The global specialty medical chairs market is valued at USD 5.12 billion in 2025 and projected to reach USD 9.77 billion by 2034, growing at a CAGR of 7.43% (2025–2034). North America leads with 43% share in 2024, while Asia-Pacific is the fastest-growing region, driven by rising elderly population, chronic diseases, and healthcare infrastructure investments.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5480

Market-size

Historical / baseline numbers (anchor points)

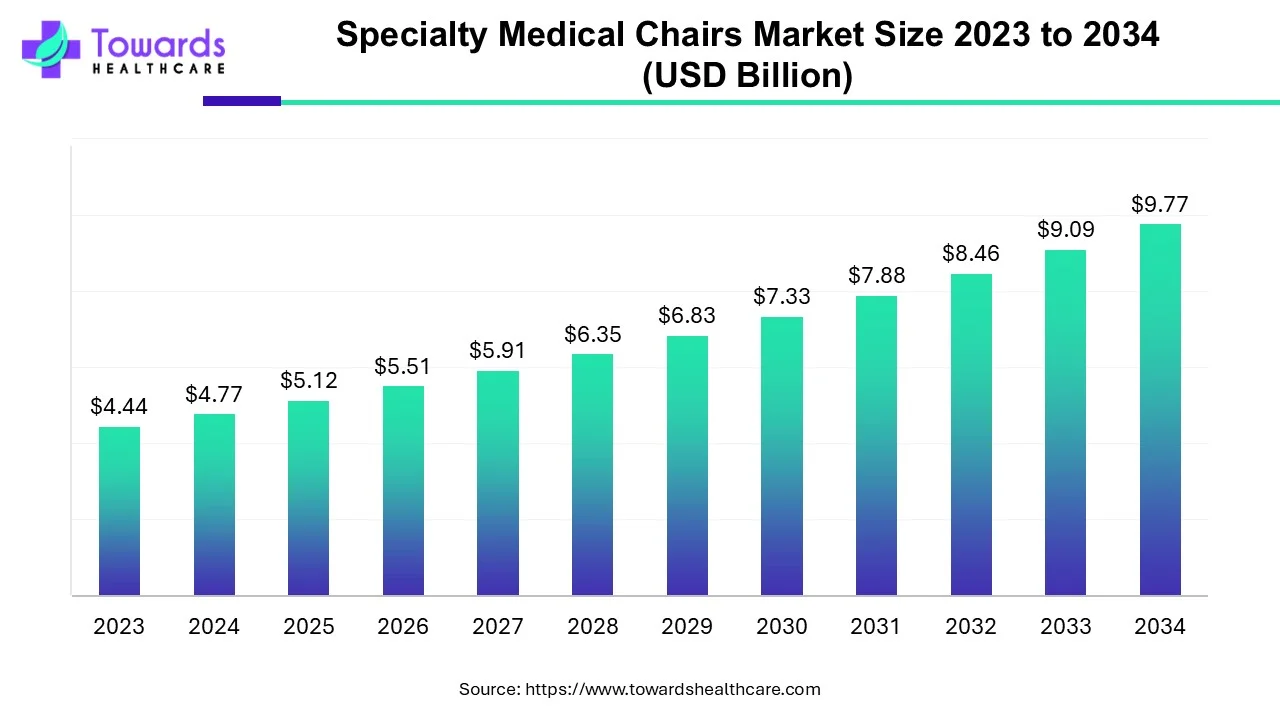

◉2024 market size (reported): USD 4.77 billion.

◉2025 market size (reported): USD 5.12 billion.

Forecast headline

◉2034 projected market size: USD 9.77 billion; CAGR 2025–2034 = 7.43%.

Yearly totals reconstructed from product breakdown (consistency check)

◉Calculated totals from the provided product-series (Examination + Rehabilitation + Treatment chairs) produce:

2024 4.77B, 2025 5.12B, 2026 5.50B, 2027 5.91B, 2028 6.36B, 2029 6.83B, 2030 7.34B, 2031 7.88B, 2032 8.47B, 2033 9.09B, 2034 9.76B.

◉Note: the derived 2034 total (9.76B) differs by 0.01B from the stated 9.77B — this is attributable to rounding in sub-segment figures; both numbers are consistent within rounding precision.

Growth pattern interpretation

◉The market exhibits a steady, mid-single-digit to low-double-digit expansion year-on-year. Growth accelerates in absolute dollars after 2029 (the total increases by larger absolute amounts as the base grows).

◉The rehabilitation chairs subseries is the largest contributor to total value and thus the main engine of absolute market expansion.

Value drivers behind the monetary growth

◉Demographic expansion (global ageing), higher prevalence of chronic disease, increased outpatient and rehabilitation care, faster uptake of premium/automated chairs and hospital capital spending (explicitly cited increases in government health capital spending).

Market trends

Demographic and clinical demand trends

◉Ageing population: WHO/statistics cited—60+ population rising sharply (from 900M in 2015 to ~2B by 2050) — increases demand for geriatric and long-term care seating.

◉Chronic disease prevalence: More patients with diabetes, cardiovascular disease, cancer and musculoskeletal disorders require recurrent procedures and rehabilitative seating.

Product evolution and technology adoption

◉Advanced/automated chairs: Increasing introduction of motorized adjustment, pressure-relief designs and digitally integrated delivery systems (example: A-dec 500 Pro / 300 Pro).

◉Digitally integrated dental & surgical chairs: suppliers adding digital workflows and integrated delivery units — trend toward software + chair bundles.

Service-setting shifts

◉Hospitals remain largest end-use (2024) due to acute care, surgeries and post-surgical rehabilitation needs.

◉Clinics/outpatient growth: Faster % growth forecast for clinics driven by outpatient surgery growth, specialized clinics (dental, ophthalmic, physiotherapy) and cost-efficient care models.

◉Regional investment & policy trends

◉Increased government capital spending (examples: India Union Budget 2025–26; UK health capital increase; Newfoundland & Labrador investments) — supports procurement of advanced chairs.

◉International aid/aid logistics example: RNZAF delivering specialized chairs to Samoa (shows philanthropic/aid channel demand).

M&A, distribution and investment activity

◉Strategic acquisitions and investments (Nakanishi → DCI; Foresight → DP Medical Systems; Infinium Medical + Lemi MD distribution) reflect consolidation and distribution expansion to capture regional demand.

Price / affordability pressure

◉High cost of premium chairs (cited EUR 4,000–8,000 for some intensive-care chairs) restrains adoption in price-sensitive markets and pushes demand for lower-cost alternatives or refurbished units.

Adjacency and substitution

◉Competition from stretchers, standard exam chairs and electric wheelchairs — rising acceptance of electric mobility devices is both an opportunity and a substitute threat depending on application.

Role & impact of AI / ML

Patient-centric real-time positioning

◉AI-driven controllers can ingest sensor streams (pressure maps, patient posture, vitals) to automatically adjust chair angle, back/leg support and headrests to prevent pressure ulcers, optimize surgical access angles, and maximize comfort without manual intervention.

Personalization & patient profiling

◉ML models trained on patient anthropometrics, clinical condition, and prior preference histories can create personalized seat-profiles (auto recall for recurring patients) — improving throughput and reducing setup time.

Predictive maintenance & uptime optimization

◉Telemetry + ML anomaly detection predicts motor, actuator, or electronics failures before breakdown; schedules preventive maintenance, reducing downtime for high-utilization hospital chairs and lowering total cost of ownership.

Surgery-grade precision positioning

◉For chairs/tables used in procedures (ophthalmic, dental, ambulatory surgery), AI can provide micro-adjustments aligned to surgical robot movements or imaging guidance — enhancing ergonomic access and reducing procedure time.

Manufacturing & supply-chain improvements

◉AI optimizes production scheduling, demand forecasting, and parts sourcing (reducing lead times); generative design can suggest lighter/stronger structural components for chairs at lower material cost.

Clinical decision support integration

◉Chairs that communicate with EHRs/monitoring systems can adjust based on patient vitals (for example: raise head at signs of respiratory distress), and report usage metrics back to clinical teams.

Adaptive user interfaces & accessibility

◉Voice-enabled, ML-driven UIs and simplified control flows help staff (and patients with disabilities) operate complex chairs safely with minimal training.

Regulatory and safety validation

◉AI systems will require clinical validation; explainable ML and traceable logs will be needed to satisfy procurement and regulatory scrutiny — a short-term barrier but long-term differentiator for compliant vendors.

Market implications

◉Premiumization: AI features command price premiums, shifting average selling prices upward (supports higher market value).

◉New revenue streams: Predictive maintenance subscriptions, software licenses, and analytics-as-a-service create recurring revenue beyond hardware sales.

Regional insights

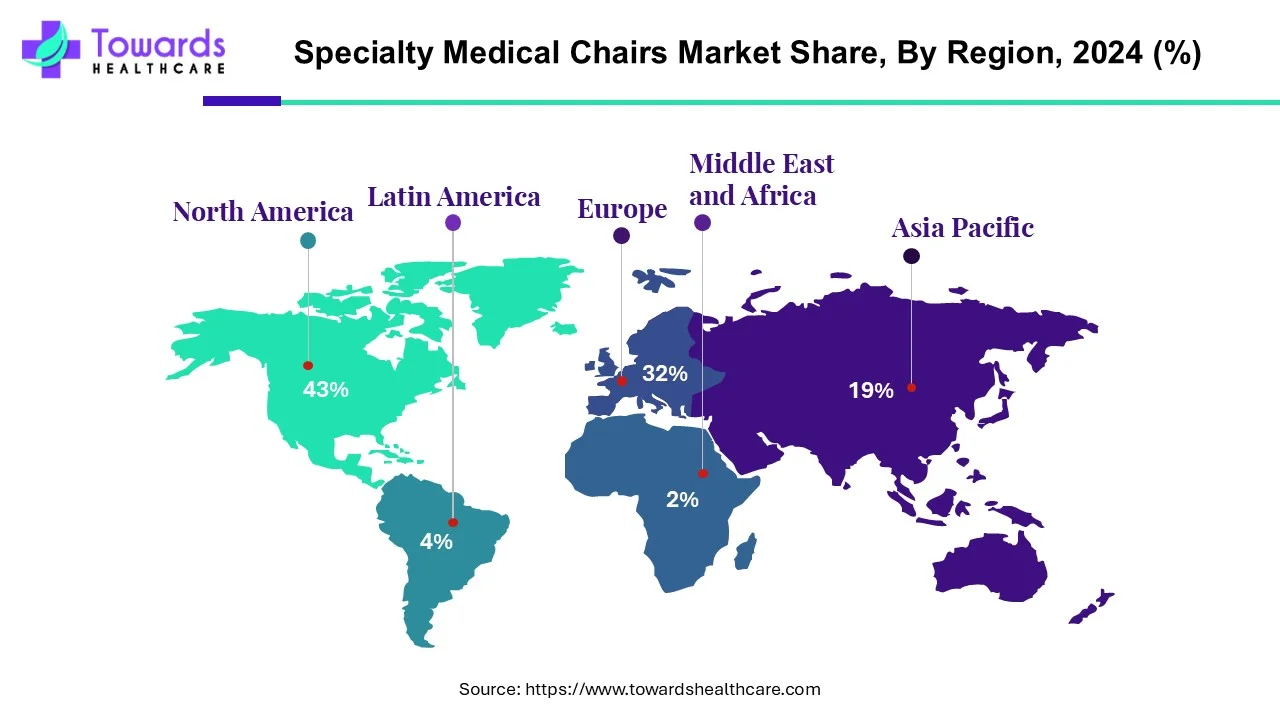

North America (dominant: 43% share in 2024)

Drivers

◉Large elderly population increase (U.S. 65+ projected +47% by 2050 from PRB data), robust reimbursement frameworks, high hospital budgets.

Capabilities

◉Strong presence of major OEMs, dense installed base of high-end chairs, rapid uptake of AI/automation features.

Challenges

◉High labor and purchase costs; procurement focus on ROI and regulatory compliance.

Implication

◉Market leader by value; largest share of premium/advanced chairs and software services.

Europe

Drivers

◉Mature healthcare systems, strong outpatient procedural volumes, emphasis on patient safety and comfort.

Capabilities

◉High adoption of advanced technologies; public procurement programs fund modernization.

Variation

◉Northern/Western Europe faster to adopt premium models; some Eastern markets more price sensitive.

Implication

◉Stable high-value market with regulatory scrutiny and strong demand for durable, certified equipment.

Asia-Pacific (fastest growth predicted)

Drivers

◉Rapid population growth, rising healthcare expenditure, growing middle class, increasing surgical volumes and road-traffic injuries.

Capabilities

◉Rapid hospital expansion and home-care services; mixed maturity — China and India are key growth engines.

Challenges

◉Price sensitivity in many markets forces OEMs to offer tiered products or localization strategies.

Implication

◉High absolute volume growth opportunity; demand for mid-to-high tier chairs and localized manufacturing/distribution.

Latin America

Drivers

◉Growing geriatric cohort, increasing medical tourism, rising healthcare spend in large markets (Brazil, Mexico).

Constraints

◉Budget constraints and uneven distribution of advanced care; reliance on multinational suppliers for premium units.

Implication

◉Growing replacement and new-installation market; potential for used/refurbished equipment trade.

Middle East & Africa

Drivers

◉Selective government investment in large hospital projects; Gulf states as premium buyers.

Constraints

◉Many countries are price sensitive with fragmented procurement; logistics and maintenance networks can be weak.

Implication

◉Patchwork market—niche premium demand (GCC) and slower growth elsewhere.

Market dynamics

Drivers (detailed)

◉Ageing population: Larger 60+ and 80+ cohorts increase long-term care and procedural volumes; WHO projections cited (60+ doubling toward ~2.1B by 2050).

◉Rising chronic disease burden: More dialysis, oncology, cardiology, and rehabilitation cases → higher seat/therapy chair demand. (U.S. example: ~129M people with at least one chronic condition.)

◉Technology premiumization: Adoption of automated/digital chairs with AI/ML, pressure-management and integrated delivery systems increases both unit value and replacement cycles.

◉Government capital spending: Documented increases in public capital (India budget, UK New Hospital Programme, regional investments) fuel procurement.

Restraints (detailed)

◉High unit cost of premium chairs: High-end models (EUR 4k–8k) limit adoption in low-income settings.

◉Maintenance & total cost of ownership: Ongoing service contracts and part replacement costs deter some buyers.

◉Awareness & training: Clinical staff unfamiliarity with advanced features reduces utilization and perceived value.

Opportunities (detailed)

◉Electric mobility convergence: Growing acceptance of electric wheelchairs and IoT sensors creates cross-sell and platform opportunities (Invacare example).

◉Home healthcare expansion: Demand for comfortable, safe chairs for home infusion, dialysis, and long-term care.

◉Software & service revenue: Predictive maintenance, remote monitoring, and analytics subscriptions as recurring revenue.

◉Emerging-market penetration: Tiered products and localized manufacturing to capture APAC and LATAM growth.

Top companies

A-dec, Inc.

◉Product focus: Dental chairs and digitally integrated delivery systems (A-dec 500 Pro / 300 Pro).

◉Overview: Established dental equipment OEM with product lines integrating ergonomic chairs and delivery units.

◉Strengths: Strong dental market brand, integrated digital workflows, North American distribution and service footprint.

ActiveAid, Inc.

◉Product focus: Specialized seating and pressure-relief chairs (rehab focus).

◉Overview: Rehab seating specialist targeting geriatrics and bariatric segments.

◉Strengths: Niche rehab expertise and product customization.

DentalEZ, Inc.

◉Product focus: Dental chairs and dental delivery systems.

◉Overview: Longstanding dental equipment vendor.

◉Strengths: Product reliability for dental clinics; broad clinic channel penetration.

Fresenius Medical Care AG & Co. KGaA

◉Product focus: Dialysis chairs and systems.

◉Overview: Global leader in dialysis solutions; chairs form part of integrated offering for dialysis centers.

◉Strengths: Deep clinical domain knowledge in dialysis, global service network, strong purchasing relationships with dialysis centers.

Topcon Corp.

◉Product focus: Ophthalmic chairs and ophthalmic equipment integration.

◉Overview: Optical/ophthalmic systems vendor offering chairs as part of wider ophthalmic suites.

◉Strengths: Clinic workflow integration, ophthalmology domain expertise.

Midmark Corp.

◉Product focus: Examination chairs, surgical chairs, treatment seating and medical-furniture solutions.

◉Overview: Broad clinical furniture and equipment OEM with manufacturing and educational outreach (e.g., WCOMP partnership).

◉Strengths: Strong OEM reputation, cross-product bundles for clinics/hospitals, emphasis on local partnerships.

Danaher (KaVo Dental GmbH)

◉Product focus: Dental chairs and instruments (KaVo brand).

◉Overview: Large diversified medical technology conglomerate; KaVo an established dental brand within Danaher.

◉Strengths: R&D resources, distribution scale, strong dental brand equity.

Dentsply Sirona

◉Product focus: Dental chairs and integrated dental solutions.

◉Overview: Global dental OEM with comprehensive product portfolio.

◉Strengths: Market reach in dental clinics, innovation in dental equipment.

Planmeca Oy

◉Product focus: Dental and imaging integrated chairs.

◉Overview: Finland-based dental equipment innovator with imaging and chair combos.

◉Strengths: Integrated imaging + chair solutions, strong European presence.

Hill Laboratories Company (and similar regional players)

◉Product focus: Hospital beds and specialty seating (varies by company).

◉Overview: Industrial / medical furniture manufacturers serving hospitals.

◉Strengths: Hospital procurement relationships, capability to supply large projects.

Rahab Seating Systems Inc.

◉Product focus: Rehabilitation and specialty seating for bariatric/pediatric/geriatric users.

◉Overview: Specialty seating OEM for rehab markets.

◉Strengths: Niche product engineering and customization.

Latest announcements

Vivid.Care — HiBack Bedside Chair (Feb 2025)

◉What: Launch of the HiBack Bedside Chair addressing height adjustability, pressure care and patient ergonomics.

◉Why it matters: Responds directly to ward-level issues (pressure sores and poor ergonomics) reported by ward managers and tissue-viability nurses; positions Vivid.Care in acute ward seating market with a product designed for staff handling and patient discharge improvement.

◉Implication: If widely adopted, improves patient throughput and reduces pressure-injury related costs; demonstrates product development driven by frontline clinician feedback.

Infinium Medical + Lemi MD distribution (Mar 4, 2025)

◉What: Exclusive U.S. distribution agreement for Lemi MD-Series surgical chairs (Dreamed Procedure Chair, Monza Mobile Surgery Chair, Lemi 4 Procedure Table).

◉Why it matters: Expands the Lemi MD footprint into the U.S., increasing availability of procedure-specific chairs optimized for ambulatory and mobile surgery.

◉Implication: Strengthens distribution channels and may accelerate sales in outpatient procedural settings.

Recent developments

RNZAF delivery to Samoa (Mar 2025)

◉Details: Five specialized chairs for chemo/dialysis delivered via RMZAF C-130J donated by Christchurch’s Forté Health Hospital.

◉Significance: Highlights role of donor/aid logistics in distributing bulky, high-value chairs to remote/rural care sites; showcases chairs’ criticality for continuity of chronic care in island nations.

Vivid.Care HiBack launch (Feb 2025) — see “Latest announcements” for full depth.

◉Foresight investment in DP Medical Systems (£4.45M, Aug 2024)

◉Details: Investment targeted at product launches and scaling distribution.

◉Significance: Example of private capital fueling distributor growth and broader market reach for specialty chairs and consumables.

Nakanishi Inc. acquisition of DCI International (Aug 2023)

◉Details: Acquisition to strengthen U.S. dental chair/instrument sales.

◉Significance: M&A to consolidate dental chair portfolio and accelerate access to U.S. dental market.

A-dec product introductions (Jun 2023)

◉Details: A-dec 500 Pro and 300 Pro digitally integrated dental delivery systems launched in North America.

◉Significance: Illustrates the trend toward digital integration in dental chairs and added value through software/equipment bundles.

Midmark + WCOMP / Ohio STEM (Mar 4, 2024)

◉Details: Partnership to promote manufacturing careers and innovation.

◉Significance: OEMs investing in talent pipelines to support future product development and local manufacturing.

Segments covered

By Product — explanations & subpoints

Examination Chairs

◉Subtypes: General exam chairs, cardiology exam chairs, mammography supports, multipurpose clinic chairs.

◉Role: First-contact seating for diagnostics and routine exams; high unit volumes in clinics and small hospitals.

◉Value driver: Lower per-unit price but high replacement cadence in outpatient settings.

Rehabilitation Chairs (dominant segment in 2024)

◉Subtypes: Pediatric chairs, bariatric chairs, geriatric chairs, positioning/bathing chairs.

◉Role: Long-use seating in rehab centers and long-term care; focuses on pressure management, positioning and mobility support.

◉Why dominant: Large elderly and chronic care populations requiring rehab; higher price points for specialized features.

Treatment Chairs

◉Subtypes: Ophthalmic chairs, ENT chairs, dental chairs, procedure/treatment chairs.

◉Role: Procedure-specific chairs that enable clinicians’ access and integrate with instruments/diagnostics.

◉Growth driver: Increasing outpatient procedural volumes and the push for clinic-based surgeries.

By End-use — explanations

Hospitals

◉Why largest share (2024): Hospitals handle acute cases, surgeries, and in-patient rehab where high-spec chairs are essential.

Clinics

◉Why fast growth: Outpatient surgery, dentistry, ophthalmology, and physiotherapy growth fuels clinic purchases.

Others

◉Includes: Home care, long-term care facilities, mobile clinics, aid deployments.

By Region — explanations

Top 5 FAQs

-

Q: What is the current size and projected growth of the specialty medical chairs market?

A: The market was USD 4.77B in 2024, USD 5.12B in 2025, and is projected to reach ~USD 9.77B by 2034, growing at a 7.43% CAGR (2025–2034). -

Q: Which product segment contributed the most value in 2024 and why?

A: Rehabilitation chairs dominated in 2024 (largest sub-segment) due to rising elderly populations, increased spinal/neurological injuries, and demand for specialized positioning (pediatric, bariatric, geriatric). -

Q: Which region leads the market and which region is fastest-growing?

A: North America led with about 43% market share in 2024, driven by ageing demographics and reimbursement frameworks. Asia-Pacific is predicted to have the fastest growth over the forecast period due to large population growth, rising healthcare spend, and expanding surgical volumes. -

Q: What restrains adoption of specialty medical chairs?

A: Key restraints include high unit cost (premium chairs often EUR 4k–8k), ongoing maintenance costs, limited awareness/training, and competition from substitutes (stretchers, standard exam chairs, or electric wheelchairs). -

Q: How will AI change the specialty medical chairs market?

A: AI/ML will enable automatic personalized positioning, predictive maintenance, surgery-grade micro-adjustments, and new software/service revenue streams — driving premiumization, higher ASPs, and recurring revenue models (licenses, maintenance subscriptions).

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5480

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest