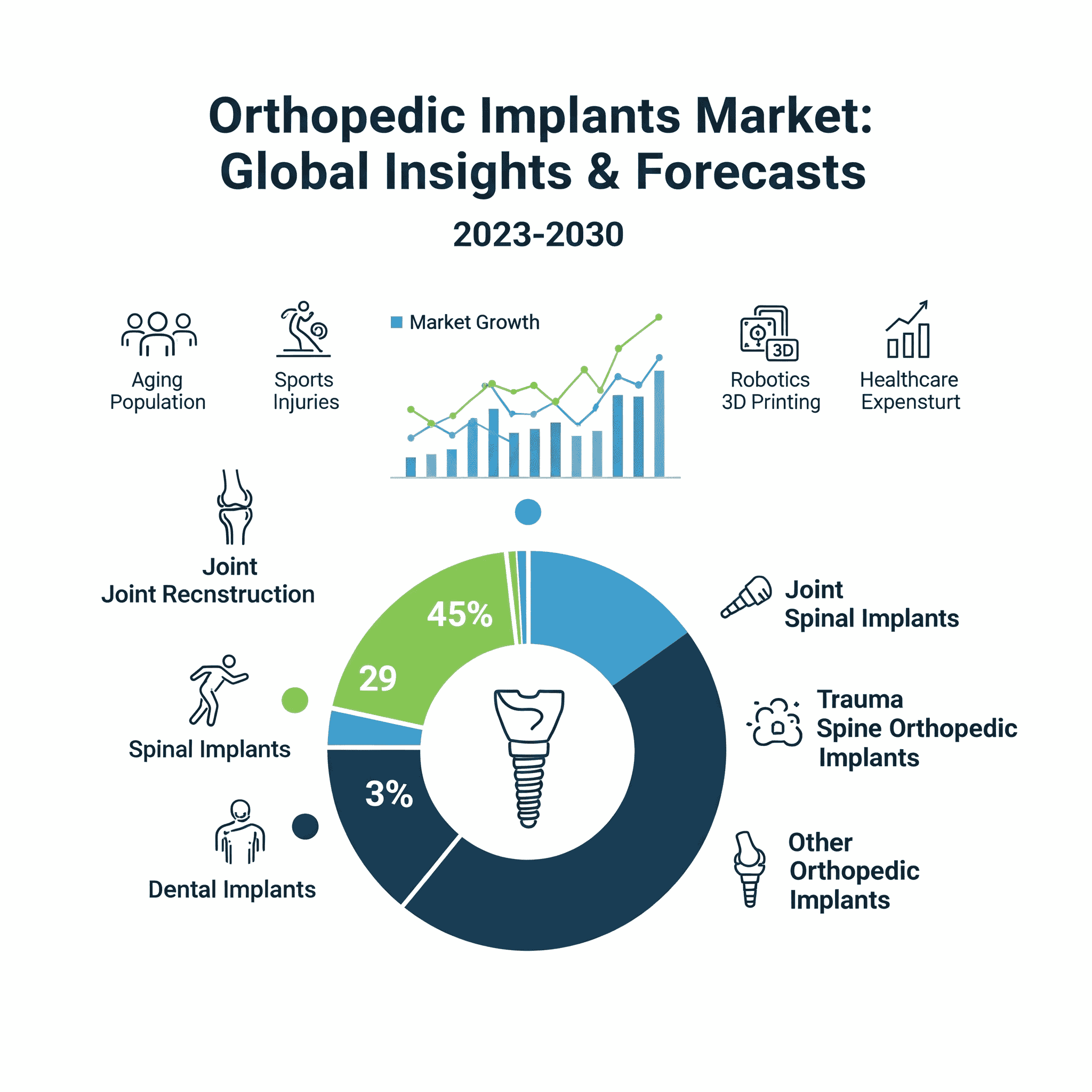

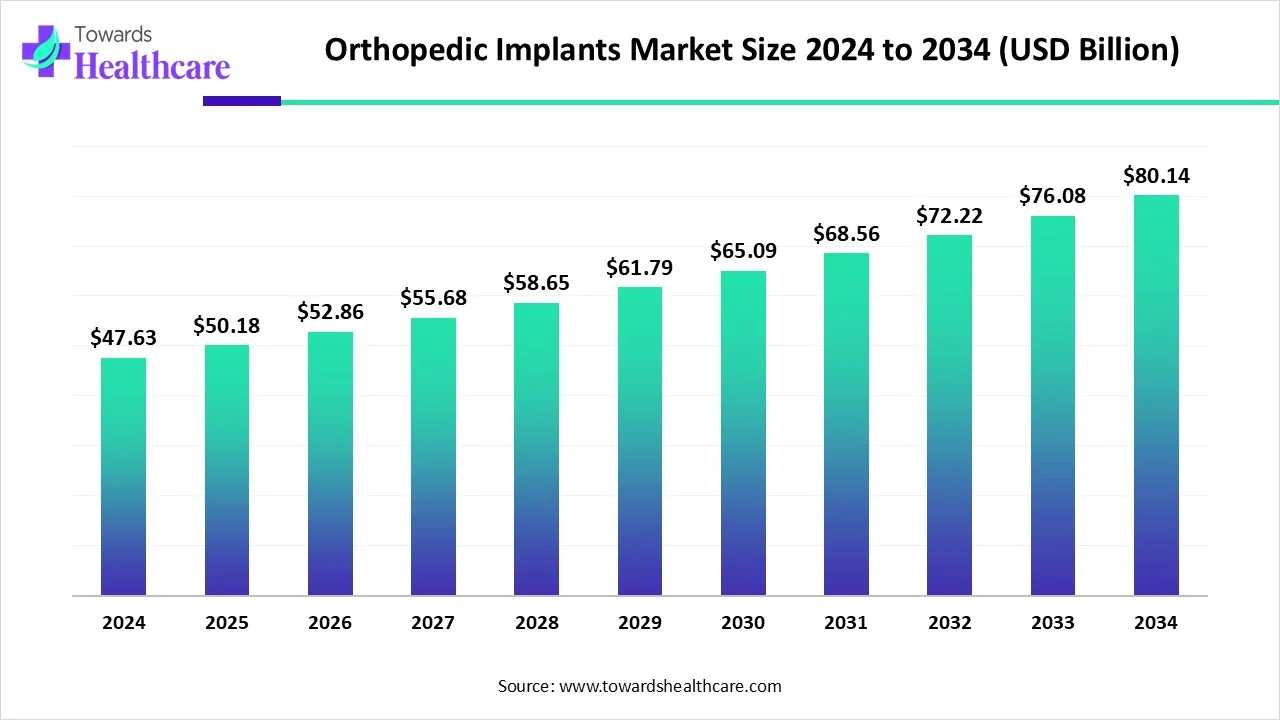

The global orthopedic implants market was valued at USD 47.63 billion in 2024, is expected to reach USD 50.18 billion in 2025, and projected to expand to USD 80.14 billion by 2034. This represents a CAGR of 5.34% (2025–2034). Growth is driven by the aging population, rising prevalence of orthopedic disorders (arthritis, osteoporosis), road accidents, and technological innovations such as 3D printing, robotic-assisted surgeries, and AI-enabled implant design. North America dominates the market, while Asia-Pacific is projected to grow fastest due to its aging population and expanding healthcare infrastructure.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5601

Market Size

◉2024 – USD 47.63 billion

◉2025 – USD 50.18 billion

◉2030 – Approx. USD 65 billion (mid-term projection)

◉2034 – USD 80.14 billion

◉CAGR (2025–2034): 5.34% steady growth.

Growth factors include:

◉Aging population (WHO: 1.4 billion aged ≥60 years by 2030).

◉Increasing road accidents & sports injuries.

◉Advancements in biomaterials, robotics, and AI.

◉Strong government support in emerging economies (e.g., India’s ₹500 Cr MedTech program).

Market Trends

Technological Advancements

◉3D printing allows personalized, faster implant production.

◉Robotic-assisted surgeries (Think Surgical’s TMINI robotic system, 2023) enhance precision.

◉Smart biomaterials improve implant durability and patient compatibility.

Mergers & Acquisitions

◉In Feb 2024, Zeda, Inc. acquired Orthopaedic Implant Company (OIC) to strengthen its value-based orthopedic portfolio.

Manufacturing Expansion

◉In Aug 2025, OIC International (U.S.), Medi Mold (India), and Fives Group (France) collaborated to build India’s most advanced orthopedic implant facility (3D-printing powered).

Investment Surge

◉In May 2025, restor3d raised $38M for scaling 3D-printed implants.

Healthcare Accessibility

◉Rising demand in Asia-Pacific (India, China) due to affordable surgeries & medical tourism.

Product Innovation

◉Spinal implants (e.g., Acelus’s Linesider Modular-Cortical System, 2024) are gaining adoption due to early spinal issues.

Role of AI in Orthopedic Implants Market

AI in Design & Development

◉Machine learning algorithms optimize customized implant designs using patient anatomy scans.

◉Predictive simulations test implant durability before manufacturing.

AI in Surgical Planning & Navigation

◉AI-driven tools assist in precision placement of implants, reducing surgical errors.

◉AI-enabled robot-assisted surgeries improve alignment accuracy in knee/hip replacements.

AI in Patient-Specific Solutions

◉AI models create 3D patient-specific models, ensuring implants are tailored to bone density and shape.

AI in Predictive Analytics & Recovery Monitoring

◉AI tools monitor post-surgery recovery using real-time data (wearable sensors, mobility tracking).

◉Predicts complications (e.g., infection, loosening) before they become critical.

AI in Cost Reduction & Value-Based Implants

◉AI optimizes manufacturing supply chains, reducing implant costs.

◉Enhances value-based healthcare models, aligning implant selection with long-term patient outcomes.

Regional Insights

1. North America (Leading Market, 2024)

◉Advanced healthcare infrastructure, skilled surgeons.

◉Major players (Stryker, Zimmer Biomet, J&J) headquartered here.

Favorable reimbursement (Medicare, Medicaid).

◉U.S. – Strong adoption of robotic & smart implants.

◉Canada – Recent Tyber Medical approval (2024) for titanium/stainless-steel plating systems.

2. Europe (Strong Growth Expected)

◉High demand for hip & knee replacements (Germany: 301 per 100k hip replacements).

◉UK – Demand for 3D-printed & minimally invasive implants rising.

◉Germany – Robust healthcare, early adoption of robotics.

◉Strong government support & strict quality standards boost adoption.

3. Asia-Pacific (Fastest Growing)

◉Aging population in Japan, China, South Korea drives joint replacement demand.

◉India – Rising accidents, sports injuries, & Make in India boosting domestic implant production.

◉China – Healthcare modernization, robotics approvals.

◉Medical tourism hub (India, Thailand) due to cost efficiency.

4. Latin America (Emerging Market)

◉Mexico – Rising rheumatoid arthritis prevalence (~518.9 per 100k by 2030).

◉Brazil – $480M government investment in surgical equipment.

◉Growing demand for affordable orthopedic surgeries.

5. Middle East & Africa (Steady Growth)

◉Saudi Arabia, UAE investing in healthcare modernization.

◉South Africa – Growing demand for trauma & spinal implants.

◉Rising orthopedic disorder awareness fueling adoption.

Market Dynamics

Drivers

◉Aging population (1.4B elderly by 2030).

◉Rising orthopedic disorders (arthritis, osteoporosis).

◉Road accidents & trauma cases fueling implant demand.

◉Technological innovation (3D printing, AI, robotics).

Restraints

◉High cost of implants (knee replacement surgery: USD 15,000–70,000).

Limited access in low-income nations.

Opportunities

◉Government initiatives (India’s ₹500 Cr MedTech program, 2024).

◉Growing demand in developing markets via local manufacturing.

◉Expansion of value-based implants for affordability.

Global Healthcare Production Insights

1) Production Landscape: Who makes what, where

◉Biopharma vs. MedTech split: Biologics/small-molecule plants cluster near major science hubs (U.S., EU, Japan), while MedTech/orthopedic production is more geographically distributed (U.S., Germany, Switzerland, Ireland, China, India, Mexico).

Maturity tiers

◉Tier 1 (innovation + volume): U.S., Germany, Switzerland, Ireland, Japan—high automation, tight supplier ecosystems, complex class II/III devices.

◉Tier 2 (scale + cost): China, India, Mexico, Malaysia, Poland—cost-advantaged precision machining, molding, assembly, contract sterilization.

◉Tier 3 (emerging nodes): Vietnam, Thailand, Turkey, Brazil—fast-growing contract assembly/packaging, selective machining.

◉OEM–CMO model: Top brands keep design, final validation, and critical processes in-house; contract manufacturers (CMOs) handle machining, molding, coatings, kitting, and sterilization.

2) MedTech/Orthopedic Value Chain (end-to-end)

◉Design & file prep → CAD/FEA, DFMA, risk management files.

◉Materials → Titanium (Ti-6Al-4V), Co-Cr alloys, stainless steel (316L), PEEK/PEKK, UHMWPE, ceramics (alumina/zirconia).

Forming & machining

◉Forging/casting for hips/knees; CNC 5-axis machining for plates/screws/instruments.

◉Additive (EBM/SLM) for lattice/porous structures; patient-specific implants.

◉Surface engineering → Grit blasting, anodizing, passivation; HA/TCP coatings, porous plasma spray; antibacterial surfaces.

◉Cleaning & passivation → Critical for corrosion/fatigue performance.

◉Assembly & packaging → ISO-class cleanrooms; sterile barrier systems (Tyvek® pouches, trays).

◉Sterilization → EtO (ethylene oxide), Gamma, e-beam; low-temp plasma for heat-sensitive sets.

◉Quality & release → Incoming, in-process, final inspection; traceability/UDI; batch record review.

◉Distribution → Regional DCs, consignment for hospitals, loaner sets for ORs.

3) Capacity, Lead Times, and Bottlenecks

◉Lead-time drivers: Material mill slots (Ti billets), forging die queues, coating vendor capacity, and sterilization windows.

Typical lead times (steady state):

◉Standard trauma screws/plates: 8–14 weeks

◉Complex joint components: 16–24+ weeks (forging + machining + coating)

◉Patient-specific/3D-printed: 2–6 weeks (depends on imaging-to-CAD cycle)

◉Choke points: EtO capacity, validated coating lines, specialty metrology (CT scanning, CMMs), MDR/technical documentation in EU.

4) Cost Structure (directional, varies by site & volume)

◉Materials 25–40% (titanium, Co-Cr, UHMWPE, PEEK; scrap & buy-to-fly ratios matter).

◉Processing 20–35% (machining/printing, coatings, finishing, cleaning).

◉Quality/Regulatory 10–20% (validation, testing, documentation, audits).

◉Packaging & Sterilization 5–12%.

◉Overheads & SG&A 15–25% (tooling amortization, facilities, compliance).

5) Quality & Regulatory Backbone (practical view)

◉Standards: ISO 13485 (QMS), ISO 14971 (risk), ISO 10993 (biocompatibility), ISO 11135/11137 (EtO/Gamma), UDI/traceability.

◉File discipline: DMR/Device History Records, design history, process validation (IQ/OQ/PQ), complaint/CAPA systems.

◉Regional nuance: U.S. 510(k)/PMA pathways; EU MDR technical docs & PMS/PMCF; Health Canada licensing; ANVISA registration.

6) Supply Risk Map & Mitigations

◉Metals: Titanium sponge & alloy availability; dual-source mills; long-term offtakes.

◉Sterilization: EtO regulatory scrutiny → diversify to Gamma/e-beam where feasible; load pattern optimization.

◉Single-source processes (e.g., HA coating): qualify backup vendors; maintain shelf-life buffers.

◉Geopolitical/logistics: Nearshoring/“China+1”; regional safety stocks; validated alternate warehouses.

Top Companies

1 Stryker Corporation

Products: Joint replacement, trauma, spinal implants.

Strength: Global leader in robotic-assisted orthopedic surgeries.

2 Zimmer Biomet Holdings, Inc.

Products: Hip, knee, extremity implants.

Strength: Strong global distribution network, advanced prosthetic designs.

3 Medtronic plc

Products: Primarily spinal implants & neurosurgical solutions.

Strength: R&D leadership, diversified medical device portfolio.

4 Smith & Nephew plc

Products: Orthopedic reconstruction, sports medicine implants.

Strength: Focus on minimally invasive and sports orthopedics.

5 NuVasive, Inc.

Products: Spinal fusion & non-fusion implants.

Strength: Motion-preserving spinal solutions, strong innovation pipeline.

6 Integra LifeSciences

Products: Extremity implants, regenerative tissue solutions.

Strength: Diversified product mix, global surgical innovation.

7 Aesculap Implant Systems

Products: Trauma, joint implants.

Strength: High-quality German engineering, precision implants.

Government Healthcare Spending & Policies in Orthopedic Implants Market

1. Government Healthcare Spending: Driving Orthopedic Implant Access

Rising Global Healthcare Expenditure

◉Governments worldwide are increasing healthcare budgets to manage the growing burden of orthopedic conditions (arthritis, osteoporosis, trauma injuries).

◉Example: The Indian government’s ₹500 crore MedTech program (2024) was launched to support local medical device manufacturing and boost exports.

Funding for Surgical Infrastructure

◉Many nations are investing in advanced surgical infrastructure to accommodate the rising number of orthopedic surgeries (hip, knee, spine).

◉Brazil announced a $480 million investment to acquire >10,000 pieces of surgical and orthopedic equipment for hospitals.

Focus on Geriatric Care

◉Aging populations in Japan, Germany, and the U.S. are pushing governments to allocate higher spending for joint replacement surgeries and post-operative rehabilitation.

Public Insurance Schemes

◉North America benefits from Medicare/Medicaid (U.S.) and universal healthcare systems (Canada, EU nations) that reimburse a large portion of implant surgeries, ensuring higher accessibility.

2. Government Policies Supporting the Market

a) Incentives for Local Manufacturing

◉India’s Make in India initiative encourages local orthopedic implant production, lowering dependence on imports and improving affordability.

◉China and South Korea are actively funding domestic MedTech innovation hubs to scale implant manufacturing.

b) Reimbursement & Insurance Coverage

◉In the U.S., Medicare covers joint replacement surgeries (especially hip/knee replacements), significantly increasing accessibility for elderly patients.

◉In Europe, national health systems subsidize orthopedic implants, making advanced solutions widely accessible.

c) Export-Oriented MedTech Programs

◉Governments in Asia-Pacific (India, China) are promoting exports of orthopedic devices, aiming to become low-cost global suppliers.

◉Policies include tax benefits, subsidies, and R&D grants.

d) Strict Regulatory Approvals

◉Agencies like FDA (U.S.), Health Canada, EMA (Europe), and ANVISA (Brazil) enforce strict approval frameworks to ensure implant quality and patient safety.

◉Example: Tyber Medical received Health Canada approval (Feb 2024) for its plating system, expanding product access.

e) Encouragement of Innovation

◉U.S. FDA provides 510(k) clearances for new implant systems (e.g., Think Surgical’s TMINI robotic system, 2023).

◉European Union encourages adoption of CE-marked implants with strict post-market surveillance policies.

3. Impact of Policies on Market Growth

◉Improved Affordability – Subsidies and reimbursement policies increase access to costly orthopedic implants.

◉Boost to Local Manufacturing – Incentives reduce costs and foster innovation in emerging economies.

◉Faster Technology Adoption – Governments backing robotics, AI, and 3D printing help hospitals adopt modern surgical solutions.

◉Medical Tourism Growth – Supportive policies in India, Thailand, and Mexico attract international patients for cost-effective orthopedic surgeries.

4. Challenges in Policy & Spending

◉High Implant Costs – Despite subsidies, implants remain expensive in many low-income regions.

◉Regulatory Delays – Lengthy approval timelines slow down the introduction of advanced implants in some markets.

◉Inequality in Access – Rural and underdeveloped areas often lack infrastructure, even when government programs exist.

Latest Announcements

◉Restor3d (May 2025): Secured $38M to expand 3D-printed personalized implants.

◉Zeda, Inc. (Feb 2024): Acquired Orthopaedic Implant Company (OIC) for value-based implants.

◉OIC International (Aug 2025): Established India’s largest 3D-print orthopedic facility with Medi Mold & Fives Group.

🔬 Recent Developments

1 Jan 2024 – Acelus Launches Linesider Spinal Implant System

◉Company: Acelus

◉Product: Linesider™ Spinal Implant System

◉Features:

◉A modular-cortical screw system designed for spine fixation.

◉Focuses on minimally invasive spine (MIS) procedures, offering surgeons increased flexibility during implantation.

◉Combines modular head options with cortical trajectory screw design, which allows better fixation in patients with compromised bone quality (e.g., osteoporotic).

Strategic Impact:

◉Strengthens Acelus’ position in the spinal implants segment by targeting growing demand for MIS surgeries.

◉Reduces surgical complexity and operative time, making it more attractive for hospitals and ambulatory surgical centers.

◉Expands Acelus’ orthopedic implant portfolio beyond conventional fixation devices.

2 Jan 2024 – Pacific Research Labs Introduces ENDPOINT Implant Simulation Tool

◉Company: Pacific Research Labs (Seattle-based medtech R&D company)

◉Product: ENDPOINT Simulation Tool

What it Does:

◉A virtual simulation platform for pre-clinical testing of orthopedic implants.

◉Allows manufacturers and researchers to predict implant performance under real-world biomechanical conditions without extensive animal or cadaver studies.

◉Helps assess durability, stress distribution, and failure modes of implants.

Strategic Importance:

◉Significantly reduces R&D costs and shortens time-to-market for implant developers.

◉Enhances compliance with regulatory requirements by generating validated pre-clinical data.

◉Strengthens Pacific Research Labs’ role as an innovation enabler for orthopedic manufacturers.

3 Feb 2024 – Tyber Medical Gains Health Canada Approval for Plating System

◉Company: Tyber Medical (US-based OEM specializing in private-label implants)

◉Approval: Health Canada clearance for its Anatomic Plating System.

System Highlights:

◉Comprehensive portfolio of locking and non-locking plates for trauma and reconstructive procedures.

◉Anatomically contoured plates designed for multiple fixation needs:

◉Small fragment fractures

◉Large fragment repairs

◉Periarticular (joint-adjacent) fracture stabilization

◉Available in various sizes and configurations for both upper and lower extremities.

Strategic Value:

◉Expands Tyber Medical’s international footprint in Canada, a key medtech market.

◉Strengthens OEM partnerships, as Tyber often supplies implants to other branded orthopedic firms.

◉Builds momentum for global regulatory expansion (e.g., CE Mark in EU, FDA in US).

Apr 2023 – Think Surgical Receives FDA Clearance for TMINI Robotic Knee System

◉Company: Think Surgical, Inc.

◉Product: TMINI™ Miniature Hand-Held Robotic System

◉Clearance: FDA 510(k) for total knee replacement procedures.

Unique Features:

◉Compact, hand-held robotic device—smaller and more affordable than large robotic systems.

◉Designed to assist surgeons in precise bone preparation for implant placement.

◉Open-platform design: compatible with implants from multiple manufacturers (not vendor-locked).

◉Enhances accuracy of alignment and cutting, improving patient outcomes and reducing revision risk.

Strategic Impact:

◉Democratizes robotic-assisted surgery by lowering costs and footprint, enabling adoption in mid-sized hospitals and surgery centers.

◉Competes with larger robotic systems (Stryker’s Mako, Zimmer Biomet’s ROSA) by offering a more accessible, flexible option.

◉Strengthens Think Surgical’s image as a pioneer in open-platform robotic solutions.

Segments Covered

By Product:

◉Joint Reconstruction (Knee, Hip, Extremities)

◉Spinal Implants (Fusion & Non-Fusion)

◉Trauma Implants

◉Others

By End-User:

◉Hospitals & Ambulatory Surgery Centers

◉Orthopedic Clinics & Others

By Region:

◉North America (U.S., Canada)

◉Europe (UK, Germany, France, Italy, Spain, Nordics)

◉Asia-Pacific (Japan, China, India, S. Korea, Australia, Thailand)

◉Latin America (Brazil, Mexico, Argentina)

◉Middle East & Africa (South Africa, Saudi Arabia, UAE, Kuwait)

Top 5 FAQs

1 What is the orthopedic implants market size in 2024 and 2034?

→ USD 47.63B (2024) to USD 80.14B (2034), CAGR 5.34%.

2 Which region dominates the orthopedic implants market?

→ North America dominates (advanced healthcare, aging population).

3 Which region is expected to grow fastest?

→ Asia-Pacific, due to aging population, medical tourism, and government initiatives.

4 What are the key growth drivers?

→ Aging population, rising orthopedic disorders, road accidents, and AI/robotics innovations.

5 Who are the top companies in this market?

→ Stryker, Zimmer Biomet, Medtronic, Smith & Nephew, NuVasive, Integra LifeSciences, Aesculap Implant Systems.

Check out the details below

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5601

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest