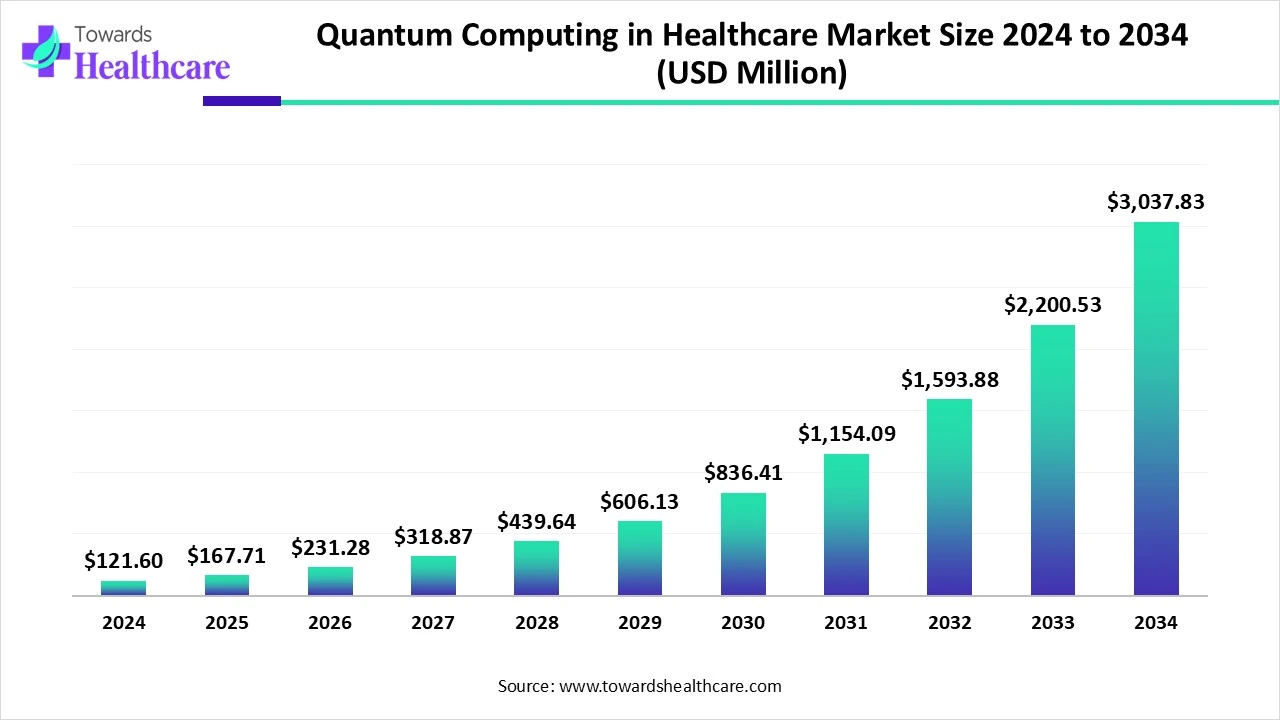

The global Quantum Computing in Healthcare market grew from USD 121.6 million in 2024 to USD 167.71 million in 2025 and is projected to reach ~USD 3,037.83 million by 2034 — a compound annual growth rate (CAGR) of 37.86% (2025–2034) — as quantum hardware, hybrid quantum-classical software, and pharma R&D converge to accelerate drug discovery, genomics, imaging and clinical-trial optimization.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6072

Market size

Baseline & near term (reported)

• 2024 actual: USD 121.6M (reported).

• 2025 actual/projection in report: USD 167.71M.

Forecast horizon (2025 → 2034)

• 2034 projected market size: USD 3,037.83M.

• Implied CAGR 2025–2034 = 37.86% (this reflects extremely rapid scaling driven by combined growth of hardware, cloud access, algorithm development, and life-science adoption).

Compound growth interpretation

• The projection implies roughly a 18× increase in total market value over nine years (167.71 → 3,037.83).

• Such growth assumes accelerating commercial utility (hybrid systems, quantum-inspired HPC, cloud access) and growing enterprise spend from pharma/biotech, tech vendors, and government R&D.

Revenue concentration & runway

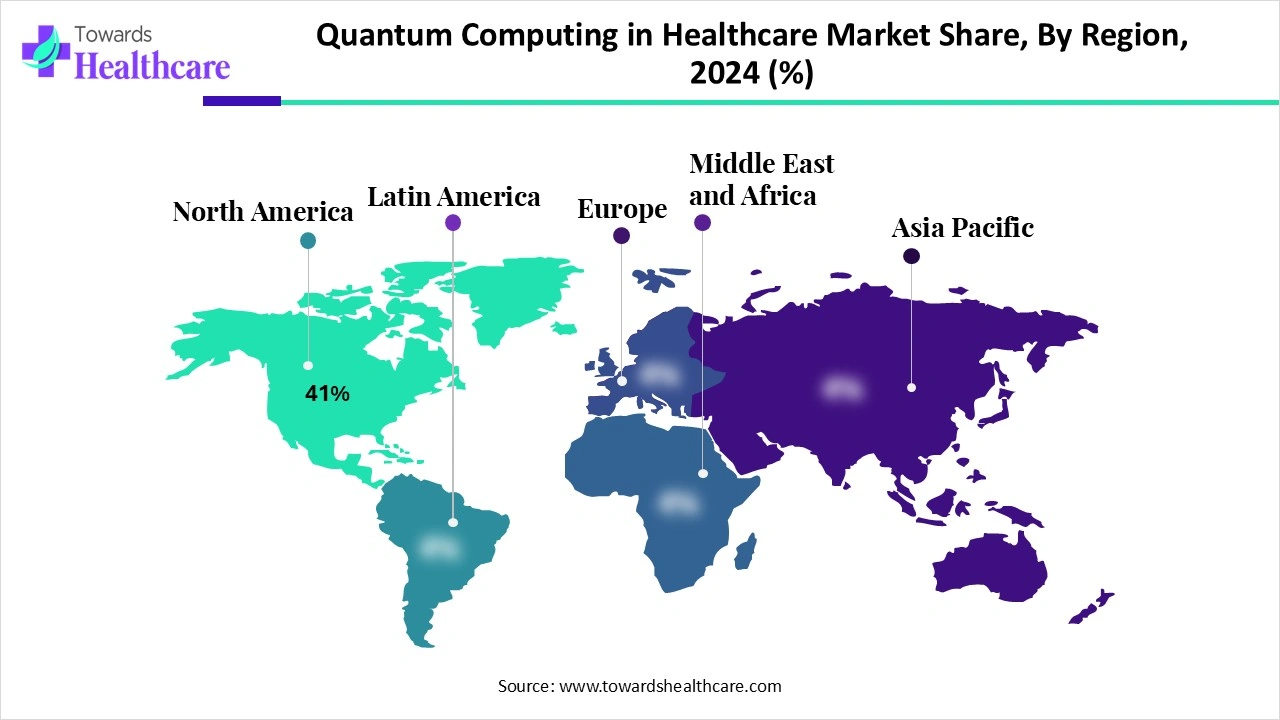

• 2024 indicated regional leader: North America 41% of market revenue — implying concentration of spend, customers, and early use-cases there.

• The balance of market value is split across early adopters (pharma/biotech, academic consortia) and technology vendors (hardware + software + services).

Segment-level monetization (service vs. hardware)

• Quantum software & algorithms comprised a dominant share in 2024 (reported 45% of service-type revenue), indicating early monetization is skewed toward algorithm development, cloud access/subscriptions, and specialized R&D services rather than mass hardware sales.

Market trends of Quantum Computing in Healthcare Market

Drug discovery & molecular modeling leads early adoption

• Reported dominant application (2024): Drug discovery & molecular modeling 35% — pharma invests first where quantum-advantaged simulation/hybrid methods can shorten lead discovery cycles.

Shift toward hybrid/quantum-inspired systems

• While quantum annealing dominated by technology type in 2024 (40%), quantum-inspired/HPC hybrid systems are the fastest growing segment — reflecting practical near-term gains from running quantum-inspired algorithms on classical HPC and cloud GPUs.

Service orientation: algorithms & custom R&D

• Quantum software & algorithms dominated 2024 (45% by service type).

• Custom quantum R&D services are forecasted to grow fastest — customers want tailored workflows (molecular simulation, optimization) rather than one-size-fits-all tools.

End-user evolution: pharma & biotech first, vendors next

• Pharmaceutical & biotech: dominant 2024 segment (36%) given direct ROI potential in drug development.

• Technology vendors / startups: expected fastest growth — cloud offerings, algorithm marketplaces, and SaaS for quantum workflows expand procurement options.

Regional investment & policy stimulus accelerate commercialization

• North America leads (41% share 2024) — heavy R&D ecosystems and government funding.

• Asia-Pacific fastest projected CAGR: large public programs, national quantum missions, and regional investments (India, China, Singapore) expand capacity.

Emergence of quantum-safe and data-security initiatives

• Post-quantum encryption and quantum-safe campaigns (noted by national labs / standards bodies) elevate demand for secure data handling in healthcare applications.

Converging AI + Quantum narrative

• Investments in generative AI and quantum simulation are merging — AI guides molecule proposals, quantum/hybrid systems evaluate candidate physics-accurately faster.

AI’s impact and role in the Quantum Computing in Healthcare Market

AI as a design-generation engine + quantum as a simulation/verification engine

• Generative models (GANs, diffusion, transformer drug design variants) propose candidate molecules; quantum algorithms/hybrid simulators validate binding modes, energy surfaces, and reaction paths with higher fidelity than many classical force-fields.

Accelerating lead optimization loops

• AI ranks and optimizes candidate chemical space; quantum/hybrid computations rapidly refine energy landscapes — shortening design → in-silico test → selection cycles and reducing experimental iterations.

Enhanced feature extraction for quantum-assisted imaging

• AI methods amplify signal processing in imaging (MRI, CT). Quantum algorithms (quantum signal processing, variational circuits) can operate on compressed representations or accelerate reconstruction tasks when integrated with AI pre/post-processing.

Hybrid AI-quantum pipelines for genomics

• Large language model-style architectures for genomes propose variant interpretations; quantum-enhanced algorithms tackle combinatorial problems (haplotype phasing, large-scale matrix factorizations) within hybrid workflows.

Optimization problems: clinical trials & logistics

• AI predicts enrollment patterns and risk; quantum annealing and quantum-inspired solvers solve combinatorial scheduling and supply chain QUBO formulations faster or with better quality for certain problem shapes.

Data privacy, federated learning & quantum-safe needs

• AI models trained across institutions require privacy-preserving techniques; quantum computing raises both opportunities (quantum encryption primitives, secure multi-party computation) and threats (need for post-quantum cryptography).

AI reduces quantum programmer burden

• AI tools (auto-differentiation, code generation, automated ansatz selection) will shorten the expertise gap for quantum algorithm deployment, enabling domain scientists (chemists/biologists) to use quantum-backed services more directly.

Modeling complexity beyond classical limits

• For strongly correlated systems (some bio-relevant molecules), AI-guided variational quantum eigensolvers or quantum-machine-learning approaches may offer qualitatively better models than classical approximations.

Commercialization driver

• AI value propositions (faster hypothesis generation, pattern recognition) combine with quantum’s potential to deliver verifiable physics — this pairing drives buyers (pharma/biotech) to allocate budgets earlier to pilot projects and R&D contracts.

Regional insights

North America (lead — 41% share in 2024)

Ecosystem & customers: Concentration of Big Pharma, cloud providers, national labs and venture capital creates an environment where pilots rapidly scale into multi-year R&D commitments.

Infrastructure: Major cloud quantum access and multiple corporate quantum labs (IBM, Rigetti, Google, Quantinuum presence) allow pharma to test use-cases without acquiring hardware. (See IBM, Rigetti, D-Wave, Quantinuum pages for corporate capabilities).

Policy & standards: U.S. policy initiatives (National Quantum Initiative, NIST guidance on post-quantum standards) provide both funding and a push toward quantum-safe healthcare systems.

Asia-Pacific (fastest projected CAGR)

National missions and funding: Several APAC countries are launching national quantum missions and centers (e.g., India National Quantum Mission, Singapore R&D funding), increasing local capacity and partnerships with global players.

Market drivers: Large population, expanding biotech sectors, and cloud adoption create a high ceiling for clinical and genomics applications.

Localization: Local data sovereignty needs encourage regional cloud/quantum centers (e.g., Quantinuum/IBM partnerships in the region).

Europe

Research-to-commercial pathways: EU funding calls for quantum chip tech and pan-European collaborations drive hardware and algorithm innovations that biotech companies can commercialize.

Regulation & ethics: Strong privacy regulations (GDPR) and clinical data governance shape deployment models (favors federated and secure hybrid workflows).

Canada & Latin America

Niche competencies: Canada’s quantum algorithms institutes and university clusters produce talent and spinouts; Latin America exhibits pockets of academic R&D that can be incubators for trials and algorithm development.

Middle East & Africa

Emerging adoption: Investments in smart health systems and partnerships with international tech vendors will likely produce pilot projects (telehealth + quantum-secure data pipelines) before large commercial uptake.

Market dynamics

Drivers

Urgent pharma need to shorten drug timelines — Quantum-assisted molecular simulation promises to reduce time/cost per candidate.

Cloud quantum access — low barrier to entry for healthcare organizations via cloud APIs and SaaS.

AI + quantum synergy — practical hybrid methods deliver incremental advantages that justify early spending.

Government & institutional funding — national quantum missions and grants reduce adoption risk for vendors and users.

Restraints

Maturity gap in hardware — noisy qubits, error rates, and limited qubit counts restrict full-scale simulation across many pharma-relevant molecules.

Skill shortage — shortage of cross-disciplinary talent (quantum physicists + computational chemists + ML engineers) slows adoption.

Regulatory & clinical validation hurdles — health regulators require high evidentiary standards for computational claims impacting clinical decisions.

High initial cost for custom solutions — bespoke quantum R&D services remain expensive, restraining mid-market adoption.

Opportunities

Hybrid quantum-classical offerings — quantum-inspired HPC and cloud simulators enable near-term ROI and faster adoption curves.

Customized R&D services — consultancies and startups can deliver tailored pipelines for lead discovery, trial design optimization, and imaging enhancement.

Post-quantum security products — growing need for quantum-safe medical data solutions yields additional revenue streams.

Cross-industry partnerships — alliances between cloud vendors, pharma, and national labs speed commercialization and lower risk.

Threats

Overhype / investor fatigue — unmet expectations could lead to funding contractions.

Competing classical methods — advances in classical simulation, AI, and HPC may sustain parity for many use-cases longer than expected.

Standards fragmentation — lack of interoperable software and data standards slows ecosystem effects.

Top companies

IBM Quantum — Products / Overview

• Offers cloud-accessible superconducting quantum processors and enterprise platforms (IBM Quantum Platform, System One/Two).

• Strengths: Extensive cloud footprint, large device fleet, strong developer ecosystem, tie-ups to enterprise services (IBM Research + Red Hat).

Google Quantum AI — Products / Overview

• Developer of superconducting architectures and algorithms; focuses on quantum supremacy/advantage demonstrations and software tools.

• Strengths: Deep research pedigree, high-visibility benchmark achievements, integrated AI/ML expertise for quantum workflows. (Wikipedia: Quantum computing activities; Google pages referenced in general quantum listings.)

D-Wave Systems — Products / Overview

• Focused on quantum annealing processors and hybrid solvers for optimization; offers cloud access to annealers.

• Strengths: Early commercial deployments for combinatorial optimization; strong product-market fit for logistics and certain drug-optimization subproblems.

Rigetti Computing — Products / Overview

• Builds superconducting quantum processors and provides cloud platform (Forest / Quil historically); pursues multi-chip architectures.

• Strengths: Tight hardware-software integration, focus on practical cloud access and multi-chip scaling; partnerships and investments to scale fabrication.

Quantinuum (Cambridge Quantum + Honeywell) — Products / Overview

• Trapped-ion and software platforms focused on high-fidelity devices and quantum software stack.

• Strengths: High quantum volume devices, strong software IP (from Cambridge Quantum), emphasis on enterprise use-cases and reproducible benchmarks.

Microsoft (Azure Quantum) — Products / Overview

• Provides access to multiple quantum vendor backends (incubating topologies), quantum-inspired solvers, and integration with Azure cloud/AI services.

• Strengths: Cloud scale, enterprise customers, hybrid solutions and partnerships that connect quantum R&D directly into existing enterprise workflows.

Others (Zapata, QC Ware, IonQ, Pasqal, Classiq, 1QBit, etc.)

• Zapata / QC Ware: algorithm/software and enterprise services focus — strength in algorithmic IP and industry partnerships.

• IonQ / Pasqal: hardware leaders in ion-trap and neutral-atom approaches respectively — strengths in connectivity and coherence for certain workloads.

Latest announcements

Rigetti (July 2025) — Announced largest multi-chip quantum computer success (July 2025). This indicates Rigetti’s multi-chip approach is moving toward scale — important because multi-chip modularity is one path to larger qubit counts and practical problem sizes for chemistry/optimization workloads. (source: user content)

IBM & Pasqal (Nov 2024) — Set vision toward a quantum-centric supercomputing initiative, signaling collaborations between circuit- and neutral-atom firms to couple strengths (IBM’s scaling & cloud access + Pasqal’s atom-based architectures) to support high-performance quantum workflows in science and pharma.

Microsoft funding & partnerships (2024–2025) — Microsoft’s investments (cloud/AI in Japan April 2024; selected by DARPA for utility-scale quantum devices) underline major cloud vendors’ commitment to support large-scale enterprise and government quantum deployments.

National & regional milestones — Multiple national investments: Singapore (US$300M for quantum R&D, July 2024), India National Quantum Mission (October 2024), China’s Hefei Institute for Quantum Computing and Data Medicine (Dec 2024) — these public programs create customer pipelines and local partnerships for healthcare applications.

Recent developments

Hardware scaling & multi-chip progress

• Rigetti’s multi-chip architecture milestone (July 2025) and IBM’s modular system developments (System Two, Osprey processors) push toward utility scale. These advances reduce bottlenecks in qubit count and support larger chemistry/ML workloads.

Cloud access & software dominance

• The dominance of quantum software & algorithms (45% service share 2024) shows that enterprise access to quantum capability is primarily via software and cloud, not raw hardware acquisition.

National initiatives accelerating market formation

• Funding and national missions (Europe funding calls, Singapore’s investment, India’s hubs, China’s Hefei institute) produced centers that partner with pharma and cloud providers to run pilots and pilot-to-production R&D.

Commercialization of quantum annealing & hybrid methods

• Quantum annealing retained strong market share in 2024 (40%), but quantum-inspired and hybrid systems are gaining traction for practical optimization in healthcare (trial design, logistics).

Confluence with AI investments

• Big tech investments in AI infrastructure and quantum simulation microservices (e.g., NVIDIA’s quantum simulation microservices, Microsoft’s cloud investments) lower the barrier for life-science organizations to trial combined AI+quantum pipelines.

Segments covered

By Application — explained

Drug Discovery & Molecular Modeling: Use quantum and hybrid algorithms to compute molecular energies, reaction pathways, and better predict binding affinities — high commercial ROI for pharma. (Dominant application in 2024, ~35% revenue share).

Genomic & Proteomic Data Analysis: Quantum methods can help with combinatorial problems (haplotype phasing, sequence alignment formulations) and accelerate certain matrix operations used in genomics pipelines.

Medical Imaging & Radiomics: Quantum signal processing and hybrid reconstruction techniques can complement AI-based feature extraction, potentially improving sensitivity/specificity in diagnostics.

Clinical Trial Design & Healthcare Logistics: Optimization of cohort selection, scheduling, and supply chains via quantum annealing/quantum-inspired solvers.

Personalized Medicine & Treatment Optimization: Integration of patient genomic profiles with treatment simulations — expected to see fastest growth as personalized regimens require complex multi-parameter optimization.

Bioinformatics & Epidemiological Modeling: Quantum-enhanced sampling and optimization for large network models and epidemiological parameter inference.

By Quantum Technology Type

Quantum Annealing: Suited for discrete optimization (trial scheduling, combinatorial molecule selection). Dominant in 2024 due to maturity and direct applicability.

Gate-Based Processors: Target general simulations (VQE, QPE) for molecular ground states and chemistry. Progress depends on coherence and error correction.

Quantum-Inspired/HPC Hybrid Systems: Use quantum principles on classical hardware (tensor networks, specialized algorithms) to capture some quantum advantages without hardware constraints—fastest growing.

Quantum Machine Learning Algorithms: Variational circuits and hybrid ML approaches for pattern recognition in omics and imaging.

By Service Type — explained

Quantum Software & Algorithms: SDKs, libraries, and algorithmic IP — the early monetization path (dominant share 2024).

Cloud-based Quantum Infrastructure Access: Subscription/SaaS models for remote access to hardware and simulators.

Custom Quantum R&D Services: Bespoke project work with domain experts — fastest growth as organizations outsource problem formulation and prototyping.

Quantum Consulting & Integration: Systems integration, compliance, and clinical validation support for regulated deployments.

Hardware Provisioning & Maintenance: For customers who procure local quantum systems or hybrid appliances — smaller but strategic revenue stream.

By End User — explained

Pharmaceutical & Biotech Companies: Primary buyers for drug discovery, process optimization, and personalized medicine pilots. (Dominant 2024: 36%).

Academic & Research Institutions: Early adopters and co-developers; produce algorithm benchmarks and validation studies.

Healthcare & Medical Imaging Organizations: Pilot implementations for imaging enhancement and diagnostics.

Government & Public Health Agencies: Fund R&D, support infrastructure and standards, and use modeling for public health responses.

Technology Vendors / Startups: Provide platforms, software, and verticalized solutions; expected fastest growth among end users.

Top 5 FAQs

Q: What is the market size and growth rate for quantum computing in healthcare?

A: The market was USD 121.6M in 2024, grew to USD 167.71M in 2025, and is projected to reach USD 3,037.83M by 2034, implying a CAGR of 37.86% for 2025–2034 (report figures provided).

Q: Which region led the market in 2024 and which region will grow fastest?

A: North America led in 2024 with 41% revenue share. Asia-Pacific is expected to show the fastest CAGR during the forecast period due to national programs and growing life-science capacity.

Q: Which application and technology types dominate today?

A: Drug discovery & molecular modeling dominated applications in 2024 (35% share). By technology type, quantum annealing dominated in 2024 (40%), while quantum-inspired/HPC hybrid systems are forecasted to grow fastest.

Q: Who are the top players to watch and why?

A: Key companies include IBM Quantum, Google Quantum AI, D-Wave, Rigetti, Microsoft (Azure Quantum), IonQ, Quantinuum, and software firms like Zapata and QC Ware — strengths span cloud access, hardware scaling (multi-chip), quantum annealing commercialization, and software/algorithm IP. (Company profiles summarized above; see IBM, Rigetti, D-Wave, Quantinuum references).

Q: What are the near-term commercial opportunities for healthcare organizations?

A: Near-term value is highest in (a) hybrid AI+quantum drug discovery pilots, (b) optimization problems such as trial design and logistics using annealers/quantum-inspired solvers, and (c) custom quantum R&D services that translate domain problems into solvable QUBOs or variational circuits. These are practical entry points before full hardware parity.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6072

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest