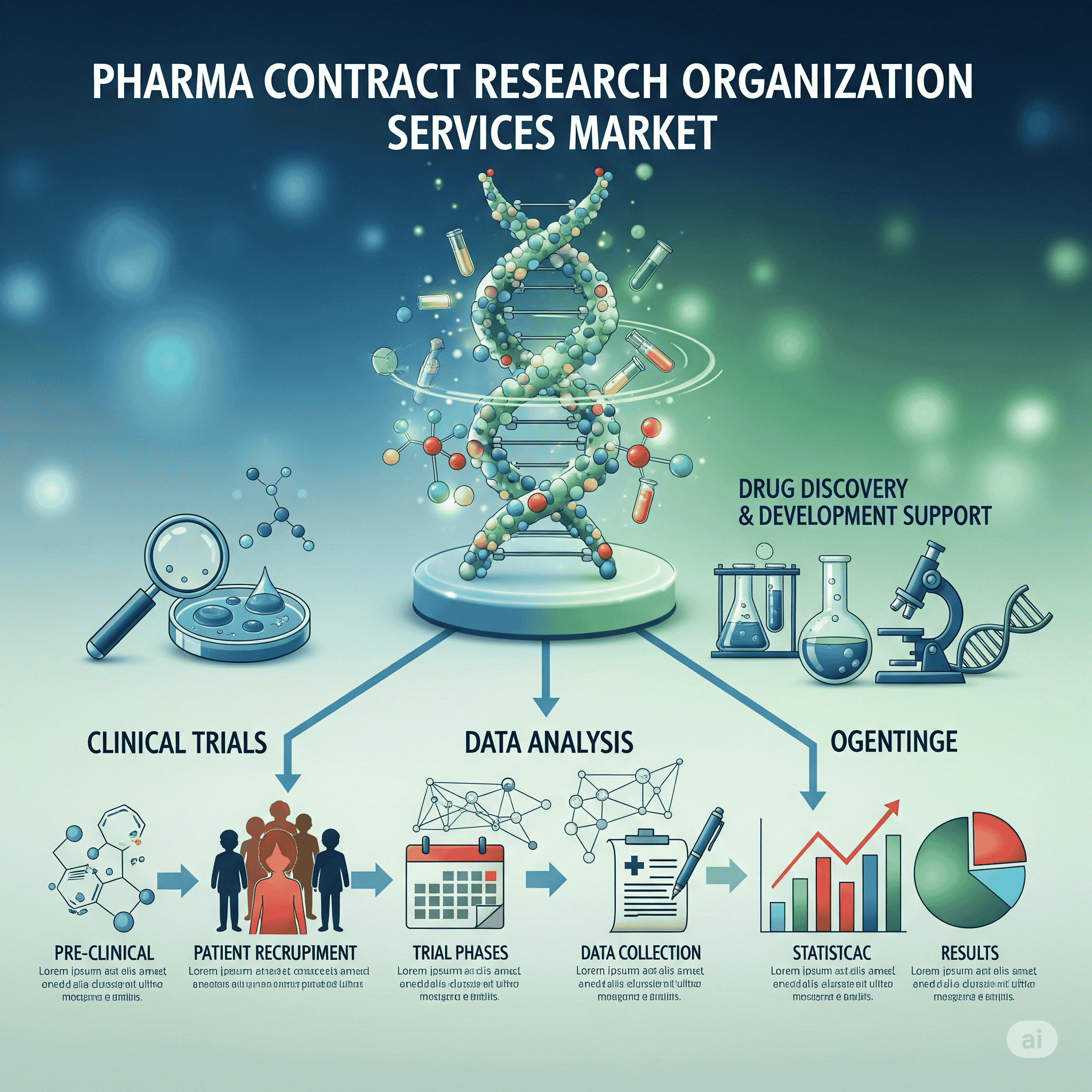

The global Pharma Contract Research Organization (CRO) services market, valued at USD 36.66 billion in 2025, is projected to reach USD 87.03 billion by 2034, growing at a CAGR of 10.04%. Growth is driven by the rising complexity and costs of drug development, the increasing need for specialized expertise in biologics and personalized medicine, and the global trend of outsourcing clinical trials and R&D processes. North America dominates due to its strong pharma and biotech industries, while Asia-Pacific is the fastest-growing region, benefiting from cost-efficient trials, large patient pools, and improving regulatory frameworks.

Download the free sample and get the full report for complete insights and forecasts on this market @ https://www.towardshealthcare.com/download-sample/5567

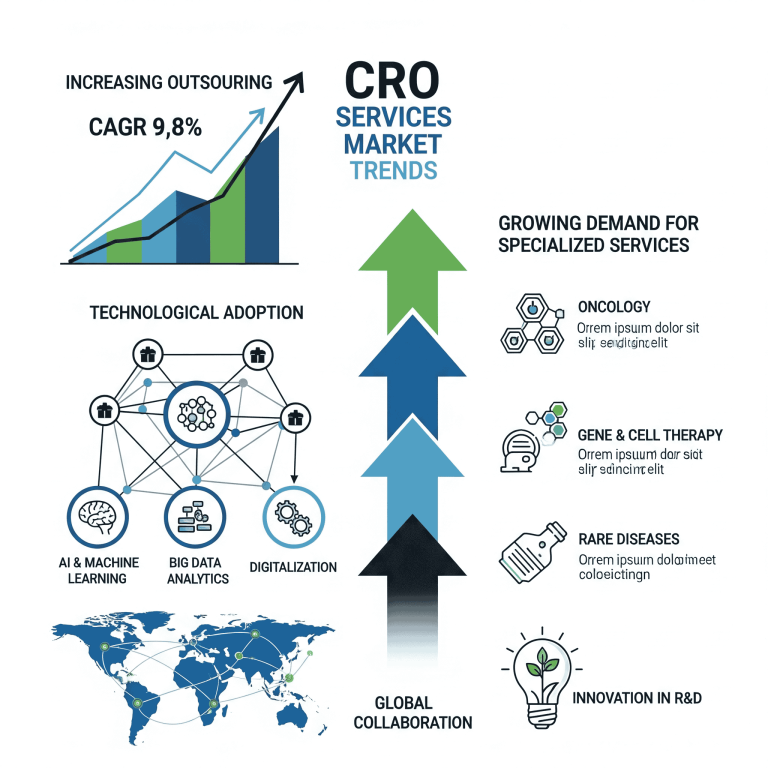

Market Trends

◉Growing Adoption of AI in CRO Services

AI streamlines trial design, patient recruitment, and data analysis, reducing costs and timelines.

◉Rising Demand for Personalized Medicine

Precision medicine requires biomarker analysis and advanced data management, boosting CRO service demand.

◉Strategic Collaborations & Acquisitions

Partnerships like PhaseV & iOMEDICO (oncology focus) and ICROM acquiring HOLODIAG are expanding specialized capabilities.

◉Biologics & Advanced Therapies Focus

Increasing R&D in biologics, gene, and cell therapies fuels CRO demand.

◉Global Clinical Trial Expansion

CROs are penetrating emerging markets like India, China, and Latin America for cost advantages and diverse patient recruitment.

Market Insights

75% of clinical trials are conducted by CROs (Thermo Fisher Scientific, 2023).

◉CRO outsourcing reduces overhead costs and accelerates time-to-market for drugs.

◉Biologics, oncology, and cardiovascular research are key growth drivers.

◉Regulatory reforms in Asia-Pacific are making the region more attractive for global trials.

Market Dynamics

Drivers

◉Increasing Complexity & Cost of Clinical Trials

Specialized expertise in biomarker analysis, genomic testing, and adaptive trial design needed.

◉Growing Outsourcing Trend

Pharma & biotech companies outsourcing to reduce costs and speed up R&D.

◉Rise in Chronic Diseases

Higher incidence of cancer, cardiovascular, and neurological disorders boosts CRO demand.

Restraints

◉Data Security & Confidentiality Concerns

Compliance with GDPR, HIPAA increases operational costs and limits full outsourcing.

Opportunities

◉Advanced Therapies & AI Integration

CROs can expand offerings in precision medicine, gene therapy, and AI-driven trial optimization.

Regional Segments

North America – Market Leader

◉Large pharma & biotech base, advanced healthcare infrastructure, and high R&D investments.

◉U.S. leads in oncology and biologics trials.

Asia-Pacific – Fastest Growth

◉Cost-effective trials, large patient pools, improved regulatory systems (India, China).

◉Government support for life sciences boosts CRO adoption.

Europe – Significant Growth

◉Strong pharma industry, EMA unified regulations, rising biologics and AI adoption.

Latin America – Emerging Market

◉Increasing R&D activities, pharma startups, and government-backed research funding (Brazil, Argentina).

Segment Highlights

By Scale of Operation

◉Discovery Services – Largest Share (2024)

Early-stage R&D outsourcing for target identification & compound screening.

◉Preclinical Services – Fastest Growth

Demand driven by stricter regulations and safety testing needs.

By Target Therapeutic Area

◉Oncology – Largest Share

High cancer prevalence and complex trial requirements.

◉Cardiovascular Disorders – Significant Growth

Rising global cardiovascular disease rates and personalized therapy developments.

Top Companies

IQVIA

Parexel International (MA) Corporation

Medpace

Charles River Laboratories

CTI Clinical Trial & Consulting

WuXi AppTec

Veeda Clinical Research

ICON plc

Laboratory Corporation of America Holdings

Syneos Health

5 FAQs

Q1: What is the projected size of the pharma CRO services market by 2034?

A1: The market is expected to reach USD 87.03 billion by 2034, growing at a CAGR of 10.04% from 2025.

Q2: Which region is expected to grow the fastest in the pharma CRO market?

A2: Asia-Pacific, due to cost-efficient trials, diverse patient recruitment, and improved regulatory frameworks.

Q3: Why is oncology the largest therapeutic area segment in CRO services?

A3: High global cancer prevalence and the complexity of oncology trials require specialized expertise, making CRO involvement essential.

Q4: How is AI transforming CRO services?

A4: AI improves trial design, speeds up patient recruitment, enhances data accuracy, and reduces operational costs.

Q5: What is the biggest challenge faced by CROs?

A5: Data security and confidentiality concerns, especially with strict regulations like GDPR and HIPAA.

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5567

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com