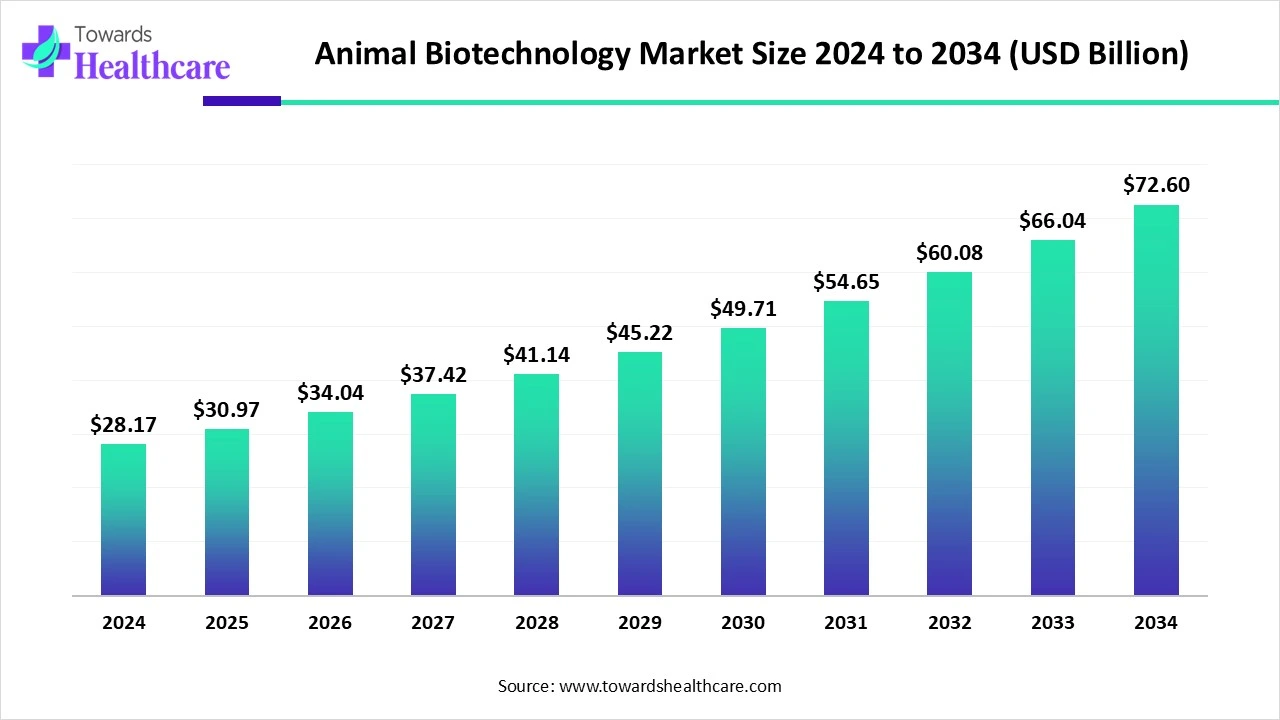

The global animal biotechnology market was USD 28.17 billion in 2024, rose to USD 30.97 billion in 2025, and is forecast to reach USD 72.6 billion by 2034 — expanding at a CAGR of 9.93% (2025–2034) as vaccines, genetic engineering and recombinant DNA technologies, plus rising demand for animal proteins and stronger animal-health R&D, drive the growth.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/5849

Market Size

Headline figures

●2024: USD 28.17 billion (reported/estimated).

●2025: USD 30.97 billion (reported/estimated).

●2034 (projection): USD 72.6 billion.

Growth trajectory & math check

●Reported CAGR for 2025–2034 = 9.93%.

2024 → 2034 absolute increase

●Increase from 2024 (USD 28.17B) to 2034 (USD 72.6B) ≈ USD 44.43 billion incremental market value over the decade.

Component contributions to size

●Vaccines were the dominant revenue contributor in 2024 (largest single product-type share).

●Genetic engineering and recombinant DNA technologies are major growth engines — genetic engineering led in 2024 and recombinant DNA is expected to grow fastest during the forecast window.

●Animal types: Livestock dominated overall value in 2024; aquaculture is the fastest growth animal type.

Regional contribution / concentration

●North America dominated in 2024 (largest regional share).

●Asia Pacific projected to show the fastest CAGR through the forecast period.

End-user & buyer mix impact on size

●Veterinary clinics were the dominant end-user segment in 2024 (stable, recurring demand).

●Biopharmaceutical companies are the fastest-growing end-user group (scaling R&D, biopharming and therapeutic pipelines).

Why size is expanding (summary)

●Rising global demand for animal protein, increasing regulatory & industry investments in animal health R&D, vaccine adoption, growth of precision breeding/gene-editing, and expanded diagnostics & molecular tools.

Market Trends

Capital & funding acceleration (2024–2025)

●Animab’s EUR 10M Series B (July 2025) — signals investor interest in oral antibody therapeutics for production animals.

●Colossal Biosciences $200M Series C (Jan 2025) — signals large-scale interest (and controversy) in advanced genetic engineering/de-extinction tech.

Vaccine innovation & rollouts

●Vaccines dominate revenue (2024). National/regional launches — e.g., Biovet (Bharat Biotech group) launched a novel vaccine to prevent lumpy skin disease (LSD) in May 2025 — demonstrates continued investment in veterinary biologics.

Diagnostics upgrading

●Focus on molecular and immunodiagnostics: new ELISA kits (Ringbio July 2024) and NIAB’s antibiotics detection diagnostics (Sept 2024) show active diagnostics innovation and food-safety focus.

Consolidation & industrial expansions

●Example: Elanco invested >USD 130 million (Aug 2024) to expand U.S. biologics production — reflects capacity build-out for veterinary biologics.

AI & data driving biotech pipelines

●AI/ML increasingly woven into genetic optimization, disease prediction, imaging and diagnostics (see detailed AI section later).

Regulatory & surveillance emphasis

●UK’s £10M (May 2025) genomics funding (GAP-DC) to strengthen pathogen surveillance underscores the role of genomics in animal/plant biosecurity.

Shift toward sustainable / welfare-oriented biotech

●Consumer pressure on environment and ethics is driving investment into animal-friendly methods, immuno-castration, and welfare-oriented biotech solutions.

Precision breeding & CRISPR adoption

●Gene editing is moving from R&D toward practical productivity and disease-resistance use cases — identified as a top growth opportunity.

Aquaculture & geographic shifts

●Rapid growth in aquaculture biotech (fastest growing animal type) — tied to China’s large aquaculture scale (noted per-capita and tonnage numbers).

Commercialization of transgenic and biopharming

●Expansion of transgenic animal research and biopharming (drug production in animals) driven by pharma interest and biopharmaceutical company involvement.

AI impacts / roles in Animal Biotechnology Market

Genomic selection & predictive breeding

●What: ML models analyze genomic markers + phenotypic data to predict desirable breeding outcomes.

●Benefit: Faster selection for disease resistance, higher feed conversion or improved milk/meat traits; reduces generation time.

●Considerations: Needs high-quality genomic + phenotype datasets, privacy/ownership rules for genetic data.

Gene-editing target discovery

●What: AI prioritizes candidate genes/variants for CRISPR or other edits by integrating multi-omics data.

●Benefit: Speeds discovery of targets that confer disease resistance or productivity traits.

●Considerations: False positives; regulatory scrutiny for edited animals.

Disease surveillance & early outbreak detection

●What: ML flags anomalies in veterinary clinic reports, sentinel farms, environmental sequencing (genomics), and supply-chain signals.

●Benefit: Faster containment, reduced economic losses.

●Considerations: Requires real-time data feeds, cross-jurisdiction data sharing.

Diagnostic interpretation (image & sequence analysis)

●What: AI analyzes microscopic images, pathology slides, or NGS reads to produce rapid, standardized diagnostics.

●Benefit: Faster, more consistent lab outputs (complements ELISA/PCR tests).

●Considerations: Validation datasets and regulatory acceptance.

Vaccine design and optimization

●What: ML helps predict antigenic epitopes, optimize formulations and adjuvant selection.

●Benefit: Shorter R&D cycles for vaccines tailored to circulating strains.

●Considerations: Wet-lab validation needed; dataset biases.

Precision dosing & treatment recommendation engines

●What: AI uses animal weight, physiology, disease risk and pharmacokinetics to suggest personalized dosing.

●Benefit: More effective therapy, reduced resistance risk, improved safety.

●Considerations: Liability and regulatory approval for automated dosing guidance.

Phenotyping automation on farms

●What: Computer vision + sensors measure gait, feeding, behavior, and feed conversion in real time.

●Benefit: Early welfare/disease detection and optimization of management strategies.

●Considerations: Sensor costs, connectivity in remote farms.

Supply-chain optimisation & traceability

●What: AI optimizes logistics for biologics, cold-chain vaccines and diagnostics; integrates traceability for food safety.

●Benefit: Reduced spoilage, faster delivery of perishable biotech products.

●Considerations: Integration with existing logistic systems and regulatory traceability requirements.

R&D automation & lab informatics

●What: ML orchestrates experiment design, automates data capture/analysis and helps prioritize experiments in transgenic research and biopharming.

●Benefit: Reduced bench time, higher R&D throughput (addresses the “manual data” gap some companies cited).

●Considerations: Requires lab digitization (lab-information management systems, standardized formats).

Regulatory compliance, risk modeling & ethics checks

●What: AI helps model ecological and zoonotic risk scenarios of modified animals and aids documentation for regulatory submissions.

●Benefit: Improves risk assessment rigor and shortens regulatory review time if accepted.

●Considerations: Models must be transparent and auditable to be useful for regulators.

Regional insights

North America (dominant in 2024)

R&D & commercial scale

●Explanation: Strong R&D ecosystems, large animal-health firms (e.g., listed top players), and capital markets support both biotech startups and scale-ups.

●Example from data: Elanco invested >USD 130M (Aug 2024) to expand US biologics production — shows manufacturing capacity expansion.

Regulatory & institutional support

●Explanation: Active regulatory agencies and government programs drive adoption of diagnostics and biologics, enabling commercialization.

Market dynamics

●High veterinary clinical penetration → strong recurring demand for vaccines/diagnostics and premium therapeutics.

Asia Pacific (fastest CAGR expected)

Demand drivers

●Rapid growth in middle-class incomes, increasing pet ownership, and rising animal-protein consumption.

Aquaculture prominence

●China stats cited: per-capita aquatic product consumption reached 50.48 kg (2023); China produced 23.95 million tons of marine aquaculture (2023) — heavy demand for aquaculture biotech.

Local innovation

●Local companies (e.g., Ringbio ELISA kit July 2024) and national programs accelerate deployment.

Regulatory & infrastructure variability

●Opportunity & challenge: markets differ widely by country (China, India, Japan, South Korea, Thailand), so commercialization strategies must be localized.

Europe

Regulation & welfare focus

●Explanation: Strong emphasis on animal welfare, sustainability and rigorous regulation – favorable to high-quality vaccines, diagnostics and welfare-oriented biotech.

Government funding & surveillance

●Example: UK £10M (May 2025) Gap-DC genomics funding for pathogen surveillance — demonstrates public investment in genomics.

India

Large cattle population & dependency

●Explanation: India has the world’s largest cattle population and animal husbandry supports two-thirds of rural population — strong domestic demand for vaccines, reproduction technologies and diagnostics.

Government R&D funding areas

●Focus areas: transgenic animal development, reproduction, genome characterization of native breeds, vaccines, diagnostics and transgenesis-based biopharma.

China

Aquaculture & food security

●Huge aquaculture scale (see China stats above) → major market for vaccines, diagnostics and feed-efficiency biotech.

Domestic R&D

●Local product launches (e.g., ELISA test kits) indicate growing domestic capabilities.

Canada

Veterinary services & market structure

●Data: >28 million pets may demand care; ~6,080 veterinary-industry companies — large service base that sustains demand for diagnostics and clinic-level biotech.

Latin America & MEA (summary)

Opportunity areas

●Large livestock sectors, expanding demand for productivity tools and vaccines.

Infrastructure & regulatory variability require tailored entry strategies.

Market Dynamics

Drivers

Rising demand for animal products

●Global population growth and higher incomes increase demand for meat, dairy and aquaculture, which drives adoption of biotech to raise productivity and food safety.

Technological advances

●CRISPR, recombinant DNA, NGS/PCR diagnostics and improved vaccine platforms increase product efficacy and lower time-to-market.

Investment and capacity expansion

●Significant corporate investments (e.g., Elanco’s US expansion) and private funding (Animab, Colossal) accelerate commercialization.

Public health & food-safety concerns

●Need to control zoonoses, antibiotic residues and ensure safe protein supply increases demand for diagnostics and biologics.

Restraints

Ethical concerns & public acceptance

●Genetic modification and de-extinction work triggers ethical debates; consumer resistance and regulatory hurdles can slow adoption.

Regulatory complexity

●Multiple, sometimes inconsistent regulations across regions increase time and cost to commercialize genetically engineered animals and some biopharmaceuticals.

Data & infrastructure gaps

●Adoption of AI and advanced diagnostics requires digitized farm data and lab capacity, which is uneven globally.

Opportunities

Precision breeding & gene editing

●CRISPR and precision breeding offer clear productivity and environmental footprint reductions — major commercial upside.

Vaccines & recombinant biologics

●Continued demand for safe, scalable vaccines and recombinant therapeutics (monoclonals, proteins) for livestock and companion animals.

Aquaculture biotechnology

●Rapidly growing aquaculture market open to vaccines, diagnostics, and nutrition biotech.

AI-enabled diagnostics & farm analytics

●AI allows scaling diagnostics and early disease detection—reduces loss and improves welfare.

Structural & competitive dynamics

Consolidation & spinouts

●Large pharma divestitures (Bayer → Elanco note) and spin-outs (Zoetis split from Pfizer historically noted in your content) concentrate expertise and capital in specialist animal health players.

Partnerships & cross sector collaboration

●Collaborations between biotech, pharma, agtech and data firms accelerate product development (examples in funding and expansion).

Top Leading Companies

Zoetis Inc.

●Products: Veterinary vaccines, pharmaceuticals, diagnostics, biologics.

●Overview: Global leader focused exclusively on animal health (named in your list).

●Strengths: Broad product portfolio across companion and production animals; deep distribution channels and R&D pipeline.

Merck Animal Health

●Products: Vaccines, parasiticides, therapeutics and diagnostics.

●Overview: Big-pharma animal health division with global reach.

●Strengths: Large R&D base, regulatory experience and global commercialization capability.

Elanco Animal Health

●Products: Veterinary biologics, pharmaceuticals, vaccines and production-animal solutions.

●Overview: Major animal health player that has expanded manufacturing (noted USD 130M+ investment Aug 2024).

●Strengths: Manufacturing capacity, large commercial footprint, acquisitions/consolidation history (includes Bayer Animal Health assets).

Boehringer Ingelheim Animal Health

●Products: Vaccines, parasiticides, animal therapeutics.

●Overview: Large, research-intensive firm in veterinary biologics.

●Strengths: Strong vaccine R&D and broad international presence.

Ceva Santé Animale

●Products: Vaccines, parasiticides, biologics and diagnostics for livestock and companion animals.

●Overview: Focused animal health company with global commercialization.

●Strengths: Strong in production-animal vaccines and field services.

Virbac

●Products: Pharmaceuticals, vaccines and nutritional products for companion and production animals.

●Overview: Specialist animal health company.

●Strengths: Niche product strengths and longstanding vet relationships.

IDEXX Laboratories

●Products: Veterinary diagnostics (ELISA, immunodiagnostics), lab services and analytics.

●Overview: Diagnostics leader in clinic/lab testing (appears in your list).

●Strengths: Wide diagnostics footprint in veterinary clinics and strong test portfolio.

Thermo Fisher Scientific

●Products: Lab equipment, molecular diagnostics platforms, reagents and analytical instruments used across animal biotech R&D and diagnostics.

●Overview: Major supplier of laboratory infrastructure to the sector.

●Strengths: Global supply chain and instrument/service ecosystem enabling diagnostics and R&D workflows.

Genus PLC

●Products: Genetics and breed improvement services (e.g., bovine/pork genetics).

●Overview: Specialist in animal genetics and selective breeding.

●Strengths: Proprietary genetic lines, breeding programs and commercial scale for livestock genetics.

Neogen Corporation

●Products: Food and animal safety diagnostics, ELISA kits, molecular tests and feed safety products.

●Overview: Focus on food-safety and animal diagnostics with commercial test kits (listed in your list).

●Strengths: Diagnostics + food-safety product portfolio that serves processors and farms.

Latest announcements

Animab EUR 10M Series B (July 2025)

●Announcement: Animab closed EUR 10 million Series B to advance oral antibody therapeutics for production animals.

●Implication: Investor appetite for non-antibiotic biologics for production animals — signals commercialization potential for oral immunotherapies and alternatives to antibiotics.

Colossal Biosciences $200M Series C (Jan 2025)

●Announcement: TWG Global and others provided $200M Series C; Colossal positions itself as a de-extinction/genetic engineering firm.

●Implication: High-risk, high-profile capital flows into advanced genetic engineering; raises technical, ethical and regulatory debates but also accelerates platform development.

Elanco USD 130M+ production expansion (Aug 2024)

●Announcement: Investment to expand Kansas biologics manufacturing by 25,000 sq ft.

●Implication: Increased biologics capacity (vaccines/biologics) — better supply resilience, scale for domestic demand.

UK £10M genomics funding (May 2025)

●Announcement: Funding for the Genomics for Animal and Plant Disease Consortium (GAP-DC) to boost pathogen surveillance.

●Implication: Stronger pathogen genomics surveillance capabilities will help early detection and containment — benefits both animal health and food security.

Biovet (Bharat Biotech group) LSD vaccine launch (May 2025)

●Announcement: Novel lumpy skin disease vaccine introduced in Andhra Pradesh.

●Implication: Regionally relevant vaccines addressing livestock disease; shows rapid translation of biotech to local needs.

NIAB diagnostics achievement (Sept 2024)

●Announcement: New diagnostic methods to detect antibiotics in animal food samples.

●Implication: Stronger food safety control and compliance tools; helps manage antibiotic residue concerns.

Ringbio ELISA test kit (July 2024)

●Announcement: ELISA kit for Brucella strain detection across multiple species.

●Implication: Local diagnostic innovation improving zoonosis detection systems.

Olden Labs commentary (May 2024)

●Observation: Animal research R&D is still manually recorded in many labs; need for digitization and modern workflows.

●Implication: A clear market opportunity for lab digitization, data platforms, and AI-enabled R&D tools.

Recent developments

Vaccine & biologics commercialization (Biovet / Elanco expansion)

●Implication: Faster deployment of animal vaccines and increased production capacity.

Diagnostics & food-safety tools (NIAB, Ringbio, Neogen presence)

●Implication: Stronger detection tools across food and animal supply chains; improves compliance and export readiness.

Funding into next-generation therapeutics (Animab, Colossal)

●Implication: Capital is available for novel biologics and high-tech genetic ventures; expect more clinical/field trials and partnerships with incumbents.

Public genomics surveillance programs (UK GAP-DC)

●Implication: Public investment in pathogen genomics will reduce outbreak risk and support more targeted vaccination strategies.

Calls for digitization (Olden Labs)

●Implication: Upside for companies offering LIMS, image analytics, and ML pipelines for animal R&D.

Segments covered

By Product Type

Vaccines

●Types: Live attenuated, inactivated, DNA vaccines, recombinant vaccines.

●Role: Primary prevention for endemic and epidemic animal diseases; dominant revenue source in 2024.

●Key issues: Safety, cold-chain, strain coverage, and cost per dose.

Diagnostics

●Subtypes: Immunodiagnostics (ELISA, lateral flow), molecular diagnostics (PCR, qPCR), biosensors.

●Role: Disease surveillance, antibiotic-residue testing, and food-safety screening.

Therapeutics

●Subtypes: Monoclonal antibodies, recombinant proteins, novel small molecules.

●Role: Treatment of infectious and chronic conditions; biopharmaceuticals for companion animals and high-value production animals.

Genetic Engineering

●Subtypes: Transgenic animals, gene-editing tools (CRISPR, TALEN).

●Role: Create traits (disease resistance, productivity) and biopharming (therapeutic protein production).

Reproductive Technologies

●Subtypes: Artificial insemination (AI), embryo transfer (ET), in-vitro fertilization (IVF), somatic cell nuclear transfer.

●Role: Accelerate genetic improvement and breed propagation.

Nutrition-based Biotechnology

●Subtypes: Probiotics, enzymes, nutritional genomics.

●Role: Improve feed conversion, gut health and reduce antibiotic use.

By Animal Type

●Livestock (cattle, sheep, pigs) — largest market share in 2024; drivers include meat/dairy demand.

●Poultry (chickens, turkeys) — high throughput sector with vaccine/diagnostic needs.

●Companion animals (dogs, cats) — rising pet adoption increases premium therapeutics and diagnostics demand.

●Aquaculture (fish, shrimp) — fastest-growing animal type; key for feed efficiency, vaccines and diagnostics.

●Other (horses, rabbits) — niche but high-value segments.

By End-User

●Veterinary clinics — frequent point-of-care diagnostic and vaccine administration; dominated 2024 usage.

●Animal research institutes — drive transgenic and basic R&D.

●Biopharmaceutical companies — large purchasers of genetically engineered animals, contract manufacturing and biopharming.

●Livestock farms — mass adoption targets for vaccines, feed-biotech and reproduction tech.

●Academic & government institutions — lead surveillance, policy and early-stage R&D.

By Technology

●Genetic engineering — primary R&D driver and market leader in 2024.

●Cloning and cell culture — enable transgenics and therapeutic production.

●Recombinant DNA technology — expected fastest CAGR during forecast period.

●PCR/NGS-based diagnostics — backbone of modern molecular disease surveillance.

Most Searched Queries

Q1: What is the current size and forecast for the global animal biotechnology market?

A: The market was USD 28.17 billion in 2024, grew to USD 30.97 billion in 2025, and is projected to reach USD 72.6 billion by 2034, with a CAGR of 9.93% from 2025–2034.

Q2: Which product segment generated the most revenue in 2024?

A: Vaccines captured the dominant revenue share of the market in 2024.

Q3: Which region led the market in 2024 and which is growing fastest?

A: North America dominated the market in 2024; Asia Pacific is expected to show the fastest CAGR during the forecast period.

Q4: What are the biggest opportunities and restraints in this market?

A: Opportunities: precision breeding/gene editing (CRISPR), aquaculture biotech, recombinant biologics and AI-enabled diagnostics. Restraints: ethical concerns about genetic modification, regulatory complexity, and data/infrastructure gaps.

Q5: Which technologies are expected to grow fastest?

A: Genetic engineering is a leader (2024), while recombinant DNA technology is expected to exhibit the highest CAGR during the forecast period.

Access our exclusive, data-rich dashboard dedicated to the biotechnology sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5849

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest