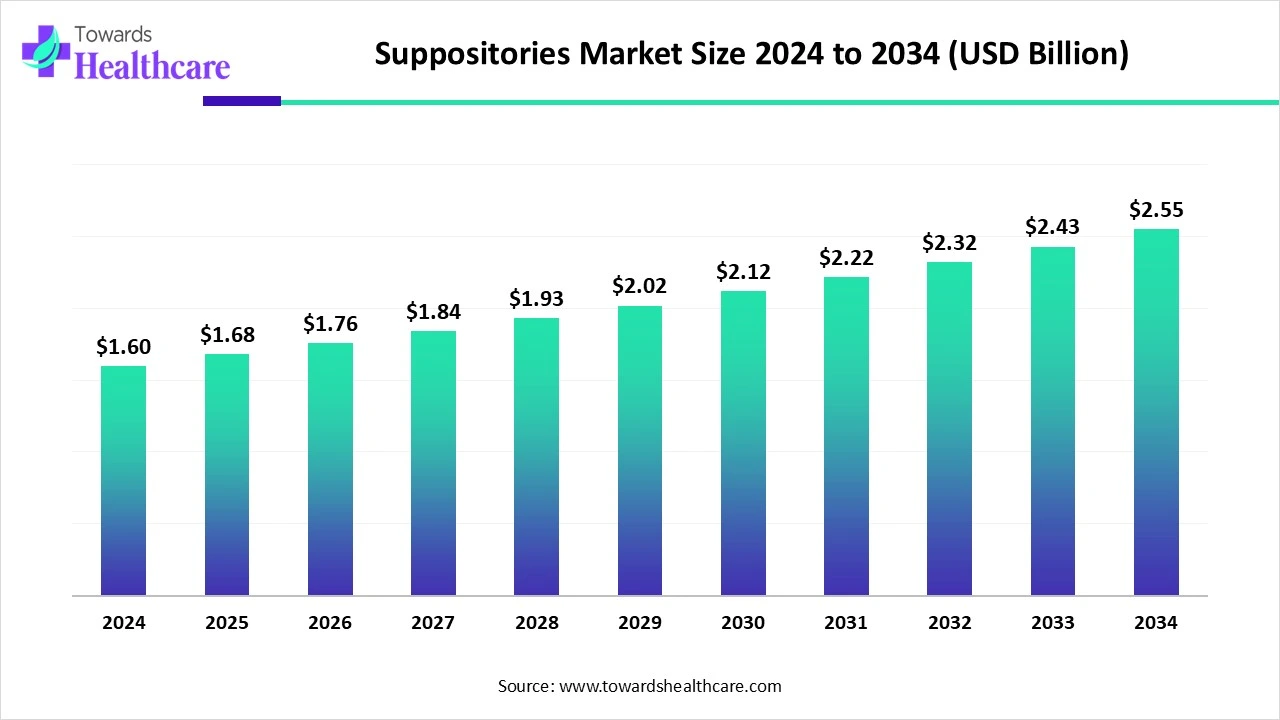

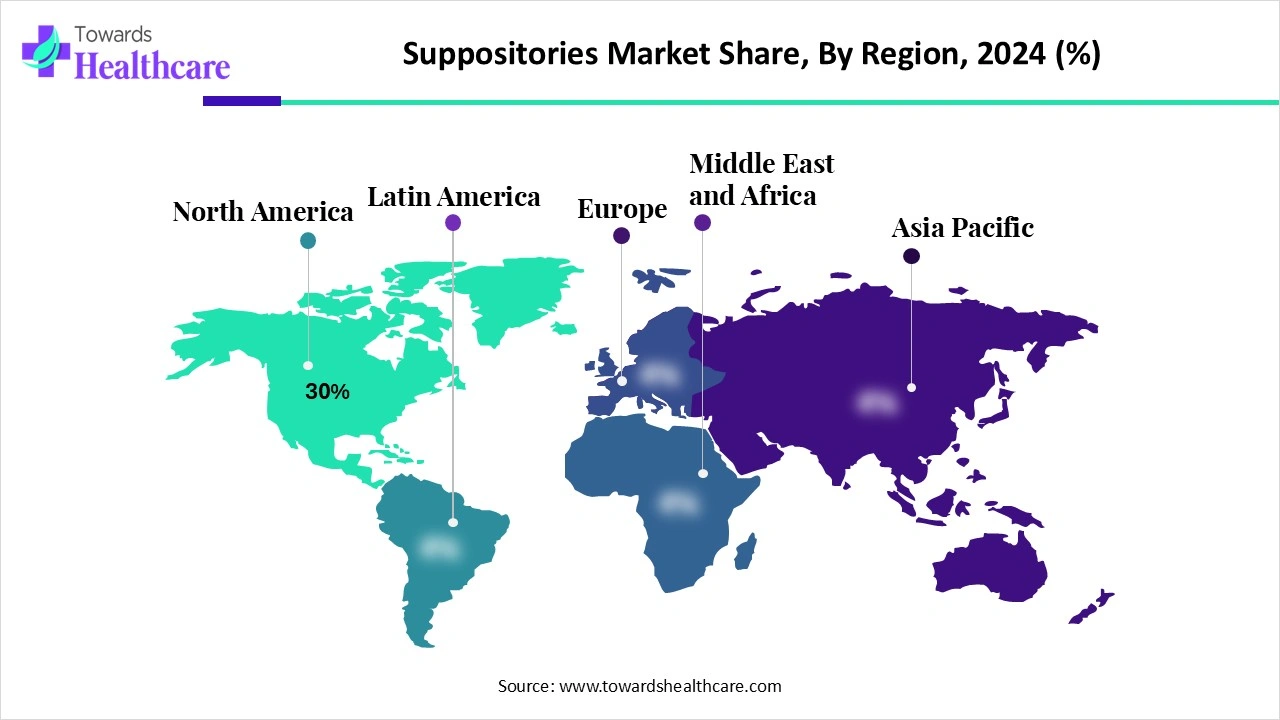

The global suppositories market was valued at USD 1.6 billion in 2024, increasing to USD 1.68 billion in 2025, and is projected to reach USD 2.55 billion by 2034, growing at a CAGR of 4.67% (2025–2034). Market expansion is driven by growing diseases, geriatric population, women’s health issues, rising awareness, and AI-driven innovations. North America led the market with 30% share in 2024, while Asia Pacific is expected to grow the fastest due to its expanding population base and healthcare access.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6033

Market Size Insights

◉2024 Market Size: USD 1.6 Billion

◉2025 Market Size: USD 1.68 Billion

◉2034 Projected Market Size: USD 2.55 Billion

◉Growth Rate: CAGR of 4.67% (2025–2034)

Regional Share (2024):

◉North America → 30%

◉Asia Pacific → Fastest growth during forecast period

Type Share (2024):

◉Rectal Suppositories → 55%

◉Vaginal Suppositories → Fastest growth expected

End User Share (2024):

◉Hospitals → 50%

◉Homecare settings → Fastest growth expected

Formulation Base (2024):

◉Cocoa butter-based → 45%

◉PEG-based → Fastest growth expected

Market Trends

Expanding Pipeline

◉Rising women’s health issues, aging population, and chronic diseases are pushing R&D.

◉Companies are developing herbal, probiotic, and thermostable suppositories.

◉Example: In June 2025, Ethypharm (France) announced the acquisition of a Mesalazine suppository from Shanghai Ethypharm Pharmaceuticals for targeted release treatment.

AI Integration in Development

◉Predicting drug-excipient compatibility.

◉Optimizing formulation and ingredient ratios.

◉Personalized pediatrics formulations.

◉Development of thermostable suppositories.

◉AI used in distribution forecasting and cold chain logistics optimization.

Mergers & Investments

◉Example: March 2025, LGM Pharma invested $6 million to expand its Texas facility for suppositories, suspensions, and semi-solid drugs.

Shift Toward Localized Drug Delivery

◉Reducing systemic side effects by targeting specific therapeutic areas like GI disorders, gynecology, and pain management.

Rising Acceptance of CBD & Plant-Based Suppositories

Example: In June 2025, CBD Life Sciences Inc. launched CBD-infused rectal/vaginal suppositories for endometriosis, GI discomfort, menstrual cramps, and pelvic pain.

AI Impact on the Suppositories Market

Formulation Optimization

◉AI predicts compatibility between active drug and excipients.

◉Reduces trial-and-error costs in R&D.

Personalized Medicine

◉AI enables customized pediatric suppositories for better dosing.

◉Can also optimize hormone/cancer suppositories for targeted therapies.

Thermostable Development

◉AI models simulate temperature resistance for storage in regions lacking cold-chain.

Clinical Trials & Patient Data

◉AI analyzes trial data faster, identifying the most promising formulations.

Demand Forecasting & Distribution

◉Predicts regional demand spikes.

◉Optimizes cold-chain logistics for international distribution.

Regional Insights

North America (30% Market Share in 2024 – Leading Region)

◉North America held the largest share (30%) in 2024, driven by advanced R&D capabilities and the presence of key global pharmaceutical companies.

🔹 U.S. Market Trends

◉Women’s Health Focus → Increasing demand for vaginal suppositories in gynecological disorders, fertility treatments, and infections.

◉CBD Integration → Growing use of CBD-based rectal/vaginal suppositories for pain management, endometriosis, and pelvic floor dysfunction.

◉Strong R&D Investments → U.S. companies are at the forefront of clinical trials and innovations in excipients for improved bioavailability.

🔹 Canada Market Trends

◉Plant & Cannabis-Based Products → Canadian firms are adopting herbal and cannabis-based suppositories for hormonal therapies and analgesics.

◉Natural & Probiotic Formulations → Focus on paraben-free and vaginal probiotics to meet rising consumer demand for safer alternatives.

◉Regulatory Support → Favorable regulations on cannabis-based healthcare solutions are boosting growth.

Asia Pacific (Fastest Growing Region)

◉Asia Pacific is projected to be the fastest-growing market during 2025–2034, driven by demographic shifts and healthcare expansion.

🔹 Growth Drivers

◉Pediatric & Geriatric Boom → High adoption due to difficulty swallowing oral medications among children and the elderly.

◉Rising Gynecological Awareness → Increased use of vaginal suppositories for infections, hormone therapies, and fertility support.

◉Healthcare Expansion → Rapidly growing hospital infrastructure and pharmaceutical manufacturing capacity in countries such as China, India, and Japan.

🔹 Country-Level Insights

◉China → Strong government push for R&D in pharmaceuticals and localized drug delivery systems.

◉India → Growing demand for affordable suppositories, with domestic pharma players expanding portfolios.

◉Japan → Aging population is accelerating demand for rectal suppositories in palliative and gastrointestinal care.

Europe

◉Europe remains a significant market, with strong focus on innovation in excipients and formulation bases.

🔹 Key Trends

◉Innovation in Excipients → European firms are leading in controlled-release and mucoadhesive suppositories.

◉Strategic Acquisitions → Companies like Ethpharm (France) and Recordati (Italy) are expanding their suppository pipelines through M&A.

◉Women’s Health Focus → Europe continues to emphasize vaginal suppositories for gynecology and fertility-related care.

Latin America & Middle East & Africa (MEA)

Both Latin America and MEA are emerging markets with strong future growth potential.

🔹 Latin America

◉Brazil & Mexico → Increasing demand for affordable rectal and vaginal suppositories.

◉Rising Healthcare Access → Expansion of hospital networks and retail pharmacies is boosting availability.

🔹 MEA

◉South Africa & GCC Nations → Gradual adoption of suppositories in palliative care and infectious disease management.

◉Barriers → Limited awareness and cultural hesitancy still restrict widespread adoption.

Market Dynamics

🔹 Drivers

◉Growing Palliative Care Needs

◉Suppositories are vital for patients who cannot swallow (nausea, vomiting, unconsciousness).

◉Provide targeted and sustained release, essential in chronic illnesses.

Adoption in Chronic & Terminal Diseases

◉Increasing use among neurodegenerative and cancer patients.

◉Growth of homecare settings fueling adoption.

Geriatric & Pediatric Applications

◉Easier administration vs. oral medication.

◉Enhances compliance in these patient groups.

🔹 Restraints

Low Patient Acceptance

◉Discomfort in rectal/vaginal insertion creates psychological barriers.

Lack of Awareness

◉Many patients and practitioners are unfamiliar with suppositories as alternatives to oral dosage forms.

🔹 Opportunities

Controlled-Release Innovations

◉Development of suppositories with longer action & enhanced bioavailability.

Thermostable Formulations

◉Useful in tropical regions with limited cold chain logistics.

Hormonal & Cancer Applications

◉Research into suppositories delivering hormones, seizure medications, and cancer drugs.

◉Example: Cristcot (Jan 2025) completed Phase III trial of hydrocortisone suppository for ulcerative colitis, proving effectiveness in rectal bleeding control & remission enhancement.

Top Companies

1 Pfizer Inc.

Overview: Global pharma leader with broad therapeutic reach.

Strengths: Strong R&D, worldwide distribution, diversified product portfolio.

2 GlaxoSmithKline (GSK)

Overview: Focus on women’s health and infectious diseases.

Strengths: Innovation in formulations, strong gynecology product line.

3 Ferring Pharmaceuticals

Overview: Specialist in reproductive health.

Strengths: Niche focus on vaginal and fertility-related suppositories.

4 Teva Pharmaceuticals

Overview: Leading generics manufacturer.

Strengths: Cost-effective suppository products, broad accessibility.

5 Novartis AG

Overview: Multinational with strong research orientation.

Strengths: Multi-therapeutic application coverage, innovative drug delivery.

6 Johnson & Johnson

Overview: Diversified healthcare giant.

Strengths: Global scale, trusted brand, extensive hospital networks.

(Other significant players: Cipla, Sanofi, Abbott, Lupin, Sun Pharma, Astellas, Boehringer Ingelheim, etc.)

Latest Announcement

September 2024 – O Positiv Health

◉Introduced URO Boric Acid Vaginal Suppository.

Composition: Boric acid + lactic acid + soothing aloe.

◉Purpose: Addresses urgent vaginal health needs with maximum efficacy and comfort.

Recent Developments

August 2025 – pH-D Feminine Health

◉Initiated Phase 3 clinical trial for boric acid suppositories in yeast infections.

◉Targeting NDA submission.

June 2025 – CBD Life Sciences Inc.

◉Launched CBD-infused suppositories for menstrual cramps, endometriosis, GI issues, pelvic pain.

June 2025 – Ethypharm

◉Acquired Mesalazine suppository asset from Shanghai Ethypharm for targeted GI therapy.

March 2025 – LGM Pharma

◉Invested $6 million in Texas facility to expand capacity for suppositories, suspensions, semi-solid drugs.

Segments Covered

By Type

Rectal Suppositories (55% Market Share in 2024 – Dominant Segment)

◉Widely used for analgesics, laxatives, and anti-inflammatory drugs.

◉Preferred for patients who cannot take oral medications due to nausea, vomiting, or difficulty swallowing.

◉Significant usage in palliative care and geriatric patients.

Vaginal Suppositories (Fastest-Growing Segment)

◉Increasing demand driven by women’s health awareness and rising cases of infections, hormonal imbalance, and use of probiotics.

◉Expanding applications in contraceptives, antifungals, and hormone replacement therapy.

Urethral Suppositories (Niche Applications)

◉Limited but important usage in erectile dysfunction and specific urological conditions.

◉Small market share but potential for innovation in niche therapeutics.

By End User

Hospitals (50% Market Share in 2024 – Leading Segment)

◉Primary adoption due to emergency cases, oncology care, and palliative medicine.

◉Suppositories are preferred when patients are unconscious, vomiting, or unable to swallow oral drugs.

Clinics & Pharmacies

◉Act as secondary distribution channels, ensuring accessibility for outpatient treatments.

◉Growing use in OTC laxatives, antifungals, and pain management.

Homecare Settings (Fastest-Growing Segment)

◉Rising adoption due to chronic disease management and increasing preference for self-administration.

◉Growing demand in developed and aging populations.

By Formulation Base

Cocoa Butter-Based (45% Market Share in 2024 – Dominant Segment)

Fast-melting properties ensure quick drug release.

◉Traditionally used due to biocompatibility and patient compliance.

◉High adoption in developing and developed markets.

Polyethylene Glycol (PEG)-Based

◉Allows for controlled and sustained drug release.

Offers better stability across temperature variations, reducing storage challenges.

◉Increasingly preferred for specialized therapeutic applications.

Glycerinated Gelatin-Based

◉Smaller market share due to limited patient acceptance.

◉Primarily used for long-acting medications and in niche pharmaceutical formulations.

By Region

North America (30% Market Share – Leading Region)

◉High adoption driven by advanced healthcare infrastructure and strong presence of pharmaceutical companies.

◉Rising use in oncology, geriatrics, and palliative care.

Asia Pacific (Fastest-Growing Region)

◉Growth fueled by expanding healthcare access, increasing awareness, and rising women’s health initiatives.

◉Major opportunities in India, China, and Southeast Asia.

Europe (Strong Innovation Hub)

◉Known for advanced R&D, regulatory support, and novel formulations.

◉Widespread adoption in Germany, UK, and France.

Latin America & Middle East & Africa (Emerging Markets)

◉Increasing adoption due to improved healthcare infrastructure.

◉Growing demand for affordable generics and OTC products.

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6033

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest