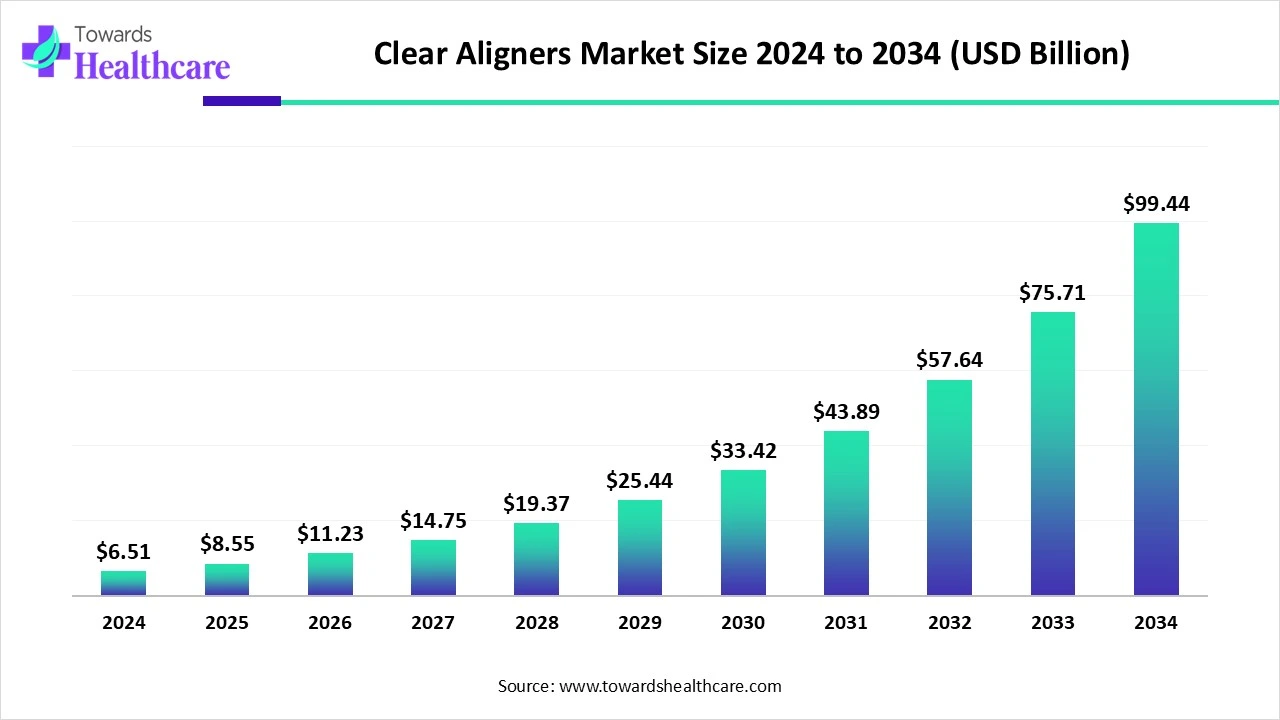

The global clear aligners market is expected to grow from USD 6.51 billion in 2024 to USD 99.44 billion by 2034, at a remarkable CAGR of 31.34%, driven by rising dental aesthetics awareness, AI adoption, and 3D printing technologies in orthodontics.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/5614

Market Size

Global Market Size:

◉2024: USD 6.51 Bn.

◉2025: USD 8.55 Bn.

◉2034 Projection: USD 99.44 Bn.

◉CAGR: 31.34% between 2025–2034, indicating exponential growth due to technological adoption and awareness.

Segment-Wise Growth Insights (Non-Application Segments):

Age Segments:

◉Adults: Dominated in 2024 due to convenience, aesthetics, and increasing acceptance of personalized orthodontics.

◉Teens: Fastest-growing segment; driven by malocclusion prevalence, parental awareness, and aesthetics.

Material Type:

◉Polyurethane: Dominant due to transparency, flexibility, strength, comfort, and high patient acceptance.

◉Distribution Channels:

◉Offline: Largest segment in 2024 because of trusted in-person orthodontic consultations and safety assurance.

◉Online: Fastest-growing segment; provides affordability, convenience, and tele-orthodontic services.

End Users:

◉Standalone Practitioners: Leading segment due to personalized treatment offerings, access to advanced technologies, and high patient satisfaction.

◉Regional Market Insights:

◉North America: Leading due to established healthcare infrastructure, AI integration, and technological adoption.

◉Asia-Pacific: Fastest-growing region, fueled by industrial development, urbanization, and dental awareness.

Market Trends

Technological Advancements:

◉AI integration in treatment planning and 3D printing for precise aligner fabrication.

◉Orthobrain® raised $7.5 million in April 2025 for expansion, reflecting investor confidence in AI-driven orthodontics.

Patient-Centric Approach:

◉Clear aligners offer comfort, removability, invisibility, and reduced pain vs. braces.

◉Rescue aligners (OrthoFX) improve patient experience and reduce clinic visits.

Shift from Conventional Braces:

◉Decline in lingual braces in the U.S., replaced by digital clear aligner solutions with improved materials and 3D scanning.

Increasing Awareness:

◉Campaigns and programs highlighting oral health are raising demand for aesthetic orthodontic solutions.

Aesthetic Dentistry Growth:

◉Rising adult population seeking cosmetic improvements in dental alignment is driving market expansion.

Tele-orthodontics Adoption:

◉AI and online platforms allow remote consultations, improving patient access and reducing costs.

Dental Tourism Impact:

◉Regions like Mexico and Brazil attract international patients due to affordability and high-quality treatment.

AI Impact / Role

Advanced Treatment Planning:

◉AI uses patient scans to predict tooth movement, optimize aligner design, and reduce errors.

Remote Monitoring & Teledentistry:

◉Platforms like DentalMonitoring provide real-time feedback, reducing in-person visits and improving compliance.

Material and Design Optimization:

◉AI assists in customizing polyurethane and other materials for comfort, transparency, and durability.

Predictive Clinical Analytics:

◉AI predicts root resorption, treatment duration, patient adherence, and potential complications.

Surgical & Extraction Assistance:

◉Provides accurate recommendations for tooth extraction and orthognathic procedures.

Integration with Orthodontic Growth Systems:

◉Orthobrain® and similar AI systems enable adaptive, patient-specific treatment protocols.

Operational Efficiency:

◉AI optimizes manufacturing workflows, reduces waste in 3D printing, and improves production scalability.

Regional Insights

North America

◉Drivers: Advanced healthcare, high disposable income, early adoption of AI and 3D printing.

◉U.S.: Increasing demand for aesthetic, effective, and minimally painful orthodontic treatments.

◉Canada: Rising awareness and adoption of new materials enhancing patient satisfaction and treatment outcomes.

Asia Pacific

◉Drivers: Industrial growth, dental awareness campaigns, and technology adoption.

◉China: Rapid investment in research and industrial automation in aligner production.

◉India: Innovations in orthodontic technology and government programs to enhance affordability.

◉South Korea & Japan: Emphasis on cosmetic dentistry and AI-enabled orthodontics.

Europe

◉Drivers: Increasing demand for aesthetic dentistry and adult orthodontics.

◉Germany: Focus on patient comfort, advanced materials, and technology-driven clinics.

◉UK & France: Industry collaboration to enhance aesthetic development and treatment options.

Latin America

◉Drivers: Growing dental tourism, cost-effective treatments, skilled professionals, and robust infrastructure.

◉Mexico: Cities like Tijuana and Cancun attract patients globally; clear aligner prices $2,000–$8,000.

◉Brazil: ~360,865 dentists, high adoption of state-of-the-art technology, and stringent safety standards.

Middle East & Africa (MEA)

◉Rising awareness of oral health, increasing disposable income, and adoption of modern orthodontics.

Market Dynamics

Drivers

◉Rising awareness of dental hygiene and aesthetic dentistry.

◉Increasing adult orthodontic population seeking comfort and invisibility.

◉Technological innovations including AI, 3D printing, and tele-orthodontics.

◉Supportive healthcare policies and campaigns.

Restraints

◉High cost of treatment limits adoption in low-income populations.

◉Clinics require advanced software and equipment, increasing entry barriers.

Opportunities

◉Integration of AI in aligner fabrication and remote patient monitoring.

◉Expanding aesthetic dentistry and dental tourism markets.

◉Material innovations improving comfort, durability, and transparency.

Top Companies

Align Technology, Inc.:

◉Product: Invisalign clear aligners, 3D scanners.

◉Overview: Global medical device company; Q4 2024 revenue $995.2M; full-year 2024 revenue $4.0B (clear aligners $3.2B).

◉Strengths: Strong manufacturing scale, advanced digital orthodontic solutions, market leader in clear aligners.

Henry Schein Inc.:

◉Product: Medical & dental supplies, vaccines, pharmaceuticals, financial services, equipment.

◉Overview: Q4 2024 net sales $3.2B; full-year 2024 $12.7B.

◉Strengths: Extensive distribution network, diverse portfolio, strong global presence.

3M ESPE:

◉Product: Dental adhesives, aligners, orthodontic solutions.

◉Strengths: R&D-driven innovations, global reach, brand trust.

Dentsply Sirona:

◉Product: Dental instruments, restorative materials, clear aligners.

◉Strengths: Comprehensive dental solutions, technological integration, strong distribution.

SmileDirect Club:

◉Product: Direct-to-consumer clear aligners, teledentistry platform.

◉Strengths: Online reach, affordability, tele-orthodontic model.

TP Orthodontics Inc:

◉Product: Orthodontic appliances, clear aligners.

◉Strengths: Focused R&D, global market penetration, technology adoption.

Angel Aligner & Institute Straumann:

◉Products: Clear aligners, orthodontic equipment.

◉Strengths: Advanced 3D printing, automated manufacturing, patient-centered care.

Latest Announcements

April 2025: OrthoFX – Rescue Aligners

◉Objective: Enhance patient experience without extending treatment duration.

Significance:

◉Reduces the need for repeated in-clinic visits.

◉Minimizes aligner replacement delays, digital scans, and administrative workload.

◉Supports orthodontic practices in maintaining high patient satisfaction and treatment efficiency.

Impact on Market: Likely to increase adoption among adults and teens due to convenience and reliability.

◉Feb 2025: Align Technology – Manufacturing Scale & Competitiveness

◉Highlights: Large-scale manufacturing capacity ensures consistent production quality.

Advantages over Competitors:

◉Faster delivery of Invisalign and other aligners.

◉Strong R&D ensures continuous material and design innovation.

Market Implication: Reinforces Align Technology’s market dominance and strengthens investor confidence.

April 2025: Angelalign Technology – New Manufacturing Facility, Wisconsin

Details:

◉Automated facility utilizing proprietary 3D printing technology.

◉Creates ~200 jobs in North America.

Benefits:

◉Higher production efficiency and scalability.

◉Reduces cost per aligner while maintaining quality.

◉Supports North American market expansion.

March 2025: LuxCreo – Entry into European Market with 4D Aligner™

Features:

◉MDR CE Class IIa certified direct print aligner.

◉Uses patented ActiveMemory™ Polymer for superior flexibility and shape memory.

Implications:

◉Brings advanced 3D printing technology to Europe.

◉Enhances precision and comfort for patients.

◉Positions LuxCreo as a technological leader in the European market.

Recent Developments

◉AI Collaboration: DentalMonitoring & Ormcotm Corporation

◉Focus: AI-powered remote monitoring of orthodontic treatments.

◉Launch: AAO 2025 Annual Session.

Benefits:

◉Enables real-time progress tracking without frequent clinic visits.

◉Improves patient compliance and treatment outcomes.

◉Integrates seamlessly with tele-orthodontic platforms.

Funding: Orthobrain® Expansion

◉Amount: $7.5 million from CareCapital, JumpStart Ventures, and JobsOhio.

◉Purpose: Expansion of AI-driven orthodontic systems.

Impact:

◉Encourages innovation in AI-enabled treatment planning.

◉Supports development of predictive analytics for patient treatment compliance.

Material Advancements: Polyurethane Dominance

◉Reason: Provides high transparency, flexibility, strength, and comfort.

Market Implication:

◉Enhances patient acceptance rates due to aesthetic appeal.

◉Supports longer wear times and durability, reducing replacement frequency.

Technological Expansion: AI + 3D Printing

◉Objective: Streamline aligner fabrication and reduce costs.

Outcomes:

◉Faster production cycles.

◉Reduced manual labor and error rate.

◉Scalable manufacturing to meet rising global demand.

Segments Covered

1. By Age

Adults (Dominant Segment):

◉Driven by aesthetic consciousness and professional requirements.

◉Prefer invisible, comfortable treatment compared to traditional braces.

◉Adults who missed earlier orthodontic treatment are increasingly adopting clear aligners.

Teens (Fastest-Growing Segment):

◉Rising incidence of malocclusion and orthodontic awareness among parents.

◉Aesthetic appeal and removable features make aligners preferable over braces.

◉Integration with AI and telemonitoring increases compliance and convenience.

2. By Material Type

Polyurethane (Dominant):

◉Offers transparency for aesthetic appeal.

◉Flexibility ensures comfortable fit and gradual tooth movement.

◉Durable and suitable for complex orthodontic movements.

Plastic PETG & Others:

◉PETG offers affordability but less flexibility than polyurethane.

◉Other materials are used for niche treatments or cost-sensitive markets.

3. By Distribution Channel

Offline (Dominant):

◉Ensures direct consultation with orthodontists.

◉Builds trust and patient confidence due to in-person assessment.

◉Supports complex treatments requiring professional supervision.

Online (Fastest-Growing):

◉Enables tele-orthodontic services with remote monitoring.

◉Affordable and convenient for tech-savvy patients.

◉Growth is boosted by AI integration and DIY aligner models.

4. By End-Use

Standalone Practitioners (Dominant):

◉Offer personalized treatment options.

◉Early adopters of AI and 3D printing, improving efficiency and patient satisfaction.

Hospitals & Group Practices:

◉Cater to bulk or specialized cases.

◉Often combine orthodontic services with other dental or medical treatments.

5. By Region

North America (Dominant):

◉Early technology adoption and robust healthcare infrastructure.

◉Integration of AI, 3D printing, and advanced tele-orthodontics.

Asia-Pacific (Fastest-Growing):

◉Industrial growth, increasing urban dental awareness, and affordability.

◉China: Technological adoption for mass production.

◉India: Government programs improve accessibility and affordability.

Europe:

◉Focus on aesthetic dentistry, especially among adult population.

◉Germany and UK: High adoption of AI-based treatment and advanced materials.

Latin America:

◉Growing dental tourism.

◉Mexico and Brazil attract international patients due to cost-effective treatment and skilled professionals.

Middle East & Africa (MEA):

◉Growing oral health awareness.

◉Increasing adoption of modern orthodontic practices.

Top 5 FAQs

Q1: What is the projected market size of clear aligners by 2034?

A: The market is projected to reach USD 99.44 billion by 2034 at a CAGR of 31.34%.

Q2: Which age segment dominates the clear aligners market?

A: The adult segment dominated in 2024, while teens are the fastest-growing.

Q3: What material is most commonly used in clear aligners?

A: Polyurethane dominates due to its strength, flexibility, transparency, and patient comfort.

Q4: How is AI impacting the clear aligners market?

A: AI is used for advanced treatment planning, teledentistry, material optimization, predictive analytics, and operational efficiency in production.

Q5: Which region leads the global clear aligners market?

A: North America is the leading region, driven by advanced healthcare, early technology adoption, and high disposable income.

Access our exclusive, data-rich dashboard dedicated to the dental sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5614

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest