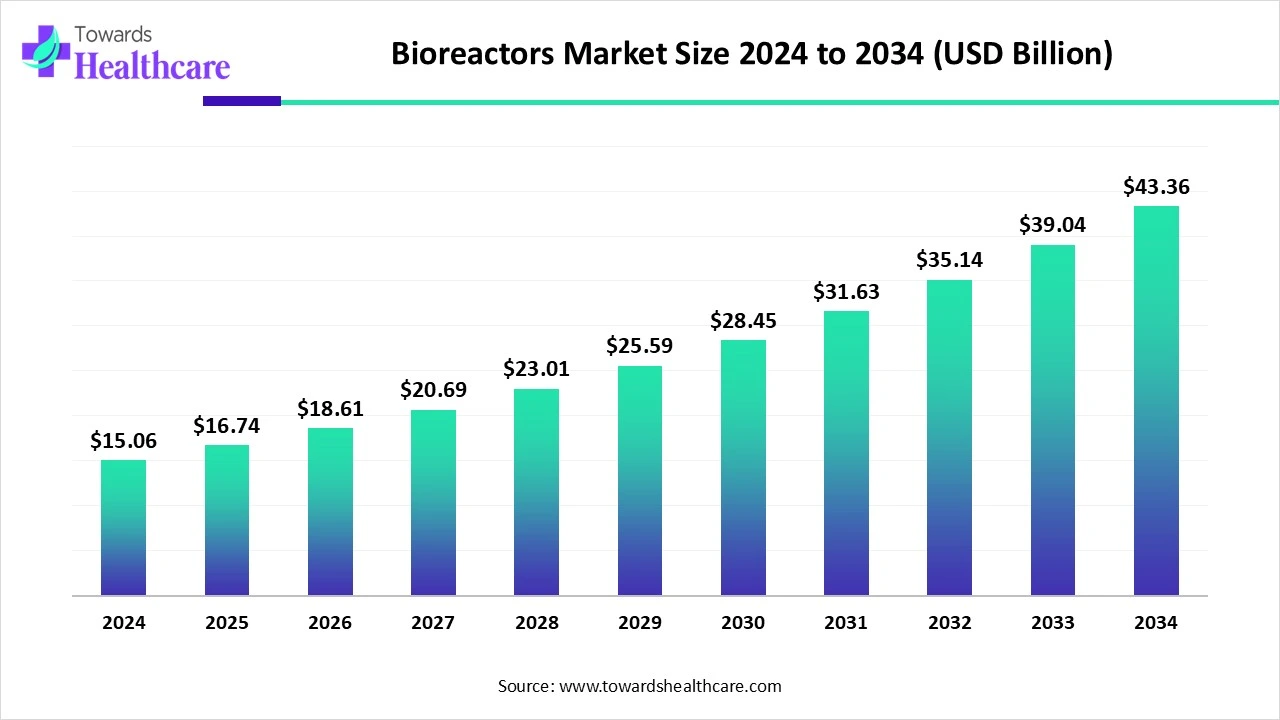

The global bioreactors market was valued at USD 15.06 billion in 2024, is forecast at USD 16.74 billion in 2025, and is projected to reach USD 43.36 billion by 2034 a CAGR of 11.14% (2025–2034) driven by single-use adoption, continuous processing, and growth in antibodies and cell-therapy manufacturing.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/5615

Market Size

Core metrics

Current and projected value

◉2024 market size: USD 15.06 Bn.

◉2025 projected: USD 16.74 Bn.

◉2034 projection: USD 43.36 Bn (reflects long-term expansion).

Growth rate

◉CAGR (2025–2034): 11.14% — implies market more than doubles over the decade due to technological shifts and rising biologics demand.

Dominant regional contribution

◉North America led in 2024 — largest share because of heavy R&D spending, established biomanufacturing base, and early adoption of new bioprocess technologies.

Segment drivers that materially affect size

◉Fabrication material: stainless steel dominant in 2024 (large/industrial scale).

◉Fastest growing fabrication: single-use bioreactors (lower capex, flexibility).

◉Bioprocess: batch & fed-batch largest share in 2024; continuous fastest growth trajectory.

◉Biologics: antibodies largest share in 2024; cell therapies fastest CAGR.

Market composition & concentration

◉Mix of legacy large OEMs (GE Healthcare, Merck, Sartorius, Thermo Fisher) and specialized vendors (BBI, Solaris, Infos HT) — this mix supports both scale and innovation.

Implication of the numbers

◉The USD 43.36 Bn forecast implies strong capex and replacement cycles for both stainless steel and single-use systems, plus investment in automation/AI and viral-vector/cell therapy manufacturing capacity.

Market Trends

Technology & product trends

Shift to single-use systems

◉Single-use segment fastest CAGR: driven by reduced contamination risk, quicker turnaround, and lower upfront capital — making them attractive for multiproduct and clinical-scale facilities.

Move from batch to continuous

◉Batch/fed-batch held largest share in 2024 (proven, regulatory familiarity).

◉Continuous bioreactors expected to grow fastest — benefits: higher productivity, consistent quality, lower downtime, and real-time control.

Scale and fabrication material dynamics

◉Stainless steel remains dominant for large commercial plants due to durability and repeated sterilization.

◉Glass still used in specific lab/pilot contexts.

Application-led demand: antibodies → cell therapies

◉Antibody production (monoclonal antibodies) drove 2024 volume.

◉Cell therapies (e.g., CAR-T) are the fastest growing biologic segment — requiring specialized closed, automated bioreactors.

Modularity, cloud integration, and mobility

◉Example: Culture Biosciences’ Stratyx 250 (Apr 1, 2025) — mobile, cloud-integrated bioreactor showing trend toward remote monitoring, modular facilities, and AI-ready data infrastructures.

Industry collaborations validating new formats

◉Aragen + Getinge (Jun 2024) validated single-use production reactors (SUPR) for recombinant antibodies — indicates industry acceptance of single-use at large scales.

Academic and niche innovation

◉FIU’s 3D-printed automated bioreactor for bone (May 2024) points toward tissue engineering and regenerative medicine needs shaping custom reactor designs.

Localized manufacturing and capacity build-out

DOE funding (Dec 2024, USD 120M) and national initiatives accelerate domestic biomanufacturing infrastructure — supporting regional market strength.

Role & Impact of AI

AI across the bioreactor lifecycle

Design & scale-up optimization

◉Machine learning models analyze historical runs to suggest scalable parameter sets (pH, DO, feed rates) that reduce the empirical experiments needed to move from bench to production scale.

Real-time process control & adaptive regulation

◉AI/ML algorithms ingest sensor streams (spectroscopy, capacitance, off-gas) to perform closed-loop control, automatically adjusting feed, agitation, or aeration for optimal productivity and robustness.

Predictive maintenance

◉AI predicts mechanical or sensor failures (valves, pumps, probes) from vibration, temperature, and electrical signatures, reducing unplanned downtime and contamination risk.

Quality prediction & PAT (Process Analytical Technology)

◉Models correlate in-process signals to final CQAs (Critical Quality Attributes) enabling earlier release decisions, fewer end-product tests, and continuous quality assurance for continuous processing.

Process development acceleration

◉Active learning and Bayesian optimization speed up DOE (design of experiments) by choosing the next most informative experiments — cutting weeks/months from development cycles.

Batch comparability and deviation detection

◉Anomaly detection flags runs deviating from historical norms, enabling rapid root-cause analysis and corrective action — important for meeting regulatory expectations.

Automation & closed systems for cell therapies

◉AI schedules, sequences, and executes automated culture steps in closed bioreactors (important for autologous therapies where timing and sterility are critical).

Data-driven single-use supply and lifecycle management

◉Predictive analytics plan disposable bag inventories and supply chains to balance cost against downtime risk — important as single-use penetration grows.

Regulatory and documentation assistance

◉AI tools help auto-generate process reports, map data trails for audits, and maintain electronic batch records compliant with GMP.

Economic optimization

◉Reinforcement learning can optimize operating parameters to maximize yield per dollar of consumables, energy, and facility time — aligning with sustainability goals.

Enabling cloud-integrated bioprocessing

◉Cloud + AI (as shown by Culture Biosciences Stratyx 250) enable remote optimization, federated learning across sites, and cross-facility model improvements while containing sensitive IP.

Barriers & considerations

◉Data quality/standardization, model explainability for regulators, cybersecurity for cloud-connected reactors, and integration with legacy control systems are practical hurdles that must be addressed.

Regional insights

North America (U.S. & Canada)

U.S. — market leader

◉Home to major OEMs, deep R&D funding, and mature bioprocess CDMOs. Large share from monoclonal antibody production and cell/gene therapy hubs. DOE USD 120M funding (Dec 2024) exemplifies public investment supporting capacity and innovation.

◉Strengths: Regulatory infrastructure (FDA), capital availability, and advanced automation adoption.

◉Challenges: High operating costs and competition for skilled talent.

Canada

◉Government support for domestic biomanufacturing (GMP facilities like STEMCELL) and investments in capacity. Focus on building resilience in vaccine/biologic supply chains.

◉Strengths: Collaborative public-private programs; niche manufacturing centers.

◉Challenges: Scale vs. US; reliance on partnerships.

Europe (Western Europe, UK, Germany, France, Switzerland examples)

Germany & France

◉Large biotech clusters and strong engineering supply chains. Germany: ~774 biotech companies — strong R&D base supporting sustainable and automated bioreactors.

UK

◉Government programs (Innovate UK) and targeted funding (USD 14M for sustainable biomanufacturing projects) drive innovation in continuous processing and sustainability.

Switzerland & EU trade

◉Switzerland’s high exports of MBR equipment (2024 examples) underline an advanced equipment manufacturing base.

Regional strengths & drivers

◉Emphasis on sustainable manufacturing, regulatory harmonization, and integration of green tech into bioprocessing.

Challenges

◉Fragmented markets, differing national incentives, and regulatory complexity across jurisdictions.

Asia-Pacific (China, India, Japan, South Korea, Australia)

China

◉Rapid capacity expansion, government investment, large CDMO growth (e.g., WuXi expansion). Fast adoption of single-use systems and scale-up to commercial quantities.

India

◉Growing pharma/biotech sector; BIRAC funding and heavy import of equipment (2,480 bioreactors imported Mar 2023–Feb 2024) reflect accelerating domestic build-out and training needs.

Japan & South Korea

◉Strong in automation, precision engineering, and adoption of advanced single-use and continuous systems.

Australia & Southeast Asia

◉Emerging markets with niche research centers, increasing demand for vaccines & biologics.

Regional strengths & challenges

◉Strengths: lower manufacturing costs, large patient populations for trials. Challenges: scaling regulatory frameworks to match pace of capacity increase.

Latin America (Brazil, Mexico, Argentina)

Brazil

◉Significant vaccine manufacturing base (Fiocruz); bioeconomy projections point to major long-term industrial opportunity.

Mexico

◉“Mexico Plan” (2025–2031) aims to boost clinical research and medical supplies — could accelerate local bioreactor demand.

Regional drivers

◉Public-private collaborations, vaccine self-sufficiency goals, and infrastructure upgrades.

Challenges

◉Need for skilled workforce and capital for large commercial plants.

Middle East & Africa (Saudi Arabia, UAE, South Africa)

Trends

◉Focus on building domestic capacity, pandemic preparedness, and selective investments in vaccine/biologic production.

Strengths

◉Sovereign funding, strategic partnerships with established CDMOs.

Challenges

◉Talent development and aligning regulatory frameworks.

Market dynamics

Drivers

Rising demand for biologics

◉Monoclonal antibodies, vaccines, gene & cell therapies require scalable bioreactors — antibodies dominated 2024; cell therapies fastest CAGR.

Shift to single-use and continuous processing

◉Single-use reduces contamination risk and capex; continuous increases productivity — both expand market spending on new reactors.

R&D and government funding

◉Examples: U.S. DOE USD 120M (Dec 2024); national incentives in Canada, UK, India support capacity growth.

Personalized medicine & cell therapy expansion

◉Autologous/allogeneic cell therapy manufacturing drives need for small-scale automated reactors and complementary automation.

Restraints

Regulatory complexity and long approvals

◉Extensive testing, documentation and country-by-country approvals delay product launches and raise costs — a key market restraint.

High capital & operating costs for large stainless-steel plants

◉Although stainless steel is durable, high upfront costs can slow adoption by smaller players.

Supply chain constraints for single-use components

◉Rapid single-use adoption relies on stable disposable supply chains; any disruptions create bottlenecks.

Opportunities

Sustainable bioprocessing

◉Demand for resource-efficient systems, waste reduction and greener processes — opportunity for new product lines.

AI, cloud, and modular mobile systems

◉Cloud-integrated and AI-enabled systems (Stratyx 250 example) open new business models (remote control, as-a-service).

Emerging regional manufacturing hubs

◉India, China, Latin America investments create new markets for mid-sized reactors and services.

Competitive dynamics

Large OEMs vs niche innovators

◉Established players (Sartorius, Thermo Fisher) compete on scale and product breadth; smaller innovators (Solaris, Infos HT) compete on specialization (cell therapy, disposables, automation).

Collaborations & validations

◉Partnerships (Aragen/Getinge) accelerate technology validation — reducing adoption risk for CDMOs and end users.

Top companies

GE Healthcare

◉Product/Portfolio: Large-scale stainless-steel & single-use bioreactors, control systems and integrated bioprocess suites.

◉Overview: Longstanding OEM with extensive global service footprint.

◉Strengths: Scale, global service, regulatory pedigree, integrated downstream/upstream offerings.

Merck KGaA

◉Product/Portfolio: Bioreactor systems, media, process consumables, and process support services.

◉Overview: End-to-end bioprocessing supplier active in both equipment and consumables.

◉Strengths: Broad portfolio from media to equipment, strong scientific support and supply chain.

Eppendorf AG

◉Product/Portfolio: Lab-scale bioreactors, pilot systems, and cell culture equipment.

◉Overview: Strong in benchtop and lab automation; reported €980.3M revenue in 2024 (total company).

◉Strengths: Lab reputation, small-scale expertise, service network for research labs.

Sartorius AG

◉Product/Portfolio: Range from 10 mL to 2,000 L working volume bioreactors; single-use and stainless options.

◉Overview: Focused bioprocess solutions provider; 2024 sales revenue €3.38B with bioprocess solutions contributing €2.69B.

◉Strengths: Extensive scale coverage, strong sales in bioprocess division, proven transferability from lab to production.

Thermo Fisher Scientific Inc.

◉Product/Portfolio: Bioreactor systems, monitoring, analytics, and process equipment; large global footprint.

◉Overview: Industrial strength in life-science tools and services.

◉Strengths: Integration with analytics, large aftermarket services, and broad customer base.

BBI-Biotech GmbH

◉Product/Portfolio: Single-use mixers, bioreactor liners, and modular systems.

◉Overview: Specialist in disposables and single-use components.

◉Strengths: Niche expertise in single-use consumables and custom solutions.

Bioengineering AG

◉Product/Portfolio: Bioreactor control systems and scalable bioprocess equipment.

◉Overview: European engineering focus with automation capability.

◉Strengths: Control/automation experience, pilot to production systems.

Danaher Corporation

◉Product/Portfolio: Through its life-science subsidiaries (e.g., Cytiva), offers equipment, single-use tech and downstream solutions.

◉Overview: Large conglomerate with strong industrial ties in bioprocessing.

◉Strengths: Integration across upstream/downstream, service network.

Getinge

◉Product/Portfolio: Sterile processing, single-use solutions and validated reactors (e.g., SUPR collaboration).

◉Overview: Known for sterile technologies and validated systems.

◉Strengths: Sterility expertise, partnerships (Aragen), industrial validation.

Infos HT

◉Product/Portfolio: Niche/additive bioreactor technologies and specialized equipment (as listed).

◉Overview: Smaller, specialized vendor.

◉Strengths: Flexibility and tailored engineering solutions.

Solaris Biotech Solutions

◉Product/Portfolio: Specialized bioprocess equipment and services focused on innovative single-use designs.

◉Overview: Emerging specialist for niche needs.

◉Strengths: Agility, customer customization.

Latest announcements

Culture Biosciences — Stratyx 250 (April 1, 2025)

What it is

◉Mobile, cloud-integrated bioreactor (Stratyx 250) with Culture Console software for remote monitoring and control.

Key capabilities

◉Real-time data streaming, remote setpoint changes, modular mobility enabling decentralised or pop-up bioprocessing.

Strategic significance

◉Marks broader industry shift to cloud-powered, modular systems and integration with AI for optimization.

Business implications

◉Enables CDMO/biotech customers to operate distributed manufacturing and leverage centralized analytics; lowers barrier to entry for R&D facilities.

Aragen Bioscience & Getinge — SUPR validation (June 2024)

What happened

◉Single-use production reactors (SUPR) validated for recombinant antibody production at scale.

Significance

◉Industry acceptance of single-use for large-scale antibodies improves cost-effectiveness and scalability for CDMOs.

FIU — 3D-printed automated bone bioreactor (May 2024)

What it is

◉An automated 3D-printed bioreactor capable of in vitro bone growth studies.

Implications

◉Accelerates regenerative medicine research and custom bioreactor design for tissue engineering.

VFL Sciences — GreatFlo parallel bioreactors (Oct 2024)

What it is

◉Chennai-based launch of parallel bioreactors and fermentors to enhance scalability and efficiency in viral vector and biologics R&D.

Multiply Labs & Wilson Wolf — G-Rex automation (May 2024)

What it is

◉Robotics automation of G-Rex® bioreactor workflow to scale and standardize cell therapy manufacturing.

Recent developments

Commercial & validation milestones

◉SUPR validation (Aragen/Getinge) confirms single-use viability for recombinant antibody commercial production — reduces perceived scale limits for single-use.

◉Stratyx 250 launch (Culture Biosciences) indicates movement to cloud-native, remotely controllable hardware — positioning bioreactors as software-driven assets.

Academic & small-scale innovation

◉FIU 3D-printed bioreactor showcases the trend of bespoke reactors for tissue engineering and regenerative medicine.

◉VFL Sciences’ GreatFlo and Multiply/Wilson Wolf automation show regional capability growth (India/US) and automation to support cell/viral vector production.

Funding & policy

◉DOE USD 120M (Dec 2024) and various national initiatives accelerate domestic manufacturing capacity and technology adoption.

Market behavior

◉Imports into India (Mar 2023–Feb 2024) — 2,480 bioreactors imported — shows demand surge and reliance on global suppliers while local capacity scales up.

Segments covered

By fabrication material

Stainless Steel

◉Use case: Large commercial production; repeated sterilization; high durability.

Why dominate: Reusability reduces long-term cost for high-volume facilities; regulatory familiarity.

Single-Use

◉Use case: Clinical, multiproduct facilities, and rapid scale-up for novel biologics.

Why fastest growing: Lower capital barrier, no cleaning/sterilization, flexible production schedules.

Glass

◉Use case: Laboratory and pilot applications where transparency and chemical inertness are needed.

Role: Niche but valuable for certain R&D workflows.

By type of bioprocess

Batch & Fed-batch

◉Use case: Traditional protein/antibody production; regulatory precedence.

Why largest (2024): Proven scalability and broad industrial acceptance.

Continuous

◉Use case: High productivity, steady-state operations for consistent quality.

Why fastest growing: Resource efficiency, reduced footprint, potential cost advantages in long runs.

By type of biologic

Antibodies

◉Use case: Monoclonal antibody therapeutics; largest revenue driver in 2024.

◉Importance: High global demand for cancer/autoimmune therapies.

Vaccines

◉Use case: Public health manufacturing — requires high throughput and scale.

◉Consideration: Pandemic lessons drive local vaccine capacity builds.

Cell Therapies

◉Use case: Personalized/advanced therapeutics (CAR-T, stem cell).

◉Why fastest CAGR: Complexity and precision needed creates strong demand for specialized reactors.

Other Biologics

◉Use case: Enzymes, recombinant proteins, viral vectors — each with specific reactor needs.

By region

◉Regions and subregions listed in report — segmentation used for regional strategy, market entry, and forecasting (North America, Europe, APAC, LATAM, MEA; country level examples included earlier).

Top 5 FAQs

1) What is the current value and growth outlook for the bioreactors market?

Answer: The market was USD 15.06 Bn in 2024, projected to USD 16.74 Bn in 2025, and USD 43.36 Bn by 2034, growing at a CAGR of 11.14% (2025–2034).

2) Which fabrication material dominates and which is growing fastest?

Answer: Stainless-steel dominated in 2024 due to durability and suitability for large commercial plants; single-use is the fastest-growing segment due to flexibility, lower initial capex, and contamination risk reduction.

3) Which bioprocess type and biologic type are most important?

Answer: Batch & fed-batch had the largest share in 2024; continuous processing is growing fastest. Antibodies were the dominant biologic in 2024, while cell therapies are the fastest-growing biologic segment.

4) Which regions are driving growth and why?

Answer: North America dominated in 2024 (strong R&D, investments, CDMOs). Asia-Pacific is expected to grow fastest (China, India investments and capacity expansions). Europe has strength in sustainable manufacturing and engineering supply chains.

5) How will AI and cloud technologies affect bioreactors?

Answer: AI will enable real-time control, predictive maintenance, process optimization, and faster scale-up, while cloud-integrated systems (e.g., Culture Biosciences’ Stratyx 250) enable remote monitoring, federated learning, and new service models — but require strong data practices and regulatory alignment.

Access our exclusive, data-rich dashboard dedicated to the laboratory equipment sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5615

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest