Smart Healthcare Market Growth, Size, Top Key Players and Latest Updates 2025

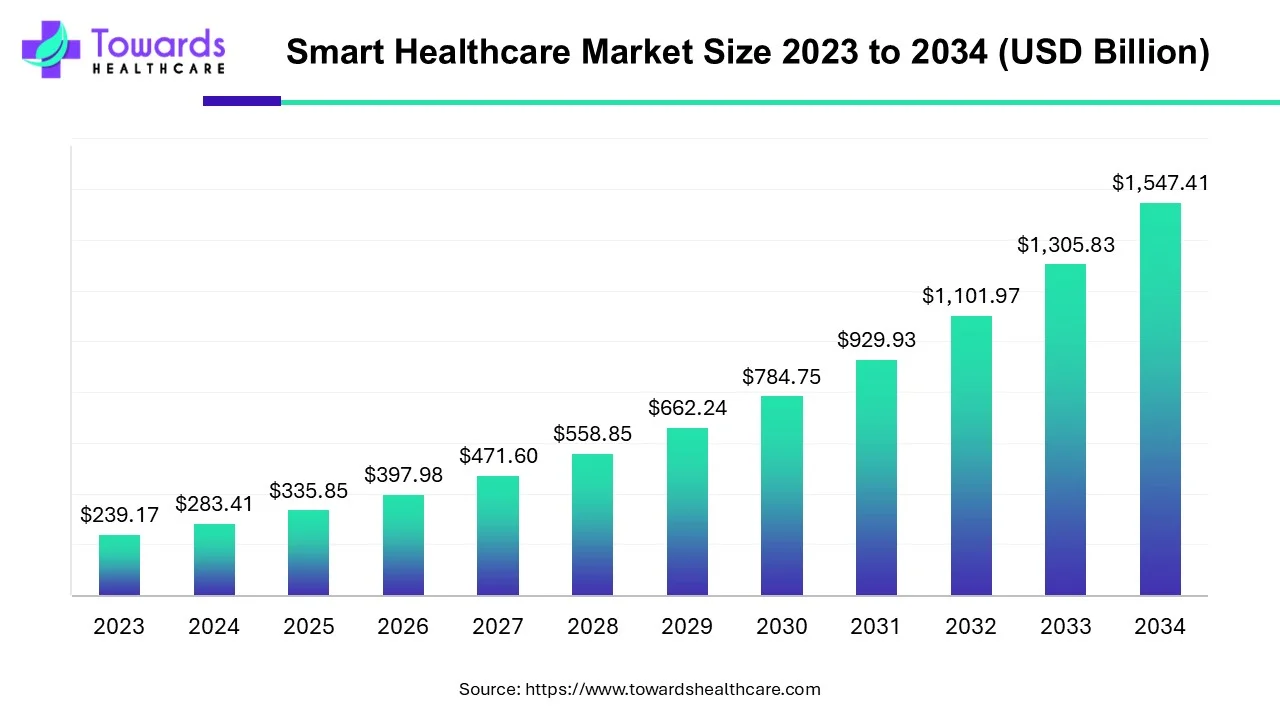

The global smart healthcare market was valued at USD 283.41 billion in 2024 and is expected to reach USD 335.85 billion in 2025, eventually projected to hit USD 1,547.41 billion by 2034, expanding at a CAGR of 18.5% between 2024 and 2034. The market growth is driven primarily by the rising popularity of telemedicine, increasing adoption of digital health solutions, and demand for home-based and remote healthcare services.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5042

Table of Contents

ToggleSmart Healthcare Market Size

◉2024: USD 283.41 billion

◉2025: USD 335.85 billion

◉2034 (Projected): USD 1,547.41 billion

◉CAGR (2024–2034): 18.5%

Key Growth Drivers:

◉Rising prevalence of chronic diseases globally.

◉Increasing demand for home-based and telehealth services.

◉Growing adoption of mobile health (mHealth), telemedicine, EHR, and remote patient monitoring systems.

Product Insights:

◉Telemedicine held the largest market share in 2024.

◉mHealth is projected to grow at the highest CAGR during the forecast period due to smartphone penetration and 5G technology adoption.

Technological Impact:

◉Integration of AI, IoT, and big data analytics is enhancing the efficiency of healthcare services.

◉Remote monitoring devices and wearables contribute significantly to revenue growth.

Smart Healthcare Market Trends

Strategic Partnerships and Collaborations:

◉January 2025: Microware Group Limited partnered with GAREA TECH to leverage AI in healthcare, improving precision and global patient outcomes.

◉November 2024: Oura partnered with Dexcom, raising $75 million in Series D to integrate glucose biosensor data with the Oura ring and expand globally.

◉October 2024: FICCI identified investment opportunities from Taiwan, allocating $15 million to Indian smart healthcare device manufacturing.

Telemedicine Growth:

◉Telemedicine continues to dominate due to chronic disease monitoring, shortage of healthcare professionals, and the need for remote consultations.

◉Virtual healthcare solutions reduce patient travel and healthcare costs while improving access in underserved regions.

mHealth Expansion:

◉Mobile apps and wearable integration facilitate preventive healthcare, epidemic tracking, treatment support, and chronic disease management.

◉Government initiatives and awareness campaigns are boosting adoption in low- and middle-income countries.

Remote Patient Monitoring (RPM):

◉RPM is gaining prominence, especially for chronic and elderly patients.

◉Devices track vital signs, medication adherence, and transmit real-time data to healthcare providers, reducing hospital readmissions.

Self-care and Wellness Integration:

◉Wearables and health apps encourage proactive health management.

◉Patients are increasingly empowered to prevent illnesses and monitor health metrics at home.

Connected Emergency Response:

◉App-based Personal Emergency Response Systems (PERS) and smart emergency solutions enable immediate medical intervention.

Role of Artificial Intelligence (AI) in Smart Healthcare

AI-Driven Diagnostics and Early Detection:

◉Accelerates disease detection via biomarker identification.

◉Enhances accuracy of imaging and lab results interpretation.

AI-Powered Telemedicine:

◉AI improves remote diagnosis efficiency.

◉Enables automated triage and patient prioritization for telehealth consultations.

Robotics and AI-Assisted Surgeries:

◉AI-driven robotic systems enhance surgical precision.

◉Reduce operational errors and improve patient recovery outcomes.

Predictive Analytics and Personalized Care:

◉AI models predict disease progression, medication response, and preventive care needs.

◉Enables personalized health recommendations and treatment plans.

Operational Efficiency in Healthcare Facilities:

◉AI optimizes hospital workflows, bed management, and supply chain logistics.

◉Can potentially save up to USD 360 billion annually in healthcare operations.

Generative AI for Education and Training:

◉AI video generators and simulations train medical staff efficiently.

◉Improves patient education through visual aids and interactive content.

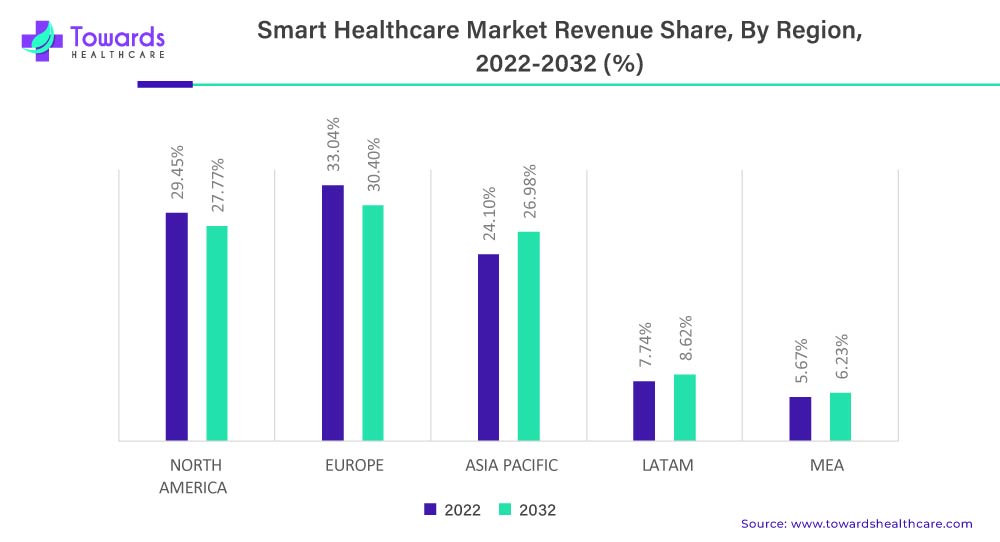

Regional Insights

1. Europe

Dominance:

◉Europe held the largest market share in 2024 for smart healthcare, establishing itself as a global leader in digital health adoption.

◉Advanced healthcare infrastructure and high technological readiness support this dominance.

Growth Drivers:

◉Aging Population: Europe has one of the fastest-growing elderly populations globally, increasing demand for telemedicine, remote monitoring, and chronic disease management solutions.

◉Rising Healthcare Costs: Escalating costs drive adoption of cost-efficient solutions like telemedicine, mHealth, and smart hospital management systems.

◉Digital Health Adoption: Europe has seen rapid integration of electronic health records (EHRs), wearable devices, and AI-powered diagnostics into mainstream healthcare.

Government Initiatives:

◉Digital Single Market Strategy: Promotes cross-border adoption of digital health tools, enabling seamless data sharing and interoperability across EU nations.

◉Favorable Reimbursements: Reimbursement schemes for telehealth and remote monitoring encourage hospitals and providers to adopt smart healthcare technologies.

Technological Landscape:

◉Emphasis on interoperability and data privacy.

◉Strong adoption of AI-powered analytics for diagnostics and patient monitoring.

◉Hospitals and clinics are integrating smart devices for operational efficiency and real-time patient tracking.

2. North America

Market Position:

◉Second-largest smart healthcare market globally, closely following Europe.

Key Growth Drivers:

◉High Healthcare Expenditure: The U.S. and Canada spend a significant portion of GDP on healthcare, enabling the adoption of advanced solutions like telemedicine, mHealth, and AI-powered hospital management.

◉Awareness and Education: High awareness among patients and healthcare providers about digital solutions accelerates adoption.

◉Reimbursement Policies: Supportive insurance coverage for telehealth services and digital consultations boosts market growth.

Technological Trends:

◉Rapid deployment of remote patient monitoring (RPM) systems.

◉Advanced telemedicine platforms providing remote consultations, chronic disease management, and virtual care.

◉Integration of smart hospital management systems for operational efficiency and workflow optimization.

3. Asia-Pacific

Growth Potential:

◉Asia-Pacific is witnessing rapid adoption of smart healthcare solutions, driven by a large patient base and rising digital literacy.

◉Projected to be one of the fastest-growing regions in smart healthcare between 2024–2034.

Growth Drivers:

◉Rising Chronic Disease Prevalence: Increasing diabetes, cardiovascular diseases, and respiratory disorders demand scalable digital healthcare solutions.

◉Infrastructure Investments: Governments and private sectors are investing in 5G networks, AI-enabled systems, and cloud computing, enhancing digital healthcare adoption.

◉Wearable Technology Adoption: India’s wearable market grew 47% YoY in 2022, primarily driven by smartwatches and fitness tracking devices.

◉Healthcare Accessibility: Digital health solutions like telemedicine and mHealth help serve rural and underserved populations.

Dominant Country:

◉China: Leads the region due to its transitional evolution in healthcare infrastructure, rapid urbanization, government support for digital health, and massive population base.

Technological Adoption:

◉Widespread use of mobile health apps, smart devices, and telemedicine platforms.

◉Expansion of remote patient monitoring (RPM) for chronic care and elderly population.

◉Smart hospitals adopting AI-assisted diagnostics, teleconsultations, and real-time health data integration.

4. Emerging Markets (Rest of the World)

Focus:

◉Affordable and accessible healthcare solutions through digital technology.

◉Rapid adoption of telemedicine, mHealth, and remote monitoring devices to bridge healthcare access gaps.

Opportunities:

Integration of RPM and mobile health apps can significantly improve healthcare delivery in underserved regions.

◉Digital health solutions enable cost-effective patient monitoring, reducing the need for in-person hospital visits.

Technological Challenges:

◉Infrastructure limitations, such as low internet penetration and limited smartphone availability, may restrict adoption.

◉Requires investment in training healthcare professionals for telehealth and smart device utilization.

Market Trends:

◉Governments and NGOs are pushing for digital literacy and telehealth adoption, creating a growing demand for smart healthcare solutions.

◉Emerging markets are likely to leapfrog traditional healthcare systems using mobile-based healthcare solutions and RPM platforms.

Market Dynamics

Drivers:

Rising demand for remote healthcare services.

Increasing prevalence of chronic diseases.

Rapid adoption of wearable devices and mobile health technology.

Restraints:

Data privacy and cybersecurity risks with connected devices and IoT.

Dependency on stable internet and smartphone penetration for app-based services.

Opportunities:

Expansion of telemedicine in rural and underserved regions.

Growing partnerships for AI integration in healthcare.

Development of app-based PERS and connected care solutions.

Challenges:

Ensuring regulatory compliance with HIPAA, GDPR, and other regional standards.

Educating patients and providers about smart healthcare adoption.

Overcoming technological limitations in developing countries.

Top Smart Healthcare Companies

1. Allscripts

◉Products: EHR, telemedicine platforms, population health management tools.

◉Strength: Strong global presence, integrated digital health solutions.

2. Cerner Corporation

◉Products: EHR, health information exchange, AI-powered analytics.

◉Strength: Leading provider of hospital information systems.

3. Samsung

◉Products: Wearables, mHealth devices, smart monitoring solutions.

◉Strength: Advanced consumer electronics integration with healthcare.

4. Siemens Healthcare

◉Products: Imaging systems, smart hospital management, AI-assisted diagnostics.

◉Strength: Expertise in medical imaging and AI-powered solutions.

5. IBM Corporation

◉Products: AI analytics, cloud healthcare solutions, telemedicine support.

◉Strength: Pioneering AI in healthcare with predictive and operational insights.

6. Medtronic

◉Products: Remote patient monitoring devices, implantable smart devices.

◉Strength: Global expertise in medical devices and chronic disease management.

Latest Announcements

◉Tata MD (Girish Krishnamurthy, CEO & MD) emphasized collaborative AI in healthcare, highlighting human-AI synergy for better accessibility and efficiency.

◉Microware-GAREA TECH (Jan 2025): Partnership to leverage AI for precision healthcare.

◉Oura-Dexcom (Nov 2024): $75 million Series D funding for international expansion and integration of glucose biosensor data.

◉FICCI (Oct 2024): $15 million investment in India for smart healthcare device manufacturing.

Recent Developments

◉ITRI (Jan 2025): Launched High-Privacy AI Digital Caregiver, Intelligent Medical Assistant Solutions, Janus, and MedBobi at CES 2025.

◉AUO Health, AUO Display Plus, DentLabX (Dec 2024): Launched 3D Smart Surgical Imaging Platform enabling remote robotic control and synchronized imaging.

Segments Covered

By Product Type

1. RFID Kanban Systems

Functionality: Streamline hospital inventory and supply chain by automating stock tracking and replenishment.

How It Works: Utilizes RFID tags and barcode scanning to monitor stock levels, triggering automatic reordering when bins are emptied.

Benefits: Reduces stockouts, enhances real-time visibility, and improves supply chain efficiency.

2. RFID Smart Cabinets

Functionality: Automate storage and access of medical supplies using RFID technology.

How It Works: Tracks inventory in real-time, records user access, and manages stock levels without manual input.

Benefits: Enhances security, reduces errors, and optimizes inventory management.

3. Electronic Health Records (EHR)

Functionality: Digitally manage patient health information across providers.

How It Works: Stores comprehensive patient data, including demographics, medical history, medications, and lab results, accessible by authorized healthcare providers.

Benefits: Improves coordination of care, supports clinical decision-making, and enhances patient safety .

4. Telemedicine

Functionality: Facilitates remote consultations and patient management.

How It Works: Utilizes digital platforms to connect patients with healthcare providers for consultations, diagnosis, and follow-up care.

Benefits: Increases access to healthcare services, especially in underserved areas, and reduces the need for in-person visits .

5. mHealth (Mobile Health Apps)

Functionality: Provides mobile-based tools for health monitoring and disease management.

How It Works: Offers features like symptom tracking, medication reminders, and health education through smartphone applications.

Benefits: Empowers patients to manage chronic conditions and promotes healthier lifestyles.

6. Smart Pills

Functionality: Monitors medication adherence through ingestible sensors.

How It Works: Embedded sensors in pills transmit data to external devices, confirming ingestion and tracking medication usage.

Benefits: Enhances adherence to prescribed therapies and provides real-time monitoring.

7. Smart Syringes

Functionality: Prevents needlestick injuries and reduces infection risk.

How It Works: Incorporates safety features like retractable needles or automatic shielding to protect healthcare workers.

Benefits: Improves safety for both patients and healthcare providers.

By Region

North America (U.S., Canada)

Adoption Drivers: High awareness, robust healthcare infrastructure, and supportive reimbursement policies.

Technologies in Use: Widespread implementation of EHRs, RFID systems, and telemedicine platforms.

Trends: Continuous innovation and integration of digital health solutions to improve patient care and operational efficiency.

Europe (UK, Germany, France)

Adoption Drivers: Strong digital health policies and government initiatives.

Technologies in Use: Extensive use of EHRs and telemedicine services, especially in rural areas.

Trends: Focus on interoperability and data privacy in digital health implementations.

Asia-Pacific (China, India, Japan, South Korea)

Adoption Drivers: Large populations, rapid infrastructure development, and increasing smartphone penetration.

Technologies in Use: Growing adoption of mHealth apps and telemedicine services.

Trends: Expansion of digital health initiatives to improve access to care and manage chronic diseases.

Rest of the World (Emerging Markets)

Adoption Drivers: Need for affordable healthcare solutions and mobile connectivity.

Technologies in Use: Implementation of basic mHealth applications and telehealth services.

Trends: Increasing investment in digital health technologies to address healthcare access challenges.

Top 5 FAQs

1 What is the current size of the smart healthcare market?

The market was valued at USD 283.41 billion in 2024 and is projected to reach USD 1,547.41 billion by 2034.

2 Which segment holds the largest market share?

Telemedicine held the largest share in 2024, while mHealth is expected to grow at the highest CAGR.

3 How is AI impacting the smart healthcare market?

AI improves diagnostics, telemedicine efficiency, predictive analytics, robotic surgeries, and operational efficiency, potentially saving USD 360 billion annually.

4 Which regions are leading in smart healthcare adoption?

Europe holds dominance; North America follows closely, while Asia-Pacific is growing rapidly due to infrastructure investments and wearable adoption.

5 What are the latest innovations in smart healthcare?

Innovations include High-Privacy AI Digital Caregivers, 3D Smart Surgical Imaging Platforms, and app-based PERS for connected emergency care.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5042

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest