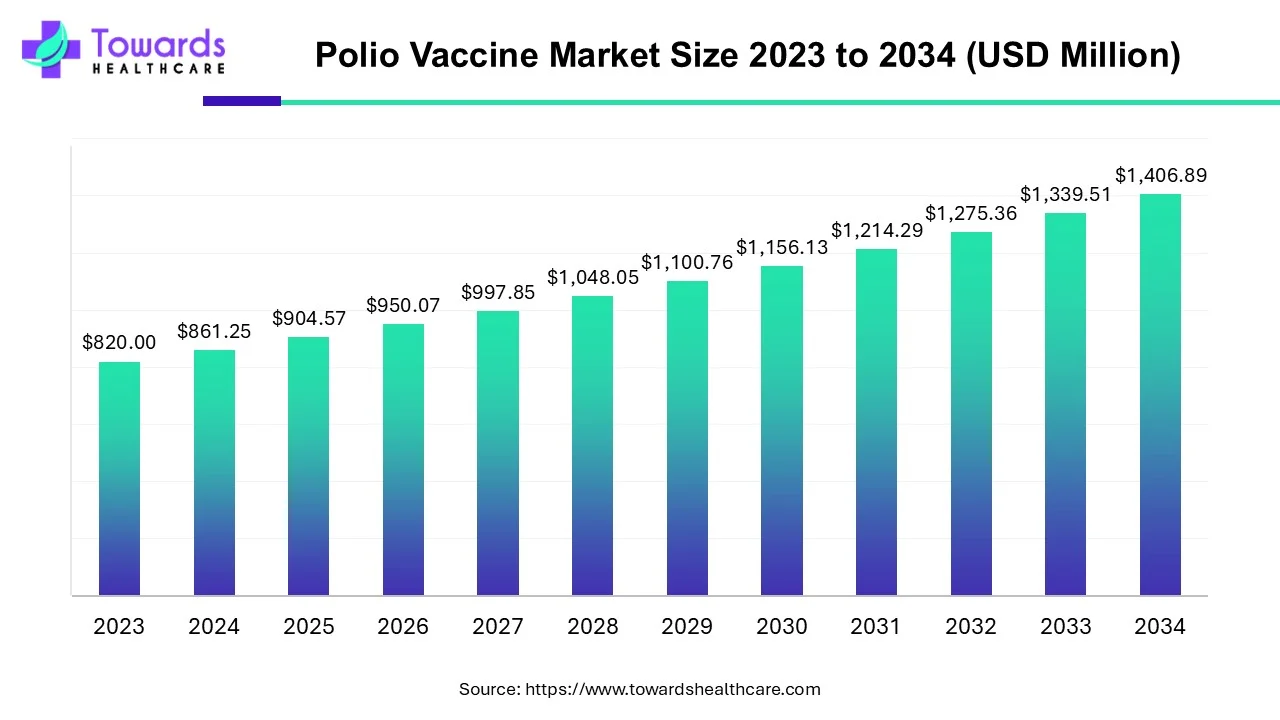

The global polio vaccine market was valued at USD 904.57 million in 2025 and is projected to reach USD 1,406.89 million by 2034, expanding at a CAGR of 5.03%, driven by eradication programs, WHO–UNICEF–GPEI initiatives, technological advancements, and continued outbreaks requiring vaccination.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5477

Market Size of Polio Vaccine Market

2023 Baseline:

◉Estimated size USD 861.25 million in 2024.

◉Sets the stage for consistent demand due to global eradication commitments.

2025 Market Value:

◉Reaches USD 904.57 million, backed by mass immunization campaigns (e.g., Gaza vaccinating 603,000 children with nOPV2).

2034 Projection:

◉Expected to grow to USD 1,406.89 million, reflecting sustained public-private partnerships and expanded IPV production in Africa and Asia.

Growth Driver:

◉CAGR of 5.03% (2025–2034) indicates steady demand despite polio-free status in several countries, as ongoing outbreak control and travel immunization sustain the market.

Dose Demand Forecasts:

◉UNICEF projects 3.7–3.9 billion bOPV doses needed in 4 years, equating to $500 million expenditure globally.

Over 1 billion nOPV2 doses administered in 35+ countries over the last 3 years.

Market Trends

Eradication Campaigns Fuel Demand:

◉Initiatives like EPI, UIP, NRHM in India and GPEI globally keep vaccines indispensable.

◉In 2024, Guinea immunized 3.2M children via UNICEF campaigns.

Partnerships Boost Local Production:

◉Sanofi + Biovac collaboration (2024) → first IPV manufacturing in Africa.

◉Strengthens supply security and reduces import reliance.

Technology-driven Innovations:

◉Thermostable vaccines & next-gen IPV → minimize cold-chain dependency.

◉China approved msIPV (Vero Cell, Sabin strains) in 2024.

Government Funding Expands Access:

◉Canada pledged $111M to GPEI (2024–2027) → part of its $1B total support.

◉UK contributed £1.65B to GAVI (2021–2025) for global immunization.

Outbreak-Driven Market Activation:

◉74 global polio cases reported (GPEI data).

◉Sudan (2024) → launched emergency campaign against cVDPV2 outbreak.

AI’s Role in Polio Vaccine Market

Supply Chain Optimization

◉AI predicts optimal delivery routes in conflict zones or rural areas.

◉Reduces wastage, ensures cold chain integrity.

Disease Surveillance & Outbreak Prediction

◉ML models detect virus circulation in wastewater (as seen in Germany 2024).

◉AI integrates epidemiological & environmental data for real-time outbreak mapping.

Targeted Vaccination Campaigns

◉AI highlights low-coverage zones → enables rapid “ring vaccination” response.

◉Helps address vaccine hesitancy hotspots with tailored communication.

Clinical Research & Next-Gen Vaccines

◉AI accelerates IPV formulation optimization, mRNA-based vaccine design.

◉Shortens R&D cycle → faster regulatory approvals.

Global Resource Allocation

◉AI systems model dose requirement forecasts (e.g., UNICEF’s 3.7B doses need).

◉Prevents understocking in high-birth regions like India, Pakistan.

Regional Insights in Polio Vaccine Market

1. North America (Market Leader, 2024)

◉Strengths: Strong healthcare infrastructure, stockpiles, CDC surveillance.

◉U.S.: Continues high vaccination coverage despite polio-free status; contributes to GPEI.

◉Canada: Routine immunization + $111M GPEI funding → ensures ongoing demand.

2. Asia-Pacific (Fastest Growth)

◉Drivers: Large child population, rising healthcare spend, active outbreaks.

◉India: Mass campaigns (UIP, NRHM), rural immunization, high birth rates sustain demand.

◉China: NMPA-approved msIPV in 2024; major vaccine producer & consumer.

◉Pakistan & Afghanistan: Endemic polio → continuous OPV campaigns required.

3. Europe (Stable Market)

◉UK: Routine immunization + largest GAVI donor (funding £1.65B).

◉Germany: Detected VDPV2 in wastewater (2024) → ensures vigilance & steady demand.

◉Region-wide: Traveler & migrant vaccination maintains vaccine coverage.

4. Latin America (Rising CAGR)

◉Brazil: Polio-free 34 years, OPV coverage 86.55% in 2023 (up from 77.20%).

◉Mexico: Ongoing “National Public Health Week” drives catch-up vaccinations.

5. Middle East & Africa (Outbreak-Driven Market)

◉Sudan (2024): Emergency vaccination against cVDPV2.

◉Africa (Sanofi–Biovac partnership): First IPV local production → supply resilience.

Market Dynamics

Drivers:

◉Global eradication initiatives (GPEI, WHO, UNICEF).

◉Government funding (e.g., Canada $111M, UK £1.65B).

◉Over 1B nOPV2 doses in 35+ countries in 3 years.

Restraints:

◉Adverse effects (fever, rare VDPV cases).

◉Vaccine hesitancy driven by misinformation.

Opportunities:

◉Next-gen IPV & thermostable vaccines.

◉Needle-free delivery systems.

◉Scaling production in Africa & Asia (Sanofi–Biovac, Sinovac msIPV).

Top Companies in Polio Vaccine Market

Pfizer Inc.

◉Products: Expanding vaccine pipeline (incl. mRNA tech).

◉Strength: Global R&D powerhouse; proven vaccine scalability.

Sanofi

◉Products: IPV portfolio, OPV supply.

◉Strength: Strategic partnerships (Biovac Africa, 2024).

GSK plc

◉Overview: Global immunization leader; vaccines integrated into EPI programs.

◉Strength: Long-standing presence in pediatric vaccines.

Serum Institute of India

◉Products: IPV & OPV bulk production.

◉Strength: Largest vaccine manufacturer; cost-effective supply for LMICs.

BIO-MED & Haffkine Bio-Pharma (India)

◉Products: Local IPV/OPV supply.

◉Strength: Strong government backing in mass immunization campaigns.

Latest announcements

India (2024): National Polio Immunization Drive launched (quote: “Every child under 5 must get drops.”)

Scope & Operational intent

◉Nationally coordinated campaign targeting all children <5 years — implies both routine immunization catch-up and door-to-door or fixed-site activities.

◉Likely to combine mass OPV rounds (for herd immunity) with IPV boosts where available (to reduce VDPV risk).

Resource implications

◉Large vaccine procurement & cold-chain mobilization (syringes for IPV, cold boxes/icepacks for IPV; for OPV oral drops less stringent cold chain but still monitored).

◉Workforce mobilization: vaccinators, community health workers (ASHA/ANM), supervisors, data teams.

Data & monitoring

◉Real-time microplanning, tally sheets, lot-wise dose tracking; emphasis on zero-missed-child strategy.

◉Likely use of line-listings and post-campaign coverage surveys to validate reach.

Public health impact

◉Short term: rapid increase in population immunity among children under 5; reduces susceptible cohort.

◉Medium term: lowers probability of cVDPV emergence where coverage gaps exist.

Policy / signaling

◉Strong political signal of continued vigilance despite India being polio-free; supports domestic and international donor confidence.

◉Reinforces public messaging to counter hesitancy: “every child must get drops” is simple, actionable call-to-action.

Canada (2024): $111M committed to GPEI (bringing total to ~$1B)

Financial mechanics

◉Multi-year funding (noted as $111M over next three years) — provides predictable financing for vaccine procurement, surveillance, outbreak responses.

◉Earmarked funding typically supports vaccine procurement, cold chain, laboratory networks, and campaign logistics in partner countries.

Strategic effects

◉Strengthens GPEI operational capacity (surge staffing, emergency stockpiles, surveillance upgrades).

◉Encourages co-funding from other donors; can be leveraged to secure multi-national initiatives (e.g., regional response pools).

Market & supply effects

◉Stable donor funding reduces procurement volatility; manufacturers can plan production volumes (important for nOPV2 and bOPV demand forecasts).

Reputational / diplomatic

◉Positions Canada as a sustained global health donor — helps in negotiating procurement frameworks and advocating global procurement standards.

Recent developments

Sudan (Nov 2024): Emergency campaign vs cVDPV2

Situation: cVDPV2 detection triggered emergency mass vaccination for children <5.

Operational response details

◉Rapid microplanning, mop-up rounds, targeted high-risk geographies.

◉Likely use of nOPV2 or mOPV2 in line with international guidance for cVDPV2 outbreaks.

Epidemiologic implication

◉Emergency campaigns reduce viral circulation quickly if high coverage achieved; failure to reach pockets risks continued transmission and further genetic drift.

Market implication

◉Increased short-term demand for OPV variants (nOPV2/mOPV2), logistical procurement, surge staffing.

China (Apr 2024): Sinovac’s msIPV (Vero Cell, Sabin strains) approved by NMPA

Product specifics

◉msIPV: Sabin-strain based, Vero cell manufacturing platform, five-dose presentation (implies multi-dose vial).

Regulatory & production impact

◉Domestic approval supports China’s self-sufficiency and export potential to markets accepting Sabin-strain IPV.

◉Multi-dose vials may reduce per-dose cost but increase requirements for safe vial handling and open-vial policies.

Programmatic effect

◉Availability of msIPV can support routine immunization and catch-up campaigns where IPV is preferred to eliminate VDPV risk.

Market dynamics

◉Adds supply diversity, potentially lowers prices and increases competition for IPV market share (especially in Asia/Africa where price sensitivity matters).

Guinea (2024): 3.2 million children immunized via UNICEF partnership

Scale & delivery

◉Two-round initiative indicates coordinated campaign strategy — coverage aims to interrupt transmission/clusters.

Operational learning

◉Demonstrates effective partnership model (government + UNICEF + partners) for rapid large-scale vaccination in resource-limited settings.

Epidemiologic signal

◉High coverage rounds are effective at rapidly increasing herd immunity in outbreak or high-risk settings.

Market note

◉Reinforces OPV’s role for mass campaigns given ease of administration.

Gaza (Feb 2025): ~603,000 children immunized with nOPV2 during ceasefire

Contextual notes

◉Use of nOPV2 (novel OPV type 2) aimed at outbreak control with reduced reversion risk vs traditional OPV2.

◉The added 40,000 children vs prior rounds suggests improved access during the ceasefire window.

Operational challenges & achievements

◉Vaccination in conflict settings requires negotiation for humanitarian access, secure cold chain corridors, and mobile teams.

◉Successful campaign indicates operational resilience and ability to vaccinate in fragile settings.

Market impact

◉Demand for nOPV2 increases; donors and WHO need to ensure sustained supply and buffer stockpiles.

Segments covered

By Type — deep technical & programmatic contrasts

1. Inactivated Polio Vaccine (IPV)

Biological/technical features

◉Composition: Killed poliovirus (Salk/IPV) or Sabin-strain inactivated (msIPV). Cannot replicate — no VDPV risk.

◉Delivery: Intramuscular or subcutaneous injection; requires trained personnel and injection safety (syringes, sharps disposal).

Programmatic role

◉Routine immunization backbone in polio-free or high-income settings to maintain individual protection.

◉Used in combination schedules where OPV is used for mass campaigns but IPV ensures individual humoral immunity without VDPV risk.

Advantages

◉No vaccine-derived poliovirus; safer for endemically polio-free populations.

◉Acceptable in settings with high vaccine hesitancy about live vaccines.

Constraints

◉Higher per-dose cost than OPV; injection logistics (cold chain, sterile devices).

◉Requires higher cold-chain reliability for multi-dose vials; training for injection safety.

Market & manufacturing

◉Growth driven by partnerships (e.g., Sanofi–Biovac) to localize production — increases supply, reduces lead times.

msIPV approvals (e.g., Sinovac) increase competitive supply and price pressure.

2. Oral Polio Vaccine (OPV)

Biological/technical features

◉Composition: Live attenuated poliovirus (Sabin strains) administered orally.

◉Delivery: Oral drops — simple, no needles, ideal for mass campaigns and door-to-door rounds.

Programmatic role

◉Primary tool for mass immunization & outbreak control due to ease of administration and induction of intestinal immunity (interrupts transmission).

Advantages

◉Low cost, easy to administer en masse (volunteers, minimally trained staff).

◉Induces mucosal immunity — better at stopping community spread than IPV alone.

Constraints & risks

◉Rare risk of Vaccine-Derived Poliovirus (VDPV), especially in settings with low coverage; drives development of nOPV2 (reduced reversion risk).

◉Requires high coverage to avoid paradoxical emergence of VDPV.

Market & operational

◉Because of mass campaign utility, OPV demand surges during outbreaks (e.g., Guinea, Gaza, Sudan).

◉UNICEF’s procurement forecasts (3.7–3.9B bOPV doses over 4 years) highlight scale and budgetary planning needs.

By End-user

Hospitals & Clinics (dominant channel)

Role & workflow

◉Primary point for routine IPV immunization and catch-up injections; equipped for injection safety, clinical monitoring for AEFI (adverse events following immunization).

◉Central to cold-chain maintenance for injectable vaccines.

Economics

◉Higher per-dose handling costs (staff, consumables) but provides reliable coverage and clinical oversight.

Quality & surveillance

◉Frontline for AEFI surveillance and reporting; labs for confirmatory testing may be associated.

Public Services (growing, outreach focus)

Role & workflow

◉Government-led campaigns: mass OPV rounds, school-based drives, community outreach.

◉Mobilizes nonclinical workforce, volunteers, and mobile outreach units.

Programmatic importance

◉Essential to reach remote, underserved populations — reduces inequity in immunization.

◉Often funded by national budgets plus donor support (GPEI, UNICEF, GAVI).

Operational tradeoffs

◉Campaigns deliver high coverage quickly but need meticulous microplanning to avoid missed pockets that can seed VDPV.

By Region

North America

Public health context

◉Polio-free status; focus on maintaining high IPV coverage, stockpiles, and rapid outbreak readiness.

Market features

◉Higher price tolerance; procurement emphasizes quality, regulatory compliance (FDA/Health Canada).

Surveillance & R&D

◉Strong lab networks (wastewater, AFP surveillance) and contribution to global funding (e.g., Canada $111M).

Asia-Pacific

Diverse epidemiology

◉Countries range from polio-free to high-risk (Pakistan/Afghanistan). India is polio-free but maintains mass immunization capability.

Market dynamics

◉Large absolute dose demand due to population & birth cohort size — significant for UNICEF forecasts.

Manufacturing & supply

◉Growing local manufacturing (Sinovac msIPV, Serum Institute production) reduces regional dependency.

Operational complexity

◉Rural access, cold chain upgrades, and addressing vaccine hesitancy are major program costs.

Europe

Surveillance emphasis

◉Wastewater surveillance detected VDPV2 signals (noted in 14 cities across five countries in 2024) — drives monitoring programs.

Policy stance

◉Maintains routine IPV schedules and readiness for targeted OPV use if importation occurs.

Travel & migration

◉Vaccination of travelers and migrants from endemic areas is policy nuance that sustains demand.

Latin America

Campaign history

◉Longstanding OPV campaigns; historical success (Brazil polio-free 34 years) but coverage fluctuations require catch-ups.

Operational drivers

◉National public health weeks and free vaccine drives boost coverage; public-private participation common.

Middle East & Africa (MEA)

Fragility & outbreaks

◉Conflict zones (Gaza), fragile states (Sudan) increase outbreak risk and complicate campaign delivery.

Manufacturing opportunity

◉Sanofi–Biovac IPV production in Africa supports supply resilience and regional self-reliance.

Donor dependency

◉Heavy reliance on GPEI/UNICEF funding for campaign implementation and vaccine procurement.

Top 5 FAQs

-

What is the projected size of the polio vaccine market by 2034?

→ USD 1,406.89 million, growing at a CAGR of 5.03%. -

Which vaccine type is dominant in the market?

→ IPV dominates due to safety, while OPV is the fastest-growing for mass campaigns. -

Which regions drive growth?

→ North America leads in 2024; Asia-Pacific grows fastest due to population and outbreaks. -

How many doses are needed globally?

→ UNICEF estimates 3.7–3.9B bOPV doses in 4 years, worth $500M. -

What are the recent major developments?

→ Sudan’s 2024 cVDPV2 campaign, Sinovac’s msIPV approval in China, and Gaza’s 2025 nOPV2 drive.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5477

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest