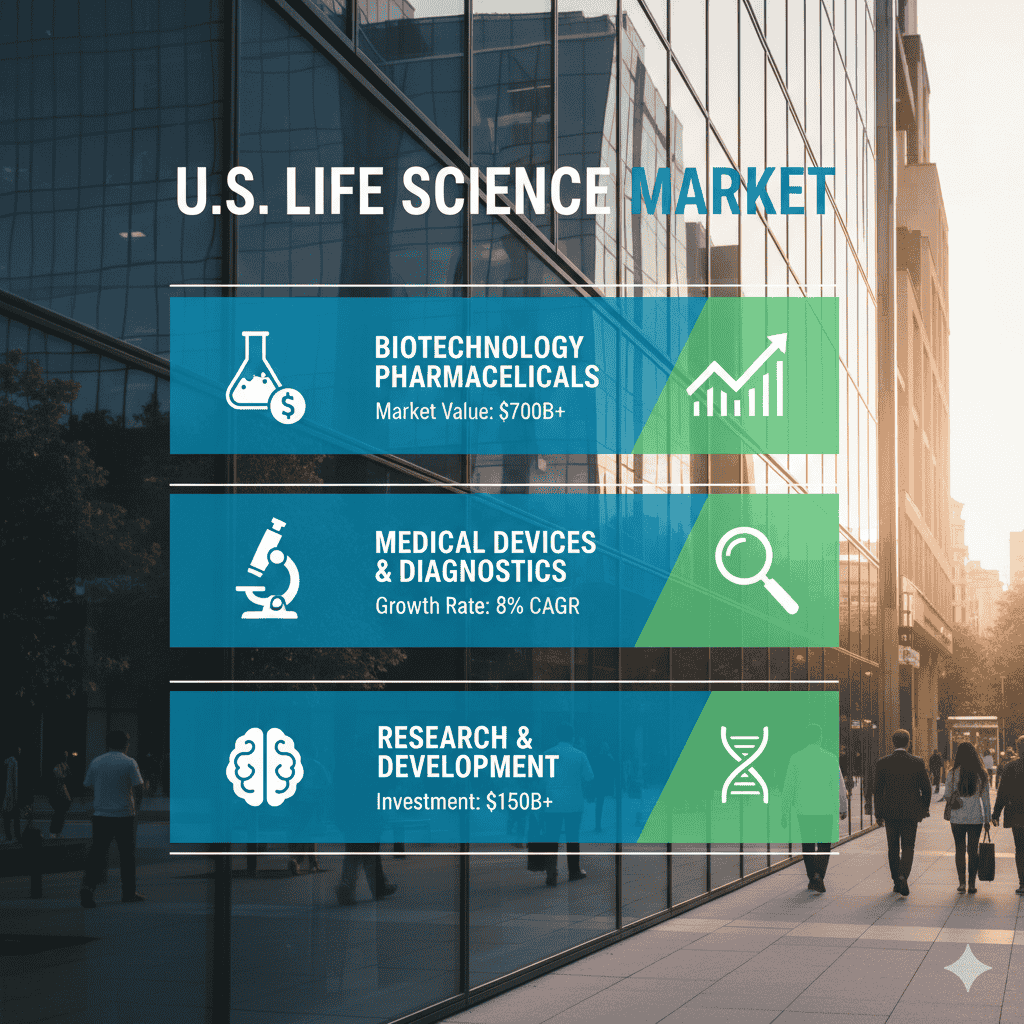

The U.S. life science market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

Download the free sample and get the complete insights and forecasts report on this market @ https://www.towardshealthcare.com/download-sample/6001

Market trends

Biopharma dominance + high-value therapeutics

●Biopharma/pharma commanded the largest market share in 2024; continued investment in biologics, gene & cell therapies and high-value small molecules underpins revenue and R&D intensity.

CROs/CDMOs accelerating

●Outsourcing of clinical research, analytical services, and manufacturing is expanding — CROs/CDMOs are expected to grow fastest during the forecast because sponsors prioritize flexibility, speed-to-market, and capital efficiency.

AI and “TechBio” investment surge

●Example: Caris Life Sciences closed a US$ 168M growth capital round in April 2025, illustrating investor appetite for AI-driven precision medicine platforms that combine large biomedical datasets with machine learning.

Biosimilars & pricing competition

●Example: Yesintek (Biocon Biologics’ Stelara biosimilar) gained U.S. market access (May 2025) with listing on major formularies — signals growing biosimilar adoption, payer shifts, and downward pressure on biologic pricing for certain indications.

Big-ticket biologics manufacturing investments

●Example: Merck’s US$1 billion Wilmington biologics campus (announced April 2025) reflects capital intensity in biologics/ADC manufacturing and the need for domestic capacity.

Clinical trial expansion & regulatory flow

●2024 saw a near-record number of registered clinical trials and through Q3 2024 the FDA authorized 59 medicines — pipeline throughput is high, creating demand for trial sites, patient recruitment, analytics, and regulatory expertise.

Lab sustainability & ESG pressure

●The sector is resource-intensive (pharmaceuticals estimated to contribute significantly to global emissions in your content). Expect sustainability initiatives, instrument energy efficiency, waste reduction, and circular procurement to become procurement decision drivers.

Supply chain fragility & reshoring discussions

●Geopolitical risk, climate events, and over-reliance on single suppliers force life science firms to diversify suppliers, evaluate near-sourcing, and invest in supply-chain monitoring & inventory analytics.

Public & philanthropic funding concentration

●NIH and federal R&D funding remain critical; in FY2024 45.3% of NIH funding went to the top five states, concentrating research capacity and talent in those hubs (California leading).

Commercialization & DTC engagement

●Example: SK Life Science used direct-to-consumer campaigns (May 2025) for an anti-seizure drug — indicates more consumer-facing commercial strategies for certain therapeutics and the need for patient education/compliance support.

Roles / impacts of AI in the U.S. life science market

Target discovery & validation acceleration

●Role: ML models analyze multi-omics, literature, and phenotypic data to prioritize targets.

●Implication: Shortens early discovery timelines; reduces wet-lab iterations.

●Limitation: Requires high-quality annotated datasets; risk of false positives without orthogonal validation.

Lead design & in-silico screening

●Role: Generative models suggest novel chemotypes and optimize ADMET properties in silico.

●Implication: Reduces cost/time of medicinal chemistry cycles and candidate attrition.

●Limitation: Synthesizability and real-world ADMET still require lab confirmation.

NGS & genomics data interpretation

●Role: AI pipelines call variants, interpret pathogenicity, and link genomic signatures to therapies.

●Implication: Faster, clinically actionable genomic reports for precision medicine.

●Real example tie-in: Companies like Caris (AI + molecular profiling) attract large capital rounds.

Clinical trial design & patient stratification

●Role: Predictive modeling for inclusion/exclusion criteria, adaptive designs, and identifying likely responders.

●Implication: Reduced trial sizes, shorter timelines, higher probability of success.

●Limitation: Regulatory acceptance and explainability for trial decisions.

Operational optimization (manufacturing & supply chain)

●Role: Predictive maintenance, demand forecasting, batch release analytics, and process control via ML.

●Implication: Higher yields, lower downtime, better compliance, and reduced supply risk.

Real-world evidence & post-market surveillance

●Role: NLP and signal detection on EHRs, claims, social media to detect safety signals faster.

●Implication: Improved pharmacovigilance and lifecycle management; faster safety interventions.

Diagnostics & companion diagnostics

●Role: Image analysis (pathology, radiology), pattern recognition in molecular assays to create companion diagnostics.

●Implication: More precise patient matching for biologics and targeted therapies.

Regulatory submission support & documentation automation

●Role: Automated generation and harmonization of submission documents, literature reviews, and regulatory intelligence.

●Implication: Faster dossier preparation; better traceability of evidence.

Commercial analytics & payer engagement

●Role: Price optimisation, formulary strategy simulation, and patient affordability modelling.

●Implication: Smarter market access strategies — critical when biosimilars (e.g., Yesintek) change pricing dynamics.

Lab automation & virtual scientists

●Role: AI orchestrates robotics, designs experiments, and interprets results — enabling higher throughput and reproducibility.

●Implication: Scale lab capacity without linear increases in headcount; aligns with lab sustainability goals by reducing repeat experiments.

●Cross-cutting challenge: data governance, model explainability, clinical validation, and regulatory acceptance remain the main barriers to broad AI adoption.

Regional insights

1) Northeast U.S. — research intensity & translational pipeline

●Funding and academic density: Concentrated academic medical centers and research hospitals attract disproportionate NIH funding (you noted top five states receive 45.3% of NIH funding; California leads).

●Translation & spinouts: Dense translational infrastructure (tech transfer, incubators) accelerates spinouts; this feeds early-stage biopharma and diagnostic companies.

●Implication: High innovation velocity but also high talent competition and real estate costs.

2) Midwest U.S. — manufacturing & med-tech backbone

●Manufacturing advantage: Strong industrial and manufacturing base supports large-scale device and biologics manufacturing.

●Workforce profile: Skilled engineering talent for instrument manufacturing and process scale-up.

●Implication: Good fit for CDMO / device scale-up investments and resilient production capacity.

3) South U.S. — cost-competitive growth & emerging hubs

●Lower cost base: Offers cheaper real estate and operational costs, attracting manufacturing and back-office functions.

●Emerging clusters: States in the South increasingly invest in life science campuses and incentives, creating alternative hubs.

●Implication: Attractive for new plants, logistics, and growing CRO footprints.

4) West U.S. — venture capital, platform biotech, and sequencing leadership

●VC concentration & platform companies: Strong VC presence funds AI/NGS and platform therapeutics. California leads NIH funding and venture activity per your content.

●Platform ecosystems: Clusters of genomics, synthetic biology, and AI companies accelerate platform innovation.

●Implication: High capex for lab space but high upside for platform commercialisation and talent access.

Cross-regional themes & operational subpoints

●Clinical trial site distribution: Trial recruitment burden drives need to spread trial sites across regions to capture diverse patient populations.

●Supply chain & logistics: Manufacturing hubs should sit near suppliers and logistics (Midwest/South advantages).

●Policy & incentives: State level incentives (tax credits, grants) materially affect where companies build facilities and hire.

●Workforce & education: Regions with strong universities provide steady talent pipelines — correlates with NIH funding and spinouts.

Market dynamics

Drivers

Rising healthcare needs (aging population & chronic disease)

●More chronic disease → higher demand for therapeutics, diagnostics, monitoring devices. This underpins the long-term revenue base and justifies R&D investments.

Technological acceleration (NGS, CRISPR, AI)

●These platform technologies lower costs per insight and open new therapeutic classes (e.g., gene editing), increasing addressable market.

Capital availability & investor confidence

●2024–2025 saw VC & IPO activity rebound in many areas; large growth rounds (e.g., Caris) show readiness to fund platform scale.

Regulatory throughput & approvals

●Near-record FDA approvals in 2024 (59 through Q3) indicate regulatory activity that enables commercialization and market expansion.

Restraints

Supply chain vulnerability

●Over-reliance on single suppliers/geographies, geopolitical disruptions, and raw material shortages create production risk and margin pressure.

Capital & operational intensity of biologics

●Building biologics capacity (like Merck’s $1B investment) requires long lead times and large capex — a barrier for smaller players.

Environmental footprint & sustainability constraints

●High energy/materials usage and waste generation increase regulatory and reputational risk; sustainability investments increase operating costs in short term.

Opportunities

CRO/CDMO market expansion

●Sponsors’ preference to outsource creates large demand for specialized CDMO services (cell & gene, sterile biologics). This is highlighted as the fastest growing segment.

Precision medicine & diagnostics

●Greater adoption of companion diagnostics and genomic profiling expands diagnostic revenues and linkage to targeted therapeutics.

Domestic manufacturing & reshoring

●Policy and commercial incentives to onshore strategic biologics manufacturing create opportunities for new facilities and cluster development.

Behavioral & market responses

●Consolidation & M&A: To obtain scale (manufacturing or clinical reach), expect continued consolidation among CROs, CDMOs, and analytics vendors.

●Vertical integration selective: Some large incumbents will verticalize if they need guaranteed capacity; others will rely on third parties.

●Sustainability as procurement filter: Lab energy and waste profiles start to influence vendor selection for reagents/instrumentation.

Top companies

Johnson & Johnson

●Product focus: Broad — pharmaceuticals, medical devices, consumer health.

●Overview: A diversified health conglomerate with global manufacturing and commercial reach.

●Strengths: Diversification across product classes, deep commercial channels, large R&D and regulatory experience.

Eli Lilly

●Product focus: Innovative small molecules and biologics (notably in diabetes, oncology, immunology).

●Overview: Strong R&D pipeline and recent commercial successes.

●Strengths: Clinical development excellence, strong go-to-market for specialty medicines.

AbbVie

●Product focus: Immunology, oncology, neuroscience (biologics-heavy portfolio).

●Overview: Large biologics footprint and legacy product base.

●Strengths: Expertise in specialty care markets and durable revenue streams from flagship biologics.

Amgen

●Product focus: Biologics and high-value specialty therapies.

●Overview: One of the largest independent biotech manufacturers with biologics process know-how.

●Strengths: Manufacturing scale, strong biologics platform capabilities, commercial presence.

Thermo Fisher Scientific

●Product focus: Laboratory instruments, reagents, genomic tools, and life science services.

●Overview: Market leader for lab automation, consumables and services supporting R&D and manufacturing.

●Strengths: Broad product breadth for workflows, deep service network, durable recurring consumable revenue.

IQVIA

●Product focus: CRO services, real-world data & analytics, clinical trial operations.

●Overview: Integrated data + service provider to pharma and biotech for development and commercialization.

●Strengths: Massive data assets, regulatory and trial operations scale, analytics capabilities.

McKesson Corporation

●Product focus: Pharmaceutical distribution, logistics, and services.

●Overview: Major distributor and supply-chain services provider to the U.S. health system.

●Strengths: Distribution scale, logistics infrastructure, relationships with hospitals & pharmacies.

Regeneron Pharmaceuticals

●Product focus: Biologics and antibody therapeutics.

●Overview: Biotech with a strong in-house discovery and development platform and marketed therapies.

●Strengths: Platform biology, rapid clinical development capabilities, manufacturing partnerships.

Laboratory Corporation of America (LabCorp)

●Product focus: Diagnostic testing, clinical labs, and central lab services.

●Overview: One of the largest clinical lab networks providing broad diagnostic services.

●Strengths: High throughput testing capacity, payer relationships, and broad commercial coverage.

Moderna

●Product focus: mRNA therapeutics and vaccines.

●Overview: Platform company leveraging mRNA for vaccines and therapeutics with rapid development capabilities.

●Strengths: Platform agility, speed of vaccine design/scale-up, strong manufacturing partnerships.

Latest announcements

Caris Life Sciences — US$168M growth capital (April 2025)

●Detail: A major growth capital infusion into an AI-driven precision medicine company (Caris).

●Implications: Validates investor confidence in AI+omics platforms; funds product scaling, clinical validation, bioinformatics expansion, and commercial rollout of precision diagnostics.

Yesintek (Biocon Biologics) — U.S. formulary access (May 2025)

●Detail: Biosimilar to Stelara gaining placements on major U.S. formularies (Express Scripts, Cigna, UnitedHealthcare).

●Implications: Will expand access to high-volume immunology therapies at lower cost, shift prescribing leverage to biosimilars, and increase price competition for originator biologics.

Merck Wilmington Biotech — US$1 billion biologics center (April 2025)

●Detail: 470,000 sq ft biologics center of excellence for labs, manufacturing and warehousing.

●Implications: Builds domestic capacity for ADCs and next-gen biologics; increases ecosystem demand for CDMOs, instrumentation, and skilled ops staff.

Mount Sinai leadership & AI drug discovery commitment (April 2025)

●Detail: Avner Schlessinger PhD named to lead Mount Sinai’s Centre for Therapeutics Discovery with a focus on AI + biology + chemistry.

●Implications: Academic translational efforts are prioritizing AI, which will boost academic–industry partnerships and spinouts.

Celltrion USA — two denosumab biosimilars commercially available (July 2025)

●Detail: STOBOCLO® and OSENVELT® (denosumab biosimilars) launched commercially in the U.S.

●Implications: Further biosimilar penetration in high-value therapeutic areas (bone health/oncology supportive care), potential price pressure, and broader patient access.

SK Life Science DTC campaign — anti-seizure medication (May 2025)

●Detail: Second national direct-to-consumer advertisement for an anti-seizure drug, positioning it as the only DTC campaign of its kind in this category.

●Implications: Signals willingness to invest in patient education and demand stimulation for neurology therapeutics; may influence commercial norms in certain specialty drugs.

Recent developments

Biosimilar commercialization wave

●Examples: Yesintek formulary access; Celltrion’s denosumab biosimilars launched.

●Depth: These moves indicate a substantive market shift where biosimilar entrants obtain payer coverage and become commercially viable in large U.S. formularies — accelerating adoption and price competition in biologics.

Large scale manufacturing buildouts

●Example: Merck’s Wilmington facility.

●Depth: Big pharma is investing heavily in domestic biologics capacity (ADCs, mAbs), likely in response to pipeline needs and supply-chain resilience strategies.

AI/TechBio funding continues

●Example: Caris fundraising and academic leadership aligned to AI discovery (Mount Sinai).

●Depth: Capital is available for platform companies that can demonstrate clinically actionable outputs; this will accelerate diagnostic commercialization and data-driven drug discovery.

Commercial & marketing innovation

●Example: SK Life Science’s DTC ad for anti-seizure medication.

●Depth: Pharma marketing strategies continue to evolve into more direct patient engagement, especially where disease awareness and diagnosis gaps exist.

Clinical & regulatory momentum

●Example: High FDA approval counts in 2024 and growth in registered trials.

●Depth: A crowded pipeline and active regulatory environment create opportunities for CROs, regulatory consultants, and labs to scale services rapidly.

Segments covered

Biopharma / Pharmaceuticals

Subpoints:

●Therapeutic biologics (mAbs, ADCs, recombinant proteins) — high margin, capital-intensive manufacturing and long development cycles.

●Small-molecule drugs — traditional pharma, broad commercial models, generics competition risk.

●Gene & cell therapies — highly specialized manufacturing (GMP vector work, cell handling), complex reimbursement models.

●Explanation: Biopharma anchors market revenue; innovation in biologics and gene therapy drives R&D spend and manufacturing demand.

Contract Research & Manufacturing (CROs / CDMOs)

Subpoints:

●Clinical research services (phase I–IV operations, site management).

●Manufacturing services (API, biologics drug substance/drug product).

●Consulting & analytics (real-world data, regulatory strategy).

●Explanation: Sponsors increasingly outsource to access specialized capabilities, speed, and cost control; this is the fastest growing product/service segment.

Diagnostics & Clinical Laboratory Services

Subpoints:

●In vitro diagnostics (IVD) — assay development, kit manufacture, regulatory clearance.

●Clinical labs — high throughput testing, central lab services, payer contracting.

●Molecular diagnostics — NGS panels, PCR assays, companion diagnostics.

●Explanation: Diagnostics are the bridge between science and clinical action — as precision medicine grows, diagnostics capture more value per patient.

Medical Devices & Equipment

Subpoints:

●Diagnostic imaging (hardware & software).

●Surgical instruments and implantable devices.

●Monitoring devices (wearables, remote monitoring).

●Explanation: Devices combine hardware, software, and regulatory complexity; integration with digital health and remote care is accelerating market expansion.

Laboratory Tools, Reagents & Consumables

Subpoints:

●Lab reagents & consumables — recurring revenue, sensitive to supply chain.

●Analytical instruments — capital purchases, long replacement cycles.

●Sequencing/genomics tools — platform sales + consumable economics.

●Explanation: Provides the operational backbone for R&D and clinical labs; margins and recurring consumable sales are attractive.

Genomics & Precision Medicine

Subpoints:

●Sequencing platforms (NGS instruments and service models).

●Bioinformatics & clinical reporting (actionable interpretation).

●Personalized medicine applications (companion diagnostics, targeted therapies).

●Explanation: Drives higher value per patient via targeted therapies and diagnostics; data & interpretation are key value levers.

Top 5 FAQs

Q1: How big is the global life science market and what is its growth trajectory?

A: The market was US$ 88.20 billion in 2024, projected to reach US$ 98.63 billion in 2025, and US$ 269.56 billion by 2034, representing an 11.82% CAGR (2024–2034).

Q2: Which segment held the largest share in 2024 and which will grow fastest?

A: The biopharma/pharmaceutical segment held the largest share in 2024. CROs/CDMOs are expected to grow the fastest during the forecast period as sponsors increasingly outsource R&D and manufacturing.

Q3: What are the main drivers of market growth?

A: Key drivers include adoption of NGS/CRISPR/AI, rising chronic disease burden and ageing population, increased clinical trial activity and FDA approvals, heavy R&D investment, and large financing rounds for TechBio platforms.

Q4: What are the biggest risks or restraints?

A: Principal restraints are supply chain vulnerabilities (over-reliance on single suppliers), the capital intensity of biologics manufacturing, and environmental/sustainability pressures that raise operating costs.

Q5: How is AI changing the life science market?

A: AI is accelerating target discovery, improving NGS interpretation, optimizing clinical trials, enabling lab automation, powering real-world evidence, and supporting manufacturing & supply chain optimization — but adoption faces challenges around data quality, explainability, and regulatory validation.

Access our exclusive, data-rich dashboard dedicated to the life sciences sector – built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/6001

Become a valued research partner with us – https://www.towardshealthcare.com/schedule-meeting

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Powering Healthcare Leaders with Real-Time Insights: https://www.towardshealthcare.com/healthcare-intelligence-platform

Europe Region – +44 778 256 0738

North America Region – +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest