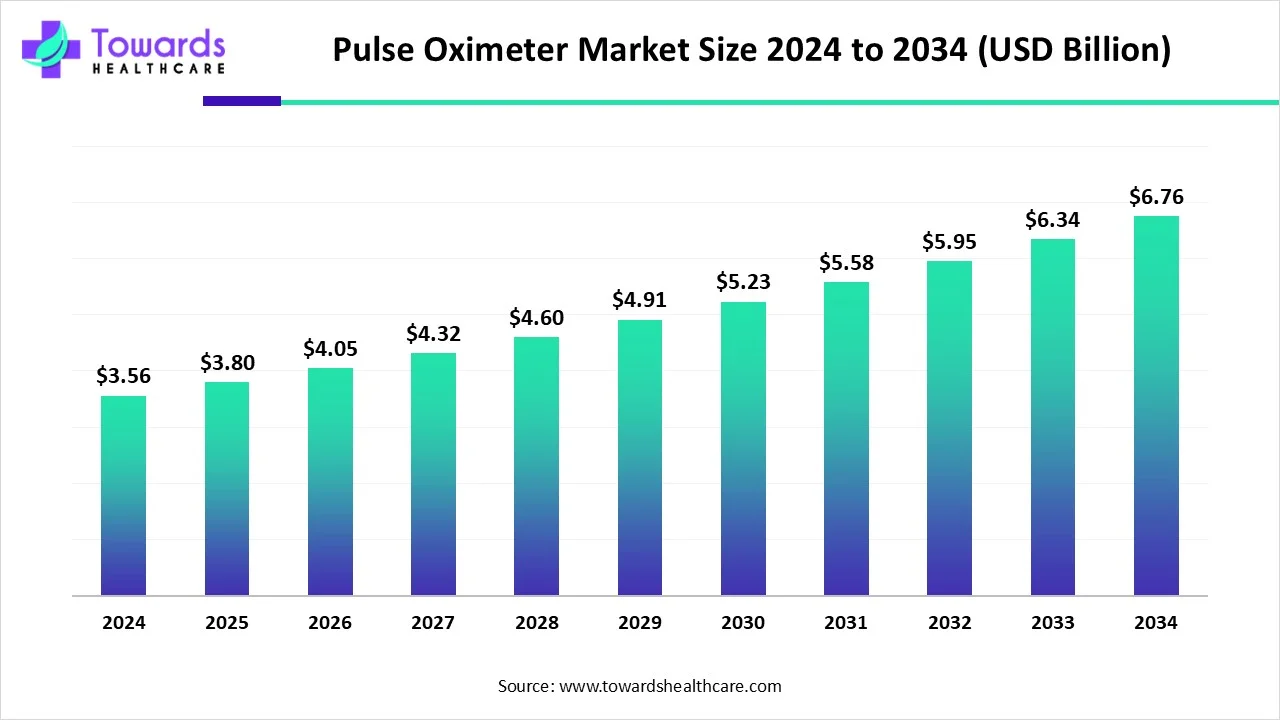

The global pulse oximeter market was valued at USD 3.56 billion in 2024 and is projected to reach USD 6.76 billion by 2034, expanding at a CAGR of 6.64% (2025–2034). Growth is primarily driven by the rising burden of respiratory and cardiovascular diseases, technological advancements such as wireless connectivity, and increased use in homecare settings.

Download this Free Sample Now and Get the Complete Report and Insights of this Market Easily @ https://www.towardshealthcare.com/download-sample/5581

While North America dominates the current market due to its advanced healthcare infrastructure, Asia-Pacific is expected to witness the highest CAGR with expanding healthcare access and rising awareness. Demand is shifting from traditional hospital usage toward portable, home-based, and wearable devices, as consumers increasingly adopt personal health monitoring. Collaborations among leading players like Masimo, Nonin, and Medtronic with digital health platforms are accelerating integration into remote patient monitoring and clinical trials, highlighting the strategic role of pulse oximeters in the evolving healthcare ecosystem.

Pulse Oximeter Market Size (2024–2034)

1 Current Market Size

◉The global pulse oximeter market is valued at USD 3.56 billion in 2024.

◉It is expected to grow to USD 3.8 billion in 2025.

2 Future Projections

◉By 2034, the market is projected to reach approximately USD 6.76 billion.

◉This represents a compound annual growth rate (CAGR) of 6.64% between 2025 and 2034.

Market Trends

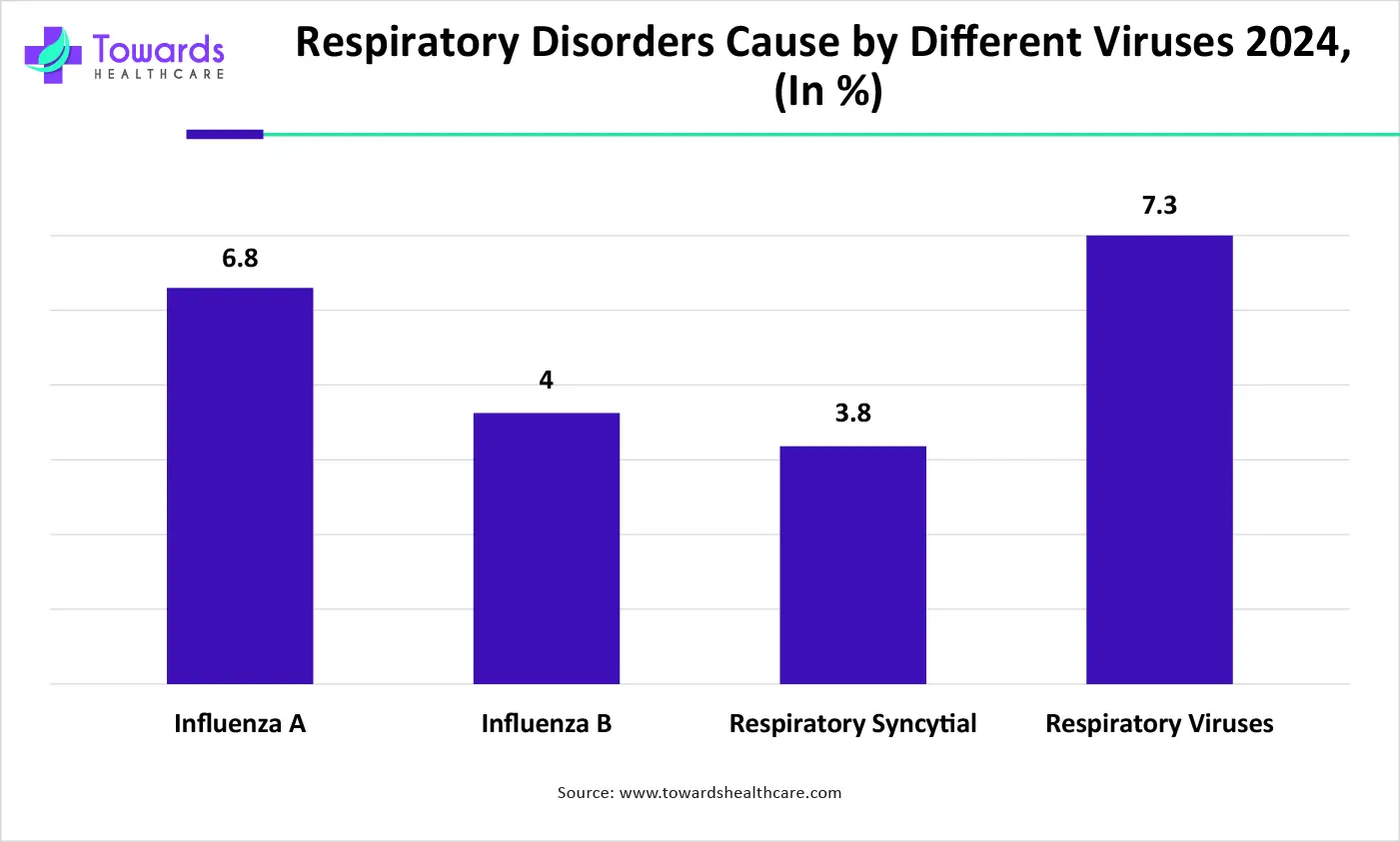

1 Rising Disease Burden Driving Demand

◉Cardiovascular diseases affect >500 million people globally, causing 20.5 million deaths annually (~⅓ of global mortality).

◉Pulse oximeters are critical in managing heart failure (1.9–2.8% prevalence in U.S. adults) and respiratory disorders.

2 Technological Advancements

◉Wireless connectivity, smartphone integration, and improved accuracy & portability make devices more user-friendly.

◉Increasing use of wearable sensors enhances continuous monitoring and integration with digital platforms.

3 Remote Patient Monitoring & Digital Health

◉Masimo & Medable (May 2024): Integrated MightySat Rx into 8 pharma clinical trials across 25 countries (breast & lung cancer).

◉Nonin & Medixine (Apr 2024): Collaboration for remote monitoring of chronic conditions in the U.S.

Shifting Usage Pattern

◉Historically dominated by hospital bedside/tabletop use, but now moving rapidly toward homecare and portable devices.

◉Fitness and wellness adoption also boosting consumer-level demand.

4 Trade & Supply Chain Dynamics

From Oct 2023 – Sept 2024:

◉China: 9,251 oximeter shipments (top exporter, mainly to India, Chile, Peru).

◉U.S.: 5,417 shipments.

◉India: 998 shipments.

◉Asia’s manufacturing strength, especially China, continues to influence global pricing & supply availability.

5 Demographic & Healthcare Drivers

◉Aging population → higher incidence of cardiovascular & respiratory diseases.

◉Expanding healthcare infrastructure in emerging economies creating new opportunities.

◉Health awareness & self-monitoring among younger demographics driving portable oximeter sales.

AI’s Role in the Pulse Oximeter Market

A. Core Functional Impact

1 Real-time pattern detection

◉Processes SpO₂ and pulse rate in real time.

◉Spots early indicators of respiratory or cardiac issues.

2 Personalized monitoring

◉Learns individual baselines.

◉Delivers accurate, customized alerts (reduces generic false alarms).

3 Remote patient monitoring (RPM) automation

◉Automatically notifies providers about critical changes.

◉Improves proactive care in home/telemedicine workflows.

Predictive assistance

◉Forecasts potential complications.

◉Enables early intervention in chronic conditions (e.g., COPD).

4 Ecosystem integration

◉Works with other wearables and health apps to form a more complete profile.

5 Clinical decision support

◉Aids clinicians to act faster with more informed decisions and optimized care.

Market Dynamics

1 Driver

Rising incidence of respiratory diseases

◉COPD, asthma, pneumonia require regular SpO₂ monitoring.

◉Non-invasive, real-time measurements underpin adoption across hospitals, clinics, and home care.

◉Early detection of low oxygen levels improves condition management, driving growth.

2 Restraint

Government regulations

◉FDA and other regulators require extensive testing, certification, safety evaluation.

◉Varying regional rules complicate global manufacturing/distribution and add cost/time.

3 Opportunity

Remote patient monitoring & telemedicine

◉Continuous home-based monitoring for asthma, COPD, heart failure, including remote/underserved areas.

◉Mobile/wearable integrations enable real-time data sharing and timely intervention.

◉Growing consumer awareness and adoption of wearables expands clinical and home use.

Regional Insights

1 North America — Dominant (2024)

Drivers

◉High prevalence of COPD and sleep apnea requiring continuous monitoring.

◉Well-developed healthcare infrastructure; early tech adoption.

◉Growing geriatric population.

◉Ongoing advances in sensor accuracy and digital health integration.

U.S. trends

◉Chronic respiratory conditions + mobile/app integration + telehealth growth.

◉March 2024: Movano Health (with UCSF) completed hypoxia trial; Evie Ring pulse oximeter exceeded FDA accuracy guidelines.

Canada trends

◉Technological innovation (wireless, smartphone, cloud).

◉Supportive government regulation (device reliability/safety).

◉Public awareness boosting early detection and home/clinical use.

2 Asia-Pacific — Highest CAGR (forecast)

Growth factors

◉Large and aging population.

◉Rising respiratory and cardiovascular disease prevalence and health awareness.

◉Telemedicine investment and home-care expansion.

◉Rising disposable income and government early-detection initiatives.

China

◉Large aging cohort; chronic diseases (COPD/asthma/cardiovascular).

◉Government investment in modernizing infrastructure, including rural areas.

◉Telemedicine + home healthcare + public awareness lifting portable adoption.

India

◉Digital health and self-monitoring focus among a tech-savvy population.

◉Start-up ecosystem and Make in India boosting local, affordable, tailored devices.

◉Expansion of private healthcare and diagnostics strengthens demand.

3 Europe — Fast growth (forecast)

Drivers

◉Personalized/preventive healthcare shift.

◉Wearable/connected health demand and telehealth integration.

◉Strict standards → high-quality, accurate devices → strong consumer confidence.

◉Rising healthcare spend and broader reimbursement.

UK

◉Rising COPD, sleep apnea, heart disease.

◉Government action on racial/ethnic device disparities lifted trust and demand.

◉Home care/RPM with smartphone/wearable integrations gaining traction.

Germany

◉Strong infrastructure, high health spending, large aging population.

◉Chronic disease prevalence.

◉Preventive healthcare emphasis and data-tracking integration appealing to consumers/providers.

Top Companies 2025

1) Smiths Group plc

Product: MiniCorr Handheld Pulse Oximeters – designed for accurate SpO₂ and pulse rate monitoring.

Overview: A British multinational with a diversified medical technology portfolio. Focuses on delivering advanced patient monitoring systems globally.

Strengths:

Strong international presence.

Continuous innovation in handheld monitoring devices.

Solid financials: Revenue of £3.12 billion in FY 2024 (ended July 31, 2024), marking a 3.1% YoY increase.

2) Nihon Kohden Corporation

Product: Broad range of medical electronics including pulse oximeters integrated into hospital monitoring systems.

Overview: Japanese leader in medical electronics, known for advanced monitoring solutions and reliability.

Strengths:

Focus on innovation and precision in patient monitoring.

Trusted global brand in hospital-grade electronics.

Strong financial performance: ¥225,424 million net sales in FY 2025 (+1.5% YoY).

3) Koninklijke Philips N.V.

Product: Advanced patient monitoring platforms with integrated SpO₂ monitoring. Recent collaboration with Masimo expanded wearable monitoring.

Overview: A global healthcare technology giant with deep expertise in imaging, monitoring, and connected care.

Strengths:

Integration capabilities across hospital systems and telehealth.

Strong partnerships: In Jan 2023, partnered with Masimo to integrate the Masimo W1 health watch into Philips’ systems.

Leadership in remote patient monitoring (RPM) and digital health solutions.

4) Masimo Corporation

Product: Pulse oximeters using Signal Extraction Technology (SET®) – maintains accuracy during patient movement or low blood flow.

Overview: U.S.-based company specializing in advanced monitoring solutions. Known for setting benchmarks in pulse oximetry accuracy.

Strengths:

Best-in-class SpO₂ accuracy under challenging conditions.

Strong partnerships: In Nov 2023, teamed with GE Healthcare to integrate SET with GE’s Portrait Mobile wireless monitoring.

Reputation for continuous R&D and advanced patient monitoring solutions.

5) Medtronic plc

Product: Hospital-grade patient monitoring devices, including integrated pulse oximeters for ICUs and surgical care.

Overview: One of the world’s largest medical device companies, offering a broad portfolio across cardiovascular, surgical, and monitoring devices.

Strengths:

Large-scale hospital penetration.

Trusted brand for critical-care monitoring solutions.

Strong focus on innovation across global healthcare markets.

6) General Electric Company (GE Healthcare)

Product: Advanced hospital monitoring systems with integrated SpO₂ modules.

Overview: A healthcare division of GE, specializing in diagnostic and monitoring technologies.

Strengths:

Strong hospital networks worldwide.

Partnership with Masimo (2023) boosted capabilities in continuous wireless SpO₂ monitoring.

Known for high-reliability clinical solutions in ICUs and surgical settings.

7) Santa Medical

Product: SM-1100 Silver Finger Pulse Oximeter, Generation 2 (launched July 2024).

Overview: Manufacturer of consumer-friendly medical devices, targeting home healthcare.

Strengths:

Focus on portable, user-friendly oximeters.

Product highlights: Premium OLED display, strong battery life.

Appeals to preventive care and home-based monitoring markets.

8) Prevounce Health

Product: Pylo OX1-LTE (launched Aug 2024) – a connected blood oxygen device for Remote Patient Monitoring (RPM).

Overview: U.S.-based company focused on remote patient monitoring solutions for chronic disease management.

Strengths:

Device designed for simplicity and patient ease of use.

Boosts RPM engagement and reduces clinician workload.

Well-positioned in COPD, asthma, COVID-19, and heart condition monitoring.

9) Movano Health

Product: Evie Ring pulse oximeter (trial completed March 2024).

Overview: A health-tech company focusing on wearable health monitoring.

Strengths:

Conducted hypoxia trial with UCSF proving Evie Ring exceeded FDA accuracy guidelines.

Strong academic collaboration supporting product credibility.

Positioned in women’s health and consumer wearables with medical-grade accuracy.

10) BRAEBON

Product: MediOX (launched May 2025) – pulse oximeter with a chest-based body position sensor.

Overview: Innovator in sleep and respiratory monitoring solutions.

Strengths:

Device targets sleep-breathing disorder screening.

Multi-parameter tracking: SpO₂, pulse rate, body position.

Expands oximetry beyond respiratory into sleep medicine applications.

Recent Developments

📌 Nov 2023 – Masimo x GE Healthcare

◉Masimo integrated its Signal Extraction Technology (SET) with GE’s Portrait Mobile, a wearable, wireless monitoring system.

Impact:

◉Enhanced continuous, noninvasive SpO₂ monitoring even during patient movement or low perfusion.

◉Helped clinicians track subtle changes in patient condition more efficiently.

◉Advanced mobile patient monitoring beyond traditional bedside units.

📌 Jan 2023 – Philips x Masimo

◉Partnership strengthened with integration of the Masimo W1 health watch into Philips’ monitoring system.

Impact:

◉Expanded remote patient monitoring and telehealth services.

◉Created a more connected ecosystem of wearable + hospital monitoring systems.

◉Positioned both companies as leaders in digital and home-based healthcare solutions.

📌 Mar 2024 – Movano Health + UCSF

◉Completed hypoxia trial for the Evie Ring pulse oximeter.

◉Results: Exceeded U.S. FDA accuracy guidelines.

Impact:

◉Reinforced academic validation for next-gen wearable devices.

◉Strengthened the clinical credibility of consumer-oriented wearable oximeters.

📌 Jul 2024 – Santa Medical

◉Launched SM-1100 Silver Finger Pulse Oximeter, Gen2.

◉Features: Premium OLED display, improved usability, strong battery performance.

Impact:

◉Set a benchmark for consumer-friendly portable oximeters.

◉Highlighted the market trend toward advanced and user-centric designs.

📌 Aug 2024 – Prevounce Health

◉Released Pylo OX1-LTE device for remote patient monitoring.

◉Target conditions: COPD, asthma, COVID-19, heart conditions.

◉CEO Daniel Tashnek emphasized simplicity for patients and reduced support workload for clinicians.

Impact:

◉Boosts RPM program scalability.

◉Aligns with the global trend toward chronic disease management at home.

📌 Jan 2025 – U.S. FDA Guidelines

◉Issued new calibration and testing rules for pulse oximeters.

Requirements:

◉Devices tested across diverse skin tones.

◉Minimum 3,000 data points (up from 200).

◉Studies must include ≥10 people (150 recommended).

Impact:

◉Push for equity and inclusivity in device performance.

◉Raises development costs but ensures accuracy for all demographics.

Segments Covered

By Product

◉Pulse oximeters are available in multiple form factors, each targeting a specific clinical or home-care use case.

Fingertip Pulse Oximeters

◉Small, portable devices that clip onto a patient’s finger.

◉Widely used in home healthcare, telehealth, and spot checks in hospitals.

◉High adoption due to affordability, ease of use, and accessibility.

◉Growing demand post-COVID for preventive and home monitoring.

Handheld Pulse Oximeters

◉Larger than fingertip models, often with advanced features such as alarms, memory, and better displays.

◉Designed for use in clinics, outpatient facilities, and during transport.

◉Example: Smiths Group’s MiniCorr Handheld Pulse Oximeters.

◉Favored for higher accuracy compared to consumer-grade fingertip versions.

Wearable Pulse Oximeters

◉Includes rings, wristbands, and health watches.

◉Focus on continuous monitoring of SpO₂ and pulse rate.

◉Example: Masimo’s W1 Health Watch, Movano Health’s Evie Ring, Apnimed’s Oximeter Ring.

◉Growing in remote patient monitoring (RPM), sleep medicine, and chronic disease management.

◉Key trend: Shift from clinical to consumer-driven health wearables.

Tabletop Pulse Oximeters

◉Hospital-grade, placed at bedside or used in ICUs and operating rooms.

◉Offer multi-parameter monitoring, alarms, and integration with hospital systems.

◉Strong adoption in critical care and surgical settings.

◉Often paired with wired/wireless connectivity for centralized patient monitoring.

By Type

◉Based on technology and placement, oximeters are classified into:

Conventional (Bedside) Pulse Oximeters

◉Large units integrated with hospital monitoring platforms.

◉Used in ICUs, ERs, and surgical units.

◉High accuracy and continuous monitoring capabilities.

◉Remain essential for high-acuity patient care.

Portable Pulse Oximeters

◉Includes fingertip, handheld, and wearable types.

◉Designed for mobility, point-of-care testing, and home use.

◉Rapidly growing due to increased demand for RPM and chronic care monitoring.

◉Favored in emergency response and telehealth programs.

By End-use

◉Different end-users adopt pulse oximeters for varying needs:

Hospitals & Clinics

◉Largest end-use segment.

◉Demand driven by surgical procedures, ICU monitoring, and emergency care.

◉Integration with multi-parameter monitoring systems is key.

◉Major buyers of tabletop and handheld units.

Ambulatory Surgical Centers (ASCs)

◉Growing adoption as ASCs perform more outpatient surgeries.

◉Need portable and reliable monitoring devices for pre- and post-op recovery.

Favor handheld and tabletop oximeters.

Home Healthcare

◉Fastest-growing end-use segment.

◉COVID-19 accelerated demand for consumer-grade fingertip and wearable oximeters.

◉Useful for chronic respiratory conditions (COPD, asthma), cardiac monitoring, and sleep apnea.

◉Increasing integration with RPM platforms and telemedicine.

By Geography

◉Pulse oximeter adoption varies significantly by region:

North America

◉Dominated the global market in 2024.

◉Growth driven by:

Advanced healthcare infrastructure.

◉Strong adoption of wearables and digital health solutions.

◉Favorable regulatory support (e.g., FDA guidelines for calibration and equity testing in 2025).

◉Key players: Masimo, Medtronic, GE Healthcare, Prevounce Health, Movano Health.

Europe

◉Strong hospital adoption due to high surgical procedure rates.

◉Increasing investment in remote monitoring and telehealth.

◉Countries like Germany and the UK leading in hospital infrastructure modernization.

Asia-Pacific

◉Fastest-growing region.

◉Driven by large patient population, rising chronic respiratory diseases, and expanding hospital capacity.

◉Adoption of affordable fingertip devices is high.

◉Local manufacturing in China and India fuels low-cost device penetration.

Latin America, Middle East & Africa (LAMEA)

◉Slower adoption but increasing due to rising healthcare investments.

◉Pulse oximeters often used in emergency care and low-resource settings.

◉NGOs and government health programs drive usage, particularly during infectious outbreaks.

Check out the details below

Access our exclusive, data-rich dashboard dedicated to the healthcare market – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ http://towardshealthcare.com/price/5581

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest