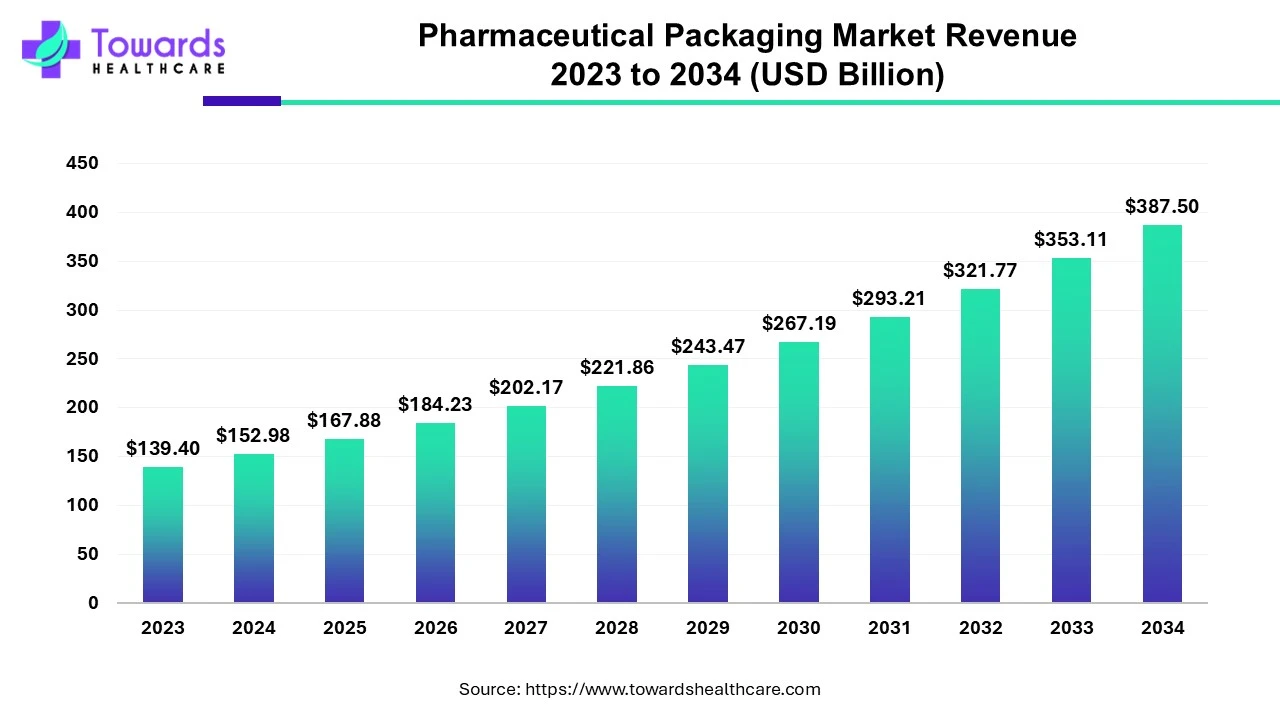

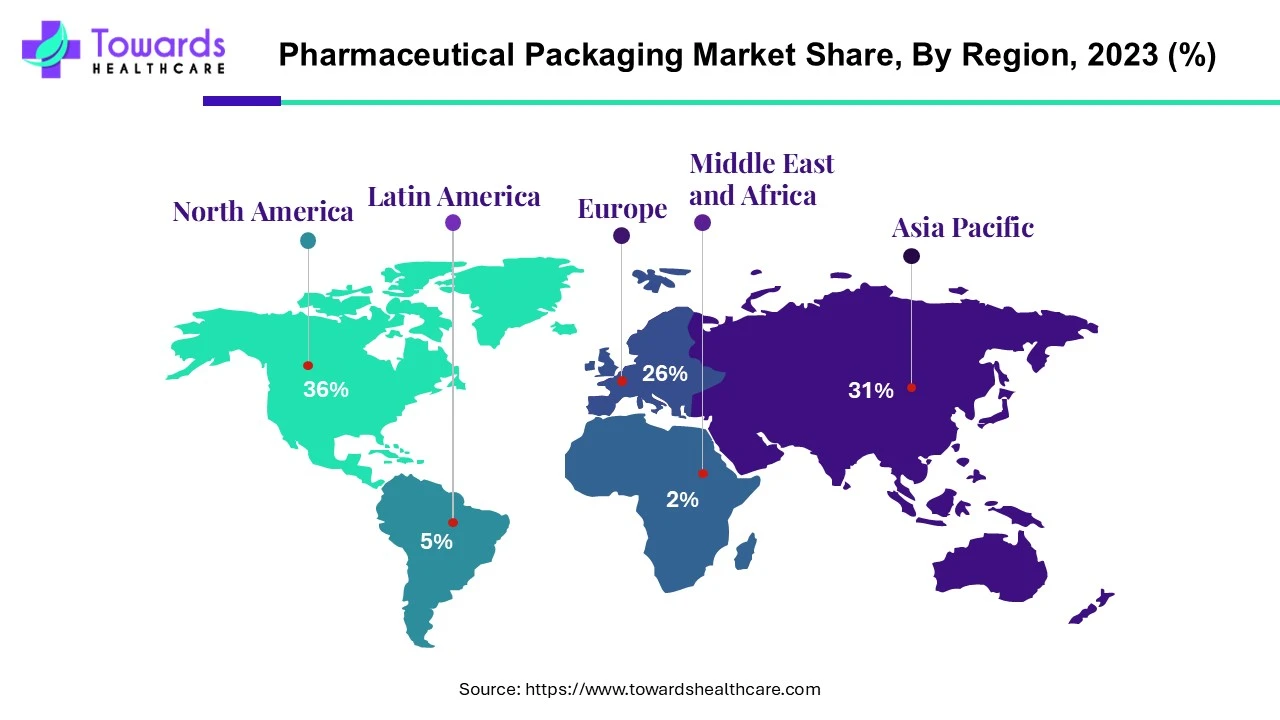

The global pharmaceutical packaging market was valued at US$ 139.40 billion in 2023 and is projected to reach US$ 387.50 billion by 2034, expanding at a CAGR of 9.74% (2024–2034). North America held the dominant share of 36% in 2023, while Asia Pacific is expected to register the fastest growth. By material, plastics & polymers led the market in 2023, whereas paper & paperboard is set to expand significantly. By product, primary packaging (such as vials, syringes, bottles, blister packs) dominated and will remain the fastest-growing. Oral drugs led by drug delivery mode in 2023, while injectables are forecast to grow at the fastest CAGR (2024–2034). On the end-use side, pharma manufacturing dominated and will remain the leading contributor.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5247

Market Size

◉2023 Market Value: US$ 139.40 billion

◉2034 Market Value: US$ 387.50 billion

◉CAGR (2024–2034): 9.74%

◉North America (2023 share): 36% of global revenue

◉Europe: Growing steadily, driven by biologics & eco-friendly innovations.

◉Asia Pacific: Fastest-growing region due to government investments, patient pool, and strong pharma base (China & India lead).

◉Latin America: Brazil & Mexico driving growth due to rising pharmaceutical exports.

◉Middle East & Africa (MEA): Emerging opportunities due to increased import dependency on pharma products.

Market Trends

Primary packaging supremacy + speed

◉Dominated 2023 and remains the fastest-growing product class: vials, ampoules, prefilled syringes, bottles, blisters.

◉Catalyst: surge in biologics/vaccines and sterile injectables.

Plastics & polymers = workhorse materials

◉2023 leader by material due to cost, weight, manufacturability; PVC, PET, PE, PP, PS central across bottles, blisters, closures, device housings.

Paper & paperboard acceleration

◉Significant growth outlook: sustainable secondary & tertiary packs, plus novel primary-adjacent concepts.

◉Example given: Push-Pak (Keystone, Jun 2024) → compact paperboard blister concept optimizes footprint.

Injectables outrun all drug-delivery modes

◉Fastest 2024–2034 CAGR due to biologics, GLP-1s, and complex therapies needing sterile, barrier-strong, device-integrated packs.

Smart/secure packaging mainstreaming

◉RFID/NFC/QR/holograms → anti-counterfeit, traceability, adherence.

◉IoT tie-ins for cold chain assurance and last-mile visibility.

Generics volume flywheel

◉Lower price points → higher SKU volumes → sustained demand for cost-optimized primary + secondary formats.

◉Your data point: Teva generic revenue US$ 8.734B (2023) and pipeline scale underline generic-led packaging volumes.

Circularity & recyclability inflection

◉CiPPPA (UK, Apr 2024) targets end-of-life recycling pathways.

◉Aluflexpack 4Form (Jul 2024) single-material lacquered aluminum blister.

◉SGD Pharma (Sep 2024) PCR glass campaign in China.

AI’s Impact

Quality & Compliance

◉Machine vision detects dents, cracks, misprints, fill-level anomalies; reduces escapes to near-zero at line speed.

◉Real-time SPC + AI drift detection flags subtle pattern shifts (seal integrity, torque variability), preventing batch rework/recall.

◉Example from your data: Sea Vision Group (Dec 2023) AI to elevate packaging quality/productivity.

Throughput & OEE

◉Predictive maintenance models for cartoners, blister thermoformers, vial washers/fillers → fewer unplanned stops; higher OEE.

◉Dynamic scheduling: AI re-sequences lots to minimize changeover, balancing sterilization windows & expiry constraints.

Material/Design Intelligence

◉AI-driven finite element & barrier simulations: optimize wall thickness, blister cavity geometry, headspace O₂ control → material savings without risking stability.

◉LCA optimizers: weigh CO₂e, recyclability, and cost under regulatory constraints (e.g., child-resistance, tamper-evidence).

Serialization & Anti-Counterfeit

◉AI cross-validates serials across line/cloud, detects copy/clone patterns, and triggers investigations.

◉Computer vision for microtext/hologram authenticity in QA sampling.

Cold Chain & Smart Packaging

◉Sensor data (temp/humidity/shock) + AI identifies route-risk corridors, anticipates excursions, and recommends packaging insulation upgrades or lane changes.

◉Adherence analytics (smart blisters) → insights for patient programs (pharma-sponsored), feeding demand planning.

Cost & Waste Reduction

◉Yield analytics pinpoint scrap sources (forming film wrinkles, label misfeeds).

◉Digital twins model new lines: avoid over/under-spec of capital.

Governance & GxP

◉AI audit trails & explainability layers structured for CSV (computer system validation) and data integrity expectations.

◉Bottom line: AI defends quality, cost, and speed simultaneously, and is decisive for injectables & smart pack success.

Regional Segments

North America (NA) — 36% share in 2023 (US$ 50.18B)

◉Demand engines: high prevalence of chronic disease; strong biologics & GLP-1 pipelines → vial/syringe/blister intensity.

◉Infrastructure: large base of CDER-recognized manufacturing sites; pharma maintains in-house primary packaging + validated suppliers.

◉What wins: compliant sterile containment (Type I glass, advanced elastomer closures), CR/SF (child-resistant/senior-friendly) Rx packs, robust serialization.

Asia Pacific (APAC) — Fastest growth

◉China: largest API producer; “Made in China 2025” → upstream self-reliance, downstream premiumization; PCR glass initiative (SGD) shows sustainability tilt.

◉India: 20% global generics share; ₹4,17,345 Cr (2023–24) pharma turnover → blister, bottle, strip packs at scale; value-engineering + compliance are key.

◉Japan/Korea: device-integrated injectables, high-precision prefilled syringes; demand for tight tolerances and cleanroom packaging.

Europe

◉Biologics/biosimilars drive temperature- & light-sensitive containment; thermo-protective primary packaging R&D (notably Germany).

◉Circularity: CiPPPA (UK) aligns value chain on end-of-life solutions; push for mono-material and recycled content (SGD PCR glass).

◉What wins: glass excellence, barrier films, re-processable formats, documented eco-footprint.

Latin America

◉Brazil/Mexico: rising pharma manufacturing and exports → formalization of GMP-compliant packaging supply, serialization adoption.

◉What wins: cost-efficient yet compliant secondary/tertiary packs, reliable cold-chain for biologics importation.

Middle East & Africa (MEA)

◉Import-led pharma consumption; expanding healthcare spend and specialty imports ⇒ demand for robust tertiary + insulated shippers.

◉What wins: validated cold-chain kits, counterfeit-resistant features, regional last-mile resilience.

Market Dynamics

Demand drivers

◉New medications (biologics, vaccines) → stringent primary containment.

◉Rising transportation volumes → reliable/sustainable packaging to defend against temperature, light, moisture, shock.

◉Biodegradable & eco-innovations → accelerate paper/paperboard & mono-material blisters.

Restraints

◉Strict regulation (patient safety, tamper-evidence, labeling, sterility).

◉Counterfeiting risks → added cost/complexity (serialization + smart features).

Opportunities

◉Smart packaging (hologram/NFC/RFID/QR) for track & trace and patient engagement.

◉Injectables outperformance (fastest-growing delivery mode 2024–2034).

◉Recycling initiatives (CiPPPA) and PCR materials (SGD) enable differentiated sustainability.

Risks & mitigations

◉Material volatility → dual-source critical films/resins; design for material substitution.

◉Regulatory change → proactive change control and modular packaging.

◉Counterfeit escalation → tiered security (overt/covert/forensic) + analytics.

Leading Companies 2025

Amcor plc — Global converter

◉Products: Flexible/rigid pharma formats (primary films, pouches, blisters; secondary cartons).

◉Strength: Scale + sustainability programs; broad GMP footprint.

WestRock Company — Fiber systems leader

◉Products: Paperboard cartons, CR/SF designs, inserts/leaflets.

◉Strength: Structural design, converting scale, sustainability credentials.

Berry Global, Inc. — Plastic systems

◉Products: Bottles, closures, specialty components for pharma.

◉Strength: High-volume polymer conversion, closure systems.

Owens-Illinois (O-I) — Glass containers

◉Products: Glass bottles/containers (pharma-use SKUs exist).

◉Strength: Glassmaking scale, barrier/inertness benefits.

Schott AG — Borosilicate excellence

◉Products: Type I glass vials, syringes, ampoules.

◉Strength: High-purity glass for injectables.

SGD Pharma (your detailed data) — Pharma glass specialist

◉Scale: 5 plants, 7 furnaces, 1 sorting, 1 decoration; 8M+ bottles/vials output; €441M turnover (2023).

◉Strength: Global production in EU & Asia; PCR glass campaign (2024) = sustainability leadership.

West Pharmaceutical Services, Inc. — Injectable containment

◉Products: Stoppers, seals, device components; containment/closure systems.

◉Strength: Deep integration with biotech fill-finish.

Gerresheimer AG — Glass & plastic pharma

◉Products: Vials, syringes, inhalation & device packaging.

◉Strength: Broad platform across primary + devices.

Vetter Pharma International — CDMO/packaging interface

◉Products: Fill-finish, combination product final assembly/packaging.

◉Strength: Sterile operations and device kitting.

CCL Industries, Inc. — Labeling specialist

◉Products: Pharma labeling, security features.

◉Strength: Serialization-ready label systems.

Drug Plastics Group — Rigid plastics

◉Products: Bottles, closures for Rx/OTC.

◉Strength: Regulatory-grade polymers, consistency.

Becton, Dickinson and Company (BD) — Systems & devices

◉Products: Syringes, needles, systems integral to primary packaging.

◉Strength: Global standardization of syringe systems.

AptarGroup, Inc. — Drug delivery pack

◉Products: Pumps, inhaler components, nasal/ophthalmic packaging.

◉Strength: Precision dosing, patient-centric usability.

International Paper — Fiber-based secondary/tertiary

◉Products: Cartons, shippers, inserts.

◉Strength: Large-scale paperboard supply.

Comar, LLC — Specialty plastics & devices

◉Products: Bottles, closures, precision components.

◉Strength: Custom molding for regulated markets.

PCI Pharma Services

◉2024: US$ 365M investment for injectables and combination products (clinical & commercial).

◉Strength: End-to-end assembly & packaging at scale; device-combo expertise.

Latest Announcements

PCI Pharma Services (Sep 2024)

◉US$ 365M infrastructure investment to support assembly & packaging for injectable drug-device combinations across clinical → commercial.

◉Implication: Capacity relief for pharma sponsors; faster tech-transfer; robust device kitting.

SGD Pharma (Sep 2024)

◉Completed first 20% PCR cullet glass campaign; introducing PCR glass bottles from Zhanjiang (China).

◉Implication: Measurable recycled content in primary glass, aligning with EU & global sustainability KPIs.

Recent Developments

◉Aluflexpack 4Form (Jul 2024): Single-material lacquered aluminum blister → improves recyclability vs multi-layer; keeps barrier performance high for oral solid doses.

◉CiPPPA (UK, Apr 2024): Industry coalition to solve end-of-life for primary pharma packs & medical devices; expects design-for-recycling migration and new takeback pathways.

◉Keystone Push-Pak (Jun 2024): Paperboard blister concept with compact cavity layout → cartonization efficiency, logistics density, and potential fiber-based primary-adjacent innovation.

◉Sea Vision AI (Dec 2023): AI-based inspection to raise quality & productivity; line-speed defect capture for cracks/dents.

◉Teva generics scale (2023): US$ 8.734B generics revenue; ~500 Rx items in market; 1,100 pipeline generics → sustained high-volume oral & secondary packaging demand.

Segments

Q1. What is the global market size of pharmaceutical packaging?

A1. Valued at US$ 139.40B (2023), expected to reach US$ 387.50B (2034) at a 9.74% CAGR.

Q2. Which region dominates the pharmaceutical packaging market?

A2. North America (36% share in 2023).

Q3. Which is the fastest-growing region?

A3. Asia Pacific, driven by China’s API dominance and India’s generic exports.

Q4. Which segment dominates by product type?

A4. Primary packaging (vials, bottles, blister packs).

Q5. What are the latest innovations in pharma packaging?

A5. Smart packaging (RFID, QR, IoT), recyclable 4Form aluminum blisters, Push-Pak paperboard packs, and PCR glass bottles.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5247

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest