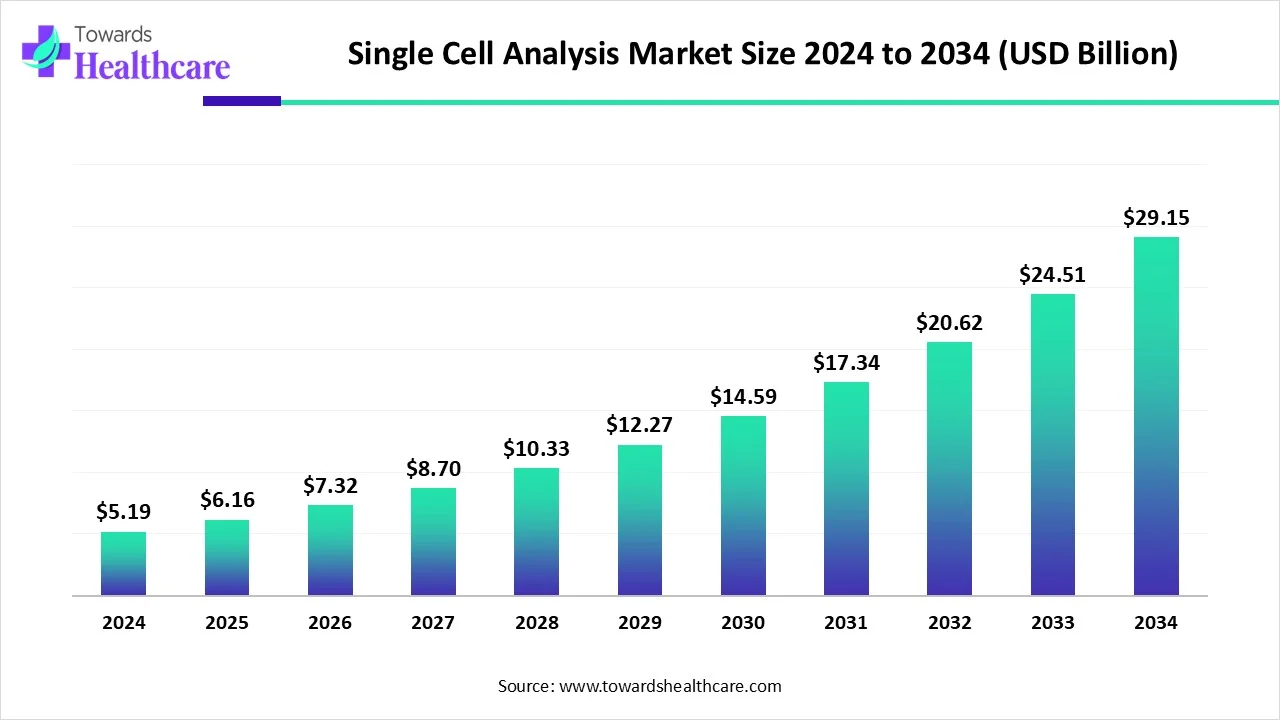

The global single cell analysis market was USD 5.19 billion in 2024, rose to USD 6.16 billion in 2025, and is projected to reach ≈ USD 29.15 billion by 2034, representing an expected multi-fold expansion (≈ 5.62× from 2024 → 2034) driven by instrument adoption, consumables demand, and bioinformatics; the report states a CAGR of 18.74% (2025–2034).

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5682

Market size

Anchor datapoints (provided):

◉2024 market size: USD 5.19B.

◉2025 market size: USD 6.16B.

◉2034 projected market size: USD 29.15B.

◉Reported CAGR (2025–2034): 18.74% (report figure).

Growth multiples & verification:

◉2024 → 2034 growth multiple: 29.15 / 5.19 ≈ 5.62× overall.

◉2025 → 2034 growth multiple: 29.15 / 6.16 ≈ 4.73×.

(Note: computing the implied CAGR from 6.16 → 29.15 over 9 years yields 18.85% by strict exponential math; the report rounds/quotes 18.74% — both indicate very rapid expansion.)

Absolute increments (illustrative):

◉Increase 2024 → 2025: +USD 0.97B (18.7% year-over-year growth).

◉Total absolute increase 2025 → 2034: +USD 23.0B (majority of value creation occurs across 2026–2034).

Value-drivers by revenue type (high-level):

◉Consumables (reagents, kits, beads, plates) already largest revenue contributor in 2024 — recurring revenue with high gross margins and predictable replacement cycles.

◉Instruments (sequencing platforms, flow cytometers, microfluidic hardware, HCS microscopes) are capital-intensive but forecast to grow fastest by CAGR as adoption expands and prices / footprint change.

◉Data analysis & downstream software (bioinformatics pipelines, multi-omics integration) contribute increasing share due to high value per sample and premium software licensing/analysis services.

Market maturity segmentation (temporal):

◉Early commercial scale (2024–2027): strong consumables revenue; instrument upgrades in center labs; pilot AI/bioinformatics.

◉Scale adoption (2028–2034): instrument installations broaden (hospitals, CROs), software/analysis becomes a substantial revenue stream and service layer.

Market trends

Consolidation & strategic partnerships (2024–2025):

◉2024–2025 saw multiple collaborations and M&A-adjacent moves (e.g., Illumina acquiring Fluent BioSciences — strengthens multiomics & single-cell offering; Roche partnering for SBX sequencing) — trend: upstream platform vendors horizontally integrate single-cell workflows.

Geographic expansion and distribution partnerships:

◉Companies expand into Asia Pacific (Singleron partnership with Bioscreen in Oct 2024; Parse + SCRUM in April 2025) — trend: distributors + local vendors to accelerate adoption in research markets.

Funding and scaleups in single-cell multomics:

◉Startups raising capital (Atrandi Biosciences $25M, Feb 2025) — trend: venture capital backs single-cell multiomics, capsule technologies and alternative library preps.

Microfluidics & droplet innovations:

◉Picodroplet and picodroplet-based microfluidic partnerships (Premas Life Sciences + Sphere Bio, May 2025; Sphere Fluidics product launches Jan 2025) indicate the trend toward higher throughput, lower cost per cell, and operational extraction methods.

Automation and throughput focus:

◉BD releasing robotics-compatible reagent kits (Oct 2024) and other vendors launching high-throughput 3D/automation friendly products (Inventia RASTRUM Allegro, Feb 2025) — trend: sample-prep automation to scale experiments and reduce operator variability.

AI + Genomics collaborations:

◉Partnerships such as NVIDIA + Illumina (Jan 2025) point to a trend: embedding AI/ML into multi-omics interpretation, accelerating clinical translation and drug discovery.

Clinical translation emphasis:

◉Government and clinical trials focus (UK government oncology initiatives, Oct 2024) — trend: regulators & public funding pushing single-cell tech toward diagnostic/therapeutic pipelines.

Product launches accelerating capability:

◉Bruker Beacon Discovery (Apr 2025), Scale Biosciences launches (Feb 2025), Sphere Fluidics Early Access (SLAS2025) — trend: vendors rapidly iterating to expand single-cell live analysis, multiomics, and accessible RNA workflows.

AI role & impact on the single-cell market

1. Data volume & complexity problem → AI necessity

◉Single-cell experiments (scRNA-seq, scATAC, multiomics) produce millions of data points per study; traditional statistics are insufficient for pattern discovery, so advanced AI/ML is required to reduce dimensionality, denoise, and discover biologically relevant clusters.

2. Preprocessing & denoising

◉AI models (autoencoders, variational methods) are used to impute dropouts, correct batch effects, and harmonize multi-center datasets — improving signal/noise and enabling meta-analyses across cohorts.

3. Integration of multi-omics at single-cell resolution

◉Deep learning enables joint modeling of transcriptome + epigenome + proteome signals per cell, identifying regulatory relationships and causal paths that single-modality analyses miss.

4. Cell-type annotation and reference mapping

◉Supervised & semi-supervised classifiers trained on large labeled atlases automatically annotate cell types and states, speeding sample interpretation and reducing manual curation.

5. Spatial transcriptomics + image analysis fusion

◉AI performs image segmentation, spot deconvolution, and links spatial patterns to single-cell profiles; convolutional neural nets interpret histology and local microdomain signals to map cellular neighborhoods.

6. Predictive modeling for treatment response & biomarker discovery

◉Models trained on single-cell signatures can predict drug sensitivity, immune checkpoint responses, and evolutionary trajectories of tumors—driving translational research and precision oncology.

7. Automation & workflow orchestration

◉AI schedules and optimizes robotic sample prep, recommends QC thresholds, and directs adaptive experiments (e.g., prioritize cells for deeper sequencing based on preliminary analysis).

8. Compression & storage optimization

◉Learned compression reduces storage and accelerate retrieval for massive single-cell datasets, reducing infrastructure costs for large centers.

9. Quality control, anomaly detection & reproducibility

◉Anomaly detection flags poor libraries, doublets, or contamination; AI-driven QC increases reproducibility and reduces wasted runs.

10. Democratization via turnkey cloud analysis

◉Partnerships (e.g., NVIDIA + Illumina) enable packaged AI analysis stacks that non-bioinformatics labs can use—turning complex single-cell output into actionable reports.

11. Regulatory & explainability challenges

◉For clinical use, AI models must be explainable; investment in interpretable models and validation datasets is required before classifiers become diagnostic tools.

12. Commercial implications

◉AI adds high-margin software & services revenue (licensing, cloud processing), shifts vendor differentiation from hardware to analytics, and creates recurring revenue streams.

13. Future frontier — generative & causal models

◉Generative models may predict unseen cell states, suggest perturbations for validation, and map causal gene regulatory networks — unlocking hypothesis generation at scale.

Regional insights

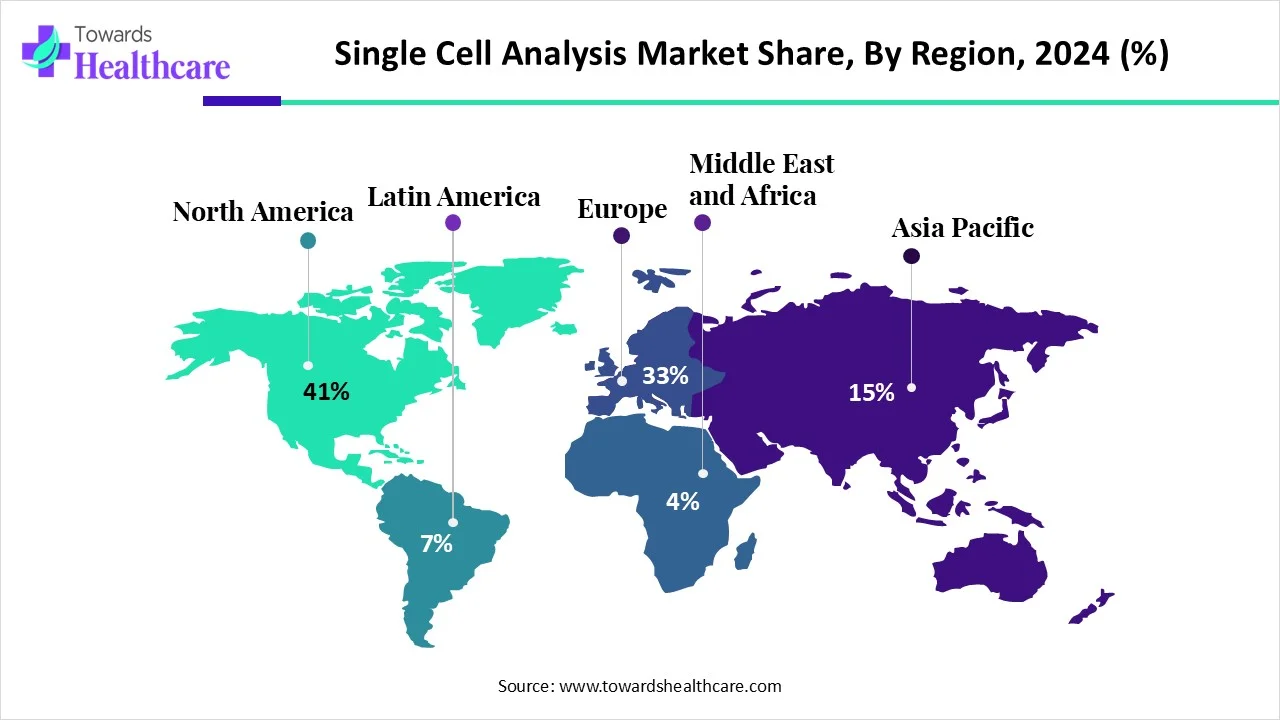

North America (Leader — 41% market share in 2024)

Ecosystem & demand drivers:

◉Dense concentration of pharmaceutical/biotech R&D centers and academic research — fuels demand for both instruments and consumables.

Technology leadership & early adoption:

◉Home to many platform vendors and early adopters; higher per-lab budgets allow instrument upgrades and adoption of high-throughput workflows.

Clinical translation & regulatory pathway:

◉Active clinical trials and diagnostic translation pathways accelerate adoption of clinically-oriented single-cell assays.

◉Market implication: Region remains the primary revenue pool and a testing ground for premium, integrated platforms and AI analytics.

Asia Pacific (Fastest growing region)

Investment & capacity building:

◉Significant public & private investment in genomics and life science infrastructure (China, Japan, India, Korea).

Distribution & local partnerships:

◉Strategic distributor alliances (e.g., Singleron + Bioscreen; Parse + SCRUM) localize supply chains and reduce time-to-market.

Cost sensitivity & volume use case:

◉Large research cohorts, high patient volumes, and lower per-test price expectations push vendors to cheaper consumable costs and scalable microfluidic platforms.

◉Market implication: Rapid growth potential; vendors focusing on low-cost, scalable consumables and regional support will capture share.

Europe

Genomics & personalized medicine emphasis:

◉Strong governmental and academic investment in personalized medicine and immunotherapy.

Regulatory caution & clinical validation:

◉Emphasis on robust clinical validation and data protection regimes influences the design of clinical single-cell products and analytics.

◉Market implication: Premium markets for validated, compliant workflow solutions and partnerships with national health systems.

Latin America

Emerging research networks & capacity building:

◉Growing symposiums and local initiatives (Single Cell LATAM Symposium, Aug 2024) indicate rising awareness.

Challenges & opportunities:

◉Lower immediate purchasing power but growing ambitions for precision medicine create demand for training, partnerships, and lower-cost consumables.

◉Market implication: Opportunity for service providers, regional distributors, and low-capex consumable models.

Middle East & Africa (MEA)

Early stages with targeted investments:

◉Select centers of excellence and government initiatives; adoption often via partnerships and centralized labs.

◉Market implication: Focus on centralized service labs and collaborations rather than broad instrument installations initially.

Market dynamics

Driver — Rising incidence of cancer & chronic disease

◉Single-cell resolves intra-tumor heterogeneity, tracks immune microenvironment, and identifies rare subclones — strong use cases drive consumable and instrument demand.

◉Supporting data: Cancer segment dominated application share (report), and North America led by research investment.

Driver — Advances in sequencing & microfluidics

◉Decreasing per-cell cost and higher throughput (NGS integration, microfluidic droplet tech) increase experiment volume — both instruments and consumables benefit.

Restraint — High cost of instruments & reagents

◉Capital expenditure for sequencers, flow cytometers, and high-content imagers and the recurrent cost of reagents pose access barriers to smaller labs.

◉Impact: Slows adoption in cost-sensitive regions; favors centralized service models or contract research organizations (CROs).

Restraint — Need for bioinformatics & skilled personnel

◉Interpreting single-cell data requires advanced bioinformatics; shortage of trained staff and complex pipelines creates friction and increases TCO (total cost of ownership).

Opportunity — AI & software monetization

◉AI + cloud analytics create recurring revenue via software licenses, managed analysis, and interpretive reports — an opportunity for vendors to diversify beyond hardware sales.

Opportunity — Clinical diagnostic and therapeutic translation

◉As trials and government programs (e.g., UK cancer detection trials) validate clinical utility, single-cell assays could move into diagnostic workflows — a high-value opportunity if regulatory hurdles are cleared.

Opportunity — Consumables as predictable revenue

◉Consumables dominance in 2024 highlights the opportunity for vendors to lock customers into long-term consumable supply agreements and subscription models.

Market structural dynamics:

◉Platform vendors vs. niche innovators: Large vendors (Illumina, Thermo Fisher, Roche) integrate vertically, while nimble startups push novel chemistries and microfluidic workflows; partnerships/acquisitions are common.

◉Service model expansion: Centralized single-cell sequencing services and CRO partnerships expand access without capital buy-in for end users.

Top companies

10x Genomics

◉Product focus: Chromium single-cell platforms (high-throughput scRNA-seq, multiomes).

◉Overview: Pioneer in droplet-based high-throughput single-cell library prep and multiomics.

◉Strength: Market recognition, large user base, ecosystem of protocols and reference datasets.

BD (Becton Dickinson)

◉Product focus: Flow cytometers, sample prep consumables, reagent kits.

◉Overview: Legacy instrument vendor expanding into automated reagent kits for high-throughput workflows.

◉Strength: Robust instrument installed base, automation partnerships, regulatory experience.

Bio-Rad Laboratories

◉Product focus: Cell analysis instruments, reagents and consumables for cell biology workflows.

◉Overview: Established maker of lab instrumentation and assay kits.

◉Strength: Broad life-science portfolio and channel reach.

Illumina

◉Product focus: Sequencing platforms and now single-cell acquisitions (e.g., Fluent BioSciences).

◉Overview: Dominant NGS vendor integrating single-cell library prep and throughput solutions.

◉Strength: Sequencing market leadership, scale, integration capability for multiomics workflows.

Qiagen

◉Product focus: Sample prep, reagents, bioinformatics solutions for molecular workflows.

◉Overview: Provides end-to-end sample processing kits; moving into single-cell compatible solutions.

◉Strength: Strong reagents business and global distribution.

Thermo Fisher Scientific

◉Product focus: Sequencing systems, mass spec, flow cytometry accessories, reagents.

◉Overview: Broad life-science instrument portfolio supporting single-cell workflows.

◉Strength: Global sales & service, integrated offerings across sample prep → analytics.

Mission Bio, Inc.

◉Product focus: Single-cell DNA sequencing (tumor heterogeneity, CRISPR screens).

◉Overview: Niche leader in single-cell DNA mutation profiling and precision oncology workflows.

◉Strength: Clinical-oriented single-cell DNA platform and partnerships (e.g., Integrated DNA Technologies).

RareCyte, Inc.

◉Product focus: Rare cell detection (circulating tumor cells) and imaging cytology platforms.

◉Overview: Specialized in rare cell detection workflows and imaging analysis.

◉Strength: Niche clinical and translational strength for liquid biopsies.

Takara Bio Inc.

◉Product focus: Library prep kits, PCR systems, reagents for single-cell and sequencing workflows.

◉Overview: Reagents and kits provider with strong presence in Asia and global coverage.

◉Strength: Reagent reliability and kit portfolio; good ties to academic researchers.

Ancilia Biosciences / CYTENA / Others (BGI, PacBio, Oxford Nanopore, Roche)

Products & strengths:

◉BGI / Novogene: High-throughput sequencing services and NGS capacity.

◉PacBio / Oxford Nanopore: Long-read sequencing options enabling different single-cell genomic analyses.

◉Roche: Diagnostics & sequencing partnerships (SBX) for clinical scale; strengths in clinical validation and distribution.

◉CYTENA: Microfluidic handling and single-cell dispensing systems, enabling automated workflows.

◉Strengths: each brings complementary capabilities — long reads, sequencing capacity, clinical pipelines, or microfluidic automation.

Latest announcements

Roche + Broad Clinical Labs — May 2025

◉What: Roche announced partnership to scale acquisition of SBX sequencing technology.

◉Why it matters: SBX frames Roche’s strategy to combine clinical diagnostics with high-throughput sequencing, improving clinical scalability for single-cell clinical applications.

◉Impact: Strengthens Roche’s clinical sequencing footprint and accelerates deployment of sequencing-based single-cell assays in diagnostics.

Mission Bio + Integrated DNA Technologies — May 2025

◉What: Partnership to develop single-cell precision in CRISPR genome editing analysis.

◉Why it matters: Improves single-cell readouts for editing outcomes — critical for gene-editing QC and therapeutic pipeline validation.

◉Impact: Enhances Mission Bio’s single-cell DNA capabilities for clinical & R&D customers.

Illumina acquisition of Fluent BioSciences — July 2024

◉What: Illumina acquired Fluent BioSciences (single-cell technology).

◉Why it matters: Integrates novel single-cell library prep tech into Illumina’s sequencing ecosystem, pushing multiomics adoption.

◉Impact: Expected to lower friction between library prep and sequencing, enabling streamlined high-throughput single-cell studies.

BD reagent kits (first in family) — Oct 2024

◉What: BD launched robotics-compatible high-throughput reagent kits.

◉Why it matters: Enables scalable, automation-friendly sample prep, reduces manual variability.

◉Impact: Facilitates larger clinical studies and higher throughput adoption.

Bruker Beacon Discovery™ — Apr 2025

◉What: Launch at AACR 2025 for live single-cell operational analysis.

◉Why it matters: New platform focusing on live single-cell assays, relevant to functional screening and discovery.

◉Impact: Broadens the instrument ecosystem for live functional single-cell readouts.

Recent developments

Platform & workflow launches (2024–2025):

◉Sphere Fluidics – Cyto-Mine® Chroma (Jan 2025): Early Access program introduces picodroplet microfluidics for operational single-cell extraction — improves throughput and single-cell capture fidelity.

◉Bruker Beacon Discovery™ (Apr 2025): Live single-cell functional analysis, enabling phenotypic screening and downstream sequencing linkages.

◉Scale Biosciences launches (Feb 2025): Five single-cell profiling products expand accessibility of scRNA workflows.

◉Inventia RASTRUM™ Allegro (Feb 2025): High-throughput 3D cell culture platform enabling drug discovery assays dovetailing with single-cell readouts.

Strategic partnerships & geographic expansion:

◉Premas Life Sciences + Sphere Bio (May 2025): Strengthens south-Asia operational microfluidics access.

◉Singleron + Bioscreen (Oct 2024): Distribution partnership to boost presence in ASAP (Asia-South-Asia-Pacific) regions.

◉Parse Biosciences + SCRUM (Apr 2025): Focus on Japan market penetration for accessible sequencing solutions.

Funding & venture activity:

◉Atrandi Biosciences $25M (Feb 2025): Funding to scale single-cell multiomics capsule technology — reflects investor confidence in next-gen sample formats and multi-modal assays.

Automation & reagent ecosystems:

◉BD high-throughput kits (Oct 2024): Shifts sample prep to automation workflows, a recurring theme across vendors.

Segments covered

By Product

Consumables

◉Subitems: reagents, assay kits, beads, microplates.

◉Role: recurring purchases; core revenue engine; drive lifetime value per instrument customer.

◉Explanation: Consumables are required for every experiment (labeling, lysis, amplification), giving vendors predictable recurring revenue and margin stability.

Instruments

◉Subitems: microscopes, hemocytometers, flow cytometers, NGS sequencers, PCR systems, HCS systems, cell microarrays, single live-cell imagers, automated cell counters.

◉Role: capital purchases that enable capability; vendors differentiate on throughput, sensitivity, and integration.

◉Explanation: Instruments are the front line enabling single-cell measurement types; instrument vendors invest in service networks and consumable lock-in.

Platform categories

◉Next-Generation Sequencing (NGS): backbone for transcriptomics & multiomics.

◉Microfluidics & droplet systems: scale cell capture and reduce per-cell cost.

◉Imaging & high-content systems: enable spatial and phenotypic single-cell readouts.

By Workflow

Single-cell isolation & library preparation

◉Explanation: Physical and molecular steps to isolate single cells and prepare nucleic acids for sequencing; innovations reduce doublets and increase capture efficiency.

Downstream analysis

◉Explanation: Post-sequencing interpretation — cluster calling, differential expression, trajectory inference; fast-growing due to demand for biological insights.

Data analysis

◉Explanation: Bioinformatics, AI/ML pipelines, cloud services; critical to convert raw reads into actionable biological interpretation and reports.

By End-use

Academic & Research Laboratories

◉Explanation: Largest 2024 share; use case: discovery, method development, atlas projects.

Biotech & Pharmaceutical Companies

◉Explanation: Drug discovery, target ID, biomarker development, translational studies — high willingness to pay for validated workflows.

Hospitals & Diagnostic Laboratories

◉Explanation: Emerging clinical applications; early adopters will be tertiary centers and reference labs.

By Region

◉Regions enumerated in the report — each with country subpoints.

Top 5 FAQs

Q1 — What is the market size and growth outlook for single-cell analysis?

A1 — The market was USD 5.19B in 2024, USD 6.16B in 2025, and is projected to reach USD 29.15B by 2034, corresponding to a reported CAGR of 18.74% (2025–2034) and an overall 5.62× expansion from 2024 to 2034.

Q2 — Which product segment generated the most revenue in 2024?

A2 — Consumables (reagents, assay kits, beads, microplates) held the largest revenue share in 2024 because every experiment requires recurring consumables, making them the primary recurring revenue source.

Q3 — Which region led the market in 2024 and which region will grow fastest?

A3 — North America led with 41% market share in 2024. Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by investments, distribution partnerships, and large research populations.

Q4 — What are the main restraints on market growth?

A4 — Major restraints include high cost of instruments and reagents, and the shortage of skilled personnel and advanced bioinformatics to interpret single-cell datasets — both increase total cost and slow adoption in smaller labs.

Q5 — How is AI changing the single-cell market?

A5 — AI is central to single-cell: denoising and batch correction, multi-omics integration, automated cell annotation, image + transcriptome fusion, predictive models for treatment response, workflow automation, and enabling SaaS/licensing revenue — all accelerating discovery and clinical translation while creating significant software service opportunities.

Access our exclusive, data-rich dashboard dedicated to the diagnostics sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5682

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest