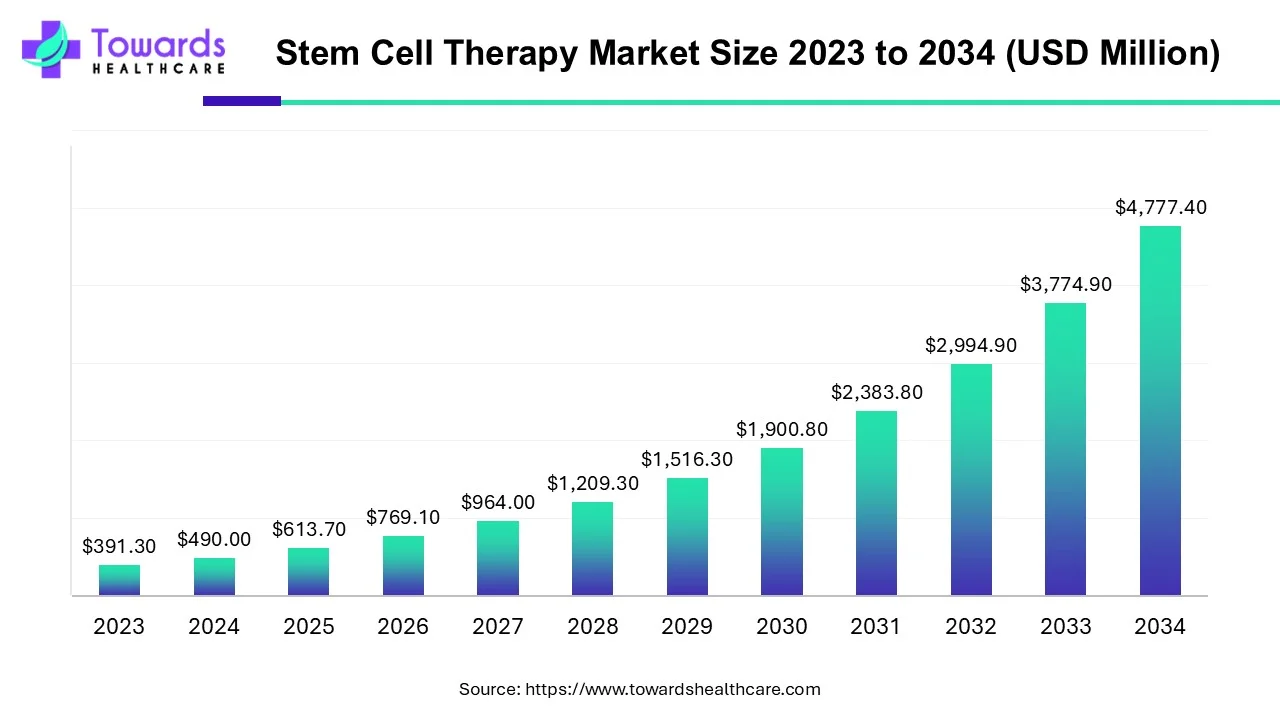

The global stem cell therapy market was valued at USD 490.0 million in 2024, grew to USD 613.7 million in 2025, and is projected to reach ≈ USD 4,777.4 million by 2034 — expanding at a CAGR of 25.26% (2025–2034) driven by rising chronic disease burden, more transplants, expanding R&D/clinical trials and improving regulatory frameworks.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5451

Market size

Base and near-term growth (2024 → 2025)

◉2024 market size: USD 490.0M.

◉2025 market size: USD 613.7M — an absolute increase of USD 123.7M year-on-year, reflecting accelerating investment and early commercial uptake of advanced cell products.

Long-term projection (2025 → 2034)

◉Projected 2034 size: USD 4,777.40M.

◉Stated CAGR (2025–2034): 25.26% — this implies a 7.79× increase from 2025 to 2034 (613.7M × (1+0.2526)^9 ≈ 4,777.4M as reported).

Scale and commercialization stage

◉Current absolute dollar base (hundreds of millions) shows this is still an emerging but fast-scaling therapeutic sector — large relative growth expected, but absolute dollar base remains small versus many established pharmaceutical markets, reflecting high per-product development costs and a small number of approved/marketed stem cell products.

Investment intensity vs. revenue realization

◉Strong R&D and clinical pipeline investments (including cross-industry alliances and CDMO growth) are fueling projected revenue growth; however, a time-lag exists between preclinical/clinical activity and realized commercial revenue — the steep CAGR assumes accelerated approvals, scale-up in manufacturing, and pricing/reimbursement traction.

Clinical activity as a leading indicator

◉4,719 registered SCT clinical trials as of Feb 2025 signals massive pipeline and future market entrants; conversion rates from trial → approval will materially influence actual realized market size versus forecast.

Pricing and affordability constraints

◉Typical SCT treatment cost range $5,000–$50,000 (expanded cell products often $15,000–$30,000 in 2023) constrains addressable patient volumes in low/middle-income regions and will shape realized revenue unless cost-of-goods falls.

Market trends

Regulatory momentum & national initiatives

◉US RMIP (Regenerative Medicine Innovation Project) and European regenerative medicine initiatives are accelerating clinical research on adult stem cells — these programs increase trial quality, patient safety oversight, and public funding, which in turn de-risk commercial development.

Orphan and high-need disease designations

◉Example: IPS Heart received FDA Orphan Drug Designation (Jan 2025) for GIVI-MPCs (Becker Muscular Dystrophy) — orphan designations improve commercial viability (regulatory incentives, exclusivity) and attract investors to niche, high-unmet-need programs.

Strategic partnerships to access platforms

◉Collaborations such as Alloy Therapeutics + Takeda (Nov 2024) on iPSC-derived CAR-T/CAR-NK platforms show a trend of established pharma licensing stem cell/IPSC platforms from specialized biotech to broaden therapeutic modality reach.

Private investment into translational programs

◉Example: Zhongzhi’s $3M into Gabaeron (Dec 2024) to advance preclinical AD programs → reflects continued private capital into early translational assets that could expand future market entrants.

Geographic investment & manufacturing scale-up

◉Government investments (e.g., Canada’s $22.5M for STEMCELL Technologies facility, July 2024) illustrate public support for domestic manufacturing — critical to lowering COGS and improving supply reliability.

Clinical translation into new indications

◉Clinical expansion from hematologic uses (the historical backbone) into neurology (Parkinson’s, AD), cardiology, ophthalmology (retinitis pigmentosa), musculoskeletal repair and more is active — early clinical signals (e.g., UC Davis CD34+ RP results, Nov 2024) fuel therapeutic diversification.

Cost pressure and payer scrutiny

◉Despite clinical promise, high treatment costs ($5k–$50k) and limited long-term outcome data create payer access barriers; cost-effectiveness data and manufacturing scale will determine reimbursement breadth.

Asia-Pacific as lower-cost provider & growth engine

◉Policy liberalization (China lifted bans on foreign investments in human stem cell & gene therapies in 2024) + large patient populations + lower procedure costs make APAC both a clinical trial and treatment destination.

Consolidation and CDMO growth

◉The need for specialized manufacturing and quality systems is spawning CDMO capacity growth and strategic M&A as companies seek to vertically integrate or secure supply.

AI impact / role

Process optimization & manufacturing scale-up

◉AI/ML models can analyze high-dimensional manufacturing data (bioreactor parameters, cell morphology time-series, media composition) to:

• predict optimal harvest times,

• minimize batch variability, and

• recommend parameter adjustments to improve viability and yield → directly reduces cost-of-goods (COGS) and raises batch consistency.

Quality control and real-time release testing (RTRT)

◉Computer vision + deep learning on microscopy/flow cytometry images enables automated, non-destructive potency and identity assessments (e.g., morphology signatures of differentiation) — shortens QC timelines and supports faster lot release.

In-silico assay development & surrogate endpoint discovery

◉ML can find predictive biomarkers or surrogate endpoints by correlating preclinical/clinical multi-omic data with outcomes — this allows smaller, faster trials and potentially earlier regulatory acceptance if surrogates validated.

Patient stratification and precision indication selection

◉Using patient genomic + phenotypic datasets, AI can identify subpopulations most likely to respond (e.g., molecular signatures predicting engraftment success or immune tolerance) — improves trial success probability and supports premium pricing in responsive cohorts.

Predictive safety / tumorigenicity screens

◉Models trained on transcriptomic/proteomic signatures can flag cell lots with tumorigenic or off-target differentiation risks before release, improving safety profile and regulatory confidence.

Automated protocol optimization for differentiation and expansion

◉Reinforcement learning and Bayesian optimization can iterate media formulations, growth factor timing, and mechanical cues to derive reproducible differentiation protocols (important for iPSCs/ESC derivatives).

Accelerating discovery & target validation

◉AI accelerates discovery by mining literature and large datasets to propose new cell engineering strategies (e.g., genetic edits to improve survival) and rank experiments by predicted impact — reduces bench cycles and R&D costs.

Clinical trial design and synthetic control arms

◉AI can design adaptive trials, identify historically matched controls, and help create synthetic comparator arms to reduce patient numbers needed; useful where rare diseases or small populations make RCTs challenging.

Supply chain and demand forecasting

◉Forecasting algorithms predict demand by indication, region, and payer coverage to optimize manufacturing scheduling for short-shelf-life cellular therapies, reducing waste and stockouts.

Regulatory submission and evidence synthesis

◉Natural language models can automate dossier drafting, extract relevant safety/evidence, and simulate Q&A for regulators — reducing time/cost to submission while maintaining documentation quality.

Economic impact pathway

◉By lowering variability and COGS, shortening trials via predictive biomarkers, and enabling targeted indications, AI materially increases the probability of converting pipeline activity (4,719 trials) into commercially viable, reimbursed products — a key enabler for the projected CAGR.

Regional insights

North America (dominant in 2024)

Drivers

◉Strong R&D ecosystem, deep venture/private capital, top academic translational centers, CDMOs, and favorable regulatory frameworks (FDA guidance, RMIP funding).

Commercial readiness

◉Higher reimbursement potential and access to specialized clinical networks accelerate uptake once approvals occur.

Manufacturing and regulation nexus

◉Investments (public & private) into GMP capacity and regulatory science mean products can scale with compliance — but commercial success depends on payer acceptance and long-term outcomes data.

Asia-Pacific (fastest growing / affordable destination)

Cost arbitrage & large patient pools

◉Lower treatment costs in India, Thailand, China make therapies more affordable; rising domestic investment and lifted investment restrictions expand capacity.

Regulatory divergence

◉Heterogeneous regulations: some countries expedite access (compassionate use / conditional approvals), improving early patient access but raising variability in standards — companies must manage multi-jurisdiction quality harmonization.

Clinical trial growth

◉Large patient populations and lower patient recruitment costs attract trials; however, post-trial commercialization depends on local reimbursement frameworks and infrastructure.

Europe (regulatory & ATMP leadership)

EMA and ATMP pathway

◉EMA has approved 25 ATMPs (somatic cell therapies, CAR-T etc.) — regulatory expertise exists, and dedicated frameworks for ATMPs (hospital exemptions, conditional marketing authorizations) are available.

Research density

◉Over 400 stem cell/regenerative labs across Europe support translational work; payers are cost-conscious, so robust health economic evidence is necessary for broad adoption.

Japan

Accelerated regulatory routes

◉Japan uses conditional/regenerative medicine approvals to speed earlier patient access. Example: Sumitomo Pharma application (Aug 2025) for manufacturing/marketing for advanced Parkinson’s — exemplifies rapid translational intent.

Trial counts & localized pipelines

◉As of 6 Aug 2025 there were 49 Japan trials registered (stem cell as intervention) — modest but strategic, with government and corporate support.

UK & MEA / LATAM (contextual)

UK

◉High rare disease burden (3.5M living with rare diseases) and NHS policy (England Rare Diseases Action Plan 2025) can create supportive demand if cost-effectiveness demonstrated.

LATAM / MEA

◉Opportunities exist where private pay or medical tourism supports adoption; limited public reimbursement may slow broad access.

Market dynamics

Drivers

Expanding clinical pipeline

◉4,719 SCT trials (Feb 2025) — immense pipeline feeding future approvals; increased trial volume raises both innovation and future commercial voice.

Rising chronic & rare disease burden

◉Demand for curative/regenerative solutions (oncology, musculoskeletal, neurodegenerative, ophthalmic) fuels therapeutic need.

Public & private investment

◉National projects (RMIP, European initiatives), corporate investments and VC funding de-risk programs and scale manufacturing capacity.

Restraints

High treatment cost & affordability

◉Per-treatment costs ranging $5k–$50k and expanded cell products typically $15k–$30k limit market penetration in price-sensitive healthcare systems.

Manufacturing complexity & scalability

◉Autologous vs allogeneic manufacturing tradeoffs, cold chain requirements, and strict GMP/quality control increase COGS and operational risk.

Regulatory and long-term safety evidence requirements

◉Need for long-term follow-up (e.g., tumorigenicity, durability) can extend time to broad reimbursement.

Opportunities

Advances in genomics & gene editing

◉CRISPR and next-gen genomic tools enable gene-edited stem cell products (precision correction of monogenic disorders), potentially increasing efficacy and opening premium indications.

AI & digital biology

◉As earlier detailed, AI can meaningfully reduce cost and failure rates across R&D and manufacturing.

Allogeneic platforms and off-the-shelf products

◉Scalable, donor-derived allogeneic products (with immune engineering) can address cost and logistics versus autologous therapy, expanding addressable population.

Top companies

Abeona Therapeutics

◉Products / focus: Clinical-stage cell & gene therapies for severe genetic diseases.

◉Overview: Focuses on developing therapies that combine cell and gene technologies for orphan indications.

◉Strengths: Solid cash position as of full-year 2024 ($98.1M cash & equivalents), enabling continued clinical programs and supporting late-stage development and regulatory interactions.

Alloy Therapeutics

◉Products / focus: iPSC and cell platform technologies enabling cell engineering and manufacturing partnerships.

◉Overview: Provides next-gen iPSC platforms and collaborates with pharma for modality expansion (e.g., CAR-T/NK).

◉Strengths: Strategic collaboration capability — notable Alloy + Takeda (Nov 2024) partnership to develop iPSC-derived CAR-T/CAR-NK platforms.

Aspen Neuroscience, Inc.

◉Products / focus: Autologous cell therapies for neurodegenerative disease (e.g., Parkinson’s).

◉Overview: Specializes in personalized neuronal replacement approaches.

◉Strengths: Deep neurology focus and autologous technical know-how; well positioned for neurological indications where autologous cells reduce rejection risk.

Astellas Pharma

◉Products / focus: Broad pharma with cell therapy and regenerative medicine programs via acquisitions or partnerships.

◉Overview: Large pharma resources to push cell therapy into later-stage development and commercialization.

◉Strengths: Scale in global regulatory strategy, commercialization and payer relations.

Athersys

◉Products / focus: Mesenchymal/stem cell-based therapeutics for inflammatory/ischemic conditions.

◉Overview: Developer of off-the-shelf MSC platforms.

◉Strengths: Platform experience in MSC manufacturing and clinical development.

Bluebird Bio

◉Products / focus: Gene and cell therapies for genetic diseases and oncology (including CAR-T space historically).

◉Overview: Integrated cell & gene developer with experience in manufacturing and complex regulatory pathways.

◉Strengths: Gene therapy know-how and prior commercialization experience.

Caribou Biosciences

◉Products / focus: Genome-edited allogeneic cell therapies using CRISPR tools.

◉Overview: Focused on transformative genome editing for allogeneic cell products.

◉Strengths: Licensing & collaboration revenue (reported $10M in 2024) indicates translational partnerships and IP monetization ability.

Gamida Cell, Inc.

◉Products / focus: Hematopoietic stem cell therapies and cell expansion technologies.

◉Overview: Focus on enhancing engraftment and availability of donor cells.

◉Strengths: Technologies that address donor availability and graft performance.

IPS Heart

◉Products / focus: GIVI-MPCs for muscular dystrophy (Becker MD).

◉Overview: Developing muscle progenitor cell therapy that generates full-length dystrophin.

◉Strengths: FDA Orphan Drug Designation (Jan 2025) — regulatory incentives and higher commercial viability for rare disease target.

Pluristem Therapeutics

◉Products / focus: Placenta-derived cell therapies for ischemia, inflammatory conditions and beyond.

◉Overview: Off-the-shelf allogeneic cell therapeutics with specialty indications.

◉Strengths: Allogeneic manufacturing focus and platform scalability.

Sangamo Therapeutics

Products / focus: Gene editing and gene regulation platforms with cell therapy applications.

◉Overview: Combines gene editing/regulation with cell therapies for durable treatments.

◉Strengths: Deep gene editing IP and translational partnerships.

Takeda Pharmaceutical Co. Ltd.

◉Products / focus: Large pharma investing in cell therapy platforms (e.g., iPSC-derived CAR programs).

◉Overview: Uses partnerships (Alloy) to accelerate internal pipelines.

◉Strengths: Global commercialization reach and resources for large-scale launches.

Novo Nordisk (Center for Stem Cell Medicine)

◉Products / focus: iPSC research and pluripotent stem cell applications, especially in neurodegeneration.

◉Overview: Academic–industry leadership in iPSC translational research (CEO Melissa Little commentary on iPSC trials in Parkinson’s).

◉Strengths: Strong research leadership and commitment to pluripotent cell translation.

◉General note on strengths across leaders: companies either bring (a) platform IP (iPSC, CRISPR), (b) clinical execution experience in ATMPs, or (c) manufacturing scale/financial resources — the intersection of these determines near-term commercial success.

Latest announcements

IPS Heart — FDA Orphan Drug Designation (Jan 2025)

Implication: ODD provides development incentives (tax credits, potential market exclusivity) for GIVI-MPCs in Becker Muscular Dystrophy, increasing investor and regulatory attention and improving the product’s commercial attractiveness in a rare disease niche.

Zhongzhi Pharmaceutical investment in Gabaeron (Dec 2024)

Implication: $3M Series A funding targets translational work to move a preclinical Alzheimer’s stem cell therapy into Phase I — demonstrates investor appetite for neurodegenerative applications and the trend of targeted early-stage financing.

Alloy Therapeutics & Takeda collaboration (Nov 2024)

Implication: Co-development of iPSC-derived CAR-T and CAR-NK platforms signals large pharma using iPSC platforms to create off-the-shelf cell immunotherapies — scale and manufacturing synergies expected.

Canada’s investment in STEMCELL Technologies facility (July 2024)

Implication: Public funding to expand domestic regenerative medicine manufacturing capability — bolsters North American manufacturing capacity and national supply chains.

UC Davis CD34+ retinitis pigmentosa phase 1 results (Nov 2024)

Implication: Early positive human data (4 of 7 patients showing measurable improvements) highlights ophthalmic regenerative potential and provides a proof-of-concept for cell-based retinal therapies.

Saveetha Institute dengue study (Feb 2025)

Implication: Preclinical murine work showing stem cells flushing dengue virus and rescuing liver cells suggests non-traditional infectious disease applications for stem cells — but human translation is pending clinical trials.

Sumitomo Pharma regulatory application in Japan (Aug 2025)

Implication: Application for manufacturing and marketing authorization for an advanced Parkinson’s stem cell therapy in Japan signals commercial readiness in Asia and use of Japan’s accelerated/regenerative medicine pathways.

Recent developments

Therapeutic expansions & translational milestones

UC Davis CD34+ RP phase 1 signals measured vision improvements in a minority of treated patients — early clinical efficacy evidence broadens indication landscape beyond hematologic cancers.

Infectious disease exploratory use

Saveetha Institute preclinical dengue work (Feb 2025) suggests potential for cell therapies in viral clearance/organ protection; human trials would be the key next step.

Investment & partnership momentum

Multiple financing events (Zhongzhi → Gabaeron) and strategic collaborations (Alloy–Takeda) illustrate a flow of capital and know-how into iPSC and gene-enabled cell therapy platforms.

Regulatory and manufacturing enablement

Government investments and regulatory designations (ODD, approvals/conditional pathways in regions) are lowering translational friction and enabling earlier commercialization attempts.

Geopolitical/regulatory shifts

China’s 2024 lift on foreign investment restrictions and Japan’s active filing environment (Sumitomo, Aug 2025) illustrate regional policy shifts that open market entry and investment.

Segments covered

By Therapy Type

Allogeneic Stem Cell Therapies

Description: Donor-derived cells used across patients.

Implications: Provide off-the-shelf availability, potential for large batch manufacturing, lower per-patient lead times; immunogenicity and graft-vs-host issues must be mitigated (immune-engineering, HLA matching). Dominant in 2024 due to established hematopoietic uses and graft-versus-tumor benefits.

Autologous Stem Cell Therapies

Description: Patient’s own cells harvested and re-infused (often after manipulation/expansion).

Implications: Lower rejection risk and ethical advantages; higher per-patient manufacturing complexity and logistics; predicted significant growth due to improved automation and point-of-care processing.

Hematopoietic Stem Cell Therapies

Description: HSCs historically used for hematological malignancies and genetic blood disorders.

Implications: Well-established clinical precedent; remains a backbone commercial segment and source of protocol/quality experience.

Mesenchymal Stem Cell (MSC) Therapies

Description: MSCs used for immunomodulation, tissue repair.

Implications: Broad interest across inflammatory, cardiac, orthopedic indications; challenges include potency definition and batch variability.

BM, Blood & Umbilical Cord-derived Stem Cells

Description: Source-based segmentation reflecting common clinical sources.

Implications: Cord blood banks, bone marrow registries, and blood-derived products shape supply economics and donor availability.

Adipose-derived Cells

Description: Readily accessible source for autologous repair/regenerative uses (orthopedics, aesthetics).

Implications: Attractive for point-of-care therapies; regulatory clarity and standardization of processing remain important.

Others

Description: Includes tissue-specific/progenitor cells and emerging engineered cell types (iPSC derivatives, gene-edited stem cells).

Implications: High upside for novel indications but require stringent safety/efficacy demonstration.

By Therapeutic Application

Oncology — largest share in 2024 due to HSCs in hematologic cancers and CAR-T/engineered cell approaches. Oncology benefits from high unmet need and potential for curative outcomes.

Cardiovascular Disorders — regenerative myocardial repair approaches under active research; commercialization depends on durable functional gains.

Musculoskeletal Disorders — promising for tissue engineering, sports medicine; projected strong growth as regenerative orthopedics mature.

Others — neurological, ophthalmic, immunologic and infectious disease applications expanding through trials.

By Region (explained briefly)

North America — leadership in R&D, investment, and early commercialization.

Asia-Pacific — cost-competitive delivery, regulatory liberalization, and high patient volumes.

Europe — ATMP regulatory expertise and academic translational density.

LATAM / MEA — niche adoption driven by private pay and medical tourism.

Top 5 FAQs

-

Q: What is the current market size and projected growth for stem cell therapy?

A: The market was USD 490.0M in 2024, increased to USD 613.7M in 2025, and is projected to reach ≈ USD 4,777.4M by 2034, growing at a CAGR of 25.26% (2025–2034). -

Q: What is driving this very high projected CAGR?

A: Key drivers include a large and growing clinical pipeline (4,719 registered SCT trials as of Feb 2025), rising prevalence of chronic/rare diseases, regulatory initiatives (RMIP, European programs), strategic partnerships and investments, and advances in genomics/AI that improve R&D and manufacturing efficiency. -

Q: What are the main barriers to market growth?

A: High per-treatment costs (typical range $5k–$50k, expanded products $15k–$30k), manufacturing complexity and scalability limits, need for long-term safety/durability data, and payer/reimbursement hurdles in many healthcare systems. -

Q: Which regions lead and which will grow fastest?

A: North America led in 2024 (largest share, strong R&D & funding). Asia-Pacific is expected to grow fastest due to policy changes, large patient pools and lower treatment costs; Europe will expand with ATMP approvals and research density. -

Q: How will AI and genomics affect the stem cell therapy market?

A: AI/ML can optimize manufacturing (raise yield, lower variability), enable real-time quality control, accelerate discovery and biomarker identification for patient stratification, reduce trial sizes via predictive surrogate endpoints, and overall help reduce costs and failure rates — complementing genomics/gene editing to create more precise, safer, and scalable SCT products.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5451

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest