The global veterinary CRO (Contract Research Organization) and CDMO (Contract Development and Manufacturing Organization) market is experiencing robust expansion. Valued at USD 7.17 billion in 2024, the market is expected to grow to USD 7.77 billion in 2025 and is projected to reach approximately USD 16.13 billion by 2034, at a CAGR of 8.43% during 2025–2034.

This growth is fueled by rising pet ownership, heightened demand for animal healthcare, and increasing outsourcing by pharmaceutical companies aiming for cost efficiency and regulatory compliance. Technological advancements and expanding veterinary clinical trials further support this upward trajectory.

Key Takeaways at a Glance

-

Market Size (2024): USD 7.17 billion

-

Projected Size (2034): USD 16.13 billion

-

CAGR (2025-2034): 8.43%

-

North America Share (2024): 40–45%

-

Fastest Growing Region: Asia-Pacific

-

Dominant Service Type (2024): Contract Manufacturing Services (Oral dosage forms lead with 28–32% share)

-

Top Product (2024): Pharmaceuticals (38–42% market share)

-

Leading Animal Segment: Companion Animals (Dogs sub-segment holds 30–40% revenue share)

Top Veterinary CRO and CDMO Companies Shaping the Market

1. Argenta

About: Argenta is a leading global veterinary CRO and CDMO specializing in end-to-end animal health solutions. Headquartered in New Zealand, it provides R&D, manufacturing, and clinical trial services.

Products: Veterinary pharmaceuticals, biologicals, and nutritional products.

Market Cap: Estimated privately held with annual revenues exceeding USD 200 million.

2. Aurigon Life Science

About: Aurigon Life Science offers contract research and regulatory services tailored for veterinary pharmaceuticals. It serves global animal health companies with a focus on regulatory compliance.

Products: Toxicology, bioanalytics, and regulatory affairs services.

Market Cap: Privately owned, with significant European market presence.

3. Avacta Animal Health

About: A division of Avacta Group, this UK-based company specializes in diagnostics and therapeutic development for animal health.

Products: Immunodiagnostic tests, allergy testing kits, and therapeutic antibodies.

Market Cap: Approx. USD 200–250 million (Avacta Group plc).

4. Charles River Laboratories

About: This global CRO giant offers a dedicated veterinary division providing preclinical and clinical support for animal health products.

Products: Safety assessment, bioanalysis, and veterinary clinical trial management.

Market Cap: ~USD 12 billion (NYSE: CRL).

5. Elanco Contract Manufacturing

About: Part of Elanco Animal Health, it offers contract manufacturing solutions for veterinary pharmaceuticals worldwide.

Products: Vaccines, oral medications, and injectable drugs for companion and livestock animals.

Market Cap: ~USD 10 billion (NYSE: ELAN).

6. Lonza (Veterinary Biologics CDMO Division)

About: Lonza’s veterinary biologics division provides contract development and manufacturing services for complex veterinary biologics.

Products: Veterinary vaccines, monoclonal antibodies, and advanced therapies.

Market Cap: ~USD 30 billion (SIX: LONN).

7. Huvepharma

About: Huvepharma is a global pharmaceutical company with a strong focus on animal health and nutrition products.

Products: Antimicrobials, anticoccidials, and nutritional supplements.

Market Cap: Estimated at USD 1.5 billion (private company).

8. Phibro Animal Health CDMO Services

About: A well-known animal health company offering CDMO services in addition to its extensive veterinary product line.

Products: Veterinary vaccines, medicated feed additives, and nutritional specialty products.

Market Cap: ~USD 1.1 billion (NASDAQ: PAHC).

Emerging Trends in Veterinary CRO and CDMO Market

-

Increased Outsourcing: Pharmaceutical companies prefer CRO/CDMOs for cost-effective R&D and manufacturing.

-

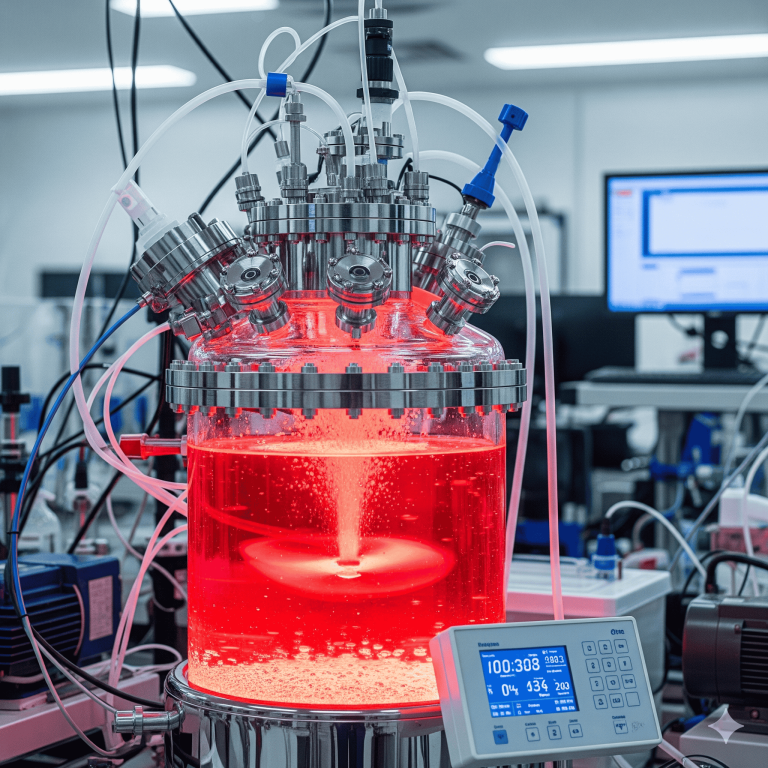

Growth in Biologics: Rising demand for veterinary biologics like vaccines and monoclonal antibodies.

-

Digital Integration: Use of AI and big data in veterinary clinical trials.

-

APAC Expansion: Rapid growth in Asia-Pacific due to increasing pet care spending and livestock farming.

Request a customized case study tailored to your business needs and gain deeper insights

into healthcare market strategies: sales@towardshealthcare.com

Frequently Asked Questions (FAQs)

1. What is driving the growth of the veterinary CRO and CDMO market?

Increased pet ownership, rising zoonotic disease concerns, and pharmaceutical outsourcing to enhance efficiency are key drivers.

2. Which region dominates the veterinary CRO and CDMO market?

North America leads the market with over 40% share in 2024, while Asia-Pacific is the fastest-growing region.

3. What are the leading service types in this market?

Contract manufacturing services dominate, with oral dosage forms being the largest sub-segment.

4. Who are the top players in the veterinary CRO and CDMO market?

Argenta, Charles River Laboratories, Lonza, Huvepharma, and Phibro Animal Health are among the top companies.

5. What is the projected CAGR for the veterinary CRO and CDMO market?

The market is expected to grow at a CAGR of 8.43% from 2025 to 2034.

Source : https://www.towardshealthcare.com/insights/veterinary-cro-and-cdmo-market-sizing

Invest in Our Premium Strategic Solution: https://www.towardshealthcare.com/price/5873