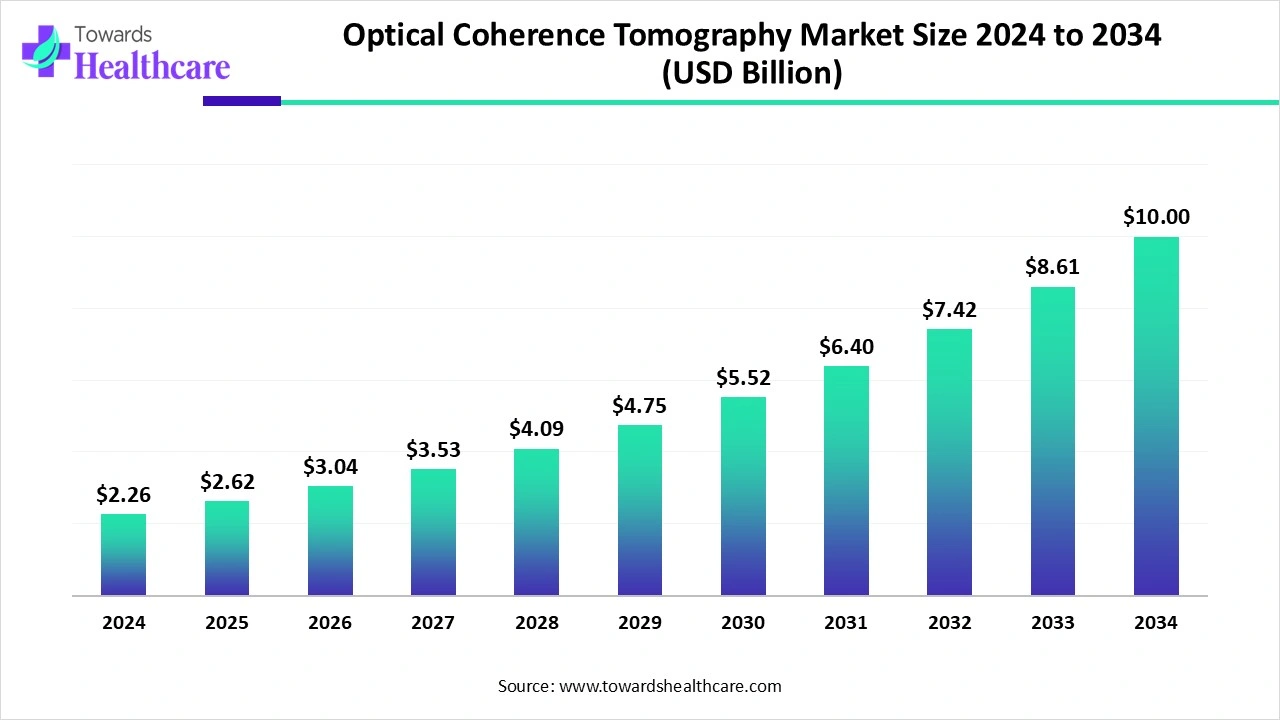

Global Optical Coherence Tomography Market reached US$2.26B in 2024, is US$2.62B in 2025, and is projected to hit US$10B by 2034 at a 15.97% CAGR (2025–2034), led by North America (≈40% share, 2024) and rapid APAC expansion.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/6087

Market size

Baseline & trajectory

◉2024: US$ 2.26B

◉2025: US$ 2.62B (start of forecast CAGR 15.97%)

◉2034: ≈ US$10.0B

Implied year-by-year benchmarks (using 15.97% CAGR from 2025):

◉2026: US$ 3.04B │ 2027: US$ 3.52B │ 2028: US$ 4.09B │ 2029: ~US$ 4.74B │

◉2030: US$ 5.50B │ 2031: US$ 6.37B │ 2032: US$ 7.39B │ 2033: US$ 8.57B │ 2034: US$ 9.9–10.0B

Revenue composition (2024 snapshot):

◉Hardware systems: 64% of revenue (consoles/scanners, light sources, detectors, interferometers)

◉Software/AI & cloud analysis: fastest-growth stream (small base in 2024; highest CAGR through 2034)

◉On-premise device ownership dominated 2024 revenue; managed service/leasing rising fastest

◉Buyer concentration: Ophthalmology clinics & eye hospitals drove 70% of 2024 spend; cardiac labs accelerating (affects catheter/consumables pull-through)

◉Geographic mix (2024): North America 40%; APAC fastest-growing through 2034

Market trends

◉Disease-burden-driven demand: Growing glaucoma, AMD, and diabetic retinopathy prevalence propels OCT adoption for early, non-invasive, high-resolution diagnostics. WHO/CDC figures underscore large addressable populations and productivity loss from vision impairment.

Tech shifts inside OCT:

◉SD-OCT led 2024 (58% share) on speed/resolution;

◉SS-OCT is the fastest-growing on deeper penetration, faster scans, and better posterior segment/biometry use;

◉OCT-A gaining reimbursement traction and clinic uptake for functional microvasculature imaging.

◉Form-factor evolution: Desktop/table-top systems held 65% in 2024 (clinical workhorse), while portable/handheld platforms show fastest CAGR (point-of-care, outreach, tele-ophthalmology).

◉Beyond ophthalmology: Expanding cardiology (IV-OCT), dermatology, oncology, ENT/dentistry, preclinical—broadens TAM and mix of hardware+consumables.

◉AI infusion: Rapid shift to AI-assisted analysis, triage, and cloud reading to cut interpretation time, standardize quality, and enable scalable screening.

◉Business model innovation: From CapEx ownership toward managed service/device-as-a-service and subscription imaging, aligning costs with throughput; boosts adoption in smaller clinics and emerging markets.

◉Regulatory/reimbursement tailwinds: New CPT coverage (incl. OCT-A in many markets) + modular approvals (e.g., faster angiography acquisition) improve economics and workflow.

AI’s impact/role

Automated image interpretation & triage

◉Detects subtle retinal layer changes (e.g., RNFL thinning, drusen characteristics) and microvascular anomalies on OCT-A.

◉Benefits: earlier detection, lower miss rates, consistent reads across operators.

Disease staging & progression modeling

◉Longitudinal AI tracks per-patient trajectories (e.g., glaucoma progression rates, fluid dynamics in DME), quantifies treatment response, flags outliers needing regimen change.

◉Decision support in clinic workflow

◉Instant quality control, segmentation fixes, artifact suppression; auto-reporting to EHR cuts documentation time; enables higher patient throughput with the same staff.

Population screening & tele-ophthalmology

◉Edge-AI on portable OCT enables rapid community screening; cloud models support hub-and-spoke reading centers—key for APAC and remote regions.

Cross-modal fusion

◉Combines OCT with fundus/UWF, perimetry, labs, EHR for risk scoring; improves specificity for referral thresholds.

R&D acceleration

◉Foundation models trained on large OCT corpora power biomarker discovery, more precise clinical trial enrichment, and adaptive endpoints.

Cardiology IV-OCT

◉AI aids plaque characterization, stent apposition assessment, and procedure guidance in cath labs—shortens procedure time, improves outcomes.

Commercial implications

◉Shifts revenue growth toward software/AI subscriptions and cloud services; raises switching costs and deepens vendor lock-in; spurs data network effects.

Regional insights

North America (40% share, 2024)

◉High-level: largest single market (≈40% of revenue in 2024). Mature payor systems, high clinical throughput, strong academic & vendor ecosystem.

Demand & clinical drivers

◉Aging population + disease burden: large cohorts with AMD, glaucoma, diabetic retinopathy drive recurring imaging and monitoring revenue.

◉Interventional cardiology adoption: IV-OCT used increasingly for PCI optimization — creates recurring consumable sales (catheters) and high-margin procedure-driven revenue.

Reimbursement & regulatory dynamics

◉Reimbursement maturity: Established CPT/insurance pathways for standard OCT and expanding coverage for OCT-A in many practices — improves economics for clinics to upgrade hardware and buy add-on modules.

◉Regulatory clarity: FDA pathways for AI/software have matured; cleared AI modules accelerate clinical adoption.

Product & tech priorities

◉High demand for premium desktop systems (throughput + integration).

◉Growing appetite for software/AI subscriptions — clinics willing to pay for time savings, triage tools, and validated decision support.

◉Cardiac IV-OCT bundles (console + catheter) perform well where hospital reimbursement covers intravascular imaging.

Channel, service & sales model

◉Direct sales + hospital procurement specialists dominate for high-end systems; distributor/partner model works for smaller regional practices.

◉Service contracts & SLAs are critical — quick on-site support, software updates, and training are differentiators.

Talent & workflow implications

◉Skilled operators & reading specialists are available, but AI reduces specialist bottlenecks and enables task-shifting to technicians.

◉Integration with EHRs and PACS is expected; interoperability is a procurement must-have.

Growth levers & go-to-market (GTM) tactics

◉Bundle hardware + subscription software + service to move purchases from CapEx to OpEx.

◉Emphasize FDA-clear performance and workflow KPIs (time saved, false positives reduced).

◉Target multi-specialty groups and academic centers for flagship deployments and peer-reviewed validation.

Risks & mitigations

◉Price sensitivity in community clinics: offer leasing/a-service.

◉Competition / consolidation: deepen service footprint and data features to increase switching costs.

Europe

◉High-level: mature clinical standards, strong research hospitals, varied national reimbursement and data-governance regimes.

Demand & clinical drivers

◉High standards of care and established ophthalmology networks; strong appetite for multi-modal imaging in tertiary centers.

◉SS-OCT adoption is accelerating in research hospitals and referral centers.

Regulatory & reimbursement environment

◉CE conformity provides market access but national reimbursement differs: some countries reimburse well for OCT-A/advanced imaging; others lag.

◉Data governance (GDPR) influences cloud usage and cross-border reads — limits some cloud-first models unless data residency and consent are solved.

Product & tech priorities

◉Multi-modal, research-grade systems favored in university hospitals.

◉Interoperable software and strong data-privacy controls are procurement musts.

Channel & service

◉Tender-driven procurement for many public hospitals — requires long lead time and strong evidence dossiers.

◉Local distributors used in many markets; after-sales service quality is often a buying differentiator.

GTM & sales tactics

◉Clinical publications and local KOLs drive adoption — invest in clinical studies and peer engagement.

◉Country-specific reimbursement strategies (e.g., pilot programs for OCT-A) help uptake.

Risks & mitigations

◉Fragmented reimbursement — map country-level payor policies and prioritize markets with favorable coverage.

◉Data residency constraints — provide localized cloud options and on-premise software.

Asia-Pacific (fastest growth)

◉High-level: highest CAGR prospect; huge population exposure (China, India) plus technologically advanced pockets (Japan, South Korea). Wide heterogeneity — from high-end hospital demand to mass screening needs.

China

◉Market posture

◉Large patient pool (high diabetes prevalence) and aggressive government screening programs expand TAM quickly.

Pricing & partnerships

◉Local–global partnerships and OEM manufacturing reduce ASP and accelerate scale.

Adoption models

◉Mass screening + AI triage programs in community clinics and county hospitals.

GTM & operational needs

◉Localization (language, workflow), local regulatory approvals, and strong local support are essential.

Opportunity & risk

◉Opportunity: scale via national screening programs.

◉Risk: price competition and need to localize AI models.

Japan

Market posture

◉High per-capita spend, advanced hospitals, homegrown leaders (Topcon, Canon) influence standards.

Tech appetite

◉Rapid SS-OCT adoption and premium product demand; strong IV-OCT use in cardiology.

GTM

◉Domestic partnerships & clinical validation with Japanese institutions accelerate uptake.

India & Southeast Asia

Market posture

◉High unmet need plus constrained budgets — ideal for portable OCT and tele-ophthalmology.

Adoption models

◉NGO/government screening creates demand for low-cost portable units; leasing enables procurement.

Operational constraints

◉Training, maintenance, and connectivity are key execution risks.

GTM

◉Partner with eye-care NGOs and public programs; offer service bundles and remote training.

APAC GTM & Strategy (overall)

◉Two-track product strategy: premium desktop + affordable portable/managed-service portfolios.

◉Invest in local regulatory & training centers to build trust.

◉Design AI models for local populations (ethnic/retinal variance) to avoid performance gaps.

Latin America

◉High-level: emerging commercial adoption led by urban private clinics; price sensitivity and fragmented reimbursement.

Demand & drivers

◉Private ophthalmology chains and tertiary centers lead purchases; preventive screening rising in urban centers.

Barriers

◉Budget constraints, inconsistent reimbursement, and service/parts logistics limit rapid spread.

Product & service fit

◉Refurbished units, lower-cost SD-OCT, and leasing models succeed.

GTM & channel

◉Local distributors with strong service networks are essential; warranty + training is persuasive.

Opportunity

◉Bundle solutions (hardware + remote reading + training) to overcome specialist shortages.

Middle East & Africa (MEA)

◉High-level: heterogeneous — GCC (wealthy hubs) vs. Sub-Saharan Africa (resource constrained). Medical tourism hubs create pockets of premium adoption.

Demand segmentation

◉GCC centers invest in high-end systems; sub-Saharan markets need portable, low-cost screening solutions.

Constraints

◉Skilled operator scarcity and long supply chains for parts/maintenance.

Product & GTM fit

◉Portable OCT + cloud reading to bridge specialist gaps; service partnerships for uptime are critical.

Strategic plays

◉Pilot programs with international NGOs and tele-reading centers; supply modular service agreements.

Risk mitigation

◉Local training programs and spare-parts depots reduce operability risk.

Cross-regional tactical recommendations

Segment GTM by clinic tier

◉Tier-1 (academic & hospital systems): sell premium integrated desktop SS-OCT + research partnerships.

◉Tier-2 (regional clinics): offer mid-range SD-OCT + managed service lease.

◉Tier-3 (rural/outreach): portable OCT + AI triage + cloud reading.

Monetize software & data

◉Offer AI-enabled subscriptions, outcome dashboards, and imaging-as-a-service to shift toward recurring revenue; provide on-premise/cloud options per region.

Localize AI & regulatory dossiers

◉Train & validate AI on regional datasets (APAC, Latin America) to ensure performance and regulatory acceptance.

Service network as moat

◉Invest in local service centers, spare parts, and training academies—especially in APAC, LatAm and MEA.

Flexible pricing

◉Introduce leasing, managed service, pay-per-scan, and refurbished routes to accelerate penetration in cost-sensitive markets.

Build clinical evidence

◉Sponsor local clinical studies and generate country-specific economics (e.g., screening ROI) to support tenders and reimbursement conversations.

Market dynamics

Drivers

◉Rising ophthalmic & chronic disorders: Large prevalent/at-risk pools; e.g., millions affected by glaucoma/DR; WHO notes 2.2B with vision impairment globally and US$411B in annual productivity loss.

◉Tech advancement: SD-OCT dominance (2024), SS-OCT fastest growth, OCT-A uptake, higher resolution, faster acquisition, better segmentation.

◉AI integration: Accuracy, speed, workflow relief; unlocks screening and remote models.

◉Broader indications: Cardiology (IV-OCT), dermatology, oncology, ENT/dentistry, preclinical.

Restraints

◉Skilled personnel needs for acquisition/interpretation;

◉Reimbursement gaps in certain countries;

◉Deep-tissue limitations and artifacts in specific conditions.

Opportunities

◉Favorable regulatory & reimbursement (new CPTs; modular approvals, incl. angiography);

◉Managed service/leasing to penetrate smaller clinics/emerging markets;

◉Cloud reading/tele-ophthalmology to scale access;

◉AI-enabled population screening reducing specialist bottlenecks.

Top companies

Carl Zeiss Meditec (incl. Optovue)

◉Products: Broad SD-OCT/SS-OCT portfolio; angiography; integrated software suites.

◉Overview: Pioneer with deep install base in ophthalmology; strong hardware–software integration.

◉Strengths: Image quality, workflow tools, expanding AI/analytics, global service.

Heidelberg Engineering

◉Products: Spectralis platform with OCT-A; SHIFT tech (faster OCT-A acquisition).

◉Overview: High-end retinal imaging; research-grade performance crossing into routine care.

◉Strengths: Robust segmentation, longitudinal tracking, academic trust, recent OCT-A speed enhancements.

Topcon Healthcare

◉Products: SD/SS-OCT systems; data management; new data-as-a-service initiatives (IDHea).

◉Overview: Strong in Asia-Pacific and global eye-care networks.

◉Strengths: Value-to-premium coverage, connectivity, growing digital health layer.

Canon Medical Systems / Canon (incl. Tomey units)

◉Products: Ophthalmic OCT systems; imaging ecosystem integration.

◉Overview: Imaging pedigree; Japan leadership.

◉Strengths: Reliability, optical engineering, hospital integration.

NIDEK

◉Products: Clinical OCT systems integrated into broader ophthalmic workflow.

◉Overview: Cost-effective clinical solutions.

◉Strengths: Installed base in clinics; service network in Asia.

Haag-Streit / Leica Ophthalmic

◉Products: Premium ophthalmic imaging/surgical visualization; OCT integration.

◉Overview: Operating-room and clinic presence.

◉Strengths: Optics quality, surgical ecosystem links.

Thorlabs / Wasatch Photonics / Santec / Lumedica (components & systems)

◉Products: Light sources, spectrometers, interferometers; research/industrial OCT kits.

◉Overview: Enable R&D and OEM supply.

◉Strengths: Customization, innovation cadence, academic relationships.

Abbott / Terumo / Boston Scientific / Philips (intravascular OCT)

◉Products: IV-OCT consoles, catheters, and integration for cath labs.

◉Overview: Interventional cardiology heavyweights.

◉Strengths: Procedure integration, consumables pull-through, extensive clinical evidence and field support.

Latest announcements

◉Heidelberg Engineering (July 2024): FDA approval for Spectralis OCT-A module with SHIFT technology—50% reduction in OCT-A acquisition time using a 125 kHz preset, targeting improved workflow while preserving image quality.

◉Optos (May 2025): Launch of MonacoPro, a next-gen spectral-domain retinal solution bundled with ultra-widefield (UWF) SLO, aimed at higher diagnostic accuracy and faster clinic throughput.

◉Topcon Healthcare (May 2025): Announced ocular data-as-a-service platform under IDHea, emphasizing research and digital-health advancements—an early move toward subscription data services in ophthalmology.

Recent developments

◉Industry/venture: May 2025 – Astranu spun out of Nokia with Celesta Capital backing to commercialize integrated OCT for hearing care—non-invasive, high-resolution 3D imaging aimed at transforming ear diagnostics (originating from Nokia Bell Labs IP).

◉AI/biomarkers: Mar 2025 – Moorfields Eye Hospital & Insitro collaboration to build foundation AI models on large ophthalmic datasets to enhance patient stratification and biomarker discovery for neurodegenerative disease links.

◉Frontier research: Jul 2025 – Reproductive biology study used OCT to image preimplantation embryo transport in mouse oviducts—signals OCT’s expanding utility beyond eye/cardiac use.

Segments covered

By Product Type / Form Factor

◉Desktop / Table-top Clinical OCT Systems (65% share, 2024)

◉Role: Gold-standard “workhorse” systems in ophthalmology clinics & hospitals.

◉Features: High throughput, stable imaging, advanced software integration, multimodal add-ons.

Trends:

◉Integration with OCT-Angiography, fundus cameras, and AI.

◉Preferred for routine AMD, glaucoma, and DR monitoring.

◉Challenges: High upfront cost and maintenance, slower adoption in emerging markets.

◉Portable / Handheld OCT Systems (Fastest CAGR)

◉Role: Mobility-focused; critical in pediatrics, outreach camps, bedside, OR use, and tele-ophthalmology.

◉Features: Lightweight, battery-operated, increasingly AI-assisted.

◉Growth Drivers: Push toward early detection, underserved populations, and remote diagnostics.

◉Challenges: Lower resolution vs. desktop, operator skill dependency.

◉Intravascular / Catheter-based OCT + Consumables

◉Role: Cardiac catheterization labs for PCI optimization (plaque characterization, stent placement).

◉Revenue Model: Hardware + recurring disposable catheters → predictable, high-margin recurring revenues.

◉Growth Drivers: Guidelines pushing for intravascular imaging, competition with IVUS.

◉Challenges: Training, procedure time, reimbursement gaps in some regions.

◉Accessories & Imaging Modules

◉Examples: Scanner heads, probes for dermatology/dentistry/ENT, surgical microscope integration.

◉Value: Adds flexibility, expands utility across specialties.

◉Trend: OR integration with robotic surgery and microsurgery platforms.

Software & AI Analytics

◉Scope: Segmentation, retinal layer analysis, OCT-A quantification, disease progression modeling, cloud-based reporting.

◉Growth Drivers: Subscription SaaS model; decision support in routine and tele-health workflows.

◉Trend: FDA-cleared AI diagnostics, cloud-based shared reading centers.

By Technology / Imaging Modality

◉Spectral Domain OCT (SD-OCT, 58% share, 2024)

◉Strengths: Balance of cost, speed, resolution → mainstream in ophthalmology.

◉Applications: Retina, glaucoma monitoring, anterior segment.

◉Trend: Integration with AI analytics to remain relevant despite SS-OCT.

Swept-Source OCT (SS-OCT, Fastest Growth)

◉Strengths: Longer wavelength (1050 nm), deeper tissue penetration, faster acquisition.

◉Applications: Choroid imaging, biometry, widefield retinal scans, intraoperative guidance.

◉Growth Drivers: Expanding use in research + high-end ophthalmology centers.

◉Challenges: High device costs; gradually decreasing as adoption scales.

◉Time-Domain OCT (Legacy, <5% share)

◉Status: Being phased out, still in use in low-resource settings.

◉Trend: Replacement market opportunity as clinics upgrade.

OCT-Angiography (OCT-A)

◉Growth Driver: Non-invasive vascular visualization; no dye required.

◉Adoption: Rapid uptake in diabetic retinopathy, AMD; improving reimbursement (esp. U.S., Japan).

◉Trend: AI-based quantification (capillary density, flow metrics).

Multi-modal Hybrids

◉Examples: OCT + fundus photography, OCT + confocal, OCT + fluorescence lifetime imaging.

◉Use Cases: Research, clinical trials, industrial metrology.

◉Trend: Niche but expanding in academic & translational research hubs.

By End User / Buyer

◉Ophthalmology Clinics & Eye Hospitals (70% share, 2024)

◉Core demand: AMD, glaucoma, diabetic retinopathy.

◉Trend: Shift from standalone OCT to integrated diagnostic platforms.

◉Growth Driver: Expanding diabetic & aging populations globally.

◉Cardiac Cath Labs / Interventional Cardiology

◉Role: Intravascular OCT adoption for PCI planning & stent optimization.

◉Growth Driver: Clinical trial data supporting improved outcomes.

◉Trend: Competes with IVUS; adoption highest in Japan & U.S.

◉Diagnostic / Reference Labs & Research Centers

◉Role: Research on biomarkers, ocular physiology, drug development trials.

◉Growth Driver: Academic funding, pharma partnerships.

Dermatology, Dentistry & ENT

◉Role: Early adoption in skin cancer imaging, oral lesions, middle ear analysis.

◉Trend: Still niche but promising diversification beyond ophthalmology.

By Component / Revenue Stream

◉Hardware Systems (64% revenue, 2024)

◉Primary Spend: High-value consoles, scanners, and imaging modules.

◉Challenge: Upfront CapEx barrier, especially in emerging markets.

Software, AI & Cloud Analysis (Highest CAGR)

◉Revenue Model: Subscription-based SaaS, pay-per-scan.

◉Growth Driver: Recurrent revenue, decision-support demand, cross-platform use.

◉Trend: AI regulatory clearances enabling clinical-grade use.

Consumables & Service Contracts

◉IV-OCT Catheters: High-margin recurring sales tied to every procedure.

◉Service, Training & Maintenance: Long-term revenue stabilizer.

By Deployment / Business Model

On-premise Device Ownership (2024 leader)

◉Preference: Larger centers, developed regions.

◉Driver: Control over data and instant availability.

Managed Service / Leasing / Imaging-as-a-Service (Fastest Growth)

◉Model: Device + software + service bundles.

◉Advantage: Reduces CapEx, expands adoption in mid-tier clinics.

Cloud-based Reading & Tele-Ophthalmology Services

◉Driver: Growing demand for remote interpretation in rural/underserved areas.

◉Region: Especially strong in APAC and Africa where ophthalmologist density is low.

By Region

North America (40% share, 2024)

◉Strengths: High device penetration, AI early adoption, strong OCT-A reimbursement.

◉Players: Carl Zeiss Meditec, Topcon, Optovue.

◉Trend: Cloud SaaS and AI-supported workflows gaining traction.

Asia-Pacific (Fastest Growth)

◉Drivers: Large diabetic/aging populations, government healthcare initiatives.

Markets:

◉Japan: Early adopter of IV-OCT.

◉China/India: Growing middle class, local low-cost OCT players.

◉Trend: Portable OCT for outreach; local production lowers pricing barriers.

◉Europe, Latin America & Middle East/Africa

◉Europe: Selective adoption due to reimbursement variations.

◉LatAm: Mid-range OCTs + refurbished units gaining traction.

◉MEA: Growth focused on portable/low-cost OCTs and telemedicine.

Top 5 FAQs

1 What is the OCT market size today and by 2034?

◉US$2.26B (2024) → US$2.62B (2025) → US$10B (2034) at 15.97% CAGR (2025–2034).

2 Which regions lead and which are growing fastest?

◉North America leads with 40% (2024); Asia-Pacific is the fastest-growing through 2034.

3 Which technologies and formats are winning?

◉SD-OCT dominated 2024 (58%); SS-OCT is fastest-growing. Desktop/table-top led (65% in 2024); portable/handheld shows the highest CAGR.

4 Who are the major companies?

◉Carl Zeiss Meditec, Heidelberg Engineering, Topcon, Canon, NIDEK, Optovue, Haag-Streit, Leica Ophthalmic, Thorlabs, Santec, Lumedica, Wasatch Photonics (components), and IV-OCT leaders Abbott, Terumo, Boston Scientific, Philips.

5 What recent announcements matter?

◉Heidelberg’s FDA-cleared OCT-A SHIFT (July 2024; 50% faster); Optos MonacoPro SD retinal + UWF SLO (May 2025); Topcon’s ocular data-as-a-service (May 2025).

Access our exclusive, data-rich dashboard dedicated to the medical imaging sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6087

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest